-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEUROPEAN MARKETS ANALYSIS: Relative Calm Ahead Of U.S. Event Risk

- Aussie bond supply dynamics and one eye on U.S. risk events applied some pressure to U.S. Tsys in Asia hours.

- The U.S. fiscal debate continues to provide the bulk of the notable headline flow.

- March saw a narrower than expectred Chinese trade surplus, with exports missing and imports beating.

BOND SUMMARY: Aussie Supply Weighs On U.S. Tsys & ACGBs

Asia-Pac headline flow was sparse at best. Still, T-Notes tagged fresh session lows ahead of European hours on the back of a couple of 2.5K clips worth of TYM1 selling (on screen), last printing -0-04 at 131-16 (0-01+ off lows). The cash curve has bear steepened, longer dated Tsys are running ~2.5bp cheaper on the day. The pressure stemmed from spill over surrounding Australian bond supply matters and news that Tencent will price a $4bn round of US$ issuance as soon as today. Today's local risk events include U.S. CPI, 30-Year Tsy supply and the announcement re: the Fed's latest Tsy purchase schedule. Tuesday's aforementioned local risk events will be supplemented by a raft of Fedspeak.

- JGB futures clung to a narrow range, last dealing +2, while cash JGBs run unchanged to a touch richer on the day, with the long end of the curve drawing some light support from a firm enough round of supply (in the form of a liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs). On the corporate supply front reports suggested that Softbank is planning to sell 5-, 7- & 10-Year JPY paper. BoJ Governor Kuroda pointed to some of the benefits of a softer JPY in parliament, while stressing the need to maintain ultra-loose monetary policy settings, although nothing in his address rocked the proverbial boat. BoJ Rinban operations covering 1- to 10-Year JGBs and the core machine orders data headline the local docket on Wednesday.

- ACGB Nov '32 syndication-related hedging resulted in above average activity for XM, and pressure on the Aussie bond space. This was the dominating factor with nothing in the way of tangible input from the latest round of ABS payroll data and the NAB business survey. Futures edged away from lows after the official pricing announcement, with YM -2.0, XM -3.0 at typing. The cash ACGB curve has bear steepened. The monthly Westpac consumer confidence reading headlines the local docket on Wednesday, while the latest RBNZ monetary policy decision will be delivered across the Tasman. A reminder that the local monthly labour market report is due to be released on Thursday.

FOREX: Antipodeans Sag In Quiet Asia-Pac Trade, USD Gains Ahead Of Local CPI Report

The Antipodeans traded on a softer footing in the quiet Asia-Pac session, even as a positive showing from core equity markets suggested that yesterday's risk aversion has petered out. BBG trader sources flagged light NZD/USD sales ahead of the upcoming monetary policy decision from the RBNZ, even as March data showed recovery in local card spending.

- AUD briefly edged away from session lows after the latest NAB Business Conditions hit record high, even as headline Confidence Index deteriorated at the margin. Resultant recovery in AUD was rather shallow and short-lived.

- The greenback led gains in G10 FX space, with the DXY clawing back yesterday's losses. USD/JPY gained into the Tokyo fix and remained afloat thanks to demand for the dollar.

- The PBoC set its central USD/CNY mid-point at CNY6.5454, 12 pips below sell-side estimate. China's trade balance unexpectedly shrank in Mar, as a miss in exports was coupled with a beat in imports. The redback showed little reaction to the data.

- U.S. CPI, German ZEW Survey, UK economic activity indicators take focus on the data front, with Fed's Harker, Daly, Barkin, Mester, Bostic & Mester, ECB's Villeroy & Norges Bank's Olsen due to speak.

FOREX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E504mln), $1.1885-1.1900(E643mln-EUR puts)

- USD/JPY: Y106.35($1bln), Y109.50($478mln)

- EUR/GBP: Gbp0.8560-70(E646mln-EUR puts)

- AUD/USD: $0.7595-0.7600(A$767mln-AUD puts), $0.7630(A$413mln-AUD puts)

- USD/CNY: Cny6.45($700mln), Cny6.60($730mln)

ASIA FX: Narrow Ranges

Greenback regained some poise after falling on Monday, most pairs saw narrow ranges ahead of US CPI data and local events on the docket.

- CNH: Offshore yuan is weaker, reversing gains made on Monday after reports that the US treasury would not label China a currency manipulator. Exports were strong but rose less than expected, while the trade surplus narrowed.

- SGD: Singapore dollar is weaker, markets await the MAS decision and GDP data tomorrow.

- TWD: Taiwan dollar is stronger, it was reported the government started distribution of AstraZeneca's Covid-19 vaccines provided through COVAX to hospitals after completes tests on the first batch.

- KRW: The won under pressure again, some attributing outflows from the expected repatriation of Samsung's huge KRW 7.7tn dividend as putting pressure on the won.

- MYR: Ringgit is weaker, Malaysian Defence Min Ismail Sabri Yaakob said that the Health Ministry's modelling suggests that a fourth wave of Covid-19 infections may hit the country. The gov't decided to extend existing CMCO & RMCO restrictions through Apr 28 (except for Sarawak, where restrictions were extended through Apr 26).

- IDR: Rupiah continued to weaken, the Finance Ministry announced that it has exempted some taxes in special economic zones for tourism businesses from Apr 1, as part of the new omnibus law on job creation.

- PHP: Peso is lower, the Philippines' tensions with China have sparked concerns over the delivery of Chinese Covid-19 vaccines. Manila asked the U.S. to help expedite the delivery of jabs produced by Moderna.

- THB: Thailand is closed for a market holiday.

ASIA RATES: Regional Divergence

Mixed in the region as US Tsys held narrow ranges ahead of CPI data later today.

- INDIA: Markets closed for a local holiday. Markets digest data yesterday that showed CPI rose 5.52%, slightly above estimates but still within the RBI's 2%-6% band, while industrial production fell faster than expected at -3.6%. Meanwhile, India reports another record number of COVID-19 cases and holds the dubious honour of overtaking Brazil as the record holder.

- SOUTH KOREA: Bonds under pressure as equity markets make gains, South Korean President Moon, likely still stinging from his parties (DPK's) defeats in two mayoral contests, hit the wires saying the government needed to actively support those still suffering from the economic effects of the pandemic. 2-year auction size was slightly larger than advertised, but demand still decent.

- CHINA: Futures are higher in China, while in the cash space yields are lower with the 10-year yield hitting the lowest level in two months. Bonds are supported after the PBOC's monetary policy department said it would keep credit growth reasonable and make credit and monetary environment conducive to high-quality economic growth. Sun Guofeng, head of the monetary policy department made the comments late yesterday at a briefing. Sun noted that Monetary supply and aggregate financing growth in 1Q basically matched China's economic growth. Data showed Exports were strong but rose less than expected, while the trade surplus narrowed.

- INDONESIA: Bond yields higher ahead of slated supply today, the government is targeting a sale of IDR 30tn after the previous sale of IDR 4.75tn. Elsewhere, the Finance Ministry announced that it has exempted some taxes in special economic zones for tourism businesses from Apr 1, as part of the new omnibus law on job creation.

EQUITIES: Higher After Rout On Monday

A generally positive day for equity markets in the Asia-Pac timezone on Tuesday, recovering from a rout on Monday. Bourses in South Korea and Hong Kong lead the way higher, the latter boosted by reports that US President Biden saw the chip shortage as a top priority and was taking steps for a summit with South Korean president Moon. The Hang Seng is higher on reports that Hong Kong has made progress on a 'travel bubble' with Singapore, while pre-tested visitors from China are soon to be allowed to enter without quarantine. Markets in mainland China were supported by another set of robust trade figures. US futures are higher, there were reports late on Monday that Nvidia was taking aim at Intel after unveiling its first server microprocessors but this has failed to dampen the Nasdaq. Markets await inflation figures from the US later today.

GOLD: The Lines Are Drawn

Little to report for bullion, with spot hemmed into the recently established ranges as participants await any decisive signals from the DXY/U.S. Tsys. Spot last deals little changed around the $1,735/oz mark, with no changes to report on the technical front.

OIL: Crude Futures Eke Out Small Gains

Crude futures made some small gains in Asia-Pac trade, with WTI & Brent sitting ~$0.20 above their respective settlement levels at typing. There was little impetus to move oil markets, with participants now looking ahead to inventory data, US API data is due later on Tuesday. Median estimates on Bloomberg are for a 2.4m bbl drop, which if confirmed would be the third consecutive weekly decline in headline crude stocks. There could be some headwinds in terms of higher production; output at the Permian Basin is expected to rise to 4.466m bpd in May according to EIA data, a level not seen since the start of the pandemic.

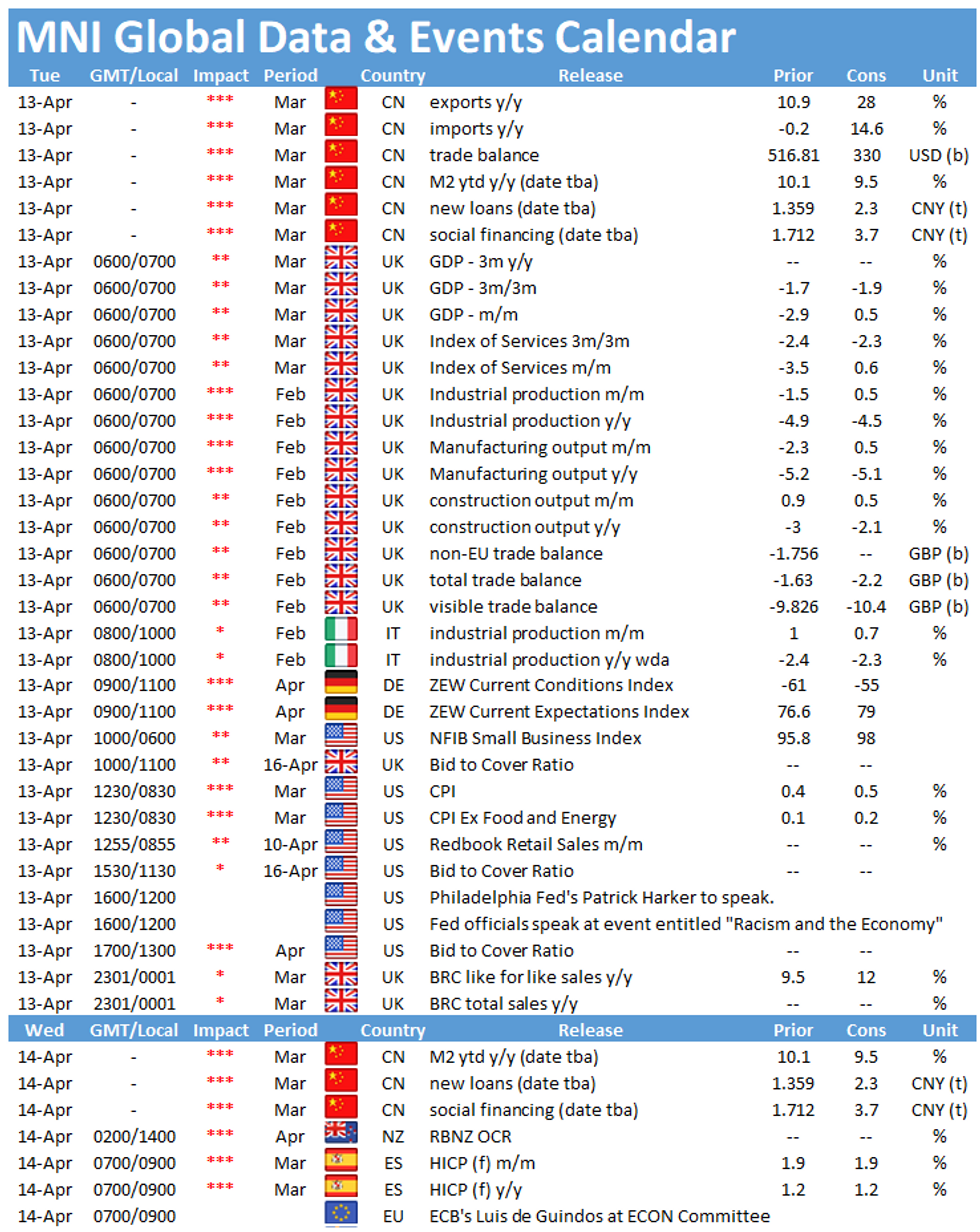

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.