-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Safe Havens Outperform Post Israel Strike

- Risk aversion spiked on headlines that Israel had launched a missile attack on Iran. Oil surged, US equity futures fell, and traditional safe havens - US TSYS, gold, JPY and CHF all rallied. We are now away from extremes in most markets though, as reports suggest the strike was limited in nature, while Iran headlines also looked to play down the significance of the event.

- On the data front we had Japan national CPI for March come in slightly weaker than forecast. Still, some of the detail was firmer compared to February. Early Fed speak also remained cautious around the rate outlook.

- Looking ahead, UK retail sales, German PPI and speeches from BoE's Ramsden & Mann, ECB's Nagel and Fed's Goolsbee, will be in focus.

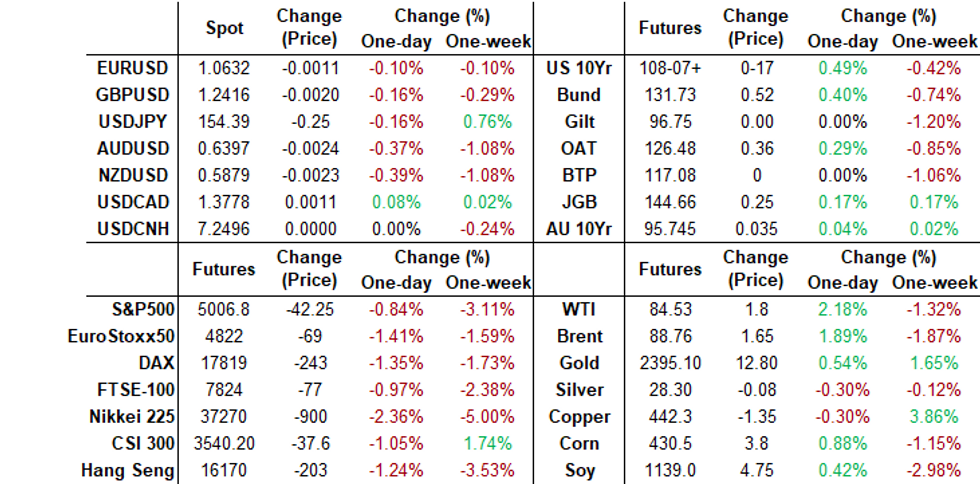

MARKETS

US TSYS: Tsys Futures Off Earlier Highs, Yields 6-9bps Lower

- Treasury futures have gapped higher after reports of explosions in Iran. 10Y futures surged + 29+ to an intraday high of 108-22+ just below initial resistance of 108-25+, the contract has reversed half of the move and now trades at 108-09+ up +19 from NY closing levels.

- Cash treasuries were 10-15bps lower as headlines came out, we have reversed some of those moves to now trade 6-9bps lower for the day, the 2y is -6.4bps at 4.920%, while the 10Y is -8.4bps at 4.549%

- Across local Asian markets, NZGBs are 5-6bps lower, ACGBs 2-5bps lower, while EM space, INDON yields are 1-4bps higher, while PHILIP yields are 1-3bps higher.

- Market moves have been dominated by the middle east tension, however there have been some fed speakers with the Fed's Williams saying there is no urgency to cut rates, while Bostic spoke earlier this morning reiterating his view of just one cut this year (MNI - see link here).

- Looking ahead: There is no economic data to report Friday while Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference (1030ET) ahead of the Fed blackout late Friday.

STIR: $-Bloc Continues To Price Out Easing

STIR markets within the $-bloc continue to price out dovish policy projections for this year. Year-end official rate projections have firmed by 10-26bps compared to levels from a week and a half ago, with the most notable increases observed in the US and New Zealand, while Australia and Canada trail behind.

- Overnight, the markets reacted negatively to comments from NY Fed Williams on the potential for a data-driven rate hike in the future.

- Speaking at an event in Florida, Atlanta Fed President Bostic stated that the economy is slowing down gradually, with wage growth outpacing the inflation rate. He mentioned that the current policy is restrictive but is on the path toward the 2% inflation target, emphasising a patient approach and reiterating his view of one rate cut this year.

- Later today, Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference ahead of the Fed blackout late Friday.

- December 2024 expectations and the cumulative easing across the $-bloc stand at: 4.93%, -40bps (FOMC); 4.40%, -60bps (BoC); 4.14%, -18bps (RBA); and 5.19%, -32bps (RBNZ).

Source: MNI – Market News / Bloomberg

JGBS: Futures Sitting Richer But Off Israeli Strike Highs, BoJ To Scale Back JGB Buying

JGB futures are stronger in the Tokyo afternoon session, +22 compared to the settlement levels, but well off session highs tied to news that Israeli missiles have hit sites in Iran.

- Cash US tsys are dealing 6-9bps richer across benchmarks, although they have retraced from the peak levels seen during the Asia-Pacific session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined National CPI, which missed expectations.

- (MNI) The Bank of Japan is toying with how it can lower the scale of its Japanese government bond-buying programme without injecting volatility into the rates market or sharply raising long-term yields and could potentially lower the largely ambiguous JPY6 trillion monthly level found within its March board communications to JPY5 trillion at the July 30-31 meeting. (See link)

- The cash JGB curve bull-flattened, with yields flat to 4bps lower. The benchmark 10-year is 2.8bps lower at 0.841% versus the YTD high of 0.891% set this week.

- The swaps curve has richened, led by the 7-10-year zone, with rates 1-5bps lower. Swap spreads are mixed.

- The local calendar is empty on Monday, ahead of Jibun Bank PMIs and 2-year supply on Tuesday. The BoJ Policy Decision is on Friday.

JAPAN DATA: Y/Y CPI Softer Than Expected, M/M Picks Up Though

Japan March national CPI was weaker than expected. The major indices all slightly below consensus expectations and showing softer y/y momentum relative to Feb. Headline was 2.7% y/y (against a forecast and prior outcome of 2.8%). Ex fresh food was 2.6% y/y (2.7% forecast and 2.8% prior). The core ex fresh food and energy measure printed 2.9% y/y (3.0% forecast and 3.2% prior).

- Softer y/y momentum was expected by the market, albeit with the actual outcomes coming below estimates.

- In terms of the detail, in y/y terms the core measure which excludes all food and energy eased back to 2.2% from 2.5% in Feb. By category, we saw either lower or steady y/y momentum for most sub-components. Strongest inflation remains for entertainment (+7.2%y/y) and food 4.8%y/y.

- In m/m terms we still saw 8 out of the 11 sub-components record a firmer pace compared with Feb. In Feb we had 5 out of 11 sub-components record a firmer pace relative to Jan. In March, Food prices rebounded, as did utilities and clothing & footwear. Transport (-0.1% m/m) was the only negative result.

- Base effects are likely to weigh on y/y momentum as we progress through Q2 and into Q3. Still, with some pick up in m/m momentum, coupled with focus on wage gain pass through, today's y/y misses may not shift the BoJ outlook a great deal. Note next Friday delivers the next meeting outcome from the central bank.

AUSSIE BONDS: Spike Richer on Israeli Strike Pared, Q1 CPI On Wednesday

ACGBs (YM +5.0 & XM +3.5) spiked higher after news broke that Israeli missiles had struck sites in Iran, according to ABC. The market initially reacted with a spike of up to 10 points from session lows. However, these gains have since been pared back.

- Cash US tsys are dealing 6-9bps richer across benchmarks, although they have retraced from the peak levels seen during the Asia-Pacific session.

- The Middle East tension has dominated market moves, however, there have been some fed speakers with the Fed's Williams saying there is no urgency to cut rates. Fed Bostic spoke earlier this morning reiterating his view of just one cut this year (MNI - see link).

- Later today, Chicago Fed Goolsbee will participate in a moderated Q&A at a SABEW conference ahead of the Fed blackout late Friday.

- Swap rates are 3-5bps lower, with the 3s10s curve steeper.

- The bills strip has bull-flattened, with pricing +1 to +6.

- RBA-dated OIS pricing has reversed early weakness to be 3-4bps softer for 2025 meetings. A cumulative 20bps of easing is priced by year-end.

- Next week, the local calendar sees Judo Bank PMIs on Tuesday, ahead of Q1 CPI on Wednesday.

- On Monday, the AOFM plans to sell A$800mn of the 0.5% Sep-26 bond.

NZGBS: Spikes Richer With Global Bonds After Israel Strikes Iran

NZGBs closed 4bps richer, aligning with the significant rally in global bonds during today's Asia-Pacific session, driven by reports of Israeli missile strikes on sites in Iran, as reported by ABC.

- Markets had moved ahead of the confirmation with reports regarding the closing of Iranian airspace. It appears flights had been diverted away from Iranian Airspace. There seemed to be little flight activity over central Iran where the explosions occurred near Isfahan.

- Cash US tsys are dealing 6-9bps richer across benchmarks but off the Asia-Pac session's best levels.

- Swap rates closed 3-4bps lower.

- RBNZ dated OIS pricing closed 3-7bps softer for meetings beyond July. A cumulative 60bps of easing is priced by year-end.

- Bloomberg reported that ANZ said the RBNZ will only pivot to an easing stance when it is sure it has domestic inflation under control, which will take until next year. While headline inflation will drop to 2.6% in the third quarter this year, returning to the Reserve Bank’s 1-3% target band for the first time since early 2021, that won’t be enough to trigger rate cuts.

- The next major release is Trade Balance data for March on Wednesday. Australia is also scheduled to release Q1 CPI data on Wednesday.

FOREX: Dollar Gains Pared Post Israeli Strike Headlines

Market risk aversion surged amid headlines of missile attacks from Israel on Iran. The BBDXY got to highs of 1271.06, but we now sit back close to 1266, only +0.20% firmer for the session.

- Yen and CHF rallied strongly, but also sit away from best levels. USD/JPY got to 153.59, but we are now back to 154.40/45, only marginally stronger in yen terms. USD/CHF is back near 0.9085, against earlier lows of 0.9013.

- The slightly weaker than expected Japan CPI print didn't impact yen sentiment.

- Part of the stabilization in risk sentiment has reflected that nuclear facilities in Iran were reportedly not damaged, while Fox News noted it was the strike was limited in scope, per US officials.

- Some Iranian headlines also deny an attack took place and hat reports of explosions were the activation of the country's air defence system.

- AUD and NZD remain weaker by around 0.30%, but away from session lows. AUD/USD was last around 0.6400 (earlier lows at 0.636), while NZD/USD tracks near 0.5880 in latest dealings (earlier lows 0.5852).

- US equity futures remain in the red, but losses are now under 1%. Earlier the Nasdaq future was off by 2%. US yields remain lower, but like elsewhere are up from earlier lows.

- Looking ahead, UK retail sales, German PPI and speeches from BoE's Ramsden & Mann, ECB's Nagel and Fed's Goolsbee, will be in focus.

ASIA EQUITIES: China & HK Equities Lower On Middle East Tensions, TSMC Outlook

Hong Kong and China equity are lower today growing tension in the middle east has been seen to be the major catalyst for the move lower, although the semiconductor sector has also sold off after TSMC scaled back its outlook for a chip market expansion, cautioning that the smartphone and personal-computing markets remain weak. All indices are in the red together other than defense stocks as they rally on hopes that intensifying concerns about escalating conflict in the Middle East can raise demand for their arms and weapons, while gold producers rally as spot gold see haven buyers.

- Hong Kong equities are lower across the board, the HSTech Index is the worst performer, trading down 2.60% and has broken below the 3300 level it had been holding above since early march, sellers are back in control with the Index now trading below the 20, 50, 100 & 200-day EMA, the Mainland Property Index is faring slightly better down 1.05%, while the HSI is down 1.23%. In China, equities are performing better however still all in the red with the CSI300 down 0.88%, while small-cap indices have been less impacted by global issues today with the CSI2000 & CSI1000 down about 0.90%.

- China Northbound saw an outflow of 5.28b on Thursday, flow momentum has been slightly decreasing over the past week with the 5-day average at -1.51billion, while the 20-day average sits at -0.90billion yuan.

- Mexico's federal government, influenced by pressure from the US, is reportedly denying Chinese automakers incentives for EV production, including low-cost land and tax breaks, signaling a shift from past practices. This decision follows pressure from the US to keep Chinese automakers out of the North American Free Trade Agreement zone, with US officials citing concerns about national security threats posed by Chinese vehicles, according to Reuters.

- Looking ahead, China's 1 & 5 yr LPR on Monday is the focus.

ASIA PAC EQUITIES: Equities Head Lower On Middle East Tensions, TSMC Revised Outlook

Today, regional Asian equities opened lower, primarily due to losses in tech stocks following TSMC's revised outlook for chip market expansion. Treasury yields to rose after US weekly jobless claims were released, indicating resilience in the labor market. Additionally, hawkish remarks from Federal Reserve officials dampened investor sentiment, Fed's Williams emphasized the data-dependent nature of future rate decisions, while Bostic reiterated expectations of only one rate cut this year. The market further reacted to reports of explosions near the City of Isfahan in Central Iran, leading to airspace closures and activated air defenses, resulting in a heavy sell-off of risk assets. Although major indices recovered some losses, they remain in negative territory, with declines ranging from 2% to 6%.

- Japanese stocks have gapped lower today, initially driven lower after TSMC earnings caused weakness in the tech sectors and hawkish comments from Fed speaker, while Japan then released inflation data that came in at 2.7% vs 2.8% y/y. The yen has ticked higher as investors move into haven assets on the back of growing tension in the middle east. The Nikkei is down 2.45%, the Topix is off 1.85%, while the Topix banks Index is faring better than the wider market down just 0.83%, which could be on the back of Berkshire Hathaway's record bond issuance.

- South Korean equities are lower today, the Kospi have now erased all the yearly gains, and trade off 1.00% for the year, today it tested the 200-day EMA of 2,571, we have recovered and trade back above it however still down 1.65% for the day.

- Taiwan equities were down as much as 4.95% earlier, the initial moves of on the back of weaker TSMC after they revised outlook down and the fact the stocks has accounted for 60% of the index's gains for the year, higher yields also impacted the market and then middle east tensions breaking out pushed the market to lows. The Taiex has recovered some of the early losses and now trade down 3%.

- Australian equities are lower, although one of the better performing markets today. There has been very little in the way of local market headlines for the country. Energy has been the only sector in the green today, with the ASX200 following global markets lower, currently down 1.20%

- Elsewhere in SEA, New Zealand Equities are down 0.70%, Indonesian equities are down 1.45%, Singapore down 0.60%, Philippines down 1.70% while Malaysian equities have managed to trade up 0.43%

ASIA EQUITY FLOWS: Equity Flow Momentum Is Negative As Market See A Week Of Net Selling

- China equities marked four of the past five days of outflows on Thursday markets for a total outflow of 7.5b yuan. Equities were little changed on Thursday as the stock rally seems to have stalled, the CSI300 continues to struggle to really test the 200-day EMA level at now at 3588, the index has traded sideways since mid to late Feb when we broke above the 3,400. Flow momentum is turning negative with the 5-day average now -1.51b, 20-day average at -0.89b and the longer term 100-day average now 0.39B yuan.

- Taiwan equities have marked the sixth straight day of foreign investors selling for a total of $3.6b. TSMC released results yesterday, beating estimates, however lowered chip market outlook and consumer weakness persists. The 5-day average is now -$673m, vs the 20-day at -$295m well below the longer-term trend of $105m, although the longer term trend is quickly losing momentum.

- South Korea equities were the only market in the region to see inflows on Thursday, while equities surged higher. The moves was linked to the weakening KRW, with investors looking to take advantage of the move lower in the currency and also could have been positioning for TSMC results, most of the flows were into semiconductor, AI and other tech related stocks. The Kospi is off 5.12% from recent highs recovering after being down as much as 7.10%, and has bounced right off the 200-day EMA, while the 14-day RSI is edging higher now at 42 after earlier trading at 30. The 5-day average is now -$14m, the 20-day average to $287m and the 100-day average to $182m.

- Philippines equities continue to see outflows with $11m leaving the market on Wednesday, making it 10 straight days of outflows for a total of $107m. Equity prices have rebounded over the past 2-days up 1.13% to 6,523 on Thursday, focus will now remain on whether the PSEi can break back above the 200-day EMA at 6,574. The 5-day average is -$11m, the 20-day average is -$5.94m, while the $1.21m.

- Indonesia had a $44m outflow on Wednesday taking it to a 12-day streak of net selling by foreign investors for a total of $933m. The JCI bounced off the 200-day EMA on Tuesday and has since recovered 1.45%, after falling 5.20% from recent highs. The 5-day average is now -$98m, the 20-day average is -$16m, while the longer term 100-day average is still positive at $14.8m.

- Malaysian equities have now marked 7 straight days of selling by foreign investors, for a total of $350m. Equity markets are holding up better than most in the region, with the Bursa now trading back above the 20, 50, 100 & 200-day EMAs while the 14-day RSI has ticked back above 50, indicating bulls are back in control. The 5-day average is -$28, 20-day average is -$61m while the 100-day average is -$4.1m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -5.3 | -7.6 | 52.7 |

| South Korea (USDmn) | 604 | -71 | 14272 |

| Taiwan (USDmn) | -195 | -3364 | 1011 |

| India (USDmn)** | -391 | -319 | 948 |

| Indonesia (USDmn) | -45 | -492 | 876 |

| Thailand (USDmn) | -9 | 34 | -1849 |

| Malaysia (USDmn) ** | -30 | -309 | -579 |

| Philippines (USDmn) | -11 | -56.1 | 77 |

| Total (Ex China USDmn) | -76 | -4577 | 14756 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 16th | |||

| *** Data Up To Apr 17th |

OIL: Surges On Israel Attack On Iran Headlines, But We Are Away From Highs

All of today's focus has been on the reported strikes Israel has launched on Iran in response to last weekend's missile attacks. At this stage, details are still limited, with reports of explosions in the Iran city of Isfahan. US officials have reportedly confirmed that a strike has taken place (per BBG), while Fox news notes that the strike was limited in scope and didn't involve manned aircraft.

- Iranian related headlines have been conflicting, stating there was no missile attack, but that reports of explosions were the activation of the country's air defence system. In any event, other Iranian headlines have noted that the country's nuclear facilities are unharmed.

- This latter point has likely been a relief for markets at the margin, given the Isfahan region contains nuclear facilities.

- At the height of the market risk aversion, front month Brent crude prices got to $90.75/bbl. We now sit back near $89.10/bbl. Opening levels were close to $87/bbl. Hence, we are still +2.3% higher, tracking up for the first gain this week. We are still sub end levels from last week ($90.45/bbl).

- For Brent recent highs around $91.50/bbl remain intact. On the downside, Thursday lows come in near $86.10/bbl.

- For WTI, we were last at $84.75/bbl, up around 2.4% for the session.

GOLD: Spikes Above $2400 On News Of Israeli Strike On Iran

Gold surged above $2400 following reports of Israeli missile strikes on sites in Iran, as reported by ABC.

- Before the official confirmation, market speculation was already rife due to reports of the closure of Iranian airspace. It was noted that flights had been diverted away from Iranian airspace, particularly over central Iran, where the explosions occurred near the city of Isfahan.

- However, the initial spike has since been tempered, with the price of bullion now standing 0.5% higher at $2391, following a 0.8% increase in Thursday's closing.

- According to MNI’s technicals team, the trend condition remains unchanged, and the outlook is still bullish, with the next objective at $2452.5, a Fibonacci projection. Initial firm support is at $2293.4, the 20-day EMA.

ASIA FX: USD/Asia Pairs Mostly Higher, But Intervention/FX Rhetoric Curbs USD Gains

USD/Asia pairs sit higher for the most part, albeit away from session highs. We saw strong risk off flows, which supported the USD on headlines that Israel has launched a missile strike on Iran. Sentiment has calmed somewhat as reports suggest the strike was limited in nature, while Iran headlines also looked to play down the significance of the event. Intervention/FX rhetoric from various authorities stepped up as well. At this stage, CNH is back to flat, while KRW, PHP and IDR spot all have losses of around 0.60%.

- USD/CNH got to highs of 7.2629, but we now sit back at 7.2490, little changed for the session. We did see a further set higher in the overnight Hibor CNH rate in Hong Kong to 6.14% (+69bps), which will raise the cost of shorting the CNH in the near term. Also the authorities have reiterated over recent sessions of the desire keep the yuan basically stable. USD/CNY spot got above 7.2400, but hasn't been able to sustain these gains.

- Spot USD/KRW got to highs near 1393, but we now sit back at 1381, still 0.60A% weaker in won terms. Still the 1 month NDF is little changed for the session, last near 1380. Local equities are down 1.7% amid broad region losses. The FinMin was on the wires earlier stating that they are closely monitoring markets in light of Middle East tensions,. It was added that they will take immediate, firm steps on excessive volatility.

- Spot USD/IDR sits only marginally sub earlier highs, the pair last close to 16275. Rhetoric from the BI has been firm around intervening in FX markets boldly to maintain market confidence. The 1 month NDF is near 16300, still sub earlier highs of 16366.

- Spot USD/PHP is above 57.50, slightly off session highs. USD/THB is around 36.88, close to fresh highs back to Oct last year.

- MYR has outperformed, the pair last near 4.7825, slightly down for the session. MYR could benefit from the spike in energy prices, although the authorities may also be guarding against a break above 4.8000 in the pair. Q1 GDP printed as expected at 3.9% y/y. The March trade data was also close to expectations.

INDONESIA: INDON Sov Curves Steepens, BI To Support Do IDR, Rate Decision Wed

The Indonesian sov curve has bear-steepened today, yields are 2-5bps higher. BI was out earlier pledging their support for the IDR after the currency has fallen over 5% for the year, while Barclays suggests the BI may opt for a 50bps rise next week.

- The INDON sov curve has steepened today, the 2Y yield is 1.5bps higher at 5.265%, 5Y yield is 3.5bps higher at 5.29%, the 10Y yield is 4.5bps higher at 5.425%, while the 5-year CDS spiked earlier hitting a high of 88bps, we are off those highs but still trade up 4bps to 82bps.

- The INDON to UST spread diff has widen over the week with the 2Y is 33.5bps (+1.5bps), 5yr is 69.5bps (+2.5bps), while the 10yr is 87bps (+4bps)

- In cross-asset moves, the USD/IDR is up 0.63% at 16,276, the JCI is 1.45% lower, Palm Oil is unchanged, while US Tsys yields are 5-9bps lower.

- Bank Indonesia, according to Governor Perry Warjiyo, pledges to uphold rupiah stability through foreign exchange intervention and other essential actions. Warjiyo emphasizes the central bank's commitment to managing foreign portfolio flows in a market-friendly manner, citing it as crucial for strengthening external resilience amid global risks.

- Barclays suggests Indonesia may opt for a 50bp rate hike at its April 24 meeting to stabilize the rupiah, driven by heightened currency stability concerns. However, a 25bp hike is more likely, with a hawkish tone expected if rates remain unchanged. Despite efforts, foreign investment in Indonesia's rupiah securities remains modest compared to government securities.

- Looking ahead: Calendar remains empty until Trade Balance on Monday and BI rate decision on Wednesday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/04/2024 | 0600/0800 | ** |  | DE | PPI |

| 19/04/2024 | 1415/1515 |  | UK | BoE's Ramsden at Peterson Institute Conference | |

| 19/04/2024 | 1430/1030 |  | US | Chicago Fed's Austan Goolsbee | |

| 19/04/2024 | 1530/1130 |  | US | New York Fed's Roberto Perli | |

| 19/04/2024 | 1630/1730 |  | UK | BOE's Mann Panelist at Capital Flows Seminar |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.