-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Ticks Lower In Asia

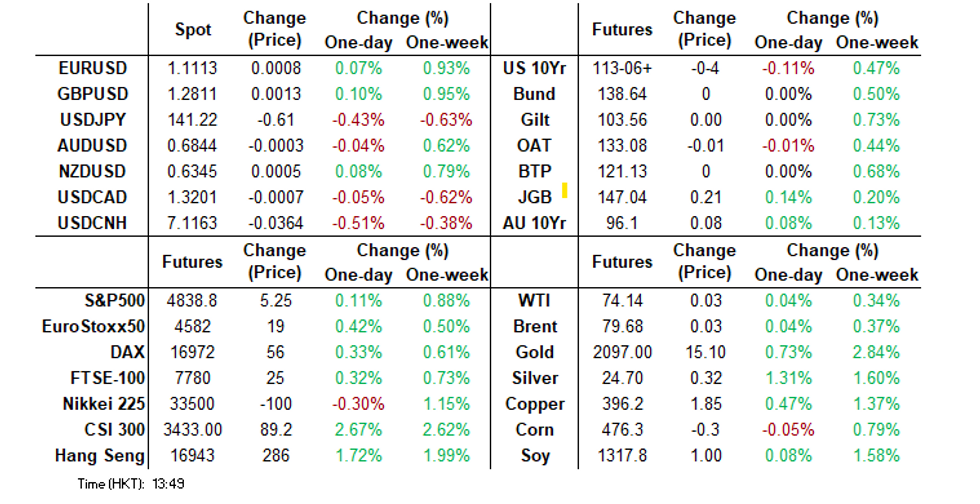

- The greenback has ticked lower in Asia today. USD/JPY is down ~0.4% and last prints at ¥141.30/35. The next support level comes in at ¥140.71, a Fibonacci retracement point. Kiwi is up ~0.2%, NZD/USD prints at $0.6350/55 as a fresh monthly high is printed. Bulls target $0.6412, the high from 14 Jul. A break through here opens $0.6563, a Fibonacci projection.

- APAC equity markets have followed the US higher again today with the MSCI APEX 50 up 1.1% to be 1.3% higher this month. The S&P e-mini is 0.1% higher and the Nasdaq +0.2% as expectations of Fed cuts rise. The only market to be down today is Japan, which is lower due to the speculation the BoJ will tighten, and the stronger yen weighing on automakers and tech firms.

MARKETS

US TSYS: Muted Asian Session

TYH4 deals at 113-06+, -0-04, a 0-04+ range has been observed on volume of 53k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys have marginally trimmed some of Wednesday's gains in a muted Asian session. Ranges have been narrow and the early downtick didn't follow through.

- Little meaningful macro newsflow crossed in light holiday trading.

- There is a thin docket in Europe, further out we have weekly jobless claims and pending home sales. The latest 7-Year supply is also due.

JGBs: Futures At Session Highs, 10/40Y Curve Steepens

JGB futures have extended morning strength, +16 compared to settlement levels, despite stronger-than-expected domestic activity data. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined retail sales, industrial production and international investment flow data.

- (Bloomberg) BoJ Governor Ueda continued to prepare the ground for the nation’s first interest rate increase since 2007 with another round of comments that further built the case for a move in the spring while not ruling out the less probable option of a January hike. (See linkICYMI)

- Cash JGBs are dealing mixed, with the belly of the curve outperforming. The benchmark 10-year yield is 1.7bps lower at 0.594% versus the recent rally low of 0.555% (20 Dec).

- The 20-40-year bucket is however significantly cheaper, with yields 2-6bps higher led by the 40-year. Bloomberg reported that the spread between 10 and 30-year JGB yields is set to widen further in the weeks ahead after the BoJ announced it will reduce the frequency of purchases for the longest maturities. (See link)

- Swap rates are lower out to the 10-year and higher beyond. Swap spreads are wider out to the 10-year and narrower beyond.

- Tomorrow, the local calendar is empty.

ACGBs: Holding Richer In An Otherwise Subdued Session

ACGBs (YM +2.0 & XM +5.5) are holding richer but are currently trading 2-3 bps below the best levels observed during the Sydney session. In the absence of significant domestic data releases, local market participants have adjusted their positions to align with the slight cheapening of US tsys in today's Asia-Pacific session.

- US tsys are presently trading 1-2 bps cheaper, reversing some of the 5-11 bps rally seen across benchmarks in yesterday's session. Today's weakness can be partially attributed to the sell-off in longer-dated JGBs following unexpectedly robust activity data. It's worth noting that the rally in JGBs yesterday, prompted by the BoJ's Summary of Opinions for the December Monetary Policy Meeting, contributed to the positive momentum in global bonds.

- Cash ACGBs are 3-5 bps richer, with the AU-US 10-year yield differential 2 bps wider at +11 bps.

- Swap rates are 3-5 bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing +1 to +4.

- RBA-dated OIS pricing is 1-3 bps softer across meetings beyond Mar’24. 66bps of easing is priced by Nov’24.

- Tomorrow, the local calendar is empty.

NZGBS: Closed A Data-Light Session On A Positive Note

NZGBs closed on a positive note, with benchmark yields 2-10 bps lower. In a session characterised by a lack of significant data releases, local participants opted to maintain their positions, initiated by the robust rally in global bonds observed yesterday. Notably, US tsys are sitting 1-2 bps cheaper in today’s Asia-Pac session.

- It's worth noting that the rally in JGBs yesterday, prompted by the BoJ's Summary of Opinions for the December Monetary Policy Meeting, contributed to the positive momentum in global bonds. However, today's weakness in US tsys can be partially attributed to the sell-off in longer-dated JGBs following unexpectedly robust activity data. 30-40-year JGBs are currently dealing 4-6 bps cheaper.

- Swap rates are 7-10 bps lower and at session lows, with the 2s10s curve flatter.

- RBNZ dated OIS pricing 3-8 bps softer across meetings beyond Feb’24. The market has 116bps of easing priced by Nov’24.

- Tomorrow, the local calendar is once again empty.

OIL: Crude Little Changed, As Supply Concerns Offset Risks

MNI (Australia) - Oil prices are little changed during APAC trading today thus holding onto Wednesday’s losses. Brent remains below $80 at $79.75/bbl and WTI is just above $74. The weaker dollar (USD index -0.2%) and risks to shipping in the Red Sea are supporting prices but higher US inventories are weighing on them given the market remains concerned about excess supply.

- WTI’s 50-day average is hovering around the 200-day, which if they cross will be seen as bearish. WTI is down 2.6% this month and Brent -1.4%.

- Sinopec expects China’s product demand growth to ease to 1.7% in 2024 from 16.1% in 2023, which had been boosted by post-Covid demand, according to Bloomberg. Gasoline is forecast at 1.6% compared with 23% and diesel flat vs 3.1%. Demand for refining should increase 3% after 10% this year. The peak in crude demand is forecast for 2027.

- Bloomberg reported a US crude inventory build of 1.84mn barrels in the latest week after almost a million the week before, according to people familiar with the API data. Gasoline stocks fell 482k but distillate rose 272k. The official EIA data is out today.

- Later US November trade data and weekly jobless claims print.

GOLD: Setting Up For Fifth Consecutive Day Of Gains

Gold is 0.5% higher in the Asia-Pac session, extending its four-day rally, after closing 0.5% higher at $2077.49 on Wednesday.

- Bullion was supported yesterday by lower US Treasury yields as investors became increasingly confident that the Federal Reserve will loosen monetary policy aggressively in 2024.

- The yield on the US Treasury 10-year dropped 11 bps to 3.79% - the lowest level since mid-July. The ball started rolling after the Richmond Fed Mfg Index (-11 vs. -3 est, -5 prior) and Business Conditions (0.0 vs. -9 prior) printed the lowest reading since April. A decent $58bn 5-year Treasury auction then allowed the rally to extend into the close.

- Projected rate cuts for early 2024 also gained momentum, with March 2024 fully pricing in a 25 bp cut. A cumulative 54 bps of easing is priced for May 2024, with -167 bps by December 2024.

- Later today the US calendar sees Weekly Claims, Retail/Wholesale Inventories and Home Sales. The US Treasury wraps up 2023's supply with a $40bn 7-year Note auction.

- From a technical standpoint, yesterday’s increase cleared resistance at $2073.4 (61.8% retrace of the Dec 4-14 bear leg) to open $2097.1 (76.4% retrace of the same move), according to MNI’s technical team.

FOREX: Yen Firms In Asia

The Yen has firmed in Asia on Thursday, USD/JPY has ticked lower after the latest round of Japanese data. Retail Sales and Industrial Production were both firmer than expected. The move in the Yen is applying mild pressure to the USD.

- USD/JPY is down ~0.4% and last prints at ¥141.30/35. The next support level comes in at ¥140.71, a Fibonacci retracement point.

- Kiwi is up ~0.2%, NZD/USD prints at $0.6350/55 as a fresh monthly high is printed. Bulls target $0.6412, the high from 14 Jul. A break through here opens $0.6563, a Fibonacci projection.

- AUD/USD is up ~0.1% following the broader USD move.

- Cross asset wise; US Tsys are a touch lower and BBDXY is down ~0.1%. The Hang Seng is up ~1%.

- The docket is light in Europe today

EQUITIES: Equity Markets Optimistic Into Year End, Except Japan

APAC equity markets have followed the US higher again today with the MSCI APEX 50 up 1.1% to be 1.3% higher this month. The S&P e-mini is 0.1% higher and the Nasdaq +0.2% as expectations of Fed cuts rise. The only market to be down today is Japan, which is lower due to the speculation the BoJ will tighten, and the stronger yen weighing on automakers and tech firms. USDJPY is down 0.4% to 141.20.

- The Nikkei is down 0.4% and the Topix -0.2%.

- HK and China shares have rallied sharply with the Hang Seng up 1.5% and the CSI 300 +1.9% and property +2%. Tech has outperformed with the Hang Seng Tech index up 2.1%. China’s independent development plan has boosted aircraft-related stocks.

- Korea’s KOSPI is up 1% and the KOSDAQ +0.6% while Taiwan’s TAIEX is flat.

- Australia’s ASX 200 is 0.6% higher to be up 7.3% this month and the NZX 50 is up 0.8% and 3.9% in December.

- India’s Nifty 50 is +0.2%.

- ASEAN markets are all higher with Indonesia’s Jakarta Comp +0.6%, SE Thai +0.4%, Philippines PSEi +0.5% and Singapore’s Straits Times +1.6%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/12/2023 | 1330/0830 | *** |  | US | Jobless Claims |

| 28/12/2023 | 1330/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/12/2023 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 28/12/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 28/12/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 28/12/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/12/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/12/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.