-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: EZ PMIs Await

EXECUTIVE SUMMARY

- WHITE HOUSE: BIDEN TO FOCUS ON COVID-19, CHINA AT G7'S FRIDAY MEETING (RTRS)

- YELLEN: EXPECT CHINA TO ADHERE TO TRADE COMMITMENT, WILL LOOK AT TARIFFS (RTRS)

- ECB SAID TO WEIGH DISCLOSING CLIMATE RISK IN BOND PROGRAMS (BBG)

- ECB'S LAGARDE: COUNTRIES MUST NOT 'BRUTALLY' PULL STIMULUS (CNN)

- PBOC KEEPS NEUTRAL STANCE ON MONETARY POLICY DESPITE DRAIN (CSJ)

- ISRAELI STUDY FINDS PFIZER VACCINE 85% EFFECTIVE AFTER FIRST SHOT (RTRS)

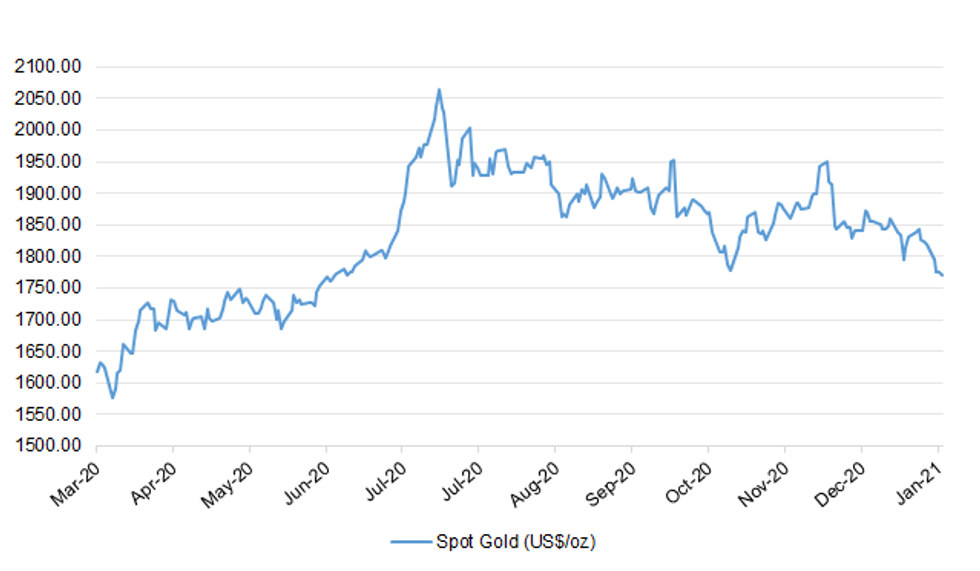

Fig. 1: Spot Gold (US$/oz)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Vaccines appear to cut Covid transmissions and infections by two-thirds according to the first "real world data" examining their impact, The Telegraph can disclose. Key data being handed to Boris Johnson as he finalises a roadmap out of lockdown shows that just one dose of either the Oxford or Pfizer vaccines has such an effect on all age groups. Mr Johnson and his scientific advisers are expected to examine key findings showing the impact of the jabs on transmission, infection, hospitalisations and deaths. Whitehall sources said the studies would be a crucial part of deliberations over Britain's route out of lockdown and that all the findings so far were "very encouraging". Separate data shows that Covid cases are falling most rapidly among the oldest, with care home outbreaks almost halving in a week. (Telegraph)

CORONAVIRUS: Britons as young as 40 could be offered a jab within a few weeks, the Mail can reveal. Government advisers are set to recommend the next phase of the vaccine rollout continues on the basis of age, rather than prioritising key workers. But the age brackets will be wider than before – meaning 40 to 49-year-olds are likely to be invited to have a jab once the 32million people in the top nine groups have had their first dose. Earlier this week t emerged this target could be hit as soon as March 24, if the daily average is maintained. This would mean the over-40s being invited for a jab in less than five weeks. It would be a huge boost for Britain's vaccine programme and could add to the pressure on ministers to ease the lockdown sooner. (Daily Mail)

CORONAVIRUS: Age should be by far the dominant factor in deciding how to prioritise the ongoing coronavirus vaccine rollout, the head of the Government's advisory committee has said. Prof Wei Shen Lim, the chairman of the joint committee on vaccination and immunisation (JCVI), said more lives would be saved by targeting age groups than by any other factor. It comes as the committee is poised to advise ministers on how to distribute jabs in the next phase of the rollout amid calls to prioritise categories of worker such as teachers and police officers. (Telegraph)

CORONAVIRUS: Voters support the plan to reopen schools in England on 8 March, according to a new poll – but think that should be the only easing of lockdown to take place in the next six weeks. The survey for i by Redfield & Wilton Strategies finds the British public is cautious about easing the rules which restrict shopping, socialising and hospitality venues despite pressure on Boris Johnson to move faster as Covid-19 cases continue to fall and the coronavirus vaccine is rolled out. The Prime Minister Boris Johnson is likely to confirm on Monday that schools will reopen to all pupils two weeks later. Asked if they approve of the decision, 52 per cent of those polled said they did with 28 per cent opposing it. Among those who think schools should not open then, nearly said it was because that date is too soon rather than too late. (i)

CORONAVIRUS: Northern Ireland's lockdown will be extended to 1 April but some children will return to school earlier, First Minister Arlene Foster has confirmed. Speaking at a news conference, Mrs Foster said the Northern Ireland Executive had decided that "a full lifting of the current restrictions is not possible at this point". The Executive had "reluctantly" accepted the advice of scientists that coronavirus measures needed to be in place for longer, she added. (Sky)

CORONAVIRUS: Ministers and officials working on plans for easing the lockdown are increasingly optimistic that Britons will be able to go on foreign holidays this summer, The Times has been told. The government is considering internationally recognised vaccination passports that will allow people to travel and is in talks with holiday destinations, such as Greece, about how they will work. (The Times)

CORONAVIRUS: Airlines have urged Boris Johnson to include a plan for the resumption of international travel when he sets out a roadmap out of lockdown next week. (FT)

FISCAL: Rishi Sunak is set to extend two crucial lifelines to companies battered by ongoing Covid restrictions by keeping the furlough scheme going until the summer and prolonging the business rates holiday for the retail, hospitality and leisure sectors. (Telegraph)

BREXIT: Lord Frost has been tasked with taking on the European Union over its "heavy-handed" approach to the Northern Ireland protocol, The Telegraph understands. (Telegraph)

POLITICS: Millions of savers would be given a chance to invest in the UK's recovery from the coronavirus crisis, under proposals set out by Sir Keir Starmer. The Labour leader's British Recovery Bond scheme is the centrepiece of his alternative plan for "national recovery", ahead of 3 March's Budget. He also proposed start-up loans for 100,000 new small firms, especially in areas outside the South-East. The Conservatives said Sir Keir had stolen most of his ideas from them. Chancellor Rishi Sunak will set out the government's plans to haul the UK economy out of the deepest recession in 300 years in his Budget speech next month. (BBC)

EUROPE

ECB: The European Central Bank is strongly considering disclosing climate risks in its bond programs and will now focus on collecting the data that will help achieve that, according to officials familiar with the matter. ECB policy makers discussed the issue in a meeting on Wednesday as part of the central bank's strategic review, said the officials, who asked not to be identified. There was also broad agreement during the seminar on incorporating climate risks in the institution's economic analysis. The plan marks another step toward a strategy for aiding the fight against climate change without the ECB being dragged into political debates that risk undermining its price-stability mandate by diverting its focus from inflation. (BBG)

ECB: Some politicians are worried that countries will borrow too much to prop up the economy over the coming year. Christine Lagarde doesn't share their concerns. The European Central Bank president told CNN Business' Richard Quest on Thursday that her biggest fear isn't that the European Union will accumulate a mountain of debt, but that governments could "brutally" withdraw job guarantees and income support before the time is right. Such programs, she said, must be eased "gradually" and with care. "That's the moment which I think is the most difficult, the most subtle, and where judgment will have to be applied," Lagarde said in the interview. (CNN)

FISCAL: MNI EXCLUSIVE: Eurozone Seen Extending Debt Rule Waiver To 2022

- The European Union is likely to extend a waiver of public borrowing rules under the eurozone's Stability and Growth Pact throughout 2022, but the bloc's overall fiscal stimulus is still set to decline next year, EU sources close to the discussions among finance ministers told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

GERMANY: Germany's health minister is demanding more government money for his department next year, a government source told Reuters, stretching the public finances as tax revenues dwindle. Health Minister Jens Spahn is demanding an additional 25.8 billion euros ($31 billion) in the 2022 budget, the source told Reuters. Labour Minister Hubertus Heil also wants 10 billion euros more for pension insurance for the year after next. The cabinet is due to decide on the main points of the 2022 budget in March. The total federal budget for this year is 498.62 billion euros. (RTRS)

FRANCE: The French state should gradually reduce financial support to the economy over the coming year as coronavirus safety measures are lifted, Bank of France Governor Francois Villeroy de Galhau said in an interview with French daily Les Echos. "It will have to be done without rush, but without fear as well", Villeroy said. Villeroy told Les Echos that there was no risk of overheating in the European economy. "Long-term interest rates (in the United States) seem to be rising as a consequence of the announcement of the Biden administration's $1,900 billion economic recovery plan. Talking about overheating and a sustained rebound of inflation in the U.S. seems premature at the least; and there is no risk of this kind in Europe," he said. (RTRS)

ITALY/BTPS: Italy plans to sell up to 2.5 billion euros ($3 billion) of zero bonds due Sep 28, 2022 in an auction on Feb 23. (BBG)

SPAIN: Spain is hoping to entice people to prepare for retirement with a voluntary saving plan as it tries to wean them off relying solely on state pensions. The aim is to set up a fund run by private investment companies by the end of the year, offering Spaniards an affordable alternative to supplement their public pension. But unlike some other countries, the system will require workers to opt in rather than being automatically enrolled. "We think there's a group of middle- and low-income Spaniards who will be interested in a boost to their lifetime savings, which can complement their public pension," Jose Luis Escriva, the social security minister for Spain's Socialist-led government, said in an interview. (BBG)

BELGIUM: A majority in the lower house of the Dutch parliament voted for a temporary emergency law that allows for a curfew to stay in place, just two days after a local court ruled the hotly-debated measure should be lifted. The bill tabled by the caretaker government of Prime Minister Mark Rutte will now move to the Senate, which is scheduled to vote on Friday. The nighttime curfew in The Netherlands was introduced on Jan. 23, triggering a few days of riots in many Dutch cities. The Senate vote will be on the same day as a government appeal against the ruling that ordered an immediate end to the curfew, which was recently extended by Rutte until early March to battle new, more contagious strains of the coronavirus. Another court postponed the implementation pending the appeal. When the court will rule on the appeal is not yet known. (BBG)

NORWAY: MNI BRIEF: Norges Olsen: Financial Risk To Justify Tightening

- Norges Bank Governor Oystein Olsen said Thursday that "room for manoeuvre in monetary policy is nearly exhausted," policy makers did not envisage any further cuts in the zero percent policy rate, and rates would move higher once there were clear signs the economy was returning to normal - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

NORWAY: Norway's central bank governor urged politicians to be more cautious in spending the returns from its $1.3 trillion wealth fund after it posted a banner year. The Oslo-based fund "has enjoyed several years of solid returns — above the returns expected," Norges Bank's Oystein Olsen said in his annual speech on Thursday, echoing recent comments from Nicolai Tangen, the fund's chief executive. "This does not mean that we should revise up expected future returns — perhaps the opposite." (BBG)

RATINGS: Sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Luxembourg (current rating: AAA; Outlook Stable) & Turkey (current rating: BB-; Outlook Negative)

- S&P on Estonia (current rating: AA-; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

U.S.

FISCAL: The House aims to pass its $1.9 trillion coronavirus relief plan before the end of February as Democrats race to beat a deadline to extend key unemployment programs, Speaker Nancy Pelosi said Thursday. The California Democrat told reporters she hopes for a vote "sometime at the end of next week." House leaders will stay in touch with the Senate about what Congress can include in the aid package under budget reconciliation, which enables Democrats to approve the plan without Republican votes, Pelosi added. (CNBC)

FISCAL: Treasury Secretary Janet Yellen defended the need for $1.9 trillion in pandemic-relief spending -- the second-largest emergency aid bill on record -- even with recent strength in retail sales and U.S. stock values. "It's very important to have a big package that addresses the pain this has caused," Yellen said on CNBC Thursday. "The price of doing too little is much larger than the price of doing something big." The Treasury chief, asked if the economy needs President Joe Biden's full package after much stronger-than-expected retail sales in January and record highs in equities, said, "I think it does." (BBG)

FISCAL: Treasury Secretary Janet Yellen said Thursday that any tax increases sought by the Biden administration to help pay for big-ticket spending would be introduced gradually. Yellen, who spoke to CNBC's "Closing Bell," added that the proposed tax increases would likely come later in 2021 as part of a larger legislative package. It would "involve spending and investments over a number of years" in agenda items such as education and infrastructure, the Treasury chief said. "And probably tax increases to pay for at least part of it that would probably phase in slowly over time." (CNBC)

FISCAL: A group of Democrats on the House Ways and Means Committee on Thursday urged the IRS to extend the tax-filing season beyond the current April 15 deadline in light of the coronavirus pandemic. "It has come to our attention that, due to the ongoing pandemic, many Americans continue to face the same challenges that necessitated extending the filing season last year," the lawmakers wrote in a letter to IRS Commissioner Charles Rettig. (The Hill)

CORONAVIRUS: The US is beginning to experience a more sustained downward trend in coronavirus deaths, catching up with hospitalisations and new cases that are hovering around their lowest levels in months. States attributed a further 2,616 fatalities to coronavirus, according to Covid Tracking Project data on Thursday, up from 2,348 on Wednesday. According to Covid Tracking Project, the seven-day average of deaths — at 1,998 — is below the 2,000 threshold for the first time since December 4. In arriving at that number, the data aggregator said it "removed major death backlogs reported by [Ohio] and [Indiana]." The backlogs reported this month by those two states — 1,507 historical deaths in Indiana and about 4,000 previously unreported fatalities in Ohio — have been added to the cumulative totals, helping push the national death toll since the start of the pandemic to 483,223. The number of people in US hospitals with coronavirus edged lower to 62,300, the lowest level of hospitalisations since November 10. States reported an additional 66,824 new infections, almost on par with the 66,839 on Wednesday. Covid Tracking Project again said the recent winter storms that have affected several parts of the US are probably affecting data reported by states. (FT)

CORONAVIRUS: Friday vaccination appointments for about 12,500 people across Los Angeles will be postponed due to delivery delays caused by severe winter storms across the US, the mayor's office said. (FT)

CORONAVIRUS: The winter storm and power outages across Texas pose a "significant" problem for Covid-19 vaccine distribution, White House Chief Medical Advisor Dr. Anthony Fauci warned Thursday. "Well, obviously it's an issue. It's been slowed down in some places going to a grinding halt," Fauci said during an interview with MSNBC's Andrea Mitchell. "We're just going to have to make up for it as soon as the weather lifts a bit, the ice melts and we can get the trucks out and the people out." (CNBC)

CORONAVIRUS: President Joe Biden's prediction that the United States could return to some semblance of normalcy by Christmas is "a reasonable answer," a senior advisor on the president's Covid-19 response team told the Washington Post. But White House Covid advisor Andy Slavitt said he's reluctant to give a timeline for when things could return to normal, warning there are still plenty of unknowns. The biggest issues that could undermine teh forecast are new, emerging variants as well as vaccine hesitancy in the U.S. and elsewhere. "There's a lot we don't know about the future," he said. "We are trying not to give a false sense of security or a false sense of precision when none exists. And I know that makes people less comfortable, but I also know people want to be leveled with and they want to be told the truth." (CNBC)

CORONAVIRUS: The U.S. vaccine supply is poised to double in the coming weeks and months, according to an analysis by Bloomberg, allowing a broad expansion of doses administered across the country. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention's long-awaited guidance on how to safely reopen schools during the pandemic could end up keeping kids out of the classroom longer than necessary, four doctors who reviewed the guidance told CNBC. (CNBC)

CORONAVIRUS: Massachusetts Governor Charlie Baker said he's considering sending National Guard troops to pick up the state's next vaccine shipments to avoid any delay from bad weather. He said the doses are warehoused in Tennessee and Kentucky. (BBG)

BUSINESS: The U.S. Department of Labor is expected to announce that it will not enforce Trump administration rules that curb investments based on environmental and social factors, and which limit shareholder voting in corporate meetings, according to two people familiar with the matter. A department spokesman declined to comment on Thursday. (RTRS)

EQUITIES: Treasury Secretary Janet Yellen told CNBC on Thursday that there could be parts of the U.S. stock market in which investors should exercise caution. In an interview that aired on "Closing Bell," Yellen said she believes higher equity valuations are understandable given the accommodative monetary policy from the Federal Reserve. "Well, partly we're in a very low interest rate environment," Yellen said. "And while valuations are very high, in a world of very low interest rates, price earnings, tight multiples tend to be high. That said there, you know, may be sectors ... where we should be very careful," added Yellen, who took over as Treasury chief in late January under President Joe Biden. (CNBC)

EQUITIES: House Democrats sparred with the leaders of Robinhood Markets and Citadel Thursday, with lawmakers pressing the firms on whether they're profiting at the expense of retail investors and complaining that they got few satisfying answers. At a closely watched Financial Services Committee hearing sparked by the frenzied trading in GameStop stock, Robinhood's Vlad Tenev and Citadel's Ken Griffin took fire on issues ranging from trading halts provoked by capital shortfalls to whether "free trades" are really free. While both were adamant that their businesses have helped small-time investors gain access to markets that have long been the domain of Wall Street, lawmakers were frequently dubious of the chief executives' often complex arguments. (BBG)

EQUITIES: A lawsuit alleging Robinhood customers lost money due to outages of the company's trading service in March 2020 will move forward after a judge refused to throw it out. U.S. District Judge James Donato in San Francisco ruled that the customers have alleged an injury concrete enough for the suit to advance. The judge pushed the two sides hard to settle the litigation. "This is an unusual case in the sense that, as the plaintiffs have acknowledged, Robinhood has pretty much said this is a problem," Donato said. "There was ownership and apology, and that's 80% of the battle in most cases." (BBG)

OTHER

U.S./CHINA: The United States is in the process of evaluating its approach to China, but tariffs imposed on Chinese goods by the former Trump administration will remain in place for now, Treasury Secretary Janet Yellen told CNBC on Thursday. "For the moment, we have kept the tariffs in place that were put in by the Trump administration, ... and we'll evaluate going forward what we think is appropriate," she said, adding that Washington expected Beijing to adhere to its commitments on trade. (RTRS)

G7: U.S. President Joe Biden will discuss the worldwide response to the COVID-19 pandemic and efforts to rebuild the global economy in his meeting with G7 leaders on Friday, White House spokeswoman Jen Psaki said. Biden will also discuss the need to invest in collective competitiveness to tackle challenges posed by China, as well as climate change, Psaki told reporters at a new briefing on Thursday. Friday's virtual meeting is the Democratic U.S. president's first event with other world leaders in the group that includes Britain, Japan, France, Germany, Italy and Canada. (RTRS)

GEOPOLITICS: Any attempt by U.S. President Joe Biden to align G7 countries against China would not succeed as the alliance lacks solid common ground and the member states were not likely to change their positions on economic and currency cooperation with China, the Global Times reported citing Chen Fengying, a research fellow at the China Institutes of Contemporary International Relations. The state tabloid reported the comments ahead of a G7 virtual meeting on Friday. China has voiced opposition to group politics based on ideological divides, and advocated that global affairs should be collectively managed by different nations, the newspaper said citing the Chinese foreign ministry. (MNI)

GEOPOLITICS: The U.S. Senate intelligence committee will hold a hearing next week on the recent hack against the United States with executives from SolarWinds, Microsoft, FireEye and CrowdStrike, it said in a statement on Thursday. The Feb. 23 hearing comes after the White House's top cybersecurity adviser said the federal government's investigation into the sprawling Russian operation would likely take several more months. (RTRS)

GLOBAL TRADE: President Joe Biden will direct his administration to conduct a review of key U.S. supply chains, including those for semiconductors, high-capacity batteries, medical supplies and rare earth metals. The assessment, which will be led by members of Biden's economic and national security teams, will analyze the "resiliency and capacity of the American manufacturing supply chains and defense industrial base to support national security [and] emergency preparedness," according to a draft of an executive order seen by CNBC. The text of the executive order is being finalized and the ultimate language could vary from the current draft. (CNBC)

CORONAVIRUS: The first dose of Pfizer Inc and BioNTech's COVID-19 vaccine is 85% effective, a study of Israeli healthcare workers published in The Lancet medical journal has found. The research was conducted on more than 7,000 healthcare workers who were vaccinated at the Sheba Medical Centre in Israel. Researchers saw an 85% reduction of symptomatic COVID-19 between 15 and 28 days after they were given the vaccine. Overall infections, including among asymptomatic patients, were reduced by 75%. (RTRS)

CORONAVIRUS: A top Pfizer Inc scientist said on Thursday the company is in intensive discussions with regulators to test a booster shot version of its coronavirus vaccine specifically targeted for a highly contagious variant that is spreading widely in South Africa and elsewhere. Phil Dormitzer, one of Pfizer's top viral vaccine scientists, said in an interview that he believes the current vaccine - developed with Germany's BioNTech SE - is highly likely to still protect against the concerning variant first discovered in South Africa. "We're not doing that primarily because we think that that means that we're going to need to change that vaccine," he said. "It's primarily to learn how to change strain, both in terms of what we do at the manufacturing level, and especially what the clinical results are. (RTRS)

CORONAVIRUS: Pfizer and BioNTech have started an international study with 4,000 volunteers to evaluate the safety and effectiveness of their COVID-19 vaccine in healthy pregnant women, the companies said on Thursday. Pregnant women are at higher risk of developing severe COVID-19, and many public health officials have recommended some women in high-risk professions take coronavirus vaccines even without proof they are safe for them. Last week, the U.S. National Institutes of Health called for greater inclusion of pregnant and lactating women in COVID-19 vaccine research. (RTRS)

CORONAVIRUS: The Biden administration will pledge $4 billion to a coronavirus vaccination program for poorer countries in hopes of prying loose bigger donations from other governments, U.S. officials said on Thursday. U.S. President Joe Biden will use his first meeting with leaders of Group of Seven advanced economies on Friday to announce an immediate $2 billion donation to the COVAX program co-led by the World Health Organization, officials said. COVAX aims to ensure a fair supply of coronavirus vaccines around the world. The United States will provide the remaining $2 billion over the next two years as other nations fulfill and make their own pledges, the officials said. (RTRS)

CORONAVIRUS: The US will not any donate any coronavirus vaccine doses to developing countries until there is a plentiful supply of jabs in the US, Biden administration officials said on Thursday in a firm rejection of a proposal made by French President Emmanuel Macron. Macron told the Financial Times this week that Europe and the US should urgently donate up to 5 per cent of their current vaccine supplies to developing countries, including in Africa, where Covid-19 inoculation campaigns have barely started and China and Russia are offering to fill the gap. (FT)

CORONAVIRUS: Boris Johnson will pledge to donate a majority of the UK's surplus vaccine supply to poorer countries in a speech to a virtual G7 meeting on Friday. He will urge rich countries to back a new 100-day target for the development of new vaccines for future emerging diseases. The UK has ordered over 400m doses of various vaccines, so many will be left over once all adults are vaccinated. But anti-poverty campaigners say the UK is not doing enough. (BBC)

CORONAVIRUS: French President Emmanuel Macron has said Europe and the US should urgently allocate up to 5 per cent of their current vaccine supplies to developing countries where Covid-19 vaccination campaigns have scarcely begun and China and Russia are offering to fill the gap. (FT)

HONG KONG: It's necessary to improve Hong Kong's electoral system and implement the principle of "patriots ruling Hong Kong," Xinhua reports, citing Han Dayuan, a member of the 12-member parliamentary committee that oversees Hong Kong law. Electoral system is a key factor in safeguarding national security, and it's necessary to consider importance of election from the national security angle. (BBG)

JAPAN: Japanese health authorities have found more than 90 cases of a new variant of the COVID-19 virus, Chief Cabinet Secretary Katsunobu Kato says. The mutant variant, known as E484K, has been found in 91 cases in the Kanto area of eastern Japan and in two cases at airports. The variant is believed to have come from overseas but is different from those that originated in Britain and South Africa, according to Japan's National Institute of Infectious Diseases. (Nikkei)

BOJ: MNI POLICY: BOJ Sees Q1 Production To Be Weaker Than Expected

- Bank of Japan officials expect downward pressure on industrial production for the first quarter to be greater than they expected in January but see no need to change the bank's baseline view made in late January, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BOJ: The Bank of Japan will probably signal its readiness to lower its negative interest rate by pledging to mitigate any harmful impact such a move would have at a review next month, according to a former BOJ official in charge of monetary policy. "The BOJ likely wants to restore a rate cut as a viable option," Kazuo Momma said in an interview Thursday. "They can show it's viable by indicating any reduction of rates would be accompanied by measures to address its side effects." (BBG)

NEW ZEALAND: Treasury Dept says January NZ Activity Index rises 0.8% from year earlier, according to statement on website. Says growth is slower than in the previous months due to contradicting signals from the constituent indicators. Says electronic card spending and heavy traffic declined compared to January 2020, the PMI is at its highest level since August 2020 and is much higher than the same month last year. "The latest result may indicate that the recovery in activity following COVID-19 related disruptions, is starting to plateau." (BBG)

NEW ZEALAND: RBNZ published new residential mortgage lending data for December on website. Lending to all borrowers rises to record NZ$9.65b from NZ$9.29b in November. (BBG)

RBNZ: RBNZ will reinstate some statistics releases from Friday after they were delayed by a data breach that hit its file transfer system, according to a notice on the central bank's website. (BBG)

SOUTH KOREA: South Korea may consider a fifth round of COVID-19 cash handouts, the country's prime minister said, even as the details of a planned fourth cash payout have yet to be completed. When asked whether the country should take a targeted approach in the fifth round, Prime Minister Chung Sye-kyun told a local radio station that "it may vary depending on the situation of the time. "It can be paid in a more widely manner if the purpose of(the cash handout) is to boost the economy (rather than an emergency aid for some)," he said. Earlier this month, the nation's ruling party said it is planning to prepare a fourth round of cash handouts and an extra budget to support those affected by some tough social distancing measures, but the details and discussions with the government have yet been finalised. (RTRS)

NORTH KOREA: Diplomats of South Korea, the United States and Japan agreed to closely cooperate to achieve complete denuclearization and lasting peace on the Korean Peninsula in video talks Friday, the foreign ministry said. Seoul's top nuclear envoy, Noh Kyu-duk, Sung Kim, acting U.S. assistant secretary of state for East Asian and Pacific affairs, and Takehiro Funakoshi, director-general for Asian and Oceanian affairs at Tokyo's foreign ministry, held the conversation to discuss North Korea-related issues. (Yonhap)

CANADA: Canada has begun to accelerate its vaccine rollout after delivery disruptions became a major political headache for Prime Minister Justin Trudeau. In an update by public-health officials Thursday, the government announced the pace of deliveries of both the Pfizer Inc.-BioNTech SE and Moderna Inc. shots is ramping up as of this week. (BBG)

MEXICO: Mexico issued a warning on the alleged illegal application of Pfizer's vaccine in the state of Nuevo Leon, according to health agency Cofepris. The vaccine has not been authorized for sale to the private sector, so any substance acquired through an intermediary is false, it said. (BBG)

MEXICO: Mexico's government will inject between $1.3 billion and $1.6 billion into state oil company Petroleos Mexicanos (Pemex) this year and offer a tax break of 75 billion Mexican pesos ($3.68 billion), a senior official told Reuters on Thursday. The world's most indebted oil company, Pemex had more than $110 billion in financial debt at the end of the third quarter last year while its liabilities far exceeded its assets. In the past two years, the government of President Andres Manuel Lopez Obrador has injected billions of dollars in capital in the loss-making company and reduced its tax burden. (RTRS)

BRAZIL: Brazil became the third country in the world to breach 10 million coronavirus cases, with infections picking up speed in recent weeks as a new variant spreads amid a shortage of vaccines. Latin America's largest nation reported 51,879 new cases Thursday, pushing the total confirmed to 10,030,626, according to Health Ministry data. It's a toll that lags only the U.S. and India. Deaths rose by 1,367 to 243,457, the second- highest globally. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro criticized Petrobras for recent hikes in fuel prices, suggesting that "something will happen" at the state-run oil company in coming days, although not providing details. As of March 1, federal tax will no longer be applied on LGP prices, the said. Govt will also scrap federal tax on diesel for 2 months as of March 1. Plan is to study a definitive way to suspend the tax. U.S. dollar appreciation in Brazil creates insecurity and alienates investors. President said that if the dollar goes down, fuel prices are also likely to fall. In his view, U.S. dollar is currently in a high level and should return to around 5 reais. "Reducing gasoline prices is very difficult," he said. (BBG)

RUSSIA: The U.S. is likely to hold off sanctioning any German entities for now over the Nord Stream 2 gas pipeline from Russia, according to four people familiar with the matter, as the Biden administration seeks to halt the project without antagonizing a close European ally. A key report to Congress that was due last Tuesday could be out as soon as Friday, and it's expected to list only a small number of Russia-linked entities, according to the people, who asked not to be identified because the policy hasn't been announced. Nord Stream 2 emerged as a major source of friction in trans-Atlantic relations during President Donald Trump's administration as the project, which would bring Russian gas into the heart of Europe, neared completion. (BBG)

SOUTH AFRICA: A top coronavirus adviser to South Africa's government expects a slower vaccine roll-out than what has been officially mapped out. The start of the program was delayed this month after studies showed AstraZeneca Plc's shot, the first to arrive in South Africa, provided little protection against mild forms of the disease caused by a variant of the virus identified late last year. The government is targeting inoculating about 67% of South Africa's population this year in a phased program that aims to achieve herd immunity. That time-line may be too ambitious, said Salim Abdool Karim, who co-chairs the health minister's ministerial advisory committee on Covid-19. (BBG)

IRAN: The Biden administration said it would be willing to meet with Iran to discuss a "diplomatic way forward" in efforts to return to the nuclear deal that President Donald Trump quit in 2018, a move that may be intended as a sign of good faith to leaders in Tehran after four years of hostility under Trump. "The United States would accept an invitation from the European Union High Representative to attend a meeting of the P5+1 and Iran to discuss a diplomatic way forward on Iran's nuclear program," State Department spokesman Ned Price said in a statement Thursday. The P5+1 refers to the participants in the nuclear deal with Iran: China, Russia, France, the U.K., the U.S and Germany. (BBG)

METALS: Rio has secured a commercial freight shipping service connecting Western Australia's Pilbara iron ore region to Singapore, the company said in a statement -- a move it expects will lower the cost and delivery time of key supplies. (BBG)

OIL: The Texas oil patch is slowly restarting wells after a deep freeze that swept through the region shut a record amount of U.S. crude output. Marathon Oil Corp., Devon Energy Corp. and Verdun Oil Co LLC have begun using restored power from local grids or generators to restart oil output across the Eagle Ford shale basin that was shut by the frigid weather, according to people familiar with the matter, who asked not to be identified because the information isn't public. The companies began work to resume operations late Wednesday. Nobody can say exactly how long it will take to restore all supply lost. But oil traders and executives have said they hope most of the production lost will return within days as temperatures rise and power becomes available. They've warned that a small percentage may be shut down longer due to the need for repairs. (BBG)

OIL: Mexico is revamping its massive sovereign oil hedge, copying some of the tactics that U.S. shale producers use in an effort to keep its presence in the market under the radar and secure better prices. The changes are among the most important since Mexico introduced the modern version of the country's strategy to lock in prices for its crude, a closely watched deal that costs its government about $1 billion in fees to big banks and commodity traders. It's considered the largest annual deal of its kind on Wall Street. (BBG)

CHINA

PBOC: The Chinese central bank may keep liquidity in a balance "between tight and loose" in the near future, according to a front-page commentary in China Securities Journal. PBOC's current monetary policy stance remains neutral. Money market rates will continue to fluctuate around rates of open market operations. Monetary policy may be adjusted in the longer term if economic fundamentals improve. (BBG)

PBOC: The market should not overinterpret recent moves by the PBOC to drain liquidity from the market on the first post-holiday trading day this week, according to a commentary in Financial News, which is owned by the central bank. The commentary said the PBOC had signaled it intends to keep interest rates stable even as it unexpectedly drained CNY260 billion this week. The weighted average interest rate of DR007 remained stable at 2.23%, the newspaper added. The PBOC is focused on short-term benchmark rates while the amount of liquidity injected or drained in OMOs vary according to cash conditions, fiscal and market demand, the newspaper said. (MNI)

ECONOMY: Several Chinese provinces have set GDP targets of over 10% for 2021, while the majority have targeted over 6%, the state-run Economic Information Daily said in a front-page report. The targets were set in the regional parliamentary sessions for this year, the start of China's 14th 5-Year economic plan when regions are expected to compete and find new drivers for growth, the newspaper said. China's growth is expected to surge this year given the pandemic hindered normal economic expansion last year, the Daily said. Local authorities are also seeking to boost expansion in higher-value sectors including innovation and the digital economy. (MNI)

OVERNIGHT DATA

JAPAN JAN CPI -0.6% Y/Y; MEDIAN -0.7%; DEC -1.2%

JAPAN JAN CPI EX-FRESH FOOD -0.6% Y/Y; MEDIAN -0.6%; DEC -1.0%

JAPAN JAN CPI EX-FRESH FOOD & ENERGY +0.1% Y/Y; MEDIAN +0.0%; DEC -0.4%

MNI POLICY: Japan Jan CPI Drop Slows But No Impact On BOJ View

- The slower pace of the decline in Japan's December core consumer price index was no surprise to Bank of Japan officials who expected downward pressure on prices after the temporary suspension of the government's Go To Travel campaign, MNI understands. Bank officials maintain the view that the inflation rate is expected to be in negative territory in the present context, and expect downward pressure on prices to increase even if the government resumes the campaign after the state of emergency is lifted - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN FEB, P JIBUN BANK MANUFACTURING PMI 50.6; JAN 49.8

JAPAN FEB, P JIBUN BANK SERVICES PMI 45.8; JAN 46.1

JAPAN FEB, P JIBUN BANK COMPOSITE PMI 47.6; JAN 47.1

The Japanese private sector economy continued to deteriorate in February, as the latest flash PMI data signalled a further decline in business activity. New orders also fell solidly, led by weaker domestic demand. The latest data pointed to some brighter spots. New export orders stabilised in February following 26 consecutive contractions. Employment levels expanded slightly, signalling job creation in the Japanese private sector for the first time in 12 months. Input price inflation continued at a similar pace to January, however prices charged for Japanese goods and services reduced at a slightly quicker pace. Businesses were optimistic that business conditions would improve in the coming 12 months. Positive sentiment stemmed from hopes that an end to the coronavirus disease 2019 (COVID-19) pandemic would induce a recovery in domestic and foreign demand. Nonetheless, disruption caused by the pandemic is likely to remain in the immediate future. (IHS Markit)

AUSTRALIA JAN, P RETAIL SALES +0.6% M/M; MEDIAN +2.0%; DEC -4.1%

AUSTRALIA FEB, P IHS MARKIT MANUFACTURING PMI 56.6; JAN 57.2

AUSTRALIA FEB, P IHS MARKIT SERVICES PMI 54.1; JAN 55.6

AUSTRALIA FEB, P IHS MARKIT COMPOSITE PMI 54.4; JAN 55.9

A key positive from the flash PMI data for Australia is the strongest pace of job creation since late-2018. This was a response not only to sustained growth of new orders, but also signs of capacity pressures returning and greater confidence in the future outlook. On a less positive note, growth in the economy has been accompanied by stronger inflationary pressures. Input costs rose at the sharpest pace in almost five years of data collection, with output price inflation also quickening. This has the potential to limit the pace of the recovery going forward. Another factor potentially putting the brakes on growth, particularly in the manufacturing sector, is the ongoing disruption to supply chains amid global shipping problems which showed no sign of letting up. Supplier lead times lengthened to the greatest extent in three months in February. (IHS Markit)

NEW ZEALAND Q4 PPI OUTPUT +0.4% Q/Q; Q3 -0.3%

NEW ZEALAND Q4 PPI INPUT +0.0% Q/Q; Q3 +0.6%

SOUTH KOREA JAN PPI +0.8% Y/Y; DEC +0.2%

SOUTH KOREA Q4 SHORT-TERM EXTERNAL DEBT $157.5BN; Q3 $144.1BN

UK FEB GFK CONSUMER CONFIDENCE -23; MEDIAN -26; JAN -28

CHINA MARKETS

PBOC NET DRAINS CNY80 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged on Friday. This resulted in a net drain of CNY80 billion given the maturity of CNY100 billion of reverse repos today, according to Wind Information. The operation aims to maintain reasonable and ample liquidity, as cash returns to the banking system after the Chinese New Year holiday, the PBOC said on its website.

CHINA SETS YUAN CENTRAL PARITY AT 6.4624 FRI VS 6.4536 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a second day at 6.4624 on Friday. This compares with the 6.4536 set on Thursday.

MARKETS

SNAPSHOT: EZ PMIs Await

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 269.16 points at 29962.1

- ASX 200 down 92.072 points at 6793.8

- Shanghai Comp. down 0.404 points at 3673.965

- JGB 10-Yr future down 13 ticks at 151.17, JGB 10-Yr yield up 0.4bp at 0.101%

- Aussie 10-Yr future down 6.5 ticks at 98.565, Aussie 10-Yr yield up 6.6bp at 1.433%

- U.S. 10-Yr future down 0-01+ tick at 135-26, U.S. 10-Yr yield down 0.34bp at 1.2922%

- WTI crude down $0.84 at $59.68, Gold down $5.51 at $1,770.18/oz

- USD/JPY down 11 pips at Y105.58

- WHITE HOUSE: BIDEN TO FOCUS ON COVID-19, CHINA AT G7'S FRIDAY MEETING (RTRS)

- YELLEN: EXPECT CHINA TO ADHERE TO TRADE COMMITMENT, WILL LOOK AT TARIFFS (RTRS)

- ECB SAID TO WEIGH DISCLOSING CLIMATE RISK IN BOND PROGRAMS (BBG)

- ECB'S LAGARDE: COUNTRIES MUST NOT 'BRUTALLY' PULL STIMULUS (CNN)

- PBOC KEEPS NEUTRAL STANCE ON MONETARY POLICY DESPITE DRAIN (CSJ)

- ISRAELI STUDY FINDS PFIZER VACCINE 85% EFFECTIVE AFTER FIRST SHOT (RTRS)

BOND SUMMARY: 10-Year JGBs Testing 0.10%

T-Notes stuck to a tight 0-03+ range, with the contract last printing -0-01 at 135-26+. The cash space has seen some marginal bull flattening in the wake of yesterday's bear steepening, with 30s sitting 1.0bp richer on the day, leaning on the downtick in equity and crude oil markets during the timezone. On the flow side, there was a 20K block in the FVJ1 125.50/124.50 risk reversal, which looked to be buying the puts to the sell calls.

- JGB bears continue to test the 0.10% level in 10-Year JGB yields, with futures last -15, threatening a clean break below the June '20 lows. The benchmark hasn't printed sustainably above the 0.10% level since H218, with the latest attempt placing some light pressure on the broader core FI space. The belly underperformed in cash trade. Japanese CPI data for January was virtually in line with expectations and wasn't as soft as the readings witnessed in December. The latest round of 1-10 Year BoJ Rinban ops saw the purchase sizes left as they were, with the offer/cover ratios nudging lower.

- YM -2.0 and XM -6.0 In Sydney. The space looked through softer than expected local retail sales data and a firm round of ACGB Nov '25 supply, with the latter's average yield printing ~0.9bp through prevailing mids at the time of supply (per BBG pricing). The weekly AOFM issuance slate revealed a lone round of ACGB supply next week, in yet another change up to the weekly format. The AOFM will auction A$2.0bn of ACGB 2.50% 20 September 2030.

EQUITIES: Markets See Red

A third consecutive negative day for Asia-Pac equity markets, bourses took a negative lead from the US where Wall Street declined as markets take stock of the recent rally in yields and weak data. Shares in Japan and South Korea are the laggards in the region sustaining losses of over 1%, while markets in Australia also endured heavy selling as oil prices sagged.

- Futures in the US are around 0.4% lower; Treasury Secretary Yellen said yesterday that there could be parts of the stock market where investors should exercise caution.

GOLD: Key Support Breached

Gold bears managed to push spot through key support in the form of the Nov 30 low in early Asia-Pac trade, as regional participants reacted to Thursday's uptick in U.S. real yields. Spot printed as low as $1,760.7/oz, but has recovered to trade ~$9/oz softer on the day at ~$1,767/oz. The July 2 '20 ($1,757.8/oz) and Jun 26 '20 ($1,747.6/oz) lows represent the next areas of technical support.

OIL: Crude Falls As Cold Weather Signaled To Abate In US

Crude futures are sharply lower in Asia-Pac trade on Friday after sustaining losses on Thursday, curbing an impressive rally. Still, WTI & Brent are off worst levels, but still over $0.75 worse off on the session.

- There are signs that the US is recpvering from weather related disruption and oil supply is slowly coming back online. Demand from refineries is expected to be subdued as operations will take time to ramp up. Milder temperatures are expected to return by Feb 20, in the US according to the National Weather Service.

- The declines come even as stockpile data is supportive; US DOE inventory figures last night showed a headline draw of 7.3m bbls, while there was also a draw in distillate inventories and a smaller-than-expected build in gasoline inventories.

- Elsewhere, the Biden administration indicated a willingness to hold diplomatic meetings with Iranin efforts to return to the nuclear deal that the US quit in 2018.

FOREX: Lower Oil Hits Commodity Currencies

Oil was sharply lower in the Asia-Pac session amid signs that supply will return shortly as adverse weather conditions look set to abate in the coming days.

- CAD and NOK were the biggest losers amid the decline in oil, other commodity currencies also struggled.

- AUD and NZD are both lower, negative data from the region compounding downward pressure. IHS Markit PMI in Australia slipped, while retail sales were below estimates. In New Zealand the January activity index rose 0.8% Y/Y, but the statement from the treasury accompanying the release said the recovery could be starting to plateau.

- JPY pairs moved in a tight range, data showed CPI fell in-line with estimates while Japan PMI rose, manufacturing rose above 50 and is back in expansionary territory. The BoJ kept rinban ops unchanged.

- Offshore yuan weakened, despite a fix below sell-side estimates. The PBOC fixed USD/CNY at 6.4524, 32 pips below sell side estimates and only the ninth lower miss of 2021 so far. The central bank used local media to emphasise it was not considering tightening policy.

- GBP/USD has retreated from highs after rallying yesterday. UK GfK Consumer Confidence for February came in at -23 against -28 expected.

FOREX OPTIONS: Expiries for Feb19 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000-15(E525mln-EUR puts), $1.2040-50(E496mln-EUR puts)

- USD/JPY: Y104.90-105.00($527mln), Y105.40-50($1.1bln)

- AUD/USD: $0.7650(A$671mln), $0.7690-00(A$652mln), $0.7900(A$911mln)

- USD/CAD: C$1.2720-35($1.3bln-USD puts)

- USD/CNY: Cny6.37($1.3bln), Cny6.38($970mln), Cny6.41($777mln), Cny6.45($2.1bln), Cny6.46($640mln), Cny6.50($613mln), Cny6.60($1.3bln)

- USD/TRY: Try6.60($950mln), Try7.10($850mln)

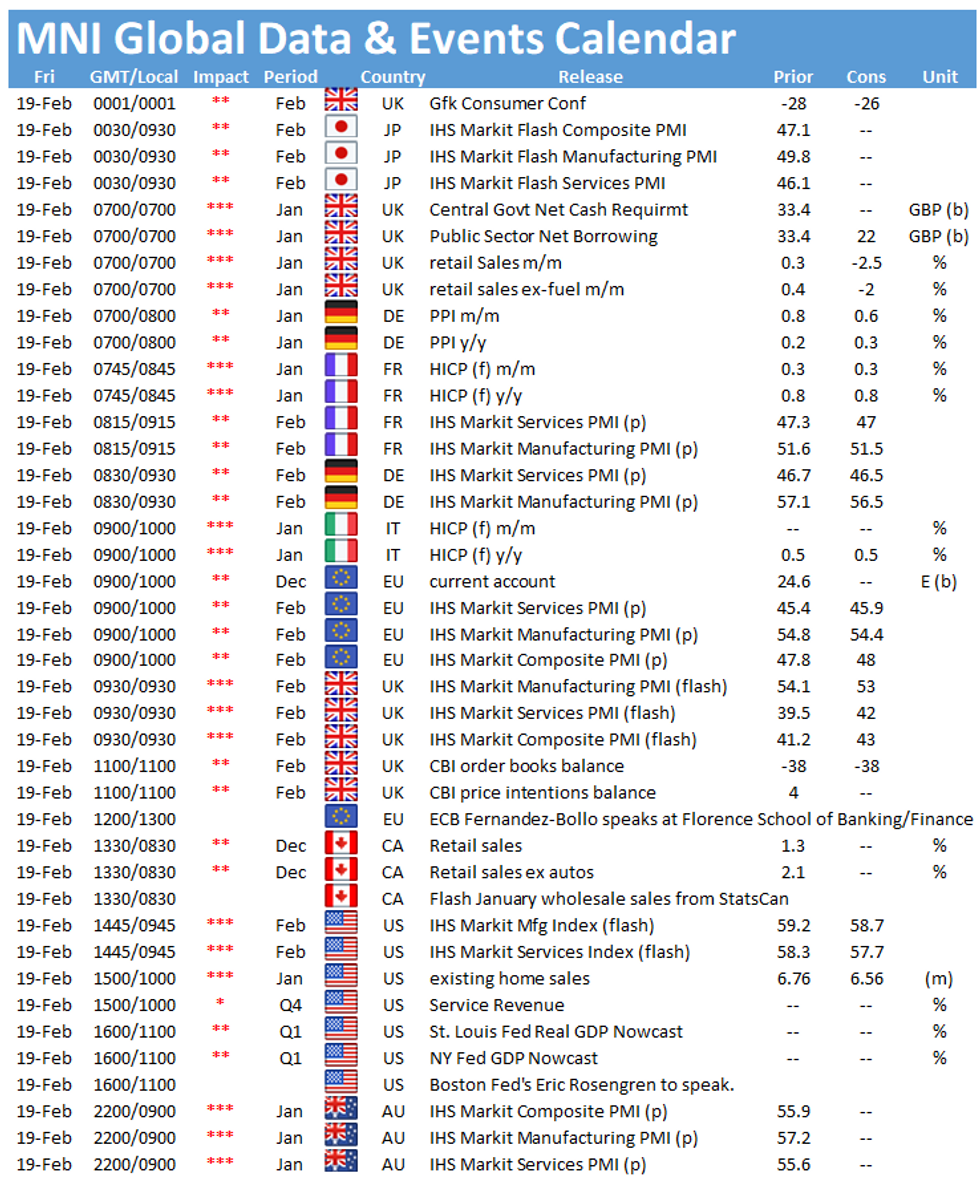

UP TODAY (TIMES GMT/LOCAL)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.