-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: NFPs On Deck Ahead Of Long U.S. Weekend

EXECUTIVE SUMMARY

- J&J SHOT EFFECTIVE AGAINST DELTA VARIANT (BBG)

- U.S. WINS INTERNATIONAL BACKING FOR GLOBAL MINIMUM TAX (WSJ)

- AUSTRALIA OUTLINES 4-PHASE PLAN AIMING TO END LOCKDOWNS AND BORDER CLOSURES

- OPEC+ OIL DEAL HANGS IN THE BALANCE AS KEY MEMBER REBELS (BBG)

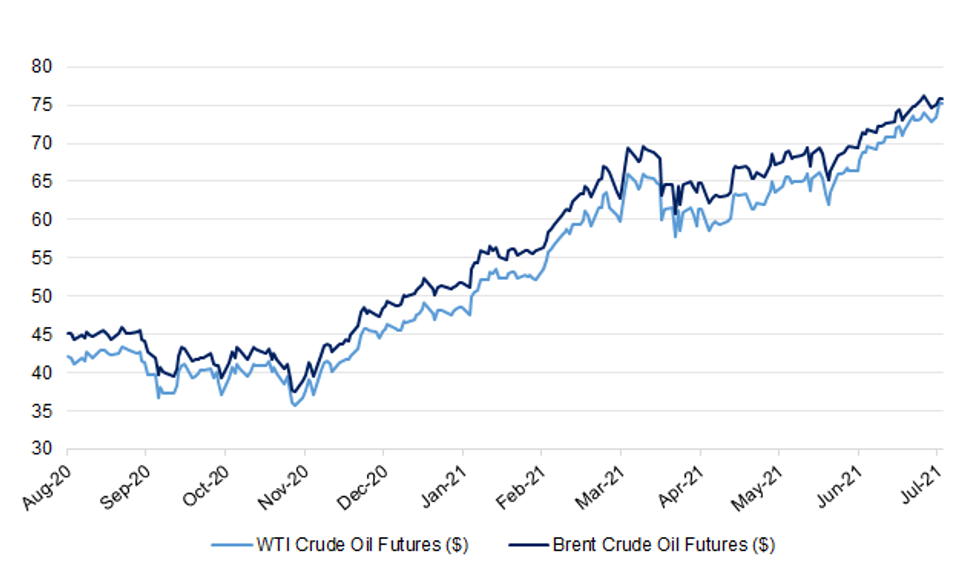

Fig. 1: WTI & Brent Crude Oil Futures ($)

Source: MN - Market News/Bloomberg

Source: MN - Market News/Bloomberg

UK

CORONAVIRUS: Germany is preparing to relax restrictions on British travellers entering the country before a meeting between Boris Johnson and Angela Merkel today. The move signals the abandonment of efforts by the German chancellor to co-ordinate a Europe-wide hardline stance on British arrivals, opening the way for fully vaccinated Britons to move more freely without quarantine. Since late May Germany has made entry from Britain largely impossible in an attempt to control the spread of the Delta variant and has pushed other EU countries to take a similar approach. (The Times)

POLITICS: Labour's Kim Leadbeater has won the Batley and Spen by-election after a closely-fought campaign, with a narrow majority of 323. Ms Leadbeater, who took the seat with 13,296 votes, said she was delighted constituents had "rejected division and... voted for hope". The campaign in West Yorkshire was marred by acrimony, personal abuse and allegations of dirty tricks. Labour leader Sir Keir Starmer welcomed the "fantastic result". "Kim ran a positive campaign of hope, in the face of division," he said. (BBC)

POLITICS: Angela Rayner has the backing of three big left-wing unions for a leadership challenge against Sir Keir Starmer, her allies have said. The Transport Salaried Staffs' Association, the rail union Aslef and the Communication Workers Union have signalled they would back Rayner were she to launch a leadership campaign, according to her supporters. MPs allied with the deputy leader have been seeking support among parliamentary colleagues and trade unions. The three unions have raised concerns about the direction Starmer has taken the party over the past year. They all signed a letter to the Labour leader in October saying that Jeremy Corbyn's suspension after his comments about antisemitism was "ill advised and unjust" and calling for unity. (The Times)

EUROPE

ECB: The European Central Bank should not start tolerating higher inflation under its new policy framework, as that could be taken as a sign that it is trying to bankroll indebted governments, ECB policymaker Jens Weidmann said on Thursday. ECB policymakers are in the middle of debating a new strategy, with many now backing the notion of letting inflation surpass 2% for a while after it has lagged below that level for most of the past decade. But Weidmann, who heads Germany's Bundesbank and has long warned that the ECB's massive purchases of government bonds risked blurring the lines between monetary and fiscal policy, rejected that approach. (RTRS)

GERMANY: The chancellor candidate for Germany's Green party, Annalena Baerbock, pushed back on accusations that she plagiarized part of a book laying out her political views. The Greens co-leader, who aims to succeed Angela Merkel after the Sept. 26 election, portrayed the claims as a personal attack and diversion from critical issues such as climate change. "For some people, it's a difficult thing that a 40-year-old woman is running" for the chancellorship, Baerbock said in an onstage interview hosted by Brigitte magazine in Berlin. (BBG)

FRANCE: French statistics agency Insee says the economy will expand 6% in 2021 after a 8% contraction in 2020. "Since the start of May, all indicators, whether monthly economic surveys or high frequency data, indicate a lively recovery as the lockdown is gradually lifted." (BBG)

ITALY: Italy jun budget deficit EUR15.800bn.

PORTUGAL: Portugal will reimpose a nightly curfew from Friday in 45 municipalities, including Lisbon, the government has said. The country faces increasing COVID-19 cases due to the spread of the more transmissible Delta variant which has become dominant in the country. "We note that last week the situation has deteriorated again," Minister of the Premiership Mariana Vieira da Silva told a press conference, adding that "the conditions are not met to say that the pandemic is under control ". (AFP)

U.S.

FED: Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday that while an interest rate rise lies some ways in the distance, he is ready for the U.S. central bank to begin slowing the pace of its asset buying stimulus this year. "I am in the camp of starting the tapering process," Mr. Harker said in an interview with The Wall Street Journal, referring to slowing the pace of the Fed's $120 billion a month in bond purchases, which aim to augment the central bank's near zero short-term interest rate target range. Asked if the process should start this year, Mr. Harker said "yes," adding that, "I would like to see tapering begin. I'd like to see it happen sooner rather than later. I'd like to see it being a slow, methodical process." (WSJ)

FED: MNI BRIEF: Fed Sees Trimmed Mean Inflation At 2.4% Next Year

- Trimmed Mean PCE inflation, a favored internal measure of underlying inflation for Federal Reserve officials, is likely to rise to 2.4% by the end of next year as price pressures stemming from supply bottlenecks broaden out, the Dallas Fed said in a blog post Thursday. At the same time, labor market slack will not restrain inflationary pressures as it did in the aftermath of the Great Recession, four Dallas Fed economists said, citing evidence of a tight labor market and strong wage growth - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI REALITY CHECK:US Hiring Capped, Wages Up on Labor Shortage

- U.S. hiring accelerated in June as vaccine uptake fueled further business re-openings and increased mobility, but a limited labor pool is still holding back even stronger job gains, industry experts told MNI, forcing many employers to raise hourly wages and salaries in an attempt to bring back workers that are still sitting out. "For the most part, it's just a continuation of trends we've seen in the past," Indeed Economist Nick Bunker said of June hiring. "There are lots of employers out there who are looking to ramp up hiring, but the big question right now is 'is there a ready supply of workers to take those jobs?'" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI INTERVIEW: US Service Wages Limit Mfg Production-ISM Chief

- Increasing wages in the service sector are luring workers away and limiting U.S. manufacturing production, Institute for Supply Management manufacturing chair Tim Fiore told MNI Thursday, adding that hiring has been difficult but appears to be easing and employment should pick up in September as jobless benefits across the country come to an end. June's ISM report continued to show demand outpacing supply capacity with the headline index slipping to 60.6 from 61.2, slightly missing expectations. The production index rose to 60.8 from 58.5, backlogs are still near record highs at 64.5, and customer inventories are near lows at 30.8, Fiore said - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: IMF Lift US PCE View on Fiscal, See Fed '22 Liftoff

- The staff of the International Monetary Fund Thursday forecast the U.S. economy to grow by 7.0% in 2021 and 4.9% in 2022 before falling under 2.0%, as core PCE inflation (Q4/Q4) is seen spiking to 3.7% in 2021 and remaining elevated at 2.6% in 2023, despite seeing the Federal Reserve hike interest rates once in 2022 and two more times in 2023 - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

ECONOMY: U.S. Commerce Secretary Gina Raimondo said Thursday that many service and retail jobs might not return in the post-COVID world, making investments in apprenticeships and job training the best ways to solve the long-term supply/demand issues within the labor market. Speaking to CNBC, Raimondo stressed that the short-term disruptions caused by COVID unemployment benefits would work their way through the system, as the program is scheduled to end in September. However, longer-term, she argued that many of the workers who lost their jobs because of COVID might have trouble returning to the workforce because conditions in the service and retail economy have changed. (Seeking Alpha)

ECONOMY: The chief executive of the U.S. Chamber of Commerce said Thursday that the No. 1 problem facing American businesses is their inability to hire enough qualified workers. Suzanne Clark, who joined CNBC's "Squawk on the Street," blamed a pervasive lack of skilled labor, Covid-era government jobless benefits, lack of access to child care and restrictions on work visas for employers' difficulty finding staff. "I get to talk to job creators across the country: Small businesses, big businesses. In every industry, in every geography. And they keep bringing up the labor shortage: It is the first thing I hear about," she said. "There is a lot of anxiety out there." (CNBC)

FISCAL: The federal government will be swimming in $3 trillion of red ink by the end of fiscal 2021, according to a Congressional Budget Office estimate released Thursday that swelled 33% from the last forecast. As a result of multiple stimulus measures aimed at combating the pandemic's economic impact, Congress will run a budgetary shortfall this year equivalent to 13.4% of GDP, the second-largest level since 1945 and exceeded only by the 2020 spending. The federal government will be swimming in $3 trillion of red ink by the end of fiscal 2021, according to a Congressional Budget Office estimate released Thursday that swelled 33% from the last forecast. (CNBC)

FISCAL: With a month to go before a suspension of the federal debt ceiling runs out, the U.S. Congress lacks a clear plan to raise it, even as the majority Democrats express confidence that a payments default will be avoided. "We're considering all the options," House Speaker Nancy Pelosi said in a brief interview Thursday when asked about her legislative strategy. (BBG)

CORONAVIRUS: The White House is deploying Covid-19 response teams across the United States focused on combatting the highly contagious delta variant, the Biden administration announced Thursday. The teams, comprised of officials from the Centers for Disease Control and Prevention and other federal agencies, will work with communities at higher risk of experiencing outbreaks and will focus on increasing the rate of Covid-19 vaccinations, White House Covid czar Jeff Zients said during a White House news briefing on the pandemic. The teams will also increase testing to expand detection of the virus, facilitate contact tracing and provide therapeutics to help treat those who become infected, he said, adding the government is ready to provide additional personnel. (CNBC)

CORONAVIRUS: About 1,000 counties in the United States have vaccination coverage of less than 30%, the director of the Centers for Disease Control and Prevention said Thursday. The counties in question are mostly located in the Southeast and Midwest and are most vulnerable to Covid infection, according to CDC director Dr. Rochelle Walensky. The agency is already seeing increasing rates of disease in these counties due to further spread of the more transmissible delta variant, Walensky said. (CNBC)

POLITICS: California on Thursday scheduled a Sept. 14 recall election that could drive Democratic Gov. Gavin Newsom from office, the result of a political uprising largely driven by angst over state coronavirus orders that shuttered schools and businesses and upended life for millions of Californians. The election in the nation's most populous state will be a marquee contest with national implications, watched closely as a barometer of the public mood heading toward the 2022 elections, when a closely divided Congress again will be in play. (AP)

POLITICS: Trump Organization Chief Financial Officer Allen Weisselberg surrendered Thursday morning to the Manhattan district attorney's office on an indictment that also charges that business of ex-President Donald Trump. Weisselberg, who has served Trump as loyal executive for decades, is expected to be arraigned in state court later on the criminal case, which NBC News reports is related to fringe benefits awarded by the Trump Organization. The indictment will be unsealed around the same time. The Trump Organization will be represented by a lawyer at the court proceeding. (CNBC)

MARKETS: New Mexico's sovereign wealth fund brought a federal antitrust lawsuit claiming Bank of America Corp., Citigroup Inc., Goldman Sachs Group Inc., and other top financial institutions rigged the credit default swap market by manipulating a key benchmark. The proposed class action, docketed Thursday, also targets Barclays Plc, BNP Paribas SA, Credit Suisse Group AG, Deutsche Bank AG, JPMorgan Chase & Co., Morgan Stanley, Natwest Group Plc, and three industry groups. By rigging the "final auction price" used "to value all CDS contracts market-wide at settlement," the banks have made "billions of dollars in cartel profits at the expense of non-dealer market participants," according to the complaint filed in the U.S. District Court for the District of New Mexico. (BBG)

MARKETS: Just over two weeks since being sworn in as FTC chair, progressive antitrust scholar Lina Khan took a first step toward expanding the agency's ability to crack down on unfair competition practices. In a 3-2 vote along party lines, the Democratic-majority commission opted at an open meeting Thursday to revoke a 2015 policy statement. The statement essentially limited the types of competition practices the agency would seek to challenge under Section 5 of the FTC Act. The decision to revoke the policy will give the FTC more leeway to pursue competition claims that may not fall squarely within the two existing antitrust statutes: the Sherman Act and the Clayton Act, which govern unlawful monopolization and mergers, respectively. (CNBC)

OTHER

GLOBAL TRADE: The U.S. has won international backing for a global minimum rate of tax as part of a wider overhaul of the rules for taxing international companies, a major step toward securing a final agreement on a key element of the Biden administration's domestic plans for revenue raising and spending. Officials from 130 countries that met virtually agreed Thursday to the broad outlines of what would be the most sweeping change in international taxation in a century. Among them were all of the Group of 20 major economies, including China and India, which previously had reservations about the proposed overhaul. Those governments now will seek to pass laws ensuring that companies headquartered in their countries pay a minimum tax rate of at least 15% in each of the nations in which they operate, reducing opportunities for tax avoidance. (WSJ)

GLOBAL TRADE: Ireland is one of nine countries that did not sign a major agreement at the OECD on Thursday to reform the global corporate tax regime, including a minimum effective tax rate for big companies of at least 15 per cent. The OECD announced that 130 of the 139 countries involved in the talks had signed up to the outlines of what would be an historic agreement, due to be concluded by October. The Minister for Finance Paschal Donohoe said he is "absolutely committed" to the process of reforming the global corporate tax regime and will work with OECD countries to find an outcome that Ireland could support. Speaking at Government Buildings on Thursday evening, Mr Donohoe said he could support "many elements" of what 130 nations have agreed to, but he has reservations about a 15 per cent minimum tax rate. (Irish Times)

U.S./CHINA: U.S. Commerce Secretary Gina Raimondo on Thursday vowed that the U.S. will continue business as usual after the country was seemingly targeted in a speech by Chinese President Xi Jinping. "We'll do everything we can to make sure that our U.S. companies are treated fairly and are able to have access to the Chinese market," she said on CNBC's "Closing Bell." "We will make sure that that is the case, that the Chinese play by the rules, protect IP, allow our markets, our companies to access that market." (CNBC)

U.S./CHINA: The United States said on Thursday that China's rapid build-up of its nuclear forces was "concerning" and called on Beijing to engage with it to reduce "the risks of destabilizing arms races." State Department spokesperson Ned Price told a news briefing the build-up had become more difficult for China to hide and it appeared it was deviating from decades of nuclear strategy based around minimal deterrence. Price was responding to a question about a report in the Washington Post that said China had begun constructing more than 100 new missile silos in a desert area in the western part of the country. (RTRS)

TAIWAN: The condition for the mainland to reunify Taiwan will be more mature in 2027, the year that will mark the 100th Anniversary of the founding of the People's Liberation Army, because the PLA's advantage against foreign intervention, especially from the U.S., will be much more overwhelming, the Global Times reported citing Li Fei, a professor at the Taiwan Research Institute at Xiamen University. The Communist Party of China showcased its military might, including 15 J-20s stealth fighter jets, to demonstrate it is capable of "smashing" all attempts that try to interrupt China's national reunification, at a ceremony on Thursday marking the party's centennial, the newspaper said. At the ceremony, Chairman Xi Jinping vowed to "utterly defeat" any attempt at Taiwan independence, according to the newspaper. (MNI)

CORONAVIRUS: Johnson & Johnson said that its single-shot coronavirus vaccine neutralizes the fast-spreading delta variant and provides durable protection against infection more broadly. The company said in a statement Thursday that recipients of its vaccine produced strong neutralizing antibodies over the course of at least eight months against all variants including delta, which was first seen in India and has been spreading around the globe. The J&J shot provides less protection initially than messenger RNA vaccines from Pfizer and Moderna, and experts have been discussing whether some people may need booster shots to keep the virus at bay long-term.

JAPAN: Japanese Prime Minister Yoshihide Suga's ruling party is expected to gain seats in a Tokyo assembly vote about three weeks before the capital hosts the Olympics, providing a fillip for his prospects in a national election expected after the games. Polling indicates Suga's Liberal Democratic Party has the most support among voters for the Sunday municipal assembly election, well ahead of its nearest challenger, Tokyoites First, which has called for holding the Olympics without spectators. The vote comes as virus numbers have been ticking up in Tokyo, raising worries about whether the government can stem infections before the July 23 opening ceremony. (BBG)

JAPAN: The Japanese government and Tokyo Olympic organizers are planning to hold some games without spectators amid concerns over virus resurgence in the capital, the Yomiuri reports, citing several unidentified officials. Some of the games scheduled to be held at large venues and at night time may be held without spectators. (BBG)

AUSTRALIA: Prime Minister Scott Morrison has announced Australia will cut international arrivals by 50% in a bid to halt a surge in the delta variant of the coronavirus, which this week forced half the population into lockdown. In his first appearance after emerging from self-isolation in the wake of traveling to Europe last month to meet leaders attending the G-7 summit, Morrison said the leaders had also agreed to a pathway to switch from virus suppression to focus on reducing the risk of serious illness, depending on a high vaccination rate that's yet to be determined. (BBG)

AUSTRALIA: Lockdown will end at 6:00pm today for parts of Queensland, but has been extended for Brisbane and Moreton Bay, Queensland Premier Annastacia Palaszczuk says. The decision comes after another three cases of community transmission were recorded in the state. The three-day lockdown will end this evening for Noosa, Sunshine Coast, Ipswich, Logan, Redlands, Gold Coast, Lockyer Valley, Scenic Rim, Somerset, Townsville and Palm Island. Lockdown will continue until 6:00pm tomorrow for the Brisbane City Council and the Moreton Bay regions, with any new case numbers to be revised overnight. (ABC)

SOUTH KOREA: South Korea's top economic policymaker and the chief of the central bank said Friday the fiscal and monetary policies should be operated in harmony as the country faces growing economic risks despite an accelerating economic recovery. The remarks came as Finance Minister Hong Nam-ki and Bank of Korea (BOK) Gov. Lee Ju-yeol held a breakfast meeting earlier in the day amid concerns that the country's expansionary fiscal policy is not in sync with the central bank's move toward monetary tightening. "It is desirable (for the government and the BOK) to operate the fiscal and monetary policies in a mutually complementary manner in accordance with economic situations and the policies' respective roles," the finance ministry and the BOK said in a joint statement after the meeting. They also shared the view that the BOK needs to adjust the accommodative monetary policy stance in a bid to reduce the side effect of a long streak of low rates. (Korea Times)

NORTH KOREA: North Korean leader Kim Jong Un and South Korean President Moon Jae-in exchanged letters around the time of summit between Moon and U.S. President Joe Biden in May, JoongAng Ilbo newspaper reports, citing unidentified diplomatic source. Moon and Kim may have discussed measures to hold non face-to-face summit. A government official declined to confirm the report, according to JoongAng. (BBG)

MEXICO: The best scenario for Mexican interest rates would be a "relatively long pause" to wait and see what the U.S. Federal Reserve does, but if inflation does not ease to near 5%, Bank of Mexico would have to act, said Banxico's deputy governor. Banxico's board decided by a majority at its last policy meeting on June 24 to raise the benchmark interest rate by 25 basis points to 4.25%, saying it was necessary to avoid adverse effects on inflation expectations and citing price formation in the United States. "The best scenario would be to have a relatively long pause for as long as we could and wait for the Fed to start raising rates to get on the train and do the same," Banxico Deputy Governor Jonathan Heath said in a podcast interview with Grupo Financiero Banorte economists that was posted on Wednesday. (RTRS)

BRAZIL: There is currently no political path for launching impeachment proceedings against Brazilian President Jair Bolsonaro, the head of the lower house said on Thursday, dashing threats to the under-pressure leader of Latin America's biggest country. The comments by Arthur Lira, who has the power to decide whether to accept the impeachment proceedings, will come as a major relief to Bolsonaro. He is feeling the heat for overseeing the world's second-deadliest coronavirus pandemic, a high-profile Senate probe into his handling of the outbreak and a scandal over alleged graft in vaccine purchases. Lira, speaking with journalists in Brasilia, said impeachment required political conditions "which are not present at this moment, neither outside nor inside Congress." (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Thursday he would hand over power to whoever wins next year's presidential election cleanly - but not if there is any fraud. His comments will do little to dispel the concerns of his critics, who fear that the far-right former army captain will not accept any election loss in next year's vote. Bolsonaro is almost certain to face his political nemesis, former leftist President Luiz Inacio Lula da Silva. Polls show Lula ahead. "I'll hand over the presidential sash to whoever wins the election cleanly," Bolsonaro said in a weekly address via social media. "Not with fraud." (RTRS)

BRAZIL: Fuel is expensive due to a distributors monopoly and the government can stop it, President Jair Bolsonaro said during his weekly live social media event. "The fuel price has to be reduced, and that's all there is to it," Bolsonaro said. (BBG)

BRAZIL: Senate probe into the govt's handling of the pandemic is hindering reforms, Brazil's Economy Minister Paulo Guedes says in a virtual meeting with businessman Abilio Diniz. Covid probe is a lose-lose game, scrambling everything, he said. (BBG)

BRAZIL: Brazil's administrative reform will not have any vested rights altered, Lower House speaker Arthur Lira told reporters in Brasilia. As for the Income Tax reform, Lira said it is important that Economy Minister Paulo Guedes takes a stand, although the debate is now in Congress. (BBG)

RUSSIA: For months, Russian military hackers have engaged in a campaign to compromise the passwords of people employed in sensitive jobs at hundreds of organizations worldwide including US and European government and military agencies, US and British national security officials said Thursday. The extensive effort also targeted political parties, government offices, defense contractors, energy companies, think tanks, law firms, media outlets and universities, the officials said. (CNN)

RUSSIA: The Economic Development Ministry will improve its economic growth forecast for 2021 from the current figure of 2.9%, Economic Development Minister Maxim Reshetnikov told reporters on Thursday. When asked whether the ministry planned to raise its GDP forecast for 2021, he said, "Yes." The authority will send an interim edition of its macroeconomic forecast to Russia's regions in the week that starts on July 5, he said. He also said that inflation would slow down to 0.65% on the month in June after 0.74% in May. Inflation in June partially stems from higher vegetable prices, as the harvest was 12% lower in 2020, and deficit emerged in May–June, he said. The ministry also expects a slight deflation in August. At the same time, the ministry will raise its forecast for Russia's inflation in 2021 from the current figure of 4.3%, he added. (Prime)

ISRAEL: IAF aircraft struck a Hamas weapons manufacturing facility in Gaza in response to incendiary balloons which were launched towards Israel earlier in the day, a spokesperson for the IDF reported on Thursday night. "The IDF will respond strongly to terrorist attempts from the Gaza Strip," the statement reads. The components which were damaged in the strike were equipment for weapons research and development, the IDF said. (Jerusalem Post)

MIDDLE EAST: The U.S. State Department is "beyond fed up" with Houthi attacks in Yemen, spokesperson Ned Price told a press briefing on Thursday, adding that the assaults were exacerbating the humanitarian crisis in the country. (RTRS)

FOREX: Near-term bets in favour of the dollar should be increased, a majority of analysts in Reuters polls said, who however were split on the duration of the greenback's bullish trend and forecast its allure to fade in a year. Tracking the Federal Reserve's surprisingly hawkish outlook at the June meeting, the dollar ended its two month losing streak and gained about 3% against a basket of currencies last month, marking its best monthly performance in 4-1/2 years. (RTRS)

OIL: The OPEC+ alliance descended into bitter infighting after a key member blocked a deal at the last minute, forcing the group to postpone its meeting and casting doubt on an agreement that could ease a surge in oil prices. The standoff between the United Arab Emirates and the rest of the cartel could ultimately mean that OPEC+ won't increase production at all, according to a delegate. Without a deal it would fall back on existing terms that call for output to remain unchanged until April 2022. That would squeeze an already tight market, risking an inflationary price spike. The dramatic turn of events leaves the market in limbo -- just as inflationary pressures are fixating investors with oil above $75. It also tarnishes the cartel's carefully reconstructed reputation, raising the specter of the destructive Saudi-Russia price war of last year. (BBG)

CHINA

PBOC: Chinese markets may face more volatile liquidity conditions in the second half as the PBOC reduced the size of injections, more MLFs are expected to reach maturity, and local government bond sales rise after slower-than-expected progress in H1, the Securities Times said citing analyst Ming Ming of Citic Securities. The PBOC has likely returned to its previous normal injection size since yesterday, when it conducted CNY10 billion 7-day reverse repo purchases, a quantity that had been consistent for three months, the newspaper said. The central bank had boosted the daily injection through reverse repos to CNY30 billion for about a week since June 24, signaling its intention to ensure a seasonal rise in liquidity demand, the newspaper said. (MNI)

YUAN: Global central banks continue to increase the holding of yuan assets, with their share of global forex reserves up to 2.45%, a record high since the IMF first reported the data in Q4 2016, the 21st Century Business Herald reported. While the Federal Reserve's retreat from QE is increasingly expected, China's continued recovery, stable monetary policy and a less volatile currency have further increased the safety and hedging properties of yuan assets, the newspaper said citing analysts. There is great potential for global investors to increase yuan bonds, the newspaper cited analysts as saying. (MNI)

OVERNIGHT DATA

JAPAN JUN MONETARY BASE +19.1% Y/Y; MAY +22.4%

JAPAN JUN MONETARY BASE END OF PERIOD Y659.5TN; MAY Y651.0TN

AUSTRALIA MAY HOME LOANS VALUE +4.9% M/M; MEDIAN +1.8%; APR +3.7%

AUSTRALIA MAY OWNER-OCCUPIER LOAN VALUE +1.9% M/M; MEDIAN +4.5%; APR +4.3%

AUSTRALIA MAY INVESTOR LOAN VALUE +13.3% M/M; MEDIAN +6.0%; APR +2.1%

NEW ZEALAND JUN ANZ CONSUMER CONFIDENCE INDEX 114.1; MAY 114.0

NEW ZEALAND JUN ANZ CONSUMER CONFIDENCE +0.1% M/M; MAY -1.2%

SOUTH KOREA JUN CPI +2.4% Y/Y; MEDIAN +2.5%; MAY +2.6%

SOUTH KOREA JUN CPI -0.1% M/M; MEDIAN 0.0%; MAY +0.1%

SOUTH KOREA JUN CORE CPI +1.5% Y/Y; MEDIAN +1.4%; MAY +1.5%

CHINA MARKETS

PBOC DRAINS NET CNY10BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 1.9578% at 09:24 am local time from the close of 2.1117% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 67 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4712 FRI VS 6.4709

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for third day at 6.4712 on Friday, compared with the 6.4709 set on Thursday.

MARKETS

SNAPSHOT: NFPs On Deck Ahead Of Long U.S. Weekend

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 58.81 points at 28765.85

- ASX 200 up 32.028 points at 7297.6

- Shanghai Comp. down 56.552 points at 3532.229

- JGB 10-Yr future up 4 ticks at 151.88, yield up 0.4bp at 0.046%

- Aussie 10-Yr future up 4.5 ticks at 98.515, yield down 4.8bp at 1.472%

- U.S. 10-Yr future +0-02+ at 132-11, yield up 0.34bp at 1.461%

- WTI crude unch. at $75.23, Gold up $1.51 at $1778.35

- USD/JPY up 4 pips at Y111.57

- J&J SHOT EFFECTIVE AGAINST DELTA VARIANT (BBG)

- U.S. WINS INTERNATIONAL BACKING FOR GLOBAL MINIMUM TAX (WSJ)

- AUSTRALIA OUTLINES 4-PHASE PLAN AIMING TO END LOCKDOWNS AND BORDER CLOSURES

- OPEC+ OIL DEAL HANGS IN THE BALANCE AS KEY MEMBER REBELS (BBG)

BOND SUMMARY: Core FI Little Changed Ahead Of NFPs, JGBs Give Back O'night Gains

T-Notes stuck to a 0-02+ range in Asia, last +0-02 at 132-10+, while the major cash Tsy benchmarks print little changed to 1.0bp cheaper, with the curve seeing some light bear flattening after Thursday's late twist flattening. Headline and market flow was light overnight, in what was a typical pre-NFP, pre-Independence Day weekend Asia-Pac session.

- JGB futures gradually gave back their overnight gains during the Tokyo morning, and last trade +3 on the day. The major cash JGB benchmarks trade little changed to ~1.5bp richer, with some light underperformance for the front end of the curve, while the belly was perhaps limited by the previously noted move in futures. There were steady and lower bid/cover ratios in the 1- to 3- and 10- to 25-Year BoJ Rinban buckets, even with the purchase sizes of the buckets being trimmed by Y25bn and Y50bn respectively from this round of Rinban operations going forwards (which was announced in the Jul-Sep Rinban plan).

- A sedate session for the Aussie bond space, outside of the previously discussed early tick higher in YM (likely linked to some pre-RBA positioning adjustment, as evidenced by the movement in the ACGB Apr '24/Nov '24 yield spread), with that contract now +2.5 on the day, while XM prints +4.5. A drab AOFM issuance outline for the first half of the current FY, with the AOFM failing to introduce a new conventional ACGB line, as well as the proximity to the U.S. NFP report and next week's RBA decision, has left the space to operate in narrow ranges.

JGBS AUCTION: Japanese MOF sells Y4.8866tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.8866tn 3-Month Bills:- Average Yield -0.0998% (prev. -0.0982%)

- Average Price 100.0249 (prev. 100.0245)

- High Yield: -0.0962% (prev. -0.0962%)

- Low Price 100.0240 (prev. 100.0240)

- % Allotted At High Yield: 3.8526% (prev. 54.3982%)

- Bid/Cover: 3.168x (prev. 3.731x)

BOJ: Rinban Conducted

The BoJ offers to buy a total of Y1.050tn of JGBs from the market, with the adjustments to purchase sizes already reflected in the BoJ's Rinban plan for Jul-Sep:

- Y450bn worth of JGBs with 1-3 Years until maturity (prev. Y475bn)

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y150bn worth of JGBs with 10-25 Years until maturity (prev. Y200bn)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '25 Bond, issue #TB161:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2025 Bond, issue #TB161:- Average Yield: 0.6217% (prev. 0.6191%)

- High Yield: 0.6250% (prev. 0.6225%)

- Bid/Cover: 4.1700x (prev. 3.5250x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 3.3% (prev. 31.5%)

- bidders 44 (prev. 48), successful 18 (prev. 22), allocated in full 10 (prev. 14)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Wednesday 7 July it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

- On Thursday 8 July it plans to sell A$1.5bn of the 24 September 2021 Note & A$500mn of the 26 November 2021 Note.

AUSSIE BONDS: AOFM Issuance Update

The AOFM notes that "this notice provides updated details of planned issuance of Australian Government Securities by the Australian Office of Financial Management (AOFM) for the first half of 2021-22."

- "At Budget planned issuance of Treasury Bonds for 2021-22 was around $130 billion. Regular issuance via tender will occur most weeks as per past practice. No new maturities are planned during the first half of 2021-22."

- "Planned issuance of Treasury Indexed Bonds (TIBs) in 2021-22 by tender is $2 to 2.5 billion. The practice of two tenders in most months will continue. A new November 2032 TIB is planned to be issued by syndication, subject to market conditions; this issuance will be in addition to the $2 to 2.5 billion allocated to regular tenders. A repurchase of the February 2022 TIB will be considered in conjunction with this syndication."

- "Regular weekly issuance of Treasury Notes will be undertaken. Issuance volumes will vary over the course of the year depending on the timing and size of government receipts and outlays and the AOFM's assessment of its liquidity requirements."

EQUITIES: China Markets Come Under Heavy Pressure

A mixed day for equities in the Asia-Pac region. Chinese equities have come under notable pressure, the downtick in margin balances lodged at the Shanghai exchange and withdrawal of the PBoC's late June seasonal liquidity injections over the last couple of days weighed, while some noted that the perceived "period of safety" ahead of the CCP's 100th anniversary (which was celebrated on Thursday) has now passed, which could be applying some pressure. Elsewhere, Sino-US tensions continue to bubble. Thursday saw US Commerce Secretary Raimondo note that the US "will make sure that the Chinese play by the rules, protect IP, allow our markets, our companies to access that market." Markets in Japan are higher alongside small gains in Australia, Taiwan and South Korea following a positive lead from the US; in South Korea inflation rose above the BoK's target but slowed down from last month. Futures are mixed in the US ahead of the NFP report later today; e-mini-Dow Jones and e-mini S&P contracts are higher while the Nasdaq has slipped slightly. Johnson & Johnson continued to gain after saying that its single-shot coronavirus vaccine is effective against the delta variant.

OIL: Oil Holds Gains Ahead Of OPEC+ Talks Resumption

Oil is higher, on track for a fourth day of gains. WTI is up $0.20 from settlement at $75.43/bbl while Brent is up $0.18 at $76.02. WTI gained 2.4% yesterday and briefly rose above $76/bbl after OPEC+ members failed to reach a final agreement on oil production plans in coming months. If the resumption of talks later today doesn't result in an agreement, the group would fall back on existing agreements and keep oil supply unchanged until April 2022 which could exacerbate deficit conditions in oil markets. The group had reportedly agreed in principle to boost oil production by 400k bpd a month from August to December but the deal was blocked by UAE at the last minute. The UAE said it would only back a deal if the baseline for its output cuts was increased.

GOLD: Tight Ahead Of NFP

Conflicting inputs from a stronger USD and marginally lower U.S. real yields (although our weighted U.S. real yield monitor continues to operate comfortably off of the cycle lows) leave gold within the confines of a tight range. The initial technical lines in the sand remain untouched, with today's NFP print the key input ahead of the elongated U.S. weekend. Spot last deals little changed, just shy of $1,780/oz.

FOREX: USD Waits For NFP, Antipodeans Lose Ground

The DXY operated in close proximity to its three-month highs in a typically quiet pre-NFP Asia-Pac session. Upbeat ADP employment data and weekly initial jobless claims released over the last two days raised expectations surrounding the upcoming NFP report. The greenback is poised to finish the week as the best G10 performer, before the U.S. closes for the observance of its Independence Day on Monday.

- USD/JPY round tripped from a fresh multi-month high (Y111.66) over the Tokyo fix, while holding a tight 15 pip range. Participants eyed the expiry of $2.0bn of options with strikes at Y111.00 at today's NY cut, with a further $2.0bn of USD calls with strikes at Y111.40-50 due to roll off.

- The Antipodeans lost ground amid continued sense of concern about Australia's Covid-19 situation and the economic fallout from virus containment measures. Their commodity-tied peers NOK and CAD were resilient.

- USD/CNH climbed to a fresh weekly high. The PBOC set its central USD/CNY mid-point at CNY6.4712, 8 pips above sell-side estimate.

- The NFP provides the main point of note today, with U.S. trade balance, factory orders & final durable goods orders also coming up. Speeches are due from ECB's Lagarde & de Cos.

FOREX OPTIONS: Expiries for Jul02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1750(E1.0bln), $1.1820-25(E1.5bln-EUR puts), $1.1850-55(E2.6bln), $1.1865-66(E1.1bln), $1.1895-1.1900(E2.0bln), $1.1940-50(E3.9bln), $1.2025-35(E543mln)

- USD/JPY: Y109.35-50($1.2bln), Y109.75($650mln), Y110.20-25($656mln), Y110.70-80($1.8bln), Y111.00($2.0bln), Y111.40-50($2.0bln-USD calls), Y111.75($1.9bln-USD calls)

- EUR/JPY: Y132.00-20(E582mln)

- AUD/USD: $0.7495-00(E514mln), $0.7625(A$593mln)

- USD/CAD: C$1.2250($988mln), C$1.2300($730mln), C$1.2325($855mln), C$1.2500-15($830mln)

- USD/CNY: Cny6.32($1.6bln-USD puts), Cny6.40($950mln), Cny6.45($875mln)

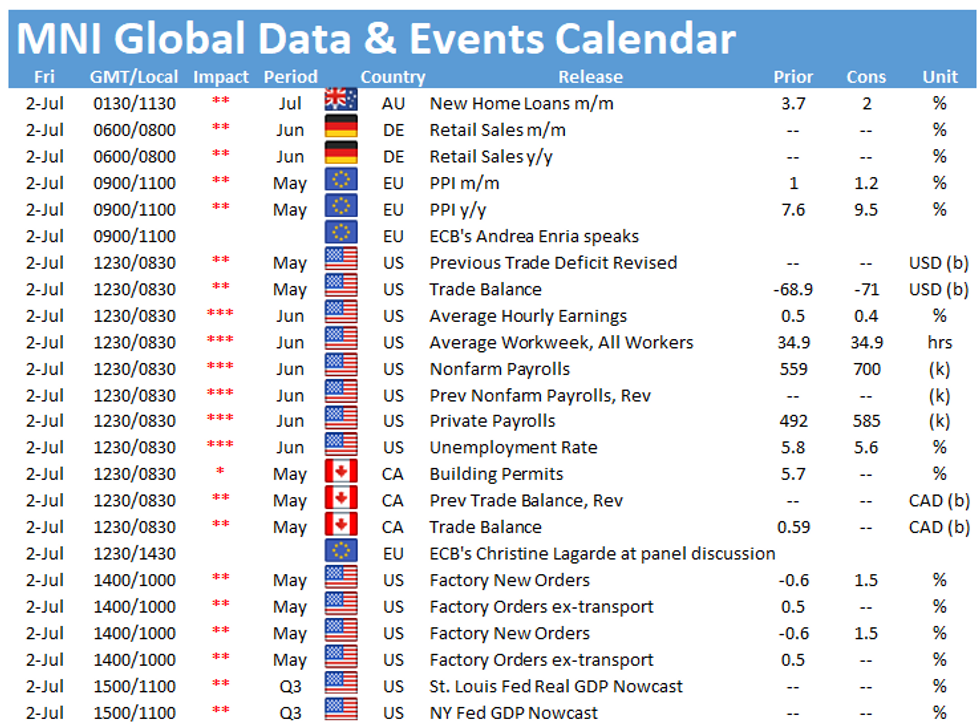

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.