-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

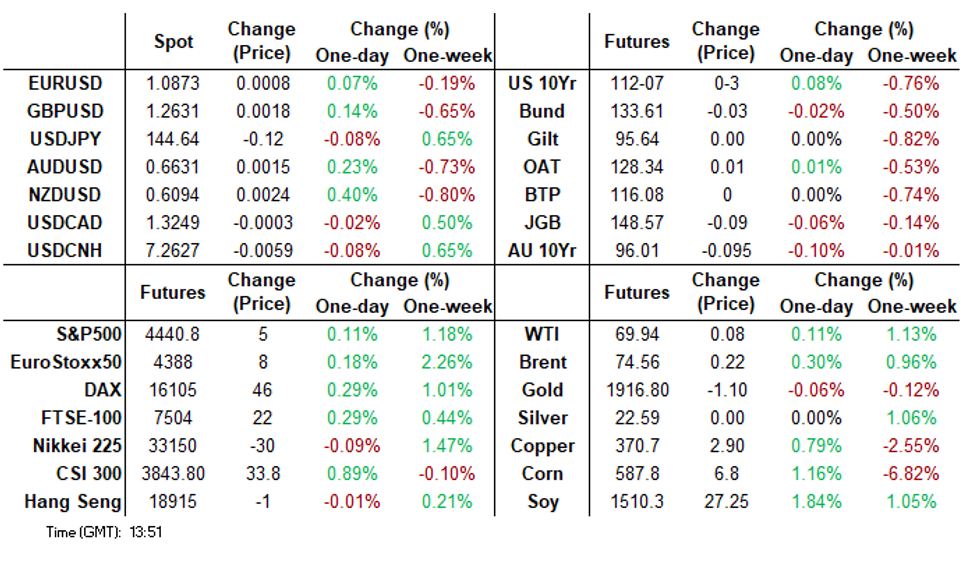

Free AccessMNI EUROPEAN Markets Analysis: USDJPY Falls After Testing ¥145

- USD/JPY briefly dealt about ¥145 before paring gains after printing its highest level since November. The pair now deals a touch softer than Thursday's closing levels last printing at ¥144.60/70.

- Kiwi is ~0.4% firmer, NZD/USD firmed as USD/JPY retreating from above ¥145 spilled over into wider greenback weakness.

- Elsewhere fixed income markets have been muted in Asia as participants await the release of US PCE deflator data later today. Oil is a touch firmer and Gold is little changed.

MARKETS

US TSYS: Muted Asian Session On Friday

TYU3 deals at 112-06, +0-02, a narrow 0-04 range has been observed on volume of 54k.

- Cash tsys sit little changed from Thursday's closing levels across the major benchmarks.

- Tsys have respected narrow ranges with little follow through on moves in Asia.

- Little meaningful macro news flow crossed.

- The highlight flow was an FV block seller (1.25k lots).

- Coming up in Europe we have the final read of UK GDP and flash Eurozone CPI. Further out we have Personal Income and Consumer Sentiment.

JGBs: Futures Holding Weaker, Tokyo CPI Miss Fails To Support Market

JGB futures are dealing at overnight closing levels, -11 compared to settlement levels after the initial pop from the Tokyo CPI miss fails to hold in early Tokyo trade.

- The muted reaction may reflect the fact that inflation in Tokyo re-accelerated for the second time in three months in June, according to a Bloomberg article. Such an outcome supports expectations the BoJ will raise its inflation forecast next month amid lingering speculation of possible policy adjustments. (See link)

- Cash JGBs are trading -0.5bp to +0.5bp beyond the 1-year zone (+1.6bp). The benchmark 10-year yield is unchanged at 0.391%, below the BoJ's YCC limit of 0.50%. The 2-year yield is 0.5bp lower at -0.074% after yesterday's supply takedown saw solid demand with the cover ratio jumping to its highest level observed at a 2-year auction since September with a reduced tail. Bloomberg reports that MUFJ-MS Buys 24.7% of Japan 2-Year Bonds at sale yesterday. (See lin)

- Swap rates are flat to 0.3bp higher out to the 3-year and 0.1-0.5bp lower beyond, out to the 30-year. 40-year swap rate is 0.7bp higher.

AUSSIE BONDS: Cheaper Ahead Of RBA Decision On Tuesday, Awaiting US PCE Deflator

ACGBs are currently trading weaker (YM -10.0 & XM -10.5), nearing the session lows observed in Sydney. Market participants are eagerly awaiting the release of US PCE deflator data later today. The market consensus expects the headline deflator to show a monthly increase of +0.1%, indicating a slowdown in inflationary pressures. However, the Core PCE deflator, which is closely watched by the Fed, is anticipated to register a monthly increase of +0.3% following the +0.4% reading in April. The annual core PCE deflator is expected to remain unchanged at +4.7%.

- Cash ACGBs are 9-10bp cheaper with the AU-US 10-year yield differential unchanged at +16bp.

- Swap rates are 9bp higher with EFPs little changed.

- The bills strip bear steepens with pricing -4 to -13.

- The local calendar sees Judo Bank PMI data (Jun F), MI Inflation Gauge (Jun), Home Loans (May), ANZ-Indeed Job Ads (Jun) and Building Approvals (May) on Monday ahead of the RBA policy decision on Tuesday. BBG consensus is currently expecting a no-change outcome although it is far from unanimous.

- RBA-dated OIS pricing is 3-8bp firmer across meetings today. The market attaches a 53% chance of a 25bp hike next week versus 31% pre-retail sales data.

NZGBS: Closed At Or Near Cheaps, Awaits US PCE Deflator

NZGBs closed with benchmark yields 5-8bp higher as the local market digested the surge in US tsy yields overnight, ahead of the all-important US PCE deflator data for May later today. Domestic drivers were scarce other than the previously mentioned consumer confidence data.

- Swap rates are 8bp higher with the 2s10s curve unchanged and implied long-end swap spreads wider.

- RBNZ dated OIS pricing closed flat to 11bp firmer across meetings with May’24 leading. Terminal OCR expectations closed at 5.65%.

- Central banks globally need to review their performance during the Covid-19 pandemic and acknowledge any policy errors, according to Bob Buckle, Emeritus Professor, Victoria University of Wellington and an external member of the RBNZ MPC in his address at the NZAE conference. (See link)

- The local calendar next week sees Building Permits (May) on Monday, NZIER Business Opinion Survey on Tuesday, and CoreLogic House Prices and the NZ Government’s 11-mth Financial Statement on Wednesday.

- In Australia, the focal point will be the RBA policy decision on Tuesday.

- The NZ Treasury also plans to sell NZ$250mn of the 0.5% 15 May 2026 bond, NZ$2000mn of the 2.0% 15 May 2032 bond and NZ$50mn of the 1.75% 15 May 2041 bond on Thursday.

GOLD: Dips Below $1900

Gold is little changed in the Asia-Pac session, after briefly dipping below $1,900 on Thursday as US tsy yields surged following the unexpectedly strong GDP revision and a decrease in jobless claims, which further raised the probability of the FOMC implementing further rate hikes.

- Rates moved to their highest levels since March, reminiscent of the previous market unease regarding aggressive actions by the Federal Reserve.

- But gold managed to quickly rebound after sliding below the $1,900 marker, a sign of enduring bids for the metal even as US bond yields and the dollar move against it.

- There has been a noticeable outflow of investments from bullion-backed exchange-traded funds (ETFs), contributing to the downward trajectory of gold prices. Data compiled by Bloomberg indicates that total holdings in gold-backed ETFs have declined for four consecutive weeks, and trading volumes are approximately 10% lower compared to the previous year. It is worth noting that sustained ETF buying played a significant role in driving the price of gold higher in 2020.

FOREX: USD/JPY Retreats After Testing ¥145

USD/JPY briefly dealt about ¥145 before paring gains after printing its highest level since November. The pair now deals little changed from Thursday's closing levels last printing at ¥144.70/80.

- USD/JPY printed a high at ¥145.07, if the pair can sustain a move through ¥145 ¥145.48, 2.0% 10-DMA envelope, provides the next resistance level. Tokyo CPI was softer than expected printing at 3.1% vs 3.4% exp. Japans Jobless Rate held steady at 2.6%.

- Kiwi is ~0.3% firmer, NZD/USD firmed as USD/JPY retreating from above ¥145 spilt over into wider greenback weakness. The pair last prints at $0.6085/90. In June Consumer Confidence rose 8.0% to 85.5 as the RBNZ's decision to pause rate hikes boosts sentiment.

- AUD/USD is up ~0.2%, the pair remains well within recent ranges and last prints at $0.6625/30.

- Elsewhere in G-10 NOK and SEK are ~0.2% firmer, however liquidity is generally poor in Asia.

- Cross asset wise; BBDXY is down ~0.1% and e-minis are a touch higher. US Tsy Yields are marginally firmer across the curve.

- Coming up in Europe we have the final read of UK GDP and flash Eurozone CPI.

AU & US STIR Firmer On Strong Data

RBA-dated OIS is pricing a 50% chance of a 25bp hike at Tuesday’s policy meeting after retail sales for May yesterday printed significantly stronger than expected at +0.7% m/m versus expectations of +0.1%. The ABS noted that the solid rise was driven by higher food and restaurant spending as well as “a boost in spending on discretionary goods”, which is in contrast to consumer surveys.

- AU STIR currently has two 25bp rate hikes priced by Dec’23.

- US STIR was also pressured firmer yesterday following an upward revision to Q1 US GDP on the third reading and softer than forecast Initial Jobless Claims.

- July 26 FOMC has a 78% chance of a 25bp hike priced. September has more than fully priced a hike with a cumulative of +32bp of tightening. November’s cumulative climbed to 35bp at 5.425%.

Figure 1: AU & US STIR

Source: MNI – Market News / Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/06/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/06/2023 | 0630/0830 | ** |  | CH | Retail Sales |

| 30/06/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2023 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/06/2023 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 30/06/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 30/06/2023 | 1430/1030 | ** |  | CA | BOC Business Outlook Survey |

| 30/06/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 30/06/2023 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.