-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ Plays Straight Bat, Sino-U.S. Tensions Surrounding Taiwan Evident

EXECUTIVE SUMMARY

- J&J PAUSES COVID SHOTS IN CLINICAL TRIALS (BBG)

- PFIZER PUSHES TO SPEED UP ITS VACCINE DELIVERY AFTER J&J PAUSE (THE HILL)

- RBNZ SEES NEED FOR PROLONGED STIMULUS AMID UNCERTAINTY (BBG)

- SINO-U.S. TENSIONS SIMMER, WITH TAIWAN FRONT AND CENTRE

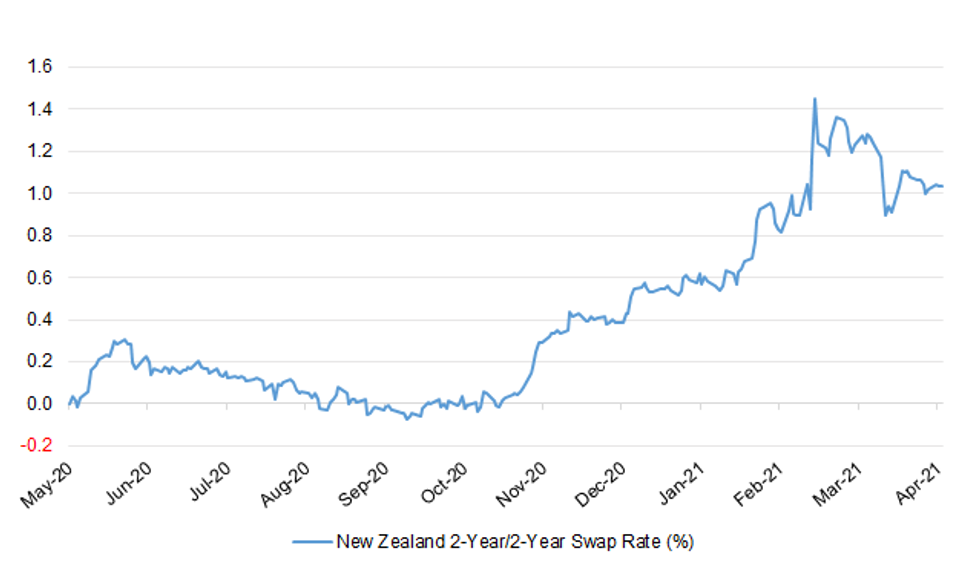

Fig. 1: New Zealand 2-Year/2-Year Swap Rate (%)

Source: MNI - Markets News/Bloomberg

Source: MNI - Markets News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has warned that the reduction in coronavirus infections, hospitalisations and deaths "has not been achieved" by the rollout of COVID vaccines. The prime minister, speaking the day after the latest easing of lockdown restrictions, instead said it was the national shutdown that had been "overwhelmingly important" in driving down COVID rates. (Sky)

CORONAVIRUS: More than 60 restaurant owners, nightclub operators and other hospitality figures have told Boris Johnson that they will not force customers to show Covid passports. (Telegraph)

BREXIT: Britain will host Irish Foreign Minister Simon Coveney in London and its EU negotiator David Frost will travel to Brussels on Thursday for talks designed to ease differences over trade with Northern Ireland, the scene of more than a week of riots. Coveney was due to hold talks with his British counterpart Dominic Raab and Brandon Lewis, Britain's minister for Northern Ireland, an Irish government source said. Frost would meet European Commission vice president Maros Sefcovic on Thursday evening to discuss a British change in Northern Ireland trading arrangements in March, which prompted a legal challenge from Brussels. (RTRS)

EUROPE

GERMANY: Bavarian Premier Markus Soeder presented himself as a force for change who can revive the fortunes of Germany's conservatives as he made his bid to follow Chancellor Angela Merkel at the top of the bloc's election ticket. His rival for the candidacy in September's federal vote, Armin Laschet, said that Soeder changes his views a little too easily, accusing him of opportunism and lacking principle, according to officials present at a private meeting with lawmakers. The battle to claim the mantel of Merkel's successor is going down to the wire with the two contenders exchanging increasingly barbed attacks that have alarmed senior officials from their bloc. (BBG)

FRANCE: France will hold regional elections in June despite the COVID-19 crisis, French Prime Minister Jean Castex told parliament on Tuesday. Castex said the first round of the elections will be held on June 20, with the second round due on June 27. The elections had already been postponed from March due to the COVID-19 control measures and the government had considered a possible new delay. A presidential election is due to be held in the spring of 2022. (RTRS)

ITALY: The COVID vaccine produced by Johnson & Johnson is important for the fight against coronavirus and will need to be used, Italian Health Minister Roberto Speranza was quoted as saying on Tuesday by Italian news agencies. The U.S. company said earlier it would delay rolling out the vaccine in Europe after U.S. federal health agencies recommended pausing its use following cases of rare blood clots in six women after they were given it. "We will evaluate the situation in the coming days over what will be the best way forward, as soon as the European and American (regulators) give us more formal and definitive news," Speranza was quoted as saying by ADNKronos agency. "But I think that this vaccine too will have to be used because it is an important vaccine." (RTRS)

NETHERLANDS: The Dutch government on Tuesday presented a roadmap for relaxing coronavirus lockdown measures, but caretaker Prime Minister Mark Rutte stressed that it is still too early to ease restrictions. In a nationally televised press conference, Rutte said hospitals in the Netherlands are as crowded with COVID-19 patients now as they were during the first wave of the pandemic last year and that it would be irresponsible to relax the country's months-long lockdown now. The government had previously said it hoped the first relaxation could have started April 21, but Rutte said that was too soon. "The reality is that the end is in sight, the reality that society can reopen again in a responsible way. We will take the first step when the peak of the third wave has passed," Rutte said. (AP)

U.S.

FED: There are "long-term disinflationary forces, like the power of big-box retailers in the purchasing departments, like the price transparency which is enabled by the internet, and like global access to lower-cost product and talent. They're keeping inflation expectations modulated," Richmond Federal Reserve President Thomas Barkin says. Barkin says he's hopeful that the U.S. is on the brink of completing its recovery and that real-time indicators suggest that the country is "in the midst of a boom;" adds supply shortages could limit the upside in U.S. gross domestic product. (BBG)

FED: MNI BRIEF: Fed's Harker Says No Reason to Withdraw Support Yet

- Philadelphia Federal Reserve Bank President Patrick Harker said Tuesday even while there are signs the economy has begun to turn around and could grow 5-6% this year, the central bank will continue to support a full recovery from the pandemic. "While the economic situation is improving, recovery is still in its early stages, and there's no reason to withdraw support yet," said Harker in a speech before the Delaware State Chamber of Commerce. Harker isn't a voting member of the rate-setting FOMC this year - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: A FOX reporter tweeted the following on Tuesday: "Boston Fed President Eric Rosengren told me: "Any infrastructure program depends on what it is that you're spending the money on, if it's a high return project. You should probably do that. And right now, interest rates are still quite low. So it may be an appropriate time to do a large infrastructure spend, but it makes sense to make sure that that infrastructure is really helping the productive capacity of the US economy. Also, how that program is financed is going to be important. I certainly think that we should be running large deficits during a time when there's a lot of labor market slack and we're trying to get the economy back to where we were pre pandemic. But there's going to be a time, hopefully by the end of next year, where we're going to want to be having more fiscal to pull back on some of the expenditures on the fiscal side and over time, also on the monetary policy side. The way we think about inflation is it's not just temporary increases in prices, but is the sustained increase in prices. I do think that we're going to be right around our 2% inflation target over the course of these next two to three years. In the near term, we're probably going to have some higher readings, partly reflecting, reflecting some of the supply chain issues, partly reflecting the fact that the base year from last year was a pandemic period where prices were quite low. So we will have some higher numbers over the course of this year. But I'm pretty confident that we will stay right around our two percent inflation target over this period." (MNI)

FED: The Federal Reserve will keep broadly unchanged the amount of debt maturing in 7-to-20 years that it buys under its existing asset-purchase program, even though some had speculated about the potential for it to change. The Federal Reserve Bank of New York, under plans announced June 10, is currently buying Treasury securities at the rate of about $80 billion a month. Its latest purchase schedule, released Tuesday, maintains that overall pace for the April 14-May 13 timeframe. It also keeps the amounts for different tenors broadly similar. Some in the market had speculated about the potential for a shift in the composition of purchases following comments last week by the New York Fed's Lorie Logan, manager of the System Open Market Account. (BBG)

FED: Directors of all 12 regional Federal Reserve banks favored keeping the discount rate on hold at 0.25%, according to minutes of discount-rate meetings released by the Fed on Tuesday. "Federal Reserve Bank directors reported that the economic recovery had gained some momentum over recent weeks, due in large part to vaccine developments and the prospect of additional fiscal support." "Many directors expected inflation to move up to or slightly above 2% over coming years." (BBG)

FISCAL: The Biden administration is not considering a hike to the federal gasoline tax as a way to help pay for its landmark infrastructure proposal, according to the White House's top spokeswoman. The subject of the gasoline tax came up during press secretary Jen Psaki's briefing Tuesday afternoon, when a reporter asked her to address reports on Monday that suggested President Joe Biden could be open to raising the gas tax from its current 18.4 cents per gallon. (CNBC)

FISCAL: While the latest stimulus package and a new massive infrastructure bill are the main topics of conversation in Washington of late, President Joe Biden continues to be under mounting pressure to take action on student loan forgiveness, too. Sen. Elizabeth Warren, D-Mass., held a hearing on Tuesday afternoon on the burden of student loan debt and urged Biden to cancel the loans as soon as possible. (CNBC)

CORONAVIRUS: White House Covid-19 response coordinator Jeff Zients said there was enough of a supply of the Pfizer and the Moderna vaccines to make up for the pause of the Johnson & Johnson vaccine and still hit the administration's vaccination targets. (NBC)

CORONAVIRUS: Pfizer's CEO said Tuesday that the company has ramped up its vaccine production to deliver doses more quickly following a pause in distribution of the Johnson & Johnson vaccine. Albert Bourla, Pfizer's CEO, tweeted that the company could complete an order of 300 million COVID-19 vaccines two weeks early following guidance from the Centers for Disease Control and Prevention (CDC) earlier Tuesday urging states to halt distribution of the J&J vaccine. Bourla wrote that his company is on pace to finish the order of 300 million doses it agreed to provide by the end of July two weeks early, adding it could provide 10 percent more than it originally agreed to by the end of May. (The Hill)

FISCAL: Senate Minority Leader Mitch McConnell said it's unlikely any Republicans will back President Joe Biden's $2.3 trillion infrastructure proposal if it includes tax increases. McConnell, a Kentucky Republican, said the measure is already flawed because it dedicates too little to fix crumbling roads and bridges. The tax increases are a nonstarter with the GOP, he said, because it would involve reversing the 2017 tax cuts that became the party's signature achievement under the Trump administration. (Washington Examiner)

FISCAL: Seventeen New York Democrats told House Speaker Nancy Pelosi that any economic recovery bills funded by tax increases will also need to fully restore the state and local tax, or SALT, deduction to get their support. "We will not hesitate to oppose any tax legislation that does not fully restore the SALT deduction," the group said in the letter Wednesday. The signatories, which include senior lawmakers such as Representative Jerry Nadler as well as progressive freshman Jamaal Bowman and Mondaire Jones, add to the list of Democrats who are threatening to block President Joe Biden's $2.25 billion infrastructure bill funded by corporate tax increases if the legislation also didn't restore a tax break valuable for many residents in high-tax states, including New York, New Jersey and California. (BBG)

POLITICS: President Biden on Tuesday accepted an invitation to address a joint session of Congress on April 28, roughly 100 days after he took office. Speaker Nancy Pelosi (D-Calif.) invited Biden in a letter released publicly earlier that day. The president accepted the invitation, a White House official confirmed late Tuesday night. (The Hill)

EQUITIES: Credit Suisse Group AG unloaded about $2 billion of stocks tied to the Archegos Capital Management blowup, according to people familiar with the matter. The stock offerings -- which included Discovery Inc. and Iqiyi Inc. -- follow a torrent of similar transactions that had already erased about $194 billion in market value as banks from New York to Zurich and Tokyo unwound leveraged equity bets by Bill Hwang's fund. (BBG)

OTHER

U.S./CHINA: The U.S. Commerce Department said on Tuesday it had issued a subpoena to an unnamed Chinese company as part of the Biden administration's review of its supply chain for any risks posed to U.S. national security. The administration of President Joe Biden has take a relatively hard line on Chinese companies, similar to that of the previous Trump White House, citing U.S. national security and underscoring the president's view that China is America's most serious competitor. (RTRS)

U.S./CHINA: China and the U.S. should increase their dialogue and boost cooperation to promote a steady development in relations because decoupling serves no one's interest, Premier Li Keqiang said in a video meeting on Tuesday with a group of U.S. executives. The two sides should manage differences through co-operation, and China will proactively open as a global market and investment destination, Li said in comments reported by Xinhua. U.S. executives, including representatives from Boeing, Qualcomm and Pfizer, urged Li to resume personnel travel and exchange. (MNI)

U.S./CHINA/TAIWAN: Former U.S. Senator Chris Dodd and former Deputy Secretaries of State Richard Armitage and James Steinberg headed to Taiwan on Tuesday at President Joe Biden's request, in what a White House official called a "personal signal" of the president's commitment to the Chinese-claimed island and its democracy. (RTRS)

U.S./CHINA/TAIWAN: China described its military exercises near Taiwan as "combat drills" on Tuesday, hours before the arrival of senior former U.S. officials in Taipei on a trip to signal President Joe Biden's commitment to Taiwan and its democracy. Taiwan has complained over the proximity of repeated Chinese military activity, including fighter jets and bombers entering its air defence zone and a Chinese aircraft carrier exercising off the island, claimed by Beijing. Twenty-five Chinese air force aircraft including fighters and nuclear-capable bombers entered Taiwan's air defence identification zone (ADIZ) on Monday, the largest reported incursion by Taipei to date. China's Taiwan Affairs Office said Taiwan's government and separatists were colluding with "external forces", seeking provocation and to damage peace and stability. (RTRS)

GEOPOLITICS: U.S. climate envoy John Kerry will travel to China this week to discuss international efforts to tackle global warming, seeking to press his counterparts to make ambitious emissions reduction targets despite tension in the U.S.-China relationship. The U.S. State Department said Kerry would travel to Shanghai and Seoul, South Korea, for talks on April 14-17, ahead of President Joe Biden's virtual summit with world leaders on climate change next week. Kerry will "discuss raising global climate ambition," during his visits, the State Department said. (RTRS)

CORONAVIRUS: Johnson & Johnson said it will pause vaccinations in all Janssen Covid-19 vaccine clinical trials while it updates guidance for investigators and participants. (BBG)

CORONAVIRUS: Moderna's Covid-19 vaccine was more than 90% effective at protecting against Covid and more than 95% effective against severe disease up to six months after the second dose, the company said Tuesday, citing updated data from its phase three clinical trial. The update brings Moderna a step closer to filing its request for full U.S. approval for its vaccine. Full approval requires a more rigorous review process to show the shot is safe and effective for its intended use. Once it gets full approval, Moderna can begin marketing the shots directly to consumers and selling them to individuals and private companies in the U.S. (CNBC)

CORONAVIRUS: Two inactivated vaccines developed by Sinopharm's China National Biotec Group have been given more than 100 million doses so far, the company says in its official WeChat account. Monthly supply of inactivated shots has reached 100 million doses since April. Annual production for the two inactivated vaccines will be boosted to 3 billion doses after completion of new facilities. (BBG)

AUSTRALIA: Scott Morrison has asked the national cabinet to meet twice a week "for the foreseeable future" in an effort to get the Covid-19 vaccination program back on track. (Guardian)

RBNZ: New Zealand's central bank signaled it is in no rush to remove monetary stimulus, saying the outlook remains uncertain as the economy gradually recovers from the Covid-19 pandemic. The Reserve Bank's monetary policy committee on Wednesday maintained its current stimulatory settings, holding the official cash rate at 0.25% and the Large Scale Asset Purchase program at NZ$100 billion ($71 billion). It reiterated it is prepared to lower the cash rate further if required. "The committee agreed that, in line with its least regrets framework, it would not remove monetary stimulus until it had confidence that it is sustainably achieving the consumer price inflation and employment objectives," the bank said. "Given that uncertainty remains elevated, gaining this confidence is expected to take considerable time and patience." (BBG)

SOUTH KOREA: South Korea's daily new coronavirus cases rebounded to over 700 on Wednesday, the most in over three months, as health authorities are looking at the option of raising social distancing rules to contain the virus resurgence. (South Korea)

TURKEY: Turkey's president announced a partial lockdown Tuesday during the first two weeks of the Muslim month of Ramadan to curb COVID-19 infections as the number of infections hit a record. In a televised address following a Cabinet meeting, President Recep Tayyip Erdogan said the government was re-imposing bans on intercity travel, barring people over 65 and under 18 from using public transport, re-adjusting public sector working hours, closing sports and leisure centers and expanding the length of night-time curfews. (ABC)

TURKEY: President Tayyip Erdogan said on Tuesday that Turkey remains committed to full membership in the European Union, for which it is a candidate country despite strains in recent years. Last month the EU opened the door to begin modernising a customs union with Turkey, and last week its leadership said it would make a proposal to ensure the flow of funding for refugees hosted by Ankara. Erdogan has downplayed EU membership in recent years as the bloc has ramped up criticism of Ankara's foreign policy and rights record, and dangled the threat of EU sanctions. (RTRS)

MEXICO: Mexico's lower house of congress on Tuesday passed a bill to regulate outsourcing and close down loopholes companies have used to avoid paying payroll taxes and social security dues. Lawmakers approved the bill in general terms with 348 in favor, 77 opposed and 32 abstentions, while reserving some articles for debate. The bill will go to the senate once those discussions conclude. (BBG)

BRAZIL: Brazil's central bank began tightening monetary policy last month after a spike in commodity and energy prices started to have an impact on core inflation, according to its President Roberto Campos Neto. "We understand that this process had some contamination in the core inflation numbers," Campos Neto, 51, said in a Bloomberg TV interview late on Tuesday. "We keep vigilant on how this process is developing." (BBG)

BRAZIL: Inquiry into the federal govt's actions to fight the pandemic was opened by the head of Senate, Rodrigo Pacheco, who read the request to kick off the commitee's work. Use of federal public funds by states and cities may be analyzed. Committee will have 11 members and 7 alternates. (BBG)

RUSSIA: President Joe Biden proposed a summit with Russian President Vladimir Putin during a phone call Tuesday between the two leaders, the White House said. Biden proposed holding the summit "in the coming months," said a readout of the call provided Tuesday by the administration. (CNBC)

SOUTH AFRICA: South Africa has halted the rollout of Johnson & Johnson vaccines after health agencies in the U.S. recommended it's suspension, citing concerns about rare and severe blood clotting side effects. South Africa will suspend its vaccine rollout "until the Johnson & Johnson vaccine is sufficiently interrogated," Health Minister Zweli Mkhize told reporters on Tuesday. "We hope that the deliberations will only take a few days. Given the preliminary literature on hand, our scientists are confident that the FDA decision is only on a precautionary basis and we expect that this will not result in the complete withdrawal of the Johnson & Johnson vaccine from the vaccination armament." (BBG)

IRAN: Iran will begin enriching uranium at 60%, a significant step toward weapons-grade material, in response to an attack at a key nuclear site, the country's top nuclear negotiator told state media on Tuesday. Iran's deputy foreign minister, Abbas Araghchi, said he informed the International Atomic Energy Agency, which oversees the monitoring and inspection of nuclear sites, of Tehran's decision. An estimated 90% of enriched uranium is needed to develop a bomb. (CNBC)

IRAN: A WSJ reporter tweeted the following on Tuesday: "Understand IAEA inspectors will be on the ground in Natanz tomorrow, according to sources."

MIDDLE EAST: Britain will withdraw nearly all its troops from Afghanistan following the U.S. plan to withdraw its troops by Sept. 11, 2021, The Times reported on Tuesday. Britain has drawn up plans to hand over control of the academy in Kabul where troops help to train Afghan soldiers to the government, the newspaper said. There are about 750 British soldiers in Afghanistan who would struggle without U.S. support because of the reliance on U.S. bases and infrastructure, according to the Times. (RTRS)

CHINA

POLICY: China should implement structural tax cuts for SMEs as soon as possible and avoid a tightening of credit or allow inflation expectations to rise, said Wang Yiming, a member of the monetary policy committee of the PBOC. In a blogpost published by CF40, Wang said recent rising commodity prices lifted the manufacturing costs of Chinese SMEs and narrowed profit margins. Credit risks of companies and local government financing vehicles are also increasing this year, Wang said. (MNI)

LGFVS: Local government financial vehicles (LGFV) which fail to repay debts may be required to file for bankruptcy and liquidate assets and restructure their debt, the 21st Century Business Herald said citing a document from the State Council. A LGFV bankruptcy is however unlikely in the short term, as it risks the region's ability to obtain future financing, the newspaper said citing unidentified market sources. (MNI)

OVERNIGHT DATA

JAPAN FEB CORE MACHINE ORDERS -7.1% Y/Y; MEDIAN +2.4%; JAN +1.5%

JAPAN FEB CORE MACHINE ORDERS -8.5% M/M; MEDIAN +2.5%; JAN -4.5%

AUSTRALIA APR WESTPAC CONSUMER CONFIDENCE INDEX 118.8; MAR 111.8

AUSTRALIA APR WESTPAC CONSUMER CONFIDENCE +6.2% M/M; MAR +2.6%

The Index is now at its highest level since August 2010 when Australia's post-GFC rebound and mining boom were in full swing. From my own perspective I considered that there was a reasonable case for the Index to pull back reflecting developments since the March survey. That pull back was not expected to be significant. However, we should always be alert to any surprising and marked direction change in the survey. Recall that the 16.4% surge in the Index in May last year was the first real sign that the economy was going to recover from the recession more quickly than anticipated. The survey continues to signal that the consumer will be the key driver of above-trend growth in 2021. (Westpac)

NEW ZEALAND FEB NET MIGRATION +674; JAN +631

SOUTH KOREA MAR UNEMPLOYMENT 3.9%; MEDIAN 3.9%; FEB 4.0%

SOUTH KOREA MAR EXPORT PRICE INDEX +5.6% Y/Y; FEB +0.6%

SOUTH KOREA MAR EXPORT PRICE INDEX +3.3% M/M; FEB +3.5%

SOUTH KOREA MAR IMPORT PRICE INDEX +9.0% Y/Y; FEB -0.3%

SOUTH KOREA MAR IMPORT PRICE INDEX +3.4% M/M; FEB +4.4%

SOUTH KOREA MAR BANK LENDING TO HOUSEHOLD TOTAL KRW1,0095TN; FEB KRW1,0031TN

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS WEDS; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1936% at 09:23 am local time from the close of 2.0232% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 35 on Monday. A higher index indicates increased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5362 WEDS VS 6.5454

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower for a second day at 6.5362 on Wednesday, compared with the 6.5454 set on Tuesday.

MARKETS

SNAPSHOT: RBNZ Plays Straight Bat, Sino-U.S. Tensions Surrounding Taiwan Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 88 points at 29660.94

- ASX 200 up 39.776 points at 7016.7

- Shanghai Comp. up 5.249 points at 3401.719

- JGB 10-Yr future up 17 ticks at 151.40, yield down 1.8bp at 0.089%

- Aussie 10-Yr future up 6.5 ticks at 98.2900, yield down 6bp at 1.750%

- U.S. 10-Yr future +0-00+ at 132-03, yield up 0.35bp at 1.618%

- WTI crude up $0.41 at $60.59, Gold down $1.74 at $1743.77

- USD/JPY down 16 pips at Y108.90

- J&J PAUSES COVID SHOTS IN CLINICAL TRIALS (BBG)

- PFIZER PUSHES TO SPEED UP ITS VACCINE DELIVERY AFTER J&J PAUSE (THE HILL)

- RBNZ SEES NEED FOR PROLONGED STIMULUS AMID UNCERTAINTY (BBG)

- SINO-U.S. TENSIONS SIMMER, WITH TAIWAN FRONT AND CENTRE

BOND SUMMARY: Narrow Ranges

Core FI markets sit little changed to a touch firmer in Asia-Pac hours, with the recent supply burden in U.S. Tsys & ACGBs now in the rear-view mirror.

- A couple of pockets of TYM1 screen buying helped support the broader U.S. Tsy space in early Asia dealing, although T-Notes have moved away from best levels to last print +0-00+ on the day, sitting at 132-03 (operating in a 0-04 range), while cash Tsys sit within ~0.5bp of settlement levels, running marginally cheaper across the curve.

- JGB futures consolidated overnight gains, last +17. The cash JGB curve initially drew support from the overnight move in futures/U.S. Tsys, with the super-long end richening further in the afternoon, longer dated yields print 2.0-2.5bp lower on the day at typing. There has been little in the way of notable headline flow to flag during Tokyo hours. The latest round of BoJ Rinban operations covering 1- to 10-Year JGBs saw some light upticks in the offer/cover ratios.

- Aussie bonds futures held onto their overnight gains and traded a touch firmer in Sydney hours, YM last +1.0, XM +6.5. The space has looked through the strongest headline Westpac consumer confidence reading in over a decade, while there was no knock-on from the latest RBNZ monetary policy decision across the Tasman.

BOJ: 1-10 Year Rinban Conducted

The BoJ offers to buy a total of Y1.375tn of JGB's from the market

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Mixed As Coronavirus Headlines Return To The Fore

A mixed day for equities in the Asia-Pac region. Markets in Taiwan lead the way lower, down around 1.25%, while markets in Japan are also under pressure over coronavirus vaccine concerns. Gains are led by mainland China and Hong Kong who took a positive lead from the US, while tech leads the way higher after China ordered its leading tech companies to self-inspect and rectify business practices that limit competition in a bid to avoid further punitive action. US futures are lower, retreating after making record highs yesterday and some scepticism that the vaccine rollout will continue as planned after suspension of the Johnson & Johnson inoculation.

OIL: Crude Futures Creep Higher

Another small bump higher for oil prices in Asia-Pac trade on Wednesday; WTI up $0.45 from settlement levels at $60.63/bbl, Brent is up $0.45 at $64.12. Since mid-March WTI has moved in a range between approximately $62/bbl and $57/bbl with the price coiling in previous sessions.

- Yesterday OPEC's monthly report upgraded the groups demand forecasts and asserted that the market is capable of absorbing extra supply. "Reductions in surplus inventories as well as an expected pick-up in product demand will pave the way for a cautious recovery of oil market balance in the summer months," the report said.

- Data from the API yesterday showed headline crude stocks fell 3.61m bbls, the third consecutive draw. A mixed report for downstream products with gasoline stocks rising 5.57m bbls, while distillates fell 3m bbls. Cushing stocks rose 917k bbls. Markets look ahead to US DOE inventory figures in the US session, also on the docket today is the IEA monthly report where markets will assess the agencies outlook for demand and supply.

GOLD: Still Coiling

Bullion continues to stick to the confines of the recent range, with the latest richening of U.S. Tsys/downtick in U.S. real yields and DXY softness supporting gold over the last 24 hours, although bulls haven't been able to force a test of resistance in the form of the April 8 high & 50-day EMA. Spot last deals little changed around the $1,745/oz mark.

FOREX: NZD Bid After Uninspiring RBNZ Decision, USD Extends Losses

The RBNZ's Monetary Policy Review was expectedly uninspiring and thus smoothly digested, albeit NZD/USD implied vols fell after the decision, with 1-month tenor printing lowest levels in more than a year. Spot NZD/USD pierced resistance from Apr 5 high of $0.7070 and accelerated gains thereafter, with BBG trader source flagging interbank purchases to cover buy stops above that level. The kiwi showed at its strongest levels in three weeks vs. both USD and AUD.

- NZD strength spilled over into AUD, to a degree. The Aussie had earlier ignored a strong Westpac Consumer Confidence print, with headline index surging to levels not seen since 2010.

- The DXY extended Tuesday's losses as participants assessed familiar developments. The greenback's weakness allowed USD/JPY to penetrate support from Apr 8 low/round figure at Y109.00.

- The PBoC set its central USD/CNY mid-point at CNY6.5362, just 2 pips below sell-side estimates and the sixth lower fix in a row.

- KRW led gains in Asia as South Korea's unemployment fell for the second month, while export prices recorded the fourth straight monthly gain.

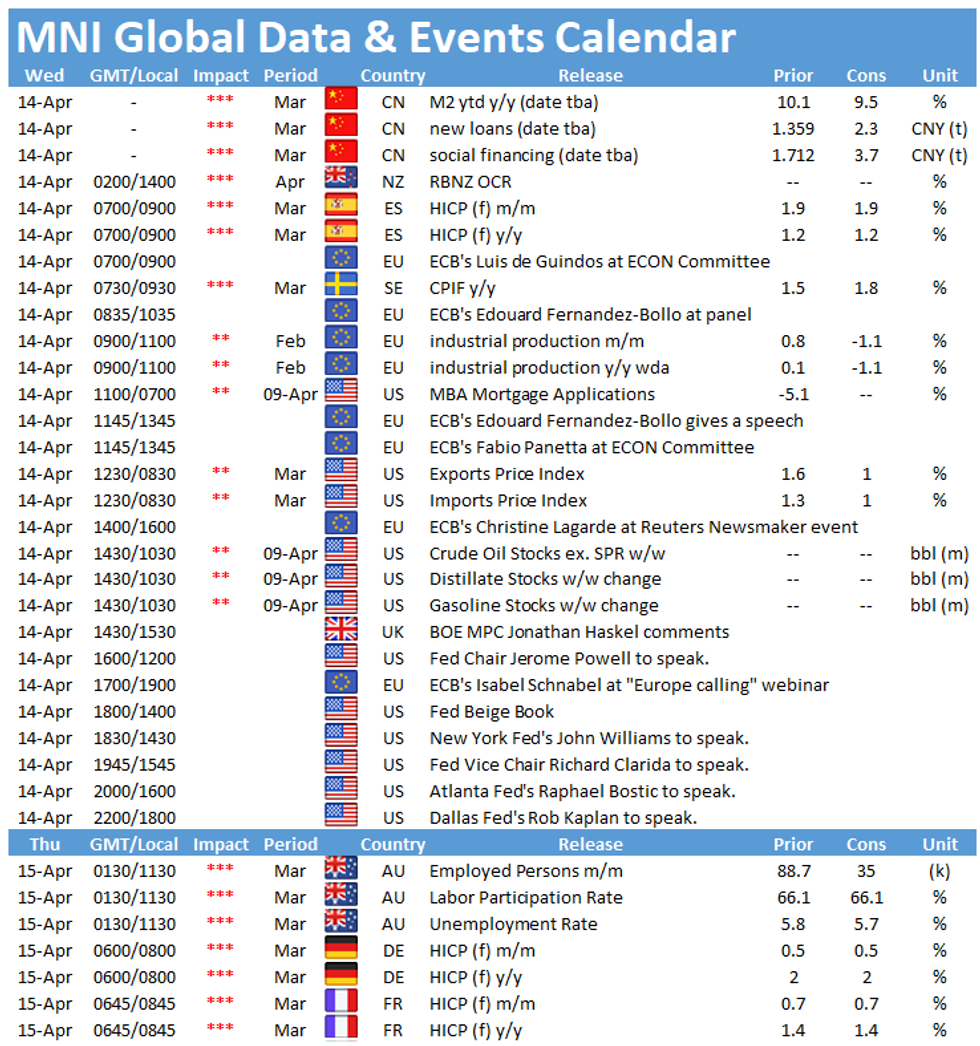

- Coming up today we have EZ industrial output, Swedish CPI and comments from Fed's Powell, Clarida, Williams, Bostic & Kaplan, BoE's Haskel as well as ECB's Lagarde, Schnabel, de Guindos & Panetta.

FOREX: Expiries for Apr14 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1795-00(E855mln), $1.1900(E1.1bln-EUR puts), $1.1925(E1.3bln-EUR puts), $1.1945-60(E1.46bln-EUR puts), $1.1975-80(E430mln-EUR puts)

- USD/JPY: Y108.00($831mln), Y108.50($525mln), Y108.75-80($477mln), Y108.95-00($868mln)

- GBP/USD: $1.3840-50(Gbp792mln-GBP puts), $1.4050(Gbp762mln)

- EUR/GBP: Gbp0.8600-15(E1.1bln)

- AUD/USD: $0.7700(A$700mln-AUD puts)

- USD/CAD: C$1.2465-70($750mln), C$1.2500($1.2bln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.