-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBA Sketches Scenarios, PBoC Avoids Opening Liquidity Taps

- RBA minutes reveal a preference for continued broad bond purchase scheme and sketch out some potential scenarios.

- PBoC liquidity matters catch the eye in the wake of recent state-owned media commentary.

- Markets were generally contained in Asia with some weakness in Chinese equities seen (albeit limited for that group of assets).

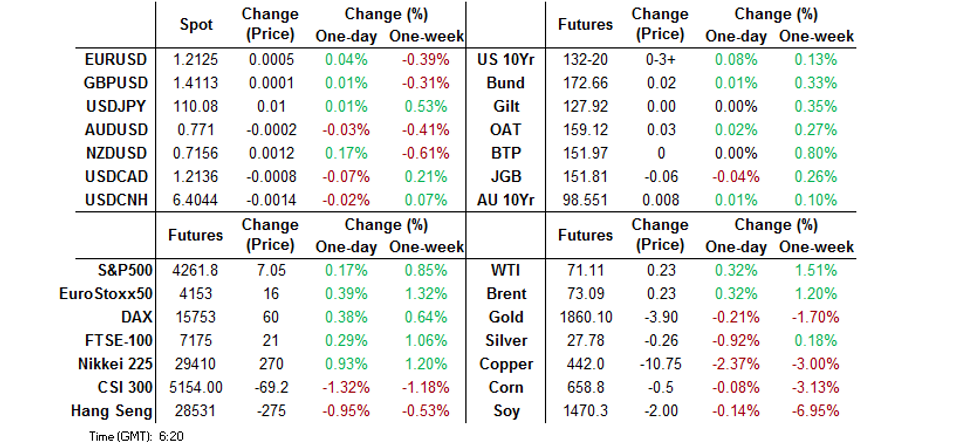

BOND SUMMARY: Mixed Performance For Core FI

T-Notes held to a very narrow 0-03 range overnight, last +0-03+ at 132-20. Cash Tsys trade unchanged to 1.0bp richer across the curve. Headline flow remains light, with ongoing bi-partisan Senator level meetings re: fiscal matters confirmed for this week, although certain, high-ranking quarters of the Democratic party continue to point towards the need for reconciliation measures. Elsewhere, the latest U.S. naval incursions into the South China Sea had little impact on broader sentiment. Broader interest will continue to fall on the setup for the latest FOMC decision, with the aforementioned round of 20-Year Tsy supply and retail sales data headlining the U.S. docket on Tuesday.

- The JGB curve runs steeper on the day, while futures have recovered from their overnight lows to last print -7. There has been little to really move the market, at least meaningfully, with the previously outlined BoJ (no fresh policy moves seen in the immediate future, per BBG sources), COVID (potential state of emergency/COVID restriction extensions) and political (a no-confidence motion in PM Suga's cabinet which is destined to fail) headlines offering little new on net. The latest liquidity enhancement auction for off-the-run JGBs with 15.5- to 39-Years until maturity was on the softer side, in terms of both cover ratio and spread dynamics. The monthly trade balance reading and core machine orders print headline the local economic docket on Wednesday. Those releases will be supplemented by the latest round of BoJ Rinban operations, which will cover 1- to 10-Year paper.

- Aussie bond futures have twist flattened, YM -1.0, XM +1.7, while cash ACGBs trade little changed to 1.0 richer across the curve. The minutes from the RBA's June meeting pointed to an extension of the Bank's broader bond buying scheme, with a variety of scenarios re: the future shape of purchases sketched out (including a straight rollover of the existing scheme, scaling back the amount purchased or spreading the purchases over a longer period, or moving to an approach where the pace of the bond purchases is reviewed more frequently, based on the flow of data and the economic outlook). Re: the potential extension of the Bank's yield targeting measure to ACGB Nov '24, the board noted that it "had previously stated that it would not increase the cash rate until actual inflation is sustainably within the 2 to 3 per cent target range. A key consideration for the decision regarding the yield target would be an assessment of the prospect of this condition being met some time in 2024." It also noted that market pricing indicated that bond market participants "did not, on balance, expect the yield target to be extended." The monthly Westpac leading index print headlines the local docket on Wednesday, but most of this week's local focus is already on RBA Governor Lowe's Thursday address titled "From Recovery to Expansion."

FOREX: AUD Softens, USD Crosses Rangebound

Commodity FX felt some mild selling pressure as caution emerged ahead of Thursday's announcement of the FOMC's latest monetary policy decision. AUD led losses in G10 FX space, as minutes from the RBA's June policy meeting noted that "monetary policy would be likely to need to remain highly accommodative for some time yet."

- Most major USD crosses stuck to tight ranges, even as markets in Australia, China, Hong Kong and Taiwan reopened after a long weekend. The DXY remained within the confines of the prior day's range.

- The first yuan fixing this week fell roughly in line with expectations, as the PBOC set its central USD/CNY mid-point at CNY6.4070 (against sell-side est. of CNY6.4074).

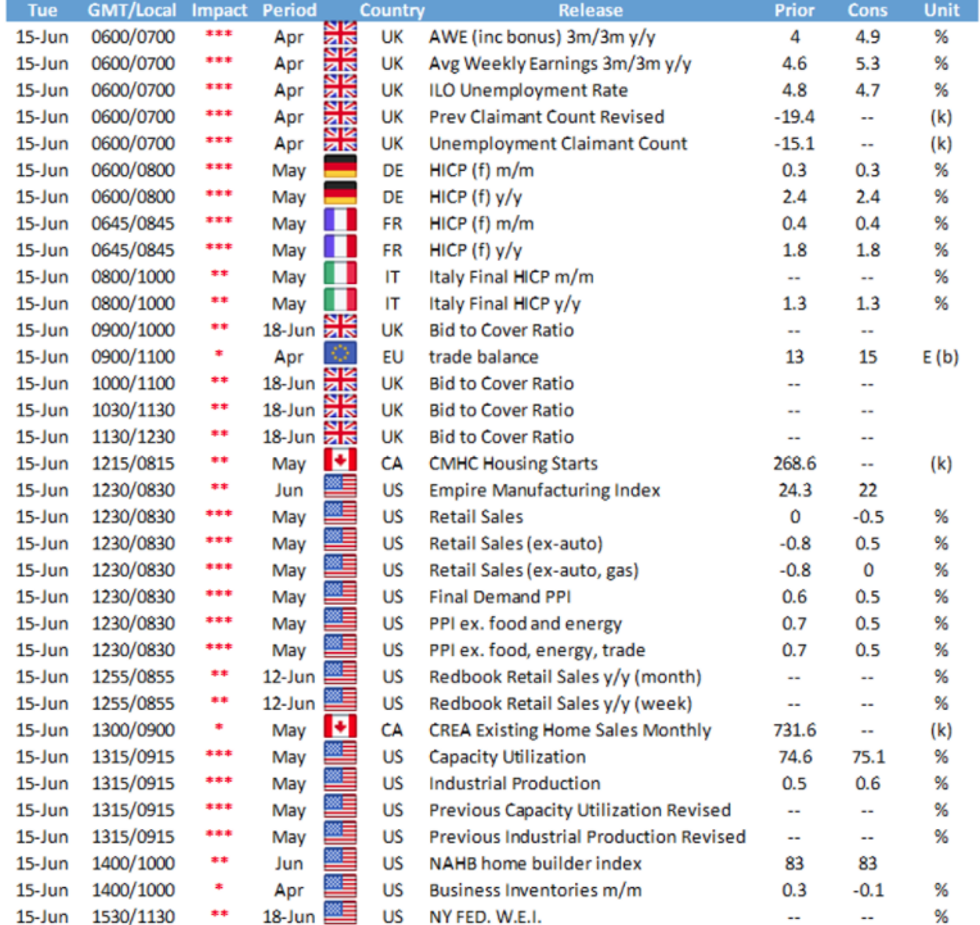

- Coming up today we have U.S. retail sales, industrial output & Empire M'fing, final German CPI, UK unemployment & Canadian housing starts. Speeches are due from BoE's Bailey as well as ECB's Lane, Rehn, de Cos, Panetta & Holzmann.

FOREX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1950-55(E552mln), $1.2075-80(E646mln-EUR puts), $1.2150-60(E590mln), $1.2200(E706mln), $1.2240-50(E870mln-EUR puts), $1.2300(E584mln-EUR puts)

- USD/JPY: Y109.00-15($620mln-USD puts), Y109.50-60($665mln-USD puts), Y110.00-11($1.45bln-USD puts), Y111.50($799mln)

- EUR/GBP: Gbp0.8600-10(E1.1bln-EUR puts)

- USD/NOK: Nok7.99($500mln), Nok8.15($400mln)

- AUD/USD: $0.7700-15(A$880mln, A$724mln-AUD puts), $0.7725-40(A$1.4bln-AUD puts), $0.7940-50(A$574mln)

- USD/MXN: Mxn19.82($635mln)

ASIA FX: Uninspired

Another quiet session with markets having one eye on the FOMC rate announcement later this week, while other markets return from a holiday on Monday.

- CNH: Offshore yuan is slightly stronger, sticking to yesterday's range. There were reports in Financial News that the yuan could face pressures to depreciate in the second half of 2021.

- SGD: Singapore dollar is flat after seeing limited movement on Monday. An MAS survey found that the Singapore economy is set to expand by 6.5% this year, higher than the Government's full-year growth forecast of 4%-6%.

- TWD: Taiwan dollar is weaker, moving away from the 27.60 support level challenged yesterday. There were reports that the government plans to increase loans available to local firms by TWD 150bn under the "Invest Taiwan" programme.

- KRW: Won is weaker, Finance Minister Hong said late yesterday that the government will consider repaying part of the country's national debt with excess tax revenue when it draws up another extra budget. Data showed money supply L rose 1.8% in April

- MYR: Ringgit is weaker, Malaysia's Covid-19 vaccine czar Khairy confirmed that inoculations of workers from key economic sectors will start on Wednesday, with m'fing sector workers first in the line. Malaysia has earmarked 30,000 jabs for vaccinations of factory workers this month.

- IDR: Rupiah declined, data showed the trade surplus widened, exports and imports both rose slightly higher than estimates.

- PHP: Peso dropped, Philippines slightly relaxed restrictions in the NCR+ bubble yesterday, including shortening curfew hours, despite earlier extending lockdown in the capital region.

- THB: Baht is flat, PM Prayuth held discussions with key economic off'ls yesterday on ways to arrest the surge in household debt, which may pose a threat to Thailand's economic recovery.

ASIA RATES: China Liquidity Concerns Creep In

- INDIA: Yields higher in early trade. CPI rose 6.30% against expectations of a 5.38% rise and above the top end of the RBI's 2%-6% band. It is thought the RBI will look through inflation overshoots in order to safeguard the recovery, but the overshoot has caught many off guard and caused speculation around impending input price pressures. As a note RBI Deputy Governor Patra said earlier in June that the Bank has chosen to look through a recent surge in inflation because it was supply-side driven, and will only turn persistent when demand kicks in. The RBI expects inflation to end up at 5.1% in the fiscal year ending March.

- SOUTH KOREA: Little of note from South Korea today, futures opened lower but moved back up to neutral levels as equity markets failed to make headway. On the coronavirus front there were 374 new cases in the past 24 hours, the lowest since late March. The vaccination drive has gathered steam with inoculations expected to top 13 million soon. Finance Minister Hong said late yesterday that the government will consider repaying part of the country's national debt with excess tax revenue when it draws up another extra budget.

- CHINA: The PBOC rolled over MLF loans today, injecting CNY 200bn at the normal 2.95% rate. The Bank injected CNY 10bn of reverse repos, resulting in a net drain of CNY 10bn with CNY 20bn coming due today. Futures are just keeping in positive territory, recovering early losses as equity markets in China drop. The China Securities Journal reported that the PBOC is expected to add liquidity in June, a sentiment floated several times in the past few weeks.

- INDONESIA: Yields higher across the curve, Indonesian off'ls announced Monday that they are introducing stricter mobility curbs and capacity limits through Jun 28, adding that police patrols will be deployed to enforce compliance. Data earlier showed a wider trade surplus in May on the back of higher commodity prices.

EQUITIES: Mixed After Return From Holiday

Mixed performance for equity markets in Asia on Tuesday; bourses in mainland China return from yesterday's holiday and have come under pressure with major indices all down by over 1% at one point. The PBOC's OMO and MLF operations resulted in a net drain of CNY 10bn despite chatter of additional liquidity on its way in June. Markets in Japan, Australia are higher, the latter supported by a dovish set of RBA minutes. Futures are higher in the US after a late rally took the S&P 500 to a fresh record high yesterday.

GOLD: Off Monday's Lows

U.S. real yield dynamics were in the driving seat on Monday driving gold lower early on, before bullion rebounded from worst levels to last trade around the $1,865/oz mark as participants await the latest FOMC decision on Wednesday. The 50-day EMA provides the next area of technical support, while resistance isn't seen until the June 8 high ($1,903.8/oz).

OIL: Flat For Second Day

WTI & Brent sit $0.25 better off at typing after a flat finish on Monday. In terms of technical levels holding above $70/bbl targets $72.06 next, a Fibonacci projection. Key trend support has been defined at $61.56, May 21 low.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.