-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY99.5 Bln via OMO Friday

MNI EUROPEAN MARKETS ANALYSIS: Yen Losses Continue, Key US Data Coming Up

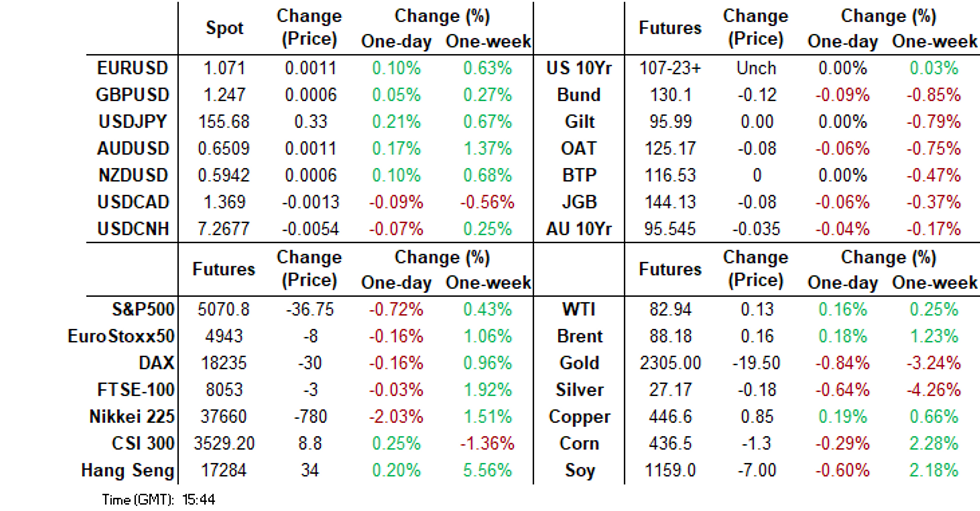

- USD/JPY gains have continued after Wednesday's break above 155.00. Yen vols have spiked as tomorrow BoJ's meeting comes into view/while verbal rhetoric around intervention continues.

- With Australian and New Zealand markets out for the ANZAC holiday, it has been relatively quiet in the fixed income space. JGB futures have rallied somewhat, but are off session highs. US Tsy futures have been relatively steady ahead of data later.

- South Korean Q1 GDP was much stronger than forecast but the won hasn't rallied much. Weaker yen levels and softness in the tech equity space post a disappointing earnings update from Meta have weighed. Nasdaq futures sit close to 1.3% weaker.

- Later US Q1 GDP and core PCE prices, March trade, inventories and weekly jobless claims print. Bloomberg consensus is at 2.5% q/q saar for GDP and an elevated 3.4% for core PCE prices.

MARKETS

US TSYS: Futures Steady As Markets Await PCE

It has been a very muted session for US Tsys. TYM4 sits at 107-25, +01+ in recent dealings, having stuck to ranges from late NY trade on Wednesday in Asia Pac today. Highs were at 107-27, lows 107-23+.

- We haven't seen much spill over from the sharp fall in US equity futures, apart from a modest rise at the open. Volumes in Tsy futures have been less than 50k so far today. AU and NZ markets are out, which has likely lightened volumes/interest to a degree.

- In the cash Tsy yield space, we are firmer, but gains are under 1bps at this stage. The 10yr last near 4.645%. The 2/10s curve is near -29bps, the steepest levels since early Fed/late Jan.

- Looking ahead, we have Wkly Claims, GDP, Core PCE Index in focus.

JGBS: Futures Unwind Most Of Wednesday's Losses Ahead Of BoJ Tomorrow

JGB futures have drifted higher today, last 144.19, -.02 for JBM4. Intra-session lows from Wednesday, post Tokyo trade, came in close to 144.00. Today we have unwound a good proportion of yesterday's sell off.

- Focus clearly rests on tomorrow's BoJ meeting outcome, although no major changes are expected at this stage.

- News flow has been light today, although FX markets remain a focus point, given fresh multi decade lows in the yen against the USD. We had familiar FX jaw boning from FinMin Suzuki before parliament today. Equity markets are also weaker, amid a negative lead from US tech futures.

- JGB yields are drifting lower, the 10yr last under 0.89%, after making highs back to Nov last year yesterday. The 30 and 40yr tenors are also down by 1-2bps.

- Swaps are all lower in yield terms for 2 to 10yr tenors. The 10yr last at 0.975%.

FOREX: USD/JPY Drifts Higher, Vols Spike Amid Intervention Risks/BoJ Coming Into View

With Australia and New Zealand markets out for the ANZAC day holiday, focus has largely rested on USD/JPY. The pair has firmed a little in the first part of Thursday trade, last in the 155.45/50 region. This is through Wednesday highs and fresh highs back to 1990 for the pair. The BBDXY USD index is unchanged though near 1261.

- Familiar FX rhetoric from FinMin Suzuki crossed the wires around watching FX markets closely. Chief Cabinet Secretary also noted that is it important for FX markets to reflect fundamentals (BBG). However, yen didn't strengthen on the comments.

- Overnight vols surged to 28% at one stage, as tomorrow's BoJ meeting comes into view. This is highs back to mid Dec last year. The skew around risk reversals has also been to the downside in USD/JPY.

- Elsewhere, the main cross asset feature of note has been a sharp fall in US equity futures at the open, led by the Nasdaq (-1.20%), as Meta's earnings update from late Wednesday US time, weighed heavily on sentiment.

- The impact on higher beta plays has been minimal though, with AUD/USD up a touch to 0.6505, while NZD/USD is around 0.5940. Liquidity is no doubt lighter though in both markets.

- US yields sit a touch higher, but gains are under 1bps at this stage.

- Looking ahead, we have Wkly Claims, GDP, Core PCE Index in US. In Europe we have German consumer confidence and some ECB speak.

ASIA EQUITIES: US Tech Future Down On Meta Disappointment, HK/China Outperform

Asia equity markets are mixed, despite a strong negative lead from US equity futures. US futures sit down sharply, led by the Nasdaq (-1.15%) as Meta's late earnings update from Wednesday US time left investors disappointed around the revenue outlook. HK/China have outperformed but sit away from best levels.

- Major markets in the region all tracked lower at the open, although Hong Kong markets have recovered. The HSI is back up 0.55%, albeit away from best levels at the break. The tech sub index was up in earlier trade, but is now back to fat. Optimism around online gaming in China is aiding sentiment in the space this week, with strong gains seen through Tues/Wed trade.

- China mainland markets are also higher, albeit to the tune of 0.24% for the CSI 300 index.

- Japan markets are off more than 1% at this stage for the Topix, nearly 2% for the NKY. Weakness in the US tech space has seen a negative spillover effect. Focus remains on USD/JPY which continues to make fresh cyclical highs back to 1990.

- Tech weakness is also weighing on the Kospi (-1.15%) and Taiex as well (-1.30%). Earlier chip maker SK Hynix posted better than expected profit results in South Korea, while the authorities also announced details of the short-sale monitoring program (see this BBG link).

- Note onshore markets in Australia and New Zealand are close today for the ANZAC day holiday.

- In SEA, trends are relatively steady with most major indices posting either modest losses or gains.

JAPAN DATA: Offshore Investors Sold Local Equities & Bonds Last Week

Last week saw offshore investors turn net sellers of Japan equities. Outflows were -¥492.4bn, ending the past 2 week run of strong inflows. Since mid-March net flows into this asset class from offshore investors has only been marginally positive.

- Offshore investors were larger sellers of local bonds last week. The trend from this segment has generally been net selling in recent weeks.

- Japan investors purchased offshore bonds last week, but we continue to see a see-saw pattern in terms of outflows to this segment. For equities, local investors were modest net sellers of offshore equities.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Apr 19 | Prior Week |

| Foreign Buying Japan Stocks | -492.4 | 1730.7 |

| Foreign Buying Japan Bonds | -1441.8 | 51.3 |

| Japan Buying Foreign Bonds | 648.1 | -1000.1 |

| Japan Buying Foreign Stocks | -20.9 | 53.9 |

Source: MNI - Market News/Bloomberg

OIL: Crude Little Changed Ahead Of Key US Data

Oil prices are little changed during APAC trading and close to intraday highs, as markets wait for Q1 GDP and the Fed’s preferred inflation measure core PCE prices. WTI is 0.1% higher at around $82.93/bbl, near today’s high of $82.95. Brent is up 0.2% to $88.16 after a high of $88.18 but has spent some of the session below $88. The USD index is unchanged.

- EIA reported that crude stocks fell sharply by 6.37mn, but there was little market reaction including in the APAC session. Gasoline inventories fell 634k but distillate rose 1.61mn barrels last week. Refinery utilisation rose 0.4pp to 88.5%.

- Geopolitical tensions have eased and oil’s associated premium has unwound this week but issues remain with Ukraine striking two Russian oil depots in western Russia and Houthis claiming they had targeted shipping off the Yemeni coast both on Wednesday.

- Bloomberg is reporting some negative market developments with options showing a bearish skew and the US Oil Fund, biggest oil ETF, recording its largest recorded daily outflow. In addition, refining margins for diesel in Asia are at their lowest in almost a year.

- Later US Q1 GDP and core PCE prices, March trade, inventories and weekly jobless claims print. Bloomberg consensus is at 2.5% q/q saar for GDP and an elevated 3.4% for core PCE prices. A stronger print would likely weigh on crude as markets worry about the demand outlook.

GOLD: Bullion Range Trading, Key PCE Price Data Coming Up

Gold prices have been range trading during the APAC session with them falling to a low of $2305.20/oz after rising to $2322.14. They are currently down only 0.1% to $2313.00 after falling 0.3% on Wednesday and are still 3.8% higher in April. There is little direction from the greenback with the USD index unchanged.

- Bullion has traded below the 20-day EMA signalling the start of a possible corrective cycle. Initial support is at $2291.60, April 23 low. It has been significantly overbought and a correction would allow that to unwind. The bull trigger is at $2431.50, April 12 high.

- Gold prices are down 3.3% this week due to the easing of geopolitical tensions in the Middle East and subsequent reduction in safe-haven purchases. It remains elevated though possibly due to increased demand from Asia, inflation hedging and central bank buying.

- Later US Q1 GDP and core PCE price index, March trade, inventories and weekly jobless claims print. Gold will watch GDP and the consumer price component closely as price moves are highly dependent on Fed expectations. Bloomberg consensus is at 2.5% q/q saar for GDP and an elevated 3.4% for core PCE prices. A print above this would likely weigh on non-yield bearing bullion as Fed easing expectations get pushed back further.

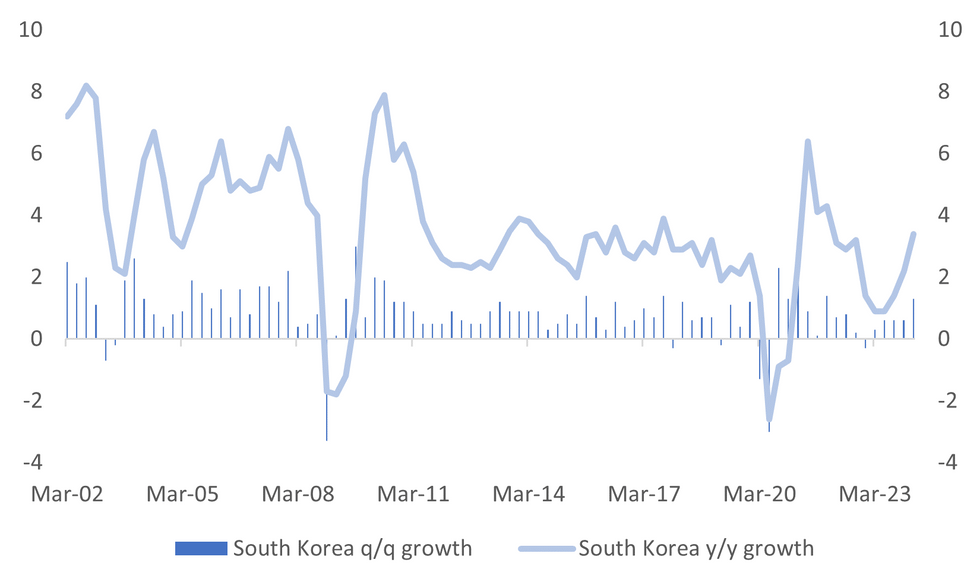

SOUTH KOREA DATA: Q1 GDP Well Above Expectations, Sentiment Points To Further Export Growth

South Korea GDP rose 1.3% q/q in Q1, well above the consensus 0.6% estimate. This was the strongest quarterly growth pace since Q4 2021. Y/Y growth was 3.4%, also well above expectations (2.5% and prior), which is also the firmest pace since end 2021.

- The main swing came from a sharp rebound in construction activity, up 4.8% q/q, versus a 3.8% decline in Q4 last year. Manufacturing activity was +1.2%, services +0.7% in q/q terms, both similar to prior outcomes.

Fig 1: South Korea Q1 GDP Accelerates

Source: MNI - Market News/Bloomberg

- Private consumption rose 0.8% q/q, against a 0.2% rise prior. Exports rose 0.9% in the quarter a slower pace compared to Q4, but imports fell 0.7% q/q, against a 1.4% gain prior, meaning net exports were still positive.

- Earlier data showed manufacturing and non-manufacturing sentiment rising in May. Both measures suggest on-going, albeit moderate growth.

- On the manufacturing side, the trend for export expectations continued to rise, up to 80. The second chart below overlays expectations against actual export y/y growth.

- The data outcomes, particularly a fairly resilient broad based GDP back drop, should reduce pressure at the margin for BoK to ease, at least from a growth standpoint.

Fig 2: Manufacturing Export Expectations Continue To Improve

Source: MNI - Market News/Bloomberg

ASIA FX: Weighed By Softer Equity Tone, Continued Yen Depreciation

USD/Asia pairs are mostly higher in the first part of Thursday trade. Part of this is catch up to USD strength post onshore closes yesterday, while weaker equity sentiment has also been evident for most parts of the region (except for HK/China markets), while yen has made fresh lows versus the USD. USD/CNH is lower, but follow through has been limited. KRW, PHP, IDR and THB spot losses have evident, although NDF trends have been steadier. Tomorrow, we have Singapore industrial production, but otherwise the data calendar is light.

- USD/CNH is back sub 7.2700, which has seen the CNH-CNY basis narrow. The USD/CNY fix was near recent levels, which may have disappointed some yuan bears hoping for a move higher. Spot USD/CNY is near 7.2470 though and remains very close to the upper limit of the daily trading range. US Secretary of State Blinken has commenced his trip to China, but nothing meaningful has emerged so far.

- Spot USD/KRW has rebounded over 0.50%, last near 1377. The 1 month NDF is a touch under 1375, so slightly below end NY levels from Wednesday. Earlier won sentiment was a little more positive amid much stronger than expected Q1 GDP growth (y/y growth is back above 3%). However, equity weakness amid tech softness coupled with on-going yen losses have been negative offsets.

- USD/IDR spot is back above 16200 in the first part of Thursday trade, around 0.35% weaker in IDR terms. Lows in the pair, after yesterday's BI 25bps rate hike, came in at 16145. Recent highs rest at 16288. The 1 month NDF was last around 16230, slightly lower for the session. BI left its macro outlook unchanged but it now expects that the Fed won't hike before Q4 and that there will only be 25bp before year end rather than 75bp. BI is unlikely to ease before the Fed given rupiah weakness. Broader risk sentiment has not helped BI's cause to stabilize IDR sentiment post yesterday's surprise hike. Weaker global equities, amidst a higher core yield backdrop, is typically not favorable rupiah backdrop.

- USD/PHP sits near session highs, the pair last in the 57.90/95 region, down nearly 0.70% for the session in PHP terms. This is fresh highs in the pair back to Nov 2022. Highs from 2022 came in around the 59.00 level. Renewed PHP weakness looks a little at odds with cross asset drivers, with broader USD trends a little more stable this week. Local equities have moved off recent lows (although offshore portfolio equity outflows persist, last at -$152mn for April to date), while the uptrend in oil prices has stabilized somewhat. Comments from Finance Secretary Recto (who also sits on the BSP board) have also crossed the wires (BBG). He stated that the policy rate will depend on the inflation, but played down risks of a near term rate hike. Earlier remarks by Recto (from Apr 19) stated if PHP fell to 59.00 versus the USD it would likely limited rate cuts going forward.

- USD/THB has rebounded back above 37.00, the pair in the 37.10/15 region. This is fresh highs back to Oct last year. Local commercial banks will cut rates by 25bps for some individuals and SMEs to ease the financial burden. Thailand PM Srettha made such a call earlier this week, which followed the steady hand from the BoT recently.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/04/2024 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/04/2024 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2024 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/04/2024 | 0700/0900 |  | EU | ECB's Schnabel Speech for 'ChaMP' | |

| 25/04/2024 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/04/2024 | 1100/0700 | *** |  | TR | Turkey Benchmark Rate |

| 25/04/2024 | 1230/0830 | *** |  | US | Jobless Claims |

| 25/04/2024 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/04/2024 | 1230/0830 | *** |  | US | GDP |

| 25/04/2024 | 1230/0830 | * |  | CA | Payroll employment |

| 25/04/2024 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 25/04/2024 | 1400/1000 | ** |  | US | NAR Pending Home Sales |

| 25/04/2024 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/04/2024 | 1500/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 25/04/2024 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/04/2024 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/04/2024 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.