-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Tsy Futures Edge Higher, Equity Rebound Aids Asia FX

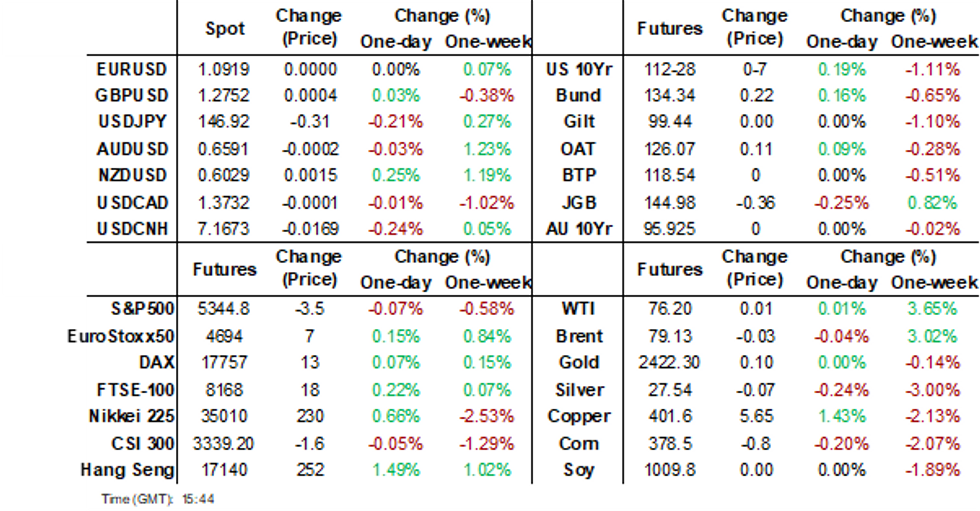

- For most of today's session the equity recovery continued, led by tech. This weighed on the USD, although more so against sensitive Asian FX plays. USD/JPY couldn't breach earlier week to date highs.

- US Treasury futures have edged higher throughout the session, slowly clawing back the weakness made overnight after lower-than-expected jobless claims. STIR markets across the $-bloc have softened over the past week, with the US outperforming and Australia underperforming.

- China headline inflation was stronger than forecast, although the weaker core reading still suggests a benign domestic backdrop. China government bond yields have continued to push higher amid further evidence of authorities attempting to crackdown on speculation in this space.

- Looking ahead, the main data point is Canadian jobs figures.

MARKETS

US TSYS: Tsys Futures Edge Higher Through Asia Session, Volumes Light

- Treasury futures have edged higher throughout the session, slowly clawing back the weakness made overnight after lower-than-expected jobless claims. There has been some block buying in the FV contract, and a block steepener trade a moment ago.

- TUU4 is +0-01¾ at 103-09 while TYU4 + 08 at 112-29.

- The cash treasury curve has bull-steepened today with yields 2-4bps lower. The 2yr is -3.3bps at 4.005%, while the 10yr is -2.5bps at 3.963%.

- The moves lower in yields could have also been helped by dovish comments from the Fed's Schmid & Goolsbee.

- Overnight the recent 30-year Treasury bond auction drew a yield of 4.314%, which was 3.1bps higher than the pre-sale yield of 4.283%, the tail is outside the normal range for long-bond auctions since 2020, marking it as the 7th worst monthly long-bond auction since the start of COVID-19. This follows a similarly poor outcome in the previous day's 10-year note auction.

- Projected rate cut pricing into year end off early morning levels (*): Sep'24 cumulative -40.5bp (-44.8bp), Nov'24 cumulative -71.5bp (-77.6bp), Dec'24 -103.2bp (-109.3bp).

- Today, it is a very empty calendar with no data or fed speak.

STIR: $-Bloc Markets Soften Further Relative To This Time Last Week

STIR markets across the $-bloc have softened over the past week, with the US outperforming and Australia underperforming.

- Year-end official rate expectations have declined by 18bps in the US, 11bps in New Zealand, 9bps in Canada, and 5bps in Australia.

- The US shift was triggered by last Friday’s weaker-than-expected Employment Report.

- In New Zealand, dovish sentiment followed the release of benign RBNZ inflation expectations data.

- Meanwhile, Australia's more modest softening reflected the RBA’s relatively hawkish stance at this week’s policy meeting, where the possibility of a rate hike was explicitly discussed.

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

JGBS: Cash Curve Twist-Flattener, BoJ Weighs On Short-End, Holiday On Monday

JGB futures are holding weaker, -32 compared to the settlement levels, but near Tokyo session highs.

- Outside of the previously outlined Money Stock data, there hasn't been much in the way of domestic drivers to flag.

- Cash US tsys are 2-3bps richer in today’s Asia-Pac session, after yesterday’s jobless claims-induced sell-off.

- Given the lack of domestic data today and the strength in US tsys, today’s price action in JGBs appears to reflect a realisation that the BoJ intends to continue to tighten policy notwithstanding the BoJ Deputy Governor’s recent dovish comments.

- (Bloomberg) “The mixed BoJ communications will only spook more volatility,” said Charu Chanana, head of currency strategy at Saxo Markets. “If only they keep their communication aligned, at least that may spare them from panic moves and unnecessary volatility both in yen and equities.” (See link)

- The cash JGB curve has twist-flattened, with yields 3bps higher to 4bps lower, pivoting at the 30s. The benchmark 10-year yield is 1.5bps higher at 0.865% versus the cycle high of 1.108%.

- The swap curve has bull-flattened, with rates flat to 5bps lower. Swap spreads are tighter.

- Next week, the local market is closed on Monday for the Mountain Day holiday, ahead of PPI data on Tuesday.

AUSSIE BONDS: Slightly Cheaper, Narrow Ranges On A Data-Light Session

ACGBs (YM -2.0 & XM -0.5) are slightly weaker after dealing in relatively narrow ranges in today’s data-light Sydney session.

- The AOFM’s sale of A$700mn of the 4.75% 21 April 2027 bond went well, with pricing comfortably through mids and the cover ratio printing a robust 3.3929x, although lower than last auction’s 3.8375x (10 April).

- The line’s inclusion in the YM basket and improved sentiment towards global bonds likely proved supportive. The RBA’s relatively hawkish stance at this week’s policy meeting didn’t appear to deter today’s bid.

- Cash ACGBs are 1-2bps cheaper, with the AU-US 10-year yield differential at +11bps. Cash US tsys are 2-3bps richer in today’s Asia-Pac session.

- Swap rates are flat to 1bp higher.

- The bills strip is slightly mixed, with pricing -1 to +1.

- RBA-dated OIS pricing is 1-3bps firmer across meetings. As a result, pricing is 5-20bps firmer across meetings than pre-RBA levels on Tuesday. A cumulative 22bps of easing is priced by year-end versus 30bps before the RBA decision.

- Next week, the local calendar will see a speech by Andrew Hauser, RBA Deputy Governor on Monday followed by Consumer and Business Confidence and the Wage Price Index on Tuesday.

- The AOFM plans to sell A$800mn of the 3.50% 21 December 2034 bond on Wednesday and A$700mn of the 2.25% 21 May 2028 on Friday.

NZGBS: Bull-Steepener Ahead Of Next Wednesday’s RBNZ Policy Decision

NZGBs closed on a positive note, with benchmark yields 2-5bps richer and the 2/10 curve steeper.

- Swap rates closed flat to 4bps lower.

- Next week, the local calendar is empty on Monday, ahead of Net Migration data on Tuesday and the RBNZ Policy Meeting on Wednesday.

- (MNI) The RBNZ's monetary policy committee is likely to hold the official cash rate at 5.5% when it meets next week, but it will debate a cut and inject greater dovish language into its communications as it prepares for reductions later this year.

- The economy has slowed and inflation moved towards the RBNZ’s 1-3% target faster than expected in Monetary Policy Statement (MPS) forecasts in May. However, the Reserve’s past comments and its reduced mandate, which no longer requires it to target employment, suggest it will take a cautious approach to any rate adjustment and may wish to examine Q3 inflation and GDP before cutting the OCR.

- RBNZ dated OIS pricing closed little changed across meetings. The market has attached a 66% chance of a 25bp cut at the August Policy Meeting versus 43% before yesterday’s RBNZ inflation expectations data. A cumulative 90bps of easing is priced by year-end.

- (Bloomberg) "Finance Minister Willis may ask the RBNZ to ease its regulation on banks if it would improve competition in the industry, the NZ Herald reports." (See link)

FOREX: USD Softer, As Equity Recovery Continues, But Less Volatility

G10 FX trends have been biased against the USD in the first part of Friday trade, although overall moves have been fairly modest. The BBDXY USD index was last near 1246, off 0.15% for the session.

- USD/JPY was volatile early but couldn't get to fresh weekly highs above 147.90. We topped out at 147.82, but haven't breached 147.00 back on the downside. We were last near 147.10 little changed for the session.

- Yen is tracking 0.40% weaker for the week, with dips in the pair supported since Monday, as global equity sentiment has recovered and market recession fears have eased somewhat.

- The A$ is a touch higher, but isn't racing above 0.6600 (with a large option expiry at this level for NY cut later a potential constraint). Still we were are +1.4% for the week, led by the broader risk recovery and the hawkish RBA backdrop. There isn't much in the way of resistance to 0.6700 (outside of the 50-day EMA near 0.6615).

- NZD/USD has outperformed so far today, up 0.30%, the pair last near 0.6035, fresh highs back to the second half of July.

- US yields sit lower across the benchmarks, led by the front end, with the 2yr near -3bps lower. This unwinds some of Thursday's gains in the yield space.

- Comments from Kansas City President Schmid stated the labour market was cooling but still healthy. If inflation continues to cool Schmid said this would support a policy adjustment.

- Looking ahead, event risks are very light for the offshore session to round out the week. The Canadian labour force survey is likely to be the main data focus point.

ASIA EQUITIES: China & HK Equities Track Global Markets High, CPI Beats Estimates

China & Hong Kong equities are tracking global equities higher today, Hong Kong is outperforming mainland stocks, with tech and property sectors the top performers. Focus has been on China's CPI & PPI beat, while the MSCI Asia Pacific Index climbed as much as 1.9%, although still on track for a 0.60% loss.

- China's largest semiconductor maker SMIC had strong earnings results after reporting better-than-expected net income for 2Q, equity was up 4.9%.

- China's CPI rose by 0.5% y/y in July, driven mainly by a pick up in food price, core inflation weakened to 0.4% from 0.6% the weakest number since January. PPI was -0.8% vs -0.9% est.

- Property stocks are higher following new of Shenzhen purchasing apartments towers, with hopes other Tier 1 cities will then follow suit

- The HSI is up 1.77% today and on track to finish the week slightly higher, while the CSI 300 is 0.14% today and trades down 2.44% for the week.

- Looking at sectors, the Mainland Property Index is 2.30% higher and on track for a 2.50% weekly gains, HSTech Index is 2.30% higher today and is on track for a 2.40% weekly gain.

- Next week we have China's Industrial Production & Retails sales on Wednesday and Hong Kong's GDP on Thursday/

ASIA PAC STOCKS: Asian Equities Higher As Recession Fears Ease, Tech Outperforming

Asian markets extended their rebound, buoyed by positive signals from both Chinese inflation data and U.S. jobless claims, which eased recession fears. The Hang Seng Index rose for the third consecutive day, with tech stocks leading gains. Japan's Nikkei 225 and Topix indices also advanced, driven by a weaker yen and strong earnings reports from major companies like Tokyo Electron. South Korea's KOSPI gained, led by large-cap stocks, as investor sentiment improved following the global market rout earlier in the week. Overall, the region's markets benefited from a stronger outlook and increased investor confidence.

- Japanese stocks rose, with the Nikkei 225 and Topix indices both gaining 1.5%, as the yen weakened and positive earnings reports lifted market sentiment. Technology firms like Hitachi and Tokyo Electron led the advance, buoyed by a strong performance in the Nasdaq. The market rebounded from earlier losses, recovering about half of the decline since the BoJ's recent interest rate hike. Additionally, individual investors continued to buy stocks, marking the fourth straight week of net buying, as optimism returned to Japan's export-driven economy. Banks are the worst performing sector over the past week with the Topix Bank Index down 7.30%, verse the TOPIX & Nikkei down just 1.50% for the same period, both major benchmarks remain in a downtrend after breaking below all key moving averages on Monday.

- South Korean equities are higher today, with the small-cap KOSDAQ up 2.90% while the KOSPI is 1.90% higher. Foreign investors remain better sellers of Korean stocks today with a net outflow of $100m although local retail investors have snapped those stocks up. Equities still trade about 5% lower for the week after Monday saw the KOSPI largest 1-day drop since 2008. Next week we have Korean's unemployment rate due on Wednesday.

- Taiwanese equities have jumped higher today, leading the way in Asia with the Taiex up 3.30% after the Philadelphia SE Semiconductor Index rallied 6.86% overnight, while TSMC is expected to release July sales figures later today.

- Australian equities are higher with metals & miners the top performers after falling the past couple of sessions, the ASX 200 is 1.40%. New Zealand equities are slightly higher with the NZX 50 up 0.40%

- In Asia EM is all higher today, Indonesia's JCI is 0.85%, Thailand's SET is 0.90% higher, Philippines PSEi is 1% higher, Malaysian KLCI is 0.80% higher and Singapore's Strait Times is closed for National day.

ASIA EQUITY FLOWS: Foreign Investors Continue Dumping Asian Equities

- South Korea: South Korean equities experienced an outflow of $520m yesterday, the KOSPI is 9.55% lower over the past 5 session and has net outflows of $1.953b over the same period from foreign investors. Outflows have been largely confined to the tech sector, with some selling also seen in transportation names. The 5-day average outflow is $391m, compared to the 20-day average outflow of $154m and the 100-day average inflow of $79m. Year-to-date, South Korea has had substantial inflows totaling $16.761b.

- Taiwan: Taiwan saw an outflow of $1.614b yesterday, taking the net outflow to $5.707b over the past five trading days. There seems to be no end to the relentless selling of Taiwanese equities with the Taiex off 8% over the past week and 14.70% off July highs, the market is also quickly on it's way to the largest quarter on record for outflows. The 5-day average outflow is $1.141b, compared to the 20-day average outflow of $793m and the 100-day average outflow of $206m. Year-to-date, Taiwan has experienced outflows totaling $11.992b.

- India: Indian equities had an outflow of $338m yesterday, resulting in a net outflow of $1.323b over the past five trading days, Indian equities are holding up better than the more tech focused markets with the nifty 50 off 5% this week, although we have seen almost two weeks of straight selling from foreign investors. The Nifty 50 is holding just above the 50-day EMA after briefly testing it on Monday during the global equity sell-off. The 5-day average outflow is $265m, compared to the 20-day average inflow of $34m and the 100-day average outflow of $48m. Year-to-date, India has seen inflows totaling $2.374b.

- Indonesia: Indonesian equities recorded an inflow of $58m yesterday and is one of the only markets to see inflows over the past week, with a net inflow of $71m, the JCI has largely recovered from Monday's sell-off to trade just 0.86% lower over the past week. The 5-day average outflow is $14m, which is below the 20-day average inflow of $18m and the 100-day average outflow of $11m. Year-to-date, Indonesia has had inflows totaling $110m.

- Thailand: Thai equities saw an outflow of $14m yesterday, resulting in a net outflow of $42m over the past five trading days. The SET made new multi-year lows on Monday and remains under pressure after breaking back below the 20-day EMA. The 5-day average outflow is $8m, which is worse than the 20-day average outflow of $3m and the 100-day average outflow of $24m. Year-to-date, Thailand has had significant outflows amounting to $3.325b.

- Malaysia: Malaysian equities had an outflow of $51m yesterday, resulting in a 5-day net outflow of $121m. The KLCI is just 1.10% lower over the past week and has managed to trade back above both the 100 & 200-day EMAs, next week we have 2Q GDP data. The 5-day average outflow is $24m, which is worse than the 20-day average outflow of $1m and the 100-day average inflow of $0m. Year-to-date, Malaysia has experienced outflows totaling $9m.

- Philippines: The Philippines had no net outflow yesterday, resulting in a net outflow of $34m over the past five trading days. The PSEi has been trading sideway for most of the year, although broke back below all key EMS on Monday and has yet to be able to trade back above them. The 5-day average outflow is $7m, compared to the 20-day average inflow of $1m and the 100-day average outflow of $7m. Year-to-date, the Philippines has seen outflows totaling $502m.

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | -520 | -1953 | 16761 |

| Taiwan (USDmn) | -1614 | -5707 | -11992 |

| India (USDmn)* | -338 | -1323 | 2374 |

| Indonesia (USDmn) | 58 | 71 | 110 |

| Thailand (USDmn) | -14 | -42 | -3325 |

| Malaysia (USDmn) | -51 | -121 | -9 |

| Philippines (USDmn) | 0 | -34 | -502 |

| Total | -2478 | -9109 | 3416 |

| * Up to 7th August |

OIL: Holding Close To Thursday Highs, Comfortably Higher For The Week

Oil prices have drifted higher today but haven't broken above late Thursday levels from US trade. Brent was last $79.25/bbl. WTI was around $76.30-35/bbl. Both benchmarks are tracking comfortably higher for the week.

- Earlier in the week saw speculation growing that an escalation in tensions in the Middle East supported oil prices.

- Overnight the Biden administration called for a new round of cease fire talks on August 15. Qatar and Egypt echoed this call as the region becomes increasingly concerned that Iran would attack Israel.

- A broader recovery in equity risk appetite, as recession fears have eased somewhat, has also supported the oil price rebound over the last few sessions.

- Next week will see OPEC release their monthly market outlook on Monday and during the week, the US will release its key inflation data which will have input into the Federal Reserve’s interest rate decision for September.

GOLD: Sharp Rally On Jobless Claims Data

Gold is 0.3% lower in today’s Asia-Pac session, after closing 1.9% higher at $2427.53 on Thursday, its first gain in six sessions.

- Thursday’s move came as the latest US data relieved concerns over a hard landing for the world’s biggest economy and helped support a broader market rally.

- US initial jobless claims fell 17k last week to 233k, a larger drop than the market expected while continuing claims were in line at 1875k. Nevertheless, it was a surprisingly large hawkish reaction from US tsys to data, which showed little improvement in underlying terms. However, the data did at least rule out a further deterioration in the labour market.

- The US 10-year yield returned to around 4%, 4bps higher on the day. The US 2-year finished 8bps cheaper at 4.04%.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, the recent weakness in gold appears to be a correction. A resumption of gains would open $2,483.7, the Jul 17 high, while support is seen at the 50-day EMA, at $2,377.4.

CHINA RATES: Authorities Continue To Show Concern As To Falling Yields

- Chinese authorities continued their focus on bond yields and their ongoing decline.

- In a sign of no tolerance towards speculators, the large state-owned banks were in the market Thursday selling 7-year maturity bonds

- Known as being a liquid part of the curve, 7-year securities a key maturity where it is suggested that speculation occurs

- Some regional banks in the larger regions were noticeably absent in any bond market activity yesterday, suggesting authorities may have directed them to cease activities.

- This news comes ahead of today’s CPI print in China.

- Surveys point to a modest uptick in the month-on-month CPI print however the risk to the authorities concerns on bond yields is today’s CPI surprises on the downside.

CHINA DATA: CPI Reaction

- The headline print of 0.5% was ahead of expectations and driven by a pickup in food prices

- The rise in food prices masks the underlying trend.

- Core CPI (ex. Food and Energy) printed a more modest 0.4%.

- Additionally, China’s PPI declined 0.8% yoy in July extends a period of contraction that extends back to 2022.

- The underlying data will likely cause the bond bulls to pause for now and give authorities time to consider the next move in policy.

CHINA RATES: Bond Wrap

- China headline CPI ahead of expectations.

- Underlying core however moderating.

- Further evidence of authorities attempting to crackdown on speculation in bond markets.

- Bond yields higher across the curve and finished higher for the week.

- Next week Date: Industrial Production and Retail Sales.

2yr 1.539% (+2.5bp) 5yr 1.866% (+4.5bp) 10yr 2.179% (+3bp) 30yr 2.367% (+5bp)

TWD FX: USD/TWD Plays Catch Up To The Downside, Equity Outflows Still Large Though

USD/TWD sits near 32.43, fresh lows in the pair back to the first half of July. The 1 month NDF sits near 32.07. Earlier we got close to 32.00, which was levels last seen in mid-May.

- This morning's low in the 1month NDF was very close to the 200-day EMA, see the chart below. A break sub this level could see mid May lows targeted. Early April lows were near 31.80. The 100-day is back above 32.31.

- The better equity tone over the past 24-48 hours, with tech indices bouncing strongly, has helped TWD. Today the Taiex is up over 3%, almost back to flat for the week after Monday's 8.35% fall.

- Still, month to date equity outflows remain large at -$4.8bn, while Taiwan related ETFs have also suffered outflow pressures. Some stabilization in such outflow pressures could aid further TWD gains.

- We noted back at the start of the month that USD/TWD could play some catch up to the downside in line with other North Asia FX gains.

- This, along with very depressed TWD NEER levels may have generated some support for TWD in recent sessions. Part of Citi's recent long TWD/THB recommendation reflected this.

Fig 1: USD/TWD 1 Month NDF Versus Key EMAs

Source: MNI - Market News/Bloomberg

USD/Asia Pairs Lower Across The Board On Further Equity Recovery, KRW Surges

USD/Asia pairs lower across the board in the first part of Friday trade. The strongest performers have been KRW and TWD amid better regional equity sentiment and reduced global recession fears. THB and MYR have also rallied, while IDR has been close to steady in spot terms.

- USD/CNH sits off earlier highs, last just under 7.1700. We were testing 7.1900 ahead of the CNY fixing, but a slightly lower outcome in USD/CNY terms tempered bullish sentiment. July inflation data saw a stronger than forecast rise in headline CPI, but this largely reflected a food price rise. Other price areas still suggest a fairly benign domestic demand backdrop. Bond yields rose onshore, aided by the headline CPI beat and the further crack down on speculation in the space by the authorities.

- Spot USD/KRW has sunk more than 1%, last under 1362. The better regional equity tone/paring back of global recession risks have been positives. We also had a former BoK board member push on near term easing risks from the central bank. Downside focus is likely to rest around Monday lows near 1355.

- TWD continue to rebound spot up 0.4%, the 1 month NDF up 0.60% in TWD terms. USD/TWD 1 month near 32.00 is testing sub the 200-day EMA. The Taiwan currency appears to be playing catch up with the firmer North Asia FX trend in recent weeks.

- USD/MYR is back to 4.4550, off 0.40%, after finding selling interest above 4.5000 in recent sessions. Malaysian IP figures were better than expected for June, up 5%, continuing some of the positive recent run of data. USD/THB is tracking in the 35.20/25 region, just up from recent lows. 35.00 will be the downside target. There have been political headlines out today in Thailand but market sentiment has not been impacted.

- USD/IDR has been relatively steady in spot terms, last near 15890. The 1 month NDF is lower, back near 15920. The recent tick up in US real yields may be tempering IDR demand at the margins.

Malaysia: Industrial Production Surprises to the Upside

- Malaysian Industrial Production surprised to the upside with a very strong print.

- The market expected 4.2% yoy expansion.

- Industrial Production expanded at 5% yoy.

- Additionally, Malaysia’s manufacturing sales value rose 5.9%.

- The expansion in Malaysia’s manufacturing has been key in driving the Industrial Production output in 2024.

RBI: The Status Quo Remains: Next Week’s CPI Key

- Yesterday the Reserve Bank of India announced their decision, keeping rates on hold for the ninth consecutive meeting.

- The RBI committee voted four to two in favour, with two members voting for a cut for the second consecutive meeting.

- Market survey consensus was for no change citing (among other things) capacity to wait ahead of the Federal Reserve and strong headline GDP numbers.

- RBI Governor Das indicated that ‘India is now significantly more resilient compared to earlier periods, but that it was crucial to wait for more data before drawing conclusions on the next step for monetary policy.’ Governor Das clearly stated, “the RBI will act as per incoming domestic, international data.”

- Next week’s release of India’s CPI may provide an insight as to the next steps for the RBI.

- Having risen in June, consensus surveys now are for a decline in the CPI in July.

- A decline may provide the RBI with room for monetary policy changes post the September announcement by the Federal Reserve.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 09/08/2024 | 0600/0800 | *** |  | DE | HICP (f) |

| 09/08/2024 | 0600/0800 | ** |  | SE | Private Sector Production m/m |

| 09/08/2024 | 0600/0800 | *** |  | NO | CPI Norway |

| 09/08/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 09/08/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 09/08/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.