-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Transition Begins

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- GSA DESIGNATES BIDEN "APPARENT WINNER", TRIGGERS TRANSITION PROCESS

- BIDEN PICKS EX-FED CHAIR YELLEN TO BECOME NEXT TREASURY SECRETARY

- FED'S EVANS: FED MAY HOLD RATES TO 2024, NEED FISCAL HELP (MNI)

- FED'S BARKIN SEES CHALLENGING NEXT FEW MONTHS (MNI)

- UK SAID TO WEIGH HUAWEI INSTALLATION BAN IN 2021 (BBG)

- NZ GOVERNMENT PROPOSES ADDING HOUSE PRICES TO RBNZ REMIT (BBG)

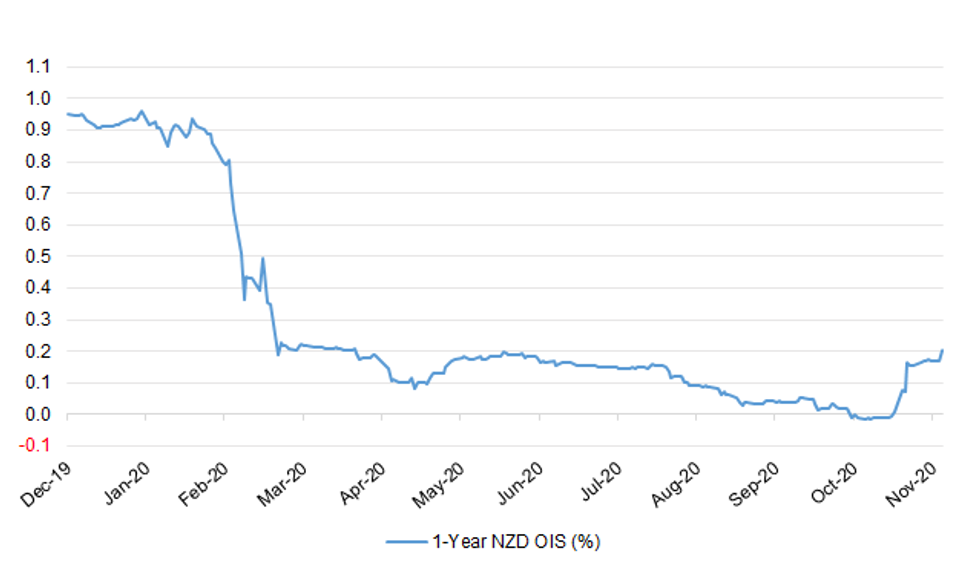

Fig. 1: 1-Year NZD OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE/BREXIT: MNI BRIEF: BOE Bailey: No Deal Positive Shock To Inflation

- If there is no trade deal with the European Union it would be more likely to be inflationary than deflationary for the UK, as it would hit supply more than demand, Bank of England Governor Andrew Bailey said Monday - for more details please contact sales@marketnews.com.

BOE/BREXIT: The governor of the Bank of England, Andrew Bailey, has warned that the economic cost of a no-deal Brexit would be bigger in the long term than the damage caused by Covid-19. Bailey said failure to agree to a deal before the Brexit transition expires at the end of December would cause disruption to cross-border trade and damage the goodwill between London and Brussels needed to build a future economic partnership. Speaking to MPs on the Commons Treasury committee, he said the fallout from the pandemic and the second national lockdown in England was having a much bigger short-term impact on the economy. However, "the long-term effects, I think, would be larger than the long-term effects of Covid. But … it would be better to have a trade deal, yes, no question about it." (Guardian)

BOE: MNI BRIEF: BOE Haldane: My Nov QE Vote Finely Balanced

- Bank of England Chief Economist Andrew Haldane said Monday it was a finely balanced decision in November on whether he should vote to approve a larger or smaller quantitative easing package in November and he came down in favour of the larger GBP150 billion in asset purchases as an "insurance policy" - for more details please contact sales@marketnews.com.

BREXIT: Negotiators are exploring the idea of review clauses to break the deadlock in EU-UK trade talks, with the possibility that parts of the deal could be revisited several years after they take effect. EU diplomats said the two sides are discussing whether review clauses and transitional arrangements have the potential to ease the pain of compromises needed to get an agreement done — but warned that both sides still have very different views of how this might work. The concept of a review clause was already broached in the negotiations last week as a way of overcoming the impasse on fishing. The UK proposed last week that the EU could retain part of its current quota rights for several years, after which there would need to be further negotiations on future arrangements. A senior EU official confirmed at an internal meeting with national ambassadors on Friday that the EU negotiating team was willing to consider the idea, but only if the review clause was linked to the broader EU-UK economic relationship. (FT)

BREXIT: No date has been set for in-person Brexit trade talks, after a member of the EU's team tested positive for coronavirus last week. The Independent understands that the UK side returned to London on Friday and that top-level negotiations are now taking place via videoconference. The disruption of face-to-face meetings could not have come at a worse time, with the end of the Brexit transition period looming. (Independent)

BREXIT: Joe Biden's reported pick for the role of America's top diplomat has referred to Brexit as "a total mess", raised concerns over its effect on the Good Friday Agreement and compared it to a dog being run over by a car. (Independent)

CORONAVIRUS: British Prime Minister Boris Johnson said on Monday that he hoped almost all Britons at high risk from COVID would be vaccinated against the disease by Easter. "We should be able to inoculate, I believe on the evidence I'm seeing, the vast majority of the people who need the most protection by Easter," Johnson told a news conference. (RTRS)

CORONAVIRUS: England will be under a new set of local Covid-19 restrictions until March when the national lockdown ends next week, Boris Johnson has announced. Areas will be placed in one of three tiers on the Thursday with the number under the most severe restrictions expected to increase significantly. Changes to the previous rules include applying the ban on pubs that don't serve food to Tier 2. It previously applied to Tier 3. Even people in Tier 1 will be asked to stay at home where possible. (Times)

CORONAVIRUS: Boris Johnson says that there are "immense logistical challenges" to rolling out the vaccines and says the NHS, local authorities, Public Health England and the Armed Forces will all play a role. "It will take a long time will take a while before we can get the shots in the arms where they're needed," he warns. (Telegraph)

CORONAVIRUS: The Oxford vaccine is likely to be the first Covid jab that large numbers of Britons receive, despite Pfizer's candidate already being analysed by the medicines regulators, experts say. The fact that the Oxford vaccine can be kept in normal fridges, whereas Pfizer's product has to be stored at -75C , may see it enter widespread usage ahead of the latter. (Guardian)

CORONAVIRUS: The Prime Minister says that the infection rate is now at 1 or "in that area". As England emerges from lockdown he says that the "key" priority for the Government is now ensuring people are in the right tiers and adhering to the guidance. He says with the right measures "we can keep things down". (Telegraph)

ECONOMY: UK company bosses and senior executives are preparing to sell down stakes in businesses ahead of a potential increase in capital gains tax next year. A review commissioned by Rishi Sunak, the chancellor, has recommended increasing capital gains tax rates to bring them in line with income tax rates, which could effectively double the cost of selling shares in companies. City brokers and accountants said they had been swamped with calls from senior executives with long term shareholdings as well as company founders that have retained large stakes in their businesses and who fear being caught by higher taxes. "Quite a few companies are asking us to find them a window to sell before March," said one senior City financier, who added that some were worried about being tied by closed periods running up to results in the spring. (FT)

EUROPE

ECB: European Central Bank policy maker Olli Rehn criticized the political standoff over the region's pandemic recovery plans, amid mounting concern that central bankers will again be forced to bear the brunt of supporting the economy. The EU's 1.8 trillion-euro ($2 trillion) spending package -- an enhanced multi-year budget and the Next Generation EU fund that ECB President Christine Lagarde said last week must be made operational without delay - - are being held up by Hungary and Poland over conditions attached to the cash. With renewed lockdowns likely to usher in a double-dip recession, the ECB is already planning more monetary stimulus in December. The risk is that if fiscal aid is curtailed, the central bank will be left with a bigger burden for the recovery at a time when its arsenal is already depleted. "I find it irresponsible that the financial framework and the Next Generation EU have been made political footballs," Rehn, a former European Commissioner, said in an interview from Helsinki. "I trust the member states will solve this issue." (BBG)

EU/U.S.: A top European Union official, in a phone call with Joe Biden on Monday, invited the U.S. president-elect to rebuild "a strong trans-Atlantic alliance" and attend a meeting with the bloc's 27 national leaders next year, his office said. European Council President Charles Michel congratulated Biden on his election and, in a 20-minute call on Monday evening, invited him to a special meeting in 2021 with EU heads in the bloc's hub Brussels, which is also home to NATO headquarters. "During the call President Michel proposed to rebuild a strong transatlantic alliance based on common interests and shared values," Michel's office said in a statement. (RTRS)

GEOPOLITICS: Russia is the dominant power in the Mediterranean Sea. Turkey is a rising one, and the West's "golden days" in the region are long gone, according to Italy's former military chief. "Russia is the pre-eminent naval power in the Mediterranean ... [and] it has earned this role in the field," admiral (retired) Luigi Binelli Mantelli, who was head of Italy's armed forces from 2013 to 2015, told EUobserver in an interview. Russian conventional firepower included two modern frigates, two submarines, and a destroyer, most of them with land-attack missile systems, permanently stationed in the western Mediterranean, he said. It was seeking a naval base in Libya and had an "advanced" one in Syria, he added. (EU Observer)

GERMANY: German Health Minister Jens Spahn told Redaktions Netzwerk Deutschland Monday he had asked the country's 16 regional states to establish coronavirus immunization centers by mid-December, assuming European authorities approved a first vaccine. "I'd rather have a ready-to-go immunization center that remains inactive for several days than a licensed vaccine that cannot be administered," the minister said, reiterating that vulnerable persons, such as the elderly, would be treated first. Germany has secured more than 300 million vaccine doses via the European Commission under bilateral contracts and options, Spahn estimated. "Even with two doses per immunization [of an individual] we would have enough for [Germany's] own population and could share with other countries," Spahn forecast. (Deutsche Welle)

FRANCE: France's National Assembly is set to approve a new security law on Tuesday designed to strengthen the powers of the police and restrict the way in which images identifying individual police officers can be used online, on air and in print. The "general security" law is the latest of several government edicts and pieces of legislation aimed at tackling crime and terrorism and introduced by President Emmanuel Macron in recent months. French journalists and editors as well as leftwing and liberal politicians have been particularly incensed by Article 24 of the law, which will make it a crime punishable by a year in prison and a €45,000 fine to "publish, by any means and in any medium, the face or any other identifying feature" of a police officer or gendarme "with the aim of causing them physical or psychological harm". (FT)

FRANCE: France reported 4,452 new Covid-19 infections on Monday, the lowest daily tally since 28 September, suggesting a second national lockdown is having an impact. The lockdown, in place from 30 October and less stringent than the first one that ran from 17 March to 11 May, has also helped lower hospitalisations, on a downward path again after peaking at 33,497 a week ago. President Emmanuel Macron will give a speech to the nation on Tuesday when he may announce a relaxation of lockdown rules. (Guardian)

FRANCE: Former French President Nicolas Sarkozy's trial on charges of corruption and influence peddling started Monday, but was immediately postponed to Thursday following a request from one of his co-defendants for health reasons. Sarkozy appeared at the Paris criminal court for the start of what is known as the "Wiretapping" affair, one of several criminal investigations involving the former president since he lost the presidency in 2012 — and with it, presidential immunity. He is accused alongside his personal lawyer Thierry Herzog and former judge Gilbert Azibert, whom Sarkozy is accused of attempting to bribe in exchange for favors at the Court of Cassation, the highest French court. The charges can warrant up to 10 years in prison. (Politico)

ITALY: The Italian government expects the budget deficit to stand at 10.4% of gross domestic product at the end of the year, according to a report seen by Bloomberg News. Prime Minister Giuseppe Conte and Finance Minster Roberto Gualtieri reported the figure to parliament as they presented budget plans designed to shield the fragile economy from a resurgence of the coronavirus. They underlined the uncertainty around forecasts for the year. Conte and Gualtieri wrote that new lockdown measures mean that in the fourth quarter, "there is a high probability of a new contraction of economic activity, though decidedly less than what was registered between the first and second quarters of this year." (BBG)

ITALY: Italy reports 630 Covid-linked deaths, bringing its overall toll to above 50,000. It becomes the sixth nation in the world to surpass 50,000 deaths, and the second in Europe after Britain. (Guardian)

SPAIN: Spain is unlikely to make vaccination against the coronavirus compulsory, at least initially, health ministry sources said on Monday. Under Spanish law, vaccination is voluntary, although in some cases, such as an epidemic, the government could make it compulsory. "There are instruments to make it so. But it is not the plan at the moment," one source said, while another said all vaccination was likely to remain optional. (Guardian)

U.S.

FED: MNI POLICY: Fed May Hold Rates to 2024, Need Fiscal Help-Evans

- The Federal Reserve could extend the duration of the assets it purchases to support the economy, adding it would be better for fiscal policy to "go big" with the central bank potentially holding near-zero interest rates into 2024, Chicago President Charles Evans said Monday - for more details please contact sales@marketnews.com.

FED: MNI POLICY: Fed's Barkin Sees Challenging Next Few Months

- Federal Reserve Bank of Richmond President Tom Barkin said Monday the "next few months can be challenging" for the economic recovery despite promising vaccines against Covid-19 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

POLITICS: The General Services Administration acknowledged Joe Biden as the apparent winner of the presidential election on Monday, following weeks of inaction, and President Donald Trump called on his agencies to cooperate. "I am recommending that Emily and her team do what needs to be done with regard to initial protocols, and have told my team to do the same," Trump said of Emily Murphy, the General Services Administration chief. Still, he said he would continue to contest the outcome of the election. The designation triggers a formal transition process, giving Biden and his team access to current agency officials, briefing books and other government resources, including some $6 million in funding. The letter was sent after nine Republican senators had called for the transition process to begin, and hours after Michigan's Board of State Canvassers had voted to certify the election's results, practically ensuring Biden's victory in the key battleground state. "Because of recent developments involving legal challenges and certifications of election results, I have determined that you may access the post-election resources and services described in Section 3 of the Act upon request," Murphy said in a letter to Biden, citing the Presidential Transition Act of 1963. (BBG)

POLITICS: White House Chief of Staff Mark Meadows, in memo to staff seen by Bloomberg, says administration will "comply with all actions needed to ensure the smooth transfer of power." "Unless specifically authorized, EOP personnel are not permitted to speak directly with a member of the Biden Transition Team or the Federal Transition Coordinator," Meadows says. "Our work here is not finished," Meadows says; adding "I am confident that each of you will represent and preserve the Executive Office of the President as we continue on". (BBG)

POLITICS: U.S. President Donald Trump tweeted the following on Monday: "I want to thank Emily Murphy at GSA for her steadfast dedication and loyalty to our Country. She has been harassed, threatened, and abused – and I do not want to see this happen to her, her family, or employees of GSA. Our case STRONGLY continues, we will keep up the good fight, and I believe we will prevail! Nevertheless, in the best interest of our Country, I am recommending that Emily and her team do what needs to be done with regard to initial protocols, and have told my team to do the same."

POLITICS: U.S. President Donald Trump tweeted the following on Monday: "What does GSA being allowed to preliminarily work with the Dems have to do with continuing to pursue our various cases on what will go down as the most corrupt election in American political history? We are moving full speed ahead. Will never concede to fake ballots & "Dominion"."

POLITICS: President-elect Joe Biden has chosen former Federal Reserve Chair Janet Yellen to serve as treasury secretary, a pivotal role in which she would help shape and direct his economic policies, according to a person familiar with the transition plans. Yellen, who is widely admired in the financial world, would be the first woman to lead the Treasury Department in a line stretching back to Alexander Hamilton in 1789. Her nomination was confirmed to The Associated Press by a person who spoke on condition of anonymity to discuss Biden's plans. (AP)

POLITICS: U.S. President-elect Joe Biden will nominate Alejandro Mayorkas to become U.S. secretary of homeland security, Biden's transition team said on Monday, entrusting the Cuban immigrant to help reverse outgoing President Donald Trump's hard-line immigration policies. Mayorkas, a former federal prosecutor in California, served as deputy secretary at the U.S. Department of Homeland Security (DHS) under President Barack Obama when Biden was vice president. Mayorkas became one of Biden's first Cabinet selections as the Democratic former vice president prepares to take office on Jan. 20. (RTRS)

POLITICS: U.S. President-elect Joe Biden will name former Secretary of State John Kerry as special climate envoy, his transition team said on Monday, a sign that Biden views diplomatic skills as vital to the job. (RTRS)

POLITICS: The Michigan Board of State Canvassers on Monday voted to certify the results of the Nov. 3 U.S. presidential election that showed Democrat Joe Biden winning the state. (RTRS)

POLITICS: Sen. Kelly Loeffler's (R-Ga.) campaign announced Monday that she "looks forward to getting back out on the campaign trail" after testing negative for COVID-19 for a second time, following earlier conflicting results. (Axios)

POLITICS: More prominent Republicans on Monday joined the call for President Donald Trump to end efforts to overturn his election defeat and allow President-elect Joe Biden to begin the formal transition to a new administration. Twenty days after Election Day, most members of Trump's party still refused on Monday to refer to Biden as president-elect, or to question Trump's insistence - without evidence - that he had only lost on Nov. 3 because of fraud. Republican Senator Rob Portman - co-chairman of Trump's campaign in Ohio who rarely breaks with party leaders - said there was no evidence of widespread election fraud and called for the transition to begin. "It is now time to expeditiously resolve any outstanding questions and move forward," Portman wrote in a Cincinnati Enquirer opinion column on Monday. However, Portman did not refer to Biden as "president-elect" and referred to his becoming the next president as a "likely event." Senator Lisa Murkowski - a Republican who charts a more independent course and has acknowledged Biden's victory - late on Sunday said it was time to start the full transition process. She denounced efforts by some Trump supporters to overturn election results in some states as "not only unprecedented but inconsistent with our democratic process." (RTRS)

CORONAVIRUS: California and Texas reported increases in cases on Monday that pulled back from record jumps in infections over the weekend, while Florida reported its biggest one-day jump in deaths in more than a month. The US states, which rank first, second and third by population — and coronavirus cases since the start of the pandemic — have begun to exhibit some of the worrying metrics they displayed during the summer, when they led a surge in cases throughout the sunbelt. (FT)

OTHER

GLOBAL TRADE: China is projected to once again to become the top U.S. agricultural export market this fiscal year -- but it could still fall short of meeting its lofty trade commitments to the Trump administration. The Asian nation is expected to buy a record $27 billion worth of farm-related goods from the U.S. in the 12 months ending Sept. 30, the Department of Agriculture said in a report Monday. That's $8.5 billion more than the agency projected in August, and would make China the biggest American agricultural market for the first time since fiscal 2017, before the trade war. The USDA outlook puts China closer to fulfilling its promise to buy $43.5 billion in U.S. agricultural goods in calendar year 2021, part of Beijing's phase-one trade deal with the Trump administration. But the new estimate still suggests that meeting the target would be an uphill climb as it will require large purchases in the last three months of next year. (BBG)

CORONAVIRUS: Tal Zaks, chief medical officer of Moderna, tells "Axios on HBO" that a COVID-19 vaccine could be available for children by the middle of next year. (Axios)

CORONAVIRUS: The leader of the U.S. government's coronavirus vaccine program said AstraZeneca Plc found that 16 participants who received a placebo in its clinical trial contracted severe Covid-19, a sign that the shot could block the worst cases of disease. The British drugmaker and its partner, the University of Oxford, said earlier Monday that none of the trial participants who received the vaccine had become severely ill, and that none of the patients in that group were hospitalized. "That's very important," said Moncef Slaoui, chief scientific adviser to Operation Warp Speed, in an interview with Bloomberg News. "It's exciting." Slaoui revealed the placebo-arm data after Astra and Oxford said their vaccine prevented 70% of people from getting Covid-19 in large trials in the U.K and Brazil. However, many observers were confused by findings showing the shot was 62% effective when given in two full doses, but 90% effective when patients were given half a dose, followed later by a full dose. "We need to understand exactly why there are those differences and hopefully identify means by which we could make all the vaccine perform at 90% efficiency," said Slaoui, an expert in immunology and former head of GlaxoSmithKline Plc's vaccines division. While the differences could be related to a chance event, he said, "the big message is overall reasonable efficacy." (BBG)

WHO: The World Health Organization (WHO) has had assurances from China that an international field trip to investigate the origins of the new coronavirus will be arranged as soon as possible, its top emergency expert said on Monday. Chinese researchers are carrying out epidemiological studies into early cases and conditions at a seafood market in the central Chinese city of Wuhan. An international team of experts has been formed to carry out phase 2 studies. (RTRS)

HONG KONG/UK: Britain is looking at withdrawing judges from Hong Kong's highest court after the territory's most prominent pro-democracy campaigner was detained and told he faces five years in jail. Dominic Raab, the foreign secretary, said he had begun consultations about "whether it continues to be appropriate" for British judges to sit on Hong Kong's Court of Final Appeal, following the imposition of a draconian new security law by Beijing in June. Carrie Lam, the pro-Beijing chief executive of Hong Kong, can appoint judges to hear cases brought under the new law. These cases can also be transferred to the Chinese mainland where the court system is politicised. (Times)

HONG KONG: Hong Kong plans further measures to tighten social distancing rules, while Japan is moving toward actions to contain the virus from spreading rapidly.

BOJ: Bank of Japan Governor Haruhiko Kuroda says ensuring Japan's finances are sustainable isimportant over the longer term and will be a key topic to be discussed after the pandemic is over. Large-scale fiscal spending is only natural to support the economy during the pandemic, Kuroda says in response to questions by a lawmaker in parliament. Fiscal policy should be conducted in a flexible manner and spending on virus response measures won'thurt Japan's credibility in financial markets. (BBG)

JAPAN: Japan's government and ruling parties are planning a third extra budget for fiscal 2020 that will exceed 20t yen, Sankei reports, without attribution. (BBG)

JAPAN: As Japan returned to work Tuesday following a holiday weekend, regional and national authorities moved toward boosting restrictions designed to contain the spread of a coronavirus surge. A campaign to spur domestic travel, which some have blamed for spreading infections, will be partly suspended. The metropolitan region of Osaka, where cases have spiked, may ask bars and restaurants to close early, while Tokyo was reported to be making plans for similar steps. The country posted a total of 1,520 cases on Monday, the first time in six days that infections fell below 2,000 cases, though that figure was likely lower due to slower testing during the holiday weekend. The "Go To Travel" subsidy program for those destined for Osaka and Sapporo is being suspended, according to public broadcaster NHK. The move comes after Prime Minister Yoshihide Suga said over the weekend that Japan would partly halt the campaign in areas where cases are increasing, without specifying the places affected. Tokyo Governor Yuriko Koike will meet with Suga later on Tuesday to discuss the program in Tokyo, NHK reported. (BBG)

RBA: MNI POLICY: AUD Weakened On Cut, QE Expectations: RBA Debelle

- The 5% depreciation in the value of the Australian dollar in the two months since mid-September was due to expectations of easier monetary policy in November, according to Reserve Bank of Australia Deputy Governor Guy Debelle - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA/CHINA: Australian Prime Minister Scott Morrison has warned that intensifying competition between the U.S. and China is pressuring other nations to choose sides, and urged the superpowers to give governments "more room to move." Morrison, who has long tried to balance Australia's close trading ties with China and enduring security alliance with the U.S., said the ongoing rivalry had created challenges for Indo-Pacific nations that could spread further west. "Like other sovereign nations in the Indo-Pacific, our preference in Australia is not to be forced into any binary choices," Morrison said in a speech to a U.K.-based think tank on Monday night. "Our present challenge in the Indo-Pacific though is a foretaste for so many others around the world, including the United Kingdom and Europe." (BBG)

AUSTRALIA: Iron ore exports reached a record high of $10.9 billion, accounting for 36 per cent of Australia's total exports, according to figures released today by the Australian Bureau of Statistics (ABS). Total exports increased by $1.8 billion, or 6 per cent, to $30.5 billion in October 2020. "The primary driver for the increase in exports was an $833 million (7 per cent) increase in exports of metalliferous ores, most of which was iron ore headed for our largest trading partner, China," said ABS Head of International Statistics, Branko Vitas. (ABS)

RBNZ: New Zealand's government has proposed adding house prices to the central bank's remit as the property market threatens to overheat amid record-low interest rates. Finance Minister Grant Robertson has written to Reserve Bank Governor Adrian Orr, asking him to consider amending the bank's remit to include stability in house prices as a factor for monetary policy. "With an extended period of low interest rates, and some time before housing supply can catch up with demand, now is the time to consider how the Reserve Bank may contribute to a stable housing market," Robertson said Tuesday in Wellington. "I want to be clear I am not proposing any changes to the mandate or the independence of the Reserve Bank." In a letter to Orr released today, Robertson said the alternative policy tools the RBNZ is using were not envisaged when its remit was first published in 2019. "I believe it is right that we consider how these tools might be impacting on the housing market, with particular regard to housing price inflation," Robertson wrote. Specifically, he proposes adding house prices to a clause in the remit so that it asks the RBNZ's Monetary Policy Committee to: "Seek to avoid unnecessary instability in output, interest rates, the exchange rate, and house prices." "I would welcome your views on any alternative proposals with regard to the Reserve Bank's monetary and financial policy that would help address our concerns," Robertson wrote. "This includes your views on any other changes that the bank could make to support the aim of achieving the sustained moderation in house prices that we have both sought." He said the government is planning to make any changes, if agreed, soon, "and so I would request that you gave it your earliest possible consideration." (BBG)

RBNZ: Reserve Bank of New Zealand Governor Adrian Orr writes letter to Finance Minister Grant Robertson in response to a proposal to include house prices in the RBNZ's remit. "We welcome the opportunity to contribute to your work program aimed at improving housing affordability. As I've said publicly on many occasions, monetary and financial regulatory policy alone cannot address this challenge". "There are many long-term, structural issues at play". Acknowledges Robertson not proposing changes to RBNZ mandate and "your ongoing commitment to the operational independence provided by the Act for specific monetary policy decisions. "Will consider how Monetary Policy Committee could further take into account house prices when formulating monetary policy and respond with considered feedback in due course. "I can assure you that the MPC, in making its decisions, gives consideration to the potential impact ofmonetary policy on asset prices". (BBG)

BOC: MNI POLICY: BOC Says Financial System Resilient So Far

- Bank of Canada Deputy Governor Toni Gravelle said Monday the financial system has been resilient to pandemic-related strains but dangers are likely to mount as the drag on incomes and employment persists - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

CANADA: MNI BRIEF: Canada Pledges Inclusive Economic Update Nov. 30

- Canadian Finance Minister Chrystia Freeland said Monday the government will present a "fall economic statement" on Nov. 30, signaling it will press ahead with record deficit spending on relief through the pandemic - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

TAIWAN: The next two months will test the Chinese government's patience and composure to the extreme with the outgoing administration in the White House likely to provoke it at every opportunity, experts warned after Washington reportedly sent a navy admiral to Taiwan. Observers called for Beijing to exercise caution to keep China-US relations stable following the undercover visit reported to have been made by Rear Admiral Michael Studeman, director of intelligence in the Indo-Pacific Command. (SCMP)

ISRAEL: Israeli Prime Minister Benjamin Netanyahu traveled in secret Sunday to the city of Neom on Saudi Arabia's Red Sea coast for a meeting with Crown Prince Mohammed Bin Salman and Secretary of State Mike Pompeo, Israeli sources told me. The latest: Saudi Foreign Minister Faisal bin Farhan on Monday denied the meeting took place — a signal that the Saudis may be unhappy with the leak or are at least trying to publicly distance themselves from the meeting. Netanyahu, on the other hand, has not denied the story. (Axios)

NIGERIA: Nigeria will bar air passengers who fail to follow the country's Covid-19 protocol from flying for six months, an official said on Monday. Passengers returning to Nigeria are currently required to test for coronavirus both before they board return flights and seven days after they arrive. They also must pay for the tests in advance. (Guardian)

OIL: Yemen's Houthi rebels said they struck a Saudi oil facility in the port city of Jiddah on Monday with a new cruise missile, just hours after the kingdom finished hosting its virtual Group of 20 leaders summit. An unnamed official at the kingdom's Ministry of Energy acknowledged the attack in a statement carried by the official Saudi Press Agency late Monday. It came after videos of a small explosion at a Saudi Arabian Oil Co. facility in Jiddah circulated on social media all day. A projectile struck a fuel tank at the Jiddah distribution station and ignited a fire, the official said. Col. Turki al-Maliki, a spokesman for the Saudi-led coalition fighting the Iran-backed Houthis in Yemen, blamed the Yemeni rebels for what he called "a cowardly attack which not only targets the kingdom, but also targets the nerve center of the world's energy supply and the security of the global economy." (AP)

OIL: Iraq is seeking an upfront payment of about $2 billion in exchange for a long-term crude-supply contract, the latest sign of Baghdad's growing desperation for cash. The Middle Eastern country is grappling with an economic crisis caused by the combination of low oil prices andOPEC+ output cuts. As state coffers crumble and school teachers go unpaid, the country risks a repeat of theupheaval that brought down the government and saw hundreds of protesters killed last year.In a letter to oil companies seen by Bloomberg News, the Iraqi government sought to mitigate its dire financialposition by proposing a five-year supply contract delivering 4 million barrels a month, or about 130,000 barrels aday. The buyer would pay upfront for one year of supply, which at current prices would bring in just above $2billion, according to Bloomberg News calculations. (BBG)

CHINA

YUAN: The yuan's recent surge against the dollar shouldn't be considered excessive as its appreciation across multiple currencies is more representative of the strength of China's exports, the Economic Information Daily said. China needs to follow a more flexible exchange pricing system and allow for independent quotes from market participants. while also managing the risks brought by exchange rate movements, the Daily wrote. It said that China needed to attract more outside capital and increase the efficiency of cross-border resource allocations.China's recent corporate bond defaults should have a limited impact on the asset quality of banks, as these bonds account for only a small portion of banks' proprietary bond investments which are mainly issued by the government and policy lenders, the PBOC-run newspaper Financial News reported on Tuesday citing analysts. Corporate bonds on banks' balance sheets amount to about CNY6 trillion, about 3% of their total bond investments, and those off-balance sheet bonds are worth about CNY10 trillion, the newspaper said citing calculations by Zhongtai Securities. (MNI)

YUAN: The impact of a stronger yuan on exporters may be lowered through changing settlement currencies with purchasers and increasing the efficiency of upstream supply chains, Peng Bo, a researcher at the Chinese Academy of International Trade and Economic Cooperation, wrote in a commentary for the 21st Business Herald. The yuan's current round of gains is due to inelastic demand for essential goods exported from China as the pandemic halted production in other countries, wrote Peng. The cycle will likely end with the development and distribution of future COVID-19 vaccines, he said. (MNI)

OVERNIGHT DATA

JAPAN OCT NATIONWIDE DEPT STORE SALES -1.7% Y/Y; SEP -33.6%

JAPAN OCT TOKYO DEPT STORE SALES -4.2% Y/Y; SEP -35.0%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 104.5; PREV. 106.6

Consumer confidence broke its record 11 week winning streak and slipped 2% as South Australia went into a short and sharp lockdown. The nationwide index remains above the neutral level, but South Australia's index dropped below the 100 level. New South Wales and Queensland gave up some recent gains, while Victoria saw a very modest decline. With South Australia reopening earlier than expected and restrictions in Victoria and New South Wales relaxed the impact on sentiment may be short-lived. (ANZ)

SOUTH KOREA Q3 HOUSEHOLD CREDIT KRW1,682.1TN; Q2 KRW1,637.3TN

CHINA MARKETS

PBOC NET INJECTS CNY20BN VIA OMOS TUES

The People's Bank of China (PBOC) conducted CNY70 billion via 7-day reverse repos with rates unchanged at 2.2% on Tuesday. This resulted in a net injection of CNY20 billion given the maturity of CNY50 billion repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:16 am local time from the close of 2.1508% on Monday.

- The CFETS-NEX money-market sentiment index closed at 40 on Monday vs 35 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5809 TUES VS 6.5719

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5809 on Tuesday, compared with the 6.5719 set on Monday.

MARKETS

SNAPSHOT: Transition Begins

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 621.07 points at 26149.35

- ASX 200 up 82.516 points at 6644.1

- Shanghai Comp. down 5.121 points at 3409.369

- JGB 10-Yr future down 12 ticks at 152.1, yield up 0.9bp at 0.021%

- Aussie 10-Yr future down 4.5 ticks at 99.11, yield up 4.5bp at 0.891%

- U.S. 10-Yr future -0-01 at 138-09, yield up 0.98bp at 0.864%

- WTI crude up $0.45 at $43.51, Gold down $13.7 at $1824.27

- USD/JPY down 8 pips at Y104.43

- GSA DESIGNATES BIDEN "APPARENT WINNER", TRIGGERS TRANSITION PROCESS

- BIDEN PICKS EX-FED CHAIR YELLEN TO BECOME NEXT TREASURY SECRETARY

- FED'S EVANS: FED MAY HOLD RATES TO 2024, NEED FISCAL HELP (MNI)

- FED'S BARKIN SEES CHALLENGING NEXT FEW MONTHS (MNI)

- UK SAID TO WEIGH HUAWEI INSTALLATION BAN IN 2021 (BBG)

- NZ GOVERNMENT PROPOSES ADDING HOUSE PRICES TO RBNZ REMIT (BBG)

BOND SUMMARY: Core FI Come Under Pressure As Trump Administration Agrees To Begin Transition

T-Notes extended Monday losses after U.S. General Services Administration recognised Joe Biden as the "apparent winner" of the presidential election and gave a green light for starting the formal transition process. The news provided further support to broader risk appetite, on top of yesterday's positive Covid-19 vaccine headlines & Biden's decision to pick ex-Fed Chair Yellen to become Tsy Sec in his administration. When this is being typed, T-Notes trade -0-01+ at 138-08+. The contract slipped as news wires circulated the GSA's decision and established itself sougth of yesterday's worst levels. Cash Tsy curve has bear steepened a tad. Eurodollar futures trade unch. to +0.5. Focus in the U.S. turns to local Conf. Board Cons. Conf. & 7-Year debt supply.

- Japanese markets re-opened after a holiday, digesting the net positive news flow from over the long weekend. JGB futures re-opened lower and slid further, pressured by the aforementioned news on White House transition. The contract last changes hands at 152.10, 12 ticks shy of last settlement. Cash JGB yield curve underwent a degree of steepening. There was little of note in the latest address from BoJ Gov Kuroda, while local news flow revolved around Japan's coronavirus situation and its fiscal ramifications, with a Sankei report suggesting that the gov't might adopt a third extra budget exceeding Y20tn. Elsewhere, the BoJ left the sizes of its 1-10 Year JGB purchases unchanged.

- Aussie bonds shrugged off a speech from RBA Dep Gov Debelle on "Monetary Policy in 2020", which added little fresh to the recent RBA speak. YM -0.5 & XM -4.5, the latter steadied after slipping in reaction to the aforementioned transition headlines. Cash ACGB curve has bear steepened, with yields sitting 0.1-5.1bp cheaper. Bills trade unch. to -2 ticks through the reds. The AOFM auctioned A$150mn worth of 20 Sep '25 I/L Bonds, while Australia's preliminary trade data for the month of Oct revealed an increase in exports, driven by record shipments of iron ore.

JGBS AUCTION: Japanese MOF sells Y3.1688tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.1688tn 6-Month Bills:- Average Yield -0.1027% (prev. -0.1128%)

- Average Price 100.051 (prev. 100.056)

- High Yield: -0.0987% (prev. -0.1068%)

- Low Price 100.049 (prev. 100.053)

- % Allotted At High Yield: 83.6926% (prev. 44.6363%)

- Bid/Cover: 3.297x (prev. 3.517x)

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.34tn of JGB's from the market, sizes unchanged from previous operations.- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

AUSSIE BONDS: The AOFM sells A$150mn of the 3.00% 20 September 2025 I/L Bond, issue #CAIN407:

The Australian Office of Financial Management (AOFM) sells A$150mn of the 3.00% 20 September 2025 I/L Bond, issue #CAIN407:- Average Yield: -0.9733% (prev. -0.2597%)

- High Yield: -0.9700% (prev. -0.2500%)

- Bid/Cover: 5.7533x (prev. 2.8933x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 96.2% (prev. 45.5%)

- bidders 51 (prev. 28), successful 11 (prev. 13), allocated in full 8 (prev. 10)

FOREX: Risk Buoyant As White House Transition Gets Underway, NZD Aided By Proposal To Amend RBNZ Remit

U.S. politics took centre stage, after the General Services Administration recognised Joe Biden as the "apparent winner" of the presidential election, triggering a formal transition process. Outgoing Pres Trump suggested that he will continue his legal fight, but said he instructed his team to cooperate, with subsequent reports pointing to various gov't agencies preparing for the transfer of power. The news bolstered risk appetite, building on yesterday's positive Covid-19 vaccine news & U.S. Pres-elect Biden's decision to nominate ex-Fed Chair Yellen to become the next U.S. Tsy Sec. Risk-on flows swept across G10 FX space, putting a bid into high-beta currencies.

- NZD comfortably outperformed its G10 peers, as existing risk-on pressure was amplified by the unwinding of RBNZ easing bets in reaction to NZ FinMin Robertson's proposal to add house prices to the RBNZ's remit. In a letter to RBNZ Gov Orr, Robertson asked the central bank to urgently consider the idea amid "the recent escalation in housing prices, and forecasts for this to continue". RBNZ Gov Orr replied that the MPC already takes asset prices into consideration, but monetary and financial policy alone cannot fix structural problems with the housing market, adding that he will respond with a broader feedback in due course.

- Greenback weakness helped NZD/USD punch through key resistance from Dec 4, 2018 high of $0.6970 and briefly approach the $0.7000 mark. AUD/NZD tested the water under key near-term support from Apr 21 low of NZ$1.0484.

- AUD looked through a speech from RBA Dep Gov Debelle, who said that the central bank's expected policy easing delivered this month helped lower the exchange rate.

- BoJ Gov Kuroda offered little in the way of fresh insights in his latest parliamentary testimony. JPY sat at the bottom of the G10 pile as Japan returned from holidays.

- German Ifo Survey & final GDP, U.S. Conf. Board Consumer Confidence take focus today, with speeches due from Fed's Bullard, Williams & Clarida, ECB's Lagarde, Lane & de Cos, BoE's Haskel & BoC's Wilkins.

FOREX OPTIONS: Expiries for Nov24 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E419mln-EUR puts)

- USD/JPY: Y102.00($996mln-USD puts), Y105.00($1.5bln)

- EUR/GBP: Gbp0.8800(E510mln-EUR puts)

- USD/CAD: C$1.3170-80($523mln)

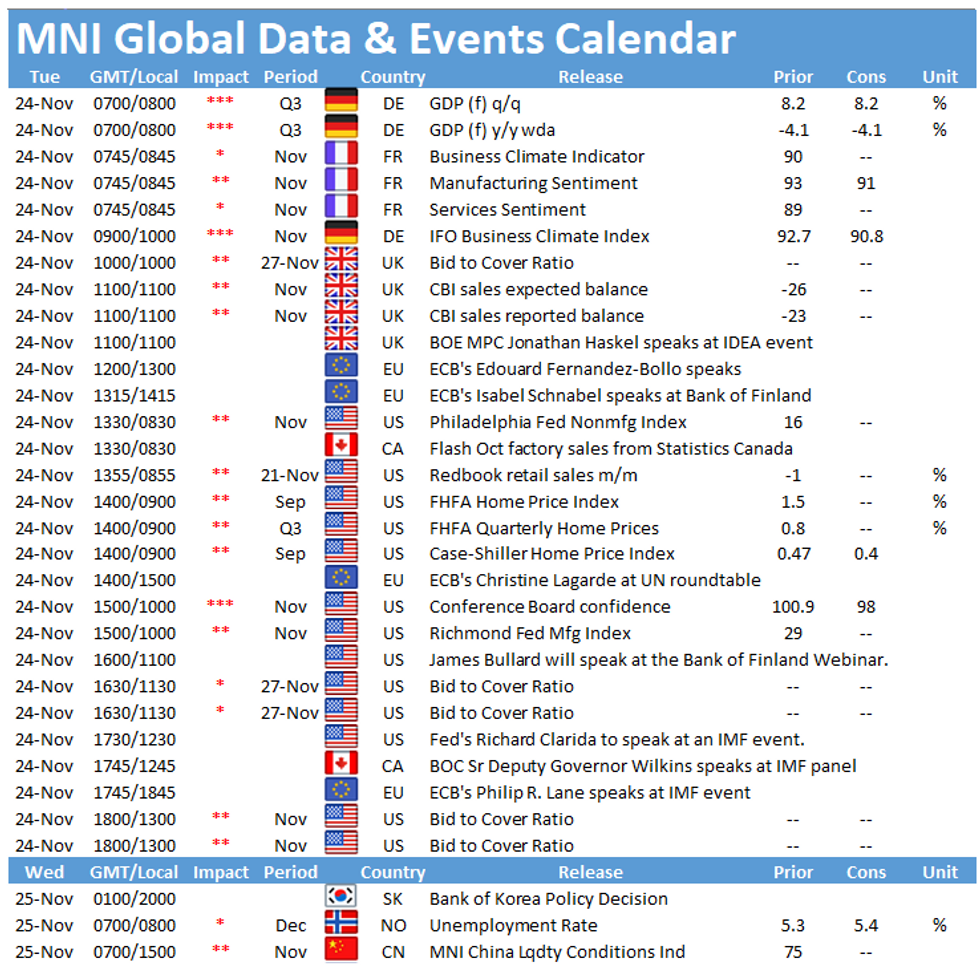

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.