-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Erdogan Sacks CBRT Chief

EXECUTIVE SUMMARY

- TRY BLINDSIDED AS ERDOGAN DROPS CBRT GOVERNOR (MNI)

- TURKEY CENTRAL BANK CHIEF PLEDGES PERMANENT PRICE STABILITY (BBG)

- TURKEY TO CONTINUE IMPLEMENTING LIBERAL FX REGIME (BBG)

- FED'S BARKIN SEES STRONG ECONOMY WITH SOME PRICE PRESSURES

- BIDEN ADMINISTRATION TO LAUNCH CYBER ATTACKS ON RUSSIA AS FEUD WITH PUTIN ESCALATES (Telegraph)

- EU/UK VACCINE SPAT ESCALATES, GERMANY TO DISCUSS EXTENDING LOCKDOWNS

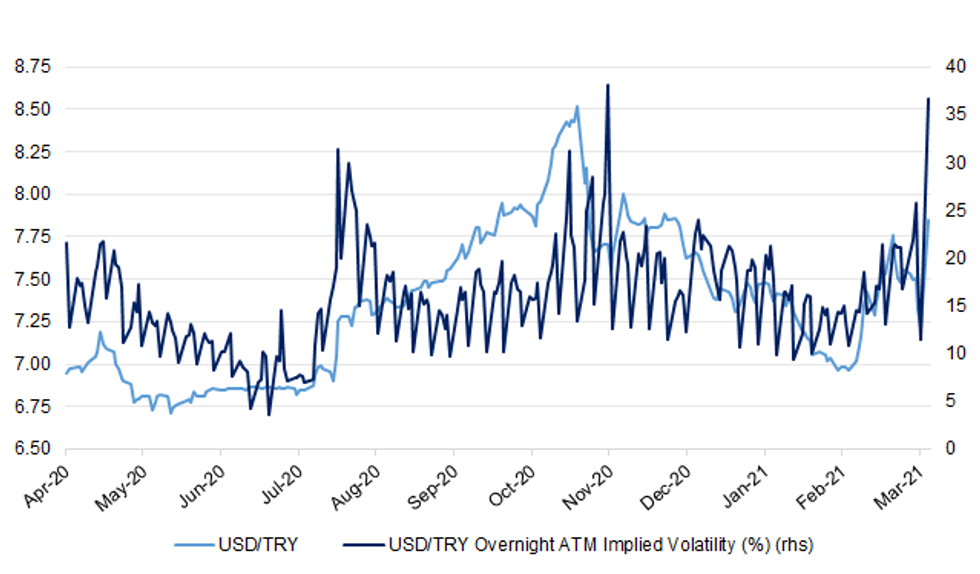

Fig. 1: USD/TRY vs. USD/TRY Overnight ATM Implied Volatility (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Chancellor Rishi Sunak will wait until the autumn before deciding whether to introduce a UK online sales tax aimed at levelling the playing field between high street and online retailers, according to government officials. Sunak wants to wait until President Joe Biden's US administration reveals whether it will support efforts to reform global digital tax rules being led by the OECD, the Paris-based organisation. On Tuesday, the chancellor will publish a range of tax consultations alongside a summary of responses to a review of the future of business rates. Sunak is considering whether to reform the levy on commercial property at the same time as introducing a possible tax on online sales. Business is deeply divided on the merits of an online sales tax — not least because many "bricks and mortar" retailers also sell their products online. Most high street retailers would favour a simple cut in business rates. Sunak will delay any decisions on an online tax, and the outcome of the business rates review launched last July, until the autumn, officials said. (FT)

ECONOMY: Half of all U.K. workers saw their pay fall in real terms last year, extending a decade-long blight on living standards for around 14 million people, according to the Resolution Foundation. In a report published Monday, the research group said the plight of those hit hardest by the pandemic, chiefly the young, contrasts with official data showing a sharp rebound in average earnings following the first coronavirus lockdown last spring. The gulf is due to the disproportionate impact of the crisis, which has destroyed hundreds of thousands of jobs in sectors such as hospitality where workers are typically young and low-paid. Figures due Tuesday are forecast to show wage growth accelerating to a 13-year high, reflecting the fact that the average person still in employment is higher paid than before the crisis. (BBG)

CORONAVIRUS: The defence secretary, Ben Wallace, has said the government will protect the success of its vaccination programme at all costs, as speculation grows that strict restrictions on foreign travel could continue into the summer. With cases rising in several EU countries and the South African variant becoming more prevalent in France, some experts have cautioned against lifting the holiday ban. Mike Tildesley, a member of the Spi-M modelling group, which feeds into the government's Scientific Advisory Group for Emergencies (Sage), has said continental holidays this summer currently appear extremely unlikely. (Guardian)

CORONAVIRUS: Ministers are working on plans to accelerate the onshoring of coronavirus vaccine production to make Britain more self-sufficient amid fears of rising vaccine nationalism. The news came as European Commission boss Ursula von der Leyen upped the ante in an ongoing dispute with vaccine supplier AstraZeneca, threatening to block exports from the bloc if the pharma firm didn't start meeting its delivery targets. France's European Affairs minister Clement Beaune reiterated the country's support for Ms von der Leyen's position insisting that Europe must "defend its interests". Under a plan hatched in Whitehall, ministers are now working at pace on bringing as much production onshore to stop the risk that other countries can disrupt the process of getting jabs into British arms. One Number 10 source said: "There is a lot of domestic production already. We are always looking at ways we can increase vaccine production in the UK. The Government is looking at ways vaccine supplies can be increased all the time." (Telegraph)

CORONAVIRUS: The UK administered 873,784 vaccines on Saturday, a second daily record in as many days, the government said. "This mammoth team effort shows the best of Britain," the health secretary, Matt Hancock said. (Guardian)

CORONAVIRUS: Delays to vaccine supplies will push back the target date for inoculating all adults to the government's original goal of the end of July, an expert has said. Health service chiefs were told last week to stop booking first-dose appointments in April for all adults under-50 after a shipment of five million doses from India was delayed by a month. The success of Britain's vaccine rollout had raised hopes inside government of bringing forward the offer of a first dose to all adults in the UK by the end of June. (Times)

CORONAVIRUS: Europe's "hopeless" response to Covid-19 has meant Britain risks the South African strain "flooding in the back door" when travel resumes, making it impossible for vaccines to curb the spread of the virus, a leading member of the Oxford AstraZeneca vaccine team has said. Sir John Bell was speaking days after the Government attempted to pour cold water on concerns that a third wave of the virus could hit Britain when more people start travelling to different countries. (Telegraph)

POLITICS/CORONAVIRUS: Conservative backbenchers are pressuring Boris Johnson not to extend coronavirus powers by another six months and are planing to rebel on the issue in a vote later this week. The prime minister is expected to get approval from MPs on Thursday to extend the powers in the Coronavirus Act until October. But a minority of his Tory colleagues object to the approach and say the speed and success of the vaccine programme means restrictions should be lifted faster. Mark Harper, the chair of the Coronavirus Recovery Group (CRG) of MPs, questioned "draconian" powers and said "reasonable people" would wonder if the government had struck the right balance. (Independent)

BREXIT: Britain and the EU are poised to agree a new "talking shop" for co-operation on financial services, but the deal will still leave the City of London facing major barriers to trade with the 27-member bloc. The two sides are closing in on an agreement on a memorandum of understanding for their future relationship on the financial sector, aimed at creating "a stable and durable" basis on which to build co-operation. (FT)

ECONOMY: The U.K. government has "significantly underestimated" how much it will cost to decarbonize heating in British homes, a touchstone of its net zero promise. The simple step of insulating Britain's drafty homes is essential before gas boilers can be replaced with low carbon technology like heat pumps. The cost of improving energy efficiency could be as much as 18,000 pounds ($24,971) a household, according to a lawmaker report. That's about five times the current U.K. government estimates. "We consider the government has significantly underestimated how much decarbonizing our homes will cost, and it needs to get a grip on this now, before it is too late," the Environmental Audit Committee said in a report published Monday. "Energy efficiency is an important precursor to low carbon heating." (BBG)

POLITICS: The U.K. government plans to bolster its navy and special forces as part of an overhaul of its defense strategy, planning to be "more active" in combating threats globally. Britain will deploy more ships and submarines, and create a special operations "Ranger Regiment" to be used in high-risk environments, the Ministry of Defense said in a statement Monday, ahead of the publication of a command paper on the U.K.'s defense strategy. A focus on maritime security and counter-insurgency comes as the U.K. is also set to cut troop numbers by 10,000, a reflection of a shift in priorities due to a perceived reduced risk of a conventional land war involving Britain. Prime Minister Boris Johnson set out a 100-page blueprint for the nation's diplomacy and defense last week, detailing an ambition to tilt toward the Indo-Pacific region, bolster Britain's nuclear deterrent and fight terrorists.

EUROPE

EU/CHINA: European Union foreign ministers are expected to sign off on a slate of punitive measures on Monday over human rights abuses, including sanctions directed at China. The restrictions would be a reaction to Beijing's alleged mistreatment of its minority Uyghur population in the northwestern region of Xinjiang, according to three people familiar with the preparations, who asked not to be identified because the discussions are private. The sanctions would target four nationals and one entity, one of the people said. The EU move to sanction the officials is likely to be mostly symbolic. While the U.S. has imposed sanctions on a number of Communist Party officials -- including two Politburo members -- the measures haven't impacted China's economy or changed its behavior. (BBG)

EU: The European Union is ready to start withholding Covid-19 shots from the U.K., risking a sharp deterioration in relations with London in a bid to turn around its lackluster vaccination campaign. The EU will start reviewing, and likely rejecting, export authorization of AstraZeneca Plc coronavirus vaccines to the U.K. until the drugmaker fulfills its delivery obligations to the 27-nation bloc, according to a senior EU official. The EU has contracts with the company that aren't being respected, and any vaccines and ingredients produced in European factories will be reserved for local deliveries, said the official, who asked not to be named because the decisions are under consideration and haven't been made public. (BBG)

EU: EU heads of state and government will hold a summit by videoconference next week as coronavirus infections surge again in several countries, European Council President Charles Michel announced on Sunday. Michel had held out strong hope that the 27 national leaders would be able to meet physically in Brussels for their regular March summit. His decision to shift to a virtual format underscored both the grave health situation and his acceptance of the political impossibility for leaders to travel after several of them ordered renewed or stricter lockdown measures in recent days. (Politico)

EU: EU Commission President Ursula von der Leyen announced on Sunday that the bloc will not share coronavirus vaccines with other countries until it has "a better production situation in the EU." "There is quite a bit of pressure on member states to obtain the vaccine for themselves," she told Germany's Funke Media Group over the weekend. (Politico)

EU: Covid-19 vaccine doses "are coming" and the European Union doesn't need Russia's Sputnik V shot, according to the EU commissioner in charge of fixing the bloc's vaccination drive. Thierry Breton, the EU's internal markets commissioner, pledged that 100 million doses would be delivered in April and said continental Europe could reach immunity by July 14, which is Bastille Day in France. Meanwhile, Russians are "struggling to get their hands" on the Sputnik vaccine, Breton said in a French television interview. By contrast, German Chancellor Angela Merkel said her country might use Sputnik. (BBG)

EU: Confidence in the safety of AstraZeneca's COVID-19 vaccine has taken a big hit in Spain, Germany, France and Italy as reports of rare blood clots have been linked to it and many countries briefly stopped using it, poll data showed on Monday. The polling firm YouGov said it had already found in late February that Europeans were more hesitant about the AstraZeneca vaccine than about those from Pfizer Inc/BioNTech and Moderna Inc, and that the clot concerns had further damaged public perceptions of the AstraZeneca shot's safety. (RTRS)

EU: The European Union's top banking regulator urged lenders to promptly write off loans that are failing in the aftermath of the pandemic, warning that without action "zombie" firms could damage the economic recovery. Jose Manuel Campa, chairman of the Paris-based European Banking Authority, said in an interview on March 19 that regulators expect non-performing loans to "increase to a significant amount" in the coming quarters, after a year of government support for borrowers and banks suppressed defaults. There should be "as early recognition as possible" of losses, Campa said. (BBG)

EU: The European Union's flagship agricultural policy risks undermining the bloc's net-zero climate targets because it supports high-polluting food industries, according to a group of investors and policy experts. Reforms to the Common Agriculture Policy don't go far enough to address climate change and biodiversity, investors managing 2 trillion euros ($2.4 trillion) of assets said Monday. The policy will give farmers of highemitting commodities like beef bigger subsidies for producing more, the group said. It urged the inclusion of climate targets in the distribution of the payments, which make up one-third of the EU budget. Greening agriculture is one of the biggest challenges in the fight against climate change. The EU is decarbonizing its economy, but agriculture, the third-largest contributor of greenhouse gases, has seen little reduction in the past 15 years. (BBG)

GERMANY: Several states are seeking to extend COVID-19 restrictions into April as Germany battles a third wave of the coronavirus, according to a draft plan obtained by news agencies on Sunday. The proposal comes as the coronavirus incidence rate crossed the critical 100 in 100,000 mark. The government had previously said this would be enough to trigger new curbs. The draft document, seen by the DPA and AFP news agencies, cited the high infection rate, which is being "accelerated by COVID-19 variants." (Deutsche Welle)

GERMANY: Some parts of Germany have already revised their easing of lockdown after local incidence rates exceeded the 100 figure for several days. Germany second-largest city Hamburg returned to a full lockdown on Friday after recording levels that peaked above 100 for four consecutive days. The city of Cologne, in Germany's most populous state, North Rhine-Westphalia, imposed limited restrictions after its rates began to hover just above the 100 mark. (Deutsche Welle)

GERMANY: A former Bavarian justice minister has become the latest German conservative politician to quit amid allegations of corruption. On Sunday, Alfred Sauter — a lawmaker in the regional parliament and a senior member of the Christian Social Union (CSU), the Bavarian sister party of Chancellor Angela Merkel's Christian Democratic Union (CDU) — resigned from all political positions he holds. Prosecutors are investigating Sauter as part of a probe into suspected bribery related to the procurement of coronavirus face masks. He has also suspended his membership of the CSU's Bavarian parliamentary group for the duration of the proceedings. German media reported this week that Sauter, a lawyer by profession, received as much as €1.2 million for helping to arrange procurement contracts. He denies any wrongdoing and said that any profits had been intended for charitable purposes from the start. (Politico)

FRANCE: The new partial lockdown attempts to stem the spread of Covid-19 while limiting the economic costs, making the restrictions very different from France's two lockdowns last year. Unlike earlier lockdowns, only 16 regions – including the Paris metropolitan area – have been put under a partial lockdown. The government on Saturday announced that it would not be necessary for residents of the 16 affected regions to fill out an attestation form (as as it was in previous lockdowns) if they are going out within a 10 kilometre radius from their homes. They will simply be required to carry a proof of address. For any travel further than 10 kilometres, an official attestation form will still be required. Forms issued by the interior ministry are available in English here. "The certificate and justification of the reason for the journey will continue to be required for journeys of more than 10 kilometres (either within the department or for inter-regional journeys)," the government said in a statement. A nighttime curfew starts at 7pm (it was previously 6pm) and ends at 6am. A declaration form is also currently mandatory for any travel during the curfew. Inter-regional travel is prohibited from Saturday, except for "imperative or professional reasons", according to the interior ministry website. (France24)

FRANCE: Paris Mayor Anne Hidalgo said she aims to rally left-wing allies to run against President Emmanuel Macron in the 2022 presidential election. "I am laying the foundations of a movement that I want to gather people and make proposals to the French," Hidalgo told Europe 1 radio Sunday. (BBG)

DENMARK: Denmark said on Saturday that one person had died and another fell seriously ill with blood clots and cerebral haemorrhage after receiving the AstraZeneca COVID-19 vaccination. The two, both hospital staff members, had both received the AstraZeneca vaccine less than 14 days before getting ill, the authority that runs public hospitals in Copenhagen said. The Danish Medicines Agency confirmed it had received two "serious reports", without giving further details. There were no details of when the hospital staff got ill. (RTRS)

CZECHIA: The Czech government's budget deficit next year "won't be less than 300 billion koruna," Finance Minister Alena Schillerova says in a debate on the country's public-service television. (BBG)

SLOVAKIA: Slovakia's prime minister Igor Matovic said on Sunday that he was prepared to stand down to defuse a coalition crisis that erupted after his decision to purchase Russia's Sputnik V coronavirus vaccine. Matovic announced earlier this month that Slovakia would purchase 2m doses of the Russian vaccine, using an emergency approvals process as the shot has not yet been approved by the European Medicines Agency. However, other members of his four-party coalition were incensed by the decision, which was taken without their agreement, and figures from two of the other parties subsequently called for Matovic's resignation. On Sunday evening — a year to the day after he was appointed prime minister — Matovic said he would be prepared to step down, but set a series of conditions, including that he should remain in the government. (FT)

U.S.

FED: The U.S. economy is set for a strong 2021 as the pandemic recedes that will push up prices, but there's no sign yet that this will deliver unwanted inflation, said Federal Reserve Bank of Richmond President Thomas Barkin. "We are going to see an extremely strong year and I think that strong year is going to lead to price pressures.," Barkin said Sunday in an interview on Bloomberg Television with Kathleen Hays. "I want to emphasize inflation is not a one-year phenomenon it's a multi-year phenomenon." He said for unwanted inflation to take hold, expectations for future price increases would have to really move and begin to get factored into business decisions and wage bargaining. "We certainly haven't seen that yet," he said. Barkin is a voter this year on the policy-setting Federal Open Market Committee. (BBG)

FED: The U.S. economy may be "on the brink of completing the recovery" from the recession triggered by the coronavirus pandemic, Richmond Federal Reserve President Thomas Barkin said on Sunday, although risks remain for some workers. "Vaccines are rolling out, and case rates and hospitalizations are falling. Excess savings and fiscal stimulus should help fund pent-up demand from consumers freed by vaccines and warmer weather," Barkin said in remarks prepared for delivery on Sunday evening to a Credit Suisse conference on investment in Asia. (RTRS)

FED: But the recovery is far from complete, so at the Fed we will continue to provide the economy with the support that it needs for as long as it takes. I truly believe that we will emerge from this crisis stronger and better, as we have done so often before. (WSJ/Fed Chair Powell's op-ed)

FED: MNI POLICY: Fed Rate Hike Seen in 2022 By Half NABE's Survey

- The Federal Reserve is likely to raise interest rates in either 2022 or 2023, according to respondents in a National Association of Business Economics survey published Monday, showing that expectations for rate hikes have been pushed back despite an outlook for faster economic growth - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FISCAL/POLITICS: Republicans are aiming to stir up a legal battle over Biden's pandemic relief bill, targeting a provision in the American Rescue Plan they say is an unconstitutional infringement on states' ability to devise their own tax policies. A provision in the bill that forbids states from using billions in aid to offset any tax cuts they might implement has sparked a backlash from Republican lawmakers and state attorneys general. Their criticisms could lay the groundwork for a court battle over states' rights and government overreach akin to the Supreme Court case over the fate of ObamaCare. This time, the GOP appears to be framing the issue as the Biden administration getting in the way of state and local leaders cutting taxes for their own residents. (Hill)

POLITICS: Former President Donald Trump will be back on social media in the near future with his own service, according to one of his senior advisers. Trump was banned from Twitter following the Jan. 6 Capitol riots. He had been a prolific poster on that platform before and during his presidency. "I do think that we're going to see President Trump returning to social media in probably about two or three months here, with his own platform," Trump senior adviser Jason Miller told Fox News' "#MediaBuzz" on Sunday. "And this is something that I think will be the hottest ticket in social media, it's going to completely redefine the game, and everybody is going to be waiting and watching to see what exactly President Trump does." (Fox)

POLITICS: Defense Secretary Lloyd Austin traveled to Afghanistan Sunday on his first visit to the country as the United States' top defense official, meeting with Afghan President Ashraf Ghani and other officials. Austin landed in Kabul Sunday morning for a previously unannounced visit after a stop in India, according to the press pool traveling with the secretary. The defense secretary's visit comes as the United States must decide whether it will adhere to an agreement the Trump administration reached last year with the Taliban to remove all US forces from the country by May 1. The Biden administration is considering a six-month extension for American troops there as that deadline draws near. (CNN)

POLITICS: President Joe Biden says he plans to visit the U.S.-Mexico border "at some point" for a first-hand look at conditions as the entry of migrants seeking refugee status in the U.S. rises sharply. The comment, made to reporters at the White House on Sunday, came after the U.S. Homeland Security secretary said he's not worried about setting a precedent on open borders by allowing thousands of unaccompanied minors to enter the country. "At some point I will, yes," Biden said about a border visit. Asked if he wanted to see first-hand what's happening at overcrowded migrant processing centers, he added, "I know what's going on in those facilities." The president's schedule for the coming week, released by the White House, shows no plans for a border visit through Thursday. (BBG)

POLITICS: Republican Julia Letlow easily won a Saturday special election for the northeast Louisiana-based U.S. House seat that her husband, Luke, couldn't fill because of his death from complications related to COVID-19. (AP)

POLITICS: Homeland Security Secretary Alejandro Mayorkas on Sunday urged migrants not to travel to the United States, as the Biden administration struggles with a surge of incomers, especially unaccompanied minors, at the southern border. "The message is quite clear, do not come. The border is closed, the border is secure," Mayorkas told host Martha Raddatz on ABC's "This Week." (Hill)

CORONAVIRUS: Despite the clamor to speed up the U.S. vaccination drive against COVID-19 and get the country back to normal, the first three months of the rollout suggest faster is not necessarily better. A surprising new analysis found that states such as South Carolina, Florida and Missouri that raced ahead of others to offer the vaccine to ever-larger groups of people have vaccinated smaller shares of their population than those that moved more slowly and methodically, such as Hawaii and Connecticut. The explanation, as experts see it, is that the rapid expansion of eligibility caused a surge in demand too big for some states to handle and led to serious disarray. Vaccine supplies proved insufficient or unpredictable, websites crashed and phone lines became jammed, spreading confusion, frustration and resignation among many people. (AP)

OTHER

GEOPOLITICS: Iran has made threats against Fort McNair, an Army base in the nation's capital, and against the Army's vice chief of staff, two senior U.S. intelligence officials said. They said communications intercepted by the National Security Agency in January showed that Iran's Revolutionary Guard discussed mounting "USS Cole-style attacks" against the base, referring to the October 2000 suicide attack in which a small boat pulled up alongside the Navy destroyer in the Yemeni port of Aden and exploded, killing 17 sailors. The intelligence also revealed threats to kill Gen. Joseph M. Martin and plans to infiltrate and surveil the base, according to the officials, who were not authorized to publicly discuss national security matters and spoke on condition of anonymity. The base, one of the oldest in the country, is Martin's official residence. The threats are one reason the Army has been pushing for more security around Fort McNair, which sits alongside Washington's bustling newly developed Waterfront District. (AP)

GEOPOLITICS: About 24 hours after military chiefs from India and Pakistan surprised the world last month with a rare joint commitment to respect a 2003 cease-fire agreement, the top diplomat of the United Arab Emirates popped over to New Delhi for a quick one-day visit. The official UAE readout of the Feb. 26 meeting gave few clues of what Foreign Minister Sheikh Abdullah bin Zayed spoke about with Indian counterpart Subrahmanyam Jaishankar, noting they "discussed all regional and international issues of common interest and exchanged views on them." Yet behind closed doors, the India-Pakistan cease-fire marked a milestonein secret talks brokered by the UAE that began months earlier, according to Officials aware of the situation who asked not to be identified. The ceasefire, one said, is only the beginning of a larger roadmap to forge a lasting peace between the neighbors, both of which have nuclear weapons and spar regularly over a decades-old territory dispute. (BBG)

GEOPOLITICS: Russian jets conducted raids on areas close to heavily populated towns and camps in opposition-held northwestern Syria near the Turkish border, the first such strikes this year, witnesses and rebel sources said on Sunday. (RTRS)

U.S./CHINA: U.S. traditional allies are not likely to join Washington's efforts to forge a multilateral push to contain China as they cannot resist a "huge and dynamic market" with 1.4 billion consumers, said the state-run Global Times in an editorial. Even Australia, bruised in a tussle with Beijing, is seeking to repair frosty trade relations with China, the newspaper said. The Biden administration's actions showed a continuation of the previous administration's anti-China policy, the newspaper said. (MNI)

U.S./RUSSIA: The Biden administration is preparing a series of aggressive cyber attacks on Russia in a major shift in tactics designed as a warning shot to rival powers. The attack, which is expected in the next fortnight, is in retaliation for the SolarWinds hack, the large-scale infiltration of American government agencies and corporations discovered late last year that was traced back to the Kremlin. It comes after Joe Biden this week engaged in a war of words with Vladimir Putin, calling the Russian president a "killer", while the White Houses attacked China for rights abuses in a tense opening of face-to-face talks. The US will not target civilian structures or networks, but the hack is instead designed as a direct challenge to Mr Putin, Russia's President, and his cyber army, The Telegraph understands. The White House confirmed it will take "a mix of actions" - both "seen and unseen" - although it did not provide specifics on when and how it would do so. (Telegraph)

U.S./CANADA/MEXICO: Canadian Pacific Railway Ltd. agreed to buy Kansas City Southern for $25 billion, seeking to create a 20,000-mile rail network linking the U.S., Mexico and Canada in the first year of those nations' new trade alliance. The transaction creates the only network that cuts through all three North American countries, giving CP access to the Kansas City, Missouri-based company's sprawling Midwestern rail network that connects farms in Kansas and Missouri to ports along the Gulf of Mexico. The network would also let CP reach deep into Mexico, which made up almost half of Kansas City Southern's revenue last year. "I've had my eye on the KCS for quite some time," CP Chief Executive Officer Keith Creel said in a telephone interview. "We extend our reach for our customers through the U.S. and into Mexico, and at the same time KCS can do the same coming from Mexico up to U.S. destinations and Canada." (BBG)

CANADA/CHINA: A senior Canadian diplomat based in China said he hopes to gain access to the trial on Monday of Canadian citizen Michael Kovrig, who is being tried on charges of espionage at a Beijing court after he was arrested in December 2018. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday that the central bank would not stop buying exchange-traded funds (ETFs) or sell them as it tries to make its easing tools more flexible and sustainable under its yield curb control policy. Speaking before the upper house financial committee, Kuroda said its review of ETF purchases would allow the BOJ to continue using easing policy "more flexibly and effectively." (RTRS)

BOJ: MNI BRIEF: BOJ Kuroda:To Prevent Wider L/T Rate Hitting Stocks

- Bank of Japan Governor Haruhiko Kuroda said on Monday that the BOJ will prevent wider movements in long-term interest rates from affecting stock prices and that the bank can prevent a sharp rise in the yield through fixed-rate purchase operations for consecutive days - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN: No international fans will be permitted at the delayed 2020 Tokyo Olympics and Paralympics this summer because of concerns over the coronavirus pandemic. Japanese authorities told the Olympic and Paralympic committees it was "highly unlikely" that entry to the country could be guaranteed. Organisers said the move now gives "clarity" to ticket holders and helps ensure "a safe and secure Games for all participants and the Japanese public". (BBC)

JAPAN: In Japan, the state of emergency for Tokyo and three surrounding prefectures expired at the end of the day on Sunday. Emergency measures took effect in early January, when coronavirus cases were surging. Since then case numbers in the capital have fallen 80 percent, and leveled off as measures were put in place to prevent a resurgence. Tokyo Governor Koike Yuriko said, "I want everyone to recognize that we need to avoid a rebound of infections. I am asking for continued cooperation to prevent a fourth wave." (NHK)

JAPAN: A magnitude 6.9 quake hit off the coast of northeastern Japan, briefly triggering a tsunami advisory for Miyagi prefecture and causing shaking in Tokyo. Initial damage reported from the earthquake that occurred Saturday evening were minor compared to the magnitude 7.3 quake that struck about a month ago further south on Japan's Pacific coast. About 200 buildings in Miyagi prefecture were left without power, Tohoku Electric Power Co. said, while broadcaster NHK said some bullet train services in the region were suspended. (BBG)

AUSTRALIA: The collision of two powerful weather systems over the east coast of NSW on Monday night may see more evacuations as western Sydney residents were forced to flee to higher ground on Sunday when floodwaters inundated their neighbourhoods. The State Emergency Service ordered about 1000 residents from western Penrith, Jamisontown and Mulgoa to pack up and leave or face being trapped by rising floodwaters. NSW Premier Gladys Berejiklian warned up to 4000 people could be displaced in the Hawkesbury-Nepean Valley over the next few days. Almost 140 schools have closed, roads and bridges have been cut off, the COVID-19 vaccine rollout has been delayed in parts of Sydney and NSW because of the extreme weather, and supplies to supermarkets have also been impeded. Later on Sunday, Newcastle Airport also suspended flights because of flooding on the runway, warning the airfield could remain closed until Wednesday. Ms Berejiklian said parts of western Sydney are experiencing a one-in-50-year weather event. Various parts of the Hawkesbury-Nepean river network is causing concern as the Warragamba Dam – which will see 75 per cent of its storage capacity flow into the catchment from the event – continues to overflow. (Sydney Morning Herald)

AUSTRALIA/CHINA: Australia's parliament debated on Monday a motion to condemn "systematic breaches" of human rights by China, saying other legislatures had described as genocide its actions towards Uighurs in the far western region of Xinjiang. (RTRS)

AUSTRALIA/NEW ZEALAND: New Zealand Prime Minister Jacinda Ardern says a date for the commencement of a quarantinefree travel corridor between New Zealand and Australia will be announced on April 6. So-called travel bubble is "highly complex" and before any final decision is made by cabinet it must be satisfied that several conditions have been met. (BBG)

NEW ZEALAND: Treasury believes New Zealand's government debt levels are manageable, but the issue of debt targets should be revisited once the country is out of the COVID-19 woods. Speaking to interest.co.nz, Chief Executive and Secretary to The Treasury, Caralee McLiesh, said: "Given the uncertainty in the economy, our view [is] that it is not an appropriate time to be setting new debt targets. Our view is that debt levels are within prudent levels and that debt levels are manageable overall. (interest.co.nz)

SOUTH KOREA: South Korean President Moon Jae-in expects "faster and stronger" economic recovery this yearthan previously expected as exports and investments have sharply increased. To prepare for economic stimulus steps if vaccinations effective and quarantine situation is stabilized,Moon says in meeting with senior secretaries. (BBG)

SOUTH KOREA: Two high-profile opposition candidates for the upcoming Seoul mayoral election led their rival from the ruling Democratic Party (DP) by wide margins in a hypothetical two-way race for the mayoralty, a public opinion poll showed Monday. (Yonhap)

SOUTH KOREA: An independent panel of experts recommended Monday that AstraZeneca COVID-19 vaccine rollout continue as there is no correlation between blood clots found in some recipients and the product. (Yonhap)

HONG KONG: The head of Hong Kong's de facto central bank has dismissed suggestions that the recent weakening of the Hong Kong dollar was caused by Beijing's overhaul of the city's electoral system, as he expressed confidence the political shake-up would not affect the city's financial standing. Hong Kong Monetary Authority chief executive Eddie Yue Wai-man on Sunday said the capital outflow had been prompted instead by previous "relatively large IPOs", which had seen mainland companies transferring the money they raised in Hong Kong dollars back across the border. (SCMP)

TURKEY: MNI MARKET ANALYSIS: TRY Blindsided as Erdogan Drops CBRT Governor

TURKEY: President Tayyip Erdogan abruptly sacked Turkey's central bank chief on Saturday, two days after a sharp interest rate hike to head off inflation, replacing him with a former ruling party lawmaker and critic of tight monetary policy. Outgoing governor Naci Agbal, appointed less than five months ago, had won market praise by aggressively raising the policy rate by 875 basis points to 19%, the highest of any big economy. His shock removal, announced in the early hours Saturday, comes after the bank hiked rates by a more-than-expected 200 points on Thursday in a "front-loaded" move meant to head off inflation near 16% and a dipping lira. The country's Official Gazette announced that Erdogan had replaced him with Sahap Kavcioglu, a former member of parliament for Erdogan's ruling AK Party (AKP). The former banker has publicly criticised Agbal's hawkish policy. "While interest rates are close to zero in the world, opting for a rate hike for us will not solve economic problems," he wrote in a column in Yeni Safak newspaper last month. (RTRS)

TURKEY: Turkey's newly appointed central bank Governor Sahap Kavcioglu pledged to use monetary policy tools effectively to deliver permanent price stability. In a written statement on Sunday, his first since being appointed on Saturday, Kavcioglu said the bank's interestrate- setting meetings will take place according to the previously announced schedule. The central bank "will continue to use the monetary policy tools effectively in line with its main objective of achieving a permanent fall in inflation," Kavcioglu said. "The decline in inflation will foster macroeconomic stability through the fall in country risk premiums and a permanent improvement in financing costs, and will contribute to the development of conditions essential for sustainable growth that will enhance investment, production, exports and employment." (BBG)

TURKEY: Turkey will continue to stick to free markets and a liberal foreign-exchange regime, Treasury and Finance Minister Lutfi Elvan said in a statement after the lira plunged following an upheaval at the central bank. The government will continue to prioritize price stability and fiscal policies will support the monetary authority in its efforts to rein in inflation, Elvan said in a written statement. (BBG)

TURKEY: Turkey has abandoned an international accord designed to protect women, drawing protests from campaigners. It signed the Council of Europe's convention 10 years ago at its launch in the Turkish city of Istanbul. The pact seeks to prevent, prosecute and eliminate domestic violence. But Turkish conservatives argue its principles of gender equality and non-discrimination on grounds of sexual orientation undermine family values and promote homosexuality. (BBC)

TURKEY/U.S.: U.S. President Joe Biden has called Turkey's abandonment of an international agreement aimed at preventing violence against women "deeply disappointing." In a White House statement posted Sunday, Biden said Turkey's withdrawal from the Istanbul Convention was "sudden and unwarranted." "This is a disheartening step backward for the international movement to end violence against women globally," Biden said. (AP)

ISRAEL: The Israeli domestic security service Shin Bet revoked Palestinian Foreign Minister Riyad al-Maliki's VIP status when he returned to the West Bank from Jordan today, Axios has learned from Israeli officials. Why it matters: According to the officials, the unusual act was retaliation for al-Maliki's push for an investigation against Israel in the International Criminal Court. The card allows easier movement and access inside the West Bank and at border crossings. (Axios)

IRAN: Iran's Supreme Leader Ayatollah Ali Khamenei said his country was in "no hurry" to revive the nuclear deal and warned the U.S. its current policy toward the Islamic Republic was doomed to fail unless sanctions are effectively and fully removed. Khamenei's speech, marking the Persian new year in Iran, highlighted his impatience with the Biden administration's decision to maintain sanctions and continue a standoff that started almost three years ago when former President Donald Trump abandoned the multilateral, 2015 nuclear deal. "We shouldn't burn opportunities, but we shouldn't hurry either," Khamenei said, adding "we have a lot of patience and will continue to do our own thing. If they accepted and implemented our desired policy, everything will be fixed. If not, things will remain as it is and there's nothing wrong with that." (BBG)

RUSSIA/U.S.: Russian Ambassador to the United States Anatoly Antonov arrived on Sunday in the Russian capital, where he had been earlier invited for consultations, a TASS correspondent reported. The plane with the diplomat onboard landed at Sheremetyevo Airport. Russian Foreign Ministry Spokeswoman Maria Zakharova said in a statement on March 17 that Antonov had been invited to Moscow for consultations on ways to mend Russia-US ties. The invitation came after US President Joe Biden's harsh remarks about the Russian leadership in an interview with ABC News. (TASS)

RUSSIA: Moscow supports the idea of forming a widest coalition of countries that stand against unilateral sanctions, Russian Foreign Minister Sergey Lavrov said in an interview with the Chinese mass media. According to the Russian top diplomat, any initiatives geared against such an illegitimate instrument as unilateral sanctions "deserve all possible support." "Venezuela came out with an initiative at the United Nations to establish a coalition against unilateral measures of compulsion," the minister recalled. "By the way, the organization has a special envoy, a special rapporteur on issues of countering unilateral sanctions. The rapporteur voices very balanced, objective attitudes." "Such initiatives should be encouraged. We must form a maximally wide coalition of countries that would combat this illegal practice," Lavrov stressed. (TASS)

PHILIPPINES: Churches in Manila will be closed, eating inside restaurants banned and leisure travel outside the Philippine capital curbed under new coronavirus rules unveiled on Sunday as the country battles a resurgence in infections. (SCMP)

CONGO: Republic of Congo pressed ahead Sunday with an election in which President Denis Sassou N'Guesso is widely expected to extend his 36 years in power, while the leading opposition candidate was flown to France after suffering COVID-19 complications. The watchdog group NetBlocks reported an internet blackout that began in the Central African country around midnight on election day. After casting his ballot, Sassou N'Guesso said the government was aware of opposition candidate Guy Brice Parfait Kolelas' illness and had taken the steps necessary for him to be transferred to France for further treatment. (AP)

OIL: Saudi Aramco, the world's largest crude oil exporter, on March 21 lowered its guidance for capital expenditures for 2021 even amid a pick-up in demand for oil and natural gas in Asia. Capex will be around $35 billion this year, down from previous guidance of $40 billion to $45 billion, Aramco said in a statement. Aramco -- which listed 1.5% of its shares in December 2019 on Saudi Arabia's Tadawul domestic stock exchange – pledged to issue a $75 billion dividend annually for five years. This promise, which it fulfilled in 2020, is further weighing on its finances and is understood to have been a main driver for the company to slash its capex. (Platt's)

CHINA

PBOC: MNI BRIEF: PBOC Leaves Loan Prime Rates Unchanged in March

- China's central bank on Monday left its key loan rate unchanged for the 11th straight month as it flags a "policy normalization" stance given the country's record-high debt - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

PBOC: China still has room to pump liquidity into the economy while keeping its leverage ratio stable, People's Bank of China Governor Yi Gang said in Beijing on Sunday. China's macro-leverage ratio, or total debt-to-GDP ratio, remains at a stable level, Yi said at the China Development Forum in Beijing. "This will not only provide positive incentives for economic players, but also help create an environment less likely to spawn financial risks." he said. China's monetary policy is within the normal range with ample tools to moderate interest rates, according to the governor. (BBG)

PBOC: The People's Bank of China has significant capacity for monetary adjustments as its pursuit of normal policies has left it with appropriate rates and plenty of tools, Governor Yi Gang said on Sunday at the China Development Forum. The central bank will cherish this position of normality and maintain policy continuity, stability and sustainability, Yi said according to an official transcript. China's M2 growth at around 10% y/y is on par with nominal GDP growth, Yi said. The PBOC plans to set up re-lending programs to encourage financial institutions to invest in green assets, Yi said. China also aims to publish a green assets standard in consultation with the EU at the end of this year, he added. (MNI)

PBOC: China's appointments of two new monetary policy advisors may reflect an emphasis on job creation , the Shanghai Securities News reports. Cai Fang, a researcher at the Chinese Academy of Social Sciences, is a specialist on population and labor. Wang Yiming, a specialist on macro policies, is the vice chairman at China Center for International Economic Exchanges. The pair replaced Ma Jun and Liu Wei, the State Council said last week. (MNI)

ECONOMY: MNI EXCLUSIVE: China To Increase Refinanced Bonds, Debt Swaps

- China will control the growth in new debt and allow local governments to refinance more maturing bonds at lower interest rates and for longer periods as well as swap some implicit debt, gaining time to address the mounting financial risk, advisors and an analyst told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

OVERNIGHT DATA

JAPAN FEB CONVENIENCE STORE SALES -5.3% Y/Y; JAN -4.9%

JAPAN JAN, F LEADING INDEX 98.5; FLASH 99.1

JAPAN JAN, F COINCIDENT INDEX 90.3; FLASH 91.7

NEW ZEALAND Q1 WESTPAC CONSUMER CONFIDENCE 105.2; Q4 106.0

While the New Zealand economy is getting back on firmer footing, many households are still concerned about the economic backdrop. Those concerns were reflected in the latest Westpac McDermott Miller Consumer Confidence Index which slipped 0.8 percentage points in the March quarter to a level of 105.2. That leaves consumer confidence sitting at below average levels. This ongoing nervousness among households isn't surprising. Our latest survey actually took place early in March, when Covid-related restrictions on activity had been dialled up again. That's likely to have dampened some households' spirits, especially in Auckland and in traditional tourism hot spots. (Westpac)

SOUTH KOREA MAR 1-20 EXPORTS +12.5% Y/Y; FEB +16.7%

SOUTH KOREA MAR 1-20 IMPORTS +16.3% Y/Y; FEB +24.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with rates unchanged at 2.2% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) jumped to 2.2289% at 09:28 am local time from the close of 2.1798% on Friday.

- The CFETS-NEX money-market sentiment index closed at 39 on last Friday vs 38 on last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5191 MON VS 6.5098

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5191 on Monday, compared with the 6.5098 set on Friday.

MARKETS

SNAPSHOT: Erdogan Sacks CBRT Chief

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 563.39 points at 29228.66

- ASX 200 up 44.278 points at 6752.5

- Shanghai Comp. up 28.391 points at 3433.411

- JGB 10-Yr future up 29 ticks at 151.27, yield down 2.4bp at 0.089%

- Aussie 10-Yr future up 4.5 ticks at 98.205, yield down 4.3bp at 1.761%

- U.S. 10-Yr future +0-11+ at 131-18+, yield down 4.41bp at 1.677%

- WTI crude down $0.21 at $61.21, Gold down $5.16 at $1740.03

- USD/JPY down 11 pips at Y108.77

- TRY BLINDSIDED AS ERDOGAN DROPS CBRT GOVERNOR (MNI)

- TURKEY CENTRAL BANK CHIEF PLEDGES PERMANENT PRICE STABILITY (BBG)

- TURKEY TO CONTINUE IMPLEMENTING LIBERAL FX REGIME (BBG)

- FED'S BARKIN SEES STRONG ECONOMY WITH SOME PRICE PRESSURES

- BIDEN ADMINISTRATION TO LAUNCH CYBER ATTACKS ON RUSSIA AS FEUD WITH PUTIN ESCALATES (Telegraph)

- EU/UK VACCINE SPAT ESCALATES, GERMANY TO DISCUSS EXTENDING LOCKDOWNS

BOND SUMMARY: Core FI Power Ahead Amid Risk-Off News Flow, Antipodean QE Ops In Focus

Weekend headline mix provided a risk-impetus, putting a bid into core FI across the Asia-Pac region. T-Notes remained in demand and last trade +0-11+ at 131-18+ as we are heading for the London session, in close proximity to the Asia-Pac high of 131-20+ and the prior trading day's high of 131-21+. Cash Tsy curve bull flattened, yields last trade 0.6-5.5bp lower. Eurodollar futures run -0.5 to +1.5 tick through the reds. Turkish Pres Erdogan's decision to replace the CBRT chief grabbed most attention in early trade, with simmering geopolitical tensions (incl. a Telegraph report re: planned U.S. cyber attacks against Russia) providing further reasons to remain cautious. The latest portion of Fedspeak saw Mr Powell reiterate the commitment to providing stimulus "for as long as it takes," while Mr Barkin saw no signs of unwanted inflation pressures. There is more Fedspeak coming up today, with existing home sales also due out of the U.S. Local issuance slate is particularly heavy this week, with focus on Thursday's seven-year note supply, after the previous auction saw the lowest bid/cover ratio on record.

- JGB futures ebbed off highs after the Tokyo lunch break but remained afloat and last sit at 151.26, 28 ticks above settlement. Cash JGB yield curve bull flattened, with 20s outperforming. In local news, Japan confirmed that the Tokyo Olympics will take place without foreign spectators, while a 6.9 mag. quake hit off the coast of Japan. The BoJ left the sizes of its 1-10 Year JGB purchases unch. There was little in the way of market-moving insights in the latest addresses from BoJ Gov Kuroda & Japanese officials.

- ACGBs powered ahead, YM last sits +2.0 & XM +5.0, both just shy of best levels of the Asia-Pac session. Cash ACGB yields sit +0.6bp to -6.1bp across a flattened curve, while bills run unch. to +2 ticks through the reds. New South Wales saw adverse weather conditions result in floods, which forced the authorities to evacuate thousands of people and disrupted Covid-19 vaccinations. QE operations on both sides of the Tasman grabbed attention. Firstly, the RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, but excluding Nov '24 ahead of this Friday's sale of ACGB 0.25% 21 Nov '24. Secondly, ACGBs may have been aided by spill-over from the RBNZ's LSAP operations, which saw very light offers for for NZGB Apr '27 & NZGB May '41, with bid/cover ratios slipping below 2.0x.

BOJ: 1-10 Year Rinban Sizes Unchanged

The BoJ offers to buy a total of Y1.19tn of JGBs from the market, sizes unchanged from previous operations.

- Y400bn worth of JGBs with 1-3 Years until maturity

- Y370bn worth of JGBs with 3-5 Years until maturity

- Y420bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Mixed

Markets are mixed in Asia, the start of trading saw a wave of risk aversion after Turkish President Erdogan removed the central bank governor. Markets in China, Taiwan and South Korea managed to squeeze out gains, while Japan and Hong Kong continued to languish in negative territory.

- In the US futures fluctuated between gains and losses, at pixel time Dow Jones futures are negative, while S&P and Nasdaq are higher, the latter leading gains.

OIL: Retreats On Demand Concerns

Crude futures are lower on Monday, giving back some of the gains seen on Friday. WTI is down $0.21 from settlement levels at $61.21/bb;, while Brent is $0.25 lower at $64.28/bbl.

- There is some uncertainty in the market as lockdown measures extend in Europe which has cast doubts over a recovery in demand. France and Germany have extended lockdown measures, while Germany is reportedly considering the same. The demand equation is further clouded by an increase in the number of unsold cargoes from West Africa in April.

GOLD: Lower At The Start To The Week

The yellow metal is lower to start the week, last trading down $3.3544 at $1741.81/oz but having come off earlier lows around $1732. The falls come amid a spate of risk aversion sparked by Turkish President Erdogan removing the central bank governor; the greenback remains resilient, holding on to its recent gains, while 10-year yields in the US hover around their highest in a year.

FOREX: Abrupt Ouster Of CBRT Chief Finds Fertile Ground For Denting Risk Appetite

Turkish Pres Erdogan's surprise decision to oust CBRT Gov Agbal sent the lira tumbling in early Asia-Pac trade. USD/TRY wiped out four months worth of losses amid thin liquidity, despite touted action by Turkish state banks, before gradually trimming gains through the rest of the session. Erdogan's move coupled with a number of press reports flagging renewed (geo)political tensions on several familiar fronts kept risk appetite at bay.

- Demand for safe haven currencies pushed JPY to the top of the G10 pile. USD/JPY dipped after the re-open with some linking the move to the suspected unwinding of TRY/JPY positions by "Mrs Watanabe" (Japanese retail accounts." Subsequent recovery attempt allowed the rate to briefly return to neutral levels, but proved short-lived. Worth noting that $1.1bn of USD/JPY options with strikes at Y108.75 expire today.

- AUD went offered and continued to lag all of its G10 peers as broader risk-off flows overlapped with large floods in NSW as well as softer oil & iron ore prices. A BBG trader source pointed to demand from local exporters who bought AUD for repatriation, helping the currency move off worst levels.

- CAD held up well despite a weaker commodity complex, even as was the second worst performer in the G10 basket. The loonie ignored headlines noting that Canadian CP Rail agreed to buy Kansas City Southern for $25bn, in the largest acquisition of a U.S. asset by a Canadian company since 2016.

- GBP weakened as the UK's spat with the EU over Covid-19 vaccine supply escalated and the two sides publicly traded barbs over the issue.

- PBOC fixed its central USD/CNY mid-point at CNY6.5191, in-line with sell side estimates, and left its 1-Year & 5-Year LPRs unchanged. USD/CNH re-opened a touch higher, after the weekend saw PBOC Governor Yi note that the central bank still has space to expand liquidity.

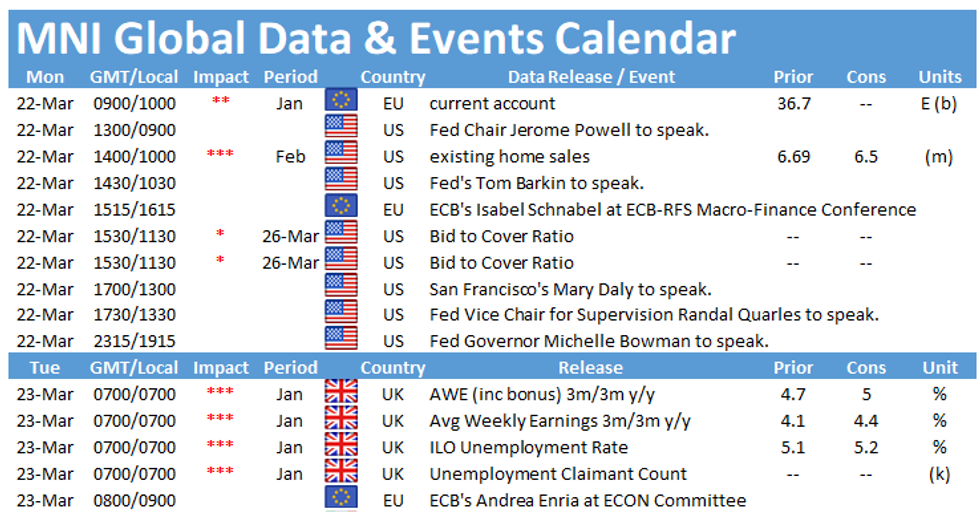

- The global data docket is rather light today, includes U.S. existing home sales. Central bank speaker slate features Fed's Powell, Barkin, Daly, Quarles & Bowman as well as ECB's Knot, Weidmann, Schnabel & de Cos.

FOREX OPTIONS: Expiries for Mar22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1840-50(E1.0bln), $1.1875-85(E660mln-EUR puts), $1.1990-1.2010(E1.1bln-EUR puts)

- USD/JPY: Y107.36-40($667mln), Y107.95-108.02($1.1bln), Y108.56-65($567mln), Y108.75($1.1bln-USD puts), Y109.05($605mln), Y109.15-20($716mln)

- EUR/GBP: Gbp0.8500(E420mln), Gbp0.8525(E650mln)

- USD/CHF: Chf0.9250($535mln)

- EUR/CHF: Chf1.1000-05(E430mln)

- NZD/USD: $0.7080(N$1.2bln-NZD puts), $0.7400(N$1.0bln-NZD puts)

- USD/CAD: C$1.2600($989mln-USD put)

- USD/CNY: Cny6.50($774mln-USD puts), Cny6.5650($800mln-USD puts)

- USD/MXN: Mxn21.00($547mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.