MNI EUROPEAN MARKETS ANALYSIS: Risk Appetite Firms, But Fallout For USD Contained By Higher Yields

- Risk appetite has mostly been on the front foot today, as no further escalation in Middle East tensions aided sentiment. Oil has slipped further, while US equity futures have risen. Most regional equity markets are higher in Asia Pac.

- The USD is lower, but only marginally. Higher US yields have likely helped limit the dollar fallout.

- Early April trade data for South Korea points to a resilient global demand backdrop, albeit with risks of a wider trade deficit as higher energy prices bite.

- Later the Chicago Fed activity index for March, and the ECB’s Lagarde and BoE’s Benjamin speak. Key US data, including Q1 GDP and March core PCE prices, are released this week.

MARKETS

US TSYS: Tsys Futures Edge Lower As Haven Trade Unwinds, Curve Bear-Steepens

- Jun'24 10Y futures have edged lower today, hitting a low of 107-17+ we trade just off these levels now down - 09 + at 107-19+, below Thursday's lows and are eyeing a test of initial support is at 107-13+ (Apr 16 low).

- Cash Treasury curve has bear-steepened today with yields 1-4bps higher, the 2Y yield is +1.6bps at 5.001%, 10Y +3.5bps to 4.656%, while the 2y10y was +1.951 at -34.985.

- Across local rate markets, NZGBs are 6-7bps higher, ACGBs are 5-7bps higher and JGBs are 1-4bps higher, in the EM space INDON & PHILIP yields are 1-5bps higher.

- Projected rate cut pricing held largely steady vs. late Thursday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -13.5% w/ cumulative rate cut -4.5bp at 5.283%. July'24 cumulative at 12.1bp, Sep'24 cumulative -23bp.

- Looking ahead: Chicago Fed Nat Activity Index later Today

JGBS: Swaps Curve Bear-Steepens, US Tsys Continue To Pare Haven Bid, 2Y Supply Tomorrow

JGB futures are weaker and at session lows, -46 compared to the settlement levels.

- The local calendar is empty today, ahead of Jibun Bank PMIs and 2-year supply tomorrow.

- The market’s focus this week, however, is the BoJ Policy Decision on Friday. No policy adjustment is anticipated at the two-day meeting ending on April 26, following last month's decision to raise rates for the first time since 2007.

- (MNI) Bank of Japan officials believe the weak yen will drive an inflation rebound over the northern summer, sooner than bank economist expectations of an autumn bottom. This could drive the Board to consider raising its policy rate pre-emptively to keep ahead of the curve, MNI understands.

- BOJ officials would prefer gradual rate increases over rapid hikes, which would considerably worsen economic activity.

- The Bank estimates underlying inflation at about 1.7%, below its 2% price target, but the weak yen could boost that to 2% via the pass-through to imported goods. (See MNI link)

- Cash US tsys are 2-4bps cheaper across benchmarks, with a steepening bias, as the market continues to pare the rally instigated by Israel’s attack on Iran on Friday.

- Cash JGBs are cheaper across the curve, with the 7-year underperforming (yield +3.6bps). The benchmark 10-year yield is 3.1bp higher at 0.882% versus the YTD high of 0.891%.

- The swap curve has bear-steepened, with rates 1-4bps higher. Swap spreads are mixed.

AUSSIE BONDS: Cheaper, Narrow Ranges, Tracking US Tsys As Haven Bid Fades

ACGBs (YM -8.0 & XM -8.0) are cheaper after dealing in relatively narrow ranges in today’s Sydney session. With the domestic calendar empty, local participants have taken their directional lead from US tsys. In today’s Asia-Pac session, cash US tsys are 2-4bps cheaper.

- The latest round of ACGB Sep-26 supply prints through prevailing mids, extending the recent trend of firm pricing at ACGB auctions. It's noteworthy that the cover ratio saw a noticeable decline. It's essential to recognise, however, that the outright yield was 30-35bps lower than the level in October 2023.

- Optimism regarding the RBA's policy outlook, coupled with the bond's inclusion in the YM basket, likely bolstered demand at today’s auction. However, the looming release of Q1 CPI figures on Wednesday probably exerted a counterbalancing influence.

- Cash ACGBs are 7-8bps cheaper, with the AU-US 10-year yield differential 1bp lower at -33bps, hovering near a cycle low.

- Swap rates are 6-7bps higher.

- The bills strip has bear-steepened, with pricing -1 to -9.

- RBA-dated OIS pricing is 1-7bps firmer for meetings beyond June, with mid-2025 leading. A cumulative 18bps of easing is priced by year-end.

- Tomorrow, the local calendar sees Judo Bank PMIs, ahead of Q1 CPI on Wednesday.

NZGBS: Cheaper But Outperforms Its $-Bloc Counterparts

NZGBs closed on a soft note, with benchmark yields 6-7bps higher. With the domestic calendar empty today, the local market has tracked US tsys’ cheapening in today’s Asia-Pac session.

- Cash US tsys are 2-4bps cheaper across benchmarks, with a steepening bias, as the market continues to pare the rally instigated by Israel’s attack on Iran on Friday.

- Nevertheless, the NZGB 10-year has outperformed its $-bloc counterparts, with the NZ-US and NZ-AU 10-year yield differentials 4bps and 2bps tighter, respectively.

- Swap rates closed 6-7bps higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed is 5-11bps firmer for meetings beyond July, with late-2024/early-2025 leading. A cumulative 49bps of easing is priced by year-end.

- The local calendar is empty until Trade Balance data on Wednesday. Also on Wednesday, Australia will release Q1 CPI data.

FOREX: Yen Underperforms Amid Risk Rebound, Equities/US Yields Higher

The BBDXY sits around 0.10% lower in the first part of Monday trade, the index back near 1263. This keeps us within recent ranges for the index. Better risk appetite has weighed on USD sentiment today, as sentiment stabilizes/improves post Friday's dip.

- Lack of fresh military action re Israel/Iran has aided sentiment, while the US house passing a weekend aid bill for Ukraine, Israel and Taiwan, has also been in focus.

- US equity futures opened higher and have stayed in the green. We were away from highs in recent dealings, Eminis last around +0.30%, while Nasdaq futures were +0.45%.

- US yields are higher, +2-4bps firmer across the curve, as Tsys lose the safe haven bid. 2yr yields are pressing marginally above 5%. This has helped drive yen underperformance. USD/JPY was last close to 154.70, although we haven't tested last week's cyclical high at 154.79 yet. There is also a reasonable option expiry at 155.00 for NY cut later ($1.4bn).

- AUD and NZD are both higher, but away from best levels. NZD/USD is up near 0.40%, last close to 0.5915. Earlier highs were at 0.5929. Likewise, AUD/USD rallied to 0.6455 earlier, but we now sit back at 0.6435/40, still +0.30% firmer for the session.

- Looking ahead, the Chicago Fed activity index for March, and the ECB’s Lagarde and BoE’s Benjamin speak. Key US data, including Q1 GDP and March core PCE prices, are released this week.

ASIA EQUITIES: HK Equities Soar After China’s Regulator Pledges Support

Hong Kong and China equity are mixed today with Hong Kong equities outperforming today led higher by the five measured announced by the CSRC on Friday, while Investors are also breathing a sign of relief after seeing no escalation of tensions in the middle east. In the property space Sunac China shares climbed as much as 11% after one of its residential housing projects in Shanghai sold out in one day. There has been little else in the way of market headlines, while China kept the LPR rates steady. Focus this week will turn to corporate earnings, with a light economic calendar for the remainder of the week

- Hong Kong equities are surging higher today with the HSTech Index up 1.95% sellers are still in control with the index trading below all Major EMA levels, while the 14-day RSI sits below 50 although it is off lows, the Mainland Property Index up 1.82%, while the HSI is up 1.74% and is now testing the 100-day EMA with a break here setting up a retest of the 200-day EMA at 17,266. China Mainland equities are underperforming this morning, with the CSI300 down 0.22% the index has been rangebound since early Feb trading between the 100 & 200-day EMA, small-cap indices are mixed with the CSI1000 unchanged while the CSI2000 is down 0.50%.

- China Northbound saw an outflow of 6.48b on Friday, momentum has been decreasing over the past week with the 5-day average at -1.33billion, while the 20-day average sits at -1.36billion yuan.

- The US House passed legislation compelling ByteDance to divest its ownership stake in TikTok, linking it to an aid package for Ukraine and Israel, amidst concerns about data privacy and Chinese propaganda, with ByteDance intending to exhaust legal challenges before considering divestiture.

- China's securities regulator announced five measures to promote Chinese companies listing in Hong Kong, including supporting IPOs by leading firms, loosening stock trading link rules, widening the scope of eligible exchange-traded funds, and supporting the inclusion of yuan-denominated stocks for mainland investors. This move aims to maintain Hong Kong's unique status as an international financial hub and comes after a decline in IPOs last year and questions about its future as a finance center.

- Looking ahead, HK CPI Composite On Tuesday & Trade Balance on Thursday

ASIA PAC EQUITIES: Asian Equities Rebound From Friday's Sell-Off

Regional Asian equities are mostly higher today recovering from Friday's losses triggered by geopolitical tensions in the Middle East eased and a broad selloff in US tech shares, caused by Nvidia's significant decline of 10%. Regional equity benchmark’s month-to-date have declined to less than 5%, while investors will turn their focus to corporate earnings and economic data, with US GDP figures and the Federal Reserve’s preferred measure of inflation due this week and the BoJ holds a policy meeting this week. Indonesian has reported a bigger trade surplus than expected, while Taiwan will released Unemployment data later. In cross-asset, yields have ticked up with the US 2yr now trading back above 5%, while the USD is down against most G10 currencies.

- Japanese stocks bounced back today, recovering from last week's downturn amid easing tensions in the Middle East. The Nikkei 225 index is 0.34% higher to 37,193 and is holding just above the 100-day EMA, while the broader Topix is up 0.80% at 2,648. Toyota Motor and Bank stocks have fueled the Topix's gains. However, caution prevailed, particularly in chip-related stocks, following underwhelming orders at ASML Holdings and a cautious outlook from TSMC, which explains the underperformance by the Nikkei. Investors are also monitoring government actions to support the yen, which has been hovering near its weakest level since 1990 at 154.69.

- South Korean equities are higher today, and now trades unchanged for the year. The Kospi traded below the 200-day EMA for the first time since Mid Jan, however has bounced back up 0.87% to 2,614 today and is now testing the 100-day EMA at 2,619. Focus this week will be on Wednesday when GDP is released.

- Taiwan equities were hammered on Friday and were by far the worst performing market in the region as TSMC forecast and Israel/Iran conflict were the main catalysts for the sell-off. The Taiex has reversed earlier gains to now trade down 0.10%, the index is now off 6.55% from recent highs and is trading below the 50-day EMA. Later today Unemployment and Export Orders are due out

- Australian equities are higher today and have erased all of Friday's sell-off, energy is the only sector lower today after being the top performing sector on Friday while Financials and Mining stocks are the top performers today. The ASX200 is up 0.93% and is now testing the 50-day EMA, looking ahead CPI is due out on Wednesday.

- Elsewhere in SEA, New Zealand Equities are up 0.25%, Singapore equities are 1.38% higher, Malaysian equities up 0.60% and Philippines equities are 0.45% higher, while Indonesia reported a Trade surplus at $4.47b (estimate +$1.225b) in March vs $867m in Feb, equities have traded down 0.70%

ASIA EQUITY FLOWS: Investors Dump Asian Equities, Middle East Tension Rise, Tech Slides

- China equities marked five of the past six days of outflows on Friday for a total outflow of 14.8b yuan. Local markets were all in the red on Friday, as Israel launched an attack on Iran, the CSI300 again tested the 3600 and 200-day EMA levels on Thursday but again failed to break above it. Flow momentum continues to track into the negative territory with the 5-day average now -1.33b, 20-day average at -1.36b and the longer term 100-day average now 0.35B yuan.

- Taiwan equities have marked the seventh straight day and the third largest daily outflow on record as foreign investors sell a total of $6.4b for that period. TSMC forecast, Israel/Iran conflict topped with consistent warnings from Taiwanese officials about inflated equity values have all contributed to the outflows. The 5-day average is now -$1.17b, vs the 20-day at -$381m well below the longer-term trend of $71m, although the longer-term trend is quickly losing momentum.

- South Korea equities saw their largest outflow in a month as $509m left the market and marked the five of the past six trading days of net outflows. Like other markets, the move was largely driven by a sell-off in risk assets as tensions in Israel and Iran grew. The Kospi is off 6.75% from recent highs, however the index again bounced off the 200-day EMA. The 5-day average is now -$114m, the 20-day average to $178m and the 100-day average to $176m.

- Philippines equities continue to see outflows with $11.5m leaving the market on Friday making it 11 straight days of outflows for a total of $119m. Equity prices have fell 1.23% on Friday and the PSEi has now closed the week below the 200-day EMA at 6,443. The 5-day average is -$11.5m, the 20-day average is -$6.48m, while the 100-day average continues to edge lower now at $1.11m.

- Indonesia had a $51m outflow on Friday taking it to a 13-day streak of net selling by foreign investors for a total of $985m. The JCI traded below the 200-day EMA on Friday and closed the week just below it at 7,087. The 5-day average is now -$103m, the 20-day average is -$41m, while the longer term 100-day average is still positive at $14.7m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -6.5 | -6.7 | 46.2 |

| South Korea (USDmn) | -510 | -574 | 13762 |

| Taiwan (USDmn) | -2733 | -5866 | -1722 |

| India (USDmn)** | -498 | -1841 | 449 |

| Indonesia (USDmn) | -52 | -514 | 825 |

| Thailand (USDmn) | -102 | -234 | -1951 |

| Malaysia (USDmn) ** | -29 | -315 | -607 |

| Philippines (USDmn) | -11 | -57.5 | 66 |

| Total (Ex China USDmn) | -3935 | -9402 | 10821 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 18th |

GEOPOLITICS: US Bill Targeting World’s Major Tensions Passes House

There was no further escalation of tensions in the Middle East over the weekend after an alleged Israeli attack on Iran’s third largest city Isfahan, where drones/missiles are manufactured. In terms of the other major conflict, the US House passed the foreign aid bill to provide help to Ukraine.

- Iran downplayed the incident in Isfahan and Israel hasn’t confirmed it but satellite footage shows likely damage to an air base, according to the BBC. Markets viewed the strike as a warning shot from Israel and were relieved as prices normalised but they remain wary.

- The US foreign aid bill finally passed through the House on the weekend and is expected to pass the senate this week. It included $61bn of military help for Ukraine. Nato also approved air defence support for the besieged nation. It is hoped to slow Russia’s recent advance. There was also $9bn of economic assistance in the form of loans that won’t have to be repaid.

- The bill also included $17.3bn of military support for Israel and $9.1bn of humanitarian aid for Gaza. There was also $8.1bn for APAC, including Taiwan.

- Also, new sanctions against Iran were included in the bill. It will extend measures to include ships and refineries that process and transport Iranian crude. It will also cover all transactions to finance the purchase of oil products between China’s financial institutions and Iranian banks facing sanctions.

- There are reports that the US is considering sanctions against a conservative Israeli army unit for alleged human rights abuses, according to the BBC. PM Netanyahu has said he would fight them.

- There were explosions at a pro-Iranian militia base in Iraq, but the Iraqi military said that drones or planes had not been detected in the area at the time. The militia has said it was an attack though but the US has denied any involvement.

OIL: Crude Lower As Markets See Tensions Easing

Oil prices have eased during APAC trading as risk appetite improved on the back of the assessment that the risk of an escalation in the Middle East has been reduced but markets remain alert to any change in this detente. WTI is down 0.8% to $81.60/bbl, close to the intraday low of $81.43. It reached a high of $82.11 early in the session. Brent is 0.7% lower at $86.65, after a low of $86.45 and high of $87.15.

- New sanctions against Iran were included in the foreign aid bill passed by the US House on the weekend. It will extend measures to include ships and refineries that process and transport Iranian crude. It will also cover all financial transactions for the purchase of oil products between China’s financial institutions and Iranian banks facing sanctions.

- EU foreign ministers will discuss additional sanctions on Iran at their meeting today.

- Later the Chicago Fed activity index for March, and the ECB’s Lagarde and BoE’s Benjamin speak. Key US data, including Q1 GDP and March core PCE prices, are released this week.

GOLD: Lower As Iran Downplays Israeli Attack

Gold is 0.9% lower in today's Asia-Pac session, after closing 0.5% higher at $2391.93 on Friday.

- Early on Friday bullion had spiked to an intra-day high of $2,418/oz following Israel’s missile strike on Iran. That gain was subsequently pared after Iran downplayed the attack.

- That left US Treasuries to focus on ongoing strength in US economic data and the potential for rate cuts to be pushed further out this year. The Fed entered its media Blackout regarding policy on Friday.

- Nevertheless, the yellow metal finished last week up 2.0%.

- US Treasury yields are 2-4bps higher in today's Asia-Pac session.

- According to MNI’s technicals team, the technical outlook for gold is still bullish and the next objective continues to be at $2452.5, a Fibonacci projection. Initial firm support is at $2293.4, the 20-day EMA.

SOUTH KOREA: First 20-days Of April Trade Shows Healthy Export Trend, But Wider Trade Deficit

The first 20-days of trade data for April held close to equivalent March levels, the print coming in at 11.1% y/y (11.2% for first 20-days of March). Imports were up 6.1% y/y, while the first 20-days trade deficit was -$2.65bn. Note for the first 20-days of March the trade deficit was -$711mn.

- The trade position does tend to improve in the final 10 or so days of the month. For the full month of March the trade position was a surplus of just under $4.3bn. Still, some deterioration in April is consistent the recent move lower in South Korea's terms of trade proxy (per Citi).

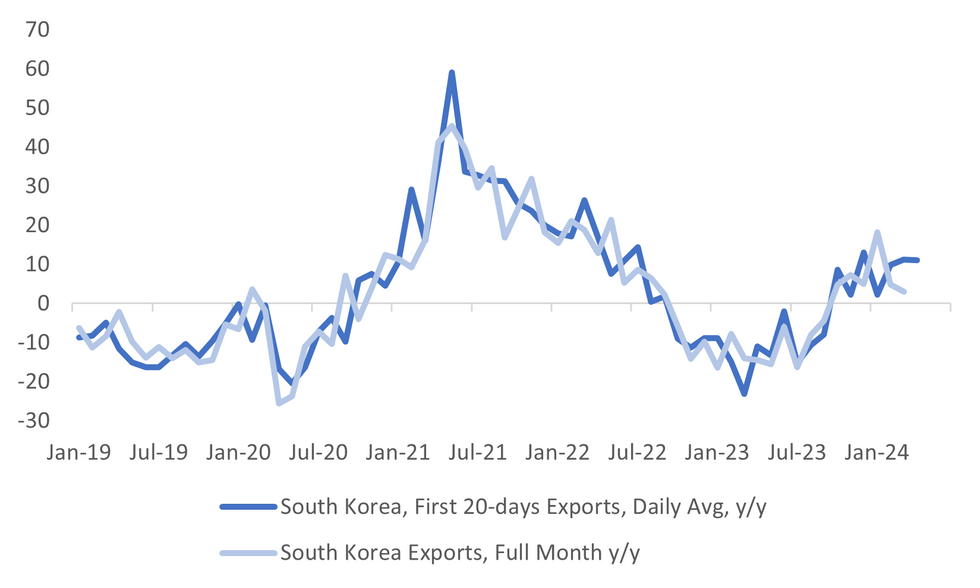

- This, at the margins, is taking the gloss of the continued export recovery. The chart below plots the first 20-days of exports y/y (in daily average terms) versus full month exports y/y.

- The detail looked firm in terms of the export rise, with chip exports up 43% y/y, albeit down slightly from the 46.5%y/y rise seen in March (first 20 days). Exports to China also rose 9% y/y in the first 20 days of the month, versus 7.5% prior. To the US, exports rose 22.8% y/y, also a step up from the prior month.

- Won weakness looks stretched in y/y terms compared with the improved export backdrop, although other factors are clearly providing an offset -pushing out of easier Fed expectations coupled with rising energy costs/Middle East tensions.

Fig 1: South Korea Exports Y/Y First 20 days & Full Month

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Mixed, Spot USD/CNY Firms Above 7.2400

USD/Asia pairs are mixed, despite a general risk on tone, particularly in terms of the major currencies. Oil prices are lower, as Middle East tensions recede, but offsets have come from firmer US yields, while spot CNY and JPY have weakened a touch. Regional equity sentiment is mostly stronger, albeit with some pockets of weakness, most notably in China and Taiwan (amid tech headwinds). Spot PHP and IDR have risen, while THB and TWD have been laggards. Still to come today is Taiwan export orders, while tomorrow we have South Korea PPI, Singapore CPI, India PMIs and Taiwan IP.

- USD/CNH sits just above 7.2500, having been range bound for the session. USD/CNY has edged above 7.2400, continuing to track close to the top end of the trading band (7.2464 today). As expected, the LPRs were left unchanged. Local equities may be weighed at the margin given US-China tensions were in focus late last week.

- 1 month USD/KRW sits around 0.40% firmer, last near 1378, slightly under session highs. The pair again found support in the low 1370 region, with highs near 1400 marking the topside. Onshore equities are higher to the tune of 0.80%, while earlier data showed continued export momentum in April, albeit with a potentially wider trade deficit for the month.

- Spot USD/TWD has hit fresh highs, above 32.60, around 0.20% weaker in TWD terms. This is fresh highs back to 2016. A weaker equity trend, as outperformance in the tech space has been unwound to some degree has weighed on TWD. Last week saw nearly -$5.9bn in weekly equity outflows from offshore investors. Later on today we get export orders for March.

- USD/THB continues to track higher, last near 36.94, slightly off session highs but still close to the 37.00 level. This is fresh highs back to Oct last year. We have seen little signs of a pull back despite broader USD sentiment moving off its highs recently. Negative April seasonality could still be playing a role. Note Oct highs from last year came in at 37.24.

- USD/PHP sits slightly off recent highs (57.60), last just under 57.47. Some relief from lower oil prices is likely, although this doesn't appear to benefiting other parts of the region. US-Philippines military exercises will be a focus point given tensions with China.

- USD/IDR spot sits lower, last near 16215 against recent highs of 16288. We are around 0.25% stronger in IDR terms. We have had March trade data print, with the trade surplus at nearly +$4.5bn. This is in line with a higher terms of trade outlook in recent months. Export growth was -4.19% y/y, against a -10.73% forecast. Still most focus is likely to rest on Wednesday's BI decision. The consensus looks for no change, but it could be a close call given recent rupiah weakness.

INDONESIA DATA: March Trade Surplus Widens But Q1 Narrower

Indonesia’s March trade surplus widened more than expected due to stronger exports and weaker imports, but both still contracted on the year. The surplus rose to $4.47bn from $0.83bn in February with exports declining 4.2% y/y up from -9.6% but imports down 12.8% y/y after rising 15.8%.

- Given recent rupiah weakness, Bank Indonesia is likely to be reassured by the largest surplus since February last year, assuming it is sustained, but Q1 was almost $5bn lower than Q1 last year. BI meets on April 24 and is expected to leave rates at 6% but around a quarter of analysts are forecasting a 25bp hike. USDIDR is up 2.3% this month and is currently trading around 16215, down from Friday’s close of 16255.

- Non-oil & gas exports improved to -4.2% y/y from -10.3% while gas fell -8.7% but improved from -19%. Coal and palm oil exports rose on the month. Q1 exports though were down 7.3% y/y.

- Non-oil & gas imports fell 16.7% y/y after rising 14.4%, which was driven by a sharp 19.5% y/y drop in goods from China. Consumer goods imports rose 5% y/y signalling continued robust private consumption, but capital goods fell 21.7% and raw materials -12.6% y/y. Q1 GDP is released on May 6.

INDONESIA: INDON Sov Curve Flatter, Trade Surplus Soars, BI Decision Wednesday

The Indonesian sov curve is flatter today, with the belly of the curve performing the strongest, after weakening last week. Indonesia's trade surplus for march soared, while Bloomberg has changed their view and now sees BI raising rates on Wednesday.

- The INDON sov curve is flatter today, the 2Y yield is 2bps higher at 5.29%, 5Y yield is 1.5bps higher at 5.325%, the 10Y yield is 3bps higher at 5.475%, while the 5-year CDS is off highs from Friday now at 80bps

- The INDON to UST spread diff has tighten over the day erasing the move widen made on Friday with the 2Y now 29bps (-4.5bps), 5yr is 63bps (-3.5bps), while the 10yr is 83bps (-4bps)

- In cross-asset moves, the USD/IDR is down 0.25% at 16,215, the JCI is 0.70% lower, Palm Oil is down 0.25%, while US Tsys yields are 1-4bps higher with curves bear-steepening

- Indonesia's trade surplus for March soared to its highest level since February 2023, surpassing economist estimates, driven by a larger-than-expected decline in imports. Exports fell on an annual basis due to decreased non-oil and gas exports, while imports experienced a notable decline, particularly in machinery and mechanical equipment shipments

- Bloomberg believes BI is likely to raise its key rate by 25 basis points to 6.25% to support the weakening rupiah, influenced by delays in US easing, heightened tensions in the Middle East, and rising inflation risks due to increasing costs. Despite strong domestic demand, the central bank aims to stabilize the currency, potentially leading to another rate hike given recent currency depreciation, this follows on from Barclay's calling for a rate hike on Friday.

- Looking ahead: Focus will turn to BI rate decision on Wednesday.

PHILIPPINES: PHILIP Curve Bear-Steepens, FinSec Suggest Rate Cuts May Be Delayed

- The PHILIP curve has bear-steepened over the day, yields are 1-3bps higher, the 2Y yield is 1.5bps higher at 5.16%, 5Y yield is 2bps higher at 5.38%, 10Y yield is 3bps higher 5.485%, while 5yr CDS is off highs made Friday at 67.5bps.

- The Philip to US Treasury spread difference is little changed in the front-end while the long-end has reversed the move widen made on Friday, the 2y is 16bps (unchanged), the 5yr is 69bps (-4bps), while the 10yr is 83bps (-4bp).

- Cross-asset moves: The USD/PHP is down 0.30% at 57.46, the PHP trades just off mulit-year lows, PSEi Index is up 0.30%, while US Tsys yields are 1-4bps higher with curves bear-steepening

- Philippine President Ferdinand Marcos Jr. has ordered the relaxation of rules on importing agricultural products like sugar to stabilize prices, streamlining administrative procedures and easing licensing requirements for importers, while also facilitating direct overseas purchases for registered industrial users. Food prices have been the major contributor to CPI.

- Philippine Finance Secretary Ralph Recto suggests that interest rate cuts may be delayed if the peso weakens further, but remains optimistic about economic growth, expecting it to range between 6% to 7% this year. The government plans to tap international debt markets to support higher spending amid trimmed economic growth forecasts and elevated interest rates.

- Looking Ahead, Budget Balance on Wednesday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2024 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/04/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 22/04/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/04/2024 | 1430/1030 |  | CA | BOC market participants survey | |

| 22/04/2024 | 1530/1730 |  | EU | ECB's Lagarde Lecture at Yale | |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/04/2024 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |