-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Tsys Flatten Again In Asia

EXECUTIVE SUMMARY

- LAGARDE: ECB MAKING 'GOOD PROGRESS' ON STRATEGY OVERHAUL (BBG)

- MACRON AND LE PEN BOTH DISAPPOINT IN FRANCE'S REGIONAL ELECTION (BBG)

- DELTA VARIANT BEGINS TO SPREAD, THREATENING EU'S COVID PROGRESS (FT)

- FED'S KASHKARI OPPOSED TO RATE HIKES AT LEAST THROUGH 2023 (CNBC)

- U.S. TSY CURVE CONTINUES TO FLATTEN AS EQUITIES STRUGGLE

- PBOC FIXES LPRS AT UNCHANGED LEVELS

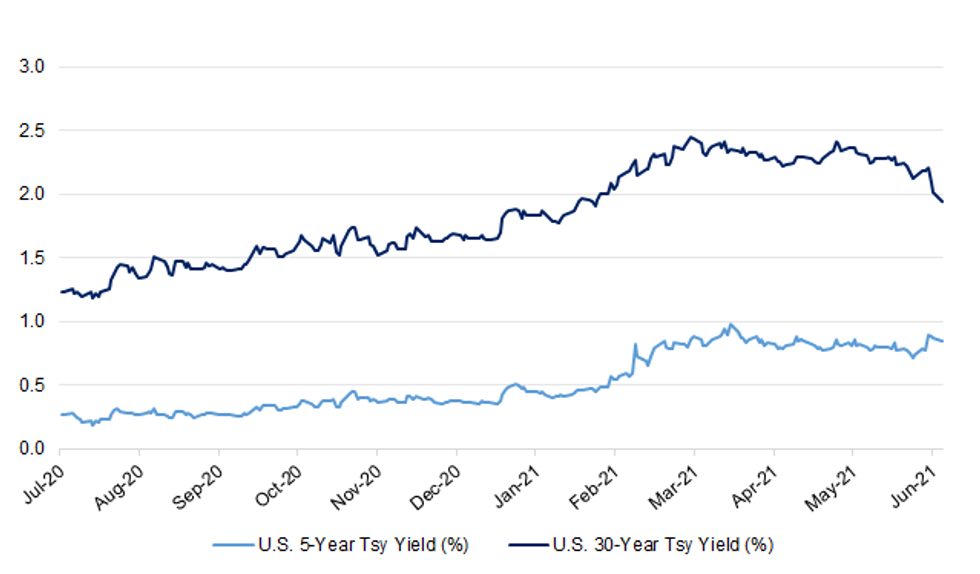

Fig. 1: U.S. 5-/30-Year Tsy Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Ministers will not bring forward reopening to July 5, despite data indicating that vaccines are winning the race with Covid. Senior government sources on Sunday night insisted the country was "probably not in the place" to lift restrictions at the two-week review stage. It came as Public Health England's senior Covid official warned that cases were "still rising quite fast" in areas of the North-East and London. Dr Susan Hopkins, PHE's strategic response director, also said a further lockdown may be needed this winter to stop hospitals becoming overwhelmed. However, other scientists have said the UK could open up "sooner rather than later" thanks to the huge numbers of people being vaccinated. More than one million jabs were booked in under 48 hours after rollout was opened up to all adults in England on Friday, according to the NHS. (Telegraph)

CORONAVIRUS: Matt Hancock did not withhold key COVID data ahead of the decision to postpone the easing of restrictions in England, the justice secretary has told Sky News. Robert Buckland defended the health secretary and said he has the "full support" of the government, denying reports that Mr Hancock held back data on the effectiveness of vaccines on the Indian variant. Mr Buckland said there is "no question" PM Boris Johnson was not told about the data. "Sadly I am afraid that that report is wrong," Mr Buckland told Sky's Trevor Phillips On Sunday. "The data was provided to the prime minister and other members of that Cabinet committee in the most up to date way before the decision was made on Monday. (Sky)

CORONAVIRUS: England may have to endure future lockdowns later this year, public health experts warned on Sunday, amid growing fears that the NHS faces a "miserable winter" in the months ahead. In an interview with the BBC, Dr Susan Hopkins, the strategic response director for Covid-19 at Public Health England, argued that the country would have to live with coronavirus, adding that in the past influenza outbreaks were not normally managed by lockdowns. The country was now equipped with additional methods to manage the virus, she said, noting that in the coming six to nine months new drugs would be available that could improve treatment for those hospitalised with the virus. (FT)

CORONAVIRUS: Seventy per cent of adults need to have had both doses of the vaccine for Boris Johnson to lift remaining restrictions on July 19, a scientific adviser has said. Dr Susan Hopkins, strategic adviser for coronavirus at Public Health England, raised hopes that people who had received two doses would soon be exempt from isolation rules. She suggested that the government should "aim for" 70 per cent in an attempt to ensure that what the prime minister has termed next month's "terminus date" is not delayed again. (The Times)

CORONAVIRUS: The U.K. government signaled it will keep restrictions on overseas travel in place for now to control a surge in coronavirus infections and the risk of new variants of the virus taking hold. Justice Secretary Robert Buckland said "normal" holidays were "never going to be the case" this year because of increasing Covid-19 cases. His comments indicate increasing concern about a third wave of cases in the U.K. despite one of the world's most aggressive vaccination programs. "There are going to have to be significant trade-offs" Buckland said on Sky News's Trevor Phillips show on Sunday. "We've tried to strike the right balance between the natural need in some cases for international travel, but also the imperative of making sure that we do everything we can at home to contain and prevent inadvertent spread of new variants." (BBG)

CORONAVIRUS: Family holidays to Europe will be back on from the end of July under plans to be considered by ministers as early as this week. It comes as official data revealed government scientists found no evidence of Covid variants in more than 23,000 people tested after arriving from amber list countries including Europe. Fully vaccinated adults will be allowed to travel to amber countries with their children without having to quarantine under the plans being drawn up by Department for Transport (DfT) officials. The DfT is understood to want to exempt unvaccinated children from the double jab scheme, enabling them to return without having to quarantine although they will still face tests to screen for Covid and its variants. The move would open up popular European holiday destinations to families that are currently amber including Spain, Greece, France and Portugal although ministers are not expected to introduce any changes until August. (Telegraph)

CORONAVIRUS: Fewer than one in 200 travellers from amber list countries are testing positive on their return, data has revealed, as pressure increases on ministers to relax rules on foreign holidays. An analysis of the latest figures from NHS Test and Trace, which are updated every three weeks, also shows no "variants of concern" were detected from any passenger returning from one of the 167 countries on the amber list. Only 89 of 23,465 passengers who travelled to the UK from these destinations between May 20 and June 9 tested positive for the coronavirus — a rate of 0.4 per cent. There were no positive cases from 151 of these countries. (The Times)

CORONAVIRUS: People who have been double vaccinated and come into contact with a Covid-19 carrier would be spared ten days in quarantine under plans to use daily tests to return to normality. The proposal would free hundreds of thousands of people from having to stay at home after being contacted by Test and Trace if they agreed to take a test each morning for a week. Each negative result would give a person 24 hours of freedom from the legal requirement to self-isolate. It is hoped that most people named as contacts will be able to carry on with life as normal. (The Times)

ECONOMY: British consumers lead the world in piling up savings during the pandemic lockdowns that closed off opportunities to shop and travel, a survey conducted in 17 nations shows. The findings by the pollster YouGov Plc shed light on one of the biggest questions economists are attempting to unravel. How quickly households spend their spare cash -- estimated at 250 billion pounds ($347 billion) in the U.K. and 500 billion euros ($596 billion) in the euro area -- will determine the strength of the recovery from the pandemic recession. (BBG)

INFLATION: Businesses are raising prices at the fastest rate in 22 years as every sector of the economy grapples with higher costs, according to a survey of companies by Lloyds Bank. All 14 sectors of the economy monitored by the lender's monthly recovery tracker reported an increase in input costs, with the rate for manufacturers hitting a 29-year high. In a sign that companies are passing those on, the rate of price rises by businesses in May was the steepest since 1999, Lloyds said. The survey will fuel fears that the UK is in the early stages of an inflationary spiral after surprisingly strong official figures for May last week. (The Times)

BREXIT: Britain remains the most attractive destination in Europe for financial services despite losing some activity to the Continent as a result of Brexit, analysis by EY has found. Foreign companies invested in 56 financial services projects in the UK last year, 43 fewer than 2019 but still seven more than France, the second most popular location. Britain also accounted for £1 in every £5 of global financial services investment in Europe, down from £1 in every £4 in 2019. London was the leading European city, with 38 projects, the annual study found. Although the gap closed, as banks and insurers prepared for the end of free access to European Union markets, investor sentiment on the future of UK financial services remained positive. (The Times)

POLITICS: Cabinet ministers are urging Boris Johnson to rethink planning reforms that have been blamed in part for the Conservatives' worst by-election defeat in seven years. (The Times)

POLITICS: The Conservatives risk losing 23 seats in the south or east of England if the Liberal Democrat surge in Chesham & Amersham is repeated in a general election, analysis for The Times shows. Dominic Raab would lose his Surrey constituency and David Cameron's old constituency of Witney would also fall to the Lib Dems, YouGov research suggests. The 23 seats are all held by Conservatives, voted Remain in 2016 and have the Liberal Democrats in second place, higher than average numbers of degree-holders and a majority smaller than that the Conservatives were defending in Chesham & Amersham. (The Times)

POLITICS: Senior Conservatives have told Boris Johnson a swathe of seats in the "blue wall" across the south of England could be at risk, as his party was gripped by recriminations after the Liberal Democrats' shock victory in the Chesham and Amersham byelection. (Guardian)

INFLATION: Inflation is on course to increase above 4% in the coming months, reducing average household incomes by £700, research suggests. The Resolution Foundation said higher than expected inflation poses more of a challenge to household incomes than to the Bank of England. The think tank said UK inflation has mirrored trends in the United States when the rate is increasing. (BBC)

FISCAL: Treasury officials are drawing up plans for a pensions tax raid in the autumn to help pay for heightened public spending during the Covid pandemic, The Telegraph understands. Three different reforms to the way in which pension contributions are taxed are being considered amid pressure on the public finances, according to well- placed Whitehall sources. One of the ideas being examined is reducing the pensions lifetime allowance from a little above £1 million to £800,000 or £900,000, lowering the point above which extra tax charges kick in. Another would see individuals contributing to pensions getting the same rate of tax relief, meaning higher-rate taxpayers lose out, while a third is new taxation on employer contributions. (Telegraph)

FISCAL: U.K. Prime Minister Boris Johnson clashed with Chancellor of the Exchequer Rishi Sunak about spending plans that will cost billions of pounds, the Sunday Times reported, citing unidentified cabinet minister and officials. Seeking to save money, the Treasury is weighing whether to scrap a commitment that would hand pensioners a 6% increase in payouts at a time when young people in the workforce are being squeezed, the paper said. Sunak, it added, has refused to fund Johnson's 200 million-pound ($276 million) project to build a new royal yacht. Tensions are likely to build next week when Health Secretary Matt Hancock is seeking 5 billion pounds a year to pay for the care of elderly people. Sunak is worried the plans don't have sufficient funding and doesn't want to increase taxes on families to pay for it, the paper said. The chancellor has ruled out increasing capital gains tax but sees pensioners as doing well enough to pay more, the paper said, citing one minister. (BBG)

FISCAL/INFRASTRUCTURE: The cost of the HS2 high-speed railway line has increased by a further £1.7bn over the past year, as Covid-19 delays put further strain on the UK's biggest infrastructure project. Work was temporarily suspended at most HS2 sites at the start of the pandemic, while social distancing measures have caused access delays and reduced productivity, increasing costs. Similar pressures have been reported by industry experts in projects ranging from Crossrail and the A303 Stonehenge tunnel to the Tideway tunnel and the Hinkley Point C nuclear power plant. (FT)

PROPERTY: Rural house prices in England and Wales are increasing twice as fast as in cities, triggering a fresh affordability crisis for young people, with hot spots flaring up across the country from Lincolnshire to Lancashire as people seek more space post-pandemic. Prices are rising 14.2% a year in countryside locations on average compared with less than 7% in urban areas, figures analysed by Hamptons estate agency for the Guardian show. It is compounding existing affordability problems in places such as Cornwall and Devon, but the biggest percentage increases of up to 30% were in Broxtowe in Nottinghamshire, around Lancaster, in Arun in West Sussex and Amber Valley in Derbyshire. (Guardian)

POLITICS: Sir Ed Davey has rejected plans for opposition parties to form a "progressive alliance" to oust the Tories, saying the Liberal Democrat victory in the Chesham and Amersham by-election shows that a "stitch-up" is not needed to beat the Conservatives. The Liberal Democrat leader said he was "very sceptical" about calls from leftwingers for Labour, the Lib Dems and the Greens to stand aside in certain seats at the next election to give the party with the best chance of victory a clear run. (Sunday Times)

POLITICS: Many Conservative voters deserted the party in the Chesham and Amersham by-election because they fear it is on course to preside over a "bloated public sector which stifles enterprise and demands ever-higher taxes", Boris Johnson's candidate has said. (Telegraph)

SCOTLAND: Cabinet ministers are pushing Boris Johnson to toughen up the fight to save the Union by allowing Scots living anywhere in the UK to vote in a second independence referendum. The prime minister is also being urged to appoint Ruth Davidson, the former leader of the Scottish Conservatives, to a newly created role of constitutional secretary, making her nominal head of the pro-Union campaign. Nicola Sturgeon, Scotland's first minister and leader of the SNP, promised a referendum before the end of 2023 after securing a pro-independence majority in Holyrood in last month's elections. She is expected to start pushing for one as soon as the autumn. Pressure is mounting on the prime minister to develop a battle plan to counter Sturgeon, with fears growing that the issue is still not being gripped. (The Times)

NORTHERN IRELAND: Northern Ireland's embattled Democratic Unionist Party has set June 26 as the date to elect its third leader since the end of May, as it tries to end a chaotic period of infighting that has imperilled the region's devolved government. Edwin Poots was forced out as the DUP's leader on Thursday evening after defying his party by agreeing a concession to nationalist Sinn Féin to save the region's power sharing government from collapse. The hardline creationist had been appointed just 21 days earlier on the premise that he would be tougher on fundamental unionist issues than Arlene Foster, who was ousted mostly for not doing enough to prevent a post-Brexit customs border in the Irish Sea. Unionists see the customs border as an assault on their identity. (FT)

UK/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed the United Kingdom at AA-; Outlook changed to Stable from Negative

EUROPE

ECB: European Central Bank President Christine Lagarde said its governing council is making "good progress" in talks on the biggest overhaul of the institution's monetary policy in almost two decades. The entire governing council met in person this weekend for the first time since the outbreak of the pandemic. The talks in Taunus, Germany aim to retool the ECB for the 21st century, with a new inflation goal, better ways of measuring the economy, and agreement on how to treat issues such as climate change and inequality. "I am glad we were able to have in-depth discussions and we made good progress in shaping the concrete features of our future monetary policy strategy at our retreat," she said in a statement on the ECB website. (BBG)

ECB: Projections for inflation to taper off beyond 2021 suggest there is "no occasion to raise interest rates" for now, European Central Bank Governing Council member Robert Holzmann said in an interview with an Austrian newspaper. Rates would need to rise if inflation approaches 2% on a "sustained basis," Der Kurier cited Holzmann, governor of the Austrian central bank, as saying. He referred to ECB projections for euro-area annual inflation to decline from 1.9% this year to 1.5% in 2022 and 1.4% in 2023. "This falling inflation forecast gives no occasion to raise interest rates," Holzmann said, while cautioning that, "in a longer-term view, that could look different." (BBG)

ECB: The European Central Bank has just revealed an unprecedented insight into how officials monitor that their policy message is understood by financial markets. Economists and strategists questioned in May predicted that the institution's pandemic bond-buying program will end in March, regular asset purchases will continue through 2023, and interest rates will rise in 2024, according to the institution's newly released Survey of Monetary Analysts, published for the first time on Friday. (BBG)

ECB: The introduction of a digital euro would boost consumers' privacy and protect the eurozone from the "threat" of competing cryptocurrencies that could undermine the bloc's monetary sovereignty, according to the central banker overseeing its development. Fabio Panetta, an executive board member at the European Central Bank, told the Financial Times that one of the project's key aims was to combat the spread of digital coins created by other nations and companies. "If the central bank gets involved in digital payments, privacy is going to be better protected . . . because we are not like private companies," he said. "We have no commercial interest in storing, managing or monetising the data of users." (FT)

CORONAVIRUS: The Delta coronavirus variant that swept the UK has become dominant in Portugal and appeared in clusters across Germany, France and Spain, prompting European health officials to warn further action is needed to slow its spread. While the new strain, which first emerged in India, still only accounts for a fraction of the total coronavirus cases in mainland Europe, it is gaining ground, according to a Financial Times analysis of global genomic data from the virus tracking database Gisaid. It accounts for 96 per cent of sequenced Covid-19 infections in Portugal, more than 20 per cent in Italy and about 16 per cent in Belgium, the FT's calculations show. The small but rising number of cases have raised concerns that the Delta variant could halt the progress the EU has made over past the two months in bringing new infections and deaths down to their lowest level since at least the autumn. (FT)

CORONAVIRUS: German Health Minister Jens Spahn warned against traveling to London for the final game of the UEFA European Football Championship, citing the prevalence there of the delta variant of the coronavirus. "Soccer is lovely, but one doesn't absolutely have to be there in London," Spahn told German broadcaster ARD. Germany requires a two-week quarantine for travelers from the U.K. (BBG)

CORONAVIRUS: German Chancellor Angela Merkel and French President Emmanuel Macron called on Friday for European Union countries to coordinate their COVID-19 border reopening policies and guard against new variants of the virus. (RTRS)

GERMANY: The delta variant will probably dominate in Germany within three to four weeks, Bavarian Premier Markus Soeder warned at a meeting of the youth wing of his party on Saturday, the Sueddeutsche Zeitung reported. "If you get out of bed too soon after being sick, you risk a severe relapse," the newspaper cited Soeder as saying. He defended a cautious re-opening strategy as authorities seek to speed the pace of inoculations, in particular second doses. (BBG)

GERMANY: The German economy faces a "serious danger" due to the delta variant of the coronavirus, Ifo President Clemens Fuest was cited as saying in an interview with T-Online. "The recovery would be delayed" if Covid incidence rates rise again in the country, the news portal quoted Fuest as saying. "We would face a difficult autumn." (BBG)

FRANCE: President Emmanuel Macron and far-right leader Marine Le Pen fared worse than expected in the first round of France's regional election, exit polls showed, in a disappointing twist for the two main contenders in the country's 2022 presidential race. The traditional right, which holds the most regions, garnered 29% on its own. The left-wing and Green parties, including that of far-left presidential hopeful Jean-Luc Melenchon and the Socialists, won 34%, according to an Ifop poll. Le Pen's National Rally got 19% -- almost 10 points behind her score in the last election -- and Macron's party took 11%. (BBG)

NETHERLANDS: The Netherlands will move forward with the next stage of its reopening plan four days earlier than planned as cases continue to decline. From June 26, face masks will no longer be a requirement except for on public transport, in airports and where maintaining 1.5 meters of distance isn't possible. The Dutch can also start to return to the office as long as social distancing is maintained. (BBG)

SWITZERLAND: Switzerland plans to allow young peopleaged 12-to-15 years to be vaccinated against Covid-19 as soon as next week, the government's vaccine chief Christoph Berger said in an interview published Sunday by the Neue Zürcher Zeitung. The development comes two weeks after Switzerland's medicines regulators, Swissmedic, extended its temporary ordinary authorization of the Pfizer-BioNTech vaccine to include people in that age group. (BBG)

SWEDEN: A last-ditch proposal by Sweden's Prime Minister Stefan Lofven to resolve a government crisis was rebuffed by his former allies on the left, setting the stage for a no-confidence vote on Monday. Lofven's announcement that a proposed rent deregulation, which made the majority in parliament turn against him, will be renegotiated by tenants and landlords, was swiftly turned down by Left Party chair Nooshi Dadgostar. The leftist leader, who formed an unlikely alliance with the conservative and nationalist opposition last week, characterized the offer as "political theater." Lofven, a 63-year-old former union leader and welder, would have a week to resign or announce snap elections if ousted in the Monday vote, the most serious threat yet for the minority coalition of Social Democrats and Greens that's ruled for 2 1/2 years. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Slovenia at A; Outlook Stable

- Moody's affirmed Slovakia at A2, outlook stable

- Moody's affirmed Luxembourg at Aaa; outlook stable

U.S.

FED: Minneapolis Federal Reserve President Neel Kashkari said on Friday he wants to keep the U.S. central bank's benchmark short-term interest rate near zero at least through the end of 2023 to allow the labor market to return to its pre-pandemic strength. "The vast majority of Americans want to work, and I am not ready to write them off – and I want to give them the chance to work," Kashkari told Reuters in his first public comments since the end of the Fed's policy meeting earlier this week. "As long as inflation expectations remain anchored ... let's be patient and let's really achieve maximum employment." Kashkari's remarks show he's in a decided minority in an increasingly hawkish Fed, which on Wednesday wrapped up a two-day meeting with an unexpected result: with inflation on the rise, most Fed policymakers now see a case for starting interest rate hikes sooner. (CNBC)

FISCAL: A senior Republican senator said a $579 billion bipartisan accord on infrastructure is on the table and he challenged President Joe Biden to decide whether he wants to pursue it. South Carolina's Lindsey Graham, who's in a group of 21 senators who last week signed onto a proposed framework to present to Biden, is among lawmakers seeking to set the stage for the next round of bargaining. Biden has said he'll review the bipartisan proposal on Monday. (BBG)

FISCAL: A bipartisan infrastructure plan costing a little over $1 trillion, only about a fourth of what President Joe Biden initially proposed, has been gaining support in the U.S. Senate, but disputes continued on Sunday over how it should be funded. (RTRS)

FISCAL: Sen. Bernie Sanders (I-Vt.) told Sunday's "Meet the Press" that the content of the bipartisan infrastructure deal is "mostly good" but expressed concern about how the deal would be funded. Sanders threw cold water on some of the funding avenues proposed by Sen. Susan Collins (R-Maine) last week, which included a tax on electric vehicles and repurposing leftover COVID-19 funding. (Axios)

CORONAVIRUS: The more-transmissible delta variant first found in India and now spread widely in the U.K. is expected to become the dominant strain in the U.S., said Rochelle Walensky, director of the Centers of Disease Control and Prevention. She added that full vaccination provides good protection against it. "As worrisome as this delta strain is with regard to its hyper-transmissibility, our vaccines work," she said Friday on "Good Morning America. "I would encourage all Americans, get your first shot, and when you're due for your second, get your second shot and you'll be protected from this delta variant." (BBG)

CORONAVIRUS: President Joe Biden is traveling to North Carolina on Thursday to encourage more Americans to get vaccinated. The president's trip to Raleigh comes 10 days before July 4, Biden's stated target date to see at least 70% of adult Americans at least partially vaccinated — a goal that risks slipping out of reach. (BBG)

CORONAVIRUS: Los Angeles's county health officials said they've seen an increase in variants first found in India in the past few weeks. The health department started reviewing tests at labs with data on residents and noticed small numbers of the highly transmissible delta variant, along with a few cases of the related kappa variant, since early April. (BBG)

CORONAVIRUS: California introduced a statewide digital Covid-19 vaccine record for residents, providing a scannable QR code and details of an individual's inoculations that replicate the information on a CDC paper card. (BBG)

CORONAVIRUS: New Jersey met its goal of fully vaccinating more than 4.7 million people who live, work and study in the state about two weeks before its original target date of June 30, Gov. Phil Murphy said Friday. The milestone comes after an aggressive vaccination campaign that included door-knocking and incentives for residents of the state, such as free beer and wine, free passes to state parks and even dinner with Murphy and his wife. (CNBC)

CORONAVIRUS: US land borders with Canada and Mexico will remain closed to non-essential travel until at least Jul 21, the US Homeland Security Department said on Sunday (Jun 20). The 30-day extension came after Canada announced its own extension on Friday of the requirements that were set to expire on Monday and have been in place since March 2020 because of the coronavirus pandemic. The US government held working-group meetings with Canada and Mexico on the travel restrictions last week and plans to hold meetings about every two weeks, US officials told Reuters. (RTRS)

AIRLINES: American Airlines said it canceled hundreds of flights this weekend due to staffing shortages, maintenance and other issues, challenges facing the carrier as travel demand surges toward pre-pandemic levels. (CNBC)

OTHER

GLOBAL TRADE: Margrethe Vestager, the EU's head of digital and competition policy, has rejected the idea that its forthcoming Digital Markets Act (DMA) will only target American tech companies. She spoke after the White House warned Brussels that the tone around its flagship new tech policy sent a negative message and suggested that the EU "is not interested in engaging with the United States in good faith" on the challenges posed by large tech platforms. In an interview with the Financial Times, Vestager, who met with President Joe Biden during his visit in Brussels this week, said: "The [DMA] is not directed toward certain businesses or toward certain nationalities of businesses." (FT)

U.S./CHINA: China will risk international isolation if it fails to allow a "real" investigation on its territory into the origins of the virus that caused the Covid-19 pandemic, U.S. National Security Adviser Jake Sullivan said. Sullivan's comments follow last week's call by Group of Seven leaders including U.S. President Joe Biden for another probe into how the virus originated. Biden last month ordered the U.S. intelligence community to "redouble" its efforts to determine where the coronavirus came from and to report back in 90 days. The goal is to present China with "a stark choice: Either they will allow, in a responsible way, investigators in to do the real work of figuring out where this came from, or they will face isolation in the international community," Sullivan said in an interview on "Fox News Sunday." (BBG)

U.S./CHINA: Chinese state-owned importers bought at least eight cargo shipments of U.S. soybeans on Friday, or at least 480,000 tonnes, the country's largest U.S. soybean purchases in 4-1/2 months, two U.S. traders familiar with the deals said. The deals, which were for shipment from U.S. Pacific Northwest ports mostly in October, came after new-crop November soybean futures on the Chicago Board of Trade tumbled nearly 7% on Thursday to the lowest point since March. China had slowed its U.S. soybean purchases in recent months as cheaper shipments of newly harvested Brazilian soybeans came available and as U.S. soybean prices soared to the highest in about 8-1/2 years. (RTRS)

U.S./CHINA/TAIWAN: The U.S. sent 2.5 million doses of Moderna Inc.'s vaccine to Taiwan, reflecting part of President Joe Biden's pledge to donate 25 million shots worldwide to stem the pandemic. (BBG)

CORONAVIRUS: Delta, the highly contagious Covid-19 variant first identified in India, is becoming the dominant strain of the disease worldwide, the World Health Organization's chief scientist said Friday. That's because of its "significantly increased transmissibility," Dr. Soumya Swaminathan, the WHO's chief scientist, said during a news conference at the agency's Geneva headquarters. Studies suggest delta is around 60% more transmissible than alpha, the variant first identified in the U.K. that was more contagious than the original strain that emerged from Wuhan, China, in late 2019. The situation globally "is so dynamic because of the variants that are circulating," she added. (CNBC)

CORONAVIRUS: As some governments and pharmaceutical officials prepare for Covid booster shots targeting more-infectious virus variants, health authorities say it's too early to tell if they will be required. "We do not have the information that's necessary to make the recommendation on whether or not a booster will be needed," Soumya Swaminathan, the World Health Organization's chief scientist, said in a Zoom interview Friday. The "science is still evolving." Such a call is "premature" while high-risk individuals in most of the world haven't yet completed a first course of vaccination, Swaminathan said. (BBG)

HONG KONG: Hong Kong's government will "carefully examine" if there's room to relax social distancing measures with current rules set to expire this week, Chief Secretary for Administration Matthew Cheung said in a blog post on Sunday. Hong Kong has reported zero locally-transmitted cases for more than 10 days, with the current social distancing rules set to remain until June 23. (BBG)

JAPAN: The Japanese government will set up a 100b yen fund in 2022 for technologies linked to economic security, such as semiconductors, batteries and AI, Nikkei reports, without attribution. The fund will be used to finance R&D projects led by businesses and universities. The government is expected to outline the details when it compiles a draft budget for fiscal 2022. (BBG)

JAPAN: Tokyo Governor Yuriko Koike scrapped plans for several Olympic public viewing sites in the capital where events from the Games were to be screened. Koike said she had canceled the plans after meeting with Prime Minister Yoshihide Suga to discuss the state of the pandemic, with Tokyo and several other areas set to end the state of emergency today. Some of the sites will be turned into mass vaccination centers instead. (BBG)

BOJ: MNI INSIGHT: Impact Of Weaker Yen A 'Mixed Bag' For BOJ

- A weaker yen will be a net boost for the Japanese economy, but Bank of Japan officials still see a risk from a lower currency on import costs and through to some companies' profitability, MNI understands. The lower yen is a teaser for bank officials: on the plus side it will help push inflation higher and increase exporters' profits, but against that it will cause an overall worsening of the terms of trade - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's third-most populous state has announced further easing of public restrictions, including lifting limits on home gatherings, outdoor places and aged care and hospital visits. The changes to the state's road map to re-opening take effect next Friday. Under the changes, self-service food setups are also now allowed, in addition to spacing in venues of three people per four square meters up from one person per two square meters. (BBG)

AUSTRALIA: Australia could open its international borders to foreign students before other visitors as a trial for travel bubbles the country is attempting to establish, the Australian newspaper said, citing an interview with the country's leader Scott Morrison. The Prime Minister told the newspaper the government is considering conducting early trials of a new recognition system for vaccinated arrivals on foreign students and has held initial talks with Singaporean Prime Minister Lee Hsien Loong on building a border clearance system that is compatible, Morrison said. (BBG)

AUSTRALIA: Western Australia has announced all travelers to the state from New South Wales must be tested for Covid-19 and self-quarantine until receiving a negative result as new cases emerging from Australia's most-populous state. Anyone who recently entered Western Australia and has visited any of the exposure sites in New South Wales during the relevant times must also get tested immediately and self-quarantine for 14 days from their date of exposure, Western Australia's Premier Mark McGowan said in a statement on Saturday. (BBG)

AUSTRALIA: Barnaby Joyce has been re-elected leader of the Nationals party and will return as deputy prime minister after MPs dumped Michael McCormack in a leadership spill on Monday. The move to reinstate Joyce comes after the prime minister, Scott Morrison, earlier praised the "wonderful partnership" he had enjoyed with McCormack, saying the pair had delivered "great, stable leadership". But after a spill motion was called by the former resources minister, Matt Canavan on Monday, Joyce was able to secure a majority of 21 votes to take back the top job. (Guardian)

AUSTRALIA/CHINA: The Australian government said on Saturday it was lodging a formal complaint with the World Trade Organization over China's imposition of anti-dumping duties on Australian wine exports, escalating further the trade standoff with Beijing. (RTRS)

SOUTH KOREA: South Korea will relax its social-distancing rules starting next month as coronavirus cases slow amid rising vaccinations. The country will increase the maximum number of people who can gather privately from July 1, Prime Minister Kim Boo-kyum said Sunday in a televised briefing. Under revised rules, shops will be able to stay open for longer, depending on daily caseloads, he said. (BBG)

SOUTH KOREA: Korea Electric Power will keep its 3Q power prices unchanged from 2Q to ease burden for citizens suffering from higher inflation pressure caused by Covid-19, according to the state-owned utility. Kepco may consider raising power prices in 4Q if higher energy costs continue to persist in 2H. (BBG)

NORTH KOREA: National Security Adviser Jake Sullivan said on Sunday that recent comments made by North Korean leader Kim Jong Un in which he urged for the preparation of "both dialogue and confrontation" were an "interesting signal." According to a Reuters report, Kim said on Friday that he preparing for both "dialogue and confrontation" with the Biden administration in his first comments of Biden's presidency. During an appearance on ABC's "This Week," Sullivan told host George Stephanopoulos that the U.S. is still waiting for direct contact with Pyongyang. (The Hill)

NORTH KOREA: The United States has offered to meet with North Korea "anywhere, anytime without preconditions" and looks forward to a positive response from Pyongyang, the new U.S. special envoy for the North said Monday. Ambassador Sung Kim made the remarks during trilateral talks with his South Korean and Japanese counterparts, Noh Kyu-duk and Takehiro Funakoshi, in Seoul, where they discussed North Korean leader Kim Jong-un's recent remarks that his country should be ready for both dialogue and confrontation. "We continue to hope that the DPRK will respond positively to our outreach and our offer to meet anywhere, anytime without preconditions," Kim said, referring to the North's official name, the Democratic People's Republic of Korea. (Yonhap)

BOC: With fiscal spending booming and households flush with cash, investors are betting that the Bank of Canada's next tightening cycle, expected to begin in 2022, will result in interest rates climbing above the previous peak for the first time in decades. In four major tightening cycles since the early 1990s, the Bank of Canada's key interest rate has peaked at a level that was lower than the preceding endpoint. But that could change in the next cycle, as historic levels of government spending globally raise prospects of an economic recovery from the COVID-19 crisis that is more robust than previous recoveries. (RTRS)

CANADA/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Canada at AA+; Outlook Stable

MEXICO: Mexico City schools will suspend in-person classes as of June 21 after the local government moved to a yellow code alert from a green light according to the country's stoplight system. The federal education authority for Mexico City said that it is suspending classes including public and private elementary, high school, college-level and teacher training, according to a joint statement with the education ministry. (BBG)

BRAZIL: Brazil hit the grim mark of half a million Covid deaths Saturday, a toll second only to the U.S. that shows few signs of easing. Yet residents are spurning vaccines that they believe are substandard in favor of hard-to-find shots from Pfizer Inc. In Sao Paulo, people demand the U.S. company's shots at public clinics and often walk out if none are available. Some health-care centers have put up signs saying "no Pfizer shots" to save time. Many vaccination centers are empty, and the few that have Pfizer have massive lines. (BBG)

RUSSIA: Russia added a further 17,611 cases, the nation's coronavirus emergency response center reported. That compares to 17,906 new infections registered on Saturday, which was the highest number since January 31. Russia is experiencing a resurgence of the virus amid a rapid spread of the more contagious delta strain first identified in India. (BBG)

RUSSIA: The U.S. is preparing additional sanctions against Russia for the poisoning of opposition leader Alexey Navalny, National Security Adviser Jake Sullivan said. President Joe Biden said he raised Navalny's case with Russian President Vladimir Putin during their summit last week and made it clear to him that Russia would face "devastating" consequences if Navalny died in prison. While Putin sought to caution the U.S. against expanding sanctions, Sullivan's comments point in that direction. (BBG)

RUSSIA: The U.S. is holding $100 million in security assistance for Ukraine "in reserve" for threats such as a renewed Russian military buildup on the border, National Security Adviser Jake Sullivan said. "So it is there and the Russians know it's there and the Ukrainians know it's there, but the idea that we have withheld any security assistance from Ukraine is simply nonsense," Sullivan said on "Fox News Sunday." (BBG)

IRAN: World powers and Iran failed after a sixth round of negotiations in Vienna to revive a nuclear deal that would lift U.S. sanctions on the oil-rich Islamic Republic in exchange for it scaling back its atomic activities. A day after hardline cleric Ebrahim Raisi was declared the winner of Iran's presidential election, diplomats adjourned their sixth round of meetings with significant gaps remaining to mend the six-year-old accord. It's the third time since talks began in April that negotiators have missed self-imposed deadlines to rejuvenate the agreement. "My expectation is that in the next round, delegations will come back from capitals with clearer instructions, clearer ideas to finally close the deal," said European Union deputy foreign policy chief Enrique Mora, who twice predicted the next round of talks would be the last, most recently on June 2. (BBG)

IRAN: The Biden administration wants to finalize a deal with Iran to return to the 2015 nuclear deal in the six weeks remaining before a new Iranian president is inaugurated, a U.S. official tells Axios. The official said it would be "concerning" if talks dragged on into early August, when Iran's transition is due to take place. "If we don't have a deal before a new government is formed, I think that would raise serious questions about how achievable it's going to be," the official said. (Axios)

IRAN: Iran said one of the "serious issues" raised in the latest round of talks to revive the 2015 nuclear deal was the need for a guarantee from the U.S. that it won't exit the accord and reimpose sanctions on the Islamic Republic again in the future. "We need guarantees that give us assurances that a repeat of these sanctions and exiting the nuclear deal, as the past U.S. government did, won't happen again," Abbas Araghchi, Iran's lead negotiator in talks with world powers in Vienna, told Iranian state TV, adding that a return to the accord won't be possible without this condition being met. (BBG)

IRAN: Ultraconservative cleric Ebrahim Raisi swept to a landslide win in Iran's presidential election, potentially setting the oil-rich country on a more hostile course toward the West as world powers attempt to revive the 2015 nuclear deal. Raisi secured 17.8 million votes and the only moderate candidate in the race, Abdolnaser Hemmati, came third with 2.4 million ballots, Jamal Orf, head of Iran's presidential election headquarters said in a statement on state TV, adding that 90% of ballots have been counted so far. (BBG)

IRAN: Iran's sole nuclear power plant has undergone an unexplained temporary emergency shutdown. An official from state electric company Tavanir, Gholamali Rakhshanimehr, said on a talk show on Sunday that the Bushehr plant shutdown began on Saturday and would last "for three to four days". Without elaborating, he said that power outages could result. (ABC)

MIDDLE EAST: The Biden administration is sharply reducing the number of U.S. antimissile systems in the Middle East in a major realignment of its military footprint there as it focuses the armed services on challenges from China and Russia, administration officials said. The Pentagon is pulling approximately eight Patriot antimissile batteries from countries including Iraq, Kuwait, Jordan and Saudi Arabia, according to officials. Another antimissile system known as a Terminal High Altitude Area Defense, or Thaad system, is being withdrawn from Saudi Arabia, and jet fighter squadrons assigned to the region are being reduced, those officials said. (WSJ)

MIDDLE EAST: Saudi Arabian air defences late on Saturday destroyed six armed drones launched by Yemen's Houthi movement towards the kingdom, bringing the total it intercepted during the day to 17, state TV cited the Saudi-led coalition as saying. (RTRS)

MIDDLE EAST: Iranian Foreign Minister Mohammad Javad Zarif said he's ready to re-establish formal diplomatic links with Saudi Arabia and reinstate an ambassador to the Sunni kingdom. "I'm ready to send an ambassador to Saudi Arabia tomorrow, but it depends on them," Zarif said during the Antalya Diplomacy Forum, according to a live stream of the event online. "There's no reason that we should not be able to resolve our differences with the Saudis." (BBG)

OIL: Iraq expects oil prices to reach $80 per barrel, the country's state news agency reported on Sunday, citing an oil ministry spokesman. (RTRS)

OIL: Crude storage tanks that were brimming a year ago when the pandemic grounded flights and kept drivers at home are beginning to empty in the main U.S. distribution hub, the latest sign of strengthening demand in the world's biggest oil-consuming country. For the first time since before the pandemic, empty tanks are being offered for lease at Cushing, Oklahoma, the delivery point for West Texas Intermediate oil futures. At least 1.4 million barrels of storage is up for rental starting in July, for roughly 12 cents per barrel a month, said Steven Barsamian, chief operating officer at storage brokerage Tank Tiger. That's a stark contrast to at least 60 cents charged when there was little space left about a year ago. (BBG)

OIL: Russian Deputy Prime Minister Alexander Novak plans to meet the nation's oil producers on June 22 to discuss fuel supplies and the oil market, RIA reported, citing Novak. There's no need to ask companies to stabilize domestic fuel prices for now but the option may be considered later if needed. (BBG)

CHINA

PBOC: The PBOC will maintain reasonable and ample liquidity in line with its goal of keeping monetary policy stable, and analysts should not make unfounded tightening predictions causing wrong expectations and volatility, the PBOC-run Financial News said in a commentary. Though some analysts had predicted a marginally tightening condition in May due to more tax payments and local government bond issuances, the average DR007 for the month, at 2.12%, was 8 bps lower than the 7-day reverse repo rate, the newspaper said. The PBOC will guide the money market rates around its short-term policy rate, the newspaper said. (MNI)

PBOC: MNI BRIEF: PBOC Keeps LPR at 3.85% Despite PPI at 13-Year High

- China's central bank Monday left its benchmark rate for loans unchanged for the 14th straight month even after the factory gate price jumped to a 13-year high. The Loan Prime Rate, guiding companies' cost of borrowing, remains at 3.85% for the one-year maturity and 4.65% for five years. The move was expected as the PBOC had left the Medium-term Lending Facility rate at 2.95% on June 15. The LPR is linked to the one-year MLF, which is viewed as being closer to market rates. The PBOC has remained moderate in its daily open market operation since March 1 with small CNY10 billion injections on most days. It has made zero net injection in the inter-bank market via OMOs this month and has rolled over CNY20 billion via MLF this month - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

MONEY MARKETS: Some Chinese banks cut interest rates of large deposit certificates as a new pricing mechanism for lenders' deposits introduced took hold, the Shanghai Securities News reported. Deposits bearing higher rates will likely see rates decline, helping lower banks' costs and ultimately their lending rates, the newspaper cited analysts as saying. The new mechanism adds basis points differentials on the benchmark interest rate, differing from the previous that was percentage-based, the newspaper said. (MNI)

CORONAVIRUS: China has given out more than one billion dose of Covid-19 vaccines as the world's most populous country speeds up its inoculation campaign to reach herd immunity. As of Saturday, 1.01 billion doses have been administered, data from the National Health Commission said Sunday, though it's unclear how many are full vaccinated. The Chinese capital Beijing has fully vaccinated over 80% of the city's adults as of Wednesday, the most among the world's major cities and financial hubs. Even after 1 billion doses are given, China has only given enough doses to cover some 30% of its 1.4 billion people, and is still trailing behind the U.S., the U.K. and leading European nations where vaccination coverage approaches or has exceeded half of their respective population, Bloomberg's vaccine tracker shows. (BBG)

CORONAVIRUS: China's southern technology hub is adding restrictions for travelers and tightening enforcement of existing virus controls, after 38 passengers aboard an inbound Air China flight from Johannesburg tested positive for Covid-19. Local authorities said this weekend that they will target 100% compliance with existing protocols on public transit, including monitoring of temperatures and health codes, as well as ensuring that all passengers wear masks. Also, passengers departing Shenzhen by air now need to show proof of a negative test result done within 48 hours. As of now, roughly 62% of the city's residents have been fully vaccinated, and officials said they would redouble efforts to reach people 60 and older. The flareup and response suggest that China could continue to follow a rigid virus-containment strategy and keep borders shut, despite the mass domestic vaccination drive that has given over 1 billion doses. (BBG)

OVERNIGHT DATA

AUSTRALIA MAY, P RETAIL SALES +0.1% M/M; MEDIAN +0.4%; APR +1.1%

SOUTH KOREA JUN 1-20 EXPORTS +29.5% Y/Y; MAY +53.3%

SOUTH KOREA JUN 1-20 IMPORTS +29.1% Y/Y; MAY +36.0%

UK JUN RIGHTMOVE HOUSE PRICES +0.8% M/M; MAY +1.8%

CHINA MARKETS

PBOC NET INJECTS CNY10BN VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. This resulted in a net injection of CNY10 billion as no reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2500% at 09:31 am local time from the close of 2.2039% on Friday.

- The CFETS-NEX money-market sentiment index closed at 57 on Friday vs 48 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4546 MON VS 6.4361

People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for a fifth day at 6.4546 on Monday, compared with the 6.4361 set on Friday, marking the weakest fixing since May 13.

MARKETS

SNAPSHOT: Tsys Flatten Again In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 1044.93 points at 27921.16

- ASX 200 down 126.249 points at 7242.6

- Shanghai Comp. down 7.922 points at 3517.175

- JGB 10-Yr future up 23 ticks at 151.86, yield down 1.9bp at 0.040%

- Aussie 10-Yr future up 9.0 ticks at 98.480, yield down 9.4bp at 1.503%

- U.S. 10-Yr future +0-15+ at 132-25+, yield down 6.71bp at 1.371%

- WTI crude up $0.27 at $71.91, Gold up $8.87 at $1773.08

- USD/JPY down 39 pips at Y109.82

- LAGARDE: ECB MAKING 'GOOD PROGRESS' ON STRATEGY OVERHAUL (BBG)

- MACRON AND LE PEN BOTH DISAPPOINT IN FRANCE'S REGIONAL ELECTION (BBG)

- DELTA VARIANT BEGINS TO SPREAD, THREATENING EU'S COVID PROGRESS (FT)

- FED'S KASHKARI OPPOSED TO RATE HIKES AT LEAST THROUGH 2023 (CNBC)

- U.S. TSY CURVE CONTINUES TO FLATTEN AS EQUITIES STRUGGLE

- PBOC FIXES LPRS AT UNCHANGED LEVELS

BOND SUMMARY: Aggressive Tsy Flattening Continues

A lack of notable news flow since Friday's U.S. close didn't sedate activity during Asia-Pac trade, with e-minis trading through their respective Friday lows and the Japanese equity markets trading particularly heavy as the Asia-Pac region reacted to Wall St.'s negative lead. This accentuated the recent round of U.S. Tsy curve flattening, with 2s and 3s seeing some modest cheapening, while the remainder of the major benchmarks richened, led by the long end as 20- & 30-Year Tsy yields fell by a little over 8bp. 10- & 30-Year yields printed at levels not witnessed since February, with the latter breaching the 2.00% level. T-Notes last trade +0-16 at 132-26, with volume nearing a more than healthy 300K. Eurodollar futures trade -0.5 to +2.5 through the reds, twist flattening, with a ~55K buyer of EDU1 with and a ~28K seller of EDH2 dominating on the flow side.

- JGB futures sit 23 ticks higher than Friday's settlement at typing, with local equity markets struggling in the wake of Friday's Wall St. sell off (Nikkei 225 last -3.7%, below 28,000) & further downbeat assessments surrounding a lack of spectators at the Tokyo Olympics. The belly of the cash JGB curve led the rally as 7s richened by ~2.0bp, pointing to a bid that was perhaps driven by futures, with the wings of the curve hovering closer to neutral levels. Super-long swap spreads briefly tightened through recent tights. Speculation continues to do the rounds re: the potential for the BoJ to step into the equity market and purchase TOPIX-linked ETFs given the morning sell off (TOPIX last -2.6%, a little off the morning lows).

- Aussie bonds followed the twist flattening theme in the U.S., with YM -2.0 and XM +9.5 at typing. Local focus fell on the (relatively limited) COVID cluster in Sydney, Barnaby Joyce regaining the leadership of the junior party within the government's ruling coalition and a slightly softer than expected round of preliminary retail sales data.

EQUITIES: In The Red

A negative day for equity markets in the region with major bourses enduring substantial losses. Markets in Japan lead the way with the Nikkei 225 down around 3.5% at the time of writing and below the 28,000 marker. Markets in mainland China are also lower though selling has been less heavy, in South Korea the KOSPI is lower by around 1.2% despite another set of robust export data. In the US futures are lower, S&P 500 e-minis dropping through Friday's lows while e-mini Dow Jones see the heaviest selling.

OIL: WTI Climbs Back Over $72/bbl

Oil is higher in Asia-Pac trade, WTI up $0.58 from settlement levels at $72.22/bbl, Brent is up $0.58 at $74.09/bbl. Oil is getting a boost after the election of conservative cleric Ebrahim Raisi as Iran's president which could be a hurdle for Iran and world powers reaching an agreement on a nuclear deal and complicate the return of Iranian supply to market.

GOLD: Unwinding Friday's Losses As U.S. Yields Fall Further

Gold has benefitted from the pull lower in U.S. Tsy yields and pressure on the U.S. & Japanese equity spaces during Asia-Pac hours, adding $10/oz to last print just shy of $1,775/oz, reversing Friday's decline in the process. Bulls still need to retake the Jun 17 high, which is some way away at $1,825.4/oz, to regain some degree of composure.

FOREX: Negative Sentiment Boosts JPY, Antipodeans Shielded By Firmer Crude Oil

G10 FX space started the new week by partially reversing last week's moves. The Antipodeans caught a bid, benefitting from an uptick in crude oil prices, linked to the weekend election of a hardline cleric as Iran's president, which may throw sand into the gears of the Iran nuclear talks. Firmer commodity markets shielded the Antipodeans from the potential impact of souring risk sentiment.

- The yen jumped onto the top of the G10 pile, as USD/JPY dipped under the Y110.00 mark on the back of a bout of broader greenback sales. A poor showing from Asia-Pac equity markets and U.S. e-mini contracts lent support to the yen, amid talk of continued trimming of reflation bets. JPY remained buoyant, even as the DXY managed to recoup its initial losses.

- GBP led losses in G10 FX space after the Telegraph reported that the UK would not lift the remaining Covid-19 restrictions at the Jul 5 review. Positioning ahead of this week's monetary policy decision from the BoE may have also affected price action.

- The PBOC left the LPRs unchanged for the 14th month in a row and set its central USD/CNY mid-point at CNY6.4546, 8 pips below sell-side estimate. USD/CNH punched through a pair of its prior daily highs located at CNH6.4645/53 and printed its strongest levels since May 6.

- Speeches from Fed's Williams & Bullard as well as ECB's Lagarde & Centeno take focus from here.

FOREX OPTIONS: Expiries for Jun21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1900(E565mln), $1.1940(E553mln)

- USD/JPY: Y110.00($1.0bln)

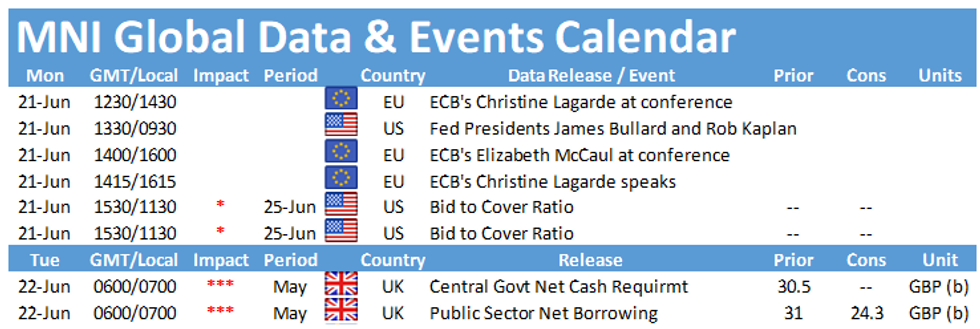

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.