-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Risk-On Feel Moderates

OVERNIGHT NEWS AND DATA

EXECUTIVE SUMMARY

- YELLEN RAISES HOPE FOR STRONGER FED BACKSTOPS (MNI)

- MNUCHIN PLANS TO PUT $455BN BEYOND YELLEN'S EASY REACH (BBG)

- CHINA'S PREMIER LI: GROWTH TO RETURN TO "PROPER RANGE" IN 2021, CHINA WON'T PURSUE TRADE SURPLUS

- ECB SIGNALS LIFTING OF BAN ON BANK DIVIDENDS NEXT YEAR (FT)

- UK CLL'R SUNAK TO UNVEIL GBP4.3BN SUPPORT TO HELP THE UNEMPLOYED

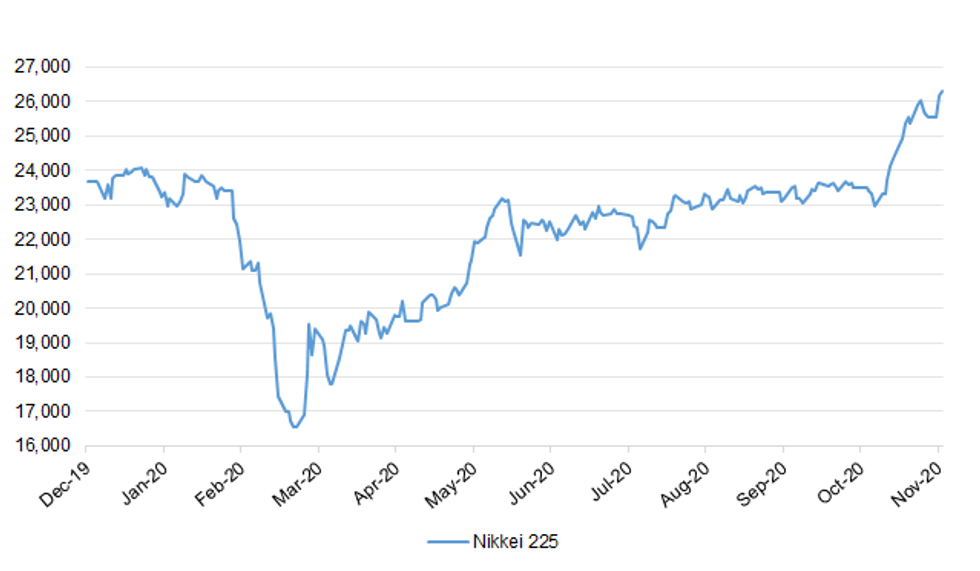

Fig. 1: Nikkei 225

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: MNI INTERVIEW: UK To Avoid Fiscal Rules In Spending Review

- The UK Treasury will avoid producing new fiscal rules to accompany a year-long spending review to be announced Wednesday, James Smith, Research Director at leading think tank the Resolution Foundation, told MNI - for more details please contact sales@marketnews.com.

FISCAL: Rishi Sunak is to acknowledge the Covid-19 pandemic will lead to a steep rise in long-term unemployment when he announces a £4.3 billion package to help the jobless. The economic devastation wrought by the virus is laid bare in a series of forecasts published alongside the Whitehall spending round tomorrow. They include an estimate of the consequences of a no-deal Brexit by the Office for Budget Responsibility (OBR). The Resolution Foundation, a think tank, has suggested the central forecast will show a permanent hit of 3 per cent to the UK's GDP, equivalent to £1,000 per person. (Times)

FISCAL: The U.K.'s Treasury should tie future updates on tax policy to annual events like the release of a budget, the committee chair overseeing tax policy said Tuesday. "I am concerned that this year the government is instead staggering tax policy announcements across the year instead of including them in the next available fiscal event," Mel Stride, chair of the Treasury Select Committee, said to Financial Secretary to the Treasury Jesse Norman in a letter. (BBG)

ECONOMY: The government has privately admitted the UK faces an increased likelihood of "systemic economic crisis" as it completes its exit from the European Union in the middle of a second wave of the coronavirus pandemic. A confidential Cabinet Office briefing seen by the Guardian also warns of a "notable risk" that in coming months the country could face a perfect storm of simultaneous disasters, including the prospect of a bad flu season on top of the medical strains caused by Covid. "Winter 2020 could see a combination of severe flooding, pandemic influenza, a novel emerging infectious disease and coordinated industrial action, against a backdrop of the end of the [Brexit] transition period," it warns. (Guardian)

CORONAVIRUS: Conservative WhatsApp groups have been lighting up with "fury" and "anger" over the post-lockdown plan, according to one senior Tory who said: "The idea seems to be to move everybody up, Tier 2 becomes a shady Tier 3, Tier 3 is lockdown. Tier 1 is all but abolished. "There's fury and anger at Boris Johnson on the backbenches about this. He doesn't seem to care about the economic impact all of this is having. There's going to be a major revolt." London MPs are pushing for the capital to be placed into Tier 1 because of the city's economic significance but this risks angering Conservatives in "Red Wall" seats facing an "inevitable" return to Tier 2 and 3. (Telegraph)

CORONAVIRUS: Families will be allowed to meet two other households in a "Christmas bubble" under a five-day festive relaxation of social distancing rules. People will be able to travel freely around the UK between December 23 and 27 to hug relatives indoors under a temporary Christmas exemption from lockdown restrictions agreed between central government and devolved administrations. Social distancing rules will not apply within bubbles, but official advice will urge people to "think carefully about what they do during this period", suggesting people take extra precautions to avoid infecting vulnerable relatives. (Times)

CORONAVIRUS: Business travellers and tour groups will be able to avoid quarantine under government plans to reopen England's borders. A cross-government plan published today said that people arriving into the country on business should be exempt from the requirement to self-isolate for up to a fortnight. The exemption, likely to be introduced in early 2021, would probably last for three days, although business travellers would be banned from "socialising or any other non-business-related activity". (Times)

CORONAVIRUS: England will return to a tiered system of coronavirus restrictions when the national lockdown ends on December 2. While for some this will mean greater freedoms than they have enjoyed in the past, more areas will face tougher restrictions than under the previous tier regime. The Government will announce on Thursday which areas will be in Tiers 1, 2 and 3, but has already briefly outlined the factors that will influence its decisions. Case rates and surges, particularly among the over-60s, as well as pressures on the testing and health systems will all be taken into account by Number 10, which has declined to give any estimate of the thresholds. Documents released by the Cabinet Office, however, reveal that "broader economic and practical considerations" will also play a part. (Telegraph)

CORONAVIRUS: London is set to be placed under Tier 2 restrictions after the national lockdown ends next week, Sadiq Khan has said. The mayor said placing the capital back in Tier 2 would be the "right and sensible decision", but added the final verdict would be made on Thursday based on the latest Covid-19 figures. (City am)

CORONAVIRUS: Matt Hancock overruled officials in insisting that the UK ordered an extra 70 million Oxford AstraZeneca Covid vaccines, the Transport Secretary has said. Regulators are about to start their assessment of the vaccine, developed with the University of Oxford, amid hopes that a roll-out programme could begin next month. The UK has ordered 100 million doses of the vaccine, which are set to stretch even further after a half-dose for the first jab was found to be even more effective then the full amount. AstraZeneca has said 20 million doses should be available by the end of this year. On Tuesday, it emerged that Mr Hancock, the Health Secretary, persuaded Government officials to buy far more stocks of the AstraZeneca jab than had been intended. (Teleraph)

POLITICS: Chancellor Rishi Sunak will on Wednesday attempt to quell a rebellion by Conservative MPs over his plan to cut billions of pounds from Britain's overseas aid budget by claiming the move will only be "temporary". He will say that the government's "goal" remains to spend 0.7 per cent of UK gross domestic product on overseas aid — a target currently enshrined in law — and that it will be met when economic circumstances allow. Mr Sunak will use his spending review to announce proposals to cut the aid budget of about £13bn a year because of the coronavirus crisis: a reduction to 0.5 per cent of GDP would save about £4bn a year. But Tory MPs are mobilising to oppose the cut, which would breach a commitment in the Conservative party's 2019 election manifesto. MPs fear that once Britain breaks the legal lock on spending 0.7 per cent of GDP on overseas aid, it will not be restored. (FT)

BREXIT: SIR Keir Starmer will order Labour MPs to back a Brexit deal to try to win back the North, his allies claim. Shadow Cabinet sources say the party will support "almost any trade deal" that PM Boris Johnson forges with Brussels. They hope that doing so will "put the issue to bed for good" and win back the trust of "Red Wall" voters lost to the Tories in last year's election. Strategists also say Labour's support will give the PM wiggle room to compromise and still have the votes to get an agreement through the Commons even with objections from those in his own party. (Sun)

BREXIT: Companies and regulators are making last-minute arrangements to avoid disruption when the UK leaves the EU's single market next month, with Paris snagging a new trading hub for Goldman Sachs and a dual listing for FTSE 100 stalwart Segro. The US investment bank said on Tuesday it would set up a hub in the French capital for Sigma X, its private European marketplace for trading shares. On the same day, Segro dual-listed its entire share capital on Euronext Paris to protect its holding structure after the end of the Brexit transition period on January 1. The UK real estate investment trust has €6.2bn of assets throughout the EU. (FT)BONDS:

BONDS: The biggest year ever for U.K. bond sales may top out just shy of half-a-trillion pounds, as the government pushes ahead with a borrowing spree to spend its way out of the coronavirus pandemic. Britain's Debt Management Office will announce on Wednesday almost 100 billion pounds ($133 billion) of extra issuance for the December-March period, taking the full fiscal-year amount to 482.8 billion pounds, according to the median estimate in a Bloomberg survey of 12 primary gilt dealers. That's more than twice the previous record set during the financial crisis. The borrowing target is seen shifting higher with Chancellor of the Exchequer Rishi Sunak set to announce a spending increase on public services. The nation's debt load has already climbed above 2 trillion pounds -- an amount bigger than the economy for the first time since the 1960s. (BBG)

EUROPE

ECB: Eurozone banks will be allowed to pay dividends again from next year if they convince supervisors that their balance sheets are strong enough to survive the economic and financial fallout from the coronavirus pandemic, a senior European Central Bank executive has said. The ECB ordered eurozone banks to stop all dividends and share buybacks to conserve €30bn of capital in March, shortly after the pandemic arrived in Europe. Since then, the sector has been lobbying hard for stronger banks to be allowed to resume capital distributions early next year. Yves Mersch, vice-chair of the ECB's supervisory board, told the Financial Times he was concerned that banks benefiting from a regulatory easing of capital requirements would pay out some of that capital to shareholders, but it would be difficult to maintain a dividend ban beyond the end of this year. He cited legal uncertainty over its enforceability and an expectation that other countries such as the UK and US will allow banks to restart payouts. The decision "would all depend on the conservatism of internal models in the banks, on conservatism in provisioning and a sound view of the capital trajectory of a bank", Mr Mersch said. (FT)

ECB: European Central Bank policy maker Pablo Hernandez de Cos urged euro-area bank executives to "continue being very prudent" on their dividend and compensation policies. Bank executives should remain prudent on dividends and compensation "until the current uncertainty subsides and the economic recovery strengthens -- regardless of what decisions are made about the continuation of the current recommendations in force at the European level," Hernandez de Cos said in an online forum. Hernandez de Cos, who is also the governor of the Bank of Spain, urged Spanish policy makers to improve the country's insolvency regime to make it more efficient. (BBG)

EU: Polish Prime Minister Mateusz Morawiecki will meet Hungarian counterpart Viktor Orban in Budapest on Thursday to discuss their veto of the European Union's budget and recovery fund, a Polish government spokesman said. Poland and Hungary have blocked the EU's 1.8 trillion euro (1.60 trillion pounds) plan to recover from the recession caused by the COVID-19 pandemic because the money is conditional on respecting the rule of law. The planned meeting between Morawiecki and Orban was announced on Twitter by Polish government spokesman Piotr Muller, who added that the main topic will be "ongoing budget negotiations in the European Union". The veto decision by Poland and Hungary, both beneficiaries of the recovery plan, is likely to delay hundreds of billions of euros in funds at a time when the 27-nation bloc is facing a second wave of COVID-19 and a double-dip recession. (RTRS)

EU/TURKEY: European Union foreign-policy chief Josep Borrell highlighted the possibility of tougher EU sanctions against Turkey over its activities in the eastern Mediterranean, saying the bloc's leaders will tackle the matter at a Dec. 10-11 meeting. "Certainly we are in a critical moment with our relationship with Turkey," Borrell told the European Parliament on Tuesday in Brussels. "The leaders will have to take a decision" if there will be more sanctions, he said. (BBG)

GERMANY: Spurred on by Chancellor Angela Merkel to come up with a "cohesive, collective answer," German state premiers have agreed on new coronavirus lockdown measures for December and probably January. They also include a mini-amnesty over the Christmas period, from December 23 to January 1, according to a draft proposal circulated on Tuesday. After being rebuffed last week in her bid to intensify some aspects of Germany's lockdown, Merkel put the onus back on regional leaders to come up with a concept on which they can all agree. They are set to present their finalized proposal to the chancellor on Wednesday. (Deutsche Welle)

GERMANY/FRANCE: German Defense Minister Annegret Kramp-Karrenbauer stressed her strong commitment to the Franco-German friendship on Tuesday, saying it had been "a somewhat unusual situation" when French President Emmanuel Macron criticized her for a pro-American op-ed. Kramp-Karrenbauer became embroiled in an unusual public spat with Macron last week after the latter, in an interview with Le Grand Continent, criticized her over an op-ed in POLITICO earlier this month in which she had argued that "Europe still needs America." The French president said that he "profoundly" disagreed with Kramp-Karrenbauer's position and described her argument as "a historical misinterpretation," claiming that German Chancellor Angela Merkel didn't agree with her minister either. Macron's words raised eyebrows because he called out a government minister from France's key EU partner and even suggested that Kramp-Karrenbauer went against the position of her own government leader. Speaking at the Berlin Foreign Policy Forum on Tuesday, Kramp-Karrenbauer said Macron's intervention had also been a surprise to her, especially given her close work with France in her prior role as the regional leader of Saarland on the French border. (Politico)

GERMANY/CHINA: Germany's carmakers cannot believe their good fortune. Chinese consumers have ridden to their rescue again, a decade after pulling them out of a hole following the financial crisis. "It's almost too good to be true," Ola Kallenius, chief executive of Daimler, said last month as he cheered a 23 per cent increase in sales in China in the third quarter. Prevented by coronavirus from taking an expensive foreign holiday, wealthy Chinese have been splashing out on luxury S-Class Mercedes cars instead. Robust Chinese demand has helped Germany's auto manufacturers and their suppliers to offset weaker European and US markets still afflicted by the pandemic. But it has also revived concerns that German industry is too dependent on China. And it has raised questions about whether Berlin will be willing to respond to growing pressure in the EU for a stronger line towards Beijing and to embrace a new transatlantic partnership on China under a Biden administration. (FT)

FRANCE: France will begin easing its Covid-19 lockdown this weekend so that by Christmas, shops, theatres and cinemas will re-open and people will be able to spend the holiday with the rest of their family, French President Emmanuel Macron said on Tuesday. In a televised address to the nation, Macron said the worst of the second wave of the pandemic in France was over, but that restaurants, cafes and bars would have to stay shut until January. French shops were authorised to reopen on Saturday, in time for the Christmas shopping period which is crucial for many retailers who have been lobbying hard for a return to business. In the 3-step path out of lockdown outlined by Macron, people will also be able to exercise outside for three hours a day from Saturday, though they will still need permits to leave the house. Indoor religious services will be allowed to resume, but the number of worshippers will be capped at 30 people. France aims to lift the nationwide lockdown on December 15 but Macron said that a 9pm-7am curfew would remain in place. Cinemas and theatres will also be allowed to reopen. The curfew will be relaxed on Christmas Eve and New Year's Eve and French people will be able to travel between regions – and without a permit – so they can spend Christmas with their families. French people should, however, avoid "pointless travel", he said. (France24)

FRANCE: A draft law that would make it a crime to circulate an image of a police officer in certain circumstances passed the first hurdle in France's parliament on Tuesday despite protests from rights activitsts and journalists. Opponents say the law - steered through parliament by tough-talking Interior Minister Gerald Darmanin - would hamper journalists' freedom to report on public events and make it harder to hold officers accountable if they use excessive force. Supporters say the planned law is designed to protect officers and their families from being trolled online and harassed or attacked when off duty. Under the plans, anyone convicted of circulating a police officer's image with the intention of seeing them harmed could be jailed for a year and fined 45,000 euros ($53,450). Despite the bill being proposed by two lawmakers from President Emmanuel Macron's centrist La République en Marche (LaRem) party, 10 LaRem members of parliament voted against it and 30 abstained. From LaRem ally MoDem, five MPs voted against it and 18 abstained. (France24)

ITALY: Italy on Tuesday reported the highest number of Covid-19 deaths in a single day since the end of March. A total of 853 people were reported to have died from the coronavirus over 24 hours by Italy's health ministry, the highest daily toll since March 28 and the worst day of the nation's second wave so far in terms of fatalities. However, other data showed signs that the severity of the second wave of the pandemic was moderating. (FT)

SPAIN: Spain lowered its target for net debt issuance again this year on better-than-expected tax revenues and early debt repayments to the central government by regional administrations, Spanish Economy Minister Nadia Calvino said. The government cut its 2020 guidance by 5 billion euros ($5.9 billion) to 110 billion euros, she said at an online forum. It's the second reduction to the target since the spring, when the government projected issuance of 130billion euros. (BBG)

SWEDEN: MNI INTERVIEW: Swedish Unemployment To Rise After Improvement

- Swedish unemployment is set to start rising again as new Covid restrictions hit sectors such as hotels and restaurants which had powered a recent labour market recovery, particularly among young workers, Sara Schanberg, an economist at the government's National Institute of Economic Research told MNI - for more details please contact sales@marketnews.com.

U.S.

- The looming appointment of ex-Federal Reserve Chair Janet Yellen to Treasury secretary raises the chances of a coordinated effort with the Fed to boost the economy even if Congress resists major new fiscal stimulus, ex-officials tell MNI - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Bullard Hopeful of Vaccine Boost To Economy

- St. Louis Fed President James Bullard told reporters Tuesday he's hopeful "there's light at the end of the tunnel" on the coronavirus crisis as progress mounts on vaccines - for more details please contact sales@marketnews.com.

FED: The Federal Reserve is well prepared to navigate the U.S. economy's challenging path to recover from the effects of the coronavirus pandemic, and the central bank can resume emergency lending efforts if it deems it necessary, Federal Reserve Bank of New York President John Williams said Tuesday. "We're still in a deep recession" with high unemployment and an economy far from full strength despite its recent dramatic rebound, Mr. Williams said during a virtual event held by The Wall Street Journal. However, Mr. Williams noted he feels positive about the future in light of news of vaccines for the Covid-19 illness, and said "We're going to see continued good growth next year. "Mr. Williams also said the Fed has the ability to help the economy recover further. "We have the tools that are most powerful, have the best cost-benefit kind of trade offs," he said, adding the central bank could nevertheless use some help from the rest of the government to support the recovery. "Fiscal policy is really the most powerful tool right now" for helping those hurt most by the crisis, Mr. Williams said. "That's the thing that would be most effective at getting through the next six months as we move, hopefully, to amuch stronger economic recovery." (WSJ)

FISCAL: Treasury Secretary Steven Mnuchin will put $455 billion in unspent Cares Act funding into an account that his presumed successor, former Federal Reserve Chair Janet Yellen, will need authorization from Congress to use. Mnuchin plans to place the money into the agency's General Fund, a Treasury Department spokesperson said Tuesday. Moving the funds, the bulk of which had gone to support Federal Reserve emergency-lending facilities, will make it virtually impossible for Yellen, if confirmed by the Senate as Treasury secretary, to deploy on her own. President-elect Joe Biden's transition team last week called Mnuchin's demand for the return of funds from the Fed "deeply irresponsible," and congressional Democrats also panned the move. Mnuchin has denied that he was attempting to limit Biden's options for reviving the economy. The Treasury's general fund can only be tapped with "authority based on congressionally issued legislation," according to the department's website. The move leaves just under $80 billion available in the Treasury's Exchange Stabilization Fund, a pot of money that can be used with some discretion by the Treasury chief. The money includes $429 billion that Mnuchin is clawing back from the Fed -- which backed some of the central bank's emergency lending facilities -- and $26 billion that Treasury received for direct loans to companies. Both initiatives were created under the sweeping Cares Act that was passed earlier this year as the coronavirus pandemic inflicted economic pain on the U.S. (BBG)

POLITICS: President-elect Joe Biden's nominee for Secretary of State Antony Blinken spoke Tuesday at an event introducing the incoming administration's top national security officials, where he told the story of his stepfather being the only one of 900 children at his school in Poland to survive the Holocaust. The big picture: In addition to Blinken, Biden introduced nominees Alejandro Mayorkas (Homeland Security secretary), Avril Haines (Director of National Intelligence), Linda Thomas-Greenfield (UN ambassador), Jake Sullivan (National Security adviser) and John Kerry (special envoy for climate). The picks are meant to look like America, as Biden seeks to assemble the most diverse Cabinet in American history. (Axios)

POLITICS: Joe Biden on Tuesday said America was "back, ready to lead the world" at an event to unveil his new foreign policy team that marked a clear break from the 'America first' administration of Donald Trump. Speaking in Wilmington, Delaware, alongside his first six cabinet nominees, the president-elect insisted that his national security appointments — all of whom held senior roles in Barack Obama's administration — would usher in a new era of multilateralism. "It's a team that reflects the fact that America is back, ready to lead the world, not retreat from it," Mr Biden said. "Once again sit at the head of the table. Ready to confront our adversaries and not reject our allies. Ready to stand up for our values." (FT)

POLITICS: Reps. Alexandria Ocasio-Cortez and Ilhan Omar are boosting a petition against Joe Biden nominating his former chief of staff to a new role in his administration, calling Bruce Reed a "deficit hawk." Why it matters: Progressives are mounting their pressure campaign after the president-elect did not include any of their favored candidates in his first slate of Cabinet nominees, and they are serious about installing some of their allies, blocking anyone who doesn't pass their smell test — and making noise if they are not heard. (Axios)

POLITICS: Pennsylvania and Nevada on Tuesday certified their 2020 general election results, formally awarding a combined 26 electoral votes from two key battleground states to President-elect Joe Biden. North Carolina's election board also certified the state's presidential vote totals on Tuesday, awarding the state's 15 electoral votes to President Donald Trump. (CNN)

POLITICS: President Donald Trump on Tuesday granted Joe Biden access to presidential intelligence briefings, according to two White House officials, after stonewalling the information amid his ongoing resistance to the transition of power. The President's Daily Brief, a summary of high-level national security intelligence, is routinely shared with the president-elect to prepare him for his move into the White House. But until Tuesday, Trump had refused to loop Biden into the briefs as he challenged the outcome of the Nov. 3 presidential election. Officials are still working out the coordination, but the briefings for Biden are likely to start early next week, one official added. (Politico)

CORONAVIRUS: A coronavirus vaccine will begin to become available in the United States "probably by the end of the second week in December," Centers for Disease Control and Prevention (CDC) Director Robert Redfield told Fox News Tuesday. Redfield told "The Daily Briefing" that a vaccine would initially be made available "in a hierarchical way" with priority going to "nursing home residents and then some combination of health care providers and individuals at high risk for a poor outcome." The Food and Drug Administration (FDA) has scheduled a Dec. 10 meeting of its Vaccines and Related Biological Products Advisory Committee to discuss Pfizer's request for emergency use authorization (EUA) of its vaccine candidate. (Fox)

CORONAVIRUS: As several coronavirus vaccines inch closer toward FDA approval, the nation's leading infectious disease expert has called on the public to double down on public health measures. Dr. Anthony Fauci, in a virtual discussion with The Hastings Center on Thursday, said the eventual vaccine is meant to protect the individual from getting sick from the coronavirus, but may not prevent that person from spreading the virus to others. Fauci, when discussing Pfizer and Moderna's results in clinical trials, explained that the vaccines are being evaluated to see if they prevent clinically apparent disease in the individual, and also to see if it prevents severe disease in a person who was inoculated. However, it is not yet clear what impact the vaccines may have on transmission. (Fox)

OTHER

U.S./CHINA: The U.S. Federal Communications Commission affirmed its decision to designate ZTE Corp. as a national security threat over concerns telecommunications gear made by the Chinese company could be used for spying. The action shows that the FCC remains determined to drive ZTE and fellow Shenzhen-based manufacturer Huawei Technologies Co. from the U.S. market, where small rural carriers rely on their cheap network equipment. The agency at its Dec. 10 meeting is to consider rules for listing prohibited gear, FCC Chairman Ajit Pai said in a Nov. 18 blog post that identified Huawei as a threat. The FCC has said ZTE and Huawei pose a risk of espionage, an allegation each company denies. The agency has increasingly scrutinized Chinese companies amid tensions between Beijing and Washington over trade, the coronavirus and security issues. The FCC is considering banning three Chinese telephone companies, and last year barred China Mobile Ltd. from entering the American market. The FCC on June 30 designated both companies national security threats, and ZTE asked the agency to reconsider its listing. The company said it supplies safe and secure equipment and is "clearly and fully dedicated to complying with all applicable laws in the United States." Pai in an emailed statement called Tuesday's rejection of ZTE's request "another important step in our ongoing efforts to protect U.S. communications networks from security risks." (BBG)

U.S./CHINA: The incoming Biden administration in the U.S. needs to restore normal competitive relations with China instead of seeing China as an enemy, the Global Times said in an editorial late Tuesday. Published following the announcement of Anthony Blinken as the next Secretary of State, the editorial said that if the State Department continues Mike Pompeo's unprofessional and ideological China policy there would be no real change to Sino-U.S. tensions. U.S. policies on China would have much broader success if Washington stopped attempting to contain China's development, and sought cooperation in addressing the pandemic and climate change, the Times editorial said. (MNI)

JAPAN/CHINA: The foreign ministers of China and Japan agreed at a meeting in Tokyo to lift some virus-related travel restrictions by the end of the month, while also re-stating their differences over disputed islands in the East China Sea. Foreign Minister Wang Yi is the first senior Chinese official to visit Japan since Prime Minister Yoshihide Suga took office in September. The two men are set to meet Wednesday, as China seeks to recalibrate its ties with key American allies ahead of U.S. President-elect Joe Biden's inauguration next year. Wang then travels to South Korea for high-level talks in Seoul. (BBG)

JAPAN: The Tokyo Metropolitan Government is poised to ask bars and restaurants that serve alcohol to shorten their hours. Officials hope the measure will help curb the number of coronavirus infections, which have been rising quickly around the capital. The affected businesses will be asked to close at 10:00 p.m. for about three weeks starting this Saturday. The Tokyo government plans to subsidize establishments that comply. Similar measures were taken in Tokyo six months ago, when the central government declared a nationwide state of emergency. Experts say infections are also surging in Hokkaido and metropolitan areas around Osaka and Nagoya. (NHK)

AUSTRALIA/CHINA: Australian Prime Minister Scott Morrison declared on Monday that his country does not want to be forced into a "binary choice" between the US and China. But hasn't Australia already picked a side? And it, obviously, was not "forced" by China. If Canberra wishes to reverse China-Australia ties with nothing more than lip service, it would be ridiculous and naive. Morrison said, "Our actions are wrongly seen and interpreted by some only through the lens of the strategic competition between China and the US… as if Australia does not have its own unique interests or views as an independent sovereign state." Australia wants to prove it has not taken sides, but when Sinophobia among Australians bubbled, Canberra did not make efforts to address the issue. Worse, instead of taking practical actions to improve ties with China, Australia proactively participated in more US-led anti-China campaigns, including promoting the Quad and Malabar exercise. Right after Australia signed the Regional Comprehensive Economic Partnership agreement, it inked a breakthrough defense pact with Japan, allowing reciprocal visits for training and operations, which is widely interpreted as targeting China. No matter how Australia attempts to justify its moves, all it has done displayed it is fulfilling missions as an US vassal state, pleasing Uncle Sam, which is filled with obsession against China. (Global Times)

RBNZ: MNI: RBNZ to reinstate LVRs as housing risk grows

- The Reserve Bank of New Zealand will reinstate loan to value ratio (LVR)restrictions for housing loans early next year in response to the country's surging property market - for more details please contact sales@marketnews.com.

CANADA: MNI EXCLUSIVE: Canada Could Have Tapped FX Reserves In Crisis

- Canada's finance department laid out options for accessing cash in May in case regular debt auctions became doubtful, like tapping emergency funds held at the central bank or dipping into foreign reserves, according to a briefing document obtained by MNI following a freedom-of-information request - for more details please contact sales@marketnews.com.

CANADA: MNI BRIEF: Canada Has No Timeframe For Ending Bank Dividend Cap

- Canada's finance department laid out options for accessing cash in May in case regular debt auctions became doubtful, like tapping emergency funds held at the central bank or dipping into foreign reserves, according to a briefing document obtained by MNI following afreedom-of-information request - for more details please contact sales@marketnews.com

CANADA: Prime Minister Justin Trudeau said Canadians won't be front of the line when COVID-19 vaccines become available, because the first doses will be made outside of our borders. "One of the things to remember is Canada no longer has any domestic production capacity for vaccines," Trudeau said outside Rideau Cottage Tuesday. "Countries like the United States, Germany and the U.K. do have domestic pharmaceutical facilities which is why they're obviously going to prioritize helping their citizens first." Trudeau said Canada's doses would follow shortly after, and he expects to see them in the first quarter of next year. But he said the first doses from the assembly line will go to the countries where the vaccine is made. (National Post)

RUSSIA: The International Monetary Fund has revised its outlook for Russian GDP drop to 4% from 4.1% in 2020 and from 2.8% to 2.5% for the recovery in 2021, IMF says in the Staff Concluding Statement of 2020. "All in all, we project the economy to contract by about 4% this year, and to expand by some 2Ѕ percent in 2021, assuming the COVID-19 situation gradually normalizes," the Fund says. "Nevertheless, the economy will remain well below full employment for the foreseeable future," according to the Statement. (TASS)

RUSSIA: Russian President Vladimir Putin hasn't been vaccinated against the coronavirus yet, months after he announced his country's Sputnik V as the "world's first" approved Covid-19 vaccine and said his own daughter had taken it. The Kremlin said Tuesday that Putin cannot get a vaccine that has not yet finished the final stage of trials, even though the jab has already been given to some Russian frontline health care workers, teachers and several top level officials outside the clinical trials. (CNN)

MALAYSIA: The vote on Malaysia's budget in Parliament, scheduled for Thursday (Nov 26), that could decide the fate of the Muhyiddin Yassin administration is set to be delayed to next week on Dec 1. Official sources told The Straits Times that Parliament is unable to take a decision on the supply Bill, Malaysia's largest ever, as about half the ministries had yet to respond to issues raised during debate in the Lower House. The process is running behind schedule largely due to the fact that proceedings are cut short, ending by 2pm every day instead of in the evening to reduce the risk of Covid-19 spreading. (Straits Times)

TURKEY: Turkey increased gold reserves to 22.46m oz last month from 22.22m oz in Sept., data on IMF website show. (BBG)

SAUDI ARABIA: Saudi Arabia's cabinet said on Tuesday that Houthi attacks committed against vital installations target the backbone of the global economy and the security of its supplies, state news agency (SPA) reported. On Monday, a fire broke out in a fuel tank at a petroleum products distribution station in the Saudi city of Jeddah as a result of a Houthi attack, SPA had reported. The cabinet also stressed the importance of facing up to "such sabotage and terrorist acts and the parties behind them." (RTRS)

ETHIOPIA: An informal militia comprising Tigrayan youths killed at least 600 Ethiopian civilians identified as belonging to other ethnic groups on Nov. 9, according to an independent human rights body. The massacre occurred less than a week after the start of a conflict between federal forces and soldiers of theTigray People's Liberation Front in the northern Ethiopian region. (BBG)

AIRLINES: Air passenger numbers are set to have weakened by almost 61% in 2020 on the year to 1.8 billion, the International Air Transport Association said in a statement Nov. 24. This is level with the number the industry carried in 2003, the association added. However, passenger numbers are expected to grow again in 2021 to around 2.8 billion, it said. Along with this, the industry can expect a net loss of $118.5 billion in 2020 and a net loss of $38.7 billion in 2021, IATA said. In the cargo segment, uplift in 2020 is expected to be 54.2 million mt, down from 61.3 million mt in 2019. In 2021, the role that air cargo will play in vaccine distribution should bolster the sector and volume should grow to some 61.2 million mt, essentially matching 2019's number of 61.3 million mt, IATA said. (Platt's)

OIL: The American Petroleum Institute late Tuesday reported that U.S. crude supplies rose by 3.8million barrels for the week ended Nov. 20, according to sources. The data also showed gasoline stockpiles up by1.3 million barrels, while distillate inventories fell by 1.8 million barrels. Crude stocks at the Cushing, Okla., storage hub, meanwhile, declined 1.4 million barrels for the week, sources said. Inventory data from the Energy Information Administration will be released Wednesday at 10:30 a.m. Eastern and gas inventories will be released at a noon, a day early due to the Thanksgiving holiday. December West Texas Intermediate crude was at $44.80 a barrel in electronic trading, up 4.1% but down from Tuesday's settlement at $44.91/bbl. on the New York Mercantile Exchange. (DJ)

METALS: Copper surged to the highest in more than six years after the start of President-elect Joe Biden's transition and a resilient Chinese economy bolstered the demand outlook. The metal commonly used in wiring and electronics is essential for many of the green polices being planned around the world, including Biden's $2 trillion climate plan. Helping sentiment is the formal start of President-elect Joe Biden's transition, a clearer sense of what his Treasury Department will have in policy preferences and a third promising vaccine candidate. Copper prices are heading for an eighth straight monthly gain, the longest rally since 2011, fueled by rebounding growth in China, a weaker dollar and promising news on Covid-19 vaccine developments that could halt further virus shutdowns. (BBG)

CHINA

CORONAVIRUS: leading Chinese vaccine developer has applied for authorization to bring its Covid-19 vaccine to the market, seeking to get a jump on Western rivals as the race for a working shot against the pandemic enters the final stretch. China National Biotec Group Co. has submitted an application to Chinese regulators, reported state media Xinhua Finance on Wednesday, citing parent company Sinopharm's vice general manager Shi Shengyi. The application likely includes data from the company's Phase III human testing conducted in the Middle East and South America. Stocks related to Sinopharm Group, including its Hong Kong unit, surged on Wednesday after the news. A CNBG spokeswoman said she had no further information when contacted by Bloomberg. Calls to Sinopharm Group went unanswered. (BBG)

ECONOMY: China will build a strong domestic market and strengthen intellectual property protection while also creating a level playing field for domestic and foreign companies as it opens up its economy, said Premier Li Keqiang. Speaking during the "1+6" Roundtable with major international institutions including the World Bank, IMF and WTO, Li said China would work towards a market-oriented and legalized international business environment to attract more foreign capital. China will continue to innovate, step up supervision of the economy and maintain policy continuity and effectiveness, Li said in a statement posted on the Government website. (MNI)

ECONOMY: China should accelerate the building of transportation projects to ensure continuous growth, the Economic Information Daily reported citing industry specialists. Investment in transportation rose 9.8% y/y to CNY2.51 trillion in the first three quarters, the Daily reported citing Wu Chungeng, the spokesperson for the Ministry of Transport. (MNI)

OVERNIGHT DATA

AUSTRALIA Q3 CONSTRUCTION WORK DONE -2.6% Q/Q; MEDIAN -2.0%; Q2 +0.5%

SOUTH KOREA DEC BUSINESS SURVEY M'FING 81; NOV 76

SOUTH KOREA DEC BUSINESS SURVEY NON-M'FING 72; NOV 69

CHINA MARKETS

PBOC NET INJECTS CNY20BN VIA OMOS WED

The People's Bank of China (PBOC) conducted CNY120 billion via 7-day reverse repos with rates unchanged at 2.2% on Wednesday. This resulted in a net injection of CNY20 billion given the maturity of CNY100 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1980% at 09:34 am local time from the close of 2.2940% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Tuesday vs 40 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5749 WED VS 6.5809

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.5749 on Wednesday, compared with the 6.5809 set on Tuesday.

MARKETS

SNAPSHOT: Risk-On Feel Moderates

Below gives key levels of markets in the second half of the Asia-Pac session:

- YELLEN RAISES HOPE FOR STRONGER FED BACKSTOPS (MNI)

- MNUCHIN PLANS TO PUT $455BN BEYOND YELLEN'S EASY REACH (BBG)

- CHINA'S PREMIER LI: GROWTH TO RETURN TO "PROPER RANGE" IN 2021, CHINA WON'T PURSUE TRADE SURPLUS

- ECB SIGNALS LIFTING OF BAN ON BANK DIVIDENDS NEXT YEAR (FT)

- UK CLL'R SUNAK TO UNVEIL GBP4.3BN SUPPORT TO HELP THE UNEMPLOYED

- Nikkei 225 up 151.63 points at 26314.51

- ASX 200 up 39.235 points at 6683.3

- Shanghai Comp. down 10.927 points at 3393.022

- JGB 10-Yr future unch. at 152.11, yield down 0.4bp at 0.021%

- Aussie 10-Yr future down 4 ticks at 99.07, yield up 4.2bp at 0.933%

- U.S. 10-Yr future -0-00+ at 138-07+, yield up 0.17bp at 0.8816%

- WTI crude up $0.33 at $45.28, Gold down $3.09 at $1804.8

- USD/JPY unch. at Y104.43

BOND SUMMARY: Core FI Get Reprieve As Early Risk-On Impulse Fades

Upbeat comments from Chinese Premier Li re: China's growth outlook combined with familiar positives applied some pressure to core FI in early trade, but the risk-on feel gradually moderated. T-Notes had a look through Tuesday lows, but recoiled from 138-04 as e-minis trimmed gains. The contract deals -0-01 at 138-07 as we type. Cash Tsy curve moved off early steeps, yields last seen unch. to +0.3bp. Eurodollar futures trade unch. to +0.5 tick through the reds. There is a U.S. data dump coming up today, with some releases front-loaded ahead of Thursday's Thanksgiving Day. Minutes from the latest FOMC MonPol meeting are also due.

- JGB futures dipped under overnight lows after the re-open, but recovered thereafter and last trades unch. at 152.12. The initial decline coincided with a rally in the Nikkei 225, which hit best levels since 1991, which was weighed against concerns over the local coronavirus situation. Cash JGB yields mostly sit lower, save for the super-long end, with 2s outperforming. Japanese MoF auctioned Y500bn worth of 40-Year JGBs, drawing a cover ratio of 2.67x, with highest yield missing expectations. Japanese news flow revolved around local virus containment measures, with Tokyo metropolitan gov't poised to ask restaurants to close early & urge citizens to limit outing.

- Aussie bonds were pressured from the off amid the aforementioned risk-on impulse, with some pointing to a potential spill-over from NZGBs. 10-Year NZGB yield jumped to a multi-month high after the RBNZ's QE ops saw one big seller. Elsewhere, the RBA offered to buy A$1.0bn worth of semi-gov't bonds, while the AOFM auctioned A$2.0bn worth of ACGB 21 May '32. YM -1.0 & XM -4.5 at typing, with XM off earlier lows. ACGB yield curve runs steeper, with yields sitting 0.3-5.5bp higher. Bills trade 1-2 ticks lower through the reds.

JGBS AUCTION: Japanese MOF sells Y499.6bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y499.6bn 40-Year JGBs:

- High Yield: 0.665% (prev. 0.610%)

- Low Price 94.30 (prev. 96.15)

- % Allotted At High Yield: 21.4007% (prev. 86.3557%)

- Bid/Cover: 2.670x (prev. 2.653x)

AUSSIE BONDS: The AOFM sells A$2.0bn of the 1.25% 21 May '32 Bond, issue #TB158:

The Australian Office of Financial Management (AOFM) sells A$2.0bn of the 1.25% 21 May 2032 Bond, issue #TB158:

- Average Yield: 1.0446% (prev. 0.9241%)

- High Yield: 1.0475% (prev. 0.9250%)

- Bid/Cover: 2.5235x (prev. 4.4424x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.0% (prev. 88.8%)

- bidders 46 (prev. 58), successful 25 (prev. 17), allocated in full 16 (prev. 8)

FOREX: Mixed Trade In Asia

Early Asia-Pac trade saw a light risk-on impetus, as Chinese Premier Li said that China's economic development will return to a "proper range" next year, while participants digested familiar risk-supportive developments. The initial impulse faded away amid little in the way of fresh macro headline flow, with G10 FX space struggling for a clear direction. JPY traded on a softer footing, as the Nikkei 225 printed best levels since 1991 while Gotobi demand may have lent some support to USD/JPY.

- EUR & Scandies led gains among major currencies, NOK likely drew some modest support from an uptick in oil prices. GBP was rangebound ahead of today's UK spending review, with Cll'r Sunak set to announce GBP4.3bn in funding to support the unemployed in seeking new jobs.

- NZD shrugged off the RBNZ's Financial Stability Review and subsequent central bank speak. Gov Orr said the MPC wants to have the banking system operationally ready for negative interest rates, but never promised to deploy this tool. His colleague Hawkesby noted that the NZD would trade 5-10% higher, if the central bank had not eased policy further.

- KRW rallied, catching up with yesterday's improvement in risk sentiment to become the best performer in Asia.

- Today's heavy calendar features some front-loaded U.S. releases, moved from Thursday's Thanksgiving. Initial jobless claims, second GDP reading, personal income/spending, final U. of Mich. Sentiment, flash durable goods orders, new home sales and FOMC Nov MonPol meeting minutes are all due. Elsewhere, focus turns to remarks from ECB's Holzmann & Riksbank's Ingves, as well as the ECB's FSR.

FOREX OPTIONS: Expiries for Nov25 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1700(E773mln), $1.1750-65(E725mln), $1.1800-10(E554mln), $1.1835-50(E719mln), $1.1870-75(E785mln), $1.2000(E835mln)

- USD/JPY: Y102.90-103.00($1.9bln-USD puts), Y104.00($965mln), Y105.50($630mln), Y105.96($500mln)

- EUR/GBP: Gbp0.8875-0.8900(E1.1bln-EUR puts)

- AUD/USD: $0.7390-0.7400(A$736mln-AUD calls)

- AUD/JPY: Y73.60-65(A$2.75bln)

- AUD/NZD: N$1.0620(A$508mln)

- USD/CNY: Cny6.6136($500mln-USD puts)

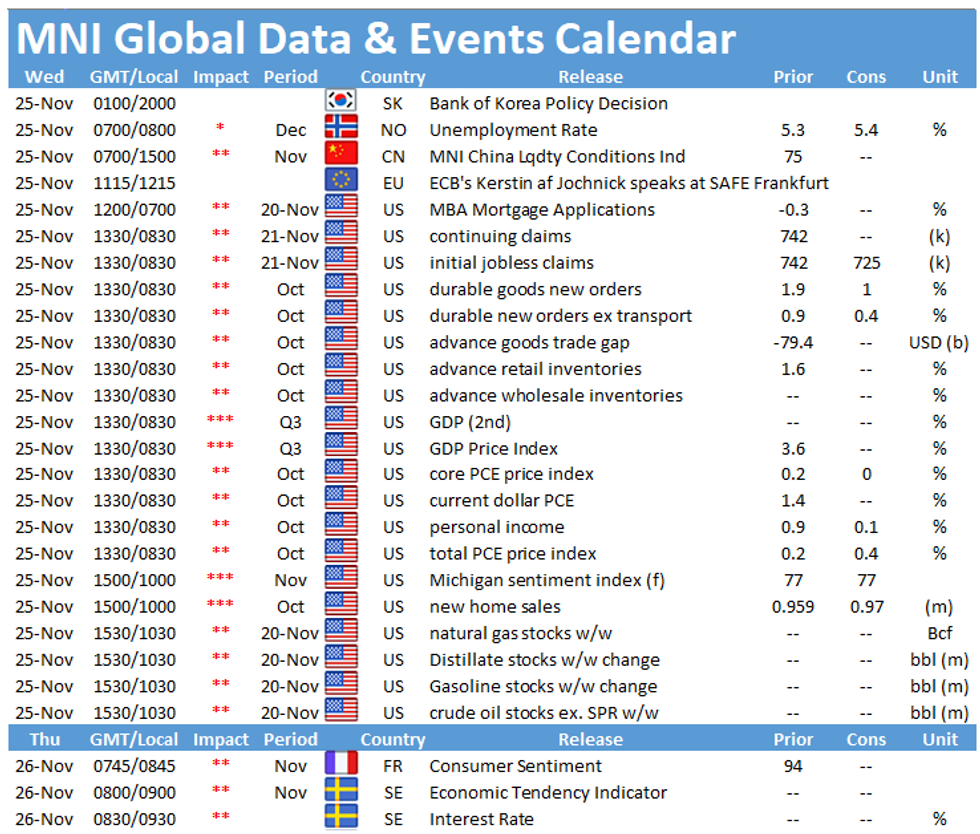

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.