-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA MARKETS ANALYSIS: Treasuries Surge On Bessent And Oil

MNI ASIA OPEN: Israel-Hezbollah Ceasefire Cautiously Reached

MNI EUROPEAN MARKETS ANALYSIS: US Debt Ceiling Concerns Overshadow The Start Of Fed Week

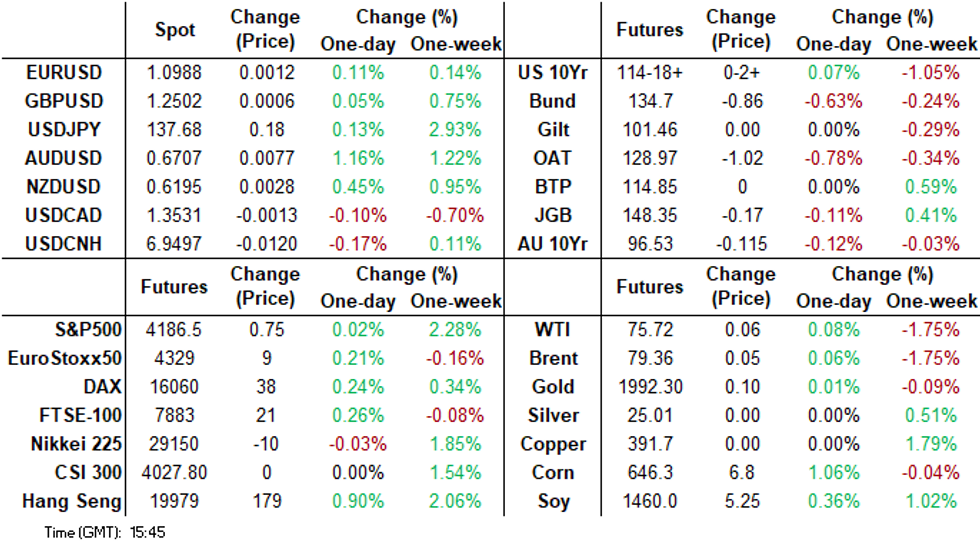

- Much of the excitement came late in the Asia Pac session, when the RBA surprised markets with a +25bps hike. The central bank also left the door ajar for additional tightening, albeit data dependent. The AUD spiked and is back above 0.6700 now, comfortably the best performer within the G10 space. RBA dated OIS has shunted 22-32bp higher across meetings with terminal rate expectations lifting to just shy of 4.0% at 3.98%.

- Elsewhere, the earlier focus was on US debt ceiling developments, with Treasury Secretary Yellen warning funds could be exhausted by June. US President Biden invited Congressional leaders to a meeting next week as the authorities seek to avoid a default.

- There was a flurry of early optimism in Hong Kong shares, amid anecdotes around strong China May holiday travel/activity, but there was little follow through. China markets remain closed until Thursday.

- Looking ahead, Final European Manufacturing PMIs and preliminary Eurozone CPI headline the European session today. Further out we have JOLTS Job opening, Factory and Durable Goods Orders.

MARKETS

US TSYS: Pares Gains In Asia As RBA Hikes 25bps

TYM3 deals at 114-17, +0-01, a touch off the base of the 0-06+ range on volume of ~99k.

- Cash tsys sit little changed from Mondays closing levels across the major benchmarks.

- Cross market spillover from ACGBs as the RBA unexpectedly raised the cash rate 25bps saw tsys pressured to session lows before marginally paring losses.

- Earlier in the session Asia-Pac participants faded Monday’s cheapening perhaps using the opportunity to exit short positions/enter fresh long positions.

- After the early richening, in the lead up to the RBAs monetary policy decision narrow ranges were observed with little follow through on moves.

- Final European Manufacturing PMIs and preliminary Eurozone CPI headline the European session today. Further out we have JOLTS Job opening, Factory and Durable Goods Orders

JGBS: Futures Back To Overnight Lows, Pressured By US Tsys & ACGBs

JGB futures sit near Tokyo session lows, -14 versus settlement levels as cross-market spill over from ACGBs as the RBA unexpectedly raised the cash rate 25bp. Us tsys were pressured to session lows after the RBA decision, 2-3bp off bests.

- Without significant domestic drivers, local participants seem to have been focusing on US tsys ahead of the Euro Area CPI release for April later today, as well as the FOMC policy decision tomorrow.

- Despite the overnight weakness, JBM3 currently sits at 148.38, sandwiched between the April trading range's top at 147.92 and the March 22 high at 149.53.

- Cash JGBs are 0.2bp richer to 2.9bp cheaper across the benchmarks with the 1-year zone the strongest and the 20-year zone the weakest. The benchmark 10-year yield is 1.9bp higher at 0.426%, well below the BoJ's YCC limit of 0.50%.

- Any impetus from solid demand at the latest liquidity enhancement auction covering off-the-run 1- to 5-Year JGBs appears to have been countered by the RBA-Induced cheapening in US tsys.

- Swaps curve twist steepens with swap spreads slightly tighter to slightly wider across the curve, except for the 20-year zone where the swap spread was materially tighter.

- With the local calendar light this week, local participants will continue to eye US tsys ahead of the FOMC decision tomorrow.

AUSSIE BONDS: Sharply Cheaper, RBA Hawkish Again On Inflation

ACGBs sit sharply lower (YM -23.0 & XM -13.5) after the RBA surprises the market by lifting the cash rate by 25bp to 3.85% from 3.60%, labelling inflation as still “too high”. RBA dated OIS pricing had only a 14% chance of a 25bp rate hike priced ahead of the decision. At the time of writing, 3-year and 10-year futures were as much as 22bp and 14bp lower respectively after the RBA decision.

- The RBA began the year with a hawkish stance on inflation but softened its stance after monthly CPI data indicated that inflation had peaked. However, the RBA has once again adopted a hawkish stance with the decision statement, stating that “Some further tightening of monetary policy may be required to ensure that inflation returns to target...”.

- RBA dated OIS has shunted 22-32bp higher across meetings with terminal rate expectations lifting to just shy of 4.0% at 3.98%.

- Cash ACGBs are 12-20bp higher after the decision with the AU-US 10-year yield differential +11bp at -7bp.

- Swap rates are 13-22bp higher after the decision with the 3s10s curve 9bp flatter.

- The bills strip bear flattens with pricing -34 to -19 after the decision.

- Elsewhere, more information is trickling out regarding the May 9 budget. The government is focused on providing cost-of-living relief while not providing fiscal stimulus that adds to inflation – The Australian.

NZGBS: Closed At Cheaps Ahead Of Employment Data Tomorrow

NZGBs closed at session cheaps with benchmark yields 9-11bp higher. Us tsys edging away from Asia-Pac bests aided the move late in the local session.

- Swap rates are 3-5bp with implied swap spread significantly wider.

- RBNZ dated OIS closed 4-6bp firmer for meetings beyond July with Feb’24 leading. The May meeting has 23bp of tightening priced with terminal OCR expectations at 5.55% (July).

- In a report titled, ‘Financial Strain on Households and Businesses’, the RBNZ noted that debt servicing costs are expected to more than double the share of disposable income required to service the interest component of mortgage debt for households with a mortgage, from 9% to 22% by the end of 2023.

- The local calendar is scheduled to release tomorrow the Q1 Labour Market Report with BBG consensus expecting some cooling in tight labour market conditions with the unemployment rate increasing to 3.5% from 3.4%. Q1 wage growth is expected to remain at Q4’s strong pace of +1.1% Q/Q.

- The RBNZ Financial Stability Report is also slated for release tomorrow.

- Given that the local market has closed ahead of the RBA rates decision, tomorrow's opening is expected to reflect not only the Australian market's response to the announcement but also any fluctuations in the US Tsys overnight.

FOREX: AUD Firms in Asia As RBA Hikes 25bps

The AUD is the strongest performer in the G-10 space at the margins on Tuesday. The RBA lifted the cash rate 25bps to 3.85%, the market had been expecting rates to be held steady at 3.60%.

- AUD/USD prints at $0.6695/0.6700, the pair has rallied ~1% since the RBA decision. We have breached the 20-Day EMA ($0.6673), bulls now target a move above $0.67.

- AUD/NZD is ~0.7% firmer, the cross is back above the $1.08 handle and has breached the 20-Day EMA. Bulls now target the 200-Day EMA at $1.0868.

- Kiwi is ~0.2% firmer, NZD/USD prints at $0.6180/85. However the pair has not yet been able to sustain a break of the 20-Day EMA ($0.6187) having met resistance here through today's Asian session.

- Elsewhere in G-10 ranges have narrow with little follow through on moves.

- Cross asset wise; e-minis are a touch softer and BBDXY is ~0.1% lower. US Treasury Yields are little changed from Mondays closing levels across the curve.

- Final European Manufacturing PMIs and preliminary Eurozone CPI headline the European session today. Further out we have JOLTS Job opening, Factory and Durable Goods Orders.

GOLD: Bullion Range Trading Ahead Of Fed Decision

Gold prices have been steady during the APAC session with trading in a range of less than $5. They fell 0.4% on Monday after briefly breaking above the $2000 level to reach an intraday high of $2006.05/oz. Gold is currently trading around $1981.80. The USD index is down slightly.

- Bullion is in a holding pattern ahead of the Fed’s rate decision on Wednesday. It is expected to hike rates another 25bp and then possibly signal that it will pause (see MNI Fed Preview: May 2023). A more dovish statement would be good for gold prices.

- A lack of agreement on increasing the US debt ceiling may also be providing some support to gold through safe haven flows. President Biden has invited congressional leaders to a meeting on May 9.

- Later today US JOLTS job openings and factory orders for March print. Also April manufacturing PMIs in Europe and preliminary April euro area CPI data are released.

OIL: Demand Outlook Troubling Crude Ahead Of Expected Fed Hike

After falling 1.3% on Monday, oil prices are stable today and trading in a narrow range. Brent is up 0.1% to $79.40/bbl and WTI stable around $75.77, both are just off intraday highs. The USD index is down slightly.

- Ahead of the Fed’s rate decision on Wednesday, crude markets continue to focus on demand uncertainties. The FOMC is expected to hike rates another 25bp and then possibly signal that it will pause (see MNI Fed Preview: May 2023). A more dovish tone to the statement would help to calm some fears re a US recession. While, China’s recovery doesn’t seem uniform with industrial data lacklustre but retail and travel trends robust.

- Later today US JOLTS job openings and factory orders for March print. Also April manufacturing PMIs in Europe and preliminary April euro area CPI data are released.

EQUITIES: HSI Volatility Dominates As Asian Markets Re-Open

Regional equity markets are mixed today. Hong Kong markets re-opened much higher (returning from yesterday's holiday), but quickly found selling interest. The HSI back close to flat. US futures are down a touch, but are away from worst levels. The market digesting late comments from the US session around the debt ceiling and developments in the banking space post J.P. Morgan's take over of First Republic.

- The HSI opened up strongly led by tech, but quickly ran into selling interest. Initial optimism rested with China spending/activity over the May day holiday period (which continues this week), with anecdotes of strong activity. We also had a decent beat on Q1 GDP for Hong Kong, but that failed to lift sentiment further.

- Fresh concerns in the property sector following a default from last Friday along with weaker earnings appeared to curb the rally. The HSI is back to around flat, the tech index is up off lows, but still more than 2% down from opening highs.

- Other markets which returned from yesterday's break have fared better. The Kospi is +0.65%, while the Taiex is +0.20%. Singapore and Malaysia markets are also higher, but away from opening highs.

- Indonesian stocks are bucking this trend, down over 1%. Construction company Waskita has fallen sharply after its CEO was detained by the Attorney General's office.

- The ASX 200 is around flat, while Japan stocks are trading slightly in the red, the Topix off by 0.20%.

NZ: Q1 Labour Market Data Not Expected To Show Pressures Easing

The Q1 employment and wages data is released on Wednesday May 3 and will be an important input into the May 24 RBNZ rate decision. The data is expected to be fairly robust showing little sign of easing labour market or wage pressures.

- Employment is expected to grow by 0.5% q/q and 1.8% y/y, which would be the fastest growth in a year. Analysts’ estimates are in a range of flat to 0.8% q/q and 1.5% to 2.2% y/y. Bank NZ is forecasting 0.4% q/q, ANZ +0.5%, Kiwibank +0.7% and Westpac +0.8%.

- The unemployment rate is expected to rise 0.1pp to 3.5% as the participation rate also rises 0.1pp to 71.8%. Unemployment rate estimates are between 3.3% and 3.8%. ANZ is predicting a fall to 3.3% but Bank NZ, Kiwibank and Westpac all expect it to be stable at 3.4%.

- Private wages including and excluding overtime are both expected to rise another 1.1% q/q in Q1 after increasing the same amount last quarter. Excluding overtime the range of forecasts is 0.7-1.1% with Bank NZ forecasting 0.9% and both ANZ and Westpac 1.1%. Wages growth has been elevated running above 8% y/y, and so the RBNZ would be pleased if these series undershot expectations.

ASIA: PMIs Mixed But Point To Subdued Global Trade

April Global S&P manufacturing PMIs were mixed with some countries seeing an improvement but not others and some in expansionary territory and others contracting. The average of South Korea’s and Taiwan’s PMIs is pointing to a tentative but subdued recovery in global trade, consistent with the global manufacturing PMI.

- Korea’s PMI improved to 48.1 from 47.6, but still indicates that industrial output is contracting. It appears to have stabilised at a lacklustre level due to subdued demand with new orders down, including export orders due to weaker global growth and customer confidence. Input prices rose at their slowest rate for 29 months due to improving supply chains and material availability.

- Taiwan’s PMI eased to 47.1 from 48.6 due to output, new orders and employment falling at a faster pace. Selling prices are being cut as costs ease. New export business fell at the fastest pace since January.

- The manufacturing PMI in Thailand rose to a record 60.4 from 53.1 with also record increases in production and new orders, signalling a quick activity growth. The rise in new orders was driven by the domestic economy as foreign orders only rose marginally. The 12-month outlook also improved. Output prices moderated but are still well above pre-Covid levels.

- Indonesia’s PMI was also stronger at 52.7 up from 51.9, the highest since September, driven by stronger domestic new orders as export sales fell due to muted overseas business conditions. Input costs rose at a slower rate while output prices increased slightly.

Source: MNI - Market News/Bloomberg

ASEAN PMIs

Source: MNI - Market News/Bloomberg

*ASEAN PMI for April 2023 has not yet been released

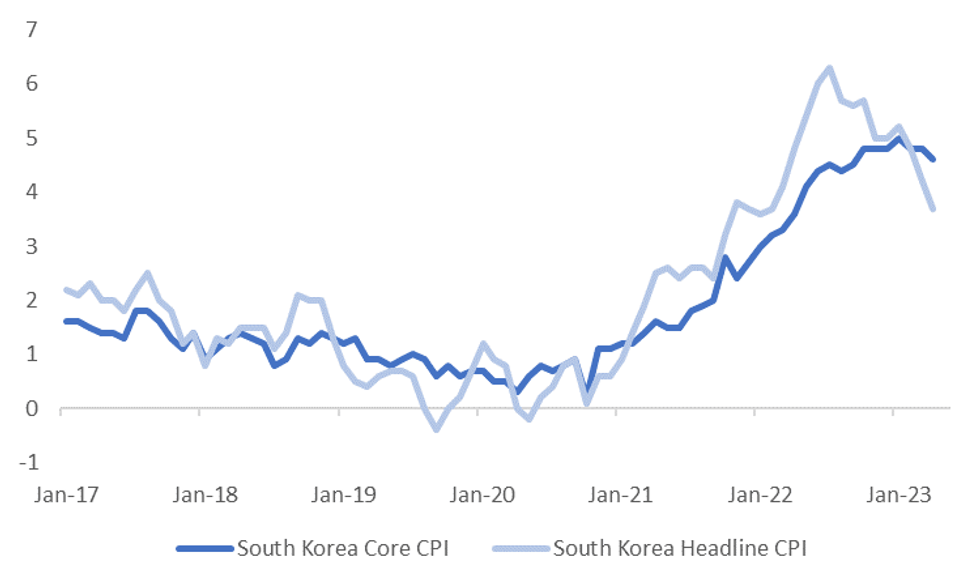

SOUTH KOREA: Inflation Eases Further

South Korean CPI eased further in April, albeit in line with market expectations. The m/m printed at 0.2%, while y/y was 3.7%. Note the prior y/y read was 4.2% and the July 2022 peak was 6.3%. So, headline pressures continued to ease. Core inflation also moderated to 4.6% y/y, from 4.8% prior. The recent peak in Jan was 5.0%, so again signs of moderating pressures, but not to the same degree as the headline. Note core CPI was up 0.4% in the month, after rising 0.2% in March.

- The results will likely be welcomed by the South Korean authorities, albeit moving in the direction they expected. It is also in line with easing consumer inflation expectations.

- The Finance Minister Commented after the release that inflation and geopolitical uncertainties remain.

- The BoK Mins are out later from the April meeting, where the central bank held steady. It will update its inflation forecast at the May meeting (currently looking for headline at 3.5% in 2023).

Fig 1: Headline & Core CPI Y/Y Momentum Eases Further

Source: MNI - Market News/Bloomberg

BNM: MNI BNM Preview - May 2023: No Change Likely

- On balance, we don’t feel that BNM needs to rush to resume the tightening cycle. Inflation pressures have cooled further, while external headwinds are starting to weigh on export growth.

- Moreover, ahead of the next policy meeting in early July, BNM will get a further two inflation updates, along with Q1 GDP. The external backdrop may also be clearer by that stage as well.

- This leaves us expecting no change at tomorrow's BNM policy meeting, which is also where the consensus sits.

- Full preview is here:

ASIA FX: Mixed Trends As Most Markets Return

USD/Asia pairs are mixed as many markets return from yesterday's holiday (although China still remains closed). Some pairs in SEA saw slightly firmer USD demand, but remain within recent ranges. Tomorrow, the focus will rest on the BNM decision, where no change is expected. Thailand CPI is also out, along with India and Singapore PMIs.

- China markets remain closed until Thursday. Still, Hong Kong equities rallied strongly at the open on optimism around the China May day holiday period, but this move ran into strong selling interest. The HSI is back to flat now. USD/CNH is back sub 6.9600, but remains close to its 200 day MA for now.

- USD/KRW 1 month is back below 1340 (last 1338/39). Apr CPI continued to cool across both headline and core measures. Otherwise, the focus was on geopolitics with Japan leader Kishida to visit South Korea this coming Sunday-Monday. Improving ties are evident between Japan-South Korea.

- The rupee is a touch firmer in early dealing, USD/INR is down ~0.1% last printing at 81.75/77. Broader based USD/Asia trends are dominating this morning as on shore markets re open after the observance of a national holiday. USD/INR printed a fresh year to date on the 27 April before paring losses into month end. Bears look to target 200-Day EMA (81.13), bulls look to break the 20-Day EMA at 82.01. April S&P Global Manufacturing PMI printed at 57.2 yesterday rising from 56.4, this was the highest print in the measure since December 2022.

- USD/MYR prints at 4.4590/4620, the pair is little changed in early dealing on Tuesday. Narrow ranges have persisted as USD/MYR consolidates above the 20-Day EMA. Rallies have been capped ahead of 4.47, with support seen at 4.45. On the wires today we had April S&P Global Manufacturing PMI which printed at 48.8 unchanged from the March read. The measure remains in contractionary territory since breaking below 50 in August 2022.

- The SGD NEER (per Goldman Sachs estimates) firmed to its highest level since the April MAS meeting yesterday before moderating gains. We currently sit ~0.9% below the top of the band. Broader USD trends dominated dealing yesterday, the pair was offered before paring losses as US data was firmer than expected. USD/SGD was supported at the 20-Day EMA ($1.3339), bears have been unable to break below the measure in recent dealing.

- USD/THB is back to 34.15/20, unable to gain much traction from a surging PMI print to the 60.0 handle. USD/IDR is also back above 14700, against recent lows under 14650. Apr CPI was close to expectations (4.33% y/y, 4.39% forecast and 4.97% prior for headline), while onshore equities are down 1.2%, which has likely weighed on FX at the margins.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 02/05/2023 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0745/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 02/05/2023 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0800/1000 | ** |  | EU | M3 |

| 02/05/2023 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2023 | 0830/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 02/05/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/05/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 02/05/2023 | 1000/1200 | ** |  | IT | PPI |

| 02/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/05/2023 | 1400/1000 | ** |  | US | Factory New Orders |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/05/2023 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/05/2023 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 03/05/2023 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 03/05/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.