-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Thanksgiving Lull Limits Activity

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- FED CONSIDERING STRONGER QE SOON, MINUTES SHOW (MNI)

- CONTE'S TOP AIDE: ITALY WANTS ECB TO CANCEL PANDEMIC DEBT (BBG)

- BRUSSELS FRUSTRATIONS GROW AS BREXIT TALKS REMAIN DEADLOCKED (FT)

- U.S. OBSERVES THANKSGIVING HOLIDAY

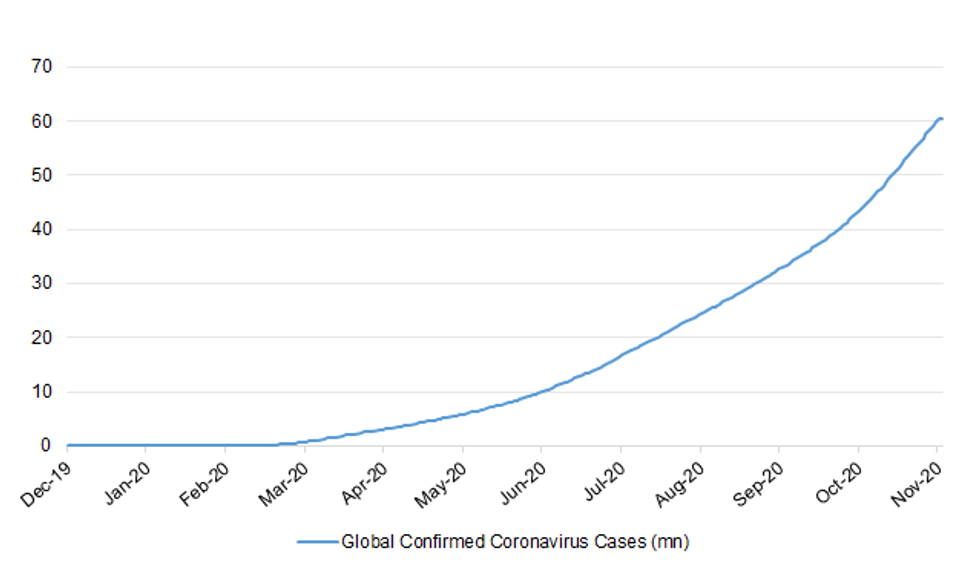

Fig. 1: Global Confirmed Coronavirus Cases (mn)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: MNI: UK Issuance Outlook and Spending Review Recap

- Today's spending review delivered a dour outlook but a "rabbit from the hat" in terms of the levelling up fund.

- From the markets side, we look at the implications for gilt issuance and set out our expectations for each gilt auction until the end of the 2020/21 fiscal year, see page 3 of the document for our expected issuance calendar.

- Our political risk team also look at the highlights of the Spending Review and the most politically controversial parts.

- Spending_Review25112020.pdf

FISCAL: Rishi Sunak has said that the "economic emergency" has only just begun as dire forecasts showed that the nation's finances face permanent scarring and borrowing is on course to hit a peacetime record of nearly £400 billion. The chancellor announced a pay freeze for public-sector workers and a cut to the foreign aid spending from 0.7 per cent to 0.5 per cent as he sought to repair the nation's finances which have ben ravaged by coronavirus. The Office for Budget Responsibility said that the economy would be 11.3 per cent smaller as a result of the pandemic, the biggest fall for 300 years. It warned of "long term scarring", with the economy 3 per cent smaller by 2025. (Times)

FISCAL: Rishi Sunak faces tough decisions in the coming years as officials warned his borrowing plans are unsustainable, while the Government's record mountain of debt raises the risk of an interest rate shock trashing the national finances. The Chancellor is keen to keep borrowing and spending to avoid smothering any economic recovery, but analysts fear he is building up problems for the future. Government borrowing will rise to almost £400bn this year, the OBR estimates, and stay at £100bn or more each year all the way out to 2025-26. Richard Hughes, the new head of the Office for Budget Responsibility (OBR), said Sunak must find tens of billions of pounds by the middle of the decade even to cover day-to-day spending without borrowing, let alone other costs such as investment. "While the Chancellor's spending review has made a £10bn downpayment on that adjustment [by trimming future non-Covid spending], a further £20bn to £30bn will be needed to meet the loosest conventional definition of balancing the books, and arrest the rise in the underlying debt-to-GDP ratio by the end of the forecast horizon," he said. (Telegraph)

FISCAL: The chancellor vowed to protect low-paid workers on Wednesday as he pressed ahead with a wages freeze that will hit more than 2 million public sector workers. To the dismay of public sector unions, Rishi Sunak said he would "pause" pay rises for workers including firefighters, police, teachers and local authority staff as he outlined Whitehall spending next year. However, a million NHS doctors and nurses will receive an annual increase next year, and 2.1 million public sector workers who earn below the median average wage of £24,000 will receive a £250 increase. Unions said that still left more than 2 million public sector workers without an increase, many of them frontline workers who have been tackling the pandemic. The TUC leader, Frances O'Grady, described the chancellor's attack on the public sector as a breach of his pledge to level up jobs and pay across the country. (Guardian)

ECONOMY: Diners ate more than 160 million discounted meals in August thanks to Rishi Sunak's "Eat Out to Help Out" scheme at a cost of £849 million, official figures show. The Treasury sponsored half the cost of meals up to £10 a head on Mondays, Tuesdays and Wednesdays in August to boost the hospitality sector after the first national lockdown. New figures from HM Revenue and Customs revealed that more than 49,000 restaurants, pubs and cafes claimed a total of £849 million by the end of September. The Treasury had originally budgeted £500 million for the scheme. (Telegraph)

POLITICS: A Foreign Office minister has resigned in protest at the Government's decision to cut the overseas aid budget, saying such a move is "fundamentally wrong". Baroness Sugg, whose brief included sustainable development, said promises should be kept in the "tough times as well as the good". Senior Tories, charities, leading religious figures and even Nobel prize winner Malala Yousafzai have all responded furiously to the plan to cut overseas aid by a third this year. (Telegraph)

BREXIT: European regulators have refused to soften rules on swaps trading by EU banks in the UK, threatening London's post-Brexit hold on a derivatives market worth €50tn a year. The Paris-based European Securities and Markets Authority on Wednesday said EU banks operating in London would continue to be subject to Brussels regulations when the Brexit transition period ends next month. UK regulators had hoped Esma would allow those banks to continue operating under British rules from January, avoiding a clash. The prospect of a doubling-up of regulations means EU banks operating in Britain could be forced to route some trades to New York, which has equivalent derivatives standards recognised by Brussels. (FT)

BREXIT: Ursula von der Leyen on Wednesday warned it remained impossible to predict whether the UK would have a trade deal with Brussels, as frustration mounted on the EU side at the lack of progress in virtual talks this week. In an address to MEPs, the European Commission president confirmed "genuine progress" had been made on a "number of important questions" in negotiations with the UK, but there were still open issues "that can make the difference between deal or no deal". "These are decisive days for our negotiations with the UK but frankly I cannot tell you today if in the end there will be a deal," Ms von der Leyen said. "With very little time ahead of us, we will do all in our power to reach an agreement, we are ready to be creative." (FT)

BREXIT: The U.K. is stalling discussions over a trade deal with the European Union and the outcome of thetalks remains "highly uncertain," French Foreign Minister Jean-Yves Le Drian told a parliamentary committee inParis.The EU and the U.K. remain "extremely far apart" on the topic of fishing rights and there's no convergence on therules for fair competition, Le Drian told a hearing of the foreign affairs committee on Wednesday."The U.K. continues to drag out the discussions on side issues and is playing with the calendar," Le Drian said. "Wewill not let the schedule take precedence over the content. It's up to the British to abandon tactical postures andmake the necessary gestures." (BBG)

BREXIT: The EU's chief negotiator, Michel Barnier, has warned David Frost that without a major negotiating shift by Downing Street within the next 48 hours he will pull out of the Brexit negotiations in London this weekend, pushing the talks into a fresh crisis. In talks via videoconference on Tuesday, Barnier told his British counterpart that further negotiations would be pointless if the UK was not willing to compromise on the outstanding issues. Should Barnier effectively walk out on the negotiations it would present the most dangerous moment yet for the troubled talks, with just 36 days to go before the end of the transition period. (Guardian)

CORONAVIRUS: Ministers are facing calls to publish scientific advice on the relaxing of Covid-19 rules over Christmas amid warnings that a single infectious guest could infect a third of those at a household gathering. Under rules revealed by the prime minister on Tuesday, up to three households can form a "bubble" for five days over Christmas. It prompted a raft of scientists to speak out, warning that mixing will inevitably lead to an increase in infections come the new year, leading to deaths. Some said the government should have put greater emphasis on the dangers and potential control measures. Now experts have called for the government to release advice given by the Scientific Advisory Group for Emergencies (Sage). (Guardian)

BONDS: The U.K. Debt Management Office will continue selling inflation-linked debt tied to the flawed Retail Price Index even after plans were announced to move away from the benchmark, according to Chief Executive Officer Robert Stheeman. And to avoid fragmenting the market, the DMO won't issue bonds tied to the preferred CPIH index, a measure that includes house prices and runs about 80 basis points below the maligned Retail Price Index. "Why would you want to have an additional line of linkers compared to those linked to RPI?" Stheeman said in an interview with Bloomberg News. "We're not talking about a new type of linker at this stage, of any description." (BBG)

EUROPE

ECB: The European Central Bank should consider wiping out or holding forever the government debt it buys during the current crisis to help nations recover and restructure, a top Italian government official said. "Monetary policy must support member states' expansionary fiscal policies in every possible way," cabinet undersecretary Riccardo Fraccaro, Prime Minister Giuseppe Conte's closest aide, said in an interview in Rome on Wednesday. That could include "canceling sovereign bonds bought during the pandemic or perpetually extending their maturity." The Italian demand reflects the nation's deep fiscal hole as it tries to counter the crisis. It was suffering under a high debt burden and sluggish economy even before the pandemic, and Fraccaro noted further costs ahead such as the European Union's green energy transition. He also proposed a "green rule" that exempts public expenditures related to environmental investment from deficit calculations. Fraccaro's call for debt relief won't be welcomed at the ECB's Frankfurt headquarters though. Officials there repeatedly say they must adhere to EU law banning them from such monetary financing. (BBG)

EU: Hungary and Poland voiced strong opposition to an EU plan to "promote gender equality and women's empowerment" as part of the bloc's foreign policy. The latest clash with Budapest and Warsaw — which last week vetoed the EU's budget and coronavirus recovery plan over opposition to a link to the rule of law — is part of an escalating fight that the two countries are waging over the term "gender equality" in various EU policies, from social affairs to artificial intelligence. On Wednesday, EU foreign policy chief Josep Borrell and the commissioner for international partnerships, Jutta Urpilainen, presented a gender equality plan for EU foreign policy, titled Gender Action Plan III, which seeks to bolster women's, girls' and LGBTQI rights worldwide by "challenging gender norms and stereotypes." (Politico)

EU: Rapid antigen tests to screen vast populations are becoming the latest weapon in Europe's fight against the coronavirus. A key advantage to antigen tests is that they're seen as cheaper, faster alternative to PCR tests. "They will be detecting disease in large numbers of people who have never previously even received a test," said John Bell, regius professor of medicine at the University of Oxford. But public health experts warn the tests aren't reliable enough to detect people without symptoms — and that researchers require more rigorous studies to understand how best to use them. They also caution that pinning hopes of a safe Christmas on these tests could do more harm than good — and is more a political PR stunt than good science. (Politico)

GERMANY: The German government has reached an agreement on when to hold the country's next general election, government spokeswoman Martina Fietz announced on Wednesday. September 26, 2021 was the chosen date, as it falls between August 25 and October 24 — the window of time determined by the German Constitution. (Deutsche Welle)

FRANCE: France's finance ministry has sent out notices to big tech companies liable for its digital service tax to pay the levy as planned in December, the ministry said on Wednesday. France suspended collection of the tax, which will hit companies like Facebook and Amazon, early this year while negotiations were underway at the Organisation for Economic Cooperation and Development (OECD) on an overhaul of international tax rules. (RTRS)

ITALY: MNI SOURCES: Italy's 5-Star May Approve EU's ESM Reform

- Italy's parliament is likely to finally vote to approve a long-delayed overhaul of the European Stability Mechanism in the next few weeks as the Five-Star Movement which has held it up drops its opposition, sources in the populist group and the Italian government told MNI - for more details please contact sales@marketnews.com.

ITALY: Authorities in Sicily asked Cuba's government to send to the region about 60 health operators, including doctors and nurses, as hospitals are struggling with a shortage of medical personnel during the second wave. The request was filed this week to the Italian embassy in Cuba and consists of intensive care specialists, nurses, anaesthetists, resuscitators, virologists and pneumologists, the Italian newspaper la Repubblica reported. (Guardian)

ITALY: Italian Premier Giuseppe Conte called for EU coordination for rules regarding the Christmas holidays and the use of ski facilities amid the COVID-19 pandemic during a joint press conference with Spanish Prime Minister Pedro Sanchez in Palma on Wednesday. (ANSA)

SPAIN: Spain's Prime Minister Pedro Sanchez said on Wednesday that his government was considering limiting Christmas celebrations to six people in an effort to curb the spread of the coronavirus. "This is not a number we have pulled out of nowhere," Sanchez told a news conference with his Italian counterpart Giuseppe Conte in Mallorca. (RTRS)

RIKSBANK: Riksbank Preview: November 2020 - A finely balanced decision

- The MNI Markets team thinks that with economic scarring expected to be greater than anticipated back in September, with the ECB likely to act more aggressively (and hence the krona appreciating more than had been expected) and with concerns about the credibility of the inflation target, the Riksbank will be pushed towards a QE extension of SEK100bln until the end of 2021, but acknowledge that the call is likely to be very close - for more details please contact sales@marketnews.com..

U.S.

FED: MNI POLICY: Fed Considering Stronger QE Soon, Minutes Show

- The Federal Reserve considered further easing such as introducing outcome-based forward guidance on QE soon, amid surging Covid cases and the absence of fiscal support, according to minutes of the last policy meeting - for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Main Street Ceasing Purchases In December

- Boston Fed on Wednesday signaled it will not be able to process Main Street program loans in time submitted beyond mid-December - for more details please contact sales@marketnews.com

POLITICS: President-elect Joe Biden will unveil his economic team next week, and his transition staff said it's now getting "extraordinary cooperation" from civil servants in the Trump administration. Intelligence agencies are working to set up a secure briefing room in Biden's hometown of Wilmington, Delaware, to facilitate classified intelligence briefings, Transition spokeswoman Jen Psaki said in a call with reporters Wednesday. Biden will begin receiving the presidential daily briefing -- the nation's most sensitive intelligence report -- beginning next Monday. (BBG)

POLITICS: President Trump on Wednesday canceled his trip to Gettysburg, Pennsylvania, where he was scheduled to join his personal lawyer Rudy Giuliani for a Republican-led state Senate Majority Policy Committee hearing on alleged election irregularities. Driving the news: The cancellation comes after Giuliani was exposed to a second person who tested positive for the coronavirus. It's unclear if that's the reason the trip was cancelled. (Axios)

POLITICS: Anthony Fauci, the nation's top infectious diseases expert, said he would "absolutely" serve on President-elect Joe Biden's COVID-19 task force if asked. "Of course, yes. The answer is absolutely," Fauci said in response to a question during a C-SPAN interview Wednesday. Fauci, who's a member of the White House coronavirus task force, said he has been in contact with Biden chief of staff Ron Klain, but added they have not discussed the "nuts and bolts" of the COVID-19 response. (Hill)

POLITICS: The U.S. State Department has informed staff that the transition process has begun and a team had been assigned inside the agency to support a handover to the incoming Biden administration, according to an internal email seen by Reuters on Wednesday. (RTRS)

POLITICS: The Biden transition team will begin receiving briefings from federal agencies Wednesday on the COVID-19 response, Biden officials said Wednesday. The transition team has requested briefings on the COVID-19 vaccine distribution, Operation Warp Speed, testing and the supply chain for personal protective equipment. "They are moving forward expeditiously," said Kate Bedingfield, a spokeswoman for Biden. (Hill)

POLITICS: President-elect Joe Biden on Tuesday said President Trump has yet to personally reach out to him since his election victory. "His chief of staff and my chief of staff have spoken," Biden told NBC's Lester Holt in an interview that aired Wednesday on the "Today" show. "But no, I have not heard anything from President Trump," Biden added in his first interview as president-elect. Biden said despite the lack of direct contact with Trump, his transition team has seen immediate results since General Services Administration head Emily Murphy authorized the beginning of the transition earlier this week. (Hill)

POLITICS: Vice President-elect Kamala Harris told reporters on Wednesday that she had "not yet" spoken with Vice President Pence since she and President-elect Joe Biden were projected to win the race for the White House earlier this month. (Hill)

POLITICS: President-elect Joe Biden is leaning toward naming former Obama administration national security adviser Tom Donilon as his CIA director, two people familiar with the situation said. While Donilon is said to be the front-runner at the moment, Michael Morell, who has previously led the CIA on an acting basis, remains a top competitor. Both men offer experience under intense pressure and familiarity with the national security bureaucracy at the highest levels. But each man has some baggage: Morell has been accused of defending the CIA's past use of torture, which has earned him the opposition of influential Democatic senators. Donilon has some detractors as well, including former staff members who say he can be an unusually tough boss who demands an excessive amount of work for little clear purpose. Another name being floated for CIA is Jeh Johnson, the former Obama-era Homeland Security secretary. Johnson, a former federal prosecutor, served as the Pentagon's general counsel during Obama's first term — trying, but failing, to shut down the prison at Guantanamo Bay. It's not clear how serious his standing is in the CIA hunt, however, and he's also being mentioned for other posts, including defense secretary and attorney general. (Politico)

POLITICS: President Donald Trump pardoned former national security adviser Michael Flynn on Wednesday despite Flynn's guilty plea to lying to the FBI about his Russia contacts. The pardon, coming in the waning days of the Trump administration, takes direct aim at a Russia investigation that he has long insisted was motivated by political bias. "It is my Great Honor to announce that General Michael T. Flynn has been granted a Full Pardon," Trump tweeted. "Congratulations to @GenFlynn and his wonderful family, I know you will now have a truly fantastic Thanksgiving!" (AP)

POLITICS: President Donald Trump has invited Republican lawmakers from Pennsylvania to the White House on Wednesday night, following a "hearing" the lawmakers hosted in Gettysburg over baseless allegations of voter fraud in this month's election that Trump called in to. Trump is expected to meet with them in the West Wing, two sources said. The President had planned on appearing in-person with his attorney, Rudy Giuliani, at the Gettysburg event but two sources told CNN Trump's trip was canceled. The move came shortly after news broke that Giuliani was exposed to another person who had tested positive for coronavirus. (CNN)

CORONAVIRUS: Several federal agencies have recommended that the White House lift an entry ban on non-U.S. citizens arriving from Europe put in place to slow the spread of Covid-19. The organizations, which participate in the White House Coronavirus Task Force, have signed off on lifting the restrictions, said two people who were briefed on the discussions. The limits have helped lead to a more than 90% reduction in the lucrative trans-Atlantic flight market. The restrictions were imposed by the Homeland Security Department after a presidential proclamation on March 11. It applied to 28 European nations and was expanded to Brazil on May 25. The department didn't immediately respond to a request for comment. It's unclear whether White House officials, including President Donald Trump, will go along with lifting the ban or what the timing of a decision will be, said the people, who asked not to be identified because they weren't authorized to discuss the issue. The nation is currently experiencing record high infection rates and growing deaths. (BBG)

OTHER

U.S./CHINA: Chinese President Xi Jinping on Wednesday congratulated President-elect Joe Biden on his victory, marking their first communication since Biden was projected to be the winner of the White House race more than two weeks ago. "Promoting healthy and stable development of China-U.S. relations not only serves the fundamental interests of the people in both countries, but also meets the common expectation of the international community," Xi said, according to the state-run Xinhua news agency. "Xi said he hopes that the two sides will uphold the spirit of non-conflict, non-confrontation, mutual respect and win-win cooperation, focus on cooperation, manage differences, advance the healthy and stable development of China-U.S. ties, and join hands with other countries and the international community to promote the noble cause of world peace and development," Xinhua added. Chinese Vice President Wang Qishan also sent a message congratulating Vice President-elect Kamala Harris. (Hill)

U.S./CHINA/RUSSIA: The U.S. sanctioned five firms in China and Russia over claims they are promoting Iran's missile program, and a Trump administration official said more penalties are to come. The Treasury Department plans to announce additional sanctions on Iran in coming weeks related to arms, weapons of mass destruction and human rights violations, Elliott Abrams, the State Department's special representative for Iran, said Wednesday at a Beirut Institute event. "Our policy will be the same through Jan. 20," Abrams said. The newly sanctioned firms are China-based Chengdu Best New Materials Co. Ltd. and Zibo Elim Trade Company Ltd. as well as Russia-based Nilco Group, Elecon and Aviazapchast, according to a State Department filing in the Federal Register. (BBG)

GEOPOLITICS: Arms control advocates are urging Joe Biden to extend the last U.S.-Russian treaty limiting deployed strategic nuclear arms for five years, but some experts argue the U.S. president-elect should go for a shorter period to maintain leverage over Moscow. Upon taking office on Jan. 20, Biden faces an immediate decision on whether to extend the 2010 New START pact, which otherwise expires 16 days later, freeing Washington and Moscow to deploy unlimited numbers of strategic nuclear warheads and the missiles, submarines and bombers to deliver them. (RTRS)

BOJ: MNI POLICY: BOJ Keeps Baseline View Despite Covid Spread

- The Bank of Japan is set to keep its baseline economic scenario unchanged, despite the resurgence of Covid-19 infections in many parts of the world MNI understands. Bank officials see exports and production levels holding up as overall demand remains solid, although weakness is still seen across the services sector - for more details please contact sales@marketnews.com.

JAPAN: Japan's state-owned export credit agency has agreed to give Nissan Motor Co up to $2 billion as part of a credit agreement to help it finance car sales in the United States. The money is part of a $4.1 billion credit agreement for Nissan Motor Acceptance Corporation, a unit of Nissan North America, Japan Bank of International Cooperation (JBIC) said in a press release on Wednesday. (RTRS)

JGBS: Japan's capital is joining a global surge in coronavirus bond sales, with the city marketing debt to help firms during pandemic. The move comes as the nation battles an upsurge in the virus. Cases are hitting a record this month, putting strains on hospitals in the capital and the local economy. It would be the first note by a Japanese municipal government that specified the proceeds would be used exclusively to help with the pandemic. The Tokyo Metropolitan Government plans to price the 60 billion yen ($575 million) bond on Friday. Tokyo plans to use the funds from its bond to offer small-to-mid sized companies long-term financing at low interest rates. The city's decision to specify the use of proceeds for pandemic-related relief "resonated with a lot of investors," according to Kosuke Suzuki, deputy director of the bond section at Tokyo Metropolitan Government's finance bureau. The local government initially planned to sell 30 billion yen of the note, but doubled the amount due to strong demand, he said.

JGBS: The Tokyo Metropolitan Government plans to sell a five-year, 60 billion yen ($575 million) bond to raise funds for loans to small-to-mid sized companies hurt by the pandemic, the first such bond issued by a municipal government in Japan

- Underwriters are still marketing the deal to investors, and planning to price it on Friday, according to underwriter Mitsubishi UFJ Morgan Stanley Securities

- Tentative coupon: 0.01%

- Amount: 60 billion yen

- Underwriters: Mitsubishi, SMBC Nikko and Goldman Sachs (BBG)

AUSTRALIA/CHINA: Prime Minister Scott Morrison said he's appointed his "best people" to work on breaking a stalemate that's seen more than 50 ships laden with Australian coal stranded off Chinese ports, as tensions between the trading partners increase. More than $500 million worth of Australian coal and about 1,000 crew on the ships are stuck after China blacklisted a wide swathe of Australian commodities and foodstuffs, amid what Morrison described on Thursday as an "extraordinary period" in the relationship. "We will work the process through with the Chinese government to get the best possible outcome that we can," Morrison said in an with Nine Network television. While he said "there are obviously tensions" in the relationship, they wouldn't be "resolved by Australia surrendering its sovereignty." (BBG)

RBNZ: New Zealand's central bank is pushing back after the finance minister asked it to do more to rein in rampant house prices, saying the government should be looking at changes to tax policy. "We will call on them to look at the full suite of whole-of-government instruments, and tax would be one," Reserve Bank Governor Adrian Orr told Radio New Zealand on Thursday. "We will talk very openly about that." With house prices surging in response to record-low interest rates, Finance Minister Grant Robertson this week wrote to Orr asking him to consider taking housing into account when setting monetary policy. Orr has framed the letter as an invitation to advise the government on how to tackle housing affordability, and said the RBNZ will not change the way it conducts policy. "It's very clear in the letter that our objectives do not change, our operational independence is not impacted, and they want advice," he said. "What is being suggested is that we have consideration for house prices, which we currently do." (BBG)

BOK: MNI REVIEW: BOK Holds Rate at 0.5%; Will Act For Economy

- The Bank of Korea kept monetary policy unchanged on Thursday, maintaining the Base Rate at the historic low of 0.5% but indicating that it was prepared to act to support the economy and stabilize the inflation rate - for more details please contact sales@marketnews.com.

BOK: MNI POLICY: BOK Raises GDP Forecast in 2020 to -1.1%

- The Bank of Korea raised its 2020 forecast for gross domestic product on Thursday to -1.1% from -1.3% in August, and the bank's forecast for GDP in 2021 was also raised to 3.0% from 2.8% - for more details please contact sales@marketnews.com.

SOUTH KOREA: The daily number of novel coronavirus cases in South Korea surpassed 500 for the first time in over eight months on Thursday due to sporadic cluster infections across the country as health authorities strive to curb a third wave of infections. The country added 583 more COVID-19 cases, including 553 local infections, raising the total caseload to 32,318, according to the Korea Disease Control and Prevention Agency (KDCA). It marks the first time that the country's daily virus cases exceeded 500 since March 6, when the figure reached 518 due to a massive outbreak in the southeastern city of Daegu. (Yonhap)

BANXICO: Mexico's central bank improved its outlook for the country's economy, saying it will grow faster than expected next year as U.S. demand drives up industrial exports. The central bank, known as Banxico, expects Latin America's second-biggest economy to shrink 8.9% this year versus its prior forecasts of contractions between 8.8% and 12.8%, according to a quarterly inflation report posted to the bank's website Wednesday. Banxico sees gross domestic product rebounding 3.3% next year, better than the previous 2.8% mid-range forecast. The bank's inflation outlook remained largely unchanged, with a year-end forecast of 3.6%, and 3.3% for the end of 2021. (BBG)

MEXICO/U.S.: Mexican President Andres Manuel Lopez Obrador on Wednesday again declined to congratulate Joe Biden for winning the U.S. presidential election, making him stand out increasingly among world leaders who have withheld their recognition. (RTRS)

SOUTH AFRICA: South African hospital operators have warned of the increasing risk of a resurgence in coronavirus cases during the upcoming December holiday season, when millions of people travel across the country to holiday destinations, home towns and villages. While the Covid-19 pandemic peaked in Africa's most industrialized economy in late July, case numbers have started to pick up again just before the busiest time of the year for intra-provincial journeys and social gatherings. "It is not the time to let your guard down, we must hold onto lessons from the first wave," Netcare Ltd. Chief Executive Officer Richard Friedland said by phone. "The numbers in the Eastern Cape are very serious and the surge at the moment is mimicking the first wave. We are also seeing increasing cases in the Western Cape." (BBG)

IRAN: Iran recorded its worst daily caseload, with the health ministry reporting 13,843 new infections. That pushed the national tally to 894,385 in the Middle East's worst-hit country. The ministry's spokeswoman, Sima Sadat Lari, told state TV the death toll rose by 469 in 24 hours to 46,207. (Guardian)

IRAN: Iran released an Australian-British academic in a prisoner swap that may signal an early easing of tensions with the West following Donald Trump's defeat in the U.S. election. Kylie Moore-Gilbert, a lecturer in Middle East studies at Melbourne University, was arrested in Tehran in September 2018 after attending a conference and sentenced to 10 years in jail for spying for Israel, charges she always denied. Iranian state television reported on its website she had been exchanged for three Iranians held overseas, without naming them or saying where they were detained. (BBG)

INDONESIA: Stimulus aimed at accelerating economic recovery can be further deployed, according to Anto Prabowo, spokesman of the nation's Financial Services Authority. FSA, which oversees the banking and non-banking industries, as well as the capital market, to push for more credit disbursement in several sectors, such as insurance, chemicals, pharmaceuticals, Prabowo says in statement on Thursday. (BBG)

PHILIPPINES: The Philippine government is beefing up the budget of an anti-communist task force that has made headlines by accusing celebrities of ties to alleged radical groups, part of a counterinsurgency campaign that overseas critics say has become a tool in President Rodrigo Duterte's crackdown on political opponents. (Nikkei)

INDIA: A senior leader of India's Congress party died of coronavirus related complications on Wednesday, his family said, a second veteran from the opposition group to fall victim to the virus in recent days, as total cases in the country touched the 9.2m mark. Ahmed Patel, a lawmaker who was party treasurer and was seen as close to the Gandhi family that leads the party, was detected with Covid-19 a month ago and died of multi-organ failure, his family said in a statement. (Guardian)

ETHIOPIA: African envoys went to Ethiopia to plead for peace on Wednesday, hours before an ultimatum was to expire for Tigrayan forces to surrender or face an assault on the northern region's capital that rights groups fear could bring huge civilian casualties. Prime Minister Abiy Ahmed's government set a 72-hour ultimatum on Sunday for the Tigray People's Liberation Front (TPLF) to lay down its arms or face an assault on Mekelle, the highland regional capital city of 500,000 people. (RTRS)

OIL: An explosion damaged a Greek-managed tanker at a Saudi Arabian terminal on the Red Sea just north of the Yemeni border, the ship's manager said on Wednesday, in an attack confirmed by Saudi Arabia. In a statement published by state media, the Saudi-led coalition fighting the Houthis in Yemen said a commercial vessel suffered minor damage from shrapnel in what it described as a foiled terrorist attack. (RTRS)

OIL: Iraq's deputy leader has criticized OPEC just days before the oil cartel makes a crucial decision on whether to raise output. OPEC should take members' economic and political conditions into account when deciding production quotas rather than adopting a "one-size-fits-all" approach, according to Ali Allawi, Iraq's finance and deputy prime minister. (BBG)

CHINA

PBOC: The PBOC is unlikely to raise policy interest rates in the short term as it eases gradually as the economy continues to recover, the China Securities Journal reported citing analysts. The need to raise OMO rates is not strong as growth hasn't returned to its full potential and the yuan has been appreciating, the newspaper said citing Li Yishuang, analyst at Cinda Securities. The central bank may first withdraw preferential policies such as deferred repayments on maturing loans, and liquidity conditions have returned to normal with little room for further tightening, the newspaper said citing Zhou Guannan, analyst at Huachuang Securities. (MNI)

YUAN: The negative impact of the rapid appreciation of the yuan on small exporters may become apparent in Q4, as most exporters haven't hedged their exposures to foreign exchange risks, the China Securities News reported citing analysts. Small exporters struggle to afford bank fees given their thin profit margins, the newspaper said citing Yuan Tao, analyst at Orient Futures. China should offer more domestic forex derivatives and promote their usage, the newspaper said citing Zhang Jing, a researcher at CITIC Futures. (MNI)

MILITARY: China's subsonic H-20 stealth bomber will give the country a "truly intercontinental" capacity expanding its reach far beyond the country's seaboard, according to a report by a leading think tank. The bomber is still under development but the Pentagon believes that when completed it will be able to target US overseas territories such as Guam, while other analysts believe its range will bring Hawaii within reach. (SCMP)

CHINA/U.S.: The incoming Biden Administration should revamp the previous White House approach on Asia Pacific affairs and seek a more constructive path of co-operation through organisations such as APEC instead of a focus on military confrontation and intelligence targeting China, the Global Times said in an editorial on Wednesday. Biden's team should address hostilities in the region and begin strategic communications with China to seek compromises, the newspaper said. China has no intention of pitting the two countries against each other but instead will conform to realities in the region, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN OCT SUPERMARKET SALES +2.8% Y/Y; SEP -4.6%

JAPAN SEP, F LEADING INDEX 92.5; FLASH 92.9

JAPAN SEP, F COINCIDENT INDEX 81.1; FLASH 80.8

AUSTRALIA Q3 PRIVATE CAPEX -3.0% Q/Q; MEDIAN -1.5%; Q2 -6.4%

NEW ZEALAND OCT TRADE BALANCE -NZ$501MN; MEDIAN -NZ$500MN; SEP -NZ$1.025BN

NEW ZEALAND OCT TRADE BALANCE 12 MTH YTD +NZ$2.191BN; MEDIAN +NZ$2.219BN; SEP +NZ$1.653BN

NEW ZEALAND OCT EXPORTS NZ$4.78BN; MEDIAN NZ$4.78BN; SEP NZ$4.01BN

NEW ZEALAND OCT IMPORTS NZ$5.29BN; MEDIAN NZ$5.28BN; SEP NZ$5.03BN

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS THU

The People's Bank of China (PBOC) conducted CNY80 billion via 7-day reverse repos with rates unchanged at 2.2% on Thursday. This resulted in a net injection of CNY10 billion given the maturity of CNY70 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity in the banking system at a reasonable and ample level, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2059% at 09:34 am local time from the close of 2.3329% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday, flat from the close of Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5780 THU VS 6.5749

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5780 on Thursday, compared with the 6.5749 set on Wednesday.

MARKETS

SNAPSHOT: Thanksgiving Lull Limits Activity

Below gives key levels of markets in the second half of the Asia-Pac session:

- FED CONSIDERING STRONGER QE SOON, MINUTES SHOW (MNI)

- CONTE'S TOP AIDE: ITALY WANTS ECB TO CANCEL PANDEMIC DEBT (BBG)

- BRUSSELS FRUSTRATIONS GROW AS BREXIT TALKS REMAIN DEADLOCKED (FT)

- U.S. OBSERVES THANKSGIVING HOLIDAY

- Nikkei 225 up 234.43 points at 26531.04

- ASX 200 down 46.933 points at 6636.4

- Shanghai Comp. down 0.847 points at 3361.48

- JGB 10-Yr future down 4 ticks at 152.10, yield up 0.4bp at 0.025%

- Aussie 10-Yr future up 2 ticks at 99.09, yield down 2.0bp at 0.913%

- U.S. 10-Yr future +0-02 at 138-10+, cash Tsys are closed

- WTI crude up $0.21 at $45.92, Gold up $2.99 at $1810.55

- USD/JPY down 14 pips at Y104.32

BOND SUMMARY: Core FI Steady In Asia

Trading activity waned in the Asia-Pac session owing to the Thanksgiving holiday in the U.S., with cash Tsy markets shut. Little to report on regional developments, as news and data flow lacked any notable market-movers. T-Notes edged higher and last trade +0-01 at 138-09+, after holding a 0-01+ range in Tokyo trade, with Eurodollars running unch. through the reds.

- JGB futures slipped through overnight lows into the lunch break, before stabilising in the afternoon session. The contract last deals at 152.11, 3 ticks shy of last settlement, as the Nikkei 225 managed to eke out some gains. Cash JGB curve underwent some very light steepening, with the super-long end underperforming. The space looked through the BoJ's decision to leave the sizes of its 1-3 & 5-25 Year JGB purchases unch. Local debt issuance outlook provided some interest. Japanese MoF officials held a meeting with bond investors and are set to meet with primary bond dealers later today, as the gov't is putting together the third extra budget.

- Aussie bonds also held relatively narrow ranges, with YM trading unch. XM slowly ground higher and last sits +2.0. Cash ACGB curve has bull flattened at the margin, with yields last seen unch. to -2.1bp. Bills trade unch. to -1 tick through the reds. The space was unfazed by the RBA's offering to buy A$2.0bn worth of ACGBs with maturities of Nov '28 - Nov '31 or Australia's below-forecast Q3 private capex data.

BOJ: 1-3 & 5-25 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.040tn of JGB's from the market, sizes unchanged from previous operations:

- Y500bn worth of JGBs with 1-3 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

- Y120bn worth of JGBs with 10-25 Years until maturity

FOREX: Activity Subdued With U.S. Off For Thanksgiving

The yen narrowly outperformed its G10 peers, with activity thinned by the Thanksgiving holiday in the U.S. Lack of any notable regional headline and data flow kept major crosses rangebound. A light sense of caution helped JPY & CHF remain afloat through the Asia-Pac session, with the Antipodeans facing a modicum of selling pressure. The greenback traded mixed, with the DXY wavering around Wednesday lows.

- The BoK left its main policy rate unchanged, as expected by all analysts surveyed by BBG. KRW shrugged off the decision, but pulled back from session highs as BoK Gov Lee expressed a sense of worry with rapid currency appreciation, driven by herd-like behaviour. Lee noted that the BoK will step in to stabilise FX markets if needed, citing negative impact of FX volatility for domestic exporters and general uncertainty.

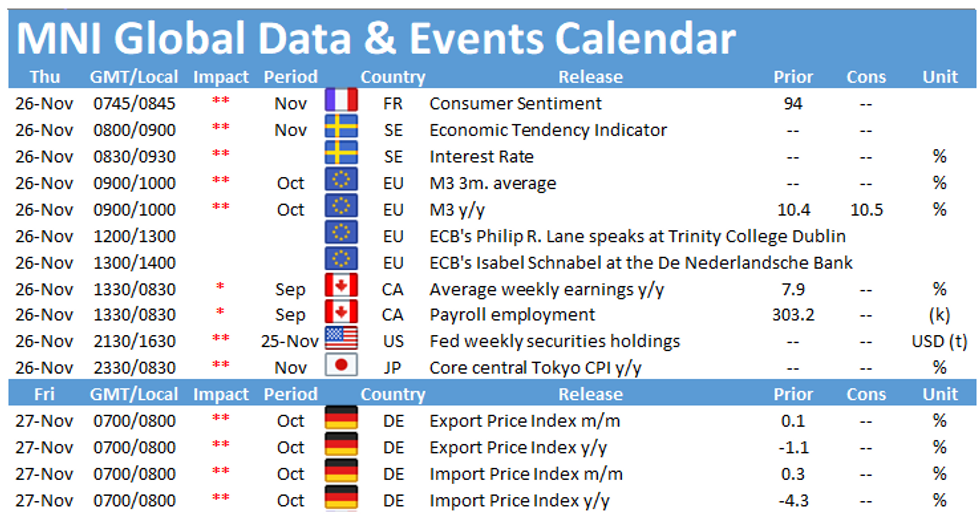

- Focus turns to minutes from the ECB's Oct MonPol meeting, Riksbank's MonPol decision, Swedish Econ Tendency Survey, French consumer confidence and comments from ECB's Lane & Schnabel, Riksbank's Breman and BoC's Macklem & Wilkins.

FOREX OPTIONS: Expiries for Nov26 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1740-50(E1.7bln), $1.1765-70(E643mln), $1.1800(E662mln), $1.1815-30(E1.0bln), $1.1850-60(E1.35bln), $1.1950-60(E654mln)

- USD/JPY: Y102.50($1.3bln-USD puts), Y104.00($1.7bln), Y104.90-00($1.1bln), Y106.45-50($907mln)

- EUR/JPY: Y124.00-15(E609mln)

- AUD/USD: $0.7300-10(A$1.2bln), $0.7400(A$733mln)

- USD/CNY: Cny6.6250($780mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.