-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: A Calm Asia-Pac Session After Wednesday's Shocking Scenes

EXECUTIVE SUMMARY

- U.S. CAPITOL SECURED HOURS AFTER PRO-TRUMP RIOTERS INVADE CONGRESS (CNBC)

- CONGRESS REJECTS OBJECTION TO BIDEN WIN IN ARIZONA, MOVES TOWARD CONFIRMING VICTORY OVER TRUMP NATIONALLY (CNBC)

- U.S. WEIGHS ADDING ALIBABA, TENCENT TO CHINA STOCK BAN (WSJ)

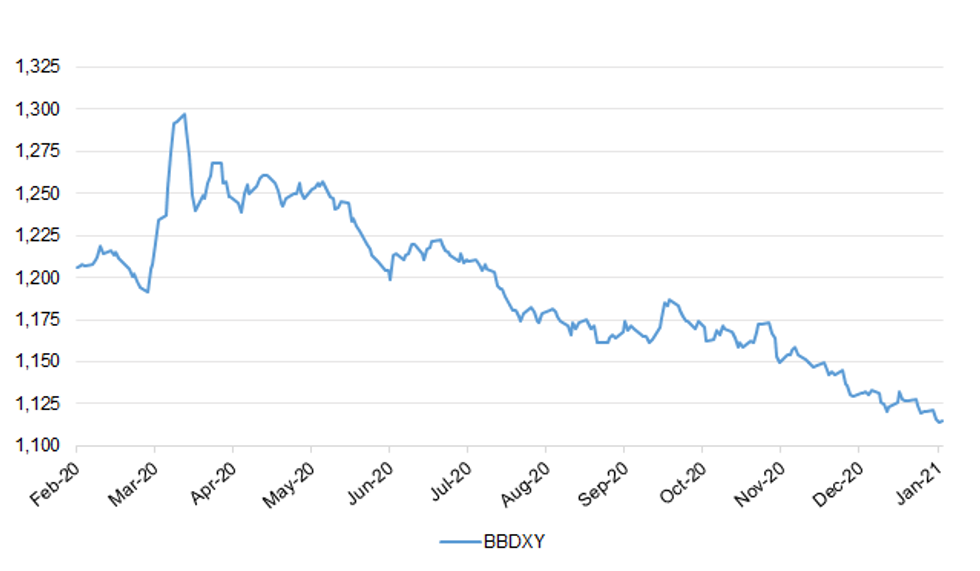

Fig. 1: BBG Dollar Index (BBDXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. reported 1,041 new coronavirus deaths within 28 days of a positive test on Wednesday, the highest daily increase since late April. A further 62,322 positive coronavirus cases were also reported on the government's dashboard, higher than a seven-day average of 55,945. More than 30,000 people are in hospitals with coronavirus as of Jan. 4, the government said. The rising numbers come as the country is subject to a nationwide lockdown, in which schools have been closed, and non-essential shops shut. (BBG)

CORONAVIRUS: London hospitals could run out of beds for patients in need of intensive care within two weeks as the number of Covid-19 cases soars, news service HSJ reported, citing a presentation by NHS England. (BBG)

CORONAVIRUS: Boris Johnson has warned the public that the easing of England's third national lockdown will be a "gradual unwrapping" and not a "big bang". The prime minister told MPs that the government will use "every available second" of another shutdown to place an "invisible shield" around elderly and vulnerable people through the rollout of COVID-19 vaccines. (Sky)

CORONAVIRUS: GPs have delayed vaccination clinics repeatedly because the delivery of supplies has been inconsistent. NHS England said that GP services would start using the Astrazeneca- Oxford vaccine today, but some said that access to the Pfizer jab was patchy. (The Times)

SCOTLAND: Nicola Sturgeon is under pressure to postpone the Scottish election after Boris Johnson said polls in England due to take place on the same day in May are under review. Senior opposition figures said Ms Sturgeon, the First Minister, must agree to delay the Holyrood ballot if she extends Scotland's "stay at home" lockdown beyond the end of this month. Scottish Parliament insiders told The Telegraph that arrangements could be put in place to allow Scots to cast their votes safely on May 6, but warned that campaigning in the midst of the new, more transmissible form of the virus would be almost impossible and engaging safely with the public difficult. (Telegraph)

EUROPE

IRELAND: Ireland tightened restrictions in a bid to contain its worst virus outbreak yet, adding extra curbs to what's already one of Western Europe's strictest lockdowns. The government will keep most students out of schools until at least the end of the month, Prime Minister Micheal Martin said in Dublin on Wednesday. Most construction will also halt, and click-and-collect services from non-essential stores will end. From Jan. 9, all passengers arriving at Irish airports and ports whose trip starts in Great Britain or South Africa will need evidence of a recent negative virus test result. (BBG)

U.S.

FED: MNI POLICY: Fed Saw Dec Guidance as Flexible, Open to More QE

- Federal Reserve officials were modestly upbeat about the economy but remained open to further strengthening QE to support growth if needed, minutes to the central bank's December meeting showed. "Some participants noted that the Committee could consider future adjustments to its asset purchases - such as increasing the pace of securities purchases or weighting purchases of Treasury securities toward those that had longer remaining maturities," the minutes said - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FISCAL: And at a news conference on Capitol Hill, Schumer acknowledged that "we sure did not take the most direct path to be here" — a nod to the party's failures in a few Senate races from November. He added that once Warnock and Ossoff are sworn in, his first priority will be to move a bill that would provide $2,000 stimulus checks to Americans. (POLITICO)

FISCAL: With a state law protecting California tenants from pandemic-related evictions expiring at the end of this month, Gov. Gavin Newsom proposed Wednesday to extend the protections and expedite distribution of $2.6 billion in federal rental assistance for low-income tenants. Newsom said the budget he was releasing Friday would include the rental assistance money and a $600 state stimulus check to low-income residents. Under the proposals, "Californians who have been impacted by this pandemic will get help to provide for their families and keep a roof over their heads," Newsom said Wednesday. (Los Angeles Times)

CORONAVIRUS: The US on Wednesday reported its second-biggest daily increases in coronavirus cases and deaths since the start of the pandemic, while hospitalisations hit a record for the fourth day running. States reported 243,346 coronavirus cases over the past 24 hours, according to Covid Tracking Project data, an increase second only to the January 2 record of nearly 279,000. (FT)

CORONAVIRUS: Slaoui: JNJ vaccine on track for EUA filing this month. (BBG)

CORONAVIRUS: About 5.3 million Americans have received an initial dose of a Covid-19 vaccine, according to the latest numbers from the Centers for Disease Control and Prevention updated Wednesday afternoon. That figure is up from 4.8 million initial shots reported as of Tuesday. More than 17 million vaccine doses have been shipped to U.S. states and territories, according to the CDC. (CNBC)

CORONAVIRUS: Walgreens and CVS Health said they are on schedule for giving Covid vaccinations to residents and staff at thousands of nursing homes and other long-term care facilities across the U.S. They said they expect to complete the first round of vaccines by Jan. 25. (CNBC)

CORONAVIRUS: CVS Health said Wednesday that it's in talks with several states "to make a limited number of doses available in the coming weeks in advance of the broader rollout" of Covid vaccines. (CNBC)

CORONAVIRUS: Health and Human Services Secretary Alex Azar recommended states open up Covid-19 vaccinations to the elderly and other vulnerable groups even if they haven't vaccinated all of their health-care workers. (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb told CNBC that life will continue to be altered by the coronavirus, even after Americans become vaccinated against Covid-19. The former Food and Drug Administration chief in the Trump administration likened it to how the Sept. 11, 2001, terrorist attacks forever changed airline travel. "It's not going to be like it was in 2017 and 2018, when we didn't worry at all about catching a respiratory pathogen," Gottlieb said on "Squawk Box." "We're going to worry about it, even if we're vaccinated. I think we'll worry much less than we're worrying right now, hopefully." (CNBC)

POLITICS: Congress on Wednesday night overwhelmingly defeated an effort to reject President-elect Joe Biden's electoral victory in Arizona, setting the stage for what could be final confirmation of his national victory over President Donald Trump. The separate votes in both chambers of Congress came as it resumed the process of counting electoral votes and confirming Biden's victory, hours after swarms of Trump's supporters broke into the U.S. Capitol and derailed the proceedings for around six hours. (CNBC)

POLITICS: The U.S. Capitol was finally secured late Wednesday afternoon, hours after supporters of President Donald Trump invaded the halls of Congress to disrupt the confirmation of Joe Biden as the next president Protesters freely roamed through the Capitol complex, including the Senate chamber, where one man stood on the president of the Senate's chair and shouted, "Trump won that election!" (CNBC)

POLITICS: A mob of angered Trump supporters has occupied the front lawn of Washington's Democratic Governor Jay Inslee's mansion as they also surrounded state capitols in Texas, California, Georgia, Michigan, Kansas and Oklahoma. (Daily Mail)

POLITICS: Multiple Republicans lawmakers dropped their objections to the certification of the Electoral College count on Wednesday night after a pro-Trump mob violently breached the U.S. Capitol Building earlier in the day. (Axios)

POLITICS: Officials in D.C. and Virginia have put out curfews for residents after pro-Trump protests at the Capitol turned to riots with demonstrators storming the building and shots being fired on the House floor. Virginia Governor Ralph Northam also issued a State of Emergency in Virginia. (FOX DC)

POLITICS: Members of President Donald Trump's 23-person Cabinet on Wednesday issued harsh rebukes of the violence that unfolded at the nation's Capitol, forcing lawmakers to halt the process to declare Joe Biden's victory in the presidential election. The officials, however, stopped short of criticizing the president, who had urged his supporters to take action. (CNBC)

POLITICS: Congresswoman Ilhan Omar is drawing up articles of impeachment against Donald Trump as she and at least six other House Democrats have called on the president to be removed from office. (Independent)

POLITICS: With 13 days left in President Trump's term, confidants and Republican officials are considering drastic steps to stop him, Jonathan Swan and Margaret Talev report. These measures include censure, impeachment or invoking the 25th Amendment — a move, long dismissed as a liberal fantasy, in which Vice President Pence would step in if Trump were found to be unable to perform his duties. This talk is coming from current and former White House and GOP Hill aides, and Republican lobbyists and political consultants — all of whom have either embraced him or quietly tolerated him until now. (Axios)

POLITICS: The head of the National Association of Manufacturers, a group representing 14,000 companies in the U.S., on Wednesday said clashes in Washington that interrupted a congressional gathering to certify Electoral College results of the 2020 presidential election were "not the vision of America that manufacturers believe in" and called on Vice President Mike Pence to "seriously consider" invoking the 25th Amendment of the Constitution to remove President Donald Trump from office. (CNBC)

POLITICS: In the hours after President Trump took to social media to openly condone the violence at the Capitol, he found himself increasingly isolated as White House officials began submitting their resignations, with more expected to follow suit. Stephanie Grisham, the former White House press secretary who served as the chief of staff to Melania Trump, the first lady, submitted her resignation after the violent protests. Ms. Grisham has worked for the Trumps since the 2016 campaign and is one of their longest-serving aides. (New York Times)

POLITICS: President Trump told people he banned Vice President Mike Pence's chief of staff Marc Short from the West Wing today, according to multiple people. (CNN)

POLITICS: Donald Trump has been suspended from Twitter and Facebook after tweeting to supporters who attacked the US Capitol. In a social media message to protesters he said "I love you" before telling them to go home. He also repeated false claims about election fraud. Twitter said it required the removal of three tweets for "severe violations of our Civic Integrity policy". The company said the president's account would remain locked for good if the tweets were not removed. (BBC)

OTHER

U.S./CHINA: U.S. officials are considering prohibiting Americans from investing in Alibaba Group Holding Ltd. and Tencent Holdings Ltd., a potential escalation of the outgoing Trump administration's efforts to unwind U.S. investors' holdings in major Chinese companies. State and Defense Department officials in recent weeks have discussed expanding a blacklist of companies prohibited to U.S. investments over alleged ties to China's military and security services, according to people familiar with the matter. The U.S. government announced its original blacklist in November with 31 companies. (WSJ)

U.S./CHINA: China and the U.S. should revive their stalled negotiations for a bilateral investment treaty as part of efforts to improve the relationship, according to Wang Huiyao, the president of the China Center for Globalization and an advisor to the State Council. China should also immediately begin negotiations on joining the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) to seek a dialogue platform with the U.S., which is expected to rejoin under the incoming Biden administration, Wang wrote in a commentary published in Global Times. The two powers can also seek cooperation on climate change, vaccine distribution and the North Korea issue, Wang said. (MNI)

U.S./CHINA: U.S. President-Elect Joe Biden should reverse the Trump administration's ban on eight Chinese Apps when assuming office as the ban was part of Trump's attempt to reverse the election outcome, the China Daily said in an editorial. China has no intention of being dragged into U.S. domestic political conflicts and the ban will hurt the interests of consumers and slow the containment of the pandemic and recovery, the Ministry of Commerce spokesperson said in a separate comment. (MNI)

U.S./CHINA/HONG KONG: American lawyer John Clancey, who was arrested on Wednesday for alleged subversion under the national security law, has been granted bail by police, Now TV reports in flash headline. (BBG)

GLOBAL TRADE: Digital services taxes adopted by India, Italy and Turkey discriminate against U.S. companies and are inconsistent with international tax principles, the U.S. Trade Representative's office said on Wednesday, paving the way for potential retaliatory tariffs. USTR, releasing the findings of its "Section 301" investigations into the digital taxes, said it was not taking specific actions at this time, but "will continue to evaluate all available options." The probes are among several still open USTR Section 301 investigations that could lead to tariffs before President Donald Trump leaves office or early in the administration of President-elect Joe Biden. Among these is a more advanced probe into France's digital services tax. (RTRS)

CORONAVIRUS: The new coronavirus variant linked to a surge in Covid-19 cases in South Africa is not only more infectious than previous forms of the virus but could make some vaccines less effective. Scientists racing to understand the new strain said they still expected the current crop of approved vaccines to work but were worried that a specific mutation, also identified in a new variant in Brazil, could affect the way the virus responds. (FT)

CORONAVIRUS: A new study from the Centers for Disease Control and Prevention found that people receiving Covid-19 vaccines experience anaphylaxis — a severe and life-threatening allergic reaction that occurs rarely after vaccination — at a rate 10 times higher compared with the flu vaccine. However, the condition is still thought to be rare, and the drugs from Pfizer and Moderna remain safe for public use, Dr. Nancy Messonnier, the director of the CDC's National Center for Immunization and Respiratory Diseases, told reporters on a conference call. (CNBC)

CORONAVIRUS: One of China's top scientists defended the country's delays in raising a global alarm in the early days of the coronavirus outbreak, saying officials were initially unsure whether the pathogen was infectious among humans because close contacts of the first patients didn't appear to fall sick. In the first days of 2020, after the mysterious pneumonia cluster emerged in the central Chinese city of Wuhan, Chinese experts quarantined 700 close contacts of the first patients -- including 400 medical workers that tended to them -- but none showed signs of illness. This led experts to hold off on concluding the coronavirus was transmissible among humans, said Liang Wannian, a senior official at the National Health Commission who oversaw China's virus response until September. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga is set to declare a state of emergency Thursday for Tokyo and adjacent areas, seeking to stem record coronavirus infections while containing the economic fallout. The declaration will cover the capital and the surrounding prefectures of Kanagawa, Saitama and Chiba, and is likely to be imposed from Friday until Feb. 7, Economy Minister Yasutoshi Nishimura said. It will be revoked when infections fall below levels laid out by the government, he added. Suga is set to hold a news conference at 6 p.m. to discuss the matter. (BBG)

AUSTRALIA: Australia's vaccination roll-out will begin by late February and 4 million people should have received at least their first dose by the end of March, Prime Minister Scott Morrison told reporters in Canberra. The program will be implemented in five stages. The first will cover quarantine and border officials, health workers and residents inaged and disability care, providing a "ring of containment" around the whole population, he said. Pfizer Inc.'s vaccine should be approved for use by Australian authorities by the end of January, with the AstraZeneca Plc product following during February, according to Morrison. (BBG)

AUSTRALIA: Daniel Andrews, the premier of the Australian state of Victoria, has called for tighter rules on overseas arrivals to reduce the risk of the highly infectious UK variant taking hold in the country. (FT)

SOUTH KOREA: South Korea will require incoming foreigners to present negative coronavirus tests as the country continues to grapple with its worst virus outbreak since the outset of the pandemic. (FT)

SOUTH KOREA: South Korea will try to achieve a speedy and strong economic recovery while closely monitoring financial market risk factors and possible increase in market volatility, Vice Finance Minister Kim Yongbeom says in a meeting. South Korea to help provide support measures for exports, which are helping to sustain hope for an economic recovery. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un told a rare congress of his ruling party he wants to raise defense capabilities to a "higher level" as the nation seeks a new path away from shortcomings that have shaken a sanctions-hit economy. (BBG)

CANADA: Quebec's premier announced Wednesday that he is imposing a provincewide 8 p.m. curfew beginning Saturday as a way to curb surging coronavirus infections and hospitalizations. The province will become the first in Canada to impose a curfew for addressing the pandemic. More than 8.4 million people live in the French-speaking province. (AP)

MEXICO: Mexico on Wednesday reported a new daily record increase in Covid-19 infections and deaths, with 1,165 new fatalities confirmed and 13,345 new cases. (FT)

RUSSIA: Hackers who tapped into government networks through SolarWinds software potentially accessed about 3% of the Justice Department's email accounts, but there's no indication they accessed classified systems, a DOJ spokesperson said in a statement Wednesday. The DOJ Office of the Chief Information Officer learned of the hack on Christmas Eve, according to the statement, where agents accessed the department's Microsoft Office 365 email environment. (CNBC)

SOUTH AFRICA: South African medical insurers will pay for a Covid-19 vaccine for as many people who don't have coverage as they have members and expect the program to cost as much as 7 billion rand ($464 million). The subsidy will mean that including medical aid members the companies will finance vaccines for 14 million adults in the country of 60 million people, Ryan Noach, the chief executive officer of Discovery Health Ltd., said in an interview on Wednesday. (BBG)

IRAN: Iran said the U.S. owes it $70 billion compensation for income lost as a result of sanctions on its oil exports, the state-run Islamic Republic of Iran Broadcasting reported on its website, quoting an adviser to the Supreme Leader. (BBG)

CHINA

CORONAVIRUS: Northern China's Hebei on Thursday reported that 120 individuals had tested positive for coronavirus in the province, after its capital declared "wartime" measures to halt the country's largest new outbreak in months. (FT)

PBOC: China may position its monetary policies on a "tight balance" as some local governments racked up large deficits coping with the pandemic and are struggling with mounting debts, the Shanghai Securities News commented. China should push for tax breaks and subsidies for technology innovations and high-quality development, while reforming the personal tax system and transfer payments to cater to low and middle-income groups, the newspaper said. (MNI)

OVERNIGHT DATA

JAPAN NOV LABOUR CASH EARNINGS -2.2% Y/Y; MEDIAN -0.9%; OCT -0.7%

JAPAN NOV REAL CASH EARNINGS -1.1% Y/Y; MEDIAN +0.2%; OCT -0.1%

MNI DATA IMPACT: Japan Nov Average Wage Dn; Real Pay Negative

- Average Japanese wages declined for the eighth straight month in November as working hours decreased amid the pandemic although base wages rose and the government held back its monthly assessment - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

AUSTRALIA NOV TRADE BALANCE +A$5.022BN; MEDIAN +A$6.400BN; OCT +A$6.583BN

AUSTRALIA NOV EXPORTS +3% M/M; MEDIAN -2%; OCT +4%

AUSTRALIA NOV IMPORTS +10% M/M; MEDIAN +3%; OCT +2%

AUSTRALIA NOV BUILDING APPROVALS +2.6% M/M; MEDIAN +2.0%; OCT +3.3%

AUSTRALIA NOV PRIVATE SECTOR HOUSES +6.1% M/M; MEDIAN +2.0%; OCT +3.1%

CHINA MARKETS

PBOC NET DRAINS CNY110BN VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged on Thursday. This resulted in a net drain ofCNY110 billion given the maturity of CNY120 billion of reverse repos today, according to Wind Information.

- The operations aim to maintain the liquidity in the banking system reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1734% at 09:26 am local time from 1.6911% for Wednesday's close.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday vs 38 on Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4608 THURS VS 6.4604

The People's Bank of China (PBOC) set the dollar-yuan central parity rates lightly higher at 6.4608 on Thursday. This compares with the 6.4604 set on Wednesday.

MARKETS

SNAPSHOT: A Calm Asia-Pac Session After Wednesday's Shocking Scenes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 382.19 points at 27438.13

- ASX 200 up 104.946 points at 6712

- Shanghai Comp. up 13.13 points at 3563.571

- JGB 10-Yr future down 13 ticks at 151.80, yield up 1.5bp at 0.036%

- Aussie 10-Yr future down 2.5 ticks at 98.895, yield up 2.0bp at 1.086%

- U.S. 10-Yr future -0-01 at 137-05+, yield up 1.01bp at 1.046%

- WTI crude up $0.44 at $51.06, Gold down $0.42 at $1918.2

- USD/JPY up 13 pips at Y103.17

- U.S. CAPITOL SECURED HOURS AFTER PRO-TRUMP RIOTERS INVADE CONGRESS (CNBC)

- CONGRESS REJECTS OBJECTION TO BIDEN WIN IN ARIZONA, MOVES TOWARD CONFIRMING VICTORY OVER TRUMP NATIONALLY (CNBC)

- U.S. WEIGHS ADDING ALIBABA, TENCENT TO CHINA STOCK BAN (WSJ)

BOND SUMMARY: Light Pressure In The Main During Asia Hours

T-Notes held to a 0-05 range overnight, last -0-01+ at 137-05, with a sense of normality coming back to the fore re: procedural matters in DC as GOP Senators rolled back their objections to the certification of the Electoral College count. Still, calls for Trump's impeachment have grown, while there are suggestions that senior members of Trump's staff could resign from roles in the coming days. Potential Asia-Pac buyers haven't shown their hand, with the fiscal dynamic in the U.S. perhaps sidelining them (as we suggested may be the case earlier). The curve has bear steepened, with 30s sitting 2.0bp cheaper vs. closing levels at typing. On the flow side 20K block buying of the TYH1 136.50/136.00/135.50 put ladder headlined.

- JGB futures are -14 ticks vs settlement levels, softening further in early afternoon trade, while the cash curve saw some twist flattening as the super long end was initially more concerned by the impending state of emergency declaration in Tokyo & the surrounding areas (details were outlined by COVID response chief Nishimura and met expectations that were a product of recent press reports), while the shorter end looked to the dynamic of global FI markets. The super-long end faded then from best levels as we moved through the day. Elsewhere, local monthly wage data was much softer than expected, in both headline and real terms.

- More attractive FX-hedged entry points for Japanese investors may have provided some support for the Aussie bond space in early Sydney trade, before the broader impetus provided some fresh pressure, with YM -1.0 and XM -3.0 at typing.

JGBS AUCTION: Japanese MOF sells Y3.0949tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y3.0949tn 6-Month Bills:

- Average Yield -0.0886% (prev. -0.0922%)

- Average Price 100.044 (prev. 100.046)

- High Yield: -0.0866% (prev. -0.0902%)

- Low Price 100.043 (prev. 100.045)

- % Allotted At High Yield: 48.6755% (prev. 75.7519%)

- Bid/Cover: 4.060x (prev. 4.163x)

JAPAN: Limited Net International Security Flows Over The Holiday Period

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -291.6 | -560.7 | 721.9 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 159.9 | -84.1 | -1281.2 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 61.6 | -2863.3 | -1839.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -85.5 | 37.1 | -396.3 |

Source: MNI - Market News/Japanese Ministry Of Finance

Little in the way of meaningful net flows witnessed in the latest round of weekly international security flow data out of Japan, which isn't surprising given the market closures and low liquidity conditions evident over the period that the data covers.

EQUITIES: Firmer Overnight

Equities have generally firmed in Asia-Pac hours, although the major e-mini contracts have stuck to the ranges established on Wednesday, with a sense of normality returning to DC after Wednesday's shocking scenes.

- The process of certification of the results from the U.S. electoral has resumed, with some notable GOP Senators removing their previously outlined opposition to the results.

- The Hang Seng was the exception to the broader rule, after a WSJ report noted that "U.S. officials are considering prohibiting Americans from investing in Alibaba Group Holding Ltd. and Tencent Holdings Ltd."

- As a reminder, Wednesday saw the NYSE finally decide that it will remove the ADR listings of the 3 major Chinese telecoms firms targeted by President Trump's executive order.

- Nikkei 225 +1.7%, Hang Seng -0.4%, CSI 300 +1.0%, ASX 200 +1.7%.

- S&P 500 futures +21, DJIA futures +152, NASDAQ 100 futures +97.

OIL: Fresh Multi-Month Highs

WTI & Brent sit ~$0.40 above their respective settlement levels, benefitting from the broader uptick in equity markets in Asia-Pac hours, geopolitical tension surrounding Iran and spillover from the large drawdown in headline crude stocks seen in Wednesday's DoE inventory report, although the large builds on the product side of the equation tempered the post-release reaction re: the latter (the figures were roughly in line with what was seen in Tuesday's API inventory estimates, at least in directional terms, if not outright levels).

- Elsewhere, that latest RTRS OPEC survey, released Wednesday, was a little less bullish as it revealed that "OPEC oil output rose for a sixth month in December, a Reuters survey found, buoyed by further recovery in Libyan production and smaller rises elsewhere in the group… The OPEC producers bound by the (OPEC+) supply deal also boosted output in December, the survey found, which meant their compliance with agreed output cuts slipped to 99% from 102%."

GOLD: Some Pressure From The Blue Wave Narrative

The uptick from lows in U.S. real yields has applied pressure to bullion over the last 24 hours, but bears have failed to force their way below $1,900/oz, with spot last dealing little changed on the day around the $1,920/oz mark. A break below the psychological $1,900/oz level (which has limited significance at present) would have bears looking to the 20-day EMA.

FOREX: G10 FX Stabilise, Congress Resumes Certification Process

G10 FX held tight ranges in the Asia-Pac session, struggling to find a coherent sense of direction, with all eyes on the Capitol Hill, where the U.S. Congress resumed the process of certifying the results of the 2020 presidential elections. Several GOP lawmakers pulled back from earlier commitments to oppose the results, as the dust started to settle after yesterday's turmoil in DC.

- JPY slipped ahead of the expected declaration of emergency in Tokyo and neighbouring prefectures, with Japanese media reporting that PM Suga will hold a presser on the matter this evening. Elsewhere, Japanese wages fell faster than exp. in Nov.

- PBOC fixed USD/CNY at CNY6.4608, slightly weaker for the yuan than yesterday after strengthening for a total of 645 pips in 2021 so far. The central bank continued its post New Year drain, withdrawing CNY 110bn from the financial system, which equates to a net drain of CNY510bn this week. USD/CNH faltered, albeit yesterday's low remained unthreatened.

- Indonesian rupiah softened after Indonesia moved to implement tighter movement restrictions in Java and Bali. USD/IDR tested weekly highs and its RSI crossed above the 30 (overbought) level, sending a bullish signal.

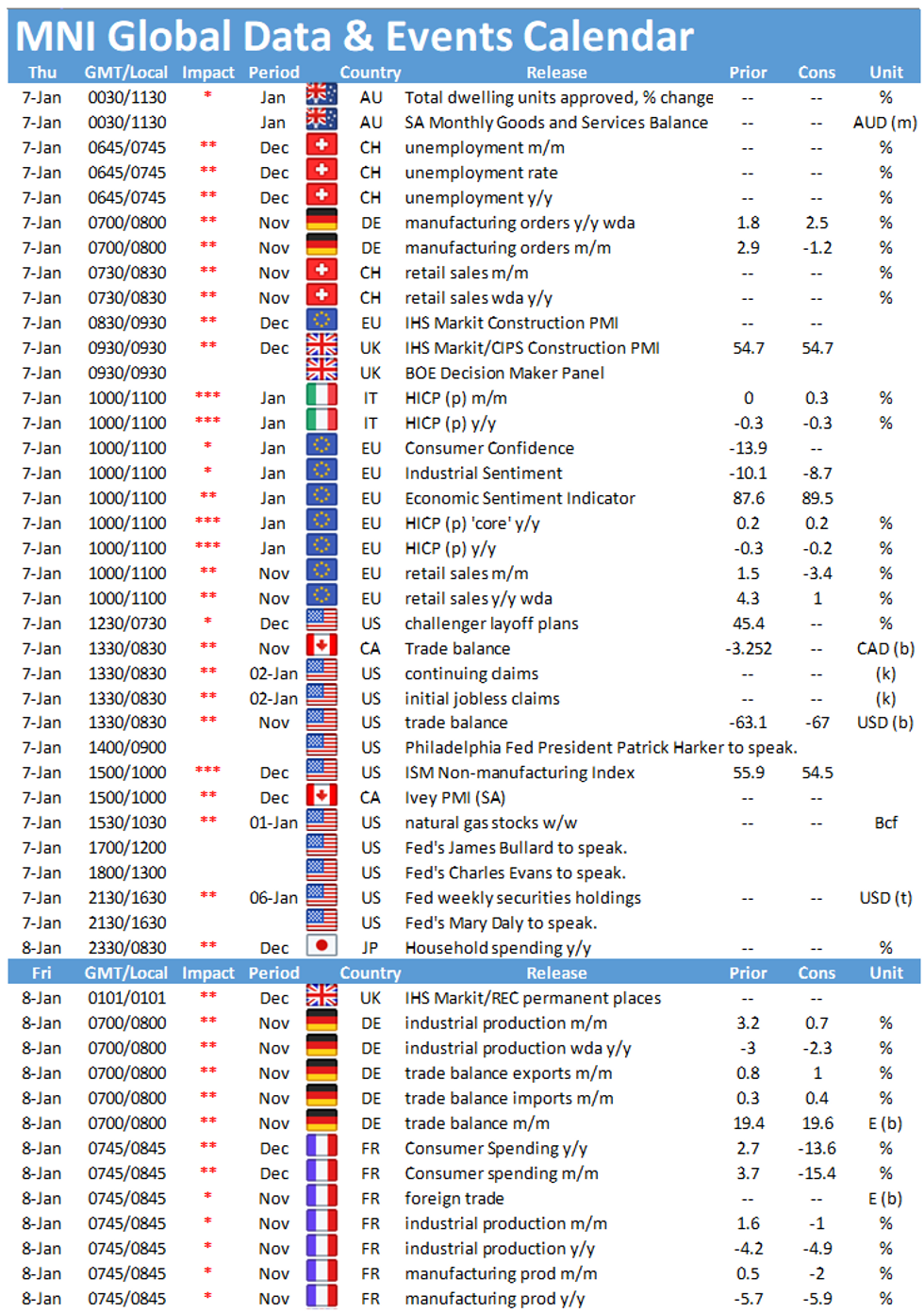

- Focus moves to U.S. initial jobless claims & ISM Services, flash EZ & Italian CPIs, German factory orders as well as Fedspeak from Harker, Barkin, Bullard, Evans & Daly.

FOREX OPTIONS: Expiries for Jan07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2155(E1.3bln-EUR puts), $1.2250(E727mln-EUR puts), $1.2300(E411mln), $1.2340-50(E499mln), $1.2700(E924mln-EUR puts)

- USD/JPY: Y102.50-60($640mln), Y103.20-25($794mln), Y103.70($670mln-USD puts), Y104.00($1.2bln)

- EUR/GBP: Gbp0.8800(E1.1bln-EUR puts), Gbp0.8850(E649mln), Gbp0.9300(E510mln)

- AUD/NZD: N$1.0690(A$640mln-AUD puts)

- USD/CNY: Cny6.4894($500mln-USD puts), Cny6.50($555mln), Cny6.5960($500mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.