-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Key U.S. Fuel Pipeline Still Down, Scottish Question Resurfaces

EXECUTIVE SUMMARY

- FED'S KASHKARI: U.S. JOB MARKET STILL NEEDS HELP TO HEAL (BBG)

- ECB'S REHN CALLS FOR CHANGE TO ECB'S INFLATION TARGET IN LINE WITH FED APPROACH (FT)

- SNP ONE SEAT SHORT OF OUTRIGHT MAJORITY, LABOUR FARES POORLY IN LOCAL ELECTIONS

- MAINLINES OF KEY U.S. PIPELINE REMAIN DOWN AFTER CYBERATTACK, NO RESTART TIMETABLE YET

- IRON ORE EXTENDS RECORD HIGH ON STRONG DEMAND FROM CHINA

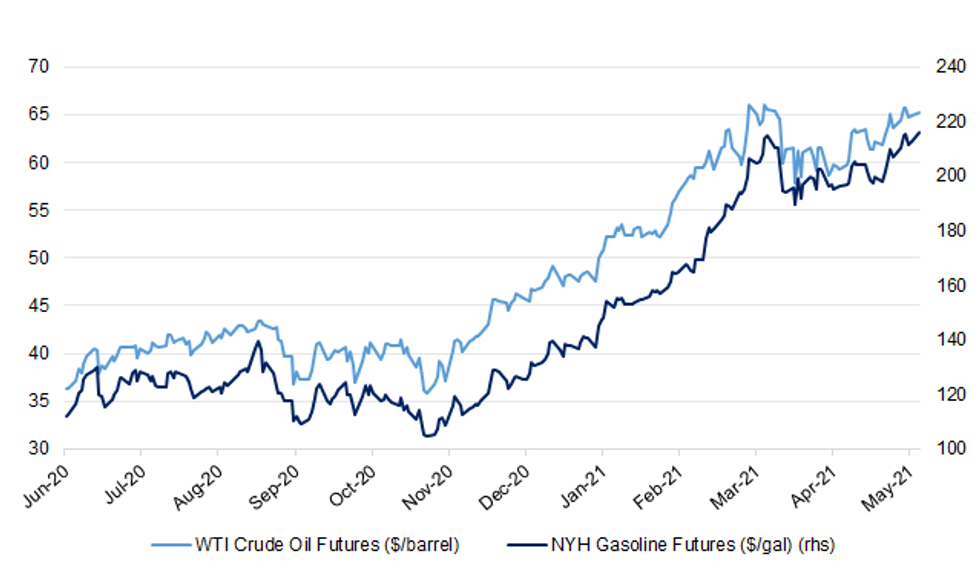

Fig. 1: WTI Crude Oil Futures ($/barrel) vs. NYH Gasoline Futures ($/gal)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

SCOTLAND: Scotland's first minister has told Prime Minister Boris Johnson that a second independence referendum is "a matter of when - not if". Nicola Sturgeon spoke directly with Mr Johnson for the first time since the SNP won an emphatic victory in Thursday's Holyrood election. Earlier, Ms Sturgeon said she did not expect the debate to end up in court. During a phone call with Mr Johnson on Sunday afternoon, the first minister pledged to work with the UK government on steering the country through the Covid pandemic towards recovery. The SNP said the leaders also agreed the importance of both governments working together "closely and constructively" to make the forthcoming UN climate conference in Glasgow a success. But a party spokeswoman added: "The FM also re-iterated her intention to ensure that the people of Scotland can choose our own future when the crisis is over, and made clear that the question of a referendum is now a matter of when - not if." (BBC)

SCOTLAND: Michael Gove has dismissed a second referendum on Scottish independence as a "massive distraction" as he repeatedly refused to say whether the UK government will seek to block a possible vote in court. Appearing on Sky News' Sophy Ridge on Sunday programme, the cabinet minister said the SNP's demand for another independence vote revealed a "skewed set of priorities" while the UK concentrates on the COVID-19 recovery. Scotland's First Minister Nicola Sturgeon said it would be "absurd and completely outrageous" if the UK government went to court to block a second referendum, which the SNP has vowed to introduce legislation for. She told the BBC's Andrew Marr Show: "For this to end up in court, which is not something I ever want to see, it would mean a Conservative government had refused to respect the democratic wishes of the Scottish people and the outcome of a democratic election and tried to go to the Supreme Court to overturn Scottish democracy." (Sky)

WALES: Welsh first minister Mark Drakeford on Sunday demanded more powers for the Cardiff parliament as he warned the UK risks break up unless Boris Johnson increases devolution. Drakeford welcomed an invitation from the UK prime minister to a summit to discuss recovery after the coronavirus pandemic, but said more powers should be handed to the devolved administrations in Cardiff, Edinburgh and Belfast. (FT)

POLITICS: Ministers are preparing to offer help to clear Scotland's cancer backlog and invest billions of pounds in infrastructure projects as part of a renewed effort to save the Union. Boris Johnson will use a summit with leaders of the Scottish, Welsh and Northern Irish governments to suggest injecting money directly into areas that need attention as the country emerges from the pandemic, even if it means encroaching on devolved responsibilities. (Times)

POLITICS: The voters who propelled Boris Johnson to election victory will no longer have to leave their home towns to find well-paid work, under plans to be outlined in the Queen's speech. In a historic rejection of traditional free-market economics, the prime minister will promise to bring jobs and skills direct to "red wall" areas so people can thrive where they grew up. The pledge to "live local and prosper" will form a centrepiece of Tuesday's speech, which will also outline plans to tackle the big backlog of delayed NHS operations and cancer treatments caused by the coronavirus. (Times)

POLITICS: Keir Starmer handed his deputy, Angela Rayner, a major promotion on Sunday night after a day of fraught negotiations and power battles. He also sacked his shadow chancellor and promoted his close ally, Rachel Reeves, to the role in a move likely to further inflame tensions with the party's left. The reshuffle of Starmer's shadow cabinet was derailed by a prolonged standoff with Rayner, who was locked in talks with the party leader's team for hours on Sunday. It came after leaked plans to sack her as party chair and national campaigns coordinator triggered an outcry. The Guardian understands Starmer initially offered Rayner a frontbench role covering the social care brief but she regarded that as a significant demotion and was determined to maintain influence over internal Labour politics and policy. Rayner emerged with a significantly beefed-up role, handed the shadow chancellor of the Duchy of Lancaster role shadowing Michael Gove as well as a newly created post as shadow secretary for the future of work. She will also retain joint control over party matters as deputy leader. Rayner's move from party chair had been planned as the first in a wider reshuffle following a series of disappointing results for Labour in Thursday's local elections. But the announcement of further changes was delayed throughout the day as Starmer's team tried to placate his livid deputy, who is widely seen as a potential future leadership challenger. (Guardian)

POLITICS: Labour's Tracy Brabin has been elected as the first mayor of West Yorkshire. She won 60.1% of the popular vote, after a run-off with the Conservative candidate when she failed to secure a majority in the first round of voting. She will have to resign her Westminster seat, triggering a by-election. At the 2019 General Election she had a majority of 3,525. (BBC)

POLITICS: Ministers are pressing ahead with changes to electoral law that could make it easier for Conservatives to win future mayoral elections, as Labour claimed 11 of the 13 posts being contested across England. The UK home secretary, Priti Patel, has already unveiled plans to switch all future English mayoral elections from the existing supplementary vote system – in which the public ranks their two favourite candidates – to the first past the post system used in elections to the House of Commons. Prof Tony Travers, of the London School of Economics, said analysis of Thursday's polls suggested this change could open a potential route to victory for the Tories in cities such as London. (Guardian)

POLITICS: A former Westminster staff member has accused Labour of abandoning her after she complained of being sexually assaulted and harassed by the party's former MP for Hartlepool Mike Hill. Known as Woman A, she told the Guardian that the party, under both Keir Starmer and Jeremy Corbyn, had shown no interest in her wellbeing for the past 18 months. She also questioned why Hill, under a parliamentary scheme, was fully insured for legal costs while she had struggled to pay legal bills while sleeping on friends' sofas. (Guardian)

TRADE: Companies in freeports will not get to enjoy the full benefits of the new tax-efficient zones if they are exporting to certain countries including Canada, Norway, Switzerland and Singapore, the government has admitted. Prime minister Boris Johnson and chancellor Rishi Sunak have declared that eight new English freeports — announced in the Budget — will be a "transformational" benefit from Brexit. But officials disclosed on Sunday that recent post-Brexit trade agreements with 23 different countries include clauses which specifically prohibit manufacturers in freeport-type zones from benefiting from the deals. (FT)

ECONOMY: Boris Johnson will use home ownership to cement Tory dominance of the Midlands and north for a generation, pressing ahead with the biggest shake-up of the planning system for more than 70 years. Cabinet ministers believe that the key to many of the Conservative Party's extraordinary gains in last week's local elections was the number of people who owned their homes. (Times)

CORONAVIRUS: Britain will allow international travel to resume from May 17 after months of banning most trips abroad, but nearly all major destinations were left off its list of countries open for quarantine-free holidays. Just 12 countries and territories made the so-called "green list". They include Portugal, Israel, New Zealand, Australia and the tiny Faroe Islands. The top four destinations - Spain, France, Italy and the United States - were among those left off, angering stricken airlines and holiday companies battling for survival. Those four sit in the amber category, requiring self-isolation for those returning to the UK. (RTRS)

CORONAVIRUS: It is inevitable that new Covid variants will continue to enter the country, scientists warned this weekend, claiming there are "obvious flaws" in the government's system for reopening international travel to and from England. (Guardian)

CORONAVIRUS: Michael Gove told Sky News the prime minister will give the green light tomorrow, clearing the way for people to meet inside and for indoor hospitality to resume in just over a week's time. Mr Gove told Sophy Ridge on Sunday: "Thanks to the success of the UK vaccination programme and also the good sense of people across the UK we can progressively relax measures. (Sky)

EUROPE

ECB: The European Central Bank should follow the lead of the US Federal Reserve by accepting an overshooting of its inflation target to make up for many years of sluggish price growth, said one of its top officials. Olli Rehn, who sits on the ECB's interest rate-setting council as governor of Finland's central bank, told the Financial Times changes in the eurozone labour market and world economy had weakened wage inflation pressures and meant "the economy can cope with lower levels of unemployment . . . without rapid inflation". "If this is the case, from the point of view of economic and social welfare it makes sense to accept a certain period of [inflation] overshooting, while taking into account the history of undershooting," Rehn said. "That is why, in addition to price stability, a focus on full or maximum employment makes sense in the current context of a lower natural rate of interest." (FT)

EU/INDIA: The European Union and India agreed to resume long-stalled talks on a free trade deal in an effort to strengthen their economic cooperation in the face of an increasingly assertive China. The agreement was struck at a virtual summit between EU leaders and Indian Prime Minister Narendra Modi on Saturday, aimed at rebooting relations and boosting cooperation across key fields including digitalization, health and climate change. "Europe and India are the two largest democracies in the world and our joint strategy is vital," Portuguese Prime Minister Antonio Costa, who holds the EU's rotating presidency, said after the summit. "Working together we can resolve many global challenges: Covid today and also fighting climate change." (BBG)

EU: Emmanuel Macron has said national divisions during the Covid-19 pandemic have highlighted the need to "beef up" EU powers, as he opened a consultation on Europe's future at an event that was almost cancelled due to internal squabbling. Speaking from a TV studio set up in the middle of the hemicycle of the European parliament in Strasbourg, the French president said he hoped the Future of Europe conference, a rolling series of events and online public opinion surveys, would strengthen EU level decision-making. Macron avoided mentioning treaty change to shift competences to EU institutions from national governments, something vehemently opposed by a large number of member state governments who might be forced to trigger referendums in response. (Guardian)

EU: The European Union cemented its support for Pfizer-BioNTech and its novel COVID-19 vaccine technology Saturday by agreeing to a massive contract extension for a potential 1.8 billion doses through 2023. EU Commission President Ursula von der Leyen tweeted that her office "has just approved a contract for a guaranteed 900 million doses (+900 million options)." The new contract, which has the backing of the EU member states, will entail not only the production of the vaccines, but also making sure that all the essential components should be sourced from the EU. (CNBC)

EU: The EU might just be able to help you get a holiday this summer. European Commission President Ursula von der Leyen said Saturday the bloc is "on track" to have its system of green passes in place by June. EU officials hope the scheme will boost tourism as the coronavirus pandemic eases by offering a standard certificate verifying travelers' jabs, tests or past infections. (Politico)

EU: The European Union has not yet placed any new orders for AstraZeneca vaccines beyond June when the current contract ends, European Internal Market Commissioner Thierry Breton said on Sunday. "We did not renew the order after June. We'll see what happens," Breton told France Inter radio, adding that AstraZeneca is "a very good vaccine." Breton reassured that the bloc was not closing the door to the British-Swedish firm. "We will have other orders," he said. (Deutsche Welle)

GERMANY: German Chancellor Angela Merkel's conservatives slipped to an all-time low in a poll published on Sunday, while the Green party stayed in the lead to form the next government despite also losing ground. Support for Merkel's Christian Democratic Union and the Bavaria-based CSU party decreased to 23% from 24% in a weekly poll by Kantar for Bild am Sonntag newspaper, a level not seen before in the poll's history. The Greens declined 1 percentage point to 26%, still close to their biggest national support in about two years. (BBG)

GERMANY: Olaf Scholz, Germany's finance minister, said the government bore no responsibility for the Wirecard scandal, in testimony that marked the high point of a six-month parliamentary inquiry into the worst case of corporate fraud in the country's postwar history. Scholz is the most senior politician to be questioned by the Wirecard committee of inquiry so far — a probe that has exposed profound weaknesses in Germany's system of financial oversight. (FT)

GERMANY: German residents who are considered fully immune to the coronavirus will no longer be subject to nightly curfews and restrictions on meeting people starting Sunday. Anyone who has had both doses of the vaccine or who has recovered after falling ill will be able to meet with others in the same category in private without any restrictions. The fully immune also won't need to show proof they tested negative to enter shops and be in quarantine after travel, except in specific cases — for example, if they enter from an area where a variant of the virus is rampant. However, they will still be required to adhere to social distancing measures, including wearing masks in shops and on public transport. (Deutsche Welle)

SPAIN: Nearly 60% of people in Japan want the Tokyo Olympics to be cancelled, an opinion poll showed on Monday, less than three months before the Games are due to begin. The survey, conducted from May 7-9 by the Yomiuri Shimbun daily, showed 59% wanted the Games cancelled as opposed to 39% who said they should be held. "Postponement" was not offered as an option. Of those who said the Olympics should go ahead, 23% said they should take place without spectators. Foreign spectators have been banned but a final decision on domestic attendance will be made in June. Another poll conducted at the weekend by TBS News found 65% wanted the Games cancelled or postponed again, with 37% voting to scrap the event altogether and 28% calling for another delay. (Politico)

GREECE: Authorities in Greece said at the weekend that the reopening of outdoor sports facilities, such as municipal swimming pools and indoor gyms, from May 17 would apply only to vaccinated citizens. The services would be opened to the unvaccinated population in June, according to Adonis Georgiadis, development and investment minister. (FT)

SWITZERLAND: Most Swiss voters are still in favour of striking a bilateral treaty deal with the European Union, a poll for newspaper NZZ am Sonntag showed, despite years of fraught negotiation and opposition by far-right and left-wing parties. Talks on a treaty text, which would simplify and strengthen ties between the bloc and the neutral country, stalled last month because of differences on how to interpret free movement accords, Switzerland said. Opponents say it would erode sovereignty and Swiss salaries. A deal would have to be put to a national vote. (RTRS)

U.S.

FED: The U.S. labor market remains in a "deep hole" and needs aggressive support to speed its healing from the Covid-19 pandemic, said Federal Reserve Bank of Minneapolis President Neel Kashkari. "We are still somewhere between 8 and 10 million jobs below where we were before the pandemic," Kashkari said Sunday on CBS's "Face the Nation." He said there was "some truth" to the idea that enhanced jobless benefits create a disincentive to returning to work. "We still are in a deep hole and we still need to do everything we can to put those folks back to work more quickly," Kashkari said. "We at the Federal Reserve are doing everything we can to accelerate that job-market recovery, because it's good for the economy and it's good for families all across the country." (BBG)

CORONAVIRUS: Anthony Fauci, the nation's top infectious diseases expert, said Sunday that the U.S. is unlikely to see a surge of COVID-19 infections over the fall and winter like it did last year, pointing to the widespread availability of vaccines as a "game changer" that would prevent future surges. "Well, the fact that we have vaccines right now, Chuck, is really a game changer," Fauci told host Chuck Todd on NBC's "Meet the Press." "I mean, if we get, which we will, to the goals that the president has established, namely if we get 70 percent of the people vaccinated by the Fourth of July, namely one single dose, and even more thereafter, you may see blips. But if we handle them well, it is unlikely that you'll see the kind of surge that we saw in the late fall and the early winter." (Hill)

CORONAVIRUS: Anthony Fauci, one of Joe Biden's top coronavirus advisers, said the US must become more liberal about mask wearing as the vaccination rate increases. Fauci, the chief medical adviser to the US president, told ABC's This Week that rules for the wearing of masks indoors could be relaxed, following updated advice on vaccinated people wearing masks outdoors. "We do need to start being more liberal as we get more people vaccinated," Fauci said. "As you get more people vaccinated, the number of cases per day will absolutely go down." (FT)

POLITICS: The Biden administration plans to name Thea Lee, a former AFL-CIO trade official, to head the Labor Department's international affairs division, according to people familiar with the appointment. Ms. Lee, who most recently served as president of the Economic Policy Institute, a liberal think tank that often critiques free trade policies, is slated to become the deputy undersecretary for international labor affairs. In that job, she will oversee the bureau that investigates labor rights, forced labor and child trafficking around the globe. (WSJ)

POLITICS: In a move that may surprise some ambitious Massachusetts Democrats, Sen. Elizabeth Warren says that she's going to run for reelection in 2024. "Yep," the 71-year-old said simply in a POLITICO interview Friday, when asked if she planned to make the run. (Politico)

POLITICS: Senator Bernie Sanders told "Axios on HBO" he opposes the efforts by Democratic leaders Chuck Schumer and Nancy Pelosi to bring back SALT, the State and Local Tax deduction that benefits wealthier residents of blue states. (Axios)

POLITICS: Senate Minority Leader Mitch McConnell (R-Ky.) is safe in his job despite repeated attack from former President Trump, Republican aides and strategists say. At the same time, GOP sources say that McConnell's long-term future atop the Senate GOP may depend on what happens in the 2022 and 2024 elections and whether Trump, who is strongly considering another presidential campaign, expands his power in the party. (Hill)

OIL: The investigation into a major cyber-attack on the biggest U.S. pipeline continued on Sunday as the White House pulled together an inter-agency task force to tackle the problem. The task force has been working through the weekend to address the breach, including exploring options for lessening its impact on the energy supply, according to a White House official. The victim, Colonial Pipeline, halted all operations on its systems when it was hit with ransomware late Friday and is working to restore operations as investigators assess the damage. (BBG)

OIL: Colonial Pipeline said May 9 that it had reopened some smaller lines between terminals and delivery points, but that its main pipeline network remained down with no set timeline for restoration after a cybersecurity attack knocked the major US fuel artery offline two days prior. (Platt's)

OIL: The ransomware group linked to the extortion attempt that has snared fuel deliveries across the U.S. East Coast may be new, but that doesn't mean its hackers are amateurs. Who precisely is behind the disruptive intrusion into Colonial Pipeline hasn't been made officially known and digital attribution can be tricky, especially early on in an investigation. A former U.S. official and two industry sources have told Reuters that the group DarkSide is among the suspects. Cybersecurity experts who have tracked DarkSide said it appears to be composed of veteran cybercriminals who are focused on squeezing out as much money as they can from their targets. "They're very new but they're very organized," Lior Div, the chief executive of Boston-based security firm Cybereason, said on Sunday. "It looks like someone who's been there, done that." (RTRS)

OTHER

CORONAVIRUS: EU leaders have confronted the Biden administration over its calls for Covid-19 vaccine patent waivers and urged the US to export jabs directly if it wants to help poor countries in need. German Chancellor Angela Merkel said after a two-day EU leaders' summit in Porto, Portugal, that suspending intellectual property rights was no solution to supply shortages and called for a focus on ramping up production instead. (FT)

GLOBAL TRADE: Israel and South Korea will sign a free trade agreement in the coming days during a visit by Israeli ministers to the Asian country. The agreement will exempt imports from customs fees and is expected to significantly increase trade between the two nations, Israel's Economy Ministry and Foreign Affairs Ministry said in an emailed statement. South Korea will be the first country in Asia to enter a free trade agreement with Israel, the ministries said. (BBG)

CANADA/CHINA: Canada is not planning new pathways to asylum for Hongkongers who flee the city, as it has well-developed processes to deal with those claiming political persecution, according to the country's top local diplomat. Jeff Nankivell, the outgoing consul general to Hong Kong and Macau, also told the Post in a farewell interview that the consulate's work had been affected by the national security law imposed on the city by Beijing last June. (SCMP)

JAPAN: Nearly 60% of people in Japan want the Tokyo Olympics to be cancelled, an opinion poll showed on Monday, less than three months before the Games are due to begin. The survey, conducted from May 7-9 by the Yomiuri Shimbun daily, showed 59% wanted the Games cancelled as opposed to 39% who said they should be held. "Postponement" was not offered as an option. Of those who said the Olympics should go ahead, 23% said they should take place without spectators. Foreign spectators have been banned but a final decision on domestic attendance will be made in June. Another poll conducted at the weekend by TBS News found 65% wanted the Games cancelled or postponed again, with 37% voting to scrap the event altogether and 28% calling for another delay. (RTRS)

BOK: South Korea's lowest paid workers suffered the biggest income falls during the pandemic, according to central bank research that shows inequality widening in the economy despite the Moon administration's progressive agenda. Excluding government virus relief payments and transfers between households, the lowest fifth of earners saw their income plunge 17% during March-December 2020 from a year earlier, while the highest income bracket experienced just a 1.5% dip, Bank of Korea economist Song Sang-yoon wrote Monday. (BBG)

SOUTH KOREA: President Moon Jae-in said Monday the government will focus all-out efforts on South Korea's economy achieving at least 4 percent growth in 2021. He also declared a push to create herd immunity here against COVID-19 earlier than scheduled, in a special address to mark his fourth inauguration anniversary. "The government will achieve a faster and stronger economic recovery," he said in the speech at the Chunchugwan press room of Cheong Wa Dae. He vowed to muster "all government capabilities so that South Korea's economy can attain 4 percent growth, or more, for the first time in 11 years and invigorate the private sector." (Yonhap)

SINGAPORE: The 2003 outbreak of severe acute respiratory syndrome provided a "playbook" for Singapore to handle the Covid-19 pandemic, the city-state's leader said. (FT)

INDIA: India's capital extended its lockdown for another week and adopted stricter restrictions to control a new wave of Covid-19 infections as the country battles the world's fastest-growing outbreak of the virus. The lockdown, which had been set to end Monday after being extended several times, will now run through the early morning of May 17, New Delhi Chief Minister Arvind Kejriwal said in an online briefing. Dining-in at restaurants will remain prohibited, shopping malls will continue to be shut and employees of businesses outside of essential services will be required to keep working from home. Metro service will be stopped as an additional measure. "The stricter the lockdown, the faster we will be able to control" the virus, Kejriwal said. (BBG)

INDIA: India's Supreme Court said it would set up a task force as part of efforts to improve the distribution of medical oxygen across the healthcare sector, as the country battles a brutal second wave of Covid-19. The court, which has been critical of the government's handling of the deepening healthcare crisis, announced on Saturday that it had established a committee to set up an "effective and transparent mechanism" to allocate oxygen supplies to states and hospitals. (FT)

ISRAEL: Israeli Prime Minister Benjamin Netanyahu has defended police action against Palestinian protesters after two nights of clashes in Jerusalem. He said Israel "shall not allow any radical element to undermine the calm" in the city amid growing concerns over the spiralling violence. The US, the EU, Russia and the UN on Saturday all expressed alarm. The clashes follow a month of tensions, with the threatened eviction of Palestinian families a focal point. The latest came on the eve of an expected hearing in the Israeli Supreme Court of the years-long case of the families, comprising more than 70 people, appealing against an eviction order in favour of a Jewish settler organisation in East Jerusalem's Sheikh Jarrah district. But the hearing was cancelled on Sunday following a request from Israel's attorney-general. A new date will be set in the next 30 days. (BBC)

IRAN: President Hassan Rouhani said some 13 million people in Iran, about 15% of the population, will be vaccinated against the coronavirus by July 22, as the country tries to combat the Middle East's worst outbreak. Rouhani said he expects all people in high-risk groups to receive at least their first dose by that date, the state-run Islamic Republic News Agency reported, adding that two domestically developed shots will be ready for mass use by June. (BBG)

IRAN: Iran is pushing for its banking industry to be given guaranteed and conclusive sanctions relief at talks to restore the country's nuclear deal with world powers. "The removal of sanctions against the central bank, Iranian banks, SWIFT, and any money transfer between them and major foreign correspondent banks, needs to be verified," Abdolnaser Hemmati, the governor of the Central Bank of Iran, said in answers to written questions, referring to restrictions on Iranian access to the Belgium-based global payments system. Hemmati said that officials from the central bank are directly involved in the talks to ensure U.S. sanctions removal is tangible. Negotiations resumed in Vienna on Friday in an attempt to rebuild the 2015 agreement struck by Tehran and a group of six leading nations. (BBG)

TURKEY: Turkey's statistics agency filed a criminal complaint against a group of local researchers publishingalternative inflation data.The government body demanded ENAGroup, an independent inflation research group, be fined for "purposefullydefaming" the official statistics institution and "misguiding public opinion," according to documents seen byBloomberg. The group started publishing its own inflation data in September amid claims from opposition partiesthat the official agency is underreporting price increases.ENAGroup's inflation figures are significantly higher than the official data. Its consumer price index rose 2.62% inApril from a month earlier, more than double the 1.1% reported by the official agency. The group reported anannual inflation rate of 36.7% for 2020. (BBG)

ARGENTINA: Argentina's president Alberto Fernandez arrived in Portugal Sunday, kicking off a five-day trip across Europe as he looks to drum up support to delay a $2.4 billion payment to the Paris Club. Fernandez will meet with top authorities in Portugal today before moving on to Spain, France and Italy. Economy Minister Martin Guzman, who completed a European trip of his own in the second week of April, will also participate in the trip. The country has asked the Paris Club to allow it to delay its payment, due at the end of May, until it has reached an agreement with the International Monetary Fund, and hopes for an answer by May 31, according to a person with direct knowledge of the negotiations. The person, who asked not to be named because talks are private, declined to say what the country's steps would be if it didn't receive a favorable response by that day. (BBG)

MEXICO: As many as one-third of Mexicans may have been exposed to the coronavirus by the end of 2020, according to a study of random blood samples taken between February and December. Antibodies were found in 33.5% of samples from blood banks and medical laboratory tests in Mexico unrelated to COVID-19. The levels varied according to regions; the highest exposure rate was in the northwest, from Baja California to Chihuahua, at 40.7%. The lowest was in western states, at 26.6%. In general, areas along the U.S. border had higher rates. (AP)

RUSSIA: A Siberian doctor who treated Kremlin critic Alexei Navalny after he collapsed on a flight in Russia last year has gone missing, Russian police said on Sunday. Police in the Omsk region, about 2,200 km (1,370 miles) east of Moscow, said physician Alexander Murakhovsky had left a hunting base in a forest on an all-terrain vehicle on Friday and had not been seen since. (RTRS)

RUSSIA: Russia is struggling with labour shortages after border closures to stem the spread of coronavirus sharply reduced the traditional cross-border migration flows from central Asia. Both sides have come to rely on the movement of people. (FT)

SOUTH AFRICA: The top leadership of South Africa's ruling party excluded its suspended Secretary-General Ace Magashule from a meeting on Saturday, confirming the sidelining of one of President Cyril Ramaphosa's biggest detractors. Magashule was ordered to vacate his post this week after he ignored an order by the African National Congress to step aside while he faces trial on graft charges. He denied any wrongdoing, said the decision to discipline him was invalid and notified party leader Ramaphosa that he was the one being suspended for violating campaign funding rules. Magashule joined an online meeting of the ANC's National Executive Committee, the party's top leadership structure, in defiance of its instruction to refrain from participating in its activities, according to three people with knowledge of the deliberations. (BBG)

CHINA

ECONOMY: China Eyes Dirty Industry Bailout To Limit Bond Defaults

- MNI talks to China advisors about help for coal companies amid the clean energy drive. On MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FOREX: China should gradually reduce dollar-denominated assets and instead increase holdings of real resources through foreign trade, said Yu Yongding, a former PBOC advisor and a member of the Chinese Academy of Social Sciences, according to a transcript published by CF40. Mounting U.S. government debt raises questions about its debt repayment ability and makes the dollar less stable, and China may suffer major losses being the biggest dollar bonds holder, Yu said. A possible geopolitical conflict between China and the U.S. may also amplify the negative effects of the Fed's policy effect on the Chinese economy when the U.S. quits fiscal expansion and monetary easing, Yu said. (MNI)

LIQUIDITY: The PBOC may inject liquidity given rising local government bond issuances in May and keep market rates around its policy rates, the China Securities Journal said citing Zhang Xu, the chief fixed-income analyst with Everbright Securities. Some market participants expect a liquidity gap of around CNY1 trillion in May when bond issuances pick up and companies remit taxes from last year, although some such as China International Capital Corp predicted a smaller gap, the newspaper reported. (MNI)

CHINA/EU: China will maintain talks with the EU over the Comprehensive Agreement on Investment, and sees giving up the deal causing regrettable losses for both European and Chinese businesses, said Global Times, responding to reports that the deal may be shelved after China's tit-for-tat sanctions against some EU members over the Xinjiang human rights issue. Suspending the deal by the EU will strain the already complicated and delicate China-EU relationship, at a time when the EU's "lukewarm" economy urgently needs a strong boost that the CAI can provide, the newspaer said. (MNI)

EQUITIES: 84 Chinese mobile apps were criticized for violating laws and rules in collecting and using personal information, the Cyberspace Administration says in a statement. Operators of the mobile apps criticized including Tencent, Baidu, Ping An and Merchants Bank. The operators are required to rectify their problems within 15 work days; they'll be punished if rectifications are not completed in time. (BBG)

CHINA NEWS: Remains of a huge Chinese rocket have landed in the Indian Ocean amid global concern the country's space program lost control of a giant chunk of debris. Pieces of the Long March 5B rocket re-entered the atmosphere at 10:24 a.m. Sunday local time and plunged into the sea at around 72.47 degrees east longitude and 2.65 degrees north latitude, according to a statement by the China Manned Space Agency posted on its official website. (BBG)

OVERNIGHT DATA

AUSTRALIA Q1 RETAIL SALES EX INFLATION -0.5% Q/Q; MEDIAN -0.4%; Q4 +2.4%

AUSTRALIA MAR, F RETAIL SALES +1.3% M/M; MEDIAN +1.4%; FLASH +1.4%

AUSTRALIA APR NAB BUSINESS CONFIDENCE 26; MAR 17

AUSTRALIA APR NAB BUSINESS CINDITIONS 32; MAR 24

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS MON

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This resulted in a net injection of CNY10 billion given no maturity of reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:26 am local time from the close of 1.7686% on last Friday.

- The CFETS-NEX money-market sentiment index closed at 35 on last Saturday, the last working day in China, vs 37 on last Friday. A lower index indicates reduced expectation for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.4425 MON VS 6.4678

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4425 on Monday, compared with the 6.4678 set on Friday, marking the lowest fixing in three months.

MARKETS

SNAPSHOT: Key U.S. Fuel Pipeline Still Down, Scottish Question Resurfaces

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 156.75 points at 29514.11

- ASX 200 up 66.371 points at 7147.2

- Shanghai Comp. up 2.025 points at 3420.899

- JGB 10-Yr future down 6 ticks at 151.38, yield down 0.3bp at 0.085%

- Aussie 10-Yr future down 3.5 ticks at 98.335, yield up 3.2bp at 1.712%

- U.S. 10-Yr future -0-03+ at 132-20+, yield up 1.41bp at 1.591%

- WTI crude up $0.34 at $65.23, Gold up $2.81 at $1834.03

- USD/JPY up 25 pips at Y108.85

- FED'S KASHKARI: U.S. JOB MARKET STILL NEEDS HELP TO HEAL (BBG)

- ECB'S REHN CALLS FOR CHANGE TO ECB'S INFLATION TARGET IN LINE WITH FED APPROACH (FT)

- SNP ONE SEAT SHORT OF OUTRIGHT MAJORITY, LABOUR FARES POORLY IN LOCAL ELECTIONS

- MAINLINES OF KEY U.S. PIPELINE REMAIN DOWN AFTER CYBERATTACK, NO RESTART TIMETABLE YET

- IRON ORE EXTENDS RECORD HIGH ON STRONG DEMAND FROM CHINA

BOND SUMMARY: Risk-On Dynamics Keep Core FI At Bay

T-Notes turned their tail as Tokyo trade got underway this week and extended their post-NFP losses, albeit Friday's low remained intact. The contract last sits -0-04 at 132-20, after bottoming out at 132-18+, with participants watching upticks in U.S. equity index futures, with S&P 500 e-minis printing fresh record highs. Fed's Kashkari reinforced the broader post-NFP feel over the weekend, as he flagged that domestic labour market remains in a "deep hole" and needs continued aggressive stimulus to recover. Cash Tsy curve bear steepened a tad (yields last unch. to +1.6bp), while Eurodollar futures trade unch. to -2.0 ticks through the reds.

- Selling pressure hit JGB futures in early trade as local players reacted to Friday's NFP report. The contract now trades at 151.38, 6 ticks shy of last settlement. Cash JGB yields were mixed and showed little deviation from neutral levels. The BoJ left its 1-5 Year purchase sizes unchanged, with bid/cover ratios ticking higher vs. the previous round of Rinban ops covering these maturities.

- Cash ACGB yield curve steepened, with yields seen -0.6bp to +3.7bp as we type. YM trades unch., while XM has ground lower and last sits -3.5. Bills are broadly unch. through the reds, with just IRM1 & IRZ1 sitting 1 tick lower apiece. The space faced pressure as Australia's benchmark stock index surged to record highs, which was a function of buoyant commodity prices. The supply of A$1.0bn of ACGB 21 Dec '30 provoked muted mkt reaction, drawing bid/cover ratio of 2.46x (prev. 2.53x). The size of the auction was small by historical standard, with A$1.2bn allotted at the previous offering. Elsewhere, the RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '24 to May '28, excluding Apr '26. Meanwhile, NAB Business Confidence rallied to an all-time high of 32 in Apr from 24 in Mar, with NAB dubbing the results of the survey as "simply stunning."

BOJ: 1-5 Year Rinban Conducted

The BoJ offers to buy a total of Y925bn of JGB's from the market, sizes unchanged from the previous operations:

- Y475bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Dec '30 Bond, issue #TB160:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 December 2030 Bond, issue #TB160:- Average Yield: 1.5984% (prev. 1.6636%)

- High Yield: 1.6000% (prev. 1.6650%)

- Bid/Cover: 2.4560x (prev. 2.5333x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 92.2% (prev. 71.0%)

- bidders 40 (prev. 41), successful 15 (prev. 17), allocated in full 9 (prev. 8)

EQUITIES: Broadly Positive

A broadly positive session for Asia-Pac equity markets, taking a positive lead from the US on Friday. Equity futures initially sold off on the miss in NFP data, before a fearsome rally set in, as concerns that the Federal Reserve could taper asset purchases and withdraw stimulus as soon as summer were rowed back, with markets seeing QE as here to stay. The post-payrolls rally put stock futures at new all-time highs. Markets in Japan and South Korea lead gains today, both higher by around 1%, in mainland China gains are smaller with major indices up around 0.3%. In Australia gains were supported by further upside in the commodity complex including iron ore. US futures are in the green, building on Friday's gains.

OIL: Crude Futures Higher But Off Best Levels

Oil gained in Asia-Pac trade on Monday, WTI up $0.19 from settlement levels at $65.10/bbl, while Brent is up $0.23 at $68.51. The benchmarks are off best levels, peaking early on and coming off highs as the greenback rose.

- Colonial Pipeline was subject to a cyberattack late Friday, which forced the company to temporarily shut its critical pipeline network supplying much of the East Coast of the U.S. with gasoline, diesel and jet fuel. Various source reports suggested that cybercriminal group DarkSide might be behind the attack, while official investigation is ongoing. The company said yesterday it is still working to full resume operations which could impact supply.

GOLD: Holds Gains

Gold moved in a tight range in Asia on Monday, holding near the top of its post-NFP range after jumping in the wake of an expectedly weak figure. The yellow metal is last up $1.33 at $1832.57. The jump higher at the end of last week capped the biggest weekly gain for gold since November as the greenback retreated and a raft of Fed speakers sought to reassure markets that policy normalization was still a long way off.

FOREX: Sterling Surges After Super Thursday Elections, Yen Loses Ground

Sterling caught a bid and led gains among the G10 pack as BBG trader sources cited interbank buying by Japanese bank, which squeezed weak short-stops in cable, while participants scrutinised the results of the UK's "Super Thursday" elections. The Tories made further inroads into traditional Labour strongholds, while Labour's Khan was re-elected as London Mayor by a slimmer margin than expected. Elsewhere, the SNP fell one seat short of an outright majority in Scotland's devolved parliament. Some may interpreted the SNP's sub-50% result as a positive, even as the party is expected to team up with pro-independence Greens in launching another bid to separate Scotland from the rest of the UK. Cable rallied to levels not seen since Feb 25.

- The yen went offered across the board amid a decent showing from regional equity benchmarks (ex-China), with e-minis printing fresh record highs. Local Covid-19 situation remained a source of worry, with questions re: implications for the Tokyo Olympics doing the rounds. USD/JPY roughly halved Friday's post-NFP losses.

- USD/CNH firmed a tad, with a weaker than expected PBOC fix helping keep the rate afloat. China's central bank set their USD/CNY mid-point at CNY6.4425, 55 pips above sell-side estimates, in a sign that officials are willing to reign in redback appreciation. The fixing came after post-NFP dollar sales took USD/CNH close to its three-year lows on Friday.

- Early trade saw commodity-tied FX draw some support from supply concerns linked to Friday's cyberattack on a critical U.S. fuel pipeline network. The initial impetus seemingly faded away as crude oil, gasoline & heating oil pulled back from their respective highs.

- Norwegian CPI, Rinksbank Apr MonPol meeting minutes as well as comments from Fed's Evans & Riksbank's Ohlsson headline today's thin economic docket.

FOREX OPTIONS: Expiries for May10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2000(E685mln), $1.2040(E683mln)

- USD/JPY: Y109.00-05($587mln), Y110.00($740mln)

- GBP/USD: $1.3800(Gbp678mln)

- EUR/GBP: Gbp0.8760-80(E670mln)

- AUD/USD: $0.7900(A$639mln)

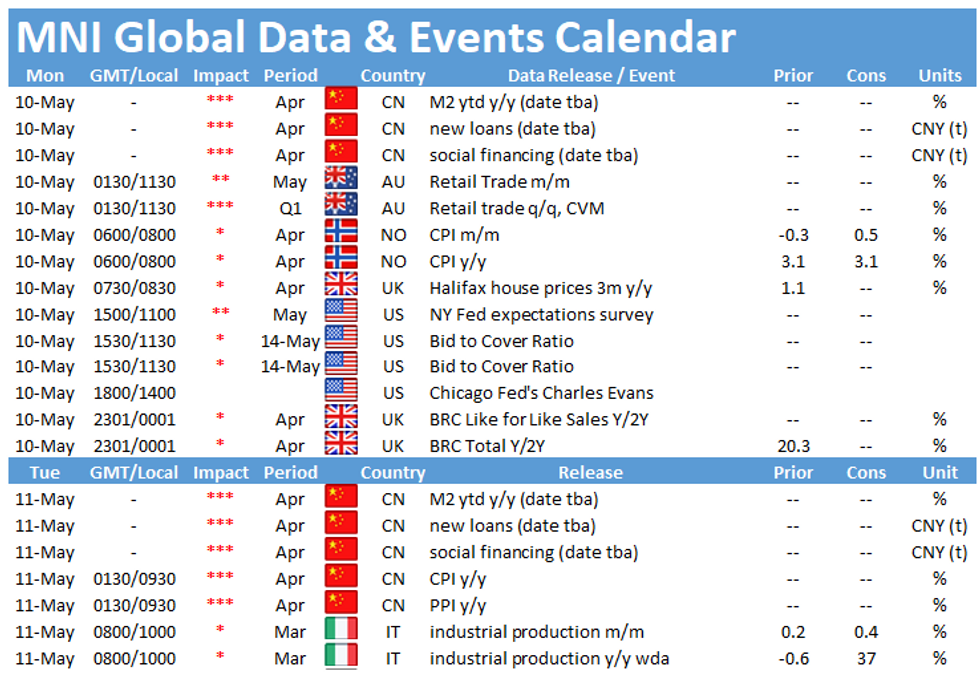

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.