-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Tariffs Initiate Talks With Mexico

MNI EUROPEAN OPEN: Global COVID Matters Headline

EXECUTIVE SUMMARY

- EU SET TO LET VACCINATED U.S. TOURISTS VISIT THIS SUMMER (NYT)

- U.S. CDC & FDA LIFT PAUSE ON J&J COVID VACCINE

- U.S. DEMOCRATIC SENATOR MANCHIN CONTINUES PUSH FOR TARGETED FISCAL STIMULUS

- PUSH TO SUPPORT INDIA'S BATTLE AGAINST COVID OUTBREAK BECOMES MORE APPARENT

- BOE'S BROADBENT FORECASTS CONSECUTIVE QUARTERS OF RAPID GROWTH (TELEGRAPH)

Fig. 1: Eurodollar December 2023 (EDZ3) Futures Contract

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The U.K. has given half of its population a first dose of coronavirus vaccine, a key milestone in Prime Minister Boris Johnson's efforts to revive an economy that was among the worst-hit in the early months of the pandemic. (BBG)

CORONAVIRUS: About half a million more people in England are being invited to book their Covid-19 jab from Monday, as the vaccine rollout opens to 44-year-olds. Two-thirds of the previous age group - 45 to 49-year-olds - have received their first dose. The NHS said it would set out when 40 to 43-year-olds would be able to book appointments "in the coming days", as supply allows. It comes as a TV advert is launched to encourage under-50s to get vaccinated. (BBC)

CORONAVIRUS: U.K. medical advisers are considering whether to offer an alternative to the AstraZeneca vaccine to those under 40 amid fears of blood clots, the Telegraph reported. The nation's Joint Committee on Vaccination and Immunisation has already advised that under-30s should be offered a different shot because of the risks of serious blood clotting. The panel is now considering whether a "further change of policy" is required, the paper reported. (BBG)

CORONAVIRUS: Vaccine chiefs are considering whether under-40s should be given a different vaccine to the AstraZeneca jab, after new figures showed a rise in risk of blood clots. (Telegraph)

CORONAVIRUS: Officials are close to finalising a deal to purchase tens of millions more doses of the Pfizer Covid-19 vaccine in time for a third booster dose to be given to the elderly this autumn. Government sources say they hope to roughly double the UK's original order of 40 million jabs. If negotiations are successful, the extra stock may also be used for those in their twenties, who are be offered an alternative to the AstraZeneca jab. The NHS will start inviting those in their thirties for vaccines by the end of this week. (The Times)

CORONAVIRUS: Social distancing should be abolished in June to allow people "to take back control of their own lives", a letter signed by 22 leading scientists and academics says. The open letter states that "a good society cannot be created by obsessive focus on a single cause of ill-health" and calls for all restrictions to be lifted on June 21 – the final date in Boris Johnson's roadmap out of lockdown. (Telegraph)

CORONAVIRUS: Holidaymakers are pinning their hopes on the "longest summer ever" as travel companies report a flood of bookings for autumn departures. Airlines, resorts and tour operators have all experienced a surge in demand for breaks later in the year, with reservations for autumn in some cases up by 80 per cent compared with 2019. Growing numbers of Britons are believed to be abandoning hope of an international holiday until later in the year, despite the vaccine success. (The Times)

ECONOMY: Solihull and Warrington will be the UK's fastest-growing towns by the end of the year as Covid-19 leads more people work from home, a new study suggests. London, meanwhile, will be home to the biggest employment casualty of the pandemic. The end of the furlough scheme and the impact of the Brexit deal will cost London more than 150,000 jobs by the end of the year with a 3.9pc fall in employment to 3.7m, according to the latest UK Powerhouse research compiled by the Centre for Economics and Business Research and law firm Irwin Mitchell. Official figures already show London has the highest unemployment rate of any UK region, at 7.2pc. The capital is also the most furloughed region in the country with 710,000 workers in the scheme at the end of February. The picture is much brighter elsewhere in the country, however, with Solihull and Warrington the biggest beneficiaries of lifestyle shifts in the wake of Covid-19. (BBG)

BOE: Bank of England Deputy Governor Ben Broadbent has forecast consecutive quarters of rapid growth but also warned that inflation will prove less predictable, according to an interview with the Telegraph newspaper. It may be too soon to call a "roaring twenties" scenario, but it certainly means "very rapid growth at least over the next couple of quarters" particularly as the economy will be boosted by people simply saving less, Broadbent said in remarks published Saturday evening in the Telegraph. (RTRS)

BREXIT: Boris Johnson is being pressed by Brussels to align the UK's food standards rules to those of the European Union in return for easing checks between Britain and Northern Ireland. Commission negotiators have told the UK that the EU will drop its demand for checks on food crossing into Northern Ireland if the government aligns itself with all EU plant, animal health, environment and food safety rules. They have also raised the prospect that pets would also be able to travel freely using the pet passport scheme and that the ban on British soil being sent to Northern Ireland would also be lifted. (The Times)

BREXIT: Inconsistent and increasingly burdensome post-Brexit bureaucracy is blighting food and drink sales to the EU, the sector warned as it published analysis showing exports to the bloc were down 40 per cent in February compared with a year earlier. The UK Food and Drink Federation said on Monday that the latest UK government data painted a stark picture of the challenges facing companies, and especially smaller businesses, as they grapple with new veterinary and customs checks introduced on January 1. The federation, which represents more than 800 companies, said the statistics showed that food and drink exports to the EU in February were worth £578.7m, down from £1bn in February 2020. This was only marginally offset by an 8.7 per cent increase, worth £55.6m, in sales to non-EU countries in February compared with the same period last year. Sales of milk and cream to the EU were down 96.4 per cent compared with February 2020, and exports of chicken and beef were both down more than 75 per cent. (FT)

BREXIT: The European Union will climb down and agree a post-Brexit deal on financial services because the bloc "needs London", PwC has predicted. John Garvey, global head of financial services at the consulting firm, said that although any agreement is unlikely to happen in the short term, there will come a point when the EU realises a deal is in its own interests. (BBG)

BREXIT: In a major blow to Priti Patel's immigration plans, EU countries have said they will not strike bilateral agreements with Britain to facilitate the deportation of refugees to Europe. New measures unveiled by the home secretary last month would see refugees who arrive in Britain via unauthorised routes denied an automatic right to asylum and instead forcibly removed to safe countries they passed through on their way to the UK, which are usually in the EU. The Home Office has said it intends to replace the Dublin Regulation, which allowed it to return asylum seekers to EU member states while Britain was part of the bloc, with "bilateral returns arrangements". But The Independent has learnt that France, Belgium and Germany do not intend to make bilateral deals with Britain, warning that the country "cannot continue to count on European solidarity" and that it "remains bound by international law". (Independent)

POLITICS: Dominic Cummings has launched a blistering attack on his old boss Boris Johnson, questioning his "competence and integrity". The former top adviser denied leaking text messages sent between Mr Johnson and businessman Sir James Dyson. And he claimed Mr Johnson once had a "possibly illegal" plan for donors to pay for renovations of the Downing Street flat. No 10 said ministers had always obeyed codes of conduct and electoral law. (BBC)

POLITICS: Dominic Cummings is preparing a dossier of evidence that will attempt to blame Boris Johnson personally for the tens of thousands of deaths during the second wave of the pandemic. The prime minister's former chief adviser is expected to use his select committee appearance before MPs next month to criticise his former boss for failures that have given Britain one of the worst death tolls in Europe. (Sunday Times)

POLITICS: There are growing calls for Boris Johnson to explain how the refurbishment of his Downing Street flat was paid for. The prime minister considered a "secret plan" to get Tory donors to foot the bill, according to his former adviser Dominic Cummings. (Sky)

POLITICS: Almost four out of 10 voters think Boris Johnson and the Conservative party are corrupt, according the latest Opinium poll for the Observer. With revelations about financial sleaze now focused on Downing Street, the findings will concern senior Tories with less than two weeks to go before council elections in England, parliamentary elections in Scotland and Wales, a string of mayoral elections including that in London, and the Hartlepool byelection, on 6 May. The poll – taken before news of Dominic Cummings's declaration of war on the prime minister in a blog post on Friday – puts the Tories a very healthy 11 points ahead of Labour (44% to Labour's 33%). But senior Conservatives believe the big lead is largely the result of a "vaccine bounce" resulting from the successful rollout of the vaccination programme, and that it will be quickly lost unless Johnson can stop the rot of sleaze and other allegations of financial self-interest in his party and government. (Observer)

RATINGS: Rating reviews of note from Friday include:

- S&P affirmed the United Kingdom at AA; Outlook Stable

MARKETS: The abolition of taxes on UK investment funds is among sweeping post-Brexit reforms the government should consider to ensure the City of London thrives as a global centre for asset management, according to an influential trade body. The Investment Association, which represents the UK's asset management industry, will call this week for rule changes to encourage the development of innovative new funds that will not suffer any tax disadvantages compared with directly competing European funds. It also wants the government to consider moving to a full exempt tax regime for all UK funds to allow the City to compete more effectively against rival European fund hubs in Dublin and Luxembourg. (FT)

EUROPE

CORONAVIRUS: American tourists who have been fully vaccinated against Covid-19 will be able to visit the European Union over the summer, the head of the bloc's executive body said in an interview with The New York Times on Sunday, more than a year after shutting down nonessential travel from most countries to limit the spread of the coronavirus. The fast pace of vaccination in the United States, and advanced talks between authorities there and the European Union over how to make vaccine certificates acceptable as proof of immunity for visitors, will enable the European Commission, the executive branch of the European Union, to recommend a switch in policy that could see trans-Atlantic leisure travel restored. (New York Times)

GERMANY: Germany's latest lock-down measures went into effect on Saturday after both houses of parliament backed Chancellor Angela Merkel's bill this week. The law -- which expires at the end of June -- triggers tighter restrictions in virus hotspots, including nighttime curfews and closing schools and non-essential stores. "This is something new in our fight against the pandemic and I am convinced it is urgently needed", Merkel said in her weekly podcast, published on Saturday. "We are in the middle of the third wave. The more contagious variant of the virus has also taken hold in Germany." (BBG)

GERMANY: German Vice Chancellor Olaf Scholz said the government may be in a position in May to set a binding timetable for the re-opening of the economy from the virus lockdown. "We need a roadmap to get back to normal life, but one that isn't revoked after a few days," Scholz, the Social Democrats' top candidate for the Sept. 26 national election, told the Bild am Sonntag newspaper. "By the end of May, we should be in a position to make robust statements." For now, Germans need to stick to the rules in order "not to ruin their chances in the next four to six weeks to sit in a beer garden and go on vacation in the summer." (BBG)

GERMANY: Germany's opposition Green Party overtook Chancellor Angela Merkel's Christian Democrat-led bloc in an opinion poll after the group nominated Annalena Baerbock as its top candidate for the Sept. 26 national election. The Greens gained six percentage points to 28% this week in a poll by opinion research company Kantar for the Bild am Sonntag newspaper. It's the the highest share ever for the Green's in Kantar's weekly survey. Support for the Christian Democratic Union and its Christian Social Union Bavarian sister party dropped two points to 27%. The latest poll follows the nomination this week of Baerbock for the Greens and Armin Laschet to run as chancellor candidate for the conservative bloc. The Social Democrats, Merkel's current coalition partner, lost two points to 13%, its lowest at Kantar since August 2019. (BBG)

FRANCE: France is "engaged in a battle against these variants which are a threat from which we must protect ourselves," Prime Minister Jean Castex said on Sunday, mentioning Brazilian and South African forms of the virus. Castex was speaking during a visit on Sunday to Paris's Roissy international airport, to highlight protective measures taken by the government including increased filtering and scrutiny, PCR tests and a mandatory quarantine for travelers from high-risk countries. (BBG)

FRANCE: French President Emmanuel Macron would beat the far-right leader Marine Le Pen in the run-off for the 2022 presidential elections even as dissatisfaction with his handling of the Covid-19 pandemic remains high in the country, according to a poll published by Le Monde. Macron would beat Le Pen by 57% to 43% in the run-off, with a margin of error of 1.4 points, according to the Ipsos-Sopra Steria survey, which polled 10,000 people aged 18 or more online between April 9 and April 15. (BBG)

ITALY: Italy's government on Saturday signed off on a large package of investment and reforms that will be financed by the European Union's 800-billion euro ($968 billion) post-pandemic recovery fund. As the largest beneficiary of EU stimulus, Italy is set to receive at least 191.5 billion euros, including 69 billion euros of grants, and plans to use the money to accelerate the green and digital transformation of the economy, and improve the training of the workforce, according to a cabinet statement. Other European funds and national resources will also contribute to the program. (BBG)

ITALY/BTPS: Italy plans to sell 6.5 billion euros ($7.8 billion) of bills due Oct 29 in an auction on Apr 28. (BBG)

PORTUGAL: The European Commission says it cleared Portugal's plan to give majority state-owned airline TAP EU462m to compensate it for damage from coronavirus-related travel restrictions. (BBG)

GREECE: Greece will lift quarantine restrictions on coronavirus-free visitors from more countries including Australia and Russia from Monday as it extends exemptions ahead of formally opening up to tourists on May 15, the transport ministry said on Sunday. (RTRS)

BELGIUM: Belgium lowered the age threshold for administering AstraZeneca's coronavirus vaccine, Wouter Beke, minister of health of Flanders said on Twitter. The shot will now be given to anyone over the age of 40. It was previously being offered only to those over 55 previously. Johnson & Johnson's single-shot vaccine will be administered without age restrictions. The decisions were taken following the latest assessment of the EU's drugs regulator. (BBG)

FINLAND: Finland's government made some progress in talks over its spending framework that had brought the five-party coalition close to a breakup. The negotiations, originally scheduled to take two days, dragged into their fifth day on Sunday and hit an impasse after several hours as leaders sought enough common ground to continue governing together. Some headway had been made by the time the talks ended at about 9 p.m. local time in Helsinki to resume on Monday. (BBG)

SWITZERLAND: The Swiss government estimates that about one-third of the population has been infected with Covid-19 since the start of the pandemic. At the end of 2020, government scientists found antibodies in about 20% of those tested and now believe that another 10% have been infected, newspaper NZZ am Sonntag reported. "Conservatively calculated, around a third of the population has been infected since the beginning of the pandemic," said Federal Office of Public Health spokeswoman, Simone Buchmann. (BBG)

RATINGS: Rating reviews of note from Friday include:

- Fitch affirmed Finland at AA+; Outlook Stable

- Fitch affirmed the Netherlands at AAA; Outlook Stable

- S&P affirmed the European Financial Stability Facility at AA; Outlook Stable

- S&P upgraded Greece to BB; Outlook Positive

- S&P affirmed Italy at BBB; Outlook Stable

- DBRS Morningstar confirmed Finland at AA (high), Stable Trend

EQUITIES: Some of Credit Suisse's largest shareholders will attempt to remove the board member in charge of risk oversight, in protest at twin scandals that have cost the bank and its clients billions and tarnished its reputation. Andreas Gottschling — a 53-year-old German who has served as chair of the risk committee since 2018, earning a $1m annual fee — has come under fire after the Swiss bank lost at least $4.7bn from the collapse of family office Archegos. That came shortly after Credit Suisse had to suspend $10bn of supply-chain finance funds linked to controversial financier Lex Greensill, whose insolvency could cost the lender's clients as much as $3bn. The bank has been forced to raise $1.9bn to shore up its capital and has cancelled investor payouts. (FT)

U.S.

FISCAL: Democratic Senator Joe Manchin on Sunday said he opposes using a maneuver that would enable his party to pass U.S. President Joe Biden's $2.3 trillion infrastructure proposal without Republican support, saying he favors a smaller and "more targeted" bill. (RTRS)

FISCAL: Democrats on Capitol Hill are pushing for the White House to propose making jobless benefits more generous permanently as part of the antipoverty package President Biden is expected to roll out next week. In a letter sent to the White House Friday, nearly 40 Democrats said President Biden should propose implementing a series of new federal standards of unemployment insurance programs, which are largely run by states. They proposed increasing the amount of jobless payments, extending the duration of the weekly benefit, expanding the pool of eligible workers, and implementing a system that would more closely tie the payments to economic conditions. (Dow Jones)

FISCAL: Senate Budget Committee Chair Bernie Sanders (I-Vt.) and 16 Democratic senators sent President Biden a letter on Sunday calling for his American Families Plan to significantly expand Medicare. (Axios)

CORONAVIRUS: U.S. health agencies lifted the pause on Johnson & Johnson's Covid-19 vaccine on Friday, 10 days after urging providers to hold off on using the shot while they reviewed serious and rare cases of blood clots among several people who received it. The Food and Drug Administration and the Centers for Disease Control and Prevention said in a statement that they have determined that the pause that was put in place on April 13 should end and that use of the vaccine should resume. The agencies said that they found the shot was safe and effective at preventing Covid-19. They added that the chance of developing the rare blood-clot syndrome is very low, but that they will continue to investigate. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention is recommending Covid-19 shots for pregnant women after preliminary data from the largest study of coronavirus vaccine use among expectant mothers showed that Pfizer's and Moderna's jabs were safe for the women as well as their babies. The researchers found no "obvious safety signals" among any of the 35,691 women who were followed in the peer-reviewed study published Wednesday by The New England Journal of Medicine. Data used in the research was self-reported, and the participants' ages ranged from 16 to 54 years old. (CNBC)

CORONAVIRUS: Dr. Scott Gottlieb told CNBC on Friday he believes the United States may struggle to reach "true herd immunity" to Covid, suggesting coronavirus infections will be around in the years ahead. However, the former commissioner of the U.S. Food and Drug Administration stressed that new cases alone should not be the metric receiving the most focus as more people are vaccinated against Covid. (CNBC)

CORONAVIRUS: Millions of Americans are not getting the second doses of their Covid-19 vaccines, and their ranks are growing. More than five million people, or nearly 8 percent of those who got a first shot of the Pfizer or Moderna vaccines, have missed their second doses, according to the most recent data from the Centers for Disease Control and Prevention. That is more than double the rate among people who got inoculated in the first several weeks of the nationwide vaccine campaign. Even as the country wrestles with the problem of millions of people who are wary about getting vaccinated at all, local health authorities are confronting an emerging challenge of ensuring that those who do get inoculated are doing so fully. The reasons vary for why people are missing their second shots. In interviews, some said they feared the side effects, which can include flulike symptoms. Others said they felt that they were sufficiently protected with a single shot. (New York Times)

CORONAVIRUS: A partisan divide remains over vaccines in the U.S., according to an NBC News poll. The survey of 1,000 adults showed that 82% of Democrats had been vaccinated or plan to as soon as possible, against 45% of Republicans. Overall, 57% said they'd had a vaccine and another 8% plan to as soon as they can. Some 24% of Republicans said they won't get vaccinated, against just 4% of Democrats. Another 19% of GOP respondents said they're waiting to see if there are problems with the shots. Vaccine hesitancy among Republicans has been cited as an impediment to reaching herd immunity in the U.S. (BBG)

CORONAVIRUS: Governor Mike DeWine said demand for the vaccine has dropped sharply in Ohio, and he's reaching out to businesses and schools to increase the number of people inoculated. (BBG)

CORONAVIRUS: Louisiana's stockpile of unused vaccine doses has reached 1 million, or a quarter allocated by the federal government, the Times Picayune reported. Vaccinations have dropped from a peak of more than 168,000 on March 18 to just above 45,000 on April 22. As demand slows across the U.S., Louisiana's vaccination rate is among the lowest. Slightly fewer than 32% of people there have received at least one dose, compared with the U.S. average of 42.2%, according to the Bloomberg Vaccine Tracker. (BBG)

POLITICS: More than half of Americans say they support President Joe Biden's performance in office so far and approve of his sweeping infrastructure proposal, according to a new NBC News poll. The poll findings released Sunday showed that 53% of respondents approve of Biden's job in office, including 90% of Democrats, 61% of independents and 9% of Republicans, while 39% of respondents disapprove of Biden's performance. (CNBC)

EQUITIES: President Joe Biden's reported plan to hike capital gains taxes on millionaires may have spooked Wall Street, but Thursday's sudden stock slide didn't seem to shake the White House. Press secretary Jen Psaki on Friday brushed aside a question about whether the Biden administration was concerned by investors' apparent lack of support for the proposal to raises taxes on the rich. "I've been doing this long enough not to comment on movements in the stock market," Psaki said during a press briefing. "But I did see data, factually, that it went back up this morning," she added before moving on. (CNBC)

OTHER

GLOBAL TRADE: The boss of networking giant Cisco has said the shortage of computer chips is set to last for most of this year. Many firms have seen production delayed because of a lack of semiconductors, triggered by the Covid pandemic and exacerbated by other factors. Cisco chief Chuck Robbins told the BBC: "We think we've got another six months to get through the short term." "The providers are building out more capacity. And that'll get better and better over the next 12 to 18 months." (BBC)

U.S./CHINA: China is seeing good progress on the terms regarding intellectual property rights protection in the phase one deal with the US, according to an official at the China National Intellectual Property Administration (CNIPA) on Sunday, sending a clear signal that China has remained committed to the deal despite the turbulence from COVID-19 pandemic last year and tense bilateral relations. At a news conference in Beijing, Shen Changyu, head of the CNIPA said that China continued to "orderly implement terms regarding intellectual property rights in the China-US phase one trade and economic agreement." The comment represents a rare mention by officials over the phase one agreement in recent months as the US is said to be reviewing the agreement along with other trade issues with China. (Global Times)

U.S./CHINA: Funds raised by Chinese groups on US equity markets surged 440 per cent in the opening months of 2021, as the allure of sky-high Wall Street valuations outweighed the threat of forced delistings. Chinese companies have raised a record $11bn this year on the New York Stock Exchange and Nasdaq via initial public offerings, follow-on share sales and issuance of convertible bonds, according to data from Dealogic. Big listings included a $1.4bn IPO by e-cigarette maker RLX Technology and a $947m offering from software company Tuya, along with those by 20 other Chinese groups. (FT)

U.S./CHINA/TAIWAN: Chinese Foreign Minister Wang Yi said "playing the Taiwan card" is a dangerous game of "playing with fire" in comments in a video meeting with the Council on Foreign Relations Friday night, according to the ministry's statements on its website. (BBG)

GEOPOLITICS: The United States will urge its Group of Seven allies to increase pressure on China over the use of forced labor in its northwestern Xinjiang province, home to the Muslim Uighur minority, a top White House official said on Friday. U.S. President Joe Biden will attend a meeting of the G7 advanced economies in person in Britain in June, where he is expected to focus on what he sees as a strategic rivalry between democracies and autocratic states, particularly China. (RTRS)

CORONAVIRUS: The U.S. will send India raw materials for vaccines and step up financing aid for Covid-19 shot production, joining European countries in helping stem the world's biggest surge in cases. Material needed to produce Covishield, the Oxford-AstraZeneca vaccine made in India, has been sourced and "will immediately be made available for India," Emily Horne, a spokesperson for U.S. National Security Adviser Jake Sullivan, said in a statement. (BBG)

CORONAVIRUS: President Joe Biden's chief medical adviser said the U.S. will consider sending India unused, unapproved doses of AstraZeneca Plc's vaccine to help stem a record-breaking surge in Covid-19 cases there. (BBG)

CORONAVIRUS: The U.K. is sending more than 600 pieces of medical kit to India to support the country in its fight against Covid-19, the government announced Sunday. Nine airline container loads of supplies, including 495 oxygen concentrators, 120 non-invasive ventilators and 20 manual ventilators, will be sent to the country this week. The first shipment is leaving the U.K. on Monday, arriving in New Delhi in the early hours of Tuesday. (BBG)

CORONAVIRUS: France plans to supply India with "significant support in terms of oxygen" in the coming days, French President Emmanuel Macron's office told Agence France-Presse on Sunday. Ventilators will also be sent, AFP reported. (BBG)

CORONAVIRUS: "To the people of India I want to express my sympathy on the terrible suffering that Covid-19 has again brought over your communities," German Chancellor Angela Merkel said in a message on Twitter. Germany is urgently preparing a support mission, she said. (BBG)

CORONAVIRUS: Chilean investigators testing the AstraZeneca-Oxford University COVID-19 vaccination in 2,200 people found no instances of blood clots among participants, they said on Friday. (RTRS)

CORONAVIRUS: Johnson & Johnson strongly supports enhanced labeling for its vaccine that details the risks of clotting and points clinicians toward information about how to respond to it, Joanne Waldstreicher, the company's chief medical officer, told a meeting of U.S. vaccine advisers on Friday. (BBG)

CORONAVIRUS: The chief executive of the vaccine-maker Pfizer has said he is "optimistic" about the jab's ability to protect against the new variant from India. Albert Bourla said: "Now we are watching the new one, in India, and I don't have data for that as well. "I feel optimistic that we should be able to control it, but the thing that makes me feel more comfortable is that we have developed a process that once a variant becomes a variant of concern, we should be able to have a new vaccine within 100 days." (Sky)

JAPAN: The rollout of coronavirus vaccines in Japan for people under 65 may begin in July depending on the availability of supplies, the health minister said Sunday. If the government can secure more COVID-19 vaccines than it needs to finish inoculating the elderly by the end of July as planned, vaccination of younger people could start the same month, Health, Labor and Welfare Minister Norihisa Tamura said in a Fuji Television program. (Nikkei)

JAPAN: Japan's ruling Liberal Democratic Party failed to win any of the three parliamentary by-elections held Sunday, a loss that weakens Prime Minister Yoshihide Suga's standing in the party ahead of a general election later this year. The races in Hiroshima, Nagano and Hokkaido were the first national elections since Suga became prime minister last September, and the first opportunity for voters to render judgment on his handling of the coronavirus. Candidates backed by the main opposition Constitutional Democratic Party of Japan won all three seats, in an outcome widely seen as a bellwether for the general election. The four-year term of the Diet's lower house ends Oct. 21, before which an election must be called. (Nikkei)

AUSTRALIA: Perth and Peel entered a snap three-day lockdown from midnight Friday after a Victorian man, who tested positive to Covid-19, spent five days in the community while infectious after leaving hotel quarantine. The Western Australian premier, Mark McGowan, announced the lockdown – which will remain in place until midnight Monday – after a close contact of the Victorian man also tested positive. McGowan said he had to do what was needed to quash the outbreak. (Guardian)

AUSTRALIA: The Australian government is considering boosting childcare subsidies in next month's budget to encourage workforce participation and increase its popularity among female voters, the Australian Financial Review reported. Getting more women into work, taking on more hours and completing skills training are key priorities, the newspaper cited Senator Jane Hume, the newly appointed Minister for Women's Economic Security, as saying in an interview. (BBG)

AUSTRALIA/CHINA: Chinese fruit industry insiders and sources confirmed on Sunday that Australian grapes and other fruits are facing inspections and delays at some ports, as China takes strict measures to inspect imported fruits to stem the spread of the COVID-19 as the global pandemic intensifies again. It remains unclear when a backlog of Australian grapes waiting to be inspected will be cleared, but Chinese importers are already moving to reduce the proportion of Australian fruit due to low profits and worsened bilateral ties, while increasing imports from other sources such as New Zealand and Thailand. (Global Times)

ASIA: A long-delayed travel bubble between Hong Kong and Singapore will finally allow quarantine-free travel starting May 26, both governments revealed on Monday. Travellers from Hong Kong will need to have been fully vaccinated two weeks prior to their date of departure for Singapore, though this will not be required for those going from Singapore to Hong Kong. Under an earlier version of the plan in November, both sides agreed the bubble would be suspended if the daily average of untraceable Covid-19 cases in a week reached more than five in either city. (SCMP)

CANADA: A surge in COVID-19 cases means Canada is at a critical juncture, Prime Minister Justin Trudeau said on Friday, while an expert panel said AstraZeneca PLC's vaccine could now be offered to more people. (RTRS)

TURKEY: President Joe Biden commemorated the 106th anniversary of the mass killing of Armenians by twice calling it a "genocide" -- a word no U.S. leader since Ronald Reagan has used to describe the event for fear of alienating NATO ally Turkey. Turkey, in response, summoned U.S. Ambassador David Satterfield to Ankara, and said it rejected Biden's characterization of the events of 1915. "The American people honor all those Armenians who perished in the genocide that began 106 years ago today," Biden said in a written statement timed to Saturday's commemoration of Armenian Genocide Remembrance Day. (BBG)

TURKEY: "President Biden spoke today with Turkish President Recep Tayyip Erdogan, conveying his interest in a constructive bilateral relationship with expanded areas of cooperation and effective management of disagreements," the White House said in a statement on Friday. It said the two leaders agreed to meet on the margins of the NATO summit in June to have a wider conversation about their two countries' relations. (Kathimerini)

TURKEY: Turkey's new central bank governor defended unannounced foreign-exchange sales in recent years that are estimated to have cost the country more than $100 billion in reserves. The lira's depreciation could have gotten out of control and borrowing costs would have soared if authorities hadn't intervened last year, Sahap Kavcioglu said in an interview with state broadcaster TRT on Friday. The governor used his first television interview since taking office to defend FX sales by state banks, which opposition parties say cost Turkey about $128 billion and still failed to stabilize the lira. President Recep Tayyip Erdogan countered by saying authorities in fact sold $165 billion in a necessary move to finance a current-account deficit and offset capital outflows. (BBG)

MEXICO: Recent changes to Mexican energy legislation enacted under President Andres Manuel Lopez Obrador have undermined investment in the industry and helped squander thousands of jobs, the Business Coordinating Council (CCE) said on Friday. (RTRS)

MEXICO: Mexico's central bank has no surplus to transfer to the government from its 2020 foreign exchange operations, Banxico said in a statement. (BBG)

RUSSIA: The United States is seeing some Russian personnel withdrawing after a huge buildup near Ukraine but it is still early and Moscow's announcement of its redeployment alone is "insufficient to give us comfort," a senior U.S. defense official told Reuters on Friday. (RTRS)

RUSSIA: A summit between president Vladimir Putin and his US counterpart Joe Biden is likely to take place as early as June, a senior Kremlin official said on Sunday, amid hopes that face-to-face talks between the two leaders will ease heightened tension between Moscow and Washington. Biden proposed to Putin earlier this month that they hold a summit in a third country in an effort to "normalise" relations between Moscow and the west, which have soured over new US sanctions against the Kremlin, Russia's large military build-up on the border with Ukraine and concerns over the health of jailed Russian opposition activist Alexei Navalny. Yuri Ushakov, Putin's foreign policy adviser, said on Russian state television that "they are talking about June, there are even specific dates," being considered for the meeting, adding: "Well, I will not talk about them yet, but it is June." (FT)

RUSSIA: A closed-door Moscow court hearing Monday is expected to officially ban the political and anti-corruption networks of jailed opposition leader Alexei Navalny, a ruling that would mark the most sweeping attempt to crush the Kremlin's greatest political threat. The evidence to be used in the case is itself a state secret. Navalny's attorney has been told he will get access to the file shortly beforehand, according to Navalny ally Ivan Zhdanov. If the court sides with the prosecutor's general request — declaring Navalny's political group and his Anti-Corruption Foundation to be extremist organizations — it would put them alongside the Islamic State, al-Qaeda and the Taliban in the eyes of Russian authorities. (Washington Post)

SOUTH AFRICA: South African government employees were told to prepare for industrial action after the public sector union declared a deadlock in wage negotiations with the state. The Public Servants Association, which represents more than 235,000 civil servants, said on Saturday that a revised wage proposal by the government is "absurd and amounts to nothing more than shifting funds." (BBG)

IRAN: The U.S. must remove sanctions designations for some 1,500 individuals as part of efforts to revive the 2015 nuclear accord, Iran's Deputy Foreign Minister Abbas Araghchi, said in an interview with the state-run ICANA news agency. Araghchi didn't give more details but Sunday's comments are in line with Iran's demands that the U.S. lift both the sanctions it reimposed on the Islamic Republic after then President Donald Trump abandoned the landmark agreement and hundreds of more penalties added by his administration (BBG)

IRAN: Iran's diplomatic efforts had been damaged by the interventions of military men such as assassinated Revolutionary Guards commander Qassem Soleimani, the country's foreign minister and nuclear negotiator Mohammad Javad Zarif said in a leaked recording. "Many diplomatic prices that we paid were because the [military] field was a priority," Zarif said in a secret interview recorded on February 24 as part of an "oral history" research scheme that was leaked on Sunday. "We paid for the [military] field but the [military] field did not pay for us." He said Soleimani — who ran Iran's foreign military operations in the Middle East and was killed in a US drone strike in Iraq in January 2020 — used to tell him what to do in his negotiations with foreign dignitaries. (FT)

ISRAEL: Tensions in Jerusalem sparked the worst round of cross-border violence between Israel and the Gaza Strip in months on Saturday, with Palestinian militants firing at least 30 rockets and Israel striking back at targets operated by Gaza's Hamas rulers. Skirmishes have spiked in recent days in Jerusalem, which has long been a flashpoint in the Israeli-Palestinian conflict, and is home to holy sites sacred to Jews, Christians and Muslims. Residents braced for possible further unrest as police stepped up security and the U.S. Embassy appealed for calm. On Friday, Israeli police said 44 people were arrested and 20 officers were wounded in a night of chaos in Jerusalem, where security forces separately clashed with Palestinians angry about Ramadan restrictions and Jewish extremists who held an anti-Arab march nearby. (AP)

MIDDLE EAST: Yemen's Houthi movement said on Sunday it had attacked and hit a military air base in southern Saudi Arabia with a drone, but the Saudi-led coalition fighting the group said it had intercepted and destroyed an armed drone fired into the kingdom. (RTRS)

OIL: Syria's oil ministry said firefighters on Saturday put out a fire on an oil tanker off the Baniyas refinery after a suspected attack by a drone coming from the direction of Lebanese waters. (RTRS)

OIL: Gov. Gavin Newsom said Friday he will halt all new fracking permits in California starting in 2024, using his executive authority to take on the state's powerful oil and gas industry in a year he will likely face voters in a recall election (CNBC)

CHINA

CORONAVIRUS: Sinopharm's recombinant Covid-19 vaccine started clinical trials in China's Henan province on Saturday, after getting approval from authorities earlier this month, according to a release posted on the company's official WeChat account. (BBG)

ECONOMY: China's economy continued to boom in April from the record growth in the first quarter, with strong exports and rising business confidence supporting the recovery. That's the outlook of an aggregate index combining eight early indicators tracked by Bloomberg, which remained unchanged from March in strong expansionary territory. Some of the strength this month may be exaggerated by the comparison with April 2020, when the country was still struggling to recover and reopen after a lockdown to contain the world's first coronavirus cases. (BBG)

ECONOMY/YUAN: The Chinese yuan is likely to trade at around 6.4-6.5 against the U.S. dollar this year, the Economic Information Daily reported citing a report by the Chinese Academy of Social Sciences. China's GDP may reach about 8% growth and policymakers should maintain policy continuity as well as prudently defuse financial risks including establishing "sustainable" model of debt growth, the newspaper said citing the Academy. Inflationary pressure will be moderate in 2021 and the macro leverage ratio may rise, the newspaper said. (MNI)

BONDS: The plan for southbound bond connect is expected be announced in May with the program to start on July 2 to commemorate the 24th anniversary of Hong Kong's return to Chinese sovereignty, Hong Kong Economic Journal reports, citing unidentified person. The start date is subject to change. The program will impose investment quota, to be controlled by the mainland regulators, because of Chinese capital controls In the early stage of the southbound bond connect, there will limitations on the bonds that can be invested. (BBG)

POLICY: China should consider subsidizing industries and provinces exposed to greater financial risks while pursuing carbon peak and neutrality goals, said Xu Zhong, deputy director of the National Association of Financial Market Institutional Investors and a former research head at the PBOC. In the long run, an auction mechanism should be established to facilitate the trading of carbon allowances and auction proceeds can subsidize risky areas to prevent systemic risks, Xu said in a blog post published by the China Finance 40 Forum. Green policy measures should be included in the monetary policy framework, as they may cause price hikes of some commodities and impact the potential growth rate, said Xu. (MNI)

BANKS: China's five major banks should increase lending to SMEs by more than 30% this year, according to a website statement released on Sunday by the China Banking and Insurance Regulatory Commission. Banks should ensure these micro loans match the rate of growth of other loans and that lending rates be stable at 2020 levels, the regulator said. Large banks should strive to achieve a higher number of new SME clients than last year and include the proportion of "first-lenders" in their internal performance indicators, the regulator said. (MNI)

CREDIT: China Huarong Asset Management Co. said its 2020 earnings results would be delayed past an April 30 deadline, potentially further fraying investors' nerves after mounting worries over potential defaults by the state-owned bad-debt manager caused a meltdown in its bonds. The company's auditors need more time to finalize an unspecified transaction before it can publish the results, according to a statement posted on Chinamoney.com, which is run by China Foreign Exchange Trade System. Huarong reiterated that its operations are stable and all lines of business are running normally. The firm, China's largest distressed-asset manager, missed an earlier March 31 deadline to announce preliminary results, also saying that its auditors needed more time. The company's shares have been suspended since April 1. (BBG)

FINTECH: Ant Group and the People's Bank of China's digital currency research institute signed an agreement to jointly push for the development of digital yuan's technology platform, Caijing reports, citing information it obtained from Digital China Summit. (BBG)

OVERNIGHT DATA

JAPAN MAR SERVICES PPI +0.7% Y/Y; MEDIAN 0.0%; FEB 0.0%

JAPAN FEB, F LEADING INDEX 98.7; FLASH 99.7

JAPAN FEB, F COINCIDENT INDEX 89.9; FLASH 89.0

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This leaves liquidity unchanged given the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2493% at 09:31 am local time from the close of 2.1767% on Sunday.

- The CFETS-NEX money-market sentiment index closed at 32 on Sunday vs 61 on Friday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4913 MON VS 6.4934

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4913 on Monday, compared with the 6.4934 set on Friday.

MARKETS

SNAPSHOT: Global COVID Matters Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 144.93 points at 29170.42

- ASX 200 down 5.207 points at 7056.3

- Shanghai Comp. up 6.509 points at 3480.675

- JGB 10-Yr future down 9 ticks at 151.47, yield up 0.4bp at 0.075%

- Aussie 10-Yr future down 0.5 tick at 98.305, yield down 0.1bp at 1.734%

- U.S. 10-Yr future -0-04 at 132-10, yield up 1.77bp at 1.575%

- WTI crude down $0.16 at $61.99, Gold up $3.72 at $1780.97

- USD/JPY down 19 pips at Y107.69

- E.U. SET TO LET VACCINATED U.S. TOURISTS VISIT THIS SUMMER (NYT)

- U.S. CDC & FDA LIFT PAUSE ON J&J COVID VACCINE

- U.S. DEMOCRATIC SENATOR MANCHIN CONTINUES PUSH FOR TARGETED FISCAL STIMULUS

- PUSH TO SUPPORT INDIA'S BATTLE AGAINST COVID OUTBREAK BECOMES MORE APPARENT

- BOE'S BROADBENT FORECASTS CONSECUTIVE QUARTERS OF RAPID GROWTH (TELEGRAPH)

BOND SUMMARY: Modest Pressure For Core FI

Headline flow was muted during Asia-Pac hours, with the NYT providing comments from EU Commission chief Von Der Leyen pointing to U.S. tourists being able to visit the EU in the summer of '21. Headline flow was also light over the weekend, with most of the focus falling on the world looking to help India through its COVID outbreak and continued insistence on the need for targeted fiscal stimulus (and resistance to the use of the reconciliation measure to pass any linked legislation) on the part of moderate U.S. Democratic Senator Manchin.

- The U.S. Tsy space has nudged lower, with T-Notes -0-03+ at 132-10+, 0-00+ off lows. There is some light steepening in play in cash trade, 5+-Year yields have cheapened by 1.0-1.5bp as of typing. Ranges remain tight. E-minis are now in the green, albeit marginally, while the USD has struggled.

- JGB futures ticked lower during the Tokyo morning, with the move extending during the Tokyo afternoon after an uptick in the offer/cover ratio in the latest round of 5- to 10-Year BoJ Rinban ops. The cash curve was subjected to some modest twist steepening.

- Very little to report for Aussie bonds. The presence of the RBA's scheduled ACGB purchases may have provided a light bid early on, but there has been a modest downtick in recent trade, with YM -1.0, XM +0.5, in line with the broader global core FI space.

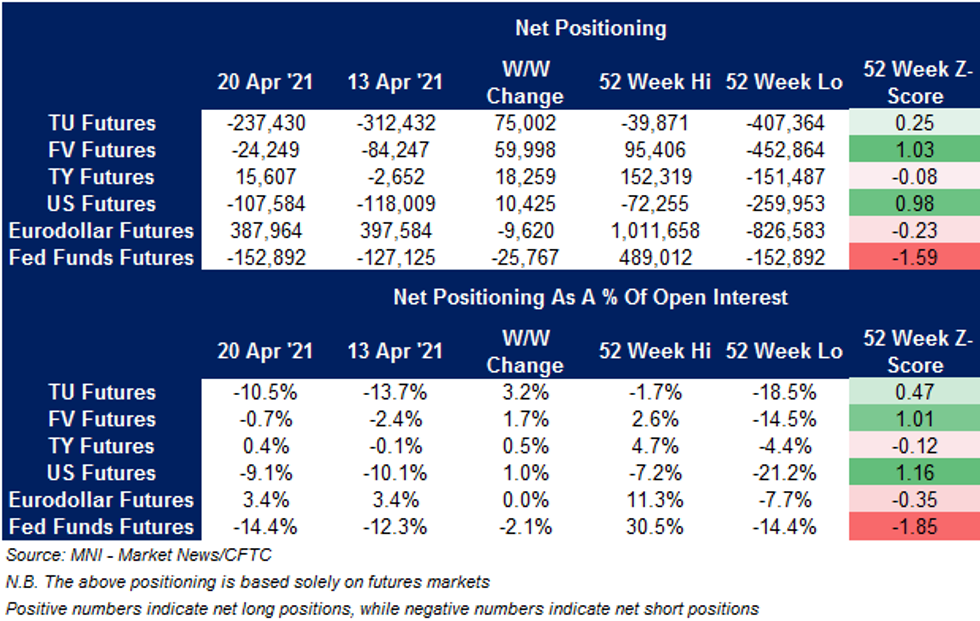

US TSY FUTURES: CFTC CoT Shows Net Shorts Trimmed In Major Tsy Futures Contracts

A quick look at the latest CFTC CoT report revealed a one-way direction of travel for net positioning across the major Tsy futures contracts, which saw net shorts pared back in the TU, FV & US contracts, while TY positioning flipped net long again (as the choppy, unidirectional, nature of that particular contract's net positioning remained evident), in the week ending Tuesday 20 April.

- In STIR futures, net length in Eurodollar futures saw another (modest) reduction. Meanwhile, net shorts in Fed Funds futures extended, hitting the shortest outright levels seen since Aug '19.

BOJ: 1- To 10-Year Riban Purchase Sizes Unchanged

The BoJ offers to buy a total of Y1.375tn of JGB's from the market

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y450bn worth of JGBs with 5-10 Years until maturity

EQUITIES: Start The Week Higher

Most markets in the Asia-Pac region in the green, though gains are fairly modest for most. Taiwan led gains, up over 1%, the semiconductor sector driving gains after strong industrial production data on Friday. Mainland China is in the green, buoyed by reports that China regulators asks banks to boost lending to SME's. A rally in iron ore and copper has also helped support sentiment. The ASX 200 failed to sustain early gains though, despite the metals rally, as AUD rose. Futures in the US are higher, focus this week will be on the FOMC meeting on Wednesday, while a slew of earnings will also help dictate price action.

OIL: Crude Lower As Demand Concerns Weigh

Oil is lower to start the week, initially moving higher but retreating as the session wore on. WTI is down around $0.18 from settlement levels at $61.97/bbl, Brent is down $0.25 at $65.86/bbl.

- Markets look ahead to the OPEC+ meeting on Wednesday this week, there had been discussions that the meeting could be downgraded from a full-scale ministerial meeting, but it appears it will go ahead as scheduled.

- Elsewhere, the preliminary signs of strain in India are starting to show; Mangalore Refinery & Petrochemicals has reduced its processing rates, while Bloomberg reports Indian Oil has so far failed to issue an expected tender to purchase West African crude further stoking demand concerns.

GOLD: Consolidating After Another Failure Ahead Of $1,800/oz

The downtick in the DXY evident during Asia-Pac hours supported gold prices in early trade this week, with spot adding a handful of dollars to last print just above $1,780/oz. This comes after Friday's pullback which was facilitated by cheapening in the U.S. Tsy space, resulting in yet another failed run at $1,800/oz. Participants eye this week's U.S. Tsy issuance schedule and Wednesday's FOMC decision.

FOREX: AUD Gains On Iron Ore Rally, Yuan Draws Support From Upbeat GDP Outlook

Iron ore caught a bid and futures on SGX printed all-time highs, bolstering AUD at the start to the week. The Aussie drew additional support from broadly positive sentiment, reflected in upticks across most regional equity benchmarks.

- NZD gained in tandem with its Antipodean cousin, with liquidity thinned out as New Zealand's markets were shut for the Anzac Day.

- USD headed in the opposite direction, as the DXY faltered to its worst levels since early March. The FOMC are in their blackout period ahead of Wednesday's monetary policy decision.

- The BoJ also hold their policy meeting this week, but USD/JPY was happy to hold Friday's range. BoJ decision announcement is scheduled for tomorrow.

- The PBoC fixed its central USD/CNY mid-point at CNY6.4913, 20 pips above sell-side estimates, but USD/CNH slipped nonetheless. The redback gained as a Chinese gov't think tank said it expects the economy to grow 8% Y/Y this year.

- German Ifo Survey, flash U.S. durable goods orders as well as comments from ECB's Lane & Panetta take focus from here.

FOREX OPTIONS: Expiries for Apr26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E654mln)

- USD/JPY: Y107.97-108.03($471mln), Y108.15-20($815mln)

- USD/CHF: Chf0.9300($600mln)

- AUD/USD: $0.7945-50(A$732mln)

- AUD/JPY: Y81.50(A$753mln)

- USD/CAD: C$1.2700-10($570mln)

- USD/CNY: Cny6.45($500mln-USD puts)

- USD/MXN: Mxn19.60($650mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.