-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Recession & Debt Ceiling Fears Pushed To The Side For Now

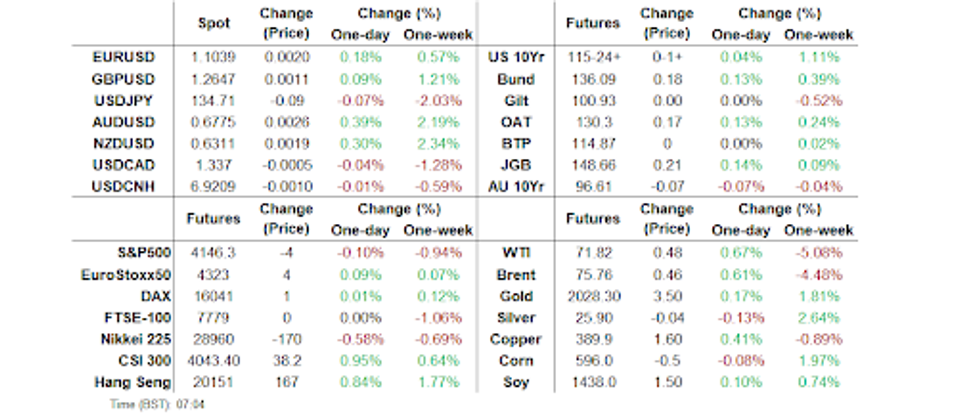

- Positive risk sentiment has continued at the start of this week, carrying over from the tail end of last week. Regional Asia Pac equities are mostly firmer, while the USD remains on the back foot against the G10, particularly the antipodeans and most Asian FX. Commodities are also higher, with Brent crude back close to $76/bbl.

- US yields have held Friday gains, although more so at the front end. Market jitters around the US debt ceiling and regional bank headwinds haven't impacted sentiment so far, but are likely to continue to dominate the headline space. Elsewhere Japan markets have returned, but moves in FX, rates and equities have been fairly muted.

- There is a thin data calendar today, German Industrial production provides the highlight. UK markets are closed for the observance of a national holiday. Further out there is likely to be some interest in the Fed loan opinion survey, particularly given the recent turmoil in the US banking sector.

MARKETS

US TSYS: Curve Flattens In Asia

TYM3 deals at 115-26, +0-03, with a 0-07 range observed on volume of ~53k.

- Cash tsys sit 1bp cheaper to 2bps richer across the major benchmarks, the curve has twist flattened pivoting on 3s.

- Improving risk sentiment in Asia saw tsys firm through the session, the USD is pressured and regional equities are higher.

- Earlier in the session Tsys were marginally pressured in early trade as local participants perhaps focused on the headline number of Friday's NFP which saw the unemployment rate tick unexpectedly lower.

- From a flow perspective a block seller in UXY (1,361 lots) was the highlight.

- FOMC dated OIS price a terminal rate of ~5.1% in June, there are ~100bps of cuts priced for 2023.

- There is a thin data calendar in Europe with UK markets closed for the observance of a national holiday. Further out we have Wholesale Inventories and the Fed releases the May 2023 Financial Stability Report.

JGBS: Slightly Richer, Tight Range After Extended Holiday

JGB futures are higher in afternoon trade at 148.60, +15 compared to Tuesday settlement levels, after trading in a relatively tight range for the Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the BoJ March Minutes which showed board members believed it was important to continue with easing for prices goals and won’t hesitate to add easing if necessary.

- US tsys are 1bp cheaper to 1bp richer across major benchmarks with the 2/10 curve twist flattening in Asia-Pac trade.

- Technical analysis from MNI suggests that breaking the March 22 high (149.53) would signal the continuation of the uptrend. To the downside, the 50-dma provides support at 147.68, just above the April 18 low.

- Cash JGB curve twist flattens pivoting at the 7-year zone. Yields are 0.9bp higher to 0.7bp lower across the curve with the 1-year zone the weakest and the 40-year the strongest. The benchmark 10-year yield is 0.3bp lower at 0.418%, well below BoJ's YCC limit of 0.50%.

- The swaps curve has twist flattened also with rates 0.1bp higher to 0.6bp lower. The curve pivots at the 3-year zone with swap spreads tighter, except for the 1-year and 40-year zones.

- The local calendar is slated to release March Household Spending and Labour Cash Earnings tomorrow along with 10-year JGB supply.

AUSSIE BONDS: Holding Weaker, Awaits Federal Budget Tomorrow

ACGBs are weaker (YM -10.0 & XM -7.0) but off session cheaps. The release of the April NAB business survey and March building approvals data failed to provide a meaningful local catalyst. Business confidence rose 1pt to flat while business conditions dropped to +14 from +16 in March. Building approvals data undershot expectations with a decline of 0.1% m/m in March (+3.0% est.) following a revised +3.9% in February.

- Without meaningful macro news flow US tsys are little changed in Asia-Pac trade.

- Cash ACGBs are 7-10bp weaker but off the worst levels set in morning trade (10-13bp cheaper). The 3/10 cash curve is 3bp flatter with the AU-US 10-year yield differential +2bp at -4bp.

- The swaps curve is 2bp flatter with rates 5-7bp higher on the day. EFPs are 2bp tighter.

- The bills strip is steeper but with pricing off session cheaps at -3 to -11.

- RBA dated OIS pricing is 5-9bp firmer for meetings beyond October with early'24 leading.

- Treasurer Chalmers is slated to hand down the Federal Budget tomorrow. If it turns out to be significantly expansionary then RBA rate expectations may be affected. BBG consensus expects a A$5.35bn deficit, 0.25% of GDP for FY23.

AUSTRALIAN DATA: NAB Business Survey Shows Lower Prices While Costs Rise

The April NAB business survey remained robust but showed that conditions are easing. Business conditions fell 2 points to 14.2, still above the 6.4 historical average, while the more volatile confidence rose 1.3 points to 0.3, but still below average. The survey showed that while capacity constraints continue, firms pricing power is falling. The NAB data are signalling that the economy is slowing but that the external side should continue providing support to growth.

- The components showed a pickup in purchase costs to 2.3% from 1.9% with labour costs steady at 1.9%; however final product prices fell to 1.1%, the lowest in 2 years, and retail prices to 1.4% from 1.7%. This indicates that profit margins are being squeezed and consistent with the profitability component declining to 11.3 from 13.

- Employment was steady at 10.5 well above the 2.5 average and signalling that there has only been a mild moderation in labour demand from 2022 and that job growth should remain solid going forward. Capacity utilisation was unchanged at 85.1%.

- Forward orders declined to 1.2 from 3.4, the lowest since September 2021 and around the long-term average. But exports and exporters sales both picked up and are above their averages.

Source: MNI - Market News/Refinitiv

Australia NAB employment vs employment y/y%

Source: MNI - Market News/Refinitiv

AUSTRALIAN BUDGET: Possible Near-Term Surplus But Deficits Thereafter

At 1930 AEST on Tuesday, the Federal Government delivers the 2023-24 budget. If it turns out to be significantly expansionary then RBA rate expectations may be affected. Analysts expect the FY23 forecasts to show a small deficit of around 0.25% of GDP but there is some speculation that it could be a small surplus, the first in 15 years.

- The budget recorded a $1bn surplus in the financial year to March due to strong commodity prices, low unemployment and higher inflation but the structural position was a deficit of $11.2bn. Treasurer Chalmers has said that a surplus is not a priority in this term and deficits are expected over the rest of the forecast horizon due to aged care, NDIS, health and defence commitments, and interest payments.

- Revenue/savings measures announced so far cover just over half of the announced additional spending. Commodity price forecasts have been lifted.

- A $14.6bn cost-of-living relief package is to be included covering up to $500 energy bill relief for 5.5mn households and 1mn small businesses. It will also include cheaper medicines and other assistance. Treasurer Chalmers has said that the measures won’t “add to inflation”.

- There is going to be an extension to the single parent payment covering children between the ages of 8 and 14 costing $1.9bn. Also an extra increase above indexation to JobSeeker for the over 55s is likely.

- Changes to the indexation of funding for community services covering domestic violence, homelessness, disability and mental health will cost an additional $4bn.

- The 15% increase to aged-care wages will cost $11.3bn and increased childcare and parental leave will cost $9bn. There will also be further investment in green energy.

- The government has found extra savings of $17.8bn on top of the $22bn in October. The 5%/year increase in tobacco tax will raise $3.3bn over 4 years and the reduction in super concessions will be worth $0.3bn.

- There will be a 90% cap on deductions firms in the petroleum & gas sector can make to reduce their petroleum resource rent tax liability introduced on July 1. This will raise $2.4bn. 8 of the 11 recommendations made by the Treasury’s Gas Transfer Pricing Review will be implemented.

- The Australian

NZGBS: Closed Weaker Near Morning Cheaps

NZGBs closed near session cheaps with benchmark yields 6-9bp higher and the 2/10 cash curve 3bp flatter. With no local data or meaningful local news flow, the NZGB market basically held near opening levels following the weaker lead-in from US tsys after solid non-farm payrolls data on Friday. NZ/US and NZ/AU 10-year yield differential both closed 1bp wider at respectively +72bp and +76bp.

- Swap rates closed 5-6bp higher with implied short-end swap spreads tighter.

- RBNZ dated OIS closed with pricing 1-6bp firmer across meetings with Apr’24 leading. 24bp of tightening is priced for the May 24 meeting.

- The local calendar is scheduled to release Retail Card Spending data for April tomorrow with a continued shift towards services expected.

- In Australia, Treasurer Chalmers is slated to hand down his first Federal Budget tomorrow. If it turns out to be significantly expansionary then RBA rate expectations may be affected.

- Further afield, the calendar is relatively light ahead of Wednesday’s release of US CPI for April.

FOREX: Antipodeans Firm As Risk Appetite Improves In Asia

The AUD and NZD are firmer on Monday as risk appetite improves, Hong Kong and Chinese equities are higher with the Hang Seng up ~0.8%.

- AUD/USD prints at $0.6770/75 ~0.3% firmer. The pair sits a touch above the high from Apr 20, with the next target for bulls $0.6806 high from Apr 14 and key resistance. April NAB Business Survey remained robust but showed that conditions are easing. Building Approvals fell in March -0.1% M/M an increase of 3.0% M/M was expected.

- Kiwi is also firmer, NZD/USD is up ~0.2%. We are consolidating in a narrow range above $0.63 handle. Bulls target a break of Apr high at $0.6379, from here they can target year to date highs at $0.6538.

- JPY was pressured in early trade before unwinding losses to deal flat. USD/JPY is now below the 135 handle and is little changed from Friday's closing levels.

- Elsewhere in G-10 EUR is 0.2% firmer and GBP is up ~0.1%.

- Cross asset wise; regional equities ex Japan are firmer, e-minis are little changed today. BBDXY is down ~0.1%.

- There is a thin data calendar today, German Industrial production provides the highlight. UK markets are closed for the observance of a national holiday.

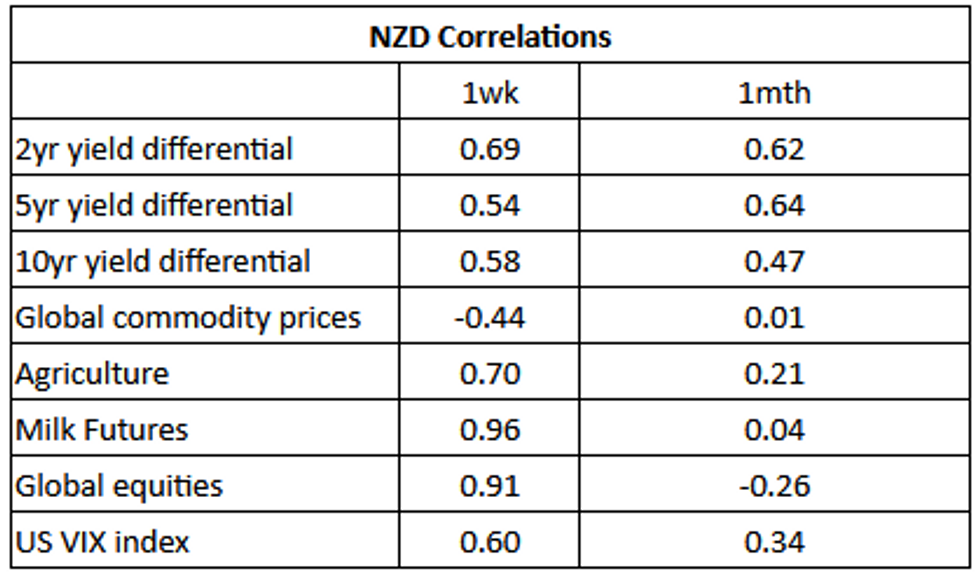

NZD Correlations: Global Equities, Milk & Agriculture Dominant Drivers

NZD/USD correlations with global equities, milk futures and agriculture have strengthened over the past week, standing out as a key macro driver in recent dealings. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Recent strength in NZD, up ~2% last week, looks to be associated with the recent strength in global equities, milk futures and agriculture. As well as the recent momentum of the 2-year yield differential.

- The pair looked through weakness in Global Commodity prices.

- Over the longer time frame rate differentials are the dominant macro driver.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

EQUITIES: Regional Markets Rally, Although Returning Japanese Markets Lag

Most regional markets are tracking higher at the start of the week. The exception is Japan, with local markets returning from a 3-day break and struggling for positive traction amid US bank jitters. US equity futures opened higher but couldn't sustain positive momentum, with the Eminis off by around 0.08% at this stage, last near 4147. Still, this isn't too far off Friday session highs (just above 4160).

- China shares are firmer across the board, with the CSI 300 +1.00%, the Shanghai Composite around +1.55%. Banks have outperformed after a number of lenders lowered deposit rates to boost margins. Insurers also maintained a positive tone. Some offset came from weaker property developer performance amid signs the housing recovery lost traction in April.

- Hong Kong shares are also higher, with the HSI +0.75% at this stage. Some positive spillover from Golden Dragon Index gains through Friday's US session is helping. Alibaba is also planning an IPO in 2024 for its logistics division.

- The Kospi (+0.74%) and Taiex (+0.60%) are both higher, following positive leads from US tech on Friday, as the risk on mood prevailed.

- Japan stocks have returned, with local markets retracing modestly. The Topix down by 0.20% at this stage. This mainly owes to underperformance in the banking segment (playing some catch up with global weakness while Japan markets were closed Wed-Fri last week).

- SEA markets are mostly positive, albeit with the Singapore Strait Times and Indonesia JCI lagging somewhat.

OIL: Prices Rise Further In Better Risk Environment

Oil prices have moved higher during the APAC session on the improved risk environment. After rising 4% on Friday, crude is 0.5-0.6% higher today with WTI at $71.75/bbl and Brent $75.68. The USD index is 0.15% weaker.

- Brent fell through $75 briefly today but then bounced off its intraday low of $74.95. WTI held above $71 reaching a low of $71.04.

- The oil market remains nervous about the growth outlook despite the recent rally. It is likely to continue reacting strongly to any developments implying soft activity, especially given thin liquidity. Bloomberg is reporting though that physical demand indicators are suggesting that recent downward price action was excessive.

- The expectations in this week’s OPEC and US EIA monthly oil market reports could be market movers given the current degree of market sensitivity. They are published on Thursday and Tuesday respectively. Saudi Aramco, the largest global producer, releases results this week too.

- Goldman Sachs is expecting large oil market deficits in H2 2023 which it expects will support higher prices. It believes that the recent price moves were mostly driven by a “macro-financial selloff”.

- Later today the Fed releases the Q1 loan officer survey and the May 2023 financial stability report. Also, Fed’s Kashkari is moderating a panel discussion on minimum wages. The key piece of US data this week is Wednesday’s April CPI plus

GOLD: Prices Climbing Back Despite Stronger Equities

Gold gave up some of its gains on Friday after US Treasury yields rose following robust payroll data. It fell 1.6% to $2016.97/oz after reaching a low of just under $2000. It was still up 1.4% on the week though. Despite stronger risk appetite during the APEC session, bullion is up 0.4% today to $2024.45, close to the intraday high, as the USD index is weaker.

- Gold fell briefly below resistance of $2000.40, the 20-day EMA, to a low of $1999.61 on Friday.

- The World Gold Council said that central bank gold purchases slowed in Q1 but they remained strong from China which added to gold reserves for the 6th consecutive month in April.

- US CFTC reported that net gold longs increased 5.6% as the yellow metal has found favour in an increasingly uncertain global economic environment.

- Later today the Fed releases the Q1 loan officer survey and the May 2023 financial stability report. Also, the Fed’s Kashkari is moderating a panel discussion on minimum wages. The key piece of US data this week is Wednesday’s April CPI.

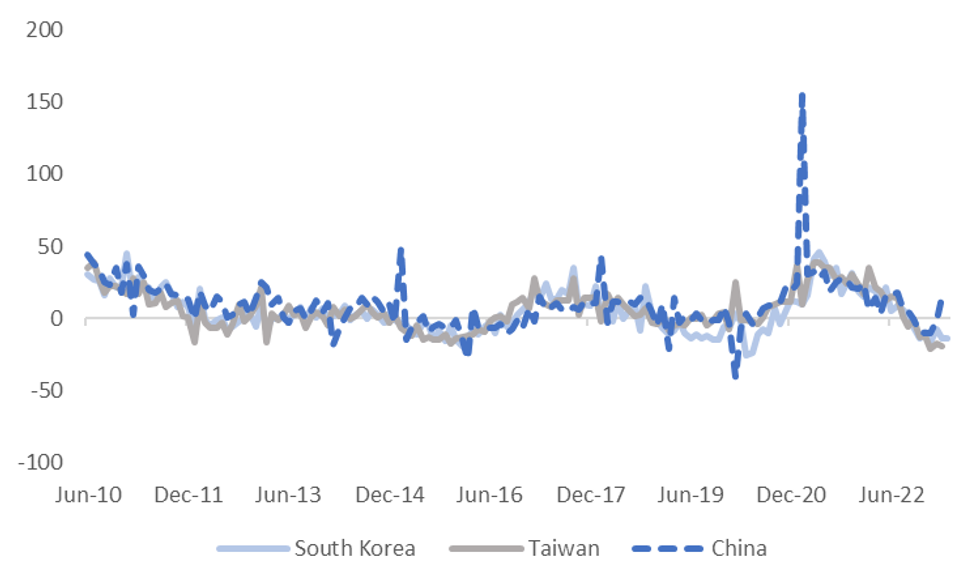

CHINA DATA: China April Trade Out Tomorrow, Export Growth Expected To Moderate

Tomorrow Apr trade figures are due. The market looks for export growth in y/y terms at 8.0% (forecast range is -5.0% to 13.8%), versus 14.8% prior. Imports are expected to be -0.2% y/y, (forecast range is -3.0% to 7.0%), versus -1.4% prior. The trade surplus is expected to narrow to $71.25bn from $88.19bn in Mar.

- Both export and import trends will be of interest. The last official manufacturing PMI print for Apri showed export orders loss a decent amount of momentum to 47.6 from 50.4 in Mar. Still, this was comfortably above 2022 Mar levels, so it isn't suggesting a sharp slowing in the y/y pace for exports.

- Other NEA economies have continued to display fairly soft growth, which makes the recent export outcome for China (in Mar) look like somewhat of an outlier (see the chart below). So, some slowing might be expected given global headwinds.

Fig 1: China Exports Outperforming Other NEA Economies

Source: MNI - Market News/Bloomberg

- The import side will be watched for external growth, particularly in light of the recent correction lower in commodities across the metals and energy space.

- China is seen as a key driver of demand in 2023 and the market will be looking for positive signs around the commodity demand backdrop.

- The trade surplus is expected to gradually narrow, as domestic demand recovers in 2023 and export growth moderates. At this stage though, it isn't expected to be a headwind for CNH.

ASIA FX: Most USD/Asia Pairs Lower, Although CNH & IDR Have Lagged

- USD/CNH has been largely range bound stuck close to 6.9200 for most of the session. Higher equities haven't aided sentiment, which largely owes to better bank stock trends post deposit cuts. This may have taken the shine off CNH at the margins.

- 1 month USD/KRW is above NY closing levels from Friday, last around 1317.50, but we did see selling interest above 1320 in earlier trade. Onshore equities are firmer, albeit away from best levels, last +0.55%.

- The rupee has firmed in early dealing, USD/INR sits at 81.70/73 ~0.1% lower than Thursday closing levels as on shore markets reopen after the observance of a national holiday on Friday. The pair continues to consolidate below the 20-Day EMA, bears look to target 200-Day EMA (81.28). Bulls first look to break the 20-Day EMA at 81.96. The data calendar is headlined this week by Industrial Production for March and April's CPI. Both cross on Friday evening, the market looks for CPI to tick lower to 4.80% from 5.66%. Finance Minister Sitharaman noted at the weekend that inflation is slightly above the tolerance limit and authorities are taking steps to rein it in.

- The SGD NEER (per Goldman Sachs estimates) firmed and now sits a touch above its pre MAS levels from mid April. We now sit ~0.7% below the top of the band. Broader USD trends dominated USD/SGD on Friday, the pair firmed in the aftermath of the NFP print in the US before the SGD firmed into the close as risk appetite improved. We now sit at $1.3245/55, ~0.1% softer on Monday.

- USD/IDR spiked higher at the open, getting close to 14720. We are now back closer to 14700, still 0.20% weaker in IDR terms versus last Friday's close. There appears to be some resistance around the 14720 region and just above this level. The rupiah has underperformed other parts of the Asian FX complex, and also versus the G10 high beta space (AUD and NZD etc). Local equities are still lagging, not enjoying the broader positive trend, which is likely hurting sentiment at the margins.

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets from the past day or so.

Economy: S. Korea eyes stronger ties with US in chip industry (link)

Economy: Korea likely to slash 2023 growth forecast amid plunging exports (link)

Economy: Vietnamese Tourists Become Biggest Spenders in Korea (link)

Asia: S. Korea to attend new round of negotiations for IPEF this week (link)

Markets: Korean Individual Investors Sell Off US Semiconductor ETFs, Buy Korean (link)

Markets: Koreans net purchase $1.2 bn in treasury bonds Jan.-April on low interest rates (link)

Markets: About 60% of listed companies’ Q1 earnings exceed market consensus (link)

Markets: Korean Inc.’s Q2 earnings outlook mixed with grim prospect for chips, displays (link)

Tech: Samsung to unveil new foldables in July to boost Q3 profit (link)

Tech: Samsung Electronics to overtake TSMC within 5 years: chip president (link)

South Korea/Japan: Yoon and Kishida seek to transcend historical issues to normalize ties (link)

South Korea/Japan: Kishida to meet with chiefs of S. Korean business lobbies (link)

INDONESIA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of Indonesian Newspapers and some other major news outlets.

Politics: “Ganjar and Prabowo remain in statistical dead heat: SMRC” – Jakarta Globe (link)

- If the 2024 Presidential election was to be between Central Java Governor Ganjar (PDI-P) and Defence minister Prabowo (Gerindra) then there would almost be a tie with the latest SMRC poll showing them on 42.2% and 41.9% respectively. Prabowo is yet to announce his candidacy.

Politics: “Vice President Ma’ruf won’t pursue 2nd term” – Jakarta Globe (link)

Politics: “Finally, Jokowi confirms Nasdem no longer in gov’t coalition” – Jakarta Globe (link)

ASEAN: “’Quiet diplomacy’ doesn’t mean we are doing nothing: Indonesia on Myanmar” – Jakarta Globe (link)

Economy: “Minister optimistic Indonesia to reach economic growth target” – Antara News (link)

- Economic Affairs Minister Airlangga has said that he believes the 5.3% 2023 growth target will be achieved. The economy is expected to remain strong given the robustness of indicators. The government is planning to revise regulations to keep export earnings in Indonesia to defend the IDR and achieve the growth target.

Economy: “Events drive up economic growth in Q1: BPS” – Antara News (link)

Economy: “Retailers threaten to sue gov’t over $23.4m unpaid cooking oil subsidies” – Jakarta Globe (link)

- The retailers’ association is saying that the government still needs to pay palm oil producers IDR 344bn for 40mn litres sold in January. The government set the price for cooking oil last year.

Trade: “Singapore ready to import pig carcasses from Indonesia: Ministry” – Antara News (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/05/2023 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/05/2023 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/05/2023 | 1400/1600 |  | EU | ECB Lane Speech/Q&A at Forum New Economy | |

| 08/05/2023 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 08/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/05/2023 | 2000/1600 |  | US | Fed's May Financial Stability Report | |

| 08/05/2023 | 2045/1645 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.