-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Antipodean Matters Headline

EXECUTIVE SUMMARY

- FED'S CLARIDA: DOWNSIDE RISKS HAVE DECLINED (MNI)

- FED OUTAGE RAISES QUESTIONS ON WALL STREET AS SERVICES RESTORED (BBG)

- NZ GOVERNMENT TELLS RBNZ TO INCLUDE HOUSING IN RATE POLICY (BBG)

- MODERNA PLANS MULTI-PRONGED APPROACH ON VIRUS VARIANTS (BBG)

- AUSSIE BOND WEAKNESS THE STANDOUT FOR MARKETS OVERNIGHT

Fig.1: AUD 1-Year/1-Year Swap Rate (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

FISCAL: Chancellor Rishi Sunak will use the election of Joe Biden as partial cover for a big Budget increase in corporation tax rates, arguing that the US president is also planning a rise in business taxes. UK government officials note Biden — and more recently US Treasury secretary Janet Yellen — have proposed an increase in corporate tax rates from 21 per cent to 28 per cent. Sunak is also expected to announce a sharp rise in Britain's corporation tax rate, currently 19 per cent, over the parliament as he tries to restore order to the country's public finances. Officials working on the Budget say Sunak wants to keep Britain's business taxes "competitive" with other G7 countries; that formulation could allow rates to rise to 25p or higher. (FT)

FISCAL: MPs could vote down plans to increase corporation tax from 19 per cent to 25 per cent amid opposition from Tory rebels and Labour, a senior minister has said. Rishi Sunak is expected to use his budget next week to announce a "pathway" to increase corporation tax over the course of the current parliament. It had been thought that he was looking to raise it to 23 per cent. (The Times)

FISCAL: Rishi Sunak will use a giveaway budget next week to pave the way for a post-lockdown boom. Help for motorists, hospitality firms and the housing market is expected to be among a string of eye-catching policies. The Chancellor is set to shelve plans for tax rises, including a threatened 5p increase in fuel duty that would have hit millions of drivers. (Daily Mail)

FISCAL: A six-month extension to the £20-a-week uplift to Universal Credit will be announced in the Budget next Wednesday, The Telegraph understands. (Telegraph)

INFRASTRUCTURE: Ever since chancellor Rishi Sunak announced the setting up of a UK government infrastructure bank last autumn, investors have wondered what its role will be. Next week, in the Budget, they will get the answer. The Treasury has only said it will focus on supporting new technologies that are too risky for private finance and would contribute to meeting the government's target of net zero carbon emissions by 2050. As examples, it gave carbon capture technology and the rollout of a nationwide network of electrical vehicle charging points. The selection process has just begun for a part-time chair, working two to three days a week, and it is scheduled to open on an interim basis on April 1. (FT)

BREXIT: A meeting of the EU-UK body overseeing the NI Brexit deal aimed at resolving issues with the Irish Sea border was "hugely disappointing", First Minister Arlene Foster has said. But Deputy First Minister Michelle O'Neill said the meeting had been "constructive and pragmatic". No breakthrough was reached on requests by the UK to extend grace periods. The grace periods mean checks and controls on goods going from GB to NI are not yet fully implemented. The first of the grace periods, which covers food and parcels, is due to end in April. (BBC)

BREXIT: Bank of England Governor Andrew Bailey warned the European Union against demanding that euro derivatives are settled by clearinghouses inside the bloc, saying such a move would be a "very serious escalation" and that it would draw a U.K. response. The EU appears to be moving towards a policy of insisting such trades are located in the bloc, Bailey said during a hearing with U.K. lawmakers on Wednesday. (BBG)

BREXIT: The Northern Ireland Protocol must be abolished rather than tweaked, the European Research Group will urge the Government on Thursday. (Telegraph)

EUROPE

FISCAL: MNI EXCLUSIVE: EU, Member States To Coordinate Borrowing

- Bond issuance to fund the EUR750 billion NextGenerationEU recovery programme will likely commence in July once national ratifications of key legislation clear the way, an EU source said, adding that the bloc will coordinate with national borrowers to avoid crowding the market. "Seven countries so far have completed ratification and others are well advanced in terms of their preparation," the source said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CORONAVIRUS: Austrian chancellor Sebastian Kurz has called on the European Union to urgently co-ordinate a special "green passport" to certify citizens as vaccinated or having tested negative for coronavirus. (FT)

FRANCE: The Northern French city of Dunkirk will institute a lockdown over the weekend as the nation turns to localized measures in an effort to curb the spread of Covid-19. "The situation is alarming," Health Minister Olivier Veran told reporters Wednesday in Dunkirk. "We'll take responsible action everywhere it's needed." (BBG)

SWITZERLAND: Switzerland is considering bringing forward the date to allow restaurants, cafes and bars to reopen to late March as coronavirus case numbers in the country continue to fall. (FT)

U.S.

FED: MNI POLICY: Fed's Clarida: Downside Risks Have Declined

- The risk of further deterioration in the U.S. economy appears to have ebbed as vaccine distributions and new fiscal stimulus measures support a brightening outlook, Federal Reserve Vice Chair Richard Clarida said Wednesday. "Prospects for the economy in 2021 and beyond have brightened and the downside risk to the outlook has diminished," Clarida said in prepared remarks ahead of a virtual presentation to the U.S. Chamber of Commerce - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: For about four hours Wednesday, Federal Reserve systems that execute millions of financial transactions a day -- everything from payroll to tax refunds to interbank transfers -- were disrupted by what appeared to be some sort of internal glitch. Systems were restored by the end of the day, but the outages once again raise questions about the resilience of critical infrastructure that Americans rely on to process payments. The episode follows two significant disruptions to the Fed's payment services that occurred in 2019. "It does raise awareness about what their business continuity measures are and what's going on over a single point of failure that doesn't have a lot of redundancies. It's pretty concerning," said David Hart, president of consulting firm NETBankAudit who was previously a senior bank examiner and IT auditor at the Richmond Fed. (BBG)

ECONOMY: Retail sales are expected to jump this year as Covid vaccines usher in an economic rebound, with the National Retail Federation estimating $4.33 trillion in sales, CNBC's Lauren Thomas reports. The industry group reported a 6.7% growth in retail sales last year on the back of a 22% surge in online retail. With more Americans receiving vaccines and lockdowns lifting, the group says the surge in retail sales will continue this year and could fall somewhere between 6.5% and 8.2%. (CNBC)

FISCAL: White House Chief of Staff Ron Klain said the administration would not try to overrule the Senate parliamentarian if she decides an increase in the minimum wage must be stripped from a coronavirus relief package. "Certainly that's not something we would do. We're going to honor the rules of the Senate and work within that system to get this bill passed," Klain said on MSBNC Wednesday. The administration is pushing its $1.9 trillion stimulus package, which includes a provision for increasing the federal minimum wage to $15 an hour by 2025. However, Democrats are anxiously awaiting a ruling from the Senate parliamentarian over whether the minimum wage provision can remain in the bill. (The Hill)

FISCAL: More than 150 New York CEOs called on Congress in a letter to pass President Joe Biden's $1.9 trillion Covid relief Bill. The letter's signatories include Goldman Sachs' David Solomon, BlackRock's Larry Fink, Deutsche Bank Americas' Christiana Riley and Blackstone's Steve Schwarzman, who previously backed former President Donald Trump. (CNBC)

FISCAL: 60% of Republicans surveyed in a new Morning Consult/Politico poll either strongly support or somewhat support President Biden's $1.9 trillion coronavirus relief package. The poll suggests GOP lawmakers' criticisms of the plan have failed to gain traction with their voters, as the massive proposal has gained bipartisan support amid enduringly high unemployment and economic pain. (Axios)

CORONAVIRUS: New coronavirus cases and deaths in the US hovered around their highest levels in several days on Wednesday, while hospitalisations eased to their lowest since early November. States reported an additional 73,258 new infections, up from 69,105 on Tuesday, according to Covid Tracking Project data. It was the biggest one-day increase in cases since Friday last week. Texas reported 7,517 new and historical cases, followed by Florida (6,923) and New York (6,189). The three states, which rank second, third and fourth by population in the US, were the only three to each reveal more than 6,000 additional infections on Wednesday. "Data from Texas is still a bit wobbly due to storm-related reporting disruptions," Covid Tracking Project said. On Tuesday, the Lone Star state reported more than 10,000 new infections for the first time in 10 days, with daily cases holding below 4,000 cases for several days during that period as Texas dealt with severe weather and power outages. (FT)

CORONAVIRUS: New coronavirus cases and deaths in the US hovered around their highest levels in several days on Wednesday, while hospitalisations eased to their lowest since early November. States reported an additional 73,258 new infections, up from 69,105 on Tuesday, according to Covid Tracking Project data. It was the biggest one-day increase in cases since Friday last week. Texas reported 7,517 new and historical cases, followed by Florida (6,923) and New York (6,189). The three states, which rank second, third and fourth by population in the US, were the only three to each reveal more than 6,000 additional infections on Wednesday. "Data from Texas is still a bit wobbly due to storm-related reporting disruptions," Covid Tracking Project said. On Tuesday, the Lone Star state reported more than 10,000 new infections for the first time in 10 days, with daily cases holding below 4,000 cases for several days during that period as Texas dealt with severe weather and power outages. (FT)

CORONAVIRUS: President Joe Biden extended the declaration of a national emergency in response to the Covid-19 pandemic beyond its March expiration date. The original declaration was made on March 13, 2020 and would have expired after one year. (CNBC)

CORONAVIRUS: New, highly transmissible Covid-19 variants "stand to reverse" the nation's control of the pandemic and could "undermine all of our efforts" against the disease if the virus is left to proliferate in different parts of the globe, the head of the U.S. Centers for Disease Control and Prevention said Wednesday. Top U.S. health officials have warned in recent weeks that the emergence of highly contagious variants, particularly the B.1.1.7 strain that emerged in the U.K., could reverse the current downward trajectory in infections in the U.S. and delay the nation's recovery from the pandemic. (CNBC)

CORONAVIRUS: The United States stands ready to deliver up to 4 million doses of Johnson & Johnson's coronavirus vaccine as soon as next week if the Food and Drug Administration authorizes the shot for emergency use, the Biden administration's Covid-19 response team said Wednesday. (CNBC)

CORONAVIRUS: A new variant of the virus, containing a mutation that may help it get past the immune system, is spreading in New York, according a report in the New York Times. The B.1.526 variant was first found in samples collected in November, according to the report, which cited researchers from Caltech and Columbia University. (BBG)

EQUITIES: A government watchdog said the Federal Aviation Administration needs to improve its oversight of new aircraft in a report released Wednesday, a review prompted by two deadly crashes of Boeing's 737 Max. The Transportation Department's inspector general said "weaknesses" in the FAA's certification processes hurt the effectiveness of its oversight of the planes. Crashes of two, nearly new Max airplanes less than five months apart, in 2018 and 2019, prompted a worldwide grounding of the jets and reviews of development and certification flaws. (CNBC)

OTHER

U.S./CHINA: The U.S. should not attack China with sanctions to contain its development, the Global Times said in an editorial referencing comments by Senate Majority Leader Chuck Schumer on China's rise and President Joe Biden's call for "extremely fierce competition". The U. S. must respect China's strengths, given China's huge population and potential consumption with an auto market twice the size of the U.S., the newspaper said. China's political system responded well to the COVID-19 epidemic, and it has a strong strategic planning ability to turn the blueprint into reality, unlike the U.S. which has seesaw policies that lead to emptiness and waste, the editorial said. (MNI)

U.S./CHINA/TAIWAN: The Arleigh Burke-class guided missile destroyer Curtis Wilbur conducted a routine Taiwan Strait transit Feb. 24, the U.S. 7th Fleet says in a statement. The transit demonstrates the U.S. commitment to a free and open Indo-Pacific; the U.S. military will continue to fly, sail, and operate anywhere international law allows. (BBG)

GLOBAL TRADE: President Joe Biden's nominee for trade chief is pledging to work with allies to take on China while also embarking on a pragmatic approach to the Asian nation, saying it's both a rival and partner whose cooperation the U.S. needs to address global challenges. Without going into specifics of how she would address tariffs, export bans and other key issues, Katherine Tai, the pick for U.S. trade representative, said she knows the "opportunities and limitations in our existing toolbox." (BBG)

GLOBAL TRADE: President Joe Biden signed an executive order Wednesday meant to address a global chip shortage impacting industries ranging from medical supplies to electric vehicles. The order includes a 100-day review of key products including semiconductors and advanced batteries used in electric vehicles, followed by a broader, long-term review of six sectors of the economy. The long-term review will allow for policy recommendations to strengthen supply chains, with the goal of quickly implementing the suggestions, Biden said at a press event Wednesday before he signed the order. (CNBC)

CORONAVIRUS: Moderna Inc. is planning to study multiple approaches to vaccine booster shots that could protect against emerging coronavirus variants, while gearing up to produce more doses of its shots this year and next. Moderna said it had completed manufacturing doses of a new version of the vaccine modified to target the South Africa strain, and shipped it to researchers for clinical study. In addition, the company is testing a third dose of its existing vaccine in a clinical study, and plans to test a booster that will combine the South Africa-specific vaccine and its existing shot. (BBG)

CORONAVIRUS: Pfizer Inc. and BioNTech SE's Covid-19 vaccine was overwhelmingly effective against the virus in a study that followed nearly 1.2 million people in Israel, results that public-health experts said show that immunizations could end the pandemic. Two doses of the vaccine prevented 94% of Covid-19 cases in 596,618 people vaccinated between Dec. 20 and Feb. 1, about one- quarter of whom were over the age of 60, a study shows. "This is the kind of vaccine that gives us hope that herd immunity may be possible," said Raina MacIntyre, a professor of biosecurity at the University of New South Wales in Sydney who wasn't involved with the study. (BBG)

CORONAVIRUS: About 4,000 cases of reinfection with Covid-19 have been found in South Africa, Barry Schoub, the chair of the country's Ministerial Advisory Committee on Vaccines, said. "This is probably to a large extent due to the variant" of the virus that was first identified in the country, he said on a webinar on Wednesday. (BBG)

CORONAVIRUS: New data suggests that people with Covid-19 can continue to suffer from symptoms for months after the initial infection, White House Chief Medical Advisor Dr. Anthony Fauci told reporters. Researchers at the University of Washington recently found that 30% of patients reported symptoms for as long as nine months, he said. Symptoms of "long Covid," which researchers are now calling Post-Acute Sequelae of Covid-19, or PASC, can develop "well after" infection, and severity can range from mild to "incapacitating," he said. (CNBC)

BOJ: MNI BRIEF: BOJ Mindful Of Higher US Yields Triggering Sell-off

- Higher U.S. yields triggering an adjustment in global stock markets and an outflow of funds from emerging market economies remains a worry for Bank of Japan officials, despite rising rates likely helping to weaken the yen, MNI understands. Officials at the BOJ are on watch for signals from the Federal Reserve as to if and when they will try and cap the rise in 10-year yields, although they acknowledge better risk sentiment and hopes for a quicker economic recovery as the vaccine rolls out is behind the uptick in longer-term rates - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: The Australian parliament on Thursday passed a new law designed to force Alphabet Inc's Google and Facebook Inc to pay media companies for content used on their platforms in reforms that could be replicated in other countries. Australia will be the first country where a government arbitrator will decide the price to be paid by the tech giants if commercial negotiations with local news outlets fail. The legislation was watered down, however, at the last minute after a standoff between the government and Facebook culminated in the social media company blocking all news for Australian users. (RTRS)

AUSTRALIA: Qantas Airways Ltd. laid out an ambitious plan to resume almost all international flights from late October, betting that vaccine rollouts will help revive the world's shattered travel industry. Qantas aims to restart 22 of its 25 overseas routes to cities including Los Angeles, London and Johannesburg from Oct. 31, it said Thursday. Low-cost arm Jetstar will restart all its 13 international routes at the same time. (BBG)

RBNZ: New Zealand's government will require the central bank to take account of rampant house prices when it sets interest rates, a change that may restrict its ability to run loose monetary policy. The Reserve Bank's remit will be amended so that the bank considers "the impact on housing when making monetary and financial policy decisions," Finance Minister Grant Robertson said in a statement Thursday in Wellington. (BBG)

RBNZ: New Zealand's central bank governor said on Thursday that inflation will need to sustainably be at its target midpoint range before any tightening of monetary conditions is considered. "We need to be patient... We need to make sure that actual inflation is sustainably at that midpoint before we jump to tightening conditions," Governor Adrian Orr told a parliamentary committee. The Reserve Bank of New Zealand (RBNZ) left interest rates unchanged on Wednesday and said it would continue to do so until it was confident inflation was sustained at the 2% per annum target midpoint and employment was at the maximum sustainable level. (RTRS)

SOUTH KOREA: MNI STATE OF PLAY: BOK On Hold; Will Act For Econ, Inflation

- The Bank of Korea kept monetary policy unchanged on Thursday, maintaining the Base Rate at the historic low of 0.5%, but the central bank said it was prepared act to support the economy and stabilize the inflation rate. The decision had been widely expected, as seen in MNI's State of Play published Tuesday. The next policy meeting is scheduled on April 15 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: Toronto has extended its cancellation of in-person major outdoor events to July 1, affecting plans for the city's festivals, fireworks and national day parades. (FT)

MEXICO: Mexico's lower house of congress approved a controversial electricity bill that prioritizes the state utility above private renewable companies in the latest nationalist move for the country's energy market. The bill, proposed by President Andres Manuel Lopez Obrador, was approved without any changes in the early morning on Wednesday, with 289 votes in favor, 152 opposed and one abstention. It will now be taken up by the senate, where the ruling Morena party and its allies have a majority. (BBG)

MEXICO: Mexico expects to receive 106m doses of vaccine against the coronavirus by the end of May, according to the Health Ministry. (BBG)

BRAZIL: Previous administrations spent a lot and my government's focus is on fiscal austerity, President Jair Bolsonaro said during a ceremony that he signed into law the Central Bank's autonomy bill. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro signed into law on Wednesday a legislation that establishes the autonomy of the country's central bank to make sure it is free of political interference. The law does not change the way the bank sets interest rates but cushions it from politics by setting fixed four-year terms for its governor and directors that will no longer coincide with the presidential election cycle. The bank's president will also no longer be part of the cabinet of ministers. (RTRS)

SOUTH AFRICA/RATINGS: South Africa's budget for the fiscal year ending March 2022 (FY21/22) reflects an improvement in the fiscal trajectory relative to Fitch Ratings' earlier forecasts, but severe challenges to the government's ability to implement consolidation persist, says Fitch. Government debt will continue to rise in the medium term, posing downside risks that are reflected in the Negative Outlook on the sovereign's 'BB-' rating. (Fitch)

IRAN: The United States' patience with Iran on returning to discussions over the 2015 nuclear deal is "not unlimited," State Department spokesman Ned Price said on Wednesday. Iran has not formally responded to a U.S. offer last week to talk with Iran in a joint meeting with the countries that negotiated the deal. Asked at a news briefing whether there was an expiration date on the offer, Price said Iran's moves away from compliance with the 2015 agreement's restrictions on its nuclear activities made the issue an "urgent challenge" for the United States. (RTRS)

OIL: OPEC+ oil producers will discuss a modest easing of oil supply curbs from April given a recovery in prices, OPEC+ sources said, although some suggest holding steady for now given the risk of new setbacks in the battle against the pandemic. (RTRS)

OIL: Exxon Mobil Corp plans to restart the small crude distillation unit (CDU) and a coker at its 369,024 barrel-per-day (bpd) Beaumont, Texas, refinery, said sources familiar with plant operations on Wednesday. The 110,000-bpd Crude A CDU and 45,000-bpd coker may start up as early as Friday, the sources said. (RTRS)

OIL: Exxon Mobil Corp. erased almost every drop of oil-sands crude from its books in a sweeping revision of worldwide reserves to depths never before seen in the company's modern history. Exxon counted the equivalent of 15.2 billion barrels of reserves as of Dec. 31, down from 22.44 billion a year earlier, according to a regulatory filing on Wednesday. The company's reserves of the dense, heavy crude extracted from Western Canada's sandy bogs dropped by 98%. (BBG)

CHINA

POLICY: China's President Xi Jinping on Thursday declared a "complete victory" in its poverty eradication campaign. Xi made the announcement while attending a ceremony marking China's accomplishments in eradicating poverty and commending role models. (RTRS)

PBOC: The PBOC may not release excessive liquidity in the near term as overall liquidity expansion will push up asset prices and serve little use to the real economy, Economic Information Daily reported citing Wang Dan, the chief economist with Heng Seng Bank. Liquidity will remain at the current tight balance for a while, leaving policy room for international uncertainties, Wang Yifeng, the chief analyst of finance with Everbright Securities told the newspaper. (MNI)

FISCAL: China is likely to cut both its fiscal deficit and the deficit to GDP ratio to improve the efficiency of government funds and the sustainability of development, the Securities Times reported citing Ye Fan, the chief analyst in Northwest Securities. China will not issue special bonds for the pandemic in 2021 and may maintain a deficit ratio around 3.3% as well as CNY3.3 trillion of special debt, the newspaper said citing CITIC Securities Policy Research Group. China's "dual circulation" development model is expected to take shape at a faster pace, and the expansion of domestic demand with fiscal policy support will be the focus of discussions at the National People's Conference beginning next week, the report said. (MNI)

OVERNIGHT DATA

JAPAN DEC, F LEADING INDEX 95.3; FLASH 94.9

JAPAN DEC, F COINCIDENT INDEX 88.3; FLASH 87.8

JAPAN JAN NATIONWIDE DEPT STORE SALES -29.7% Y/Y; DEC -13.7%

JAPAN JAN TOKYO DEPT STORE SALES -33.8% Y/Y; DEC -15.9%

JAPAN JAN SUPERMARKET SALES +1.2% Y/Y; DEC +2.7%

AUSTRALIA Q4 PRIVATE CAPEX +3.0% Q/Q; MEDIAN +1.0%; Q3 -3.1%

NEW ZEALAND FEB, F ANZ BUSINESS CONFIDENCE 7.0; FLASH 11.8

NEW ZEALAND FEB, F ANZ ACTIVITY OUTLOOK 21.3; FLASH 22.3

The bounce in business sentiment and activity indicators has flattened out, as was always inevitable and isn't alarming. The levels remain solid, but the consolidation is consistent with our view that the economy will go through a flatter period this year as the real costs of pandemic and the closed border start to be more broadly felt. (ANZ)

SOUTH KOREA JAN DISCOUNT STORE SALES -11.7% Y/Y; DEC +2.1%

SOUTH KOREA JAN DEPARTMENT STORE SALES -6.3% Y/Y; DEC -16.9%

CHINA MARKETS

PBOC INJECTS CNY20BN VIA OMOS THURS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rate unchanged on Wednesday. The operations leave the liquidity unchanged given the maturity of CNY20 billion in reverse repos today, according to Wind Information.

- The operation aims to maintain reasonable and ample liquidity in the banking system, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2000% at 09:22 AM local time from the close of 2.1427% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Wednesday vs 33 on Tuesday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4522 THURS VS 6.4615

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4522 on Thursday. This compares with the 6.4615 set on Wednesday.

MARKETS

SNAPSHOT: Antipodean Matters Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 441.96 points at 30114.39

- ASX 200 up 56.183 points at 6834

- Shanghai Comp. up 38.198 points at 3602.278

- JGB 10-Yr future down 19 ticks at 150.93, yield up 0.9bp at 0.135%

- Aussie 10-Yr future down 11.0 ticks at 98.280, yield up 10.8bp at 1.720%

- U.S. 10-Yr future -0-02 at 135-03, yield up 2.22bp at 1.398%

- WTI crude down $0.07 at $63.15, Gold down $7.83 at $1797.27

- USD/JPY up 3 pips at Y105.90

- FED'S CLARIDA: DOWNSIDE RISKS HAVE DECLINED (MNI)

- FED OUTAGE RAISES QUESTIONS ON WALL STREET AS SERVICES RESTORED (BBG)

- NZ GOVERNMENT TELLS RBNZ TO INCLUDE HOUSING IN RATE POLICY (BBG)

- MODERNA PLANS MULTI-PRONGED APPROACH ON VIRUS VARIANTS (BBG)

- AUSSIE BOND WEAKNESS THE STANDOUT FOR MARKETS OVERNIGHT

BOND SUMMARY: Aussie Bond Weakness Drives Broader Core FI In Asia

U.S. Tsys have largely been driven by the weakness in Aussie bonds, with little to go off on the broader macro headline flow front. The long end of the cash curve sits ~3.0bp cheaper on the day as the space bear steepens. T-Notes last -0-02 at 135-03, 0-05 off the lows after Aussie bonds regained some poise. Eurodollar futures run unchanged to 1.0 tick lower through the reds, with sizeable 2-way flow in EDM2 (at the same price) noted during Asia-Pac hours.

- While there has been little in the way of headline flow to wet the whistle for JGB traders, the broader weakness witnessed in core FI markets has dragged the space lower. Futures -18 at typing. Cash JGB trade has seen some bear steepening, with swap spreads widening across most of the curve outside of the super-long end. The JSCC/LCH spreads hold signs of foreign payers driving the moves in longer dated swaps. The BoJ left the size of its 1-10 Year Rinban operations as they were, with mixed offer/cover ratios, although the ratios didn't provide anything in the way of meaningful swings.

- Aussie bond futures have stabilised off of lows, at least for now, with YM last printing -2.5 (6.0 ticks off of lows) and XM -11.0 (2.5 ticks off of lows). There seemed to be several factors that intertwined to drive the latest leg of weakness: The market being disappointed with the size of RBA purchases employed to enforce the Bank's 3-Year ACGB yield target, stronger than expected local CapEx data & trans-Tasman impetus after the tweak to the RBNZ's remit, with the Bank now set to consider "the impact on housing when making monetary and financial policy decisions." Some also pointed to cross market AUD longs/received positions being washed out.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGB's from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y370bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Rebound

Asia-Pac equity markets are in the green today, taking cues from the US after markets staged an impressive rebound from pressure at the open. Chipmakers on several Asian bourses gained after US President Biden said would address a shortage in components have caused stoppages at some auto plants. The Hang Seng has reversed yesterday's losses after the announcement of a 0.03ppt hike in stamp duty to 0.13%.

- Futures in Europe and the US are higher, buoyed by testimony from Fed Chair Powell yesterday that the Fed would remain accommodative for some time with the economy still a long wat from employment and inflation targets.

OIL: Oil Gains Even As Stocks Build

Crude futures have managed to squeeze out some small gains, but seem reluctant to go higher and have moved in tight ranges for the majority of the Asia-Pac session. WTI is $0.08 higher at $63.31/bbl, brent is $0.16 higher at $67.20.

- Inventory data from the US DOE released yesterday showed headline crude stocks increased 1.28m bbls. The build came contrary to analysts' expectations of a 4.8m bbl draw, and was attributable to power outages and extreme low temperatures in southern US, which shut up to 4.4m bpd of refinery capacity at its peak. The data also showed a 10,000 bbl increase in US gasoline inventories, with a sharp reduction in refinery production countered by a reduction in demand. Implied gasoline demand registered a 1.2m bbls barrel fall -- the biggest such decline since early April 2020. The market largely shrugged off the bearish elements and continued to focus on oil's robust demand outlook amid declining COVID-19 infection numbers. European stockpiles have fallen though as global markets look elsewhere for supply, Genscape ARA crude stocks fell to the lowest since September.

GOLD: Range Respected

The yellow metal is a little softer over the last 24 hours or so, albeit back from Wednesday's cheaps, last trading just shy of $1,800/oz, with the well-defined technical boundaries remaining in play. The DXY is back from the highest levels witnessed over that time period, while U.S. real yields hold higher. ETF holdings of gold continue to edge away from all-time highs, but remain elevated from a historical standpoint.

FOREX: Tight Asia Session, Kiwi Loses Shine After Jumping On RBNZ Remit Tweak

The Asia-Pac session didn't see much volatility, but saw NZD lose some ground after rallying in the U.S./Asia crossover. The upswing was a reaction to NZ FinMin's decision to double down on efforts to reign in house price inflation and amend the RBNZ's remit, forcing the MPC to consider "the impact on housing when making monetary and financial policy decisions." As regional players came in, the kiwi started the Asia-Pac session on a marginally firmer footing before faltering later in the day. Worth flagging that NZ$1.1bn of NZD/USD options with strikes at $0.7400 expire at today's NY cut, with the spot trading flat at $0.7434 as we type.

- JPY struggled from the off and Gotobi day flows may have played some role in the absence of market-moving headlines. USD/JPY accelerated gains into the Tokyo fix, but eased off after having a brief look above Wednesday's high.

- GBP outperformed at the margin, likely drawing continued support from familiar positives surrounding the UK's Covid-19 situation.

- The PBOC fixed its USD/CNY mid-point at CNY6.4522, broadly in line with sell side estimates.

- On the radar today: U.S. initial jobless claims, second GDP reading, flash durable goods, EZ & Italian confidence gauges as well as central bank speak from Fed's Williams, Quarles, Bullard, George & Bostic and ECB's de Guindos, Lane & de Cos.

FOREX OPTIONS: Expiries for Feb25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E863mln), $1.2095-1.2115(E906mln), $1.2130-50(E1.3bln)

- USD/JPY: Y104.25-30($775mln), Y105.00($623mln), Y105.40-50($551mln), Y106.65-80($718mln)

- EUR/GBP: Gbp0.8600(E891mln-EUR puts)

- AUD/USD: $0.7910(A$1.3bln), $0.7950(A$503mln)

- NZD/USD: $0.7400(N$1.1bln)

- USD/CAD: C$1.2624-25($1.0bln), C$1.2750-60($1.0bln)

- USD/CNY: Cny6.4685-00($575mln), Cny6.7295($1.25bln)

- USD/TRY: Try7.00($955mln-USD puts), 7.10($1.5bln-USD puts), Try7.25($1.0bln-USD puts)

- USD/MXN: Mxn20.00($522mln)

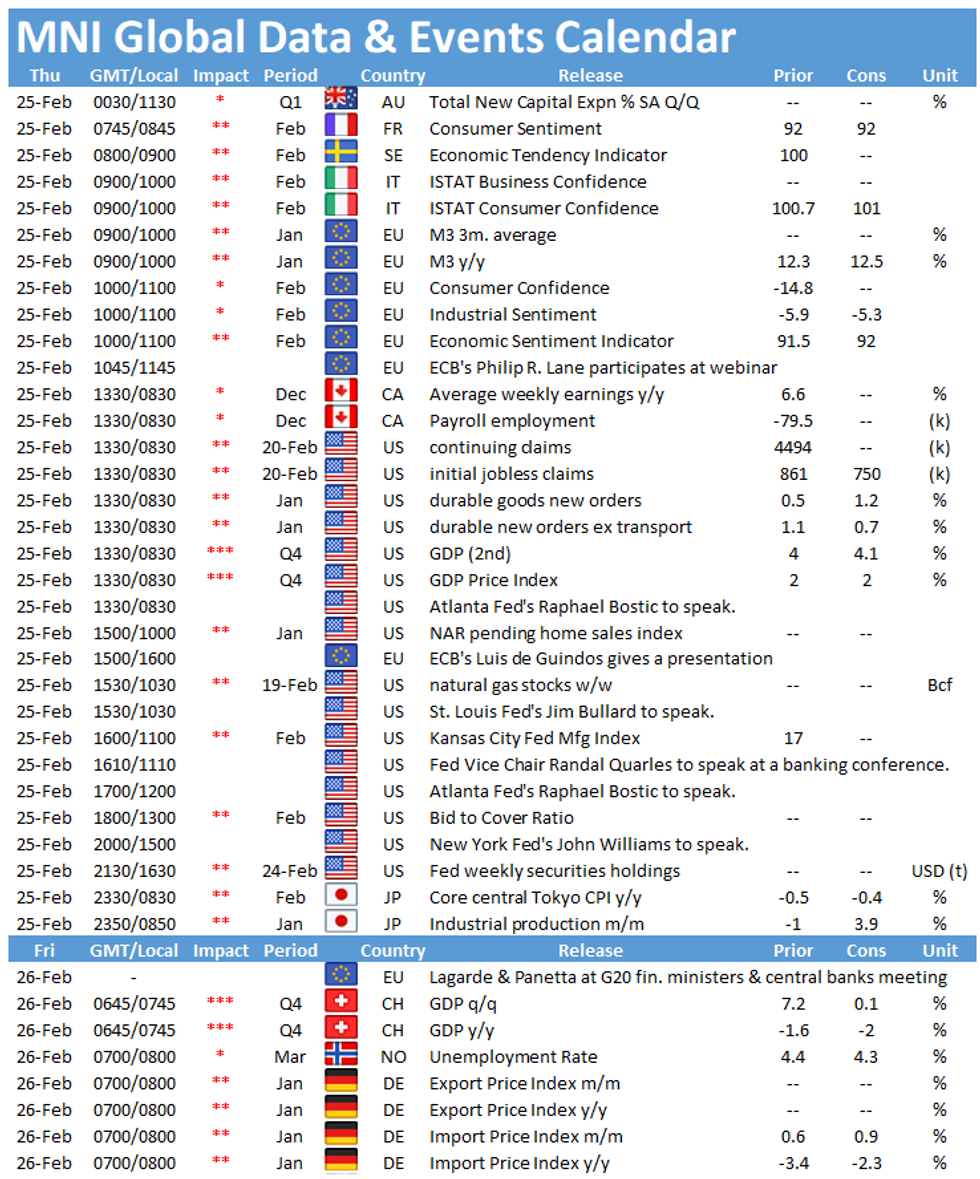

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.