-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: Tech-Led Equity Rout Continues, Geopolitical Jitters Emerge

- Asia-Pac equity benchmarks falter as tech rout continues, while e-minis extend losses

- ACGB yields jump after ambitious Australian Federal Budget forecasts wider than expected fiscal deficit

- Escalating exchange of fire in Israel/Gaza and Sino-Taiwanese tensions fuel risk aversion

BOND SUMMARY: Aussie Yield Curve Bear Steepens On Federal Budget, T-Notes Edge Lower In Quiet Asia-Pac Trade

Australian yield curve bear steepened, digesting overnight impetus from U.S. Tsys & the 2021/22 Federal Budget delivered by Treasurer Frydenberg yesterday evening. The government made bold spending promises and forecast a wider than expected budget deficit of A$106.6bn., noting that 2021/22 debt issuance would total A$130bn (that is slightly more than expected) and revising issuance plan for the remainder of this year to A$210bn (of which $198 billion has been completed). That said, cash ACGB yields trade off steeps, last 0.5-5.9bp higher across the curve, with 10s underperforming. YM sits -1.0, with XM -6.0 as we type; futures contracts have been rangebound. Bills last seen unch. to -1 tick through the reds. Worth noting that the RBA offered to buy A$1.0bn of semis today, while across the Tasman, NZGBs took a hit on the back of weak pricing seen at the latest round of RBNZ LSAP ops.

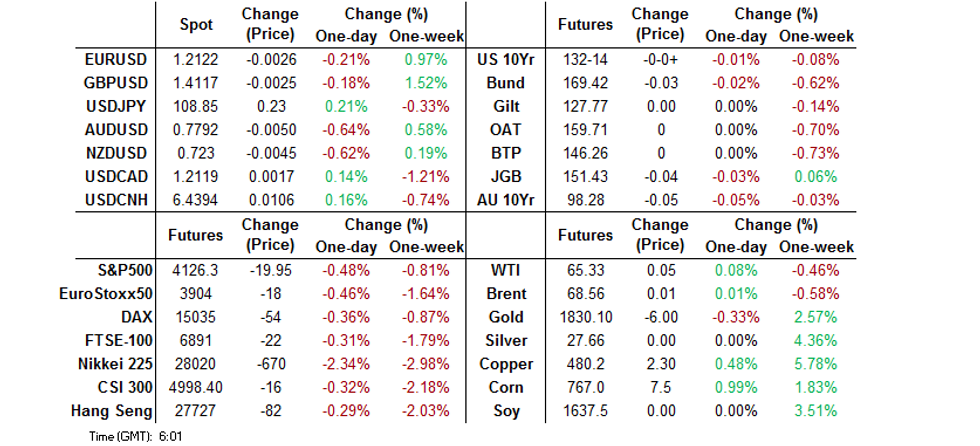

- T-Notes were biased lower but Tuesday's low of 132-12+ provided firm support. The contract last sits -0-01+ at 132-13, as e-minis slipped in a fairly quiet Asia-Pac session. The escalation of violence in Gaza may have weighed on risk appetite amid the absence of other catalysts, as IDF & Hamas continued to trade fire. Cash Tsy yields are broadly higher, albeit very marginally. Eurodollar futures last trade +0.5 to -0.5 tick through the reds. April CPI report, 10-Year auction & Fedspeak take focus in the U.S. today.

- JGBs saw little in the way of domestic drivers. Futures eased off ahead of the lunch break and last trade at 151.34, 13 ticks below Tuesday's settlement. Cash JGB yields were marginally mixed, with 4s underperforming. Focus in Japan moves to Thursday's 30-Year debt supply.

AUSSIE BONDS: AOFM Provides Guidance On Planned Debt Issuance

The AOFM writes the following in an emailed note:

- Issuance of Treasury Bonds in 2021-22 will be around $130 billion.

- Issuance of Treasury Indexed Bonds by tender in 2021-22 will be around $2-2.5 billion.

- The AOFM will remain active in the Treasury Notes market with regular issuance for cash management purposes.

- Issuance of Treasury Bonds for 2020-21 has been revised to around $210 billion (of which $198 billion has been completed). Issuance of Treasury Indexed Bonds for 2020-21 will be around $2.5 billion (of which $2.05 billion has been completed).

- More detailed guidance on issuance plans for 2021-22 will be provided on 2 July 2021.

- Details of each week's transactions will be announced at midday on the preceding Friday.

FOREX: USD Gains Ahead Of CPI Report, AUD Softens After Budget Speech

The greenback garnered some strength in Asia-Pac hours, as U.S. equity index futures edged lower while participants prepared for the upcoming U.S. CPI report. The DXY extended its recovery from a multi-week low printed on Tuesday. Most G10 crosses respected tight ranges as news and data flow was relatively subdued, albeit continued exchange of fire in Gaza may have reduced appetite for riskier currencies.

- The Antipodeans traded on a softer footing but AUD/USD struggled to penetrate the $0.7800 mark. BBG trader sources flagged the cutting of long positions in AUD initiated before the delivery of Federal Budget, while CBA warned that Australia would "mostly likely" lose its AAA credit rating.

- The PBOC set the central USD/CNY mid-point at CNY6.4258, 9 pips above sell-side estimates, which may have helped USD/CNH grind higher later on.

- Focus turns to U.S. CPI, final German CPI, UK quarterly GDP & monthly economic activity indicators as well as speeches from BoE's Bailey, ECB's Centeno, Riksbank's Breman and Fed's Clarida, Rosengren, Bostic & Harker.

FOREX OPTIONS: Expiries for May12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E542mln)

- USD/JPY: Y108.25-35($769mln), Y109.95-00($783mln)

- AUD/USD: $0.7900(A$619mln)

- USD/CAD: C$1.2800($610mln)

ASIA FX: Risk Aversion Pressures Asia EM FX

The greenback rose amid general risk aversion in Asia, while a steeper yield curve in the US also added pressure to most Asia EM FX.

- CNH: Offshore yuan is weaker, despite another fix stronger than expectations from the PBOC, its fourth in a row. The PBOC injected a net CNY 10bn today, the fourth injection in a row after a lengthy hiatus.

- SGD: Singapore dollar weakened, concern over a pickup in coronavirus cases remains. The head of the virus taskforce said late yesterday that situation is at a tipping point as it grapples with the costs of imposing more restrictions.

- TWD: Taiwan dollar is weaker for the second day, USD/TWD rising above the 28.00 handle. The Taiex has now fallen 10% from April highs, while there are reports in Liberty Times that Taiwan could further tighten coronavirus restrictions.

- KRW: Won is weaker despite strong labour market data, South Korea reported 635 daily new coronavirus cases, back above 600. Meanwhile, an aide to President Moon has said that a vaccine partnership with the US is one of the major agenda items for the summit with the US next week.

- MYR: Ringgit weakened, post-GDP yesterday BNM flagged the positive impact of "improvement in domestic demand and robust exports performance," but the data did not cover MCO 3.0 imposed across the whole country earlier this week. Palm oil rose to a record high during the session, jumping above MYR 4,500.

- PHP: Peso decline, BSP will deliver their latest monetary policy decision later today. Policymakers are widely expected to leave interest rates on hold, according to BBG poll of analysts, with the lone dissenter calling for a 25bp cut. We have also forecast a stand-pat decision.

- THB: Baht is lower. Public Health Ministry said it aims at inoculating 70% of Bangkok residents (~5mn people) in two months after PM Prayuth expressed concern about disappointing level of registrations for the vaccines.

ASIA RATES: Key Data On The Docket Today

Key US data and coronavirus are the main drivers for the Asia bond space; South Korea vows to step in if bond markets become too volatile.

- INDIA: Yields lower in early trade. Markets await inflation and industrial production data today. CPI is expected to have slowed last month as the effects of a surge in virus cases took hold, while industrial production is expected to surge due to a low base effect. INR denominated debt sales are expected to slow this week for the third consecutive week, the coronavirus situation is clouding the outlook with many companies having already suspended operations. The RBI will go ahead with its planned INR 260bn bond sale tomorrow. As a note, Indian markets will be closed tomorrow for Ramzan.

- SOUTH KOREA: Futures gapped lower at the open but have come off worst levels, the decline pausing around 125.30, the lowest for the contract since March. Data earlier showed the unemployment fell to 3.7% from 3.9%, lower than estimates. Second Vice Finance Minister said yesterday South Korea plans to respond to potential volatility in the state bond market as global inflation concerns and other risk factors could spark instability in the debt market.

- CHINA: The PBOC injected CNY 10bn today, repo rates have risen, overnight repo rate up 17bps at around 1.95%, while the seven day repo rate is flat at 1.90% after initially opening higher. The PBOC has now injected funds for the fourth day in a row. Futures are higher, 10-year contract briefly touching a contract high. An article from a senior researcher at the MOF said China should raise the amount of new local government bonds and allow hidden debts to be swapped with these bonds in order to reduce liquidity risks.

- INDONESIA: Markets closed for Hari Raya Aidilfitri.

EQUITIES: Tech Rout Continues

Equity markets in Asia mostly in the red as the global tech rout continues; the Taiex is the worst performer, down over 5% at its nadir which equates to over 10% from its April highs. South Korea also sustaining heavy losses despite strong labour market data. Japanese markets also in the red for the second day, having wiped out all of last week's gains. The Hang Seng and bourses in mainland China have managed to just about keep their head above water. In the US futures are negative with the Nasdaq leading the way lower, markets await the US CPI report as well as a speech from US President Biden.

GOLD: Falling

Bullion declined in Asia, undermining its recovery after bouncing during the US session on Tuesday. The yellow metal last trades at $1828.71, down $8.71 having hit session lows at $1826. The decline in gold has come despite general risk aversion, the greenback has risen with markets now focusing on the US CPI report as well as a speech from US President Biden after fairly upbeat assessments of the economy from several Fed speakers yesterday.

OIL: Crude Futures Tread Water

After building on Tuesday's gains earlier in the session oil has since retreated and trades around neutral levels; WTI is up $0.01 from settlement at $65.29/bbl while Brent is flat at $68.55/bbl. Earlier Colonial Pipeline said it was making progress on returning system to services and that it was prioritizing markets with supply constraints. The company said it should know later today if it is safe to restart the network. US Energy Sec Granholm said it could take days to fully restore shipments. After market on Tuesday API data showed headline crude stocks fell 2.53m bbls, distillate stocks fell 900k bbls and stocks at Cushing fell 1.2m bbls. Gasoline stocks rose 5.6m bbls. Elsewhere, markets continue to digest the EIA forecast for lower output though 2022, while OPEC raised demand forecasts. The IEA will release its monthly report today, while participants will also watch for US DOE stockpile data.

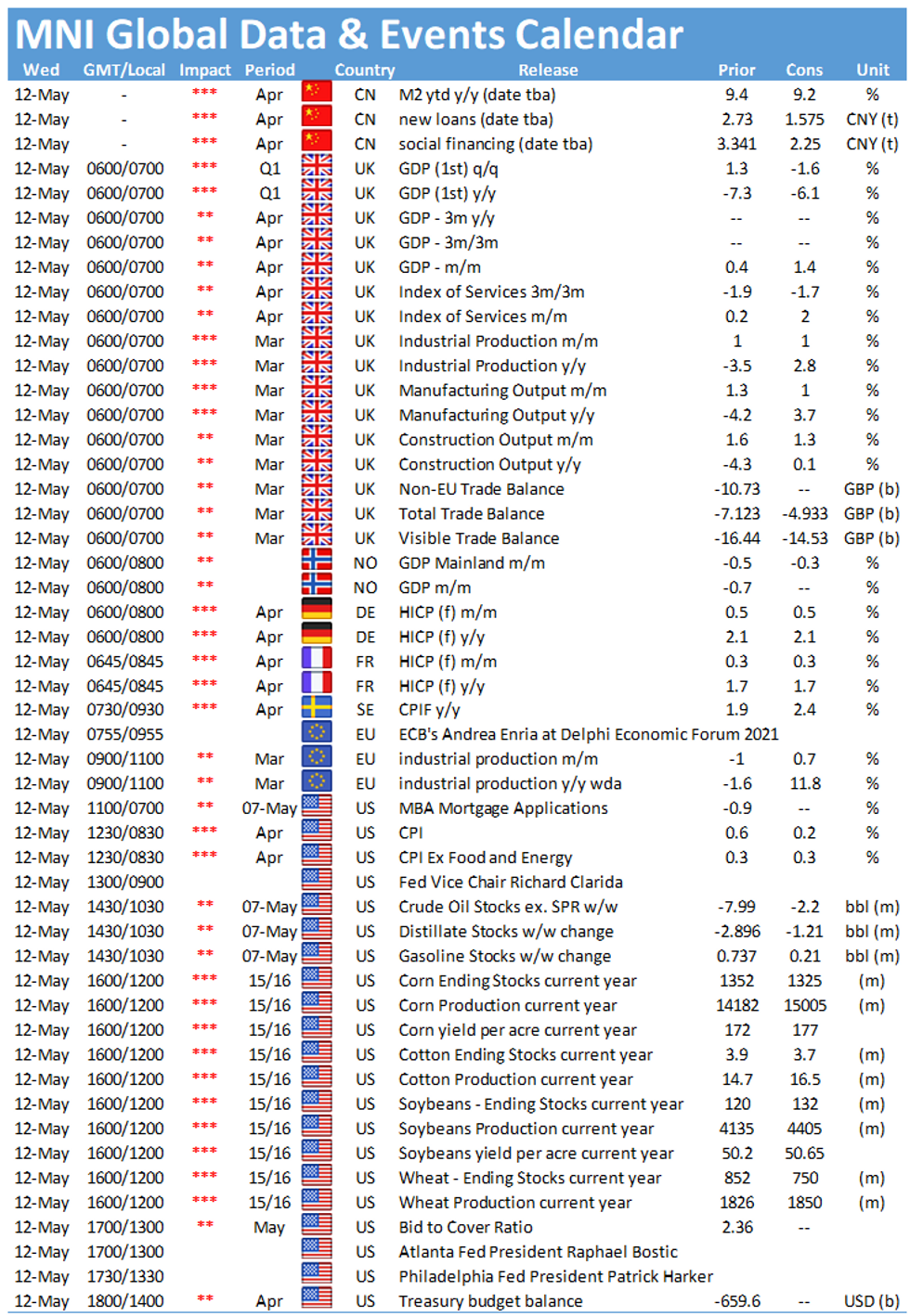

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.