-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Equities Mixed, Chinese Data Disappoints

EXECUTIVE SUMMARY

- CHINESE MONTHLY ECONOMIC ACTIVITY DATA MISSES EXPECTATIONS

- PBOC ROLLS OVER MATURING MLF LIQUIDITY PROVISION

- ISRAELI-PALESTINIAN TENSIONS SIMMER

- SIGNS OF UK UNREST EVIDENT RE: BREXIT

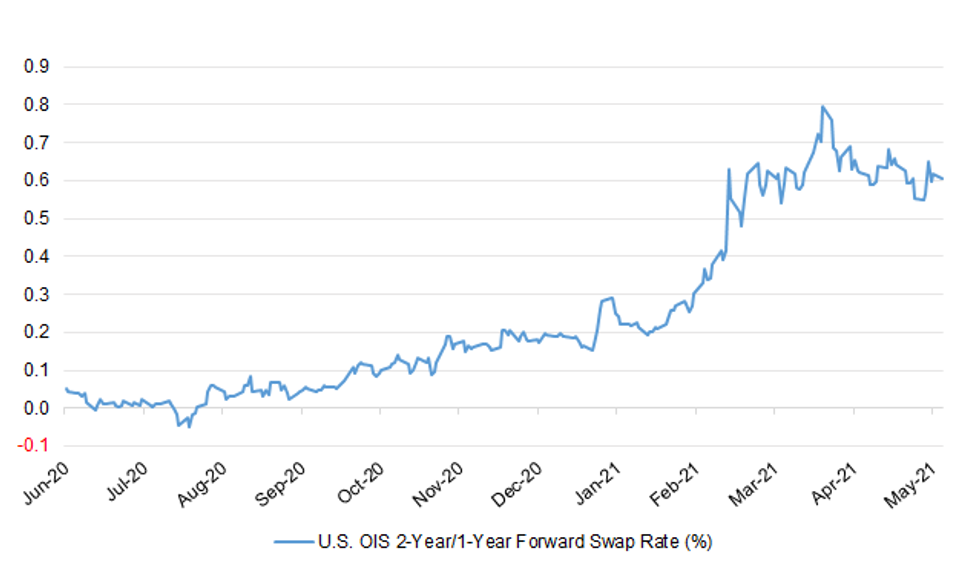

Fig. 1: U.S. OIS 2-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The Indian virus variant could pose "serious disruption" to lockdown easing in England on 21 June, the PM says. Boris Johnson said if it was found to be "significantly" more transmissible there could be "some hard choices". The wait between jabs will be cut from 12 weeks to eight for the over-50s and clinically vulnerable because of concern over the variant, he added. (BBC)

CORONAVIRUS: Boris Johnson has said everyone "must play their part" and get a Covid jab, amid concern that the spread of the Indian variant is being fuelled by those who have refused to be vaccinated. (Telegraph)

CORONAVIRUS: The U.K. government will make its decision on whether to go ahead with the final lifting of Covid-19 restrictions on June 14, with the spread of the Indian variant in parts of the country threatening to delay the end of lockdown measures set for June 21, Health Secretary Matt Hancock said Sunday on Sky TV. (BBG)

CORONAVIRUS: Tight coronavirus restrictions will stay in place in Glasgow and Moray when lockdown eases, Nicola Sturgeon said yesterday as an expert warned that Scotland was losing control of the Indian strain. An effective travel ban has been imposed on the areas for at least a week. The first minister said that she had taken the "difficult" decision after Glasgow overtook Moray as the country's virus hotspot. There were 80 cases per 100,000 people in the seven days to May 11. In Moray it was 69 per 100,000. (The Times)

CORONAVIRUS: At least 20,000 passengers who could have been infected with a virulent strain of Covid-19 were allowed to enter Britain while Boris Johnson delayed imposing a travel ban from India. (Sunday Times)

CORONAVIRUS: The Government wants to vaccinate as many as one million people a day as part of a drive to beat the Indian variant of Covid-19 and save the British summer, The Telegraph can disclose. As a first step, ministers have told MPs they "safely" expect to increase daily doses from 500,000 to 800,000 within a fortnight, by drawing on a stockpile of 3.2 million doses. Government insiders hope this daily run-rate could be further increased, with the possibility of reaching a peak of around one million during some days over the summer. (Telegraph)

CORONAVIRUS: Health officials in Bolton have defied the government and fast-tracked jabs to residents as young as 17 as the town battles to avoid a new lockdown. More than 9,000 people in the area were vaccinated against the coronavirus over the weekend with hundreds in their twenties and thirties queueing up. The government said that people younger than 38 would not be eligible for vaccinations but the town's doctors have offered on-the-spot assessments to everyone in hotspot areas. Helen Wall, the senior responsible officer for the vaccination programme in Bolton, said the focus was on eligible groups but urged others to inquire. "If you are not sure if you are eligible, get yourself down here today, we will check it out for you," she told residents. (The Times)

ECONOMY: Monday sees another milestone in the reopening of the economy: people in most of the UK will be able to go to a bar or restaurant and eat indoors. But some favourite haunts will no longer be there: over the last year, thousands of establishments have closed, latest surveys indicate. Across Britain, there are 9.7% fewer restaurants to choose from, compared with before the pandemic. (BBC)

ECONOMY: Job recruitment has returned to pre-pandemic levels with hiring intentions at an eight-year high as the economy recovers from the easing of restrictions. All sectors are experiencing a recovery in jobs and an improvement in pay prospects, a quarterly report by the Chartered Institute of Personnel and Development has found. There is employer optimism across the private, public and voluntary sectors. It extends to industries including retail and hospitality, parts of the economy that have been most exposed to the crisis. Employment intentions are at their highest since February 2013 when Britain was emerging from the recession of the global financial crisis. (The Times)

ECONOMY: Britain's employers are struggling to hire staff as lockdown lifts amid an exodus of overseas workers caused by the Covid pandemic and Brexit, industry figures reveal. According to the Chartered Institute of Personnel and Development (CIPD) and the recruitment firm Adecco, employers plan to hire at the fastest rate in eight years, led by the reopening of the hospitality and retail sectors as pandemic restrictions are relaxed in England and Wales on Monday. However, in a sign of growing pressures in the jobs market amid rapid growth in consumer spending, the professional body for HR and people development said there had been a sharp decline in the numbers of EU workers, fuelling the risk of labour shortages. Separate figures from Adzuna showed rapid growth in hiring, with almost 1m vacancies listed on the jobs website, up 18% on six weeks ago amid a rise in jobs in hotels, restaurants and in the events and leisure sector. But it warned there had been a steep decline in overseas jobseeker interest. (Guardian)

ECONOMY: British businesses ramped up their search for new staff as pubs, restaurants and other hospitality and travel firms got ready for Monday's lifting of coronavirus restrictions in England, a survey showed. But an exodus of foreign workers is aggravating a shortage of candidates, with more than 10 jobs on offer for every job-seeker in some cities, according to the survey by job search website Adzuna. Job adverts on Adzuna jumped to 987,800 in the first week of May, up by 18% from the end of March, which was before the reopening of non-essential retailers and hospitality firms for outdoor service on April 12. (RTRS)

FISCAL: Ministers are mulling plans for regionally-targeted tax breaks to persuade multinational corporations to invest in northern parts of the country as part of the levelling up agenda. (Telegraph)

BREXIT: The Northern Ireland Protocol is "dead in the water", a senior ally of Boris Johnson has said as the Government gave the European Union two months to make the system work. Ministers are increasingly worried about the way that the European Union is enforcing checks when goods move from Great Britain and Northern Ireland. There are fears among senior figures that unless the EU eases checks in time for when the marching season reaches its peak on July 12, tensions could flare. A Government source said: "The marching season is a date whereby you would want to have a material improvement in what is happening. (Telegraph)

BREXIT: Brussels should stop "point-scoring" and work with the U.K. to implement the Brexit trade deal, according to David Frost, the British minister in charge of relations with the European Union. (BBG)

BREXIT: New Democratic Unionist Party leader Edwin Poots will try to "strip away" parts of the Brexit trade agreement covering Northern Ireland, as tensions in the region intensify. (BBG)

BREXIT: Britain is drawing up plans to axe swathes of pre-Brexit financial rules after giving up hope that Brussels will grant the City widespread access to the Single Market, The Sunday Telegraph can reveal. The Treasury has begun scrutinising the whole suite of finance regulations which were kept in British law after our departure from the European Union, with a view to weeding out cumbersome red tape and enhancing London's role as a global trading hub. (Telegraph)

POLITICS: After 10 days of negative coverage since the local elections, Labour nationally has dropped six points to just 31%, and now stands 13pts behind the Tories, who are up two points to 44% compared with a fortnight ago. Just under a half (49%) of 2019 Labour voters think Starmer should remain as Labour leader but a third (33%) think he should resign. The government's handling of the pandemic now has a net approval rating of +14%, the highest since mid-April 2020. Now just under half (47%) approve of their handling, while 33% disapprove. (Observer)

POLITICS: Keir Starmer has said Labour will have a completely new blueprint for power not based on previous manifestos, as he told activists he would spend the summer making extended visits to places the party must win. The Labour leader told a conference hosted by the centre-left thinktank Progressive Britain on Sunday that the party's policy review would not take previous manifestos as its starting point, despite the close attachment of many members to the radical manifestos drawn up under Jeremy Corbyn's leadership. Those promised to re-nationalise key industries, including rail, energy networks and Royal Mail, and made extensive new offers on childcare, adult education and social care. (Guardian)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed the United Kingdom at AA (high), Stable Trend

EUROPE

CORONAVIRUS: A health travel pass in the EU will be available from around June 20, French junior minister for European Affairs Clement Beaune said in an interview Sunday on Europe 1 radio interview. The pass will show either proof of vaccination against Covid-19, immunity due to past infection or the result of a negative PCR test. Beaune says he's pushing for quarantine measures to be lifted once the pass is operational. Only vaccines approved by the European Medicine Agency will be accepted as proof of vaccination. That would exclude Russian and Chinese vaccines, he said. (BBG)

GERMANY: Germany's Greens narrowed the gap to Chancellor Angela Merkel's conservative alliance to one percentage point in the latest Insa poll for Bild am Sonntag newspaper. Merkel's CDU/CSU bloc retained the lead but lost half a point to 25% compared with the previous week's survey, while the Greens gained half a point to 24%. (BBG)

FRANCE: France is set to reach a milestone of 20 million vaccinated with a first dose today, local media cited Prime Minister Jean Castex as saying during a visit to a vaccination center in Paris. The next step is to have 30 million vaccinated with a first dose by mid-June, according to Castex. "The situation is improving," he was cited as saying. (BBG)

ITALY: Italy may permit second shots of the Covid-19 vaccine to be administered at holiday destinations. Europe's third-largest economy has accelerated its vaccination campaign, with more than half a million shots given per day. This means most second doses are scheduled for August, when most Italians are on holiday. While regional and national authorities debate the logistics of such a step, allowing shots away from home would boost the country's battered tourism industry. Italians are keen to be vaccinated, even overcoming initial skepticism over AstraZeneca Plc's shot, whose use has been restricted because of blood-clot risks. In Rome, thousands of people queued up until late into the night on Saturday to receive their dose in the first open day organized by the Lazio region.(BBG)

SWITZERLAND: Swiss lawmakers will debate whether banking regulations should be tightened when a parliamentary committee sits this week to discuss the losses suffered by lenders in the collapse of Archegos Capital Management LP, SonntagsZeitung reported. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Portugal at BBB; Outlook Stable

- Moody's affirmed Latvia at A3; Outlook Stable

- DBRS Morningstar confirmed Cyprus at BBB (low), Stable Trend

U.S.

FED: Dallas Federal Reserve President Robert Kaplan on Friday raised the prospect of a worrisome rise in U.S. inflation expectations, as imbalances between supply and demand for labor and goods put upward pressure on prices. Most U.S. central bank policymakers see the upward pressure - evident in a 4.2% jump in annual consumer prices last month - as transitory, expecting supply chains to eventually catch up to higher demand, more workers to return to the labor force as the rollout of COVID-19 vaccines alleviates safety concerns, and working parents to have more flexibility as more schools and childcare facilities reopen. (RTRS)

ECONOMY: People view the current spike in inflation in the United States as a transitory phenomenon, White House economic adviser Cecilia Rouse said on Friday. Rouse, speaking to reporters at the White House, said a mismatch between supply and demand due to the pandemic and the economic snap-back had pushed inflation higher but that the mismatch should prove temporary. "I fully expect that will work itself out in the coming months," she said. (RTRS)

ECONOMY/POLITICS: President Joe Biden's top advisers detect a growing political challenge from the spike in inflation, even as they see little immediate peril to the economy from price increases that officials expect will last through the rest of the year. Senior administration aides contend the current jump in prices is being caused by a surge in demand for specific items -- like used cars, air travel and hotels -- that reflects the American economy's revival from the Covid-19 crisis, along with vaccinated consumers getting more comfortable to move around freely. That's different from a sustained pick-up in inflation, they argue. (BBG)

CORONAVIRUS: CDC Director Dr. Rochelle Walensky defended the agency's decision to tell people who are fully vaccinated against Covid-19 they can go without a mask as state and local officials grapple with whether to follow suit. "We are asking people to be honest with themselves," Walensky said on NBC's "Meet the Press" which aired Sunday. "If they are vaccinated and they are not wearing a mask, they are safe. If they are not vaccinated and they are not wearing a mask, they are not safe." (CNBC)

CORONAVIRUS: Any mandates in the U.S. to require people to be vaccinated against Covid-19 will be set at the local level by companies and institutions such as colleges, the head of the Centers for Disease Control and Prevention said. "It may very well be that local businesses, local jurisdictions, will work towards vaccine mandates," CDC Director Rochelle Walensky said on NBC's "Meet the Press." "That is going to be locally driven and not federally driven." Separately, on "Fox News Sunday," Walensky cited colleges or universities that may enforce vaccine mandates for students, and that the cruise ship industry may also consider it for people about to embark on multiday journeys at sea. (BBG)

CORONAVIRUS: The Centers for Disease Control and Prevention updated its guidance for K-12 schools Saturday, noting that reopened schools should "require universal and correct use of masks and physical distancing." (Axios)

CORONAVIRUS: Andy Slavitt, a senior advisor on President Joe Biden's coronavirus response team, confirmed Friday he will be leaving his role in early June. Slavitt, whose temporary position on Biden's Covid panel was known to be expiring next month, said that while the administration had achieved many of its goals for the pandemic, more work remains to be done. (CNBC)

MARKETS: FOX Business has learned that the Securities and Exchange Commission is launching a series of inquiries into whether corporations make proper disclosures involving so-called Environment, Social, Governance issues, known by the short-hand ESG. The purpose of the crackdown, initiated at the behest of Gensler, who became SEC chairman last month, is to prod corporate America to adopt policies that improve diversity, and other non-financial issues such as environmental concerns, securities lawyers who represent potential targets tell FOX Business. (FOX Business)

EQUITIES: AT&T Inc. is in talks to combine its sprawling WarnerMedia division with Discovery Inc., according to people familiar with the matter, potentially unwinding the telecom giant's signature bet on media, as pressure on the traditional entertainment business mounts. The talks, which likely value the AT&T business at well over $50 billion with debt, could lead to an agreement by Monday, the people said, who cautioned that the talks could still fall apart. (Dow Jones)

OTHER

U.S./EU: The Biden administration is set to announce it's reached a truce in a dispute with the European Union over metal tariffs, sparing iconic products such as U.S. bourbon whiskey from a doubling of EU duties next month, people familiar with the matter said. A resolution could be announced as soon as Monday, said the people, who declined to be identified because the talks are private. (BBG)

GLOBAL TRADE: The Biden administration is weighing concerns about commodity shortages and inflation as it reviews trade tariff policy, the top White House economist said on Friday. Strong demand for consumer goods and other products in a U.S. economy still scarred by the coronavirus pandemic have led to shortages in commodities from lumber to computer chips. (RTRS)

GLOBAL TRADE: China spent a record 213.6 billion yuan ($33 billion) in industry subsidies in 2020, eager to shore up key sectors including semiconductors and defense in its heated technology race with the U.S. The figure represents a 14% increase from a year earlier, with payments to 113 businesses in the semiconductor sector totaling 10.6 billion yuan, or a 12-fold expansion from a decade ago. The figures were compiled by Nikkei based on listed companies' earnings data obtained by information firm Wind. (Nikkei)

GLOBAL TRADE: US warnings of espionage by Huawei are failing to dissuade governments in Africa, Asia and Latin America from hiring the Chinese tech group for cloud infrastructure and e- government services, a study has found. The report by the Washington-based think-tank CSIS seen by the Financial Times identified 70 deals in 41 countries between Huawei and governments or state-owned enterprises for these services from 2006 to April this year. (FT)

GLOBAL TRADE: Rishi Sunak is holding back support for Joe Biden's plans for a 21 per cent minimum global business tax rate, as Britain pushes the US to ensure any agreement includes a fairer system for taxing digital technology giants. The chancellor, who chairs the G7 finance ministers, said he would consider a global minimum levy only as part of a broader package, with Treasury officials fearing Biden is intent on compelling tech firms to pay tax "in California when it ought to be paid in the UK". Sunak has come under pressure from Labour to endorse the US plan for a 21 per cent global minimum corporation tax rate. Lisa Nandy, shadow foreign secretary, charged that Britain was showing hesitancy, not leadership. (FT)

CORONAVIRUS: Britain said on Saturday it plans to hold a virtual meeting on June 2 to encourage global take-up of COVID-19 vaccines, bringing together medical experts, officials from G7 countries and other partners. The event will discuss how to tackle misinformation about vaccines, including the role social media companies can play in stopping the spread of damaging falsehoods. (RTRS)

CORONAVIRUS: Pfizer's most senior UK executive has criticised the call to forgo patents on Covid vaccines, warning that it would lead to a global shortage of raw materials. Ben Osborn, who leads the American drugs giant in the UK, said an intellectual-property waiver was "not the answer". "We would see a very rapid short-term impact," he said. "It could allow any organisation to start procuring some of these basic raw materials across multiple countries." Osborn, 44, said it could even mean that existing vaccine manufacturers — which include Astra Zeneca and US biotech venture Moderna — would be unable to fulfil their obligations to deliver doses. (Sunday Times)

JAPAN: Support for Japanese Prime Minister Yoshihide Suga fell to 32.2%, the lowest since he took office in September, in a poll published by Jiji Press late Friday. The proportion of respondents saying they didn't support him rose to 44.6%, the highest level so far, amid growing dissatisfaction over his handling of the pandemic and the vaccine rollout. (BBG)

BOJ: MNI BRIEF: BOJ To Study If Firms, Banks Have Coped With Risks

- Bank of Japan officials will analyse whether smaller firms, especially those offering in-person services, and regional financial institutions have coped with market and credit risks the bank warned about in April's Financial System Report by examining their earnings, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CANADA: "On a national level, we're seeing hopeful signs that we have passed the peak of the third wave," Dr. Theresa Tam told a Friday news conference in Ottawa. She said the latest seven-day moving average of daily case counts is more than 20 per cent lower than the peak in April, dropping to fewer than 7,000 cases daily for the first time since early April. Dr. Tam also said there have been reductions in the number of people experiencing severe and critical illness, with fewer than 4,000 people being treated in hospitals for COVID-19 each day, including fewer than 1,400 in intensive care and an average of 48 deaths being reported daily. (Globe & Mail)

CANADA: Prime Minister Justin Trudeau's government has begun preliminary internal discussions about reopening the border with the U.S., even as Canada remains well behind its neighbor in vaccinations. Senior officials have begun to formally talk about options for how to proceed, three people familiar with the matter said, speaking on the condition they not be identified. One question under consideration is whether to employ a two-track system in which quarantine and testing requirements would be relaxed for vaccinated travelers. (BBG)

TURKEY: Turkey will ease its virus restrictions from Monday as new cases of Covid-19 decline following a three-week lockdown, offering a glimmer of hope for the summer tourist season. Infections plummeted to 11,472 on Saturday from a record high of 63,082 a month ago, though that's still above the target of no more than 5,000 cases set by President Recep Tayyip Erdogan when he announced the national lockdown from April 29. (BBG)

MEXICO: Mexico's inflation likely peaked this year when it breached the 6.0% level in April and should decline to below 5.0% by the end of this year, central bank board member Jonathan Heath wrote in an article published on Friday. (RTRS)

BRAZIL: Government spending during the Covid-19 pandemic spending has to be well explained, Central Bank President Roberto Campos Neto says during a virtual event. Brazil's Covid-19 vaccination to speed up in second half of May. Brazil is clearly on economic recovery path. Vaccination makes Central Bank optimistic about a recovery in 2H21. Central bank sees no fiscal dominance risk. Implicit inflation is rising everywhere, he says. FX rate is showing higher exports estimates. (BBG)

BRAZIL: Brazil's Central Bank remains committed to bringing inflation to its center target through a partial adjustment of its monetary policy, but it could adjust plans if economic conditions change, Economic Policy Director Bruno Serra says during an online event. Recent inflation shocks are temporary due to rising commodity Prices. (BBG)

RUSSIA: The Russian government said on Friday it had officially deemed the United States and the Czech Republic "unfriendly" states, and that U.S. diplomatic missions could no longer employ local staff while Czech missions could employ a maximum of 19. Russian President Vladimir Putin signed a law last month to limit the number of local staff working at foreign diplomatic missions and other agencies, and ordered the government to draw up a list of "unfriendly" states that will be subject to the restrictions. (RTRS)

SOUTH AFRICA: South Africa said it will broaden its Covid-19 vaccine rollout to health-care workers and people over the age of 60 starting Monday. The government will start a mass vaccination effort at 87 sites across the country using Pfizer Inc. doses administered to frontline health-care workers and the elderly, health minister Zweli Mkhize said in an online briefing Sunday. The rollout will start at a slower pace and will be stepped up over the coming days, Mkhize said. South Africa expects more deliveries of the Pfizer vaccine tonight, raising the number to 975,780 doses. Deliveries from Pfizer are expected to rise to about 4.5 million doses by the end of June, with another 2 million doses coming from Johnson & Johnson, Mkhize said. The government aims to inoculate more than 5 million senior citizens by the end of June "provided supply of vaccines flow as anticipated," he said. (BBG)

SOUTH AFRICA: South Africa's struggling power utility Eskom Holdings SOC Ltd. said Sunday it will cut power to customers after losing capacity at some of its electricity generating units. The state-owned company said it will cut 2,000 megawatts from the grid from Sunday to Tuesday after losing 10 generating units at some of its key power stations. Eskom said it's bringing back rolling blackouts due to steam leaks at its Matla plant, while generation has also been affected at the Medupi, Kusile and Dhuva plants. The disruptions are being investigated, Eskom said in a statement. (BBG)

ISRAEL: Benjamin Netanyahu warned on Sunday that Israel's biggest military offensive against Hamas in seven years would "take time" despite UN calls for a ceasefire. Speaking to the nation after a security cabinet meeting, Israel's prime minister also said the country would continue its military campaign against the Islamist group that controls the Gaza enclave "with full force." "There is talk about international pressure. There is always pressure but all in all we are receiving very serious backing, first of all from the US," he said. (FT)

ISRAEL: President Joe Biden spoke to Israeli Prime Minister Benjamin Netanyahu and Palestinian Authority President Mahmoud Abbas on Saturday as the violence in Israel and the Gaza Strip escalated with no sign that it would cease any time soon. (CNBC)

ISRAEL: United Nations Security Council members condemned the violence in the Middle East during an emergency session Sunday but failed to agree on a unified position after China accused the U.S. of blocking a joint statement. "Regrettably, simply because of the obstruction of one country, the Security Council hasn't been able to speak with one voice," Chinese Foreign Minister Wang Yi said during the virtual meeting. "We call upon the United States to shoulder its due responsibilities of taking a just position." The State Department didn't respond to a request for comment. Secretary of State Antony Blinken, asked last week about reports that the U.S. had delayed a public Security Council meeting, said he wanted to "give some time for the diplomacy to have some effect and to see if, indeed, we get a real de-escalation." (WSJ)

ISRAEL: An Axios reporter tweeted the following on Sunday: "Gaza cease fire talks resume. Diplomatic source tells me that over the past 24 hours, UN Special Coordinator Tor Wennesland has been holding extensive talks with all sides, including with Israel's National Security Adviser Meir Ben-Shabbat and other security officials." (MNI)

EQUITIES: SoftBank Group Chairman and CEO Masayoshi Son told Nikkei on Thursday that his Japanese tech conglomerate wants to more than double its Vision Fund portfolio to 500 companies, bringing dozens to public markets every year. (Nikkei)

OIL: Iran is preparing to ramp up global oil sales as talks to lift sanctions show signs of progress. But even if a deal is struck, the flow of additional crude into the market may be gradual. State-controlled National Iranian Oil Co. has been priming oil fields -- and customer relationships -- so it can increase exports if an accord is clinched, officials said. In the most optimistic estimates, the country could return to pre-sanctions production levels of almost 4 million barrels a day in as little as three months. It could also tap a flotilla's worth of oil that's hoarded away in storage. But there are many hurdles to overcome. Any agreement must fully dismantle the gamut of U.S. barriers on trade, shipping and insurance involving Iranian entities. Even then buyers may still be reluctant, according to Mohammad Ali Khatibi, a former official at NIOC. (BBG)

OIL: Saudi crude exports were constrained last month by Riyadh's voluntary initiative to produce 1mn b/d below its formal Opec+ output ceiling. Crude loaded from Saudi terminals in April dropped to 5.46mn b/d, down by 13,000 b/d from March and 476,000 b/d lower than January, according to Argus tracking data. This factors in Saudi Arabia's portion of exports from the Neutral Zone that it shares with neighbouring Kuwait, and excludes Bahraini shipments that load from Saudi terminals. April marked the last month of Saudi Arabia's extra 1mn b/d production cut. It plans to gradually unwind it by 250,000 b/d in May, 350,000 b/d in June and 400,000 b/d in July. This coincides with a 113,000 b/d rise in the country's Opec+ quota this month, a further 115,000 b/d hike next month and a 148,000 b/d increase in July. (Argus Media)

OIL: Gasoline shortages that have plagued the U.S. East Coast over the last week slowly eased on Sunday as the country's largest fuel pipeline network recovered from a crippling cyberattack. The six-day closure of Colonial Pipeline's 5,500-mile (8,900-km) system was the most disruptive cyberattack on record, preventing millions of barrels of gasoline, diesel and jet fuel from reaching fuel tanks throughout the eastern United States. Thousands of gas stations ran dry as supplies failed to arrive and drivers fearing a prolonged outage filled tanks and jerry cans. Refiners and fuel distributors are racing to recover before the Memorial Day holiday weekend at the end of May, the traditional start of the peak-demand summer driving season. "Colonial Pipeline is currently shipping at normal rates, based on shipper nominations," company spokesman Eric Abercrombie said in an email. "It will take some time for the supply chain to fully catch up." In Washington, D.C., 80% of stations were still empty, according to tracking firm GasBuddy. (RTRS)

OIL: U.S. regulators on Friday ordered the Limetree Bay refinery on St. Croix, U.S. Virgin Islands, to cease operations for at least 60 days, throwing the multibillion-dollar overhaul of the massive plant into jeopardy. (RTRS)

CHINA

EQUITIES: China's stock market regulator on Sunday launched an investigation into alleged stock manipulation of some publically traded companies and vowed to crack down on illegal activities to protect investors' interests, amid growing controversies about stock manipulation. The China Security Regulatory Commission (CSRC) announced that it has started an investigation into the alleged manipulation of stock prices of firms, including Jiangsu Lettall Electronics Co and ZOY Home Furnishing Corp, by relevant accounts, in response to media reports of suspected manipulation. In a statement, the CSRC said that it would adopt a "zero tolerance" policy toward vicious market manipulation activities and conduct thorough investigations and punish violators severely. (Global Times)

PENSIONS: China wants insurance companies to develop more pension products that last longer than 10 years as the country seeks increased commercial retirement options for its aging population. A pilot program will kick off in the eastern province of Zhejiang and the western city of Chongqing from June, the China Banking and Insurance Regulatory Commission said in statement on Saturday. PICC Life Insurance Co., China Life Insurance Co. and four other Chinese insurers will join the one-year project. Insurers should develop products with flexible premium payments and steady returns with buyers only receiving pension payments when they reach the age of 60, the regulator said. (BBG)

CORONAVIRUS: More people across China rushed to receive Covid-19 vaccines after a resurgence of cases was reported in Anhui and Liaoning provinces, with people in Anhui's capital Hefei lining up late into the night in rain, the Global Times reported. China has had low inoculation rates, with 10 of the 31 provinces not reaching the country's average rate of around 14 percent, as many felt the virus had been well contained, the newspaper said. China, with a population of 1.4 billion, had administered just over 390 million doses as of May 16. The recent resurgence may have originated in the port city of Yingkou in Liaoning, and has links to imported cases, the newspaper said. (MNI)

CORONAVIRUS: China is vaccinating almost 14 million people a day, a record for the nation as worries grow amid a Covid-19 flareup. The ramp up in shots comes just days after China detected its first new cluster in months with a smattering of cases in the eastern province of Anhui and northeastern region of Liaoning. Videos on social media showed citizens rushing to get their vaccines, with long queues at inoculation sites despite heavy rainfall. (BBG)

COMMODITIES: The current commodity rally in China may ease in H2 as the government reserves the tools including adjusting monetary policies and limiting construction activities, the China Securities Journal said citing Chen Li, the chief economist with Chuancai Securities. The levels of liquidity and construction activities are not strong enough to sustain further price gains, therefore the central bank may not see the need to tighten yet given the persistent global pandemic and China's weak employment, Chen said. (MNI)

PROPERTY: Launching a property tax may help the Chinese government to curb the rising home price and the market will stabilize in the long run after initial fall, the 21st Century Business Herald said in an editorial. The property tax will only target those holding too many houses and won't impact most families, the newspaper said. Boosting domestic consumption, the key of China's dual circulation model, also requires controls over housing and reduce pressure owning a home, it said. The editorial was published after last week some ministries convened to discuss the long-deliberated property tax. (MNI)

OVERNIGHT DATA

CHINA APR INDUSTRIAL OUTPUT +9.8% Y/Y; MEDIAN +10.0%; MAR +14.1%

CHINA APR INDUSTRIAL OUTPUT YTD +20.3% Y/Y; MEDIAN +21.1%; MAR +24.5%

CHINA APR RETAIL SALES +17.7% Y/Y; MEDIAN +25.0%; MAR +34.2%

CHINA APR RETAIL SALES YTD +29.6% Y/Y; MEDIAN +31.9%; MAR +33.9%

CHINA APR FIXED ASSETS EX RURAL YTD +19.9% Y/Y; MEDIAN +20.0%; MAR +25.6%

CHINA APR PROPERTY INVESTMENT YTD +21.6% Y/Y; MEDIAN +20.0%; MAR +25.6%

CHINA APR UNEMPLOYMENT 5.1%; MEDIAN 5.2%; MAR 5.3%

CHINA APR NEW HOME PRICES +0.48% M/M; MAR +0.41%

JAPAN APR PPI +3.6% Y/Y; MEDIAN +3.1%; MAR +1.2%

JAPAN APR PPI +0.7% M/M; MEDIAN +0.5%; MAR +1.0%

MNI DATA IMPACT: Japan Apr CGPI Up 3.6% Y/Y; Best Since 2014

Japan's corporate goods price index has posted a second straight year-on-year rise in April, up 3.6%, with the index rising to the highest level since September 2014, according to data released by the Bank of Japan on Monday - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

JAPAN MAR LOANS & DISCOUNTS CORP +6.29% Y/Y; FEB +7.43%

NEW ZEALAND APR SERVICES PMI 61.2; MAR 52.9

Like its sister survey the month before, activity in New Zealand's services sector reached its highest level since the survey began in 2007, according to the BNZ - BusinessNZ Performance of Services Index (PSI). The PSI for April was 61.2, which was up 8.3 points from March (A PSI reading above 50.0 indicates that the service sector is generally expanding; below 50.0 that it is declining). It was the first time since June 2007 that the sector recorded a post-60 result. BusinessNZ chief executive Kirk Hope said that the strong April result matches what is occurring across many countries we typically compare ourselves with. "Australia, the UK and the USA are also posting post-60 results at present, which is indicative of the global economy slowly but surely getting back to some form of normality through increased business activity". BNZ Senior Economist Doug Steel said that "the Achilles heel of the PSI remains supplier deliveries. Given supply issues obviously remain a significant issue for many, especially when viewed alongside very strong demand side indicators at present, it points to significant upwards pressure on prices". (BNZ)

NEW ZEALAND MAR NET MIGRATION +825; FEB 415

UK MAY RIGHTMOVE HOUSE PRICES +1.8% M/M; APR +2.1%

CHINA MARKETS

PBOC NET INJECTS CNY90BN VIA MLF AND REPOS MON

The People's Bank of China (PBOC) injected CNY100 billion via one-year medium-term lending facility (MLF) with the rate unchanged at 2.95% on Monday. This aims to roll over the CNY100 billion of MLFs maturing today and fully meet liquidity needs, the PBOC said on its website.

- The PBOC also injected CNY10 billion via 7-day reverse repos at 2.20%. In total, the central bank net injected CNY90 billion as CNY20 billion repos mature today.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:27 local time from the close of 1.9942% on last Friday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 45 on last Friday vs 38 on last Thursday. A higher index indicates strengthened market expectations for tighter liquidity.

CHINA SETS YUAN CENTRAL PARITY AT 6.4307 MON VS 6.4525

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4307 on Monday, compared with the 6.4525 set on Friday.

MARKETS

SNAPSHOT: Equities Mixed, Chinese Data Disappoints

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 312.93 points at 27772.83

- ASX 200 up 23.958 points at 7038.2

- Shanghai Comp. up 35.716 points at 3526.092

- JGB 10-Yr future up 9 ticks at 151.44, yield down 0.9bp at 0.080%

- Aussie 10-Yr future up 4.0 ticks at 98.300, yield down 3.7bp at 1.758%

- U.S. 10-Yr future +0-03+ at 132-16+, yield down 1.02bp at 1.618%

- WTI crude up $0.04 at $65.42, Gold up $9.68 at $1853.07

- USD/JPY up 1 pip at Y109.36

- CHINESE MONTHLY ECONOMIC ACTIVITY DATA MISSES EXPECTATIONS

- PBOC ROLLS OVER MATURING MLF LIQUIDITY PROVISION

- ISRAELI-PALESTINIAN TENSIONS SIMMER

- SIGNS OF UK UNREST EVIDENT RE: BREXIT

BOND SUMMARY: Core FI Marginally Firmer In Asia

T-Notes last +0-03+ at 132-16+, sticking to a 0-05+ range overnight, while cash Tsys are little changed to 1.0bp richer on the day. There has been a distinct lack of tier 1 headline flow, both over the weekend and since the broader markets reopened. Focus has therefore fallen on the simmering Israeli-Palestinian tensions and apparent distaste from various corners of the UK political sphere re: certain Brexit matters. Some worry evident in the Asia-Pac region re: COVID (most notably in Taiwan) likely provided some incremental support to Tsys. Elsewhere, there was no immediate reaction in the space to the softer than expected round of the Chinese monthly economic activity data, with the releases still reflecting significant bounces in Y/Y terms (albeit slower growth vs. what was seen March). Elsewhere, China's surveyed unemployment rate moved lower, now printing in line with late '19 levels. China's NBS stressed that the Chinese economic recovery continues to be "uneven."

- A downtick in the Nikkei 225 and some residual spill over from Friday's afterhours trade supported the JGB space during the Tokyo session. Futures last +9. The major cash benchmarks richened with 7s leading the way (trading a little over ~1.0bp firmer), perhaps indicating that the move was particularly aided by the bid in futures. 10-Year JGBi supply passed smoothly, while the space looked through a firmer than expected round of April PPI readings.

- Aussie bond futures were little changed to a touch higher, with the cash curve playing catch up to the flattening witnessed in the final overnight session of last week, as longer dated ACGBs richened by ~4.0bp. YM +0.5, XM +4.0. A lack of local input was evident in early dealing this week, although the A$ IG issuance pipeline is building. Focus falls on this week's major domestic risk events (the RBA's May meeting minutes and the local labour market report).

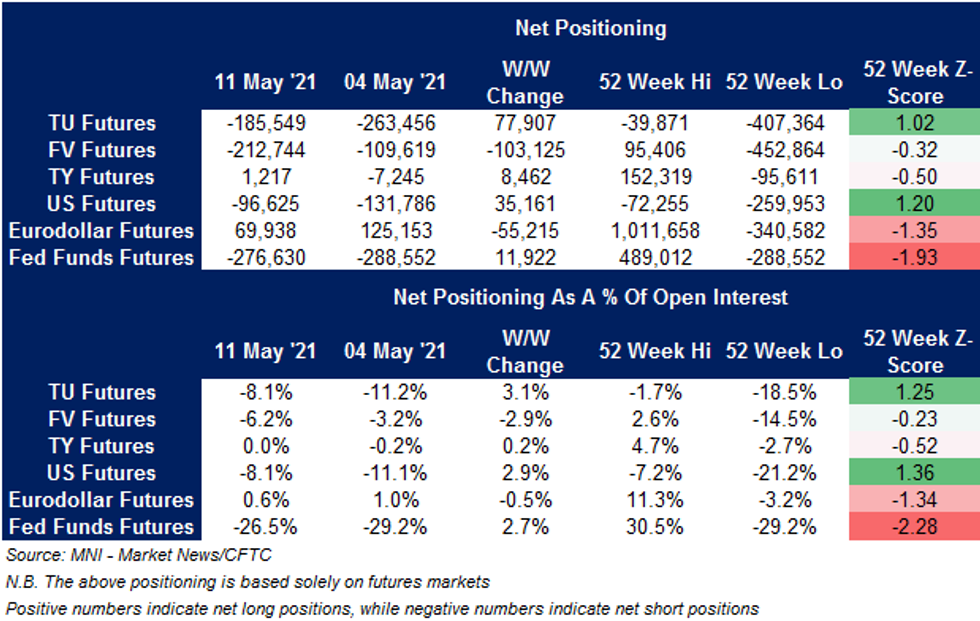

US TSYS: A Mixed Bag In Latest CFTC CoT

The latest CFTC CoT report (covering the week ending 11 May) revealed a trimming of net short positions in the TU & US contracts, while TY positioning flipped back to marginally net long. Positioning in FV was the exception to the broader rule among the major Tsy futures, with net short positioning deepening there.

- STIR positioning lacked a clear direction, with net length in Eurodollar futures trimmed, while the net short positioning in Fed Fund Futures was trimmed.

JGBS AUCTION: Japanese MOF sells Y199.9bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y199.9bn 10-Year JGBis:- High Yield: -0.185% (prev. -0.121%)

- Low Price 101.90 (prev. 102.95)

- % Allotted At High Yield: 30.2491% (prev. 51.0638%)

- Bid/Cover: 3.818x (prev. 3.070x)

EQUITIES: Mixed

Equity indices in the Asia-Pac region are mixed; Japan, Taiwan and South Korea have come under pressure while bourses in China, Hong Kong and Australia have gained. In Japan the Covid-19 state of emergency was formally declared in Hokkaido, Hiroshima and Okayama on Sunday, while Taiwan announced the tightest restrictions of the pandemic after recording a record 206 virus cases on Sunday, it follows a soft lockdown already announced in Taipei. In China the CSI 300 is up around 1.7%, data from China that showed while activity continues to expand, the pace slowed. Elsewhere the CSRC launched an investigation into alleged stock manipulation of some publicly traded companies and promised to crack down on illegal acts to protect investors' interests, amid growing controversies about stock manipulation. Futures in the US are lower, losing around 0.2% heading into the European open as the greenback rebounds from its decline.

OIL: Builds On Gains

Oil is higher in Asia on Monday, building on Friday's gain. WTI is $0.32 up from settlement levels a $65.69/bbl, Brent is up $0.31 at $69.02/bbl. Markets digest data from China that showed while activity continues to expand, the pace slowed. Retail sales was the big miss at 17.7% compared to consensus 25%. Industrial output missed estimates at 9.8% Y/Y against 10.0% expected, while fixed asset investment was also narrow miss at 19.9% against 20% expected, while the jobless rate fell to 5.1%. Data showed that demand in India slowed as the nation battled the pandemic, road fuel sales dropped around 20% from the previous month data showed.

GOLD: Multi-Month Highs Printed

Spill over from Friday's session saw spot gold print at the highest levels witnessed since Feb during Asia-Pac hours, last dealing just under $10/oz better off on the day, a little above $1,850/oz. Immediate technical resistance is located at the Feb 10 high of $1,855.5/oz, with any sustained break above there opening up the potential for a move to the Jan 29 high at $1,875.7/oz. Investors continue to assess U.S. real yield dynamics and the ability of the Fed to look through the current upward trend in inflationary metrics.

FOREX: Covid Resurgence, Chinese Data Inspire Caution

Lingering concern about Covid-19 resurgence in a number of locations across the region (and the resultant tightening of restrictions) undermined broader sentiment. Risk aversion materialising in early Asia-Pac trade deepened as China's economic activity indicators for the month of April proved, on balance, worse than expected. Commodity currencies were dumped, with the kiwi bringing up the rear in G10 pack. BBG trader sources flagged selling pressure from leveraged accounts, which reloaded NZD shorts after a squeeze in Friday's NY session.

- USD/CNH traded on a firmer footing, but its upswings remained shallow. The PBOC set its central USD/CNY mid-point at CNY6.4307, just 5 pips above sell-side estimates. China's central bank is also set to issue CNH10bn of 3-Month Bills & CNH15bn of 1-Year Bills in HK on Friday.

- The yen led gains in G10 space on safe haven demand, as e-minis gave up their initial upticks & slid into negative territory. USD was also able to garner some strength, but the DXY remained way off its Friday's high.

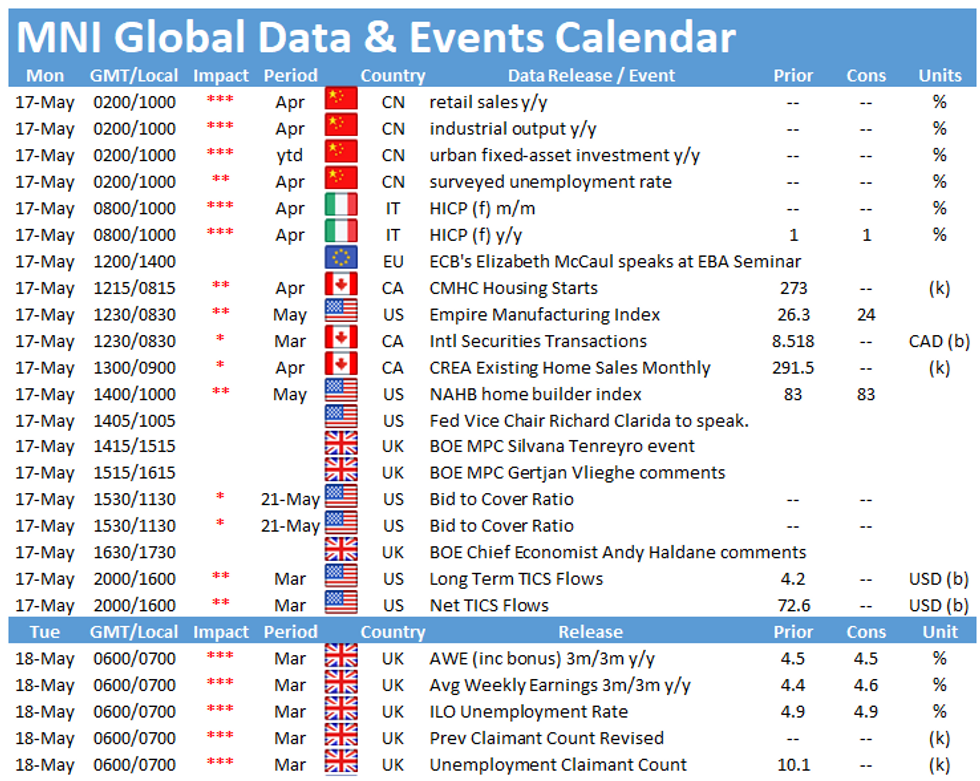

- U.S. Empire M'fing, Italian CPI, Canadian housing starts and Fedspeak from Clarida & Kaplan take focus today.

FOREX OPTIONS: Expiries for May17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1980-95(E817mln), $1.2120-25(E689mln-EUR puts), $1.2150(E1.94bln-EUR puts)

- AUD/USD: $0.7750-60(A$1.6bln)

- USD/CNY: Cny6.35($500mln), Cny6.45($906mln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.