-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Pressured Ahead Of NFP

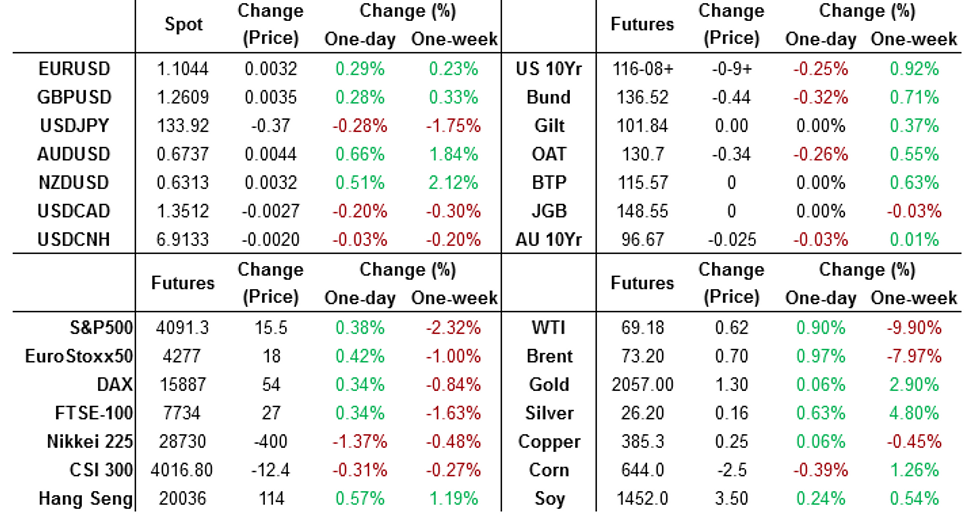

- The greenback is pressured in Asia, rising US Equity futures and a firmer Hang Seng have boosted risk appetite on Friday. BBDXY is at its lowest level of the week dealing at 1219.20, the April low at 1214.06 is the next support level.

- Oil is edging up from recent lows, but is still ~8% lower for the week.

MARKETS

Narrow Ranges For TY, Cash Closed In Asia, NFP In View

TYM3 deals at 116-09, -0-09, with a narrow 0-04+ range observed on volume of ~30k.

- Cash tsys are closed in Asia today due to the observance of a national holiday in Japan and will re-open in the London session.

- TY has observed narrow ranges with little follow through on moves, the proximity to today's NFP print as well as the reduced liquidity due to the aforementioned Japanese holiday may be keeping some participants on the sidelines.

- The space looked through the latest SoMP from the RBA and a softer than forecast Caixin Services PMI print.

- April NFP print provides the highlight data wise today, the MNI preview of the event is here. Fedspeak from Minneapolis Fed's Kashkari, St Louis Fed President Bullard and Fed Governor Cook will also cross.

At Cheaps Ahead of US Non-Farm Payrolls

ACGBs sit at session lows (YM -1.0 & XM -3.0) ahead of US non-farm payroll later today. The immediate market reaction to forecast changes contained in the RBA’s quarterly Statement on Monetary Policy appeared more like an unwind of pre-release strength. However, the post-statement cheapening gathered momentum in afternoon trade. Volumes were however relatively low ahead of US Non-Farm Payrolls, particularly with cash tsys closed until the London session. US tsy futures trading was muted in Asia-Pac.

- Cash ACGBs are 1-3bp cheaper with the 3/10 curve 2bp steeper and the AU-US 10-year yield differential flat at -4bp.

- 3s10s swaps curve twist steepened with rates 1bp lower to 3bp higher with 3-year EFP 2bp tighter.

- Bills pricing is flat to +3.

- RBA dated OIS pricing is flat to 3bp firmer after the statement but 1-3bp softer on the day.

- The local calendar releases April NAB Confidence and March Building Approvals on Monday.

- Until then, the local participants will be watching US tsys as they navigate April Non-Farm Payrolls.

- The AOFM announced that it plans to sell A$150mn of the 0.75% 21 November 2027 Index Linked bond on Tuesday, May 9 and A$800mn of the 3.25% 21 April 2029 bond on Wednesday, 10 May.

NZGBS: Richer, Curve Steeper, Outperforms ACGBs

NZGBs closed 3-5bp richer with the 2/10 cash curve adding 2bp to yesterday’s steepening move. NZGBs outperformed ACGBs with the NZ-AU 10-year yield differential 4bp tighter. The 2-3bp cheapening in ACGBs after the release of the RBA’s quarterly Statement on Monetary Policy appeared to be more of an unwind of pre-release strength with the net reaction muted.

- Local participants are likely to have largely remained on the sidelines ahead of US Non-Farm Payrolls, particularly with cash tsys closed until the London session due to the observance of a national holiday in Japan. US tsy futures trading was muted in Asia-Pac.

- Swap rates closed flat to 5bp lower with the 2s10s curve 5bp steeper and long-end implied swap spread wider.

- RBNZ dated OIS closed 2-4bp softer across meetings with 23bp of tightening priced for the May 24 meeting.

- The local calendar next week sees April Credit Card Spending, REINZ House Sales and Manufacturing PMI data along with March Net Migration and the RBNZ’s Inflation Expectation data for Q1.

- In Australia, NAB Confidence (Apr) and Building Approvals (Mar) are slated for early in the week.

- Until then, the local market will eye US tsys as they navigate the release of Non-Farm Payrolls for April later today.

Greenback Pressured In Asia

The greenback is pressured in Asia, rising US Equity futures and a firmer Hang Seng have boosted risk appetite on Friday. BBDXY is at its lowest level of the week dealing at 1219.20, the April low at 1214.06 is the next support level.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD prints at $0.6730/35 up ~0.6% and at its highest level of the week. The 50-Day EMA has been cleared and the next level for bulls is $0.6772 high from Apr 20. RBA's SoMP didnt move the dail as the forecasts were in line with what the RBA said on Wednesday. The AUD has looked through a fall in the Iron Ore prices with prices now below $95/tonne as demand softens in China.

- Kiwi is also firmer, NZD/USD is up ~0.5%. The pair broke through its 200-Day EMA yesterday and has extended gains in Asia today.

- USD/JPY is a touch about the ¥134 handle, the pair is down ~0.2% today.

- Elsewhere in G-10 EUR and GBP are both 0.3% firmer benefiting from the broad based pressure on the greenback.

- The highlight today is the April NFP print, the MNI preview of the event is here.

Steady Ahead Of US NFP

Gold has largely tracked sideways in the first part of Friday trade ahead the US non-farm payrolls print. We currently sit close to $2050, little change versus Thursday closing levels, with a $2045.56 to $2053 range so far today. Recent highs come in around the $2060 region. On the downside, the 20-day EMA sits back closer to $2000.

- Gold has benefited from the weaker USD tone today, not fazed by the firmer US equity futures backdrop. The BBDXY is at fresh week to date lows sub 1220.

- For the week gold is up an impressive 3%, as global recession fears are still apparent. Gold ETF holdings are a touch below recent highs.

Edging Up From Recent Lows, But Still ~8% Lower For The Week

Brent crude is tracking higher so far today, last just above $73/bbl, which is +0.80% above Thursday closing levels. Still, we are still tracking more than 8% lower for the week, which is the third straight week of losses. WTI had a much quieter start at the open compared to yesterday and is ticking higher as well, last above $69/bbl.

- For Brent, we have consolidated above $72/bbl after testing below this level earlier in the week. A break below this level would open up a test of previous YTD lows near $70/bbl.

- Recessionary fears, coupled with a still comfortable supply backdrop, continues to weigh on sentiment more broadly. We need to get back above $75/bbl to turn sentiment more favorable in the near term.

- Saudi Arabia cut oil prices for Asian markets for June delivery late yesterday, albeit not as much as some in the market expected.

- Also note, US National Security Advisor Sullivan is visiting Saudi Arabia this weekend to meet with the country's leaders.

Regional Picture Mixed Despite Higher US Futures

Once again regional equities are mixed, with China bourses underperforming, along with Indonesia. US futures are higher, led by the tech side, following Apples earnings update late in the US on Thursday. Nasdaq futures currently track 0.50% higher, Eminis around +0.40%, both indices are close to session highs.

- Hong Kong shares are tracking higher, albeit away from best levels. The HSI last +0.64% at the break. The Golden Dragon Index rallied in US trade, buoyed by a potential Alibaba IPO, which is likely aided sentiment today.

- Still, China mainland shares are down. The CSI 300 off 0.50% at the break. The weaker than expected Caixin services PMI, while still comfortably in expansion territory, moved off recent highs. This has taken some of the shine off the outlook at the margins.

- The JCI in Indonesia is down over 1.4% with resource names weighing. The index continues to underperform for May.

- Japan and South Korea markets are closed today.

- The ASX200 is up modestly, last +0.30%.

AU-NZ 10Y Differential Not Showing Concerns About NZ Current Account Deficit

In his testimony to parliament yesterday regarding the Financial Stability Report (FSR) RBNZ Deputy Governor Hawkesby said:

- “We note that the current account deficit has increased recently, and that’s partly a story around the resilience of consumption and demand in NZ. We take some comfort that for a long period now we’ve had a downward trend in our net foreign liabilities, and that’s really a key source of vulnerability typically.”

- “If markets are worried about the current account deficit, what we’re likely to see is interest rates rising and the exchange rate falling.”

- “We’re not seeing concerns about New Zealand government debt in markets. New Zealand government debt is still relatively low.”

- In early March, the AU-NZ 10-year yield differential narrowed to -100bp, its lowest level since the late 1990s on the back of a worse-than-expected deterioration in NZ’s current account deficit and the resultant S&P bond ratings comments.

- A simple regression of the AU/NZ 10-year yield differential versus the AU-NZ 1Y3M swap differential revealed that NZ's current account deficit concerns had added around 20-25bp to the 10-year differential.

- The same analysis today however reveals a model error of only -5bp, supporting Hawkesby's comments, particularly given the AU/US 10-year yield differential appears too low.

Figure 1: AU/NZ Model Error - 10-Year Yield Cash Differential Vs. 1Y3M Swap Differential

Source: MNI – Market News / Bloomberg

USD/Asia Lower, But CNH Lags

Most USD/Asia pairs are lower, albeit with CNH again underperforming. USD/CNH has largely been range bound, with the weaker expected Caixin services PMI weighing at the margin. 1 month USD/KRW is lower, even with onshore markets shut today, the pair last at 1315. Other pairs have been more muted but still a modest USD/Asia downside bias. Still to come today is Taiwan CPI.

- USD/CNH is currently just above 6.9100, tracking recent ranges, despite the 0.20% pull back in the BBDXY. Onshore equities are weaker, while the Caixin services PMI suggested growth momentum cooled further.

- USD/IDR hasn't seen much downside post earlier losses. The pair got to 14653, but we now sit higher near 14670, little change from closing levels yesterday (14680). Yesterday's lows were under 14600, which marked fresh YTD lows in the pair. On the topside recent highs have been just above 14700. • Earlier Q1 GDP came out close to expectations, y/y at 5.03% (4.97% expected), while q/q was -0.92% (-1.00% forecast). The detailed looked reasonably firm, with private sector consumption up 4.54% y/y. The data calendar is quiet until the start of next week (FX reserves for Apr print).

- Philippines Apr inflation came in below market expectations, +6.6%, (7.0% forecast and 7.6% prior). However, it was close to the mid-point of the BSP's expectations (6.3-7.1%). Headline inflation is moving off early the 2023 peak (8.7% y/y in Jan). We saw a continued slowdown in both food and transport costs. CPI was negative (-0.2%) for the second straight month. Still, core inflation is only just down off multi-decade highs, printing at 7.9% y/y for Apr, versus 8.0% in Mar. Moreover, official comments from National Economic and Development Authority Secretary Balisacan stated that the risks to the inflation outlook remain tilted to the upside. The BSP made similar comments post the release. USD/PHP has tracked lower, last at 55.25.

- The SGD NEER (per Goldman Sachs estimates) firmed and now sits a touch below its pre MAS levels from mid April. We now sit ~0.8% below the top of the band. USD/SGD is under pressure today, the pair is down ~0.3% following broader greenback trends. We last print at $1.3240/50 the lowest level in the pair since 14 April. The pair has ticked away from its 20-Day EMA ($1.3323) after breaking below the measure on Wednesday, bears first target the low from 14 April at $1.3204. Bulls look to target high from March 10 at $1.3576. March Retail Sales rose 4.5% Y/Y firmer than expected 1.1% fall.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 05/05/2023 | 0545/0745 | ** |  | CH | Unemployment |

| 05/05/2023 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 05/05/2023 | 0630/0830 | *** |  | CH | CPI |

| 05/05/2023 | 0645/0845 | * |  | FR | Industrial Production |

| 05/05/2023 | 0700/0900 | ** |  | ES | Industrial Production |

| 05/05/2023 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 05/05/2023 | 0800/1000 | * |  | IT | Retail Sales |

| 05/05/2023 | 0800/1000 |  | EU | ECB Elderson Speech at European University Institute | |

| 05/05/2023 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 05/05/2023 | 0900/1100 | ** |  | EU | Retail Sales |

| 05/05/2023 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 05/05/2023 | 1230/0830 | *** |  | US | Employment Report |

| 05/05/2023 | 1645/1245 |  | US | Minneapolis Fed's Neel Kashkari | |

| 05/05/2023 | 1700/1300 |  | US | St. Louis Fed's James Bullard | |

| 05/05/2023 | 1700/1300 |  | US | Fed Governor Lisa Cook | |

| 05/05/2023 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.