-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

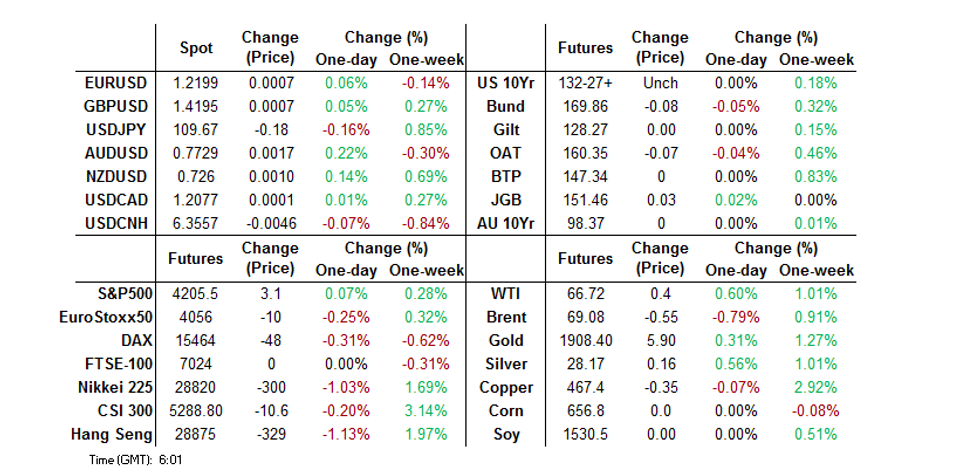

Free AccessMNI EUROPEAN MARKETS ANALYSIS: All About The Yuan

- Chinese commentary surrounding the CNY weighed on the redback in early dealing, before it managed to regain some poise, reversing early losses as the USD softened.

- Chinese official PMI data was largely in line with broader expectations.

- U.S. & UK holidays set to thin markets on Monday.

BOND SUMMARY: Core FI Markets Stick To Tight Ranges In Asia

T-Notes stuck to the confines of a 0-02+ range in Asia, last -0-05 at 131-25, with the movement in the Chinese yuan garnering the most attention early this week after Chinese state owned media and a mixture of former & current policymakers flagged risks to those betting on a continued appreciation in the CNY vs. the USD. Broader headline flow and market moves remain limited as the U.S. and the UK observe holidays on Monday, with the former resulting in the closure of the cash Tsy market.

- JGB futures ticked away from overnight highs during the Tokyo morning, given the moves in T-Notes during late NY/early Asia dealing, but still sit 4 ticks above Friday's settlement levels. The major benchmarks across the cash curve generally sit within 0.5bp of Friday's closing levels, trading firmer in the main. On the data front, domestic prelim. industrial production and retail sales missed expectations, but there has been little else to note outside of some limited activity in the JPY corporate issuance space. 2-Year JGB supply passed smoothly enough, with the low price meeting broader dealer expectations (proxied by the BBG dealer poll), although the internals were mixed, with the cover ratio softening a touch as the tail narrowed.

- Yields are little changed across the Aussie curve, with slightly softer than expected domestic private credit data and in-line with broader exp. official Chinese PMI readings doing little for the space. The front end of the curve remains underpinned, with lifts in the white IR contracts headlining the session thus far. YM unch., XM -0.5, with Bills running unchanged to -2 through the reds.

FOREX: Early Moves Reversed As USD Slips

Initial gains in the greenback were reversed as the session wore on, as a result AUD and NZD both head into the European open in positive territory, while JPY has firmed.

- AUD/USD up 13 pips, Victoria state reported 5 new COVID-19 cases, gains were supported by higher iron ore prices. Data showed private sector credit rose 1.3% Y/Y against estimates of a 1.4% rise.

- NZD/USD is up around 6 pips, ANZ activity outlook fell to 27.1 in May, while business confidence fell to 1.8.

- USD/JPY is down 19 pips, domestic prelim. industrial production and retail sales both missed expectations.

- Offshore yuan is in positive territory, reversing losses of around 120 pips earlier in the session. May manufacturing PMI missed estimates at 51.0, which was slower than April's expansion, while non-manufacturing PMI rose to 55.2, the PBOC also fixed USD/CNH 26 pips above sell side estimates, indicating a preference for a weaker yuan after several commentary pieces expressing the same over the weekend.

- SNB's Joran gave an interview to a Swiss newspaper over the weekend, he noted that CHF remains highly valued but noted this worked to dampen inflation. USD/CHF is down 10 pips.

FOREX OPTIONS: Expiries for May31 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2100-17(E764mln), $1.2145-55(E756mln)

- USD/CAD: C$1.2400($1.1bln-USD puts)

ASIA FX: Greenback Gives Ground

The greenback gave back early gains which saw most Asia EM FX move into positive territory for the session despite mostly risk off sentiment.

- CNH: Offshore yuan is in positive territory, reversing losses of around 120 pips earlier in the session. May manufacturing PMI missed estimates at 51.0, which was slower than April's expansion, while non-manufacturing PMI rose to 55.2, the PBOC also fixed USD/CNH 26 pips above sell side estimates, indicating a preference for a weaker yuan after several commentary pieces expressing the same over the weekend.

- SGD: Singapore dollar is flat, bank loans and advances rose 0.4% Y/Y, while foreign currency deposits slipped to SGD 759.7bn.

- TWD: Taiwan dollar gained, USD/TWD hitting the lowest since April 1997, the Taiex was the best performer in regional equity markets with gains of around 1.5% as lawmakers approved a TWD 840bn relief budget.

- KRW: Won is higher, data earlier showed South Korea's industrial output fell 1.6% M/M against estimates of a 0.4% increase. The figure denoted the biggest decline in 11 months as production in the chipmaking industry slumped due largely to a higher base effect. The Y/Y figure did beat estimates due to a low base effect.

- MYR: Ringgit is weaker, the worst performer in the region after reports that Malaysia will move into a full lockdown.

- IDR: Rupiah is flat, there were reports that Indonesia and the US are to have wide ranging discussions with the US on a number of partnerships as well as geopolitical issues.

- PHP: Peso is stronger, BSP Gov Diokno said May inflation is likely to print 4.4% Y/Y with a band of 4.0%-4.8% a reasonable range of estimates, above the central banks 2%-4% target band for the fifth month if this were to transpire.

- THB: Baht is stronger, data showed April manufacturing production rose 18.46% Y/Y, above estimates of 14.9%.

CNY: Continued Minimal Deviations Between Mid-Point Fixing & Expectations

The PBoC USD/CNY mid-point fixing continues to show a minor bias towards a weaker yuan when compared to broader market expectations, although the deviation between the two is limited, as shown in the chart below i.e. the PBoC hasn't shown much in the way of outright, overt pushback against the recent strengthening, at least from a fixing perspective. A quick reminder that the CFETS RMB index moved to the highest level witnessed since '16 last week.

Fig. 1: USD/CNY vs. Differential Between USD/CNY Mid-Point Fixing & BBG Survey Estimate

Source: MNI - Market News/Bloomberg

- As we flagged earlier, the weekend saw current & former policymakers and state-owned media highlight issues which could push back against the continued swift appreciation of the CNY, with the authorities keen to maintain the message that the CNY will operate in a 2-way environment around "basically stable" levels.

- If USD/CNY does continue its move lower then technical support at the following levels may come into play:

- CNY6.3554 - Low May 17 2018

- CNY6.3292 - Low May 11 2018 & key support

CHINA RATES: China Repo Rates Jump

Mixed performance in a data heavy session, liquidity was thinner than usual with market holidays in the US and UK.

- INDIA: Bonds lower in early trade, yields were already under pressure after last week's auctions had to be rescued by primary dealers again. On Friday the finance minister said that India will need to borrow more in order to compensate regional governments, confirming a sources piece earlier in the week. An additional INR 1.58tn will be added to supply for this fiscal year, bringing total borrowing to INR 13.8tn. Markets look ahead to GDP figures later in the session.

- SOUTH KOREA: Futures in South Korea are sharply lower, 10-year down around 37 ticks having declined from the open. Data earlier showed South Korea's industrial output fell 1.6% M/M against estimates of a 0.4% increase. The figure denoted the biggest decline in 11 months, though the Y/Y figure was above estimates thanks to a low base effect. South Korea reported 430 daily new coronavirus Monday, in the 400s for the second consecutive day partly due to fewer tests over the weekend. The MOF sold KRW 3.5tn 30-year debt, demand slipped slightly from the previous auction but was in line with recent averages.

- CHINA: Repo rates rose in China, the overnight repo rate hitting 2.3543%, the highest since January, while the 7-day repo rate rose as high at 2.90%. There were reports that the PBOC may increase liquidity injection through daily reverse repos in June if market rates rise as local government special bond issuances peak and rising PPI fuel tightening expectation. Futures in China rose as equity markets came under pressure. May manufacturing PMI missed estimates at 51.0, which was slower than April's expansion, while non-manufacturing PMI rose to 55.2.

- INDONESIA: Yields lower across the curve with some bull steepening seen. A quiet session on the domestic headline front, there were reports that Indonesia and the US are to have wide ranging discussions with the US on a number of partnerships as well as geopolitical issues. Markets look ahead to PMI and CPI data during tomorrow's session.

EQUITIES: Data Misses Hit Sentiment

A broadly negative day for equity markets in the Asia-Pac region with liquidity thinner than usual due to market holidays in the US and UK. Markets in Japan are lower, industrial production and retail sales data both missed estimates. Markets in mainland China are under pressure, the CSI 300 down around 0.4%, NBS PMI data showed the pace of growth in the manufacturing industry dipped slightly in May. In Taiwan the Taiex posted solid gains though, TWD rose to the strongest since April 1997. In the US futures are marginally higher, markets look ahead to data this week including PMI, ISM and NFP.

GOLD: Atop $1,900/oz Again

The DXY initially ticked higher in Asia-Pac hours before giving back those modest gains to operate towards the bottom end of Friday's range, albeit comfortably above the lows that were witnessed in early trade last week. That, coupled with Friday's pullback from highs in the DXY and slight richening of U.S. Tsys, has allowed spot to consolidate above $1,900/oz, with bulls looking to force a break of $1,910/oz at present. Technical resistance resides at the nearby May 26 high of $1,912.8/oz, followed by the Jan 8 high at $1,917.6/oz, with the market's assumption surrounding the level of transitory inflationary impulse, coupled with the U.S. yield & DXY backdrop front & centre.

OIL: Crude Futures Edge Higher As USD Slips

Oil edged higher in Asia-Pac trade on Monday; with WTI & Brent last printing ~$0.40 better off on the day. Prices initially dipped lower but managed to reverse the early losses as the greenback lost some ground. Markets now look ahead to the OPEC+ meeting this week, with other focus on the talks between world powers and Iran in Vienna.

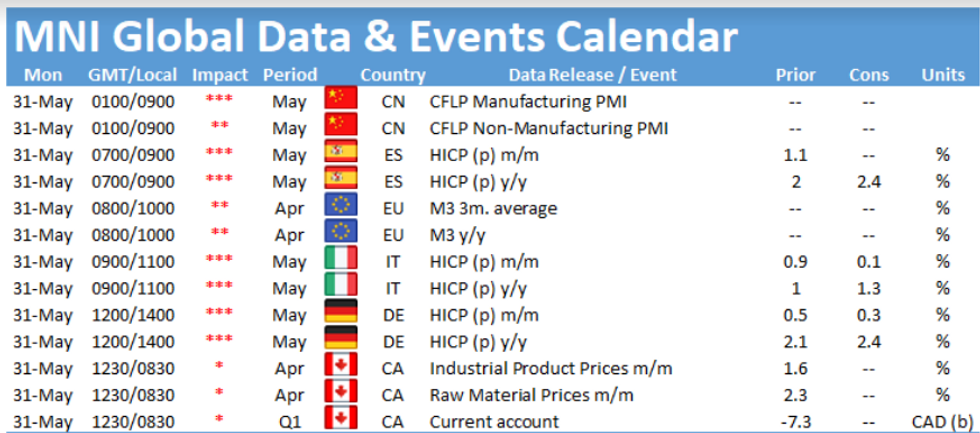

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.