MNI EUROPEAN MARKETS ANALYSIS: USD Recovery Continues, Retail Sales Print Later

- The US cash treasury curve has bull-flattened throughout the day with yields 1.5-2.5bps lower, although curves remain close to 2024 highs. Broader USD sentiment has remained supported, a continuation of Monday's recovery theme. JPY and NZD have been the weakest performers in the G10 space.

- NZGBs closed on a strong note, with benchmark yields 6-7bps lower. Tomorrow, the local calendar will see Q2 CPI.

- China & Hong Kong's equity markets are mixed again today, with stocks in Hong Kong, particularly those linked to China's economy, facing declines amid concerns over economic growth prospects.

- Later the Fed’s Kugler speaks. There are US June retail sales, trade prices and July NAHB housing, as well as June Canadian CPI and euro area July ZEW data.

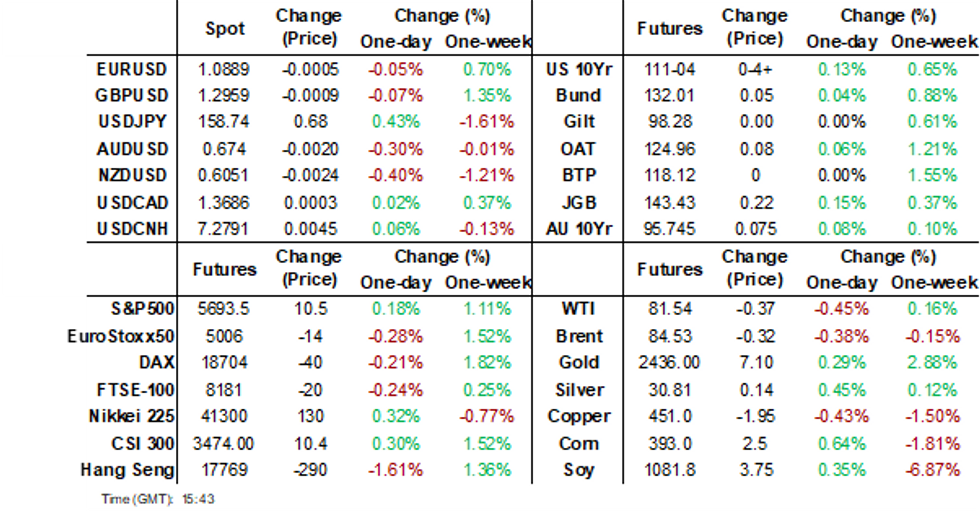

MARKETS

US TSYS: Tsys Futures Edge Higher, Curve Flattens

- Treasury futures have ticked higher today with the long-end outperforming, TUU4 is + 00¾ at 102-19⅝, while TYU4 is trading + 04 at 111-03+.

- Tsys flows: Block Seller 2,590 TY DV01 168k, Block Buyer 2,900 TU DV01 110k

- Volumes: Slightly below recent averages with TU 41k, FC 45k & TY 75k

- Cash treasury curve has bull-flattened throughout the day with yields 1.5-2.5bps lower.

- APAC Rates: ACGB yields are 6-8bps lower, with better buying through the belly, NZGB yields are 5-8bps lower with the curve bull-flattening and JGB yields are 1-3.5bps lower, curve bull-flattening.

- Projected rate cut pricing into year end have gained vs. this morning's levels (*): July'24 at -6.5% w/ cumulative at -1.6bp at 5.313%, Sep'24 cumulative -27.5bp (-24.8bp), Nov'24 cumulative -44.1bp (-41.6bp), Dec'24 -65.8bp (-63.3bp).

- Today, Retail Sales, Import/Export Price Index

JGBS: Holding A Bull-Flattener, BoJ Rinban Operations Tomorrow

JGB futures are stronger and near session highs, +16 compared to the settlement levels.

- May’s tertiary activity index fell 0.4% m/m versus +0.1% est.

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session, after yesterday’s modest bear-steepening.

- Today, the US calendar will see Retail Sales and Import/Export Prices data, and upcoming earnings from Bank of America, Charles Schwab, State Street and Morgan Stanley.

- The cash JGB curve has bull-flattened, with yields 1-4bps lower. The benchmark 10-year yield is 3.6bps lower at 1.029% versus the cycle high of 1.108%.

- Swap rates are flat to 3bps lower, with the curve flatter and swap spreads wider.

- Tomorrow, the local calendar is empty apart from BoJ Rinban Operations covering 1-3-year and 5-25-year JGBs.

- (Bloomberg) Japan’s debt position argues for a weak yen and accommodative monetary policy as inflation boosts the nation’s capacity to repay its creditors. (See link)

AUSSIE BONDS: Dealing On A Strong Note, US Retail Sales Later Today, Nov-33 Supply Tomorrow

ACGBs (YM +6.0 & XM +7.0) are richer and close to Sydney session highs. With the domestic calendar light, local traders have found direction from cash US tsys, which are 1-2bps richer in today’s Asia-Pac session. The US calendar will see Retail Sales and Import/Export Prices data, and earnings from Bank of America, Charles Schwab, State Street and Morgan Stanley.

- The market’s focus, however, remains on Thursday’s Employment Report. Bloomberg consensus expects a +20k employment change following May’s +39.7k, with the unemployment rate rising to 4.1% from 4.0% prior.

- Cash ACGBs are 6-7bps richer, with the AU-US 10-year yield differential at +5bps.

- Swap rates are 7-9bps lower.

- The bills strip has bull-flattened, with pricing +2 to +8.

- RBA-dated OIS pricing is 6-8bps softer for 2025 meetings. Terminal rate expectations sit at 4.40%, the lowest level since the release of May’s higher-than-expected CPI Monthly data.

- Tomorrow, the local calendar will see the Westpac Leading Index.

- Across the Tasman, the NZ calendar will see the release of Q2 CPI data tomorrow.

- Tomorrow, the AOFM plans to sell A$500mn of the 3.00% 21 November 2033 bond. A sale of A$700mn of the 2.75% 21 November 2027 bond is also scheduled for Friday.

NZGBS: Closed On A Strong Note, Q2 CPI Tomorrow

NZGBs closed on a strong note, with benchmark yields 6-7bps lower.

- Outside of the Non-Resident Bond Holdings, there hasn't been much in the way of domestic drivers to flag. NZ bonds held by foreigners fell to 60.7% in June from 61.5%.

- Cash US tsys are 1-2bps richer in today’s Asia-Pac session, ahead of Retail Sales and Import/Export Prices data, and bank earnings.

- Today’s move brings the cumulative post-RBNZ Decision rally to 27-35bps, with the 2/10 curve 8bps steeper.

- It is also noteworthy that the NZGB 10-year yield finished at its lowest closing level this year at 4.37%.

- On a relative basis, as well, the recent rally has been impressive, with the NZ-AU 10-year yield differential closing at +12bps, its lowest level since August 2022.

- Tomorrow, the local calendar will see Q2 CPI. Bloomberg consensus expects headline to moderate to 0.5% q/q and 3.4% y/y from 0.6% and 4% in Q1, while the RBNZ forecast in May that it would ease to 3.6% y/y with a 0.6% quarterly rise.

- The RBNZ will present revised forecasts at its August 14 meeting and the Q2 CPI will be important in determining if the target return is brought forward and thus also the first rate cut in the OCR profile.

NZ BONDS: NZ-US Curve Correlation Collapses After RBNZ Policy Decision

In yesterday’s bullet, we asserted that the current high positive correlation between AU and US bond curves may prove fleeting in the current environment, given that global curve correlations tend to weaken as global policy tightening matures and policy rates diverge into their respective easing cycles.

- This month’s collapse in the cross-market correlation between the NZ and US cash 2/10 curves serves as a prime example.

- After returning to the upper end of its range earlier this month, the NZ-US cross-curve correlation collapsed following the RBNZ’s dovish tilt at its policy meeting, as the market shifted its focus to domestic rather than US and global factors.

Figure 1: Rolling 10-day Correlation – NZGB 2/10 Curve Vs. US Tsy 2/10 Curve

Source: MNI – Market News / Bloomberg

NEW ZEALAND DATA: Non-Tradeables & Core CPIs Key For Rate Outlook

Q2 NZ CPI prints on Wednesday and Bloomberg consensus expects headline to moderate to 0.5% q/q and 3.4% y/y from 0.6% and 4% in Q1, while the RBNZ forecast in May that it would ease to 3.6% y/y with a 0.6% quarterly rise. It will present revised forecasts at its August 14 meeting and the Q2 CPI will be important in determining if the return to target is brought forward and thus also the first rate cut in the OCR profile. But it will be core and non-tradeables that will determine if it cuts in August.

- Headline forecasts are in a reasonable range with Bloomberg consensus between +0.3% and 0.6% q/q and 3.2-3.6% y/y.

- The non-tradeables CPI will be watched closely as it is domestically driven. Consensus is at 0.8% q/q, in line with the RBNZ, with forecasts between +0.7% and +1.0% q/q. Tradeables expectations are expected to rise 0.1% q/q, below the RBNZ’s 0.3%, as demand has slowed materially.

- The local banks’ headline forecasts are varied with Kiwibank at consensus but ANZ and ASB below at 0.4% q/q and 3.3% y/y, while BNZ and Westpac are above with 0.6%/3.5%.

- The RBNZ’s measure of core from its sector factor model is also published on Wednesday and ANZ expects it to fall below 4%. The release includes underlying non-tradeables inflation too. A significant move lower in these measures would be needed for the RBNZ to ease policy as soon as August.

FOREX: Dollar Nudges Higher, JPY & NZD Underperformers

The USD has recovered further ground in the first part of Tuesday dealings. The BBDXY USD index was last near 1253.35, up 0.10% versus end Monday levels. We remain comfortably sub pre CPI levels from last Thursday around 1259.

- Data outcomes have been very light today, while earlier Fed speak from Daly stated a policy adjustment is coming but timing is uncertain. This comes after Fed Chair Powell stated the central bank was getting more confident inflation is on its way to 2% (paving the way for rate cuts) during Monday's US session.

- US yields sit 1.5-2bps lower today, with cash Tsy curves still close to 2024 highs, as the market contemplates a potential Trump Presidency, which all else equal, may be reflationary. This, for the USD, is providing some offset to dovish Fed pricing.

- The Republican National Convention continued today, with Trump stating his VP candidate would be JD Vance, a Senator from Ohio.

- USD/JPY has risen around 0.40%, last near 158.70. Reuters reported onshore USD demand ahead of the Tokyo fix and from importers, with onshore markets returning today from the long weekend.

- NZD/USD is off 0.30%, last under 0.6060, fresh lows back to early July. AUD/USD is only down, but marginally less, last near 0.6745. The AUD/NZD cross just off fresh highs (1.1143), last near 1.1135.

- Looking ahead, we have some ECB speak, the German ZEW survey, along with US data outcomes, highlighted by retail sales.

ASIA STOCKS: HK & China Equities Lower As Market Awaits Third Plenum Updates

China & Hong Kong's equity markets are mixed again today, with stocks in Hong Kong particularly those linked to China's economy, facing declines amid concerns over economic growth prospects, the HS China Enterprises Index dropped by up to 1.5%, marking a second consecutive day of losses. Investor sentiment was dampened by downgraded GDP forecasts for China from major global investment banks, the market is also worried about what a Trump presidency would mean for China. There was no major economic data released in the region today with the market awaiting any headlines that come out of the Third Plenum meetings, although these meetings are being held behind closed doors.

- Hong Kong equities are lower today, tech stocks are the worst performing with the HSTech Index down 1.73% and we are now flat over the past 5 sessions. Meanwhile, property stocks are also lower with the Mainland Property Index down 0.85% and the HS Property Index off 1.57%, the wider HSI is 1.37% lower.

- China equity markets are mixed today with the CSI 300 is 0.21% higher, small-cap indices are lower with the CSI 1000 down 0.37% and the CSI 2000 is down 0.48%, while the growth focused ChiNext is 0.40% higher.

- Analysts suggest China may cut interest rates or reduce banks’ reserve requirements by late third quarter or fourth quarter to bolster economic support, influenced by global rate cuts and expected improvements in Chinese banks’ net interest margins, according to Shanghai Securities News

- Outflows from US listed ETFs that track Chinese equities have experience their sixth consecutive week of outflows, according to BBG. Recent economic indicators from China, such as inflation, trade, and credit data, have fallen short of expectations. This has heightened concerns about China's economic outlook, while overnight major global investments banks including Goldman Sachs, Barclays & JP Morgan all lower their GDP forecasts for China, there is also growing concern that a Trump presidency will have a negative impact on the region.

- Looking ahead, focus will be on any headlines from the Third Plenum.

ASIA PAC STOCKS: Asian Equities Mixed As Trump's Odds Gain

Asian stocks are mixed today, despite gains on Wall Street with the possibility of a second Donald Trump term increasing, PredictIt now has him at a 68% chance of winning the election. Trump trades have been the focus today, with regions perceived to benefit from a Trump presidency out-performing, while the bonds market continues to see curve steepener trades. Regionally it has been a slow session, with very little in the way of economic data or market headlines the market has been awaiting headlines out of the Third Plenum policy meetings happening in China right now where they are expected to set strategies and policies for the coming decade.

- Japanese equities are benefiting from growing expectations of a US rate cut, with the futures market currently fully pricing in a cut in September, while Japan is also expected to gain from a Trump presidency. Later we have Tertiary Industry Index which is expected to to 0.1% m/m for May, down from 1.9% prior. The Topix is 0.50% higher, while the Nikkei is up 0.25%

- South Korean large-cap stocks have erased earlier losses with the Kospi now up 0.30%, while small-cap stocks underperform with the Kosdaq down 1.50%. President Yoon Suk Yeol holds cabinet meeting after returning home from a five-day trip to US, which included the NATO summit. In June, South Korea's export price index rose 12.2% year-on-year and 0.9% month-on-month, while the import price index increased 9.7% year-on-year and 0.7% month-on-month, according to the BOK.

- Taiwan equities have done very little today, trading steady. Overnight, the Philadelphia SE Semiconductor Index closed 0.04% higher, and we have yet to see any headlines out of the Third Plenum meeting to cause a directional trading move. The Taiex is currently trading 0.13% higher.

- Australian equities are a touch lower today after reaching a record high on Monday. Miners declined due to falling commodity prices amid weak Chinese demand and after Rio Tinto's quarterly production report. Conversely, financial stocks rose, mirroring gains in US financial stocks following positive results from Goldman Sachs and BlackRock. The ASX200 is down 0.20%.

- Elsewhere, New Zealand equities are 0.35% higher, Philippines equities are 0.10% higher, Indian equities are 0.25% higher, while Malaysian equities are 0.25% lower, Singapore equities are down 0.25% and Indonesia equities are down 0.45%

Asian Equity Flows Mixed, Foreign Investors Sell Asia Tech Stocks

- South Korea: South Korean equities saw inflows of $22m yesterday, contributing to a net inflow of $661m over the past five trading days. The 5-day average inflow is $132m, slightly lower than the 20-day average of $182m but higher than the 100-day average of $127m. Year-to-date, South Korea has experienced substantial inflows totaling $19.53b.

- Taiwan: Taiwanese equities had significant outflows of $421m yesterday, resulting in a net outflow of $2.34b over the past five trading days. Recent trends in Taiwanese equities show significant volatility, with large outflows dominating recent activity. The 5-day average flow is -$468m, considerably lower than the 20-day average of -$108m and the 100-day average -$21m. Year-to-date, Taiwan has accumulated inflows of $1.92b.

- India: Indian equities experienced inflows of $643m Friday, contributing to a net inflow of $1.15b over the past five trading days. The 5-day average $230m, lower than the 20-day average of $302m but significantly higher than the 100-day average of -$38m. Year-to-date, India has seen net inflows of $2.64b.

- Indonesia: Indonesian equities recorded inflows of $7m yesterday, resulting in a net inflow of $113m over the past five trading days. The 5-day average is -$23m, below the 20-day average inflow of $14m and the 100-day average -$6m. Year-to-date, Indonesia has experienced outflows totaling $161m.

- Thailand: Thai equities saw outflows of $12m yesterday, contributing to an outflow of $109m over the past five trading days. The 5-day average is -$22m, slightly better than the 20-day average -$29m and the 100-day average of -$26m. Year-to-date, Thailand has seen significant outflows amounting to $3.35b.

- Malaysia: Malaysian equities experienced inflows of $70m yesterday, contributing to a 5-day net inflow of $172m. The 5-day average inflow is $34m, higher than the 20-day average inflow of $4m and the 100-day average outflow of $2m. Year-to-date, Malaysia has experienced minor inflows totaling $83m.

- Philippines: Philippine equities saw outflows of $1m yesterday, with a 5-day net inflow of $1m. The 5-day average inflow is neutral at $0m, better than the 20-day average outflow of $2m and the 100-day average outflow of $7m. Year-to-date, the Philippines has seen outflows totaling $520m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 22 | 661 | 19534 |

| Taiwan (USDmn) | -421 | -2341 | 1918 |

| India (USDmn)* | 643 | 1148 | 2644 |

| Indonesia (USDmn) | 7 | 113 | -161 |

| Thailand (USDmn) | -12 | -109 | -3352 |

| Malaysia (USDmn) | 70 | 172 | 83 |

| Philippines (USDmn) | -1 | 1.0 | -520 |

| Total | 308 | -356 | 20146 |

| * Up to 12th July | |||

OIL: Crude Down Slightly As US Dollar Strengthens

Oil prices are moderately lower again today with both Brent and WTI down 0.3% to $84.62/bbl and $81.63/bbl respectively, and close to the intraday lows. Trading volumes have been tended to be thin, due to summer holidays in the northern hemisphere. The US dollar has weighed on crude today with the index up 0.1% after rising 0.2% on Monday despite Fed Chair Powell saying that the FOMC has “greater confidence that inflation was moving sustainably” toward target.

- This week’s Third Plenum of China’s Communist Party is likely to be watched for stimulus announcements to boost growth. It is the largest importer of crude in the world, and disappointing Q2 GDP data added to existing market concerns re the demand outlook on Monday.

- Bloomberg is reporting that China’s imports from sanction-hit Iran continued to rise in June, a trend begun in 2022, according to Kpler. Shipments rose 148kbd last month boosted by discounting. Whereas overall crude-at-sea headed for China as of last Friday was its lowest since September last year.

- Attacks on vessels off the coast of Yemen continued on the weekend. The situation has added to shipping times and costs, as the alternative route around southern Africa is utilised.

- Later the Fed’s Kugler speaks. There are US June retail sales, trade prices and July NAHB housing, as well as June Canadian CPI and euro area July ZEW data.

GOLD: Fed Chair Powell’s Remarks Provide A Boost

Gold is trading 0.2% higher in the Asia-Pacific session after closing 0.4% higher at $2,422.27 yesterday. This follows an intra-day high of $2,439.80, just $10 short of the May 20 record.

- On Monday, Fed Chairman Powell had a cordial interview with David Rubenstein at the Economic Club of DC. While expressly stating he would not comment on markets, Chairman Powell’s remarks struck a predictably dovish-leaning message in light of recent data, repeating previous comments that the labour market is back to roughly where it was pre-pandemic; for inflation, in Q2 we had "3 better readings" following June's reports.

- The market’s focus now turns to today’s Retail Sales, Import/Export Prices, and upcoming earnings from Bank of America, Charles Schwab, State Street and Morgan Stanley.

- The market is pricing about 65bps of Fed rate cuts by the end of the year.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, key resistance is at $2,450.1, the May 20 high, while initial support to watch lies at the 50-day EMA, at $2,339.3.

INDONESIA: MNI BI Preview – July 2024: On Hold, BI Has Other Tools To Support IDR & Growth

- Bank Indonesia (BI) meets on July 17 and is unanimously expected to leave rates as 6.25% as inflation remains well within the 1.5-3.5% band and the rupiah has strengthened since the last meeting. However, FX stability will remain the central bank's focus and rates are likely to be unchanged until the Fed eases and the IDR has strengthened further and consistently.

- BI has a numerous tools and we expect it to continue using macroprudential policies to support the economy. On the FX front, Governor Warjiyo said that he prefers to use non-rate tools to defend the rupiah, such as intervention and money market deepening securities.

- Bank Indonesia is likely not only to hold rates at 6.25% in July but also in the months ahead as it waits to be confident that the rupiah has sustainably strengthened and of the timing of the first Fed rate cut. We don’t believe it will risk FX stability by cutting ahead of the US.

- See full preview here.

ASIA RATES: Asia Sovs Little Changed, BI Rate Decision Wednesday

Asian EM sovs have had another slow session, yields are little changed. INDON is slightly outperforming PHILIP with the front-end spread difference closing.

- Tomorrow, Bank Indonesia meet for the July rate decision. BI is expected to keep its key rate at 6.25% to support the rupiah, the currency has somewhat recovered since the June meeting where is traded at 16,430, it is currently trading at 16,203, however there are concerns the currency remains vulnerable due to future fiscal policies from the new government.

- The BI Governor Warjiyo mentioned there is a possibility of a rate cut later in 2024 if the rupiah stabilizes further while Inflation is projected to meet the 1.5%-3.5% target, according to BBG.

- The front-end PHILIP curve currently trades 4.5bps tighter than INDON but flattens out and trades 6-7bps wider out the curve.

- Cross-asset: Ahead of BI tomorrow the USD/IDR is 0.14% higher at 16,202, while the USD/PHP is unchanged at 58.458, the IDR is the worst performing Asian currency today behind JPY. In Equities, the JCI is down 0.35%, while the PSEi is up 0.10%.

- Looking ahead, Bank Indonesia is expected to keep rates at 6.25% on Wednesday

SOUTH KOREA: Multiple Factors Likely To Keep Chip Exports Supported In Coming Months

A surge in exports of semi conductors to the US in June, could be symptomatic of companies forecasting a Trump win in November and an increase in protectionism.

- Semi conductor exports rose by $13.4bn or 51% year on year, shipments to the US were up 15%. Shipments to China were up only 1.8% for a fourth consecutive month of growth, despite PMI's pointing to a contraction.

- At the same time, a weaker local currency (the won) has fed into falling import demand for the country as Korean firms call for stability in the currency as a policy initiative.

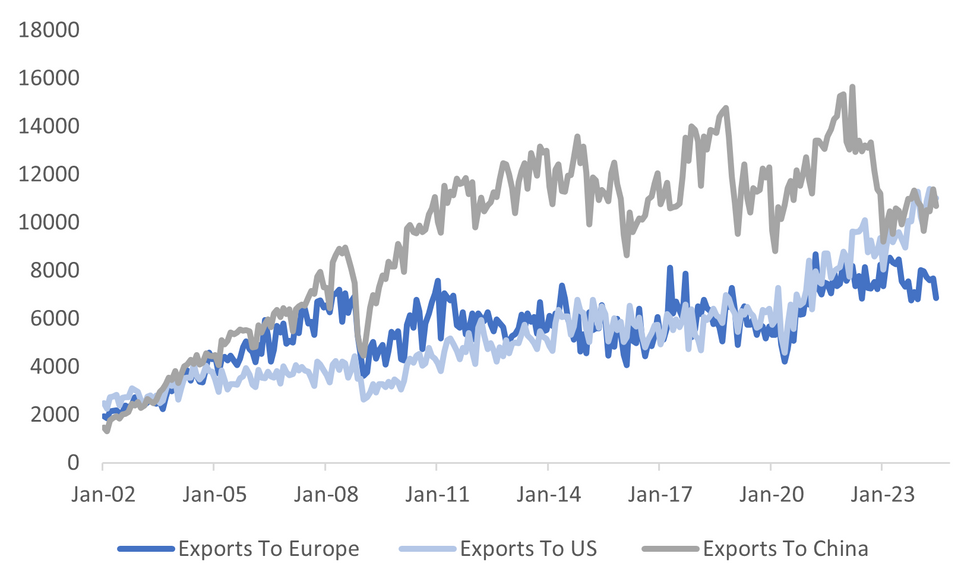

- Korean government policy has been focusing on initiatives to boost supply chain resilience and reduce dependence on China. The chart below shows that in recent months the US has passed China in terms of the largest export destination for South Korea.

- This recent export/chip export print is likely a combination of policy impact and potential movement ahead of November and is projected to continue into year end. The BoK also stated the chip export cycle would remain a key driver of overall South Korea growth trends. The broader tech outlook, supported by continued AI investment is another support point.

- Note next Monday we get a fresh trade update, with the first 20-days trade data for July out in South Korea.

Fig 1: South Korea Exports By Major Economy/Region, US Has Overtaken China

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Modestly Higher, Broader Dollar Gains Continue

Most USD/Asia pairs have had an upside bias today, although overall moves have been fairly modest. Negative spill over from G10 FX losses against the USD has been evident, although Asian FX has outperformed some of the losses (such as JPY, -0.45%) seen in this space. Dollar strength looks a carry over from Monday's session. A mixed equity backdrop has also been in play for the region. Tomorrow we have Singapore June trade data, while later on the BI decision is due, although no change is expected.

- USD/CNH has drifted higher, but at 7.2800, remains sub early Monday highs. USD/CNY spot is back to 7.2650 which is still sub recent highs. The USD/CNY fixing rose but didn't reach fresh highs. Equity sentiment is mixed onshore, while negative in Hong Kong as markets await Third Plenum details/policy initiatives.

- Spot USD/KRW has firmed, but found some selling interest above 1387. We were last around 1386, still 0.20% weaker in won terms. Local equities are higher, but remain sub recent highs. On the data front we had June trade prices earlier, with the export price index gaining 12.2% y/y, up form 7.6% prior, while import prices rose 9.7%, (from 4.7%). The data calendar is now quiet until next Monday's first 20-days of trade data for July prints.

- USD/IDR has crept higher, last above 16200, around 0.20% weaker in IDR terms. Risk appetite metrics, such as Indonesian CDS have moved against the local currency. This puts the pair back around the 50-day EMA, with recent lows at 16135. Most focus rests on tomorrow's BI meeting outcome, although no changes are expected. BI has a numerous tools and we expect it to continue using macroprudential policies to support the economy. On the FX front, Governor Warjiyo said that he prefers to use non-rate tools to defend the rupiah, such as intervention and money market deepening securities (see our full preview here).

- USD/THB has stabilized, last near 36.25, only modestly up from recent lows (just under 36.12). The pair is sub all key EMAs, except the 200-day, which is near 36.08. The baht remains the best EM Asia FX performer in July to date, and over the past trading month. Still, it remains nearly 5.8% weaker against the USD in 2024 to date, with TWD and KRW the only worst performers in the region. Recent baht gains have aligned with lower US-TH yield differentials (amid dovish Fed signs), along with broader USD softness. Firmer gold prices have also likely helped at the margin. We may need to such trends continue for USD/THB to test further on the downside.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/07/2024 | 0700/0900 |  | EU | ECB's De Guindos in ECONFIN meeting | |

| 16/07/2024 | 0800/1000 | ** |  | EU | ECB Bank Lending Survey |

| 16/07/2024 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/07/2024 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/07/2024 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/07/2024 | 0900/1100 | * |  | EU | Trade Balance |

| 16/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 16/07/2024 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 16/07/2024 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 16/07/2024 | 1230/0830 | *** |  | CA | CPI |

| 16/07/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 16/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/07/2024 | 1400/1000 | * |  | US | Business Inventories |

| 16/07/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/07/2024 | 1845/1445 |  | US | Fed Governor Adriana Kugler | |

| 17/07/2024 | 2245/1045 | *** |  | NZ | CPI inflation quarterly |