-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN MARKETS ANALYSIS: USD Nudges Lower Overnight

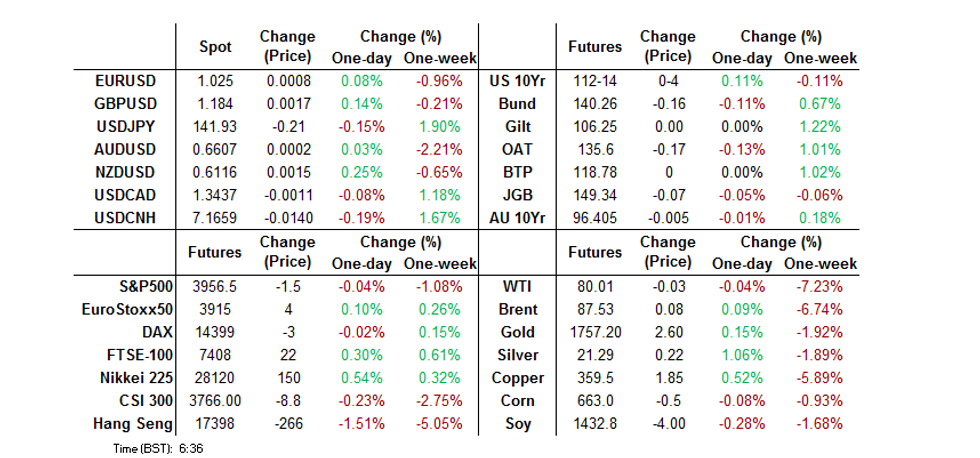

- Tsys have firmed a touch into London hours, with comments from the Chinese Defence Minister crossing the wires after a meeting with his U.S. counterpart. The Minister has stressed that no outside force has the right to interfere with Taiwan, while noting that the Chinese military has the ability to maintain unification. Similar things have been said before, with markets perhaps a bit jittery after the meeting.

- The USD has stayed under pressure for much of the session, although overall losses have remained fairly modest. The BBDXY is off by around 0.20% (1289), the DXY by a similar amount. Headline flow has remained light, while slightly lower UST yields and a firmer equity backdrop have weighed on the USD from a cross asset standpoint.

- Looking ahead, we will get an address from RBA Governor Lowe, UK public finances are also on tap, along with some ECB speakers. In the U.S., the Richmond Fed m'fing survey will cross, while Fed speak is due from Bullard, George & Mester.

US TSYS: Firmer Into London

Tsys have firmed a touch into London hours, with comments from the Chinese Defence Minister crossing the wires after a meeting with his U.S. counterpart. The Minister has stressed that no outside force has the right to interfere with Taiwan, while noting that the Chinese military has the ability to maintain unification. Similar things have been said before, with markets perhaps a bit jittery after the meeting.

- TYZ2 is +0-06 at 112-16, 0-01 off its fresh session high, operating in a 0-10+ range on volume of 147K (boosted by roll activity). Cash Tsys are 2.0-4.5bp richer, with the belly of the curve leading.

- A light bid was apparent in earlier rounds of Asia-Pac trade. There was little in the way of overt catalysts noted as cross-market flows aided the bid, with the broad USD ticking lower in FX trade.

- A block buy of FV futures (+2,030) and quarterly roll activity headlined on the flow side.

- Markets looked through the latest Chinese COVID case update, with the country recording another 2 COVID-linked deaths after recording 3 over the weekend (the first such deaths observed in nearly 6 months, albeit within the elderly community, with 2 of the initial 3 instances also exhibiting complex medical conditional pre-COVID).

- NY hours will see the release of the Richmond Fed m’fing survey, 7-Year Tsy & 2-Year FRN supply, as well as Fedspeak from Bullard, George & Mester.

JGBS: A Little Steeper Ahead Of Mid-Week Break

JGB futures meandered through Tokyo trade, with a lack of meaningful headline flow apparent, leaving the contract -10 into the bell, consolidating most of its overnight losses.

- Cash JGBs sit little changed to 2bp cheaper, with the long end edging away from worst levels. The steepening impulse may have been a product of some jitters ahead of Friday’s 40-Year JGB supply, with tomorrow’s holiday not aiding liquidity.

- Local news flow was light, with Chief Cabinet Secretary Matsuno playing down news reports which pointed to the likelihood of a fairly imminent cabinet reshuffle from PM Kishida, given the recent headwinds for his approval ratings/loss of 3 ministers.

- Elsewhere, Kishida provided familiar tones re: the BoJ & FX markets, while noting that pay rises shouldn’t be outstripped by inflation.

- Spreads tightened and the cover ratio jumped at the latest liquidity auction covering off-the-run 1- to 5-Year JGBs. Offshore participants perhaps took advantage of x-ccy basis swap related yield pickups, while domestic names may have looked to the BoJ’s on hold stance and relative stability of this area of the curve to park any excess cash, given continued market volatility and elevated FX-hedging costs, which renders many offshore bond investments unviable.

- As mentioned above, tomorrow is a national holiday in Japan, which will result in the closure of the country’s financial markets.

AUSSIE BONDS: Flattening, Lowe Eyed

Tuesday provided a muted round of trade for ACGBs as participants look ahead to the impending Antipodean risk events, namely this evening’s dinner address from RBA Governor Lowe (on the topic of “Price Stability, the Supply Side and Prosperity”) and tomorrow’s monetary policy decision from the RBNZ.

- We don’t expect Lowe to offer much new when it comes to the outlook for monetary policy, after the RBA recently stepped down to 25bp increments re: cash rate hikes, while stressing that policy is not on a pre-set path.

- The flattening impulse from Monday’s U.S. Tsy trade held throughout the session, with a light bid in Tsys lending support, leaving YM -2.0 & +0.5 at the close, paring some of the losses observed in post-Sydney trade. Wider cash ACGB trade saw the major benchmarks running 3bp cheaper to 2bp richer late in the day, with the wings providing the extremes and a pivot observed around 12s.

- The 3-/10-Year EFP box was a little flatter, suggesting receiver side swap flows may have aided the bid in the longer end.

- Bills were +2 to -4 through the reds at the bell, as the strip twist steepened.

- Wednesday’s local docket will bring A$900mn of ACGB May-32 supply and flash PMI data from S&P Global.

NZGBS: Impending RBNZ Decision Front & Centre

A twist flattening move became apparent in NZGBs as the day wore on, with the impulse from Monday’s U.S. Tsy trade and a light bid in global core FI markets during the Asia-Pacific session providing some support as NZGBs recovered from early session cheaps.

- That left the major NZGB benchmarks running 5.5 cheaper to 4.0bp richer at the bell, pivoting around 7s.

- Swap spreads were mixed across the curve, tightening in the front end but widening a little further out the curve.

- The 2/10-Year swap curve moved deeper into inverted territory, printing fresh cycle extremes in the process, representing the most inverted level witnessed since ’08.

- Local headline flow was light ahead of tomorrow’s RBNZ decision. A reminder that the majority of analysts look for a 75bp rate hike ahead of the Bank’s three-month hiatus, with just under 70bp of tightening priced into RBNZ dated OIS for the event. Terminal OCR pricing prints just above 5.15% (see our full preview of that event here)

- Early Wednesday trade may see some adjustment to RBA Governor Lowe’s dinner time address, if there is anything in the way of notable trans-Tasman impetus generated.

FOREX: USD Stays On The Back Foot

The USD has stayed under pressure for much of the session, although overall losses have remained fairly modest. The BBDXY is off by around 0.20% (1289), the DXY by a similar amount. Headline flow has remained light, while slightly lower UST yields and a firmer equity backdrop have weighed on the USD from a cross asset standpoint.

- NZD has generally outperformed, despite a wider trade deficit posted for October. Focus likely rests on tomorrow's RBNZ meeting, where 75bps is the consensus, although not fully price by markets. NZD/USD is around +0.35% since the open, last at 0.6120/25.

- AUD has lagged but is still firmer for the session. The pair was last close to 0.6620. A firmer backdrop for China property stocks has helped at the margin and dragged the currency off earlier lows (close to 0.6600). The AUD/NZD cross got close to 1.0800, but is now back at 1.0815/20.

- JPY has firmed as the session has progressed, moving further away from overnight highs above 142.00. The pair last just under 141.70.

- Still to come is RBA's Lowe Speech, 7:30pm AEDT, 8:30am BST. UK public finances are on tap as well, along with some ECB speakers. In the US the Richmond Fed prints, while Fed speak is also due.

FX OPTIONS: Expiries for Nov22 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9835-50(E878mln)

- USD/CNY: Cny7.1000($525mln), Cny7.2500($810mln)

MNI RBNZ Preview - November 2022: Fighting For Credibility

EXECUTIVE SUMMARY

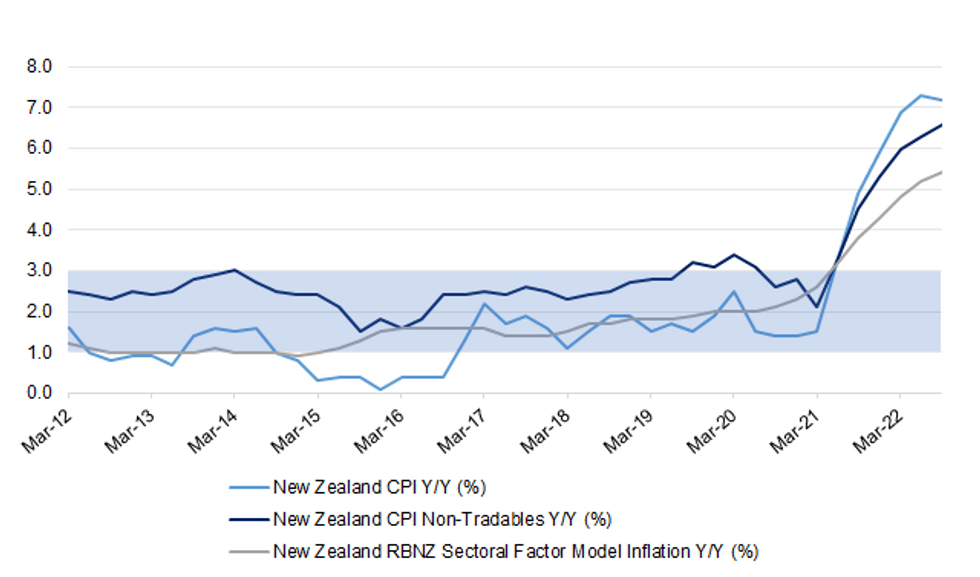

- The October interim monetary policy review surprised to the hawkish side, with the Reserve Bank demonstrating its resolve by language surrounding the expected 50bp rate hike. Domestic data flow since the October meeting underscored the need for continued aggressive tightening. In our view, the odds are high that the RBNZ will raise the OCR by 75bp this week, which would be consistent with its least regrets approach.

- Although the RBNZ has been at the forefront of the global tightening campaign, price pressure are refusing to show signs of letting up, putting the central bank’s inflation-fighting credibility at a risk. The pass-through from persistently elevated inflation into inflation expectations is evident, making the RBNZ’s task all the more urgent. Acute price pressures are accentuated by ultra-tight labour market conditions.

- We are cautiously siding with the 75bp camp, albeit there is a risk that the Committee will tip hat to the higher starting point and stick with raising the OCR in 50bp increments. The dovish reception of a half-percentage point increase could be partly offset by ostensibly hawkish revisions to forecasts and the OCR track, but only to an extent. In any case, given the recent surprises on the inflation front, the Reserve Bank will likely chart a new interest-rate forecast with a higher terminal rate.

Source: MNI - Market News/Bloomberg

Click here to see the full preview: MNI RBNZ Preview November 2022.pdf

ASIA FX: USD/Asia Pairs Mostly Lower, IDR Lags

USD/Asia pairs are mostly lower, with strength in the majors and lower UST yields helping. CNH and KRW have been the leaders, while IDR has remained a laggard. Tomorrow South Korean manufacturing survey data is due, along with the Singapore CPI. Thailand customs trade figures also print.

- USD/CNH has moved away from overnight highs above 7.1800, although support is evident ahead of the 7.1500 level. The CNY fixing was close to neutral, while domestic covid headwinds persist, although there didn't appear to be any fresh tightening in restrictions. Equities are higher led by the property sector.

- 1 month USD/KRW has stayed offered for much of the session, but hasn't been able to get back below 1350, (last 1352). Local equities are weaker, although away from worst levels. Consumer sentiment fell, but so too did inflation expectations.

- USD/IDR has been a laggard, not seeing much fresh downside. The pair was last around 15715. On-going hawkish Fed rhetoric is unlikely to be helped, while commodity prices have also been softer.

- USD/INR remains supported on dips. The early move sub 81.70 has been supported (last at 81.78). Lower oil prices aren't doing much for sentiment at this stage. USD/INR bulls will look for a break through back above 82.00.

- USD/PHP is back to 57.30, around -0.06 figs for the session. The finance secretary stated the country could hit the upper end of the GDP target (6.5-7.5%). The BSP Governor also stated that the central will still have to follow the Fed to some degree, as to not do so would risk undermining the local currency.

NBH Preview: NBH To Maintain Tightening Pace

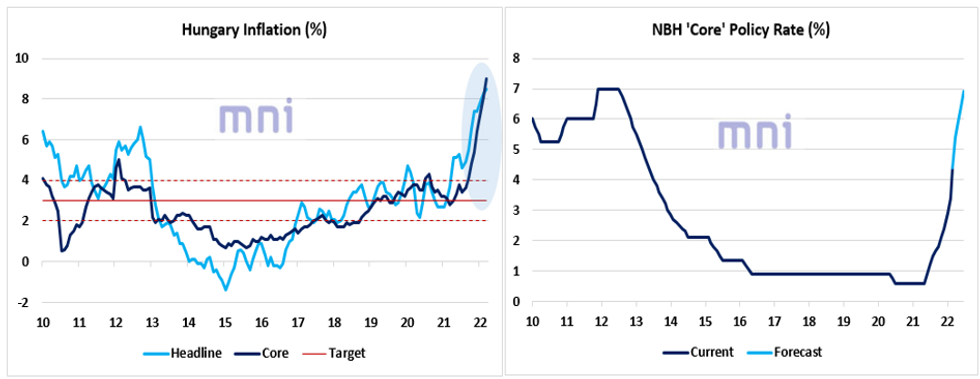

EXECUTIVE SUMMARY

- The NBH is likely to maintain the pace of its policy tightening and hike its ‘core’ policy rate by 100bps today (1pm London), which would levitate the benchmark rate to 5.4% (highest since January 2013).

- It is important that the NBH keeps a hawkish policy to limit the downside risk on the forint in order to anchor inflation expectations.

- The central bank is also likely to proceed with a 30bps in the 1W depo rate after pausing at 6.15% in the past month.

- Link to full publication: NBH CB Prev - April 26 - F.pdf

Source: MNI - Market News/Bloomberg

EQUITIES: China Property Stocks Recover, Mixed Trends Elsewhere

Regional equities have enjoyed a better afternoon session relative to earlier in the session. Onshore China shares have recovered from earlier weakness, but trends are mixed elsewhere throughout the region. US futures have stayed in positive territory for most of the session, last around 0.10-0.20% firmer for the main indices.

- The CSI 300 is up 0.77% at this stage, likewise for the Shanghai Composite index. Early concerns around Covid trends dominated, with officials calling for the greater efforts to curb the virus spread in major cities.

- Support has come from the property sub-sector though, with the Shanghai sub-index up 1.80%. Late yesterday the China regulators stated that banks should step up lending support for property developers/construction companies.

- Japan stocks have outperformed for much of the session, the Topix +1.2%, as exporter related names have outperformed. The yen was the worst performer in the G10 FX space yesterday (-1.2%), and it has only retraced some losses today (+0.30%).

- The Kospi is off by 0.34%, but the Taiex is outperforming (+0.55%). The ASX 200 is up close to 0.70%, as resource companies led the move higher. Higher coal prices are helping, while iron ore is down slightly from recent highs.

- The Philippines bourse is up a further 0.90%. The country's finance minister stated the Philippines' may hit the top end of this year's GDP target (6.5-7.5%).

GOLD: Gold Price Advance As USD Softens

Gold prices are higher during APAC trading today after falling overnight. They are 0.4% higher than the NY close and are now around $1744.50/oz. After reaching a low of $1737.53 early in the session, prices rose to a high of $1745.08. Bullion has been helped by a slightly weaker USD with DXY down 0.25%.

- The short-term trend for gold remains bullish and any pullback in prices is considered corrective. $1786.50 is the bull trigger with $1800 the level to watch and key resistance at $1807.90, the August 10 high. Initial support is at $1702.30, the November 9 low.

- Central bank purchases of gold are at record highs and the IMF reported that Kazakhstan, the UAE, India and Cambodia all increased their gold reserves in October. (bbg)

- There is little economic data tonight but there is some Fed speak and any further hawkish comments or suggestions of a 75bp move at the December meeting would weigh on gold prices.

OIL: Oil Prices Range Trading As Supply And Demand Concerns Offset Each Other

Oil prices have been trading in a very tight range after OPEC+ denied any imminent output increases overnight. They also don’t seem to have been rattled by China Covid news today. They are again balancing an uncertain supply outlook and concerns regarding Chinese demand. WTI crude is up 0.3% from the NY close around $80.25/bbl, it has spent the day in a 50c range. Brent is up 0.4% around $87.80.

- WTI has been trading close to its initial resistance of $80.49. If it breaks this then the next level to watch is $85.60, the 50-day EMA. Initial support is $74.96, which is a key medium-term support level. WTI remains in a bearish trend and has been extending its reversal from $92.53, the November 7 high.

- The WTI spread between the two nearest contracts is still in backwardation but has narrowed over the week, suggesting an easing of supply pressures.

- The details of the G7 oil price cap on Russia could be announced as soon as Wednesday, according to Bloomberg. The plan bans companies from providing all shipping-related services to transport Russian oil if it is being sold above a certain price.

- There is US API weekly crude oil inventory data published tonight. There are also a number of Fed speakers and a bearish tone would weigh on oil prices.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/11/2022 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 22/11/2022 | 0900/1000 | ** |  | EU | EZ Current Account |

| 22/11/2022 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/11/2022 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 22/11/2022 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/11/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/11/2022 | 1500/1000 | ** |  | US | Richmond Fed Survey |

| 22/11/2022 | 1600/1100 |  | US | Cleveland Fed's Loretta Mester | |

| 22/11/2022 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/11/2022 | 1645/1145 |  | CA | BOC's Sr Deputy Rogers talk on financial stability | |

| 22/11/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 22/11/2022 | 1915/1415 |  | US | Kansas City Fed's Esther George | |

| 22/11/2022 | 1945/1445 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.