-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Appetite Softens As China 5yr LPR Held Steady

- US Tsys were pressured on Monday after China held the 5-Year LPR steady at 4.20%, a cut of 15bps had been expected. The 1-Year LPR was cut 10 bps when a cut of 15bps was expected. Cash tsys sit 1-3bps cheaper across the major benchmarks, the curve bear steepened.

- Regional equity sentiment has seen China and Hong Kong equities underperform post the above LPR moves. The USD has firmed against CNH and most other Asia FX pairs, while it also slightly higher against AUD and NZD. Commodities are mixed, with oil outperforming the modestly risk-off trend in Asia Pac markets today.

- Looking ahead, PPI from Germany headlines an otherwise thin docket on Monday. The data calendar this week is headlined by S&P Global Mfg and Services PMI on Wednesday and on Friday Fed Chair Powell speaks at the Jackson Hole Symposium.

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 109-15+, -0-05,a 0-08+ range has been observed on volume of ~64k.

- Cash tsys sit 1-3bps cheaper across the major benchmarks, the curve bear steepened.

- Tsys were pressured on Monday after China held the 5-Year LPR steady at 4.20%, a cut of 15bps had been expected. The 1-Year LPR was cut 10 bps when a cut of 15bps was expected.

- The move lower didn't follow through and losses were marginally pared, tsys dealt in a narrow range for the remainder of Monday's Asian session.

- PPI from Germany headlines an otherwise thin docket on Monday.

- The data calendar this week is headlined by S&P Global Mfg and Services PMI on Wednesday and on Friday Fed Chair Powell speaks at the Jackson Hole Symposium.

JGBS: Futures Dealing At Session Cheaps In Tokyo Afternoon Trade

In afternoon trade, JGB futures are dealing near Tokyo session lows, -14 compared to settlement levels.

- A thin local docket on Monday left participants on headlines and US tsys watch.

- US tsys have been pressured after China held the 5-Year LPR steady at 4.20%, a cut of 15bps had been expected. The 1-Year LPR was cut 10 bps when a cut of 15bps was expected. Regional equities are lower, and the USD is marginally firmer. Cash tsys sit 1-3bps cheaper across the major benchmarks, with the curve bear steepening.

- Bloomberg reports that the BoJ is purchasing government bonds at a record pace this year, a factor that likely prompted its recent move to allow larger yield movements to reduce the strain on its control of longer-term interest rates. (See link)

- Cash JGBs are cheaper, with yields 0.1-1.1bp higher. The benchmark 10-year yield is 0.8bp higher at 0.643%, above BoJ's YCC old limit of 0.50% but below its new hard limit of 1.0%.

- The swaps curve has bear steepened, with rates 0.2-2.0bp higher. Swap spreads are wider.

- Tomorrow the local calendar is empty, apart from Liquidity Enhancement Auction for OTR 5-15.5-Year JGBs.

AUSSIE BONDS: Weaker, Near Session Cheaps, Pressured By PBoC’s Decision To Leave The 5Y LPR Unchanged

ACGBs (YM -1.0 & XM -2.0) are weaker and near Sydney session cheaps. With the local calendar light today, local participants have been on headlines and US tsys watch.

- Against consensus expectations, the China 5-yr LPR was left unchanged at 4.20%, versus a forecast of 4.05%. The 1yr LPR was cut by 10bp to 3.45%. The consensus had been for this rate to fall to 3.40%. At the margin, the market was disappointed, particularly in terms of no change to the 5yr LPR rate, as these longer-term rates tend to feed into home mortgage rates etc. So, it may dent sentiment around expectations for the housing market.

- US tsys sit 1-3bp cheaper in Asia-Pac trade, with the curve steeper.

- The cash ACGB curve has bear steepened, with yields flat to 2bp higher. The AU-US 10-year yield differential is 4bp tighter at -3bp.

- Swap rates are flat to 1bp higher, with the 3s10s curve steeper and EFPs little changed.

- The bills strip is mixed, with pricing -1 to +1.

- RBA-dated OIS is little changed, with a 5% chance of a 25bp hike in September priced.

- This week the local calendar is very light, with Judo Bank PMIs on Wednesday being the only release.

NZGBS: Closed On A Weak, $-Bloc Bonds Pressured By China’s Unchanged 5Y LPR

NZGBs closed on a weak note, with benchmark yields finishing 2bp higher.

- $-bloc bonds US tsys have been pressured on Monday after China held the 5-Year LPR steady at 4.20%, a cut of 15bp had been expected. The 1-Year LPR was cut 10 bp when a cut of 15bp was expected.

- Swap rates closed flat to 1bp higher, with the implied long-end swap spread narrower.

- RBNZ dated OIS pricing closed 1-5bp firmer for meetings beyond November. Terminal OCR expectations nudged higher to 5.70%.

- NZ’s trade deficit widened to NZ$1.11bn in July. Exports to China and Australia declined respectively by 18.1% m/m (-24% y/y) and 9.4% m/m (+8.9% y/y). Dairy product exports fell 19% to NZ$1.48bn in July.

- Bloomberg reports that Westpac NZ economists expect the Treasury’s pre-election economic and fiscal update will project a wider budget deficit in the year through June 2024. They expect the 2023-24 forecast deficit to widen by NZ$4-5bn, with the 2023-24 borrowing program rising by ~NZ$6bn. (See link).

- Tomorrow the local calendar is empty, ahead of Q2 Retail Sales Ex-Inflation on Wednesday. Spending appetites likely remained subdued through the June quarter. The softness in retail spending reflects that high inflation and interest rate rises have squeezed households' purchasing power.

STIR: $-Bloc Near-Term Tightening Expectations Have Been Steady Over Past Week

Near-term tightening expectations have been steady over the past week in the $-bloc. The chances of a 25bp hike at the next policy meeting sit at:

- 11% for Sep 20 (FOMC);

- 34% for Sep 6 (BoC);

- 4% for Sep 5 (RBA); and

- 19% for Oct 4 (RBNZ).

Figure 1: $-Bloc STIR

Source: MNI – Market News / Bloomberg

EQUITIES: Lower Than Expected LPR Cut Weighs On China Shares

Regional equity trends are mixed, with HK and China markets mostly under pressure, while trends elsewhere are somewhat more encouraging, albeit in selective markets. US equity futures have been range bound, Eminis drifting sideways and last near 4384, slightly firmer for the session (Friday's low came in at 4350). Nasdaq futures are also up a touch, last near 14763. Both indices ticked down after China held the 5-yr LPR steady.

- The 1yr LPR was cut, but by 10bps, more was expected, with the consensus looking for a -15bps cut. The bigger surprise though was the 5yr LPR held steady at 4.20%, against a -15bps cut expectation.

- These moves have weighed on China equities, with the CSI 300 down 0.52% at the break and comfortably sub the 3800 level. The real estate sub index is down 1.17% at this stage. In HK the HSI is down 1.38% at the break.

- Japan stocks have fared better the Topix last up 0.50%, the Nikkei 225 +0.75%. Sentiment has recovered from the earlier dip post the China LPR announcements. Toyota gains have aided broader sentiment, along with gains in information and communication.

- The Kospi is doing better, after faltering late last week. The index is up +0.60%, away from the 2500 level. The Taiex is close to flat at this stage. In SEA, trends are mixed, with major markets not too far from flat at this stage.

FOREX: Narrow Ranges In Asia

There have been narrow ranges across G-10 FX in Asia today, as moves have had little follow through. The USD firmed off early session lows after China held the 5-Year LPR steady at 4.20%, a cut of 15bps had been expected. The 1-Year LPR was cut 10 bps when a cut of 15bps was expected.

- Kiwi is the weakest performer in the G-10 space at the margins. Pressure was seen on NZD after the Chinese LPR decisions however support came in ahead of YTD lows and losses were pared.

- AUD/USD is holding above the $0.64 handle dealing in a narrow range for the most part on Monday. Technically the trend remains bearish, support comes in at $0.6365 Aug 17 low and $0.6285 low from Nov 4 2022. Resistance is at $0.6480, high from Aug 16.

- Yen is little changed from opening levels, moves have had little follow through in today's Asian session. The uptrend in USD/JPY remains intact, resistance is at ¥146.56 (high from Aug 17) and ¥146.93 (8 Nov 22 high). Support comes in at low from Aug 18 ¥144.93.

- Elsewhere in G-10 EUR and GBP are marginally firmer

- Cross asset wise; BBDXY is marginally firmer and 10 Yr US Tsy Yields are up ~2bps.

- July PPI from Germany headlines an otherwise thin docket on Monday.

OIL: Outperforms Broader Risk Sentiment Today

Brent crude is tracking higher today, last near $85.35/bbl, down slightly from session highs of $85.66/bbl. We opened at $84.80/bbl. This puts Brent around 0.65% above Friday closing levels in NY, which if maintained would be the third straight session of gains. WTI last tracked near $81.90/bbl, slightly firmer for the session so far at +0.80%.

- Oil moves today have slightly outperformed the broader risk tone in markets, particularly post the surprise hold in China's 5yr LPR rate. Regional equities are mixed, while the USD indices are steady, albeit with the USD outperforming some higher beta plays.

- Oil's resilience may be more reflective of tighter supply conditions biting. Outside of the well documented OPEC+ cuts, the US rig count is down to 520, its lowest level since early 2022.

- There are also some signs of concerns around diesel supply as we head into the winter months for the northern hemisphere, which may be spilling over into Brent/WTI.

- For Brent, on the downside, lows from last week came in near $83/bbl, while the 200-day EMA is near $82.75. On the topside, earlier August highs rest just above $88.00/bbl.

GOLD: Slightly Higher Today After A Torrid Week

Gold is slightly higher in the Asia-Pac session, after closing basically unchanged at $1889.31 in trade ahead of the weekend. Friday’s close capped off a torrid week for the yellow metal, as the USD appreciated fuelled by higher US yields and EM-related frailties.

- It was a quiet end to the week for US tsys, with no economic data or Fed speakers. US tsys finished 1bp cheaper to 2bp richer across the major benchmarks on Friday.

- There is no US economic data of note today either. Market participants await details on this week's KC Fed Economic Policy Symposium in Jackson Hole: ‘Structural Shifts in the Global Economy,’ from August 24 to August 26 (schedule/attendees list is likely announced on the evening of the 24th).

- MNI’s technicals team reports that bullion sits around Friday’s close but has breached key support at $1893.1 (Jun 29 low). This signals scope for $1865.8 (76.4% retrace of Feb 28 – May 4 bull leg).

ASIA FX: USD/CNH Firms On Weaker Equity Tone As 5yr LPR Held Steady

Most USD/Asia pairs have gravitated higher today, with USD/CNH rebounding from the low 7.3000 region, due to weaker equity sentiment post the steady 5yr LPR decision. THB has outperformed though, while USD gains have been relatively modest elsewhere. Taiwan export orders are still to come later today. Tomorrow, we get South Korea consumer confidence, along with Indonesia's Q2 BOP.

- USD/CNH has pushed above Friday session highs. We sit at 7.3260/70 currently, against an earlier high of 7.3283. Lows were close to 7.3020 in earlier dealing. Some disappointment around the 5yr LPR being held steady (the economic consensus looked for a 15bps cut) has weighed on local equity sentiment. This has spilled over to CNH FX, but we would expect reasonable resistance on any move into the 7.34/7.3500 region, which marked highs from last week.

- USD/THB has shrugged off a weaker than expected Q2 GDP print, which also saw the officials revise down their 2023 growth estimate, to track at fresh lows for the session. The pair last near 35.25, around 0.35% stronger in baht terms versus closing levels from the end of last week. Recent highs come in around 35.60, while the 20-day EMA is just under 35.00. Tomorrow the PM vote is expected, with Pheu Thai expected to announce the parties backing its PM candidate ahead of the vote.

- Spot USD/HKD is just a touch below recent highs, last near 7.8345. The broad uptrend in the pair has been maintained. Friday lows around the 7.8250 region were supported. Late June highs aren't too far away, which come in around 7.8390, beyond that is earlier June highs around 7.8440, then the top of the peg band at 7.8500. On the downside, the 200-day EMA is near 7.8300, the 100-day at 7.8265.• A move back below the 20-day, near 7.8200, is likely required to unwind current bullish momentum. Spill over from higher USD/CNH levels has also been a factor today.

- USD/INR is a touch softer this morning however the pair is holding above the 83 handle in early trade on Monday. The pair extended gains seen in early August rising ~0.3% last week as broader USD trends dominated flows. We sit a touch off the highest level since 20 Oct 22. Moody's affirmed India's rating at Baa3, the lowest investment grade score. The outlook remains stable. The docket is empty this week with no data due.

- The SGD NEER (per Goldman Sachs estimates) sits a touch off its highest level since 10 Aug, we sit ~0.7% below the top of the band. USD/SGD is holding a narrow range below the $1.36 handle, broader USD trends continue to dominate flows in recent sessions. Wednesday's July CPI print provides the highlight this week, headline CPI is expected to tick lower to 4.2% Y/Y and Core to 3.8% Y/Y. Industrial Production on Friday rounds off the week, a fall of 4.4% Y/Y is expected.

- USD/MYR prints at 4.66510/4.6550, the pair is little changed from Friday's closing levels in a muted start to today's dealing. The pair sits a touch off its highest level since mid-July as August's gains are consolidated in a narrow range on Monday. USD/MYR is up ~3.3% in August. July CPI headlines this week, a downtick to 2.1% Y/Y is forecast. Also on the wires is Aug 15 Foreign Reserves which crosses tomorrow.

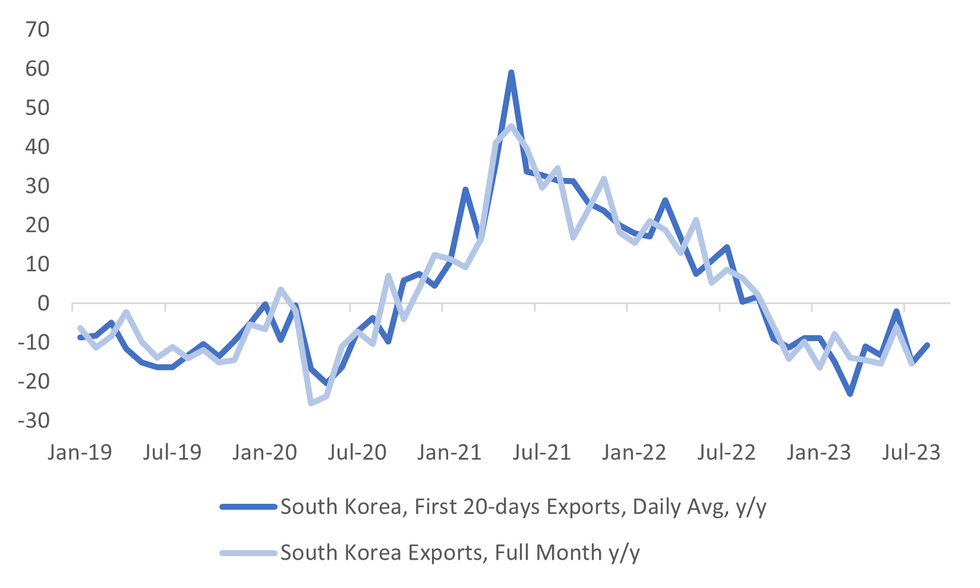

SOUTH KOREA: Exports Still Printing Negative Y/Y, Trade Deficit Widens In First 20-days Of August

South Korea's first 20-days of trade data for August was reasonably close to prior outcomes. For exports we printed at -16.5% y/y, the prior outcome being -15.2%. Note full month exports y/y for July were -16.5%. On the import side we were at -27.9% y/y, prior was -28.0% (full July month -25.4%). The trade deficit printed at -$3.566bn for the first 20-days of August.

- The headline export number takes us back towards recent lows from early in 2023/late last year. We were slightly better on a daily average basis, with exports down -10.7% y/y. The chart below shows that this suggests a slightly less adverse y/y backdrop for the full August month print.

- The detail indicated that chip exports were down -24.7% y/y, versus -35.4% prior. While exports to China fell -27.5%y/y. The US also slipped back to -7.2% y/y, from -7.3% in July.

- The trade deficit does tend to improve in the final part of the month, so the full August number should be better than the first 20-day outcome. Still, note that the first 20-days trade deficit for July was -$1.361bn, so for August we have seen a re-widening.

Fig 1: South Korea Exports - First 20-Days Versus Full-Month Y/Y

Source: MNI - Market News/Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/08/2023 | 0600/0800 | ** |  | DE | PPI |

| 21/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 21/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/08/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 22/08/2023 | 0600/0800 | ** |  | NO | Norway GDP |

| 22/08/2023 | 0800/1000 | ** |  | EU | EZ Current Account |

| 22/08/2023 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 22/08/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 22/08/2023 | - | * |  | FR | Retail Sales |

| 22/08/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/08/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/08/2023 | 1400/1000 | *** |  | US | NAR existing home sales |

| 22/08/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 22/08/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/08/2023 | 1830/1430 |  | US | Chicago Fed's Austan Goolsbee | |

| 23/08/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.