-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD Firms A Little, Equities Mixed

- Chinese economic activity data disappoints.

- Pockets of COVID worry evident in Asia.

- USD ticks higher & global equities mixed against a lack of tier 1 news flow.

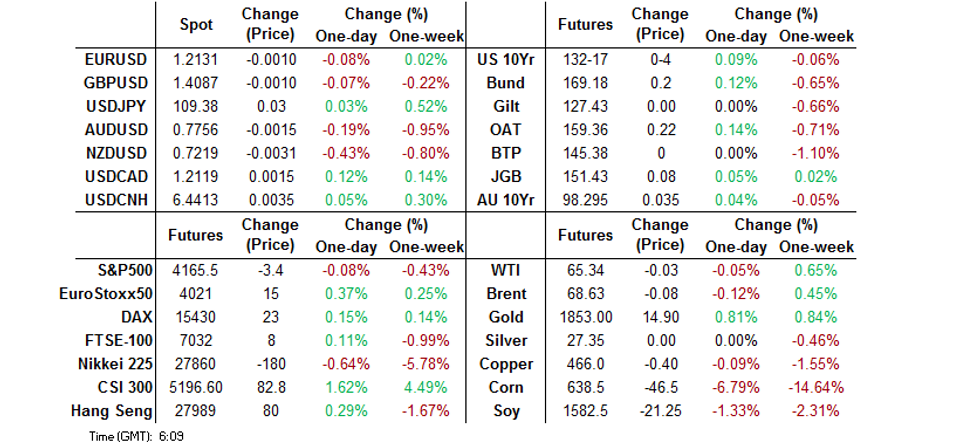

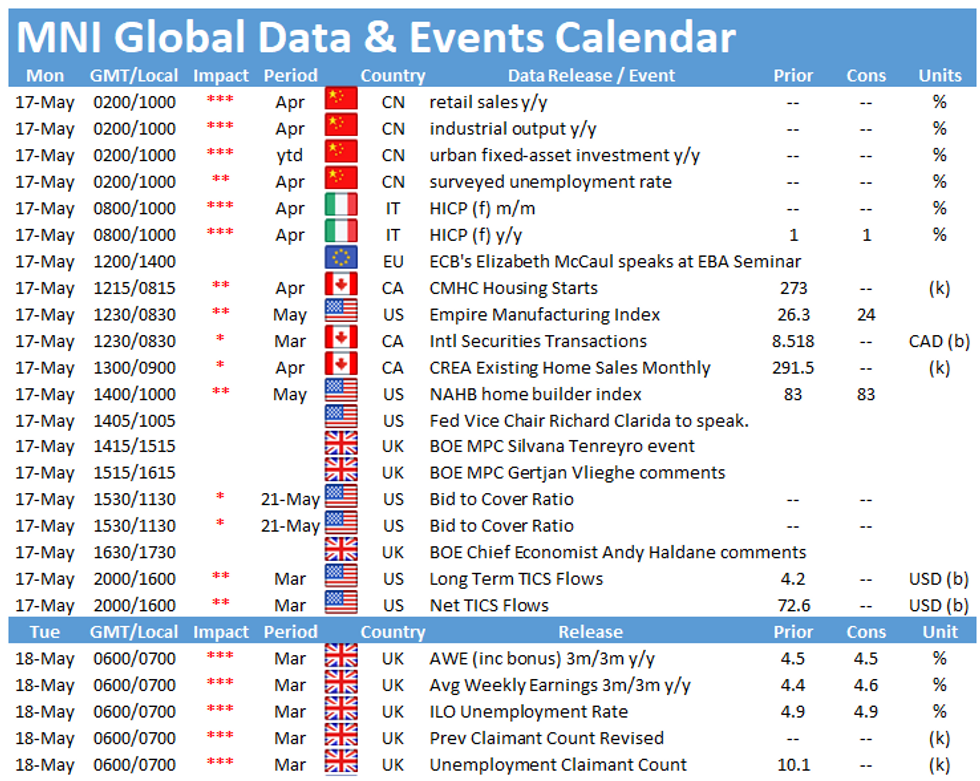

BOND SUMMARY: Core FI Marginally Firmer In Asia

T-Notes last +0-03+ at 132-16+, threatening to break above Friday's highs while sticking to a 0-05+ range on volume of ~80K overnight. Cash Tsys trade little changed to 1.0bp richer across the curve. There has been a distinct lack of tier 1 headline flow, both over the weekend and since the broader markets reopened. Focus has therefore fallen on the simmering Israeli-Palestinian tensions and apparent distaste from various corners of the UK political sphere re: certain Brexit matters, although this did little for markets. Some worry evident in the Asia-Pac region re: COVID (most notably in Taiwan) likely provided some incremental support to Tsys. Elsewhere, there was no immediate reaction in the space to the softer than expected round of the Chinese monthly economic activity data, with the releases still reflecting significant bounces in Y/Y terms (albeit slower growth vs. what was seen March). Elsewhere, China's surveyed unemployment rate moved lower, now printing in line with late '19 levels. China's NBS stressed that the Chinese economic recovery continues to be "uneven." Commentary from Fed Vice Chair Clarida headlines the domestic docket on Monday. That will be supplemented by comments from regional Fed President's Kaplan & Bostic, as well as the release of the latest Empire manufacturing survey & NAHB housing data.

- A downtick in the Nikkei 225 and some residual spill over from Friday's afterhours trade supported the JGB space during the Tokyo session. Futures last +7, a touch shy of highs. The major cash benchmarks richened with 7s leading the way (trading a little over ~1.0bp firmer), perhaps indicating that the move was particularly aided by the bid in futures. 10-Year JGBi supply passed smoothly, while the space looked through a firmer than expected round of April PPI readings. Preliminary Q1 GDP data headlines the local docket on Tuesday.

- Aussie bond futures were little changed to a touch higher in Sydney dealing, with the cash curve playing catch up to the flattening witnessed in the final overnight session of last week, as longer dated ACGBs richened by ~4.0bp. YM +0.5, XM +3.5. A lack of local input was evident in early dealing this week, although the A$ IG issuance pipeline is building. Focus falls on this week's major domestic risk events, namely the RBA's May meeting minutes (Tuesday) and the local labour market report (Thursday).

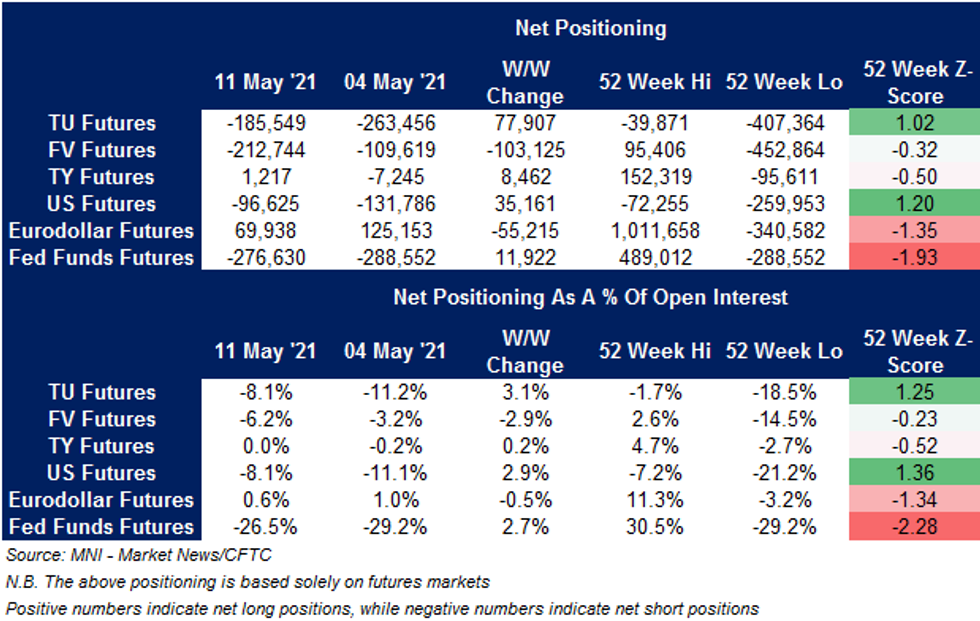

US TSYS: A Mixed Bag In Latest CFTC CoT

The latest CFTC CoT report (covering the week ending 11 May) revealed a trimming of net short positions in the TU & US contracts, while TY positioning flipped back to marginally net long. Positioning in FV was the exception to the broader rule among the major Tsy futures, with net short positioning deepening there.

- STIR positioning lacked a clear direction, with net length in Eurodollar futures trimmed, while the net short positioning in Fed Fund Futures was trimmed.

FOREX: Covid Resurgence, Chinese Data Inspire Caution

Lingering concern about Covid-19 resurgence in a number of locations across the region (and the resultant tightening of restrictions) undermined broader sentiment. Risk aversion materialising in early Asia-Pac trade deepened as China's economic activity indicators for the month of April proved, on balance, worse than expected. Commodity currencies were dumped, with the kiwi bringing up the rear in G10 pack. BBG trader sources flagged selling pressure from leveraged accounts, which reloaded NZD shorts after a squeeze in Friday's NY session.

- USD/CNH traded on a firmer footing, but its upswings remained shallow. The PBOC set its central USD/CNY mid-point at CNY6.4307, just 5 pips above sell-side estimates. China's central bank is also set to issue CNH10bn of 3-Month Bills & CNH15bn of 1-Year Bills in HK on Friday.

- The yen led gains in G10 space on safe haven demand, as e-minis gave up their initial upticks & slid into negative territory. USD was also able to garner some strength, but the DXY remained way off its Friday's high.

- U.S. Empire M'fing, Italian CPI, Canadian housing starts and Fedspeak from Clarida & Kaplan take focus today.

FOREX OPTIONS: Expiries for May17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1980-95(E817mln), $1.2120-25(E689mln-EUR puts), $1.2150(E1.94bln-EUR puts)

- AUD/USD: $0.7750-60(A$1.6bln)

- USD/CNY: Cny6.35($500mln), Cny6.45($906mln-USD puts)

ASIA FX: Greenback Bounce Sees Most Asia FX Decline

The greenback rebounded which put pressure on most Asia EM FX, regional dynamics in the form of data and pandemic fears contributed to the extent of the decline.

- CNH: Offshore yuan is weaker, data showed that while indicators continued to grow, the pace of expansion slowed. The PBOC kept MLF rates unchanged and drained CNY 10bn from the system. The rate came off worst levels seen post data.

- SGD: Singapore dollar is lower, Singapore has announced tighter restrictions from May 16 to June 13. There were 38 new cases reported on Sunday, the highest in over a year.

- TWD: Taiwan dollar fell, over the weekend authorities announce the tightest restrictions of the pandemic after recording a record 206 virus cases on Sunday, it follows a soft lockdown already announced in Taipei.

- KRW: Won is lower, South Korea reported 619 daily new coronavirus cases, staying in the 600s for the third consecutive day Monday, as infections from private gatherings, schools and military bases continued amid little progress in vaccinations.

- MYR: Ringgit declined, the coronavirus situation continues to deteriorate. In some states, ICU occupancy rate hovers above 80%, while some hospitals have already used up all of their dedicated Covid-19 beds.

- IDR: Rupiah is lower. The gov't expressed concern about social mobility over the holiday period and its ramifications for the national fight against Covid-19. Transportation Min Sumadi said that more than 1.5mn people may have gone on traditional "mudik" trips, despite a mudik ban imposed between May 6-17.

- PHP: Peso is marginally stronger, Pres Duterte signed off on temporary cuts of rice duties, in a move devised to address supply-side drivers of inflation. He also approved an adjustment of earlier pork tariff cuts after striking a deal with Senators, who stepped in to protect domestic hog industry.

- THB: Baht is lower. Data showed GDP rose 0.2% Q/Q against expectations of 1% decline, the Y/Y reading fell 2.6% against expectations of a 3.3% fall. The 2021 GDP estimate range was revised to 1.5%-2.5%.

ASIA RATES: Liquidity & Supplementary Measures In Focus

Repo rates jumped to the highest since late April in China as the PBOC drained a net CNY 10bn from the financial system. Focus on supplementary measures in India as conversion offer and SLTRO on the slate, while the 10-year auction cancellation on Friday also helped yields lower.

- INDIA: Yields are lower, extending their move from Friday after the RBI cancelled yet another 10-eyar debt sale with cut off yields at unmanageable levels for the bank. Elsewhere the RBI will conduct a conversion offer today for INR 200bn today, converting shorter dated paper into longer. The bank will also hold the first SLTRO auction for INR 100bn today, the Special Long-Term Repo Operations (SLTRO) was announced earlier in May and targets liquidity for small banks, the scheme has a maturity of 3-years.

- SOUTH KOREA: Futures higher in South Korea as equity markets come under pressure. South Korea reported 619 daily new coronavirus cases, staying in the 600s for the third consecutive day Monday, as infections from private gatherings, schools and military bases continued amid little progress in vaccinations. The MOF sold 10-year paper, demand was decent but lower than the previous auction despite a 13.5bps yield concession.

- CHINA: Repo rates rose, the overnight repo rate jumping some 33 bps to 2.17%. The PBOC drained a net CNY 10bn of liquidity from the system today, injecting CNY 10bn against CNY 20bn maturing. The bank also matched maturities in the MLF operations, conducting CNY 100bn to match the CNY 100bn rolling off at an unchanged 2.95%. Futures are lower, heading into the European hours at session lows. Data earlier showed that while indicators continued to grow, the pace of expansion slowed.

- INDONESIA: Short end yields rise in Indonesia as the curve twist flattens, market plays catch up after a holiday last week. Indonesia suspended the use of a certain batch of AstraZeneca Covid-19 batch and ordered an investigation into potential side effects. Private COVID-19 vaccination will start on May 18.

EQUITIES: Mixed

Equity indices in the Asia-Pac region are mixed; Japan, Taiwan and South Korea have come under pressure while bourses in China, Hong Kong and Australia have gained. In Japan the Covid-19 state of emergency was formally declared in Hokkaido, Hiroshima and Okayama on Sunday, while Taiwan announced the tightest restrictions of the pandemic after recording a record 206 virus cases on Sunday, it follows a soft lockdown already announced in Taipei. In China the CSI 300 is up around 1.7%, data from China that showed while activity continues to expand, the pace slowed. Elsewhere the CSRC launched an investigation into alleged stock manipulation of some publicly traded companies and promised to crack down on illegal acts to protect investors' interests, amid growing controversies about stock manipulation. Futures in the US are lower, losing around 0.2% heading into the European open as the greenback rebounds from its decline.

GOLD: Multi-Month Highs Printed

Spill over from Friday's session saw spot gold print at the highest levels witnessed since Feb during Asia-Pac hours, last dealing just under $10/oz better off on the day, a little above $1,850/oz. Immediate technical resistance is located at the Feb 10 high of $1,855.5/oz, with any sustained break above there opening up the potential for a move to the Jan 29 high at $1,875.7/oz. Investors continue to assess U.S. real yield dynamics and the ability of the Fed to look through the current upward trend in inflationary metrics.

OIL: Builds On Gains

Oil is higher in Asia on Monday, building on Friday's gain. WTI is $0.32 up from settlement levels a $65.69/bbl, Brent is up $0.31 at $69.02/bbl. Markets digest data from China that showed while activity continues to expand, the pace slowed. Retail sales was the big miss at 17.7% compared to consensus 25%. Industrial output missed estimates at 9.8% Y/Y against 10.0% expected, while fixed asset investment was also narrow miss at 19.9% against 20% expected, while the jobless rate fell to 5.1%. Data showed that demand in India slowed as the nation battled the pandemic, road fuel sales dropped around 20% from the previous month data showed.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.