-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

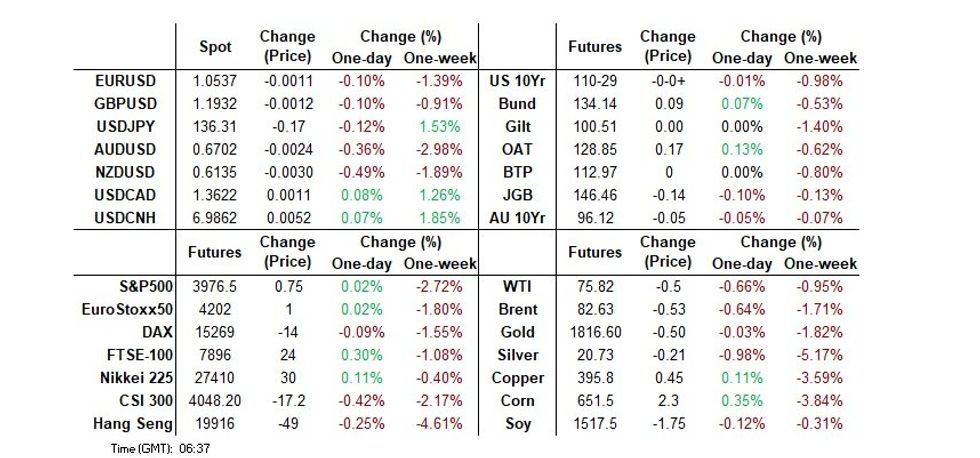

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Nudges Higher In Asia

- Cash Tsys sit 2bp cheaper to 1bp richer, the curve has twist flattened pivoting around 10s, with Friday's post-PCE flattening impulse ultimately proving somewhat sticky. Asia-Pac participants faded Friday's post-PCE cheapening in early dealing, perhaps using the opportunity to square short positions as we approach month end. The lingering impact of Friday's PCE print then saw Tsys retreat from session highs as the front end of the curve was pressured. However, Friday's lows remain intact in TU futures. We also saw some light steepener flow in the STIR space.

- The greenback has marginally firmed through the Asian session, after beginning the day on the back foot the USD was bid as U.S. Treasuries retreated from best levels and e-minis pared gains.

- In Europe today the Eurozone Economic Sentiment Indicator is the highlight of an otherwise thin data calendar, with ECB's Lane & De Cos, as well as BoE's Broadbent, headlining the regional speaker slate. Further out we will see Durable Goods Orders, Pending Home Sales and Dallas Fed Manf Activity. Fedspeak from Governor Jefferson will also cross.

US TSYS: Curve Flattens In Asia

TYH3 deals at 110-28+, -0-01, operating in a limited 0-06 range on volume of ~70K.

- Cash Tsys sit 2bp cheaper to 1bp richer, the curve has twist flattened pivoting around 10s, with Friday's post-PCE flattening impulse ultimately proving somewhat sticky.

- Asia-Pac participants faded Friday's post-PCE cheapening in early dealing, perhaps using the opportunity to square short positions as we approach month end.

- The lingering impact of Friday's PCE print then saw Tsys retreat from session highs as the front end of the curve was pressured. However, Friday's lows remain intact in TU futures.

- We also saw some light steepener flow in the STIR space.

- Little meaningful macro headline flow was seen through the Asia-Pac session.

- In Europe today the Eurozone Economic Sentiment Indicator is the highlight of an otherwise thin data calendar, with ECB's Lane & De Cos, as well as BoE's Broadbent, headlining the regional speaker slate. Further out we will see Durable Goods Orders, Pending Home Sales and Dallas Fed Manf Activity. Fedspeak from Governor Jefferson will also cross.

JGBS: No Curve Balls From Ueda

JGB futures were defensive as Tokyo reacted to Friday’s moves in wider core global FI markets, leaving the contract -14 at the close. Participants were unwilling to force a meaningful break of the overnight session base in the contract, only managing a short-lived and modest look below (low to average cover ratios in BoJ Rinban covering 3- to 25-Year paper likely limited losses).

- Cash JGBs were more mixed, running 1bp cheaper to 2bp richer, with 7s providing the weak point owing to the move seen in futures. Super-long end outperformance may signal domestic life insurers putting some capital to work ahead of FY end after shedding super-long exposure in January.

- BoJ Governor-in-waiting Ueda appeared in front of the upper house in parliament today, mostly reiterating Friday’s comments made to the lower house.

- Note that the BoJ’s previously flagged limitations to SLF lending surrounding certain 10-Year JGBs (a move to protect YCC settings) went into action today.

- Looking ahead to tomorrow, preliminary industrial production data and 2-Year JGB supply are due. We will also hear from the government’s nominations for the BoJ Deputy Governor roles (Uchida & Himino), as they deliver their own nomination hearings to the upper house.

AUSSIE BONDS: Weaker But Outperform U.S. Tsys

ACGBs close weaker (YM -7.0 & XM -5.0) as Q4 Business Indicators fail to offset PCE-induced weakness in U.S. Tsys. Cash ACGBs do however outperform across the curve with yields 7-8bp higher versus the 8-12bp move in U.S. Tsys yields seen in pre-weekend NY trading. The AU/US 10-year differential closes 2bp tighter at -5bp.

- Bills finished 1 to 9bp cheaper through the reds..

- RBA dated OIS firm +7-12bp for meetings beyond June, with terminal rate pricing back within striking distance of its cycle high (4.42%) at 4.36%.

- With quarterly Business Indicators often difficult to interpret given their construction, the market appears destined to track U.S. Tsys, at least until tomorrow’s data drop of monthly Retail Sales and Private Sector Credit data, and the remaining quarterly partials (Q4 GDP on Wednesday). Abroad, PMI data globally is released on Wednesday, with European CPI and unemployment data on Thursday.

- Elsewhere, Treasurer Chalmers, in India for the G20 meetings, spoke on Sky News of the “opportunity to refresh the Reserve Bank Board” in response to news that two members would not seek re-appointment. On Sunday, the Treasurer said that a decision on the Governorship of the RBA will be made around mid-year.

NZGBS: Softer Retail Sales Fails To Change The Tone

NZGBs close 3-4bp weaker despite softer than expected Q4 real retail sales suggesting an easing in demand. The inability of the data to sustain a bid likely reflected the cross currents of base effects and some remaining Covid trends. RBNZ’s Chief Economist Conway was also on the wires touting a familiar message on inflation. He did however “see some signs we are at an inflation turning point”, but with “a lot of uncertainty”.

- Today’s move in NZGBs saw the 2-year yield push to a post-RBNZ meeting high (37bp above last Monday’s close) and the 10-year retrace around half of Friday afternoon’s 9bp rally. On a relative basis, NZGBs were slightly stronger versus Australia after last week’s 20bp+ underperformance across the curve. On Friday, the AU-NZ 10-year cash yield differential narrowed to within 3bp of its mid-December low of -83bp, representing a 40bp round-trip since the start of the year.

- Swap rates close 5-6bp higher, implying a widening in swap spreads.

- RBNZ dated OIS closed 2 to 4bp firmer across meetings beyond April with November leading. April meeting pricing held at 39bp of tightening with terminal OCR (Aug-23) at 5.49% (the RBNZ’s peak forecast).

- Without a domestic impetus, the market will turn to U.S. Tsys for guidance ahead of the release of monthly Building Approvals data tomorrow. Australia also releases monthly Private Sector Credit data and further quarterly partials.

FOREX: USD Marginally Firmer In Asia

The greenback has marginally firmed through the Asian session, after beginning the day on the back foot the USD was bid as US Treasuries retreated from best levels and e-minis pared gains.

- Kiwi is the weakest performer in G-10 space, last printing $0.6140/45 down ~0.4%. NZD/USD printed its lowest level since 22 Nov, waning risk appetite weighed. RBNZs Chief Economist noted that Cyclone Gabrielle is a supply shock which will add to inflation, also noting RBNZ sees signs that demand is starting to slow and higher rates are needed to cool the economy.

- AUD/USD prints at $0.6710/15, down ~0.2%. Iron Ore futures were down ~2% following an order by Chinese authorities to cut production in Tangshan in a bid to curb pollution. Q4 Company profits printed at 10.6% firmer than the expected 1.6%. Inventories fell 0.2%, the expectation had been for a flat print.

- JPY was firmer in early trade before paring gains, USD/JPY found support at ¥136.00 and pared losses to deal flat last printing ¥136.30/40. Upside resistance comes in at ¥136.67, the 38.2% retrace of Oct-Jan bear leg. Ueda's appearance hasn't moved the needle. He has reiterated comments from Friday stressing challenges facing whoever succeeds Kuroda amid uncertainty on the economic outlook.

- Elsewhere in G-10 moves have been limited with little follow through. EUR and GBP sit little changed from opening levels. NOK and CHF are ~0.1% softer.

- Cross asset wise; regional equities are softer, Hang Seng is down ~0.75%, and e-minis are ~0.1% firmer. The US Treasury curve is flatter. BBDXY is ~0.1% firmer.

- In Europe today EZ Economic Sentiment Indicator is the highlight of an otherwise thin calendar. Further out we will see Durable Goods Orders, Pending Home Sales and Dallas Fed Manf Activity.

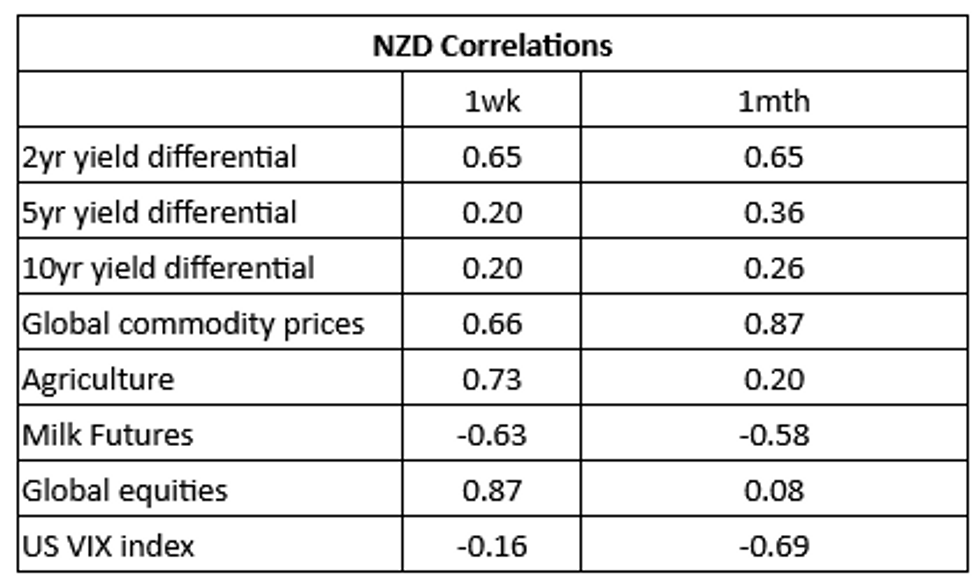

NZD: Equities Dominant Macro Driver For Kiwi Last Week

NZD/USD was pressured last week, down ~1.31%, printing its lowest level since late November. The table below presents levels of correlations between NZD and key macro drivers (note the yield differential reflects swap rates).

- Global equities were the dominant macro driver in recent dealing, with weakness in global commodity and agriculture indices also weighing.

- Over the longer term 2-Year Yield Differentials and Global Commodities continue to be the main driver in NZD.

- Resilience in milk prices hasn't aided the Kiwi in both the short term and long term time frames.

Fig 1: NZD/USD Correlation with Global Macro Drivers:

Source: MNI/Bloomberg

FX OPTIONS: Expiries for Feb27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0455-62(E757mln), $1.0500(E1.5bln), $1.0550-65(E1.0bln), $1.0600(E625mln), $1.0695-00(E1.2bln)

- USD/JPY: Y132.80-00($1.1bln), Y137.00($1.0bln)

- AUD/USD: $0.6680(A$1.1bln), $0.6800(A$1.1bln), $0.6930-50(A$539mln)

- USD/CAD: C$1.3595-05($1.0bln)

ASIA FX: USD/CNH Resistance Ahead Of 7.00 Doesn't Prevent Dollar Gains Elsewhere

USD/Asia pairs are higher across the board, albeit to varying degrees. USD/CNH is up modestly, with some potential resistance ahead of the 7.00 handle. KRW, PHP and THB have all fallen sharply. Weaker equities, amid on-going US yield strength continues to benefit the USD. The main focus tomorrow will be on Q4 GDP out of India, with Singapore unemployment figures also out, along with Thailand trade and IP figures.

- USD/CNH dipped to 6.9650 in the first part of trade, but rebounded towards 6.9900 before selling interest capped the pair. The CNY fixing remains neutral, while onshore and HK equities struggle for positive traction.

- Spot USD/KRW is above 1320, with the 1 month NDF not far behind, which is around 0.5% weaker (in won terms) relative to Friday closing levels. Weaker onshore equities have hurt sentiment and we are now through the simple 100 and 200-day MAs. The authorities haven't made comments on FX markets so far today.

- INR has been resilient in recent trade, with the USD/INR respecting narrow ranges as the Rupee outperforms its Asia peers. The INR NEER continues to climb, now back at 67.30 (J.P. Morgan Index), highs back to early Dec last year. Headlines crossed earlier that the RBI was likely selling USDs via State Banks (Reuters). We got to 82.95, but now sit slightly lower. Clearly there is still some resistance to a break through of 83.00. Technically the pair remains in a bullish trend, bulls still target high from October at 83.17.

- The SGD NEER (per Goldman Sachs estimates) is marginally firmer today. NEER currently sits around ~0.5% below the top of the trading band, similar levels to Friday's session. USD/SGD is little changed today, last printing at $1.3500/05. The pair saw resistance ahead of the 50-day EMA on Friday ($1.3518). Bulls still look to target the 200-day EMA at $1.3636. Bears first look to break the 20-day EMA at $1.3349 to turn the tide.

- Spot USD/PHP is noticeably firmer today. The pair up around 1.15% at this stage, taking us back to 55.50/55. This is fresh highs back to early Jan. Note onshore markets were closed on Friday, so some of this reflects catch up given the generally supportive USD backdrop. The 100-day EMA is nearby, just under 55.60. Note the simple 200-day MA sits slightly higher at 55.75. PHP is one of three EM Asia currencies to still show positive gains for 2023 to date (with IDR and TWD being the others). There still seems scope for USD/PHP to catch up to the topside, given the rebound in core yields, particularly in the US. The Philippines current account/trade deficit position should still leave it vulnerable to such moves.

ASIA: Equity Outflows Persist Amid Higher US Real Yields, Not Yet At Previous Trough Points

Equity outflows from offshore investors were evident across the region last week. The table below presents flows across the major economies in the region for the past week, month and 2023 to date (note for China this represents Northbound stock connect flows).

- Even with the outflows seen over the past week, for February to date a lot of markets still remain in positive territory from a flow standpoint. This is even more evident when looking at 2023 as a whole.

Table 1: EM Asia Equity Flows

| Past Week | Month To Date | 2023 To Date | |

| China* (Yuan bn) | -4.1 | 12.5 | 153.8 |

| South Korea (USDmn) | -742 | 1329 | 6440 |

| Taiwan (USDmn) | -418 | 1107 | 8348 |

| India (USDmn) | -37 | 283 | -3377 |

| Indonesia (USDmn) | 20 | 224 | 20 |

| Thailand (USDmn) | -563 | -1109 | -564 |

| Malaysia (USDmn) | 46 | -6 | -88 |

| Philippines (USDmn) | -32 | -63.2 | 58.8 |

| * Northbound Stock Connect Flows |

Source: MNI - Market News/Bloomberg

- We aren't at previous trough points for EM Asia (ex China) flows, at least on a rolling monthly sum basis, see the second chart below.

- There is even less confidence of a trough point given the one key driver of such outflow pressures, higher US real yields, continues to move against the flow picture.

- Taiwan and South Korea flows have the largest negative correlation with 1 month changes in US real yields over the past 12 months. This likely reflects the tech exposure in both of these markets. All other economies in the region have a negative correlation with real yields, except for Indonesia and Malaysia.

- Indonesia's correlation has been positive which likely owes to the relationship between commodity prices and real yields, i.e. both were going up over the past 12 months, However, this is not the case for the most recent round of US real yield strength, which may impart less of a positive bias in terms of Indonesian equity flows.

Fig 1: EM Asia (Ex China) Equity Flows & US Real 10 Yr Yield

Source: MNI - Market News/Bloomberg

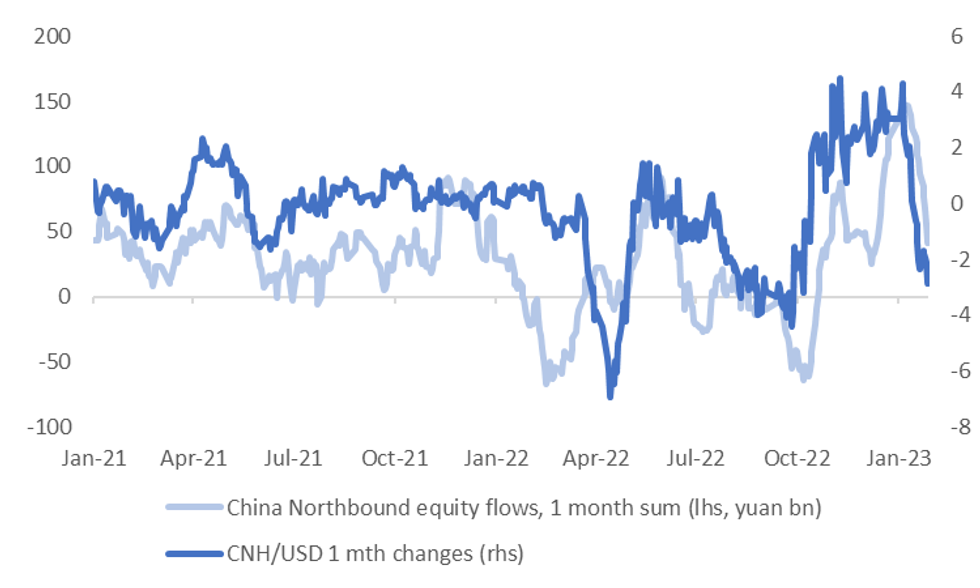

- The markets may be hoping for positive news this week in terms of China PMI prints, and what it states about the recovery process. Next week's National People's Congress will also be eyed closely in terms of 2023 growth targets and the outlook for key sectors such as housing.

- The final chart plots CNH against Northbound equity flows. Any positive news from China has scope to spill over to the rest of the region.

Fig 2: CNH Versus Northbound Equity Flows

Source: MNI - Market News/ Bloomberg

EQUITIES: Soft Start To The Week

Regional bourses are tracking lower, with markets continuing to see fall-out from firmer than expected inflation data through Friday's US session. China/HK markets are away from worst levels, while US futures are higher, but down from session highs, with Eminis almost back to flat.

- The HSI erased losses of 1%, due to better earnings results from Haidilao (a hot pot chain). We are still lower at this stage, -0.5%. The commodity space has seen some steel and coal names do better as well, as pollution curbs are seen as boosting prices. This hasn't helped iron ore, which is off today. The CSI 300 is down by around 0.3% at this stage.

- The Nikke 225 is down slightly, but the Kospi (-1.13%) and Taiex (-0.70%) have fared worse. This followed tech losses on Friday, with pressure coming from higher core yields.

- The ASX 200 is down by over 1%, as miners were hurt by the iron ore pull back. NZ stocks were also off by nearly 1%.

- Philippines markets are down around 2% at this stage, as markets played some catch up after being closed on Friday.

GOLD: Bullion Lower Again Today As USD And US Yields Rise Further

Gold prices are lower again today as the USD index is up 0.1% and Treasury yields are higher after stronger-than-expected US PCE inflation on Friday. Bullion fell 0.6% on Friday and is down another 0.1% today to $1809/oz, close to the intraday low and late December levels.

- Gold has been moving lower after reaching an intraday high of $1814.22. Its low was $1806.79. It is now approaching its 100-day simple moving average. Trend conditions are now bearish for the yellow metal.

- Later the Fed’s Jefferson discusses inflation and US January durable goods orders data are published. Headline orders are projected to decline 4% m/m with the core down 0.1%. There is also the EC’s February survey.

OIL: Crude Continues To Range Trade As Demand And Supply Factors Balance Out

Oil prices are lower during APAC trading as the USD index is up 0.1% and Treasury yields are higher after stronger-than-expected US PCE inflation on Friday. Crude rose over 1.2% on Friday and today WTI is down 0.3% to $76.10/bbl and Brent -0.3% to $82.88, both are close to intraday lows.

- Brent reached a high earlier in the day of $83.51 and WTI of $76.75. Both are sitting just under the 50-day simple moving averages. Both are above support levels of $80.40 and $73.80, the February 23 lows, respectively.

- The market continues to be concerned that Fed tightening will result in a US recession and weigh on demand for oil but it also remains optimistic about increased needs in China, resulting in range trading. An unexpected stoppage of oil from Russia through a pipeline in Poland also provided recent support to prices but Poland has said it was prepared for this eventuality.

- Later the Fed’s Jefferson discusses inflation and US January durable goods orders data are published. Headline orders are projected to decline 4% m/m with the core down 0.1%. There is also the EC’s February survey.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/02/2023 | 0700/0800 | ** |  | SE | Retail Sales |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Business Confidence |

| 27/02/2023 | 0900/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 27/02/2023 | 0900/1000 | ** |  | EU | M3 |

| 27/02/2023 | 0900/0900 |  | UK | BOE Broadbent Opens BEAR Research Conference | |

| 27/02/2023 | 1000/1100 | ** |  | EU | EZ Economic Sentiment Indicator |

| 27/02/2023 | 1330/0830 | * |  | CA | Current account |

| 27/02/2023 | 1330/0830 | ** |  | US | Durable Goods New Orders |

| 27/02/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 27/02/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 27/02/2023 | 1530/1030 |  | US | Fed Governor Philip Jefferson | |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 27/02/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 27/02/2023 | 1700/1800 |  | EU | ECB Lane Lecture at Goethe University Frankfurt |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.