-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Xi-Biden Call Fails To Introduce Anything Fresh As LNY Gets Underway

EXECUTIVE SUMMARY

- FAMILIAR RHETORIC DEPLOYED IN FIRST BIDEN-XI CALL

- JOE BIDEN CREATES PENTAGON TASK FORCE ON CHINA (FT)

- SENIOR OFF'L: U.S. TO LOOK AT MORE RESTRICTIONS ON TECH EXPORTS TO CHINA (RTRS)

- FED CHAIR POWELL: STRONGER JOBS WON'T PROMPT FED HIKES (MNI)

- BIDEN CONSIDERING LISA COOK FOR OPEN FED SEAT (AXIOS)

- EU REBUFFS U.K. CALL TO RESET POST-BREXIT RELATIONSHIP (BBG)

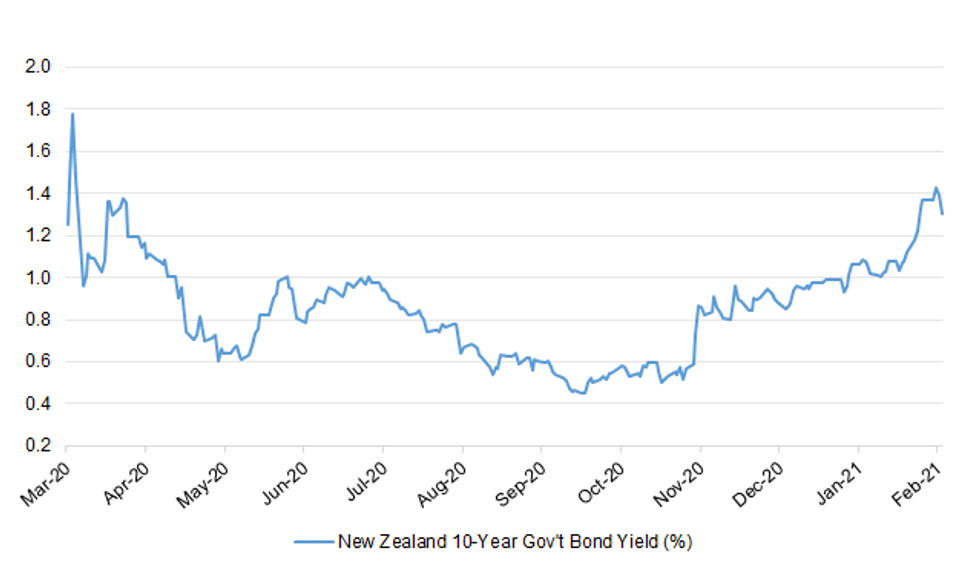

Fig. 1: New Zealand 10-Year Gov't Bond Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Official data from the UK's vaccination campaign show that a single dose of the BioNTech/Pfizer jab offers good protection against Covid-19, boosting the government's approach of extending the gap between doses. Although not enough evidence is available to draw definitive conclusions about the impact of the vaccination campaign on deaths and hospitalisations, several people with access to government data said indications showed it was reducing cases in the groups prioritised to receive the jab. The initial analysis will come as a boost to ministers after concerns were expressed that the government's decision to extend the gap between first and second jabs from three to 12 weeks could weaken the immune response. (FT)

CORONAVIRUS: Boris Johnson has appealed for the final two million people who are over 70 or work in healthcare and who have not yet been vaccinated to come forward, warning that leaving large numbers unprotected could delay the easing of lockdown. GPs are being urged to make personal calls to all their older patients who have not had the jab, while roving teams will seek out care home staff who have been missed. (The Times)

CORONAVIRUS: Britons should regard COVID-19 vaccinations like a flu shot that the vulnerable will have on a regular basis, Prime Minister Boris Johnson said on Wednesday. "I certainly think we need to be getting ready for a world in which we do have booster jabs against new variants in the autumn," he told a news briefing. "We should start to think about it as a flu jab, something that elderly or vulnerable people make sure they have every year." Johnson added he was confident vaccines would get "better and better" at being able to tackle all variants. (RTRS)

BREXIT: The European Union rebuffed the U.K.'s call to reset the two sides' relationship, saying Britain needs to honor the promises it made on Northern Ireland as part of the Brexit deal. In a letter to Cabinet Office Minister Michael Gove, European Commission Vice-President Maros Sefcovic gave a cool response to Britain's request to delay the implementation of border checks on some goods entering the province, saying that measures the U.K. previously signed up to "urgently need to be fully and faithfully implemented." (BBG)

BREXIT: Half of British exporters to the EU are facing difficulties with mounting Brexit red tape and border disruption after a month of the new rules, according to one of the most comprehensive business surveys since leaving the bloc. The British Chambers of Commerce (BCC) said that 49% of UK-based exporters in a survey of 470 firms had suffered problems with post-Brexit arrangements since the start of the year, as companies struggled to adapt and faced higher costs due to extra border checks and paperwork. Little more than a month into the UK's new relationship with Brussels, the leading business lobby group warned that urgent action from both the British government and the EU was necessary to solve severe issues with cross-border trade. (Guardian)

BREXIT: Amsterdam surpassed London as Europe's largest share trading centre last month as the Netherlands scooped up business lost by the UK since Brexit. An average €9.2bn shares a day were traded on Euronext Amsterdam and the Dutch arms of CBOE Europe and Turquoise in January, a more than fourfold increase from December. The surge came as volumes in London fell sharply to €8.6bn, dislodging the UK from its historic position as the main hub for the European market, according to data from CBOE Europe. The shift was prompted by a ban on EU-based financial institutions trading in London because Brussels has not recognised UK exchanges and trading venues as having the same supervisory status as its own. (FT)

ECONOMY: Rishi Sunak must provide "crucial" support for retailers in the budget after lockdowns cost non-essential shops £22 billion in lost sales last year, according to the British Retail Consortium. It said that 2020 was the worst year on record for retail sales growth, with sales at in-store non-food retailers down 24 per cent year-on-year. The results were reflected in footfall, which was down by more than 40 per cent, the group said. The BRC called on the chancellor to extend business rates relief and the moratorium on debt enforcement as well as removing the state aid caps on Covid business grants in the budget on March 3. (The Times)

BOE: The governor of the Bank of England said the European Union's post-Brexit requirements to grant market access for financial services are unrealistic. "The EU has argued it must better understand how the U.K. intends to amend or alter the rules going forwards," Andrew Bailey said at a virtual event hosted by the City of London on Wednesday. "This is a standard that the EU holds no other country to and would, I suspect, not agree to be held to itself." The comments underline the gulf between the U.K. and the bloc around so-called equivalence rulings on whether each side's rules are robust enough to enable seamless access for financial services. EU officials have said the bloc's in no rush to make these decisions. (BBG)

BOE: MNI BRIEF: BOE Tenreyro Sees Disinflationary Covid Hit

- Although the Covid-19 shock has thrown up a high degree of uncertainty with upside inflationary pressure from disrupted supply chains, but the rapid growth of online retail would likely result in long-run disinflationary effects, Bank of England Monetary Policy Committee member Silvana Tenreyro said Wednesday - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

EUROPE

ECB: European Central Bank Executive Board member Fabio Panetta said a digital euro might be the innovation that sees negative interest rates passed directly to consumers. Speaking at an event on Wednesday, Panetta said officials keen to prevent bank runs could make the hoarding of digital central bank money unattractive by "penalizing remuneration" of holdings in excess of 3,000 euros. (BBG)

GERMANY: German schools and kindergartens may reopen as soon as next week, a win for state leaders over Chancellor Angela Merkel in a wider battle over how quickly Europe's biggest economy reopens. Authorities on Wednesday set guidelines for relaxing curbs, should the country's coronavirus outbreak continue to recede, starting with granting states the power to open schools and daycare centers. Merkel had argued for maintaining consistent rules across the country and keeping children at home until the end of the month. Tensions ran high in Berlin amid mounting pressure to relax lockdown rules. There were some concessions, with hair salons allowed open at the beginning of next month. Other measures -- which were slated to expire on Feb. 14 -- were extended until March 7. (BBG)

ITALY: The northern Italian region of Lombardy, epicentre of the country's original coronavirus outbreak last year, is set to reopen its ski resorts from February 15, the country's health ministry said. It will be the first time skiing has been permitted in Italy's ski resorts this season after three months of lockdown. Skiing could also resume in other Italian regions if they remain designated as lower-risk "yellow" areas — the health ministry reassesses risk colours of regions each Friday on the basis of weekly monitoring. (FT)

U.S.

FED: MNI POLICY: Powell: Stronger Jobs Won't Prompt Fed Hikes

- The Federal Reserve must keep supporting the U.S. recovery with low interest rates because officials have learned a stronger job market will bring broad-based benefits without generating undue inflation, Fed Chair Jerome Powell said Wednesday. "We will not tighten monetary policy solely in response to a strong labor market," Powell said in prepared remarks to an Economic Club of New York webinar. Powell suggested the economy is still a long way from full employment because a recent drop in the jobless rate to 6.3% in January overstates the level of improvement. "Published unemployment rates during COVID have dramatically understated the deterioration in the labor market," Powell said citing the biggest 12-month decline in labor force participation since 1948 - on MNI Main Wire and email now - for more details please contact sales@marketnews.com.

FED: President Biden is considering nominating Lisa Cook, an economist at Michigan State University, to fill an open seat on the Federal Reserve Board, people familiar with the matter tell Axios. (Axios)

FISCAL: President Biden's first budget proposal will be delayed, the White House said Wednesday, citing a lack of cooperation during the transition from budget staff in former President Donald Trump's administration. "There were some challenges that came about during the transition in terms of a bit of intransigence from the outgoing administration and lack of cooperation as it related to [the Office of Management and Budget] and the budget process, so we expect there to be a delay in the release of his first budget," White House press secretary Jen Psaki said during a Wednesday briefing with reporters. She declined to say when the budget would be released or in what form. (WSJ)

FISCAL: The White House has been reaching out to executives in several industries to rally support for the Biden administration $1.9 trillion Covid-19 relief plan, according to people familiar with the matter. In the past week, administration officials have held at least two calls with leaders from multiple business sectors, including Wall Street and tech, said these people, who declined to be named in order to speak freely. (CNBC)

FISCAL: One third of small business owners say they'll likely lay off workers if Congress raises the federal minimum wage to $15 an hour, according to the latest quarterly CNBC|SurveyMonkey Small Business survey. The fight over the federal minimum wage has emerged as one of the more contentious elements of the larger battle on Capitol Hill over President Biden's $1.9 trillion Covid relief package. (CNBC)

FISCAL: Neera Tanden, Democratic President Joe Biden's nominee to head the U.S. Office of Management and Budget, told U.S. senators on Wednesday she would support raising the federal minimum wage, without giving a target for a higher rate. "Absolutely," she said at a confirmation hearing before the Senate Budget Committee after the panel's chairman, Senator Bernie Sanders, asked her if she would help move to end "starvation wages" in the country "by raising the minimum wage over a period of several years." Tanden said recent studies had challenged the conventional view about the impact of minimum wage increases on jobs and determined that job loss rates due to such raises were "relatively low." (RTRS)

FISCAL: House Committee approves $50bn in small business aid for COVID relief (BBG)

FISCAL: Republicans on three committees are fuming that they will be sidelined from putting their touch on the coronavirus relief package while the House Budget and Rules committees determine how some $12 billion in federal funding will be spent. Lawmakers on the House Foreign Affairs, Natural Resources, and Science, Space and Technology committees penned a letter to Speaker Nancy Pelosi (D-Calif.) urging Democratic leadership to "stop shutting us out" and allow minority members a chance to weigh in on the final markup. (The Hill)

FISCAL: Biden to meet with Senators Thursday to discuss infrastructure. (BBG)

FISCAL: The US budget deficit swelled to $163bn in January, a fivefold increase from a year ago, as Americans received a fresh round of stimulus payments to cushion the blow from the coronavrius pandemic. (FT)

CORONAVIRUS: The US on Wednesday reported almost 3,500 coronavirus deaths, offsetting other trends that remained encouraging, such as new daily infections holding below 100,000 for the fourth day running. Authorities attributed 3,445 fatalities to the virus, according to Covid Tracking Project data. That was up from 2,795 on Tuesday and marked the biggest one-day increase since Friday last week. (FT)

CORONAVIRUS: The Biden administration is considering whether to impose domestic travel restrictions, including on Florida, fearful that coronavirus mutations are threatening to reverse hard-fought progress on the pandemic. Outbreaks of the new variants — including a highly contagious one first identified in the United Kingdom, as well as others from South Africa and Brazil that scientists worry can evade existing vaccines — have lent urgency to a review of potential travel restrictions within the United States, one federal official said. (Miami Herald)

CORONAVIRUS: Large stadiums and arenas in New York can reopen beginning Feb. 23 with limited capacity if preapproved by the state's Department of Health, Gov. Andrew Cuomo announced Wednesday. (CNBC)

CORONAVIRUS: The Biden administration will partner with New York to build and staff two mass Covid-19 vaccination sites in the New York City area aimed at getting shots to minority communities hit hardest by the pandemic. (CNBC)

CORONAVIRUS: The federal government will partner with Texas officials to build three new community vaccination centers in Dallas, Arlington and Houston, the Biden administration announced. (CNBC)

CORONAVIRUS: Chicago Mayor Lori Lightfoot on Wednesday announced a roadmap for the city to further ease curbs on businesses, with limited expansion of indoor dining capacity coming into effect on Thursday. "This strategy … identifies a series of metrics that will determine when and how Chicago can carefully reopen businesses and expand indoor capacity so as not to reverse the progress made in the City's fight against Covid-19 in recent weeks and months," the mayor's office said in a statement. (FT)

OTHER

U.S./CHINA: President Joseph R. Biden, Jr. spoke today with President Xi Jinping of China. The President shared his greetings and well wishes with the Chinese people on the occasion of Lunar New Year. President Biden affirmed his priorities of protecting the American people's security, prosperity, health, and way of life, and preserving a free and open Indo-Pacific. President Biden underscored his fundamental concerns about Beijing's coercive and unfair economic practices, crackdown in Hong Kong, human rights abuses in Xinjiang, and increasingly assertive actions in the region, including toward Taiwan. The two leaders also exchanged views on countering the COVID-19 pandemic, and the shared challenges of global health security, climate change, and preventing weapons proliferation. President Biden committed to pursuing practical, results-oriented engagements when it advances the interests of the American people and those of our allies. (White House)

U.S./CHINA: U.S. President Biden tweeted the following on Wednesday: "I spoke today with President Xi to offer good wishes to the Chinese people for Lunar New Year. I also shared concerns about Beijing's economic practices, human rights abuses, and coercion of Taiwan. I told him I will work with China when it benefits the American people." (MNI)

U.S./CHINA: Chinese President Xi Jinping said Thursday that China and the United States should re-establish their various dialogue mechanisms so as to accurately understand each other's policy intentions and avoid misunderstanding and miscalculation. In a phone conversation with U.S. President Joe Biden, Xi said Chinese and U.S. foreign affairs departments may deepen communication on a broad range of issues in bilateral relations and on major regional and international affairs. Xi added that more contact may also be carried out between the economic, financial and law enforcement agencies as well as the militaries of the two countries. (Xinhua)

U.S./CHINA: President Joe Biden's administration will look at adding "new targeted restrictions" on certain sensitive technology exports to China in cooperation with allies, a senior administration official said on Wednesday. The official spoke ahead of Biden's first call with Chinese leader Xi Jinping. The U.S. will also not move to lift Chinese trade tariffs imposed by the Trump administration before it has conducted "intense consultation and review" with allies, the official told reporters during a briefing on Biden's approach to Beijing. (RTRS)

U.S./CHINA: Joe Biden has created a Pentagon task force to help craft a comprehensive China policy that will examine everything from the deployment of US forces around the world to relations with the Chinese military. The US president announced the formation of the working group during a visit to the Pentagon on Wednesday. The task force, which will include uniformed officers and civilians, will produce recommendations within four months. It will be led by Ely Ratner, a China expert and Pentagon official. Biden said the task force would "work quickly . . . so that we can chart a strong path forward on China". (FT)

U.S./CHINA: The Biden administration signaled it would slow down an effort to force TikTok to unwind its U.S. operations, asking a federal judge on Wednesday to pause a lawsuit over former President Donald Trump's ban of the popular video app while the new White House reviews its predecessor's policies. The White House said TikTok, owned by China-based ByteDance Ltd., is part of a wide-ranging examination of the government's posture toward Beijing, including how to guard against risks to Americans' online data. Those risks, White House Press Secretary Jen Psaki said, will be addressed "in a decisive and effective fashion," though no action is imminent. "It's a broad review that's expanded beyond TikTok," Psaki told reporters in a briefing at the White House. (BBG)

U.S./CHINA: A Fox reporter tweeted the following on Wednesday: "@WhiteHouse sources say decision on @tiktok_us @Oracle deal to come after DOJ/Treasury political appointments made; concern over role of former Treasury Secty Mnuchin negotiating w Trump ally Larry Ellison of $ORCL." (MNI)

GEOPOLITICS: The United States will not hesitate to use force if necessary to protect its people and allies, President Joe Biden said Wednesday. "As your commander in chief, I will never hesitate to use force to defend the vital interests of American people, and our allies around the world when necessary," Biden said during his visit to the Pentagon. "The central indispensable mission of the Department of Defense is to deter aggression from our enemies, and, if required, to fight and win wars to keep America safe," he added. Still, Biden said the use of force must always be the last resort. (Yonhap)

GEOPOLITICS: Japanese Foreign Minister Toshimitsu Motegi and U.S. Secretary of State Antony Blinken agreed Wednesday they will work together to address China's unilateral attempts to change the status quo. The two ministers, talking over the phone, shared concerns over such moves by China, including the recent enactment of a law allowing coast guard ships to fire on foreign vessels. Motegi and Blinken agreed that Japan, the United States, Australia and India will strengthen cooperation to ensure a free and open Indo-Pacific region. (jiji)

GEOPOLITICS: President Joe Biden announced Wednesday that he will impose sanctions on military leaders in Myanmar who directed the coup that deposed and detained its elected leader Aung San Suu Kyi, President Win Myint and others. Biden also said the Myanmar's "military must relinquish the power it seized" on Feb. 1, and to release its prisoners. (CNBC)

GLOBAL TRADE: French President Emmanuel Macron suggested to President Joe Biden two weeks ago that the countries seek a negotiated settlement in the Boeing-Airbus conflict over aircraft manufacturing that has lasted nearly two decades, according to a person familiar with the matter. (CNBC)

CORONAVIRUS: The dominant coronavirus variant in the U.K. is becoming more resistant to vaccines, scientific experts have warned. Two leading scientists in the U.K. warned Wednesday that the variant of the virus first identified in Kent has acquired the same E484K mutation on its spike protein that makes the South Africa variant so worrying for experts. (POLITICO)

CORONAVIRUS: The World Health Organization may clear AstraZeneca's COVID-19 vaccine for emergency use as early as this week, a Pan American Health Organization (PAHO) official said on Wednesday. (RTRS)

CORONAVIRUS: AstraZeneca has enlisted German drug manufacturer IDT Biologika to help boost production of its Covid-19 vaccine and tackle supply shortages in Europe. Relations between the EU and AstraZeneca deteriorated after the pharma group announced last month that it would fall far short on its promise to deliver the bloc at least 100m doses of the vaccine, developed with Oxford university, in the first quarter. AstraZeneca has since revised its first-quarter delivery forecast up from 31m to 40m doses, and announced that it would expand manufacturing capacity in Europe. (FT)

CORONAVIRUS: Merck & Co. is in talks with governments, public-health authorities and companies to potentially help with manufacturing Covid-19 vaccines already authorized, a company spokesman said. The discussions mean Merck could play an even larger role in responding to the pandemic, beyond its current effort in advancing two potential Covid-19 therapies, according to Merck. Helping manufacture Covid-19 vaccines could also allow the Kenilworth, N.J.-based company to remain involved in the global vaccination drive. Last month, Merck scrapped its two vaccine programs after disappointing results in clinical trials. "We believe we have an important responsibility to contribute to the pandemic response and remain at the ready to do so," the spokesman said. (Dow Jones)

CORONAVIRUS: NIAID director Anthony Fauci said during a White House briefing Wednesday that 20,000 pregnant women have been vaccinated against COVID-19 without complications. The new figure comes weeks after the World Health Organization altered its guidance for pregnant women and inoculation to say those at high risk of exposure to COVID-19, or who have comorbidities that increase their risk of severe disease, may be vaccinated, in line with CDC guidance. (Axios)

CORONAVIRUS: About 90 people were hospitalized with Covid-19-like symptoms in central China in the two months before the disease was first identified in Wuhan in late 2019, according to World Health Organization investigators, who said they pressed Beijing to allow further testing to determine whether the new virus was spreading earlier than previously known. Chinese authorities performed antibody tests on about two-thirds of those patients in the past two months, according to the investigators, and said they found no trace of infection by the virus. But members of the WHO team probing the pandemic's origins said any antibodies could have subsided to undetectable levels during the delay. "Further studies are needed," said Peter Ben Embarek, the food-safety scientist who led the WHO team, which wrapped up a four-week visit to China on Wednesday. (Dow Jones)

JAPAN: Yoshiro Mori on Thursday decided to step down as head of the Tokyo Olympics organizing committee amid a furor at home and abroad over his recent comments about women. (Nikkei)

AUSTRALIA: The economic recovery is probably "locked in" and the nation should shift to a "growth mindset" as vaccines are rolled out, Treasury secretary Steven Kennedy says. While it was necessary in the early days of the pandemic to "hold the place" together through JobKeeper wage subsidies, the time was now right to change tack, Dr Kennedy said on Thursday. Reviving weak non-mining business investment over the next one to two years through tax incentives was the key to transitioning from the strong "consumer-led" recovery to a broader-based economic revival, he told a parliamentary committee. (Australian Financial Review)

RBA: Reserve Bank board member Ian Harper said Australia's unemployment is too high and the economy has too much lost activity for monetary stimulus to be fueling excessive stock and property valuations. "The tendency of this to produce an asset-price bubble is way off where we're presently headed," said Harper, one of six independent directors on the RBA board, giving his personal views in an interview with Bloomberg News. "There's still plenty of excess capacity in the economy." Harper's remarks indicate that the RBA is in no hurry to call an end to its recently extended quantitative easing program on the current basis of asset prices. The speed of the economy's recovery both locally and globally and actions by other central banks are the main factors that will determine whether the program is extended again, he said. (BBG)

TURKEY: Greece has invited Turkey, and given dates, for attending further exploratory talks in Athens on the issue of their continental shelf and EEZ, and is waiting for a reply, Greek PM Kyriakos Mitsotakis says in interview with Greek Skai TV. (BBG)

TURKEY: State Department spokesperson Ned Price on Wednesday called for Turkey to immediately release the jailed Turkish philanthropist Osman Kavala and criticized as baseless charges against an American citizen that are included in Kavala's case. Kavala is one of a number of prominent figures amid thousands of individuals who were swept up in mass arrests by the Turkish government following the failed 2016 coup attempt against Turkish President Recep Tayyip Erdoğan. (The Hill)

MEXICO: Mexico, which became the first country outside China to authorise the CanSino Biologics' Covid-19 vaccine, has also authorised another Chinese jab – the Sinovac vaccine – bringing to five the number of vaccines accepted for use in the country. Martha Delgado, a foreign ministry undersecretary, told a radio interviewer that the Sinovac and CanSino vaccines had been authorised on Tuesday, joining the BioNTech/Pfizer, Oxford/AstraZeneca and Sputnik V jabs that have been cleared for use in Latin America's second biggest economy. (FT)

BRAZIL: Brazil's congress approved legislation that grants the central bank its long-sought formal autonomy, while adding a full-employment goal to its main inflation target. The bill's main text was approved in a final lower house vote by 339 votes in favor and 114 against. All amendments were rejected. The proposal is now set to be signed into law by President Jair Bolsonaro, with no date scheduled. "It's a victory for congress and an important step for the economy of Brazil," Congressman Silvio Costa Filho, the bill's rapporteur, wrote on Twitter. "With this we can guarantee price stability, inflation control, greater allies in job creation." (BBG)

SOUTH AFRICA: South Africa aims to immunise between 350,000 and 500,000 health workers with Johnson & Johnson's COVID-19 vaccine in an "implementation study" to further evaluate the shot, the president of the country's Medical Research Council said. Glenda Gray, co-lead investigator on the local leg of a J&J global trial, told Reuters South Africa expected to get batches of around 80,000 doses every seven to 14 days for the study, once it is approved. The implementation study would be aimed at further evaluating J&J's vaccine in the field and would be akin to a phase IIIb study, Gray said. J&J's vaccine has already been tested in the global phase III trial involving more than 40,000 participants including over 6,000 in South Africa. (RTRS)

SOUTH AFRICA: South Africa's Cabinet approved the extension of the country's so-called state of disaster by a month until March 15 to allow the continued implementation of measures related to the coronavirus. (BBG)

SOUTH AFRICA: Eskom has announced there will be no load shedding on Thursday, February 11, 2021, as generation capacity has sufficiently improved. The power utility had implemented Stage 3 load shedding from 13:00 on Wednesday until 06:00 the next morning, citing the loss of generation units. "Over the past 24 hours, Eskom teams successfully returned our generation units to service, helping ease the capacity constraints sufficiently to enable us to not require load shedding. Another five units are expected to return to service during the next two days," the power utility's spokesperson Sikonathi Mantshantsha said in a statement. (The South African)

IRAN: Iran has carried out a major new breach of the 2015 nuclear accords, producing a material than can be used to form the core of a nuclear weapon as it seeks to escalate pressure on the Biden administration to lift sanctions. A confidential report by the United Nations atomic agency, seen by The Wall Street Journal, said Iran had started producing uranium metal on Feb. 6 at a nuclear facility in Isfahan that is under the agency's inspection. (WSJ)

IRAN: The United States has sold more than a million barrels of Iranian fuel seized under its sanctions program last year, a Department of Justice official said, as another ship with intercepted Iranian crude oil sails to a U.S. port. (RTRS)

CHINA

CORONAVIRUS: Health authorities in China reported no locally transmitted Covid-19 cases for a fourth day following strict policies imposed to control a series of outbreaks. The country imposed lockdowns and rolled out multiple mass testing programmes in a string of northern cities last month to control the spread of the virus ahead of the lunar new year. One person was found to be infected in Jilin province but showed no symptoms. China does not include asymptomatic cases in its official tally. (FT)

SOES: Embattled Chinese chipmaking conglomerate Tsinghua Unigroup is looking to sell part of its stake in its Unisoc unit to raise cash, a move which could also help revive plans for an initial public offering of the key mobile chip affiliate, four people familiar with the development said.

EQUITIES: An executive at Tencent Holdings Ltd., China's most valuable publicly listed company, has been held by Chinese authorities, part of a probe into a high-profile corruption case involving one of the country's former top law-enforcement officials, people familiar with the matter said. (BBG)

OVERNIGHT DATA

NEW ZEALAND JAN CARD SPENDING RETAIL -0.4% M/M; DEC -0.6%

NEW ZEALAND JAN CARD SPENDING TOTAL -1.2% M/M; DEC -0.6%

UK JAN RICS HOUSE PRICE BALANCE 50%; MEDIAN 60%; DEC 63%

MARKETS

SNAPSHOT: Xi-Biden Call Fails To Introduce Anything Fresh As LNY Gets Underway

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 5.302 points at 6851.6

- Shanghai Comp. is closed

- JGBs are closed

- Aussie 10-Yr future up 2.5 ticks at 98.800, yield down 3.4bp at 1.188%

- U.S. 10-Yr future +0-01 at 136-30+, cash Tsys are closed

- WTI crude down $0.28 at $58.40, Gold down $6.91 at $1835.95

- USD/JPY up 2 pips at Y104.61

- FAMILIAR RHETORIC DEPLOYED IN FIRST BIDEN-XI CALL

- JOE BIDEN CREATES PENTAGON TASK FORCE ON CHINA (FT)

- SENIOR OFF'L: U.S. TO LOOK AT MORE RESTRICTIONS ON TECH EXPORTS TO CHINA (RTRS)

- FED CHAIR POWELL: STRONGER JOBS WON'T PROMPT FED HIKES (MNI)

- BIDEN CONSIDERING LISA COOK FOR OPEN FED SEAT (AXIOS)

- EU REBUFFS U.K. CALL TO RESET POST-BREXIT RELATIONSHIP (BBG)

BOND SUMMARY: Core FI Looks Through Biden-Xi Call, While Holidays Sap Liquidity

T-Notes remain stuck in the 0-02 range established early in Asia-Pac hours, last +0-01 at 136-30+, looking through the communique surrounding the Biden-Xi phone call, with no smoking guns revealed. Ahead of the call a senior U.S. official told RTRS that "President Joe Biden's administration will look at adding "new targeted restrictions" on certain sensitive technology exports to China in cooperation with allies." Flow remained sub-par owing to the earlier flagged holidays evident across the Asia-Pac region, with cash Tsys closed until London hours on the back of a Japanese holiday. T-Notes have seen ~55K lots trade on the day.

- Aussie bond futures ticked along in a narrow range during Sydney hours, with no reaction to the communique surrounding the phone call between the U.S. & Chinese Presidents. YM -0.5, XM +3.0 last, as the curve flattens, with swaps wider vs. ACGBs across most of the curve. On the central bank front a BBG interview with RBA board member Harper saw focus fall on the remaining excess capacity in the Australian economy, while he played down the risk of asset bubbles. On QE, Harper noted that the pace of the economic recovery, in both local and global terms, in addition to actions by other central banks are the main factors that will determine whether the Bank's bond buying scheme is extended again. Elsewhere, the space looked through comments made by Australian Treasury Secretary Kennedy (who also sits on the RBA board), as he noted that the country's economic recovery is probably "locked in" and the nation should shift to a "growth mindset."

EQUITIES: Quiet Amid Lack Of Catalysts, Market Closures

Most Asia equity markets are closed for the Lunar New Year holiday, news flow has been extremely thin in the time zone. In Australia the ASX 200 is flat, hovering around neutral levels throughout the session.

- US futures are subdued, in minor positive territory after equity markets dropped for a second day yesterday.

- During the session there were reports that US President Biden had spoken with his Chinese counterpart Xi about trade and other issues. A senior administration official said in the wake of the call that the US would not remove all tariffs on China prematurely, but there would be changes in trade policy.

OIL: Rally Pauses

Crude futures are in negative territory in Asia, oil managed to squeeze out gains yesterday after seeing losses early on. WTI is down around $0.37 at $58.31, brent is down $0.41 at $61.06. Yesterday US DOE stockpile data showed headline inventories declined by 6.65m/bbls against estimates for an 800k/bbl draw. The data showed that in downstream products gasoline stocks rose for the third consecutive week to the tune of 4.3m/bbls. News flow in Asia has been light with many markets away for LNY.

GOLD: Tight After 50-EMA Capped On Wednesday

The yellow metal has seen little net movement over the last 24 hours or so, with spot ~$5/oz softer on the day at typing, a touch above the $1,835/oz mark after a brief foray above $1,850/oz on Wednesday. From a technical perspective bulls now look for a break above the 50-day EMA after failing to print above that metric yesterday. U.S. real yields are flat to a little lower across the curve over the last 24 hours, with the DXY showing little net change over that horizon.

FOREX: Market Closures Limit Activity In Asia

Light pressure emerged on safe haven currencies as e-minis erased early losses in what was a very quiet Asia-Pac session, as a number of market closures across the region put markets in a lull. The DXY softened, consolidating below its 50-DMA.

- NZD cemented its position as the worst G10 performer this week (on a par with USD). The kiwi's wings were clipped by weak NZ card spending data, albeit the currency clawed back initial losses towards the London morning tracking gains in AUD.

- USD/JPY held a tight range with Japan off for the National Foundation Day, establishing itself above the 100-DMA, which limited losses yesterday. Worth noting that $1.1bn of options with strikes at Y105.00-05 expire at today's NY cut, with spot currently trading at Y104.59.

- Lunar New Year holidays kicked off in China and USD/CNH tread water, ignoring headlines re: U.S. Pres Biden's phone call with Chinese Pres Xi.

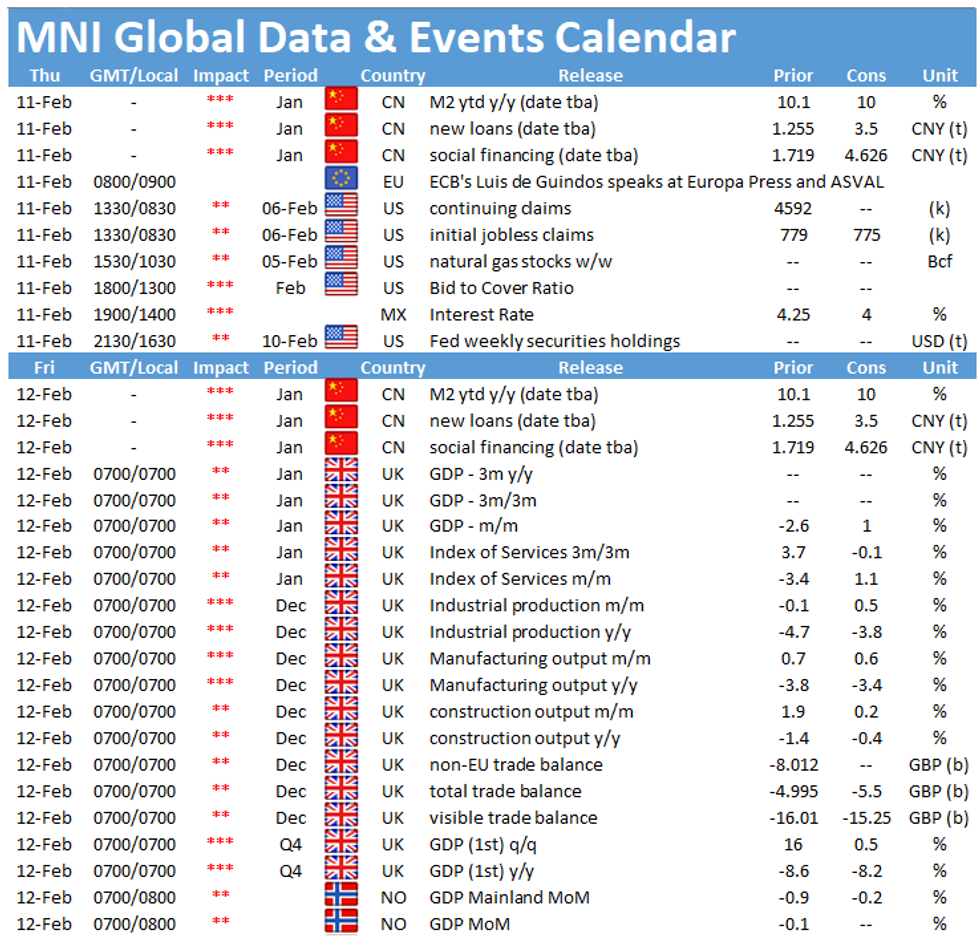

- U.S. initial jobless claims headline the data docket today. Speeches are due from ECB's de Guindos, Villeroy & Knot, while the European Commission will release its economic forecasts.

FOREX OPTIONS: Expiries for Feb11 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1955-65(E517mln), $1.1985-95(E800mln), $1.2100(E459mln)$1.2280(E607mln)

- USD/JPY: Y105.00-05($1.1bln), Y105.75($2.1bln), Y106.05-10($600mln)

- EUR/GBP: Gbp0.8765-80(E886mln)

- AUD/JPY: Y79.00(A$659mln), Y80.73-75(A$1.0bln)

- AUD/USD: $0.7650-60(A$591mln), $0.7675(A$558mln)

- USD/MXN: Mxn20.88($700mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.