-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk Assets Off Lows, JGBs Probing Key Levels

- Equities and crude pared early losses in Asia, with little in the way of macro headline flow driving the move. Early pressure may have came in the wake of a loose warning from U.S. Tsy Sec. Yellen re: the valuation of some sectors within the equity space.

- PBoC continued to drain LNY-related liquidity out of the market.

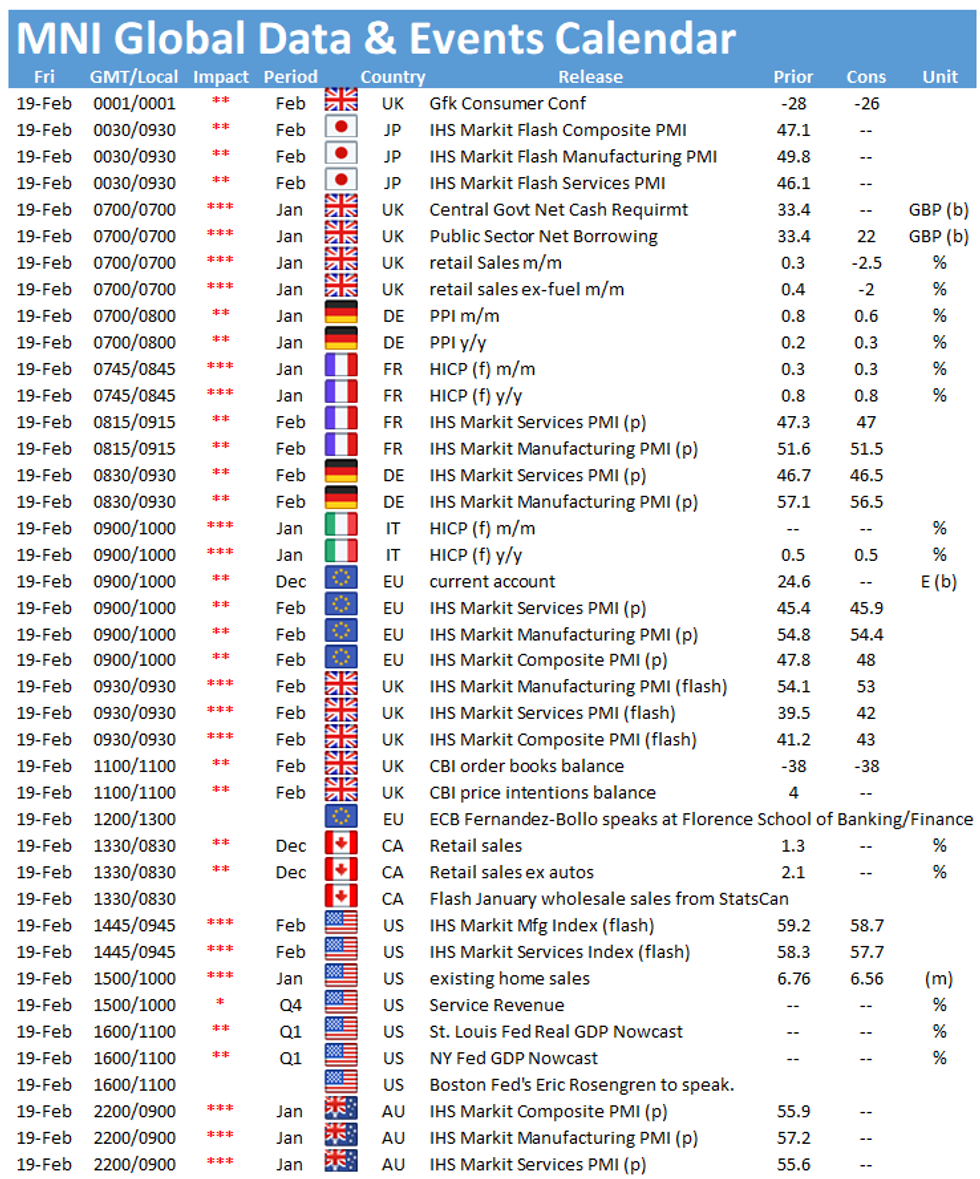

- Flash Eurozone PMIs headline during European hours on Friday.

BOND SUMMARY: Core FI Unchanged To Lower Overnight

T-Notes stuck to a tight 0-03+ range in Asia-Pac hours, with the contract last printing -0-01+ at 135-26. The cash space has seen some marginal bull flattening in the wake of yesterday's bear steepening, leaning on the downtick in equity and crude oil markets during the timezone. The impetus in the equity/crude move has waned into European hours. On the flow side, there was a 20K block in the FVJ1 125.50/124.50 risk reversal, which looked to be buying the puts to the sell calls. Flash Eurozone PMI data will likely set the tone ahead of NY hours on Friday, with the equivalent U.S. readings set to hit later in the day. Elsewhere, Fedspeak from Barkin & Rosengren will cross.

- JGB bears continued to test the 0.10% level in 10-Year JGB yields, with futures closing -11, after threatening, but ultimately failing to make a clean break below the June '20 lows. The aforementioned benchmark hasn't printed sustainably above the 0.10% level since H218. The belly underperformed in cash trade. Japanese CPI data for January was virtually in line with expectations and wasn't as soft as the readings witnessed in December. The latest round of 1-10 Year BoJ Rinban ops saw the purchase sizes left as they were, with the offer/cover ratios nudging lower. 10-25+ Year BoJ Rinban ops and services PPI data headlines Monday's local docket.

- YM -2.0 and XM -6.5 in Sydney at the close. The space looked through softer than expected local retail sales data and a firm round of ACGB Nov '25 supply, with the latter's average yield printing ~0.9bp through prevailing mids at the time of supply (per BBG pricing). The weekly AOFM issuance slate revealed a lone round of ACGB supply next week, in yet another change up to the weekly format. The AOFM will auction A$2.0bn of ACGB 2.50% 20 September 2030. Weakness was seen into the close, as Westpac lifted their target "for the U.S. 10-Year bond rate by end 2021 from 1.50% to 1.80%. In turn the expected rate by end 2022 has been increased from 1.75% to 2.40%. We expect that higher rate profile to persist right out to end 2024 when we see the U.S. 10-Year bond rate settling at around 3.00% (reaching a sustainable peak before the first rate hike by the Fed). That next cycle can be expected to be more gradual than previous cycles. In turn that adjustment boosts our forecast for Australian 10-Year bonds to 1.90% by end 2021, from 1.55%; 2.50% by end 2022; and 3.15% by end 2024."

FOREX: Lower Oil Hits Commodity Currencies

Oil was sharply lower in the Asia-Pac session amid signs that supply will return shortly as adverse weather conditions look set to abate in the coming days.

- CAD and NOK were the biggest losers amid the decline in oil, other commodity currencies also struggled.

- AUD and NZD are both lower, negative data from the region compounding downward pressure. IHS Markit PMI in Australia slipped, while retail sales were below estimates. In New Zealand the January activity index rose 0.8% Y/Y, but the statement from the treasury accompanying the release said the recovery could be starting to plateau.

- JPY pairs moved in a tight range, data showed CPI fell in-line with estimates while Japan PMI rose, manufacturing rose above 50 and is back in expansionary territory. The BoJ kept rinban ops unchanged.

- Offshore yuan weakened, despite a fix below sell-side estimates. The PBOC fixed USD/CNY at 6.4524, 32 pips below sell side estimates and only the ninth lower miss of 2021 so far. The central bank used local media to emphasise it was not considering tightening policy.

- GBP/USD has retreated from highs after rallying yesterday. UK GfK Consumer Confidence for February came in at -23 against -28 expected.

FOREX OPTIONS: Expiries for Feb19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E525mln-EUR puts), $1.2040-50(E496mln-EUR puts)

- USD/JPY: Y104.90-105.00($527mln), Y105.40-50($1.1bln)

- AUD/USD: $0.7650(A$671mln), $0.7690-00(A$652mln), $0.7900(A$911mln)

- USD/CAD: C$1.2720-35($1.3bln-USD puts)

- USD/CNY: Cny6.37($1.3bln), Cny6.38($970mln), Cny6.41($777mln), Cny6.45($2.1bln), Cny6.46($640mln), Cny6.50($613mln), Cny6.60($1.3bln)

- USD/TRY: Try6.60($950mln), Try7.10($850mln)

ASIA FX: Local Dynamics At Play Amid Broad Negative Sentiment

Limited price action to close out the week, the greenback held the majority of its decline while equity markets in the region sold off.

- CNH: Offshore yuan weakened, despite a fix below sell-side estimates. The PBOC fixed USD/CNY at 6.4524, 32 pips below sell side estimates and only the ninth lower miss of 2021 so far. The central bank used local media to emphasise it was not considering tightening policy.

- SGD: Singapore dollar weakened slightly, USD/SGD moving higher through the session amid limited catalysts. The pair has gained over 0.2% this week.

- TWD: Taiwan dollar sold off today alongside domestic equity markets. USD/TWD rose from its lowest close since 1997 yesterday.

- KRW: The won started higher but gave back gains, there were reports of a potential fifth round of cash handouts, while coronavirus cases remain high but have slipped under 600.

- IDR: Rupiah weakened, spot USD/IDR has hit a 3-week high after BI cut rates yesterday. Indonesia C/A surplus narrowed to $800m vs estimates of $1.25bn.

- MYR: Ringgitt weakened slightly alongside oil, the pair has moved in a narrow range, swaps spreads have widened in recent sessions.

- PHP: Peso is stronger, snapping a four day losing streak. Government officials have reportedly agreed to recommend easing coronavirus containment measures in the capital.

- THB: Baht is slightly higher, the government are due to meet on Monday to discuss lifting remaining lockdown restrictions.

ASIA RATES: A Plethora Of Themes

- CHINA: The bank drained a net CNY 80bn of liquidity via its OMOs, injecting CNY 20bn via 7-day reverse repos. After spiking following a CNY 260bn liquidity withdrawal on the first day back from the LNY break yesterday, the overnight repo rate has dropped and is now at 1.85% - broadly in line with levels pre-break. Cash bonds were bid as equity markets suffered, some light steepening seen.

- INDIA: Indian bond markets are closed for a holiday, cash bonds sold off yesterday after weak auctions and up to 99% dealer takedown mandated by the RBI.

- SOUTH KOREA: Futures sold off at the open amid talk of a fifth government handout, without details of the fourth being finalized, but pared some of the move as equity markets sold off with coronavirus cases still above 500.

- INDONESIA: BI cut rates and downgraded growth forecasts yesterday, the bank noted limited room for further cuts. Bonds sold off across the curve with the move more dramatic in the 5-year sector, yields up 8bps.

EQUITIES: Markets See Red

A third consecutive negative day for Asia-Pac equity markets, bourses took a negative lead from the US where Wall Street declined as markets take stock of the recent rally in yields and weak data. Chinese equities managed to pare losses in the afternoon, representing the outperformance in the

- E-minis have pared losses, to sit marginally lower on the day into Europe. Treasury Secretary Yellen said yesterday that there could be parts of the stock market where investors should exercise caution.

GOLD: Key Support Breached

Gold bears managed to push spot through key support in the form of the Nov 30 low in early Asia-Pac trade, as regional participants reacted to Thursday's uptick in U.S. real yields. Spot printed as low as $1,760.7/oz, but has recovered to trade unch. on the day at ~$1,775/oz. The July 2 '20 ($1,757.8/oz) and Jun 26 '20 ($1,747.6/oz) lows represent the next areas of technical support.

OIL: Crude Falls As Cold Weather Signaled To Abate In US

Crude futures are sharply lower in Asia-Pac trade on Friday after sustaining losses on Thursday, curbing an impressive rally. Still, WTI & Brent have recovered from lows, and last trade $0.60-0.70 lower on the day.

- There are signs that the US is recovering from weather related disruption and oil supply is slowly coming back online. Demand from refineries is expected to be subdued as operations will take time to ramp up. Milder temperatures are expected to return by Feb 20, in the US according to the National Weather Service.

- The declines come even as stockpile data is supportive; US DOE inventory figures last night showed a headline draw of 7.3m bbls, while there was also a draw in distillate inventories and a smaller-than-expected build in gasoline inventories.

- Elsewhere, the Biden administration indicated a willingness to hold diplomatic meetings with Iranin efforts to return to the nuclear deal that the US quit in 2018.

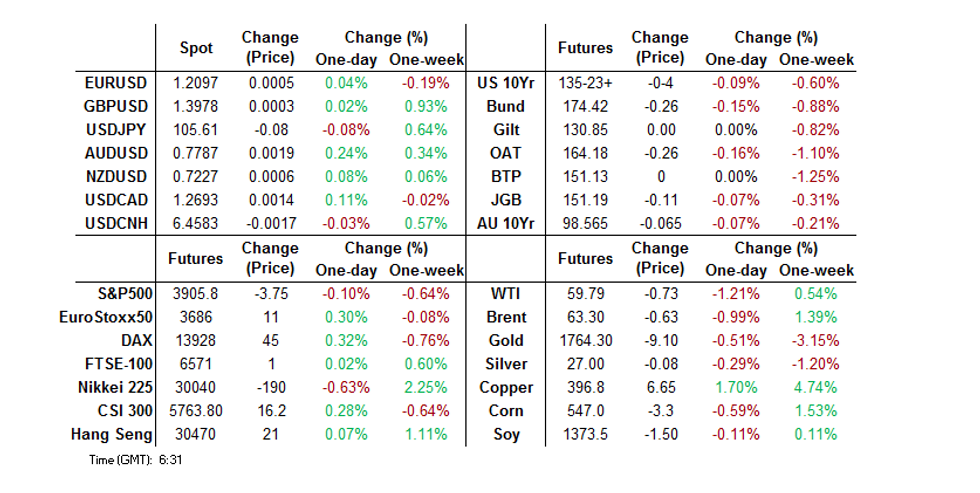

UP TODAY (TIMES GMT/LOCAL)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.