-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Chinese Liquidity & U.S. Infrastructure Headlines Eyed

- Asia-Pac equities followed the positive lead from Wall St., with further support coming from a PBoC net liquidity injection via OMOs.

- U.S. infrastructure matters continue to dominate the headlines, with the potential from reconciliation already aired.

- Fedspeak & U.S. PCE headline the broader docket on Friday.

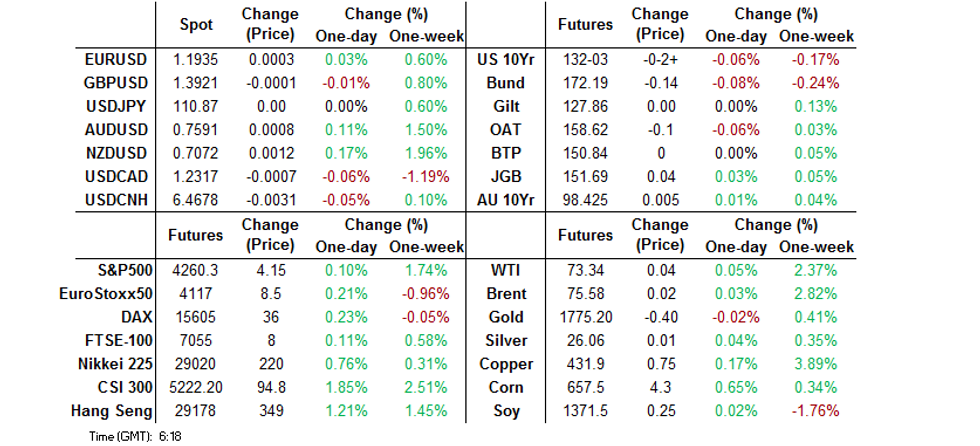

BOND SUMMARY: Mixed Performance In Asia, RBNZ Calls & JGB Steepening Eyed

Broader macro headline flow was light during Asia-Pac hours, allowing T-Notes to settle into a 0-02+ range, last -0-03 at 132-02+, while cash Tsys trade little changed to 1.0bp cheaper across the curve. Some questions have done the rounds re: the prospect of bipartisan passage of the proposed infrastructure deal, although key Democratic Senator Manchin deemed the use of reconciliation procedures to force the package through as "inevitable" on Thursday. Friday's U.S. docket will be headlined by May's PCE data and 4 Fed speakers.

- JGB futures print +3 last, sticking to a tight range during Tokyo dealing. The JGB curve is the exception to the broader rule in terms of the global core FI curves, twist steepening as opposed to twist flattening, with 20+-Year paper cheapening. It is hard to pin a particular reason to the move. There has been a lack of domestic news flow to focus on, outside of the flat prints across all 3 major Tokyo CPI readings, with that outcome a touch firmer than expected. 10-Year JGB supply and the Q2 Tankan survey provide the major focal points on next week's local docket.

- The overnight twist flattening of the Aussie futures curve extended a little in Sydney, although that particular extension is back from the day's extremes, with YM -2.0 and XM +0.5 at typing. The front end of the curve (including Bills) was seemingly subjected to some trans-Tasman pressure after ANZ maintained their call for a Feb '22 hike from the RBNZ, but highlighted "that the balance of potential policy regrets has firmly tilted, with the risk being we'll see a higher OCR before the year is out." 3-Year EFPs sit the best part of 3.0bp wider on the day, with some pointing to mortgage related flow in swaps. There was no reaction in futures to the announcement of a rare tap of a long bond (ACGB Jun '51) via auction in the AOFM's weekly issuance slate, while the space also shrugged off a lockdown order covering 4 areas of Sydney (the lockdown will last for at least a week). The aforementioned round of ACGB Jun '51 supply headlines locally on Monday. As a quick note, for those of you that were looking ahead to the panel participation by RBA Governor Lowe at the Australian Banking Association Banking Conference on 30 June 2021, the RBA website notes that "this event has been postponed by the organisers."

FOREX: Risk-On Feel Remains

Risk-on impetus unleashed by the infrastructure deal struck by the White House and a bipartisan group of senators lingered, as Asia-Pac news flow provided little to rock the boat. Positive sentiment reduced demand for safe haven currencies, which left USD and JPY lagging the G10 pack. USD/JPY ticked higher early on, but gave away its initial gains into the Tokyo fix.

- The Antipodeans led gains at the margin, even as NSW gov't declared that parts of Sydney will go into lockdown in a bid to prevent further spread of Covid-19 infections.

- The PBOC set its central USD/CNY mid-point at CNY6.4744, just 4 pips above sell-side estimate. USD/CNH traded on a softer footing, mostly on the back of broader greenback weakness.

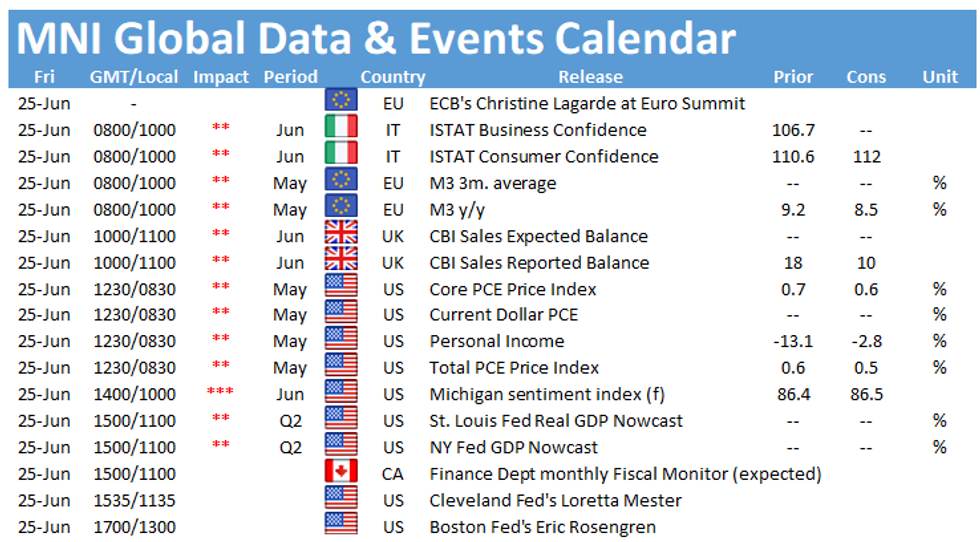

- U.S. PCE and personal income/spending data provide the main points of note on today's data docket, in addition to the final reading of U. of Mich. Sentiment. Comments are due from Fed's Williams, Mester, Kashkari & Rosengren as well as ECB's de Cos.

FOREX OPTIONS: Expiries for Jun25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800-05(E933mln), $1.1895-05(E595mln), $1.1950-65(E910mln), $1.2085(E543mln)

- USD/JPY: Y110.00($593mln), Y110.50($834mln), Y111.00($1.5bln)

- EUR/GBP: Gbp0.8500(E1.1bln-EUR puts)

- USD/CHF: Chf0.8900($1.0bln-USD puts)

- AUD/USD: $0.7500-05(A$559mln)

- USD/CNY: Cny6.50($640mln), Cny6.55($500mln)

ASIA FX: Positive Risk Mood Supports Asia EMFX, Won Leads Gains On Hawkish BoK

The dollar index faltered in Asia, while broader risk tone remained positive, as light regional headline flow failed to offset the optimistic reception of the U.S. infrastructure deal.

- CNH: USD/CNH extended yesterday's losses past its 100-DMA, with an in-line PBOC fix providing little in the way of fresh impetus.

- KRW: The risk-sensitive won outperformed its regional peers, with USD/KRW printing a one-week low. Yesterday's hawkish rhetoric from BoK Gov Lee and continued improvement in business sentiment among South Korean manufacturers provided local tailwinds for the KRW.

- IDR: The rupiah struggled to follow suit and benefit from better risk sentiment. The difficult Covid-19 situation in Indonesia continued to sap demand for the IDR.

- MYR: The ringgit firmed a tad. Science Min Khairy said yesterday that the gov't is set to announce a "big economic assistance package," but refused to reveal any details. Malaysian May CPI printed at +4.4% Y/Y, missing consensus forecast of +4.7%.

- THB: USD/THB retreated after a failure to take out the THB32.00 figure yesterday. Thailand's parliament approved only a limited tweak to the constitution, shrugging off demands of pro-democracy protesters.

- PHP: The peso gained alongside most Asia EM currencies. Bangko Sentral ng Pilipinas held rates on hold Thursday and marginally upgraded its 2021 CPI forecast.

- SGD: USD/SGD fell to a new one-week low. Singapore pledged to expand its Covid-19 vaccination campaign from next month, while FinMin Wong anticipated looser rules for inoculated residents.

- TWD: USD/TWD slipped, but struggled to get past its 50-DMA. Japan said Taiwan's stability is directly linked to its own security and pledged to donate 1mn vaccine doses to the island.

EQUITIES: In The Green

Regional equity indices benefitted from Wall St.'s positive lead during Asia-Pac hours, with the major Chinese indices garnering further support from another CNY20bn net liquidity injection from the PBoC via its daily OMOs. U.S. equity index futures also nudged higher in Asia, even with a lack of new flow evident, as the space continued to benefit from the positives surrounding infrastructure developments in Washington.

GOLD: Will PCE See A Reaction?

Gold has meandered through Asia-Pac trade to last deal little changed at $1,778/oz after a limited round of trade on Thursday. The previously outlined technical picture remains intact, with participants looking to today's U.S. PCE data release as a potential catalyst for price action.

OIL: Familiar Focal Points

The uptick in Asia-Pac equity indices provided a light bid for crude futures during overnight trade before oil pared early gains, leaving WTI & Brent +~$0.05 vs. their respective settlement levels at typing. Focus continues to fall on broader geopolitical worries surrounding Iran and next week's OPEC+ gathering.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.