-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Hawkish RBNZ View Changes Dominate In Asia

EXECUTIVE SUMMARY

- COVID: MOST RULES SET TO END IN ENGLAND, SAYS PM (BBC)

- MERKEL, MACRON URGE CHINA TO ALLOW MORE FLIGHTS TO HELP TIES (BBG)

- RBA DECISION EYED

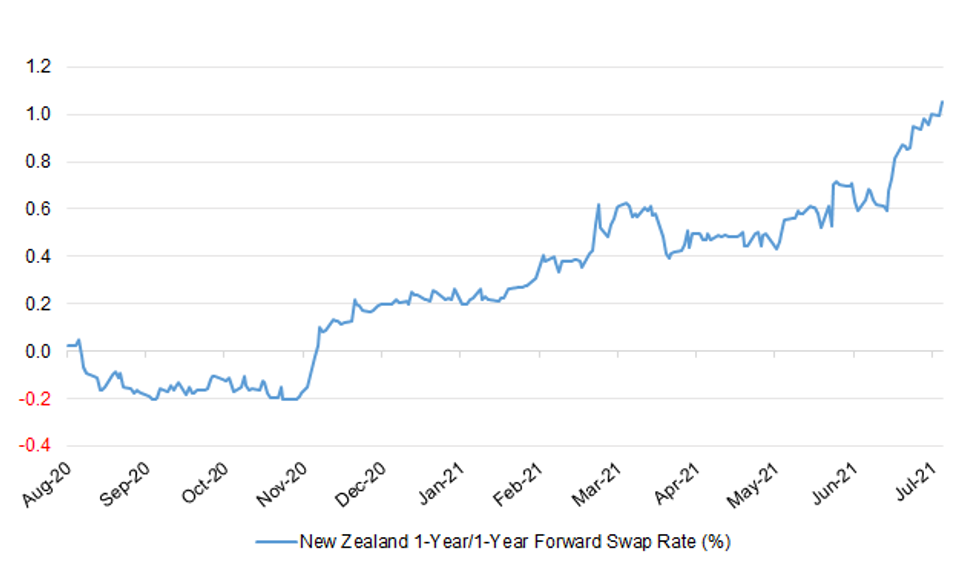

- 2 NOTABLE SELL-SIDE NAMES ROLL FORWARD THEIR CALL FOR RBNZ OCR HIKE TO NOV '21

- SAUDI-UAE RIFT CONTINUES TO THWART OPEC+ OIL QUOTA DEAL, AS MEETING IS CANCELLED (PLATTS)

- BIDEN OFFICIALS URGE OPEC MEMBERS TO FIND OUTPUT COMPROMISE (BBG)

Fig. 1: New Zealand 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Face masks will no longer be legally required and distancing rules will be scrapped at the final stage of England's Covid lockdown roadmap, Boris Johnson has confirmed. The rule of six inside private homes will be removed and work-from-home guidance abolished as 16 months of on-off restrictions on daily life end. The PM said he expected the final step would go ahead as planned on 19 July. This will be confirmed on 12 July after a review of the latest data. Further updates on school bubbles, travel and self-isolation will follow in the coming days, Mr Johnson told a Downing Street news conference. He said that even after the removal of the legal requirement to wear a face covering, he would continue to wear one himself in crowded places "as a courtesy". (BBC)

CORONAVIRUS: Prof Chris Whitty, England's chief medical officer, has set out three simple personal guidelines for when to continue wearing face masks after the Covid restrictions have been lifted. Boris Johnson and Whitty were asked at Monday's Downing Street press conference what circumstances they would still use face coverings after 19 July. Johnson said he wanted to move away from "government diktat". But then Whitty offered a three-part rule of thumb for continuing to wear a mask: in crowded indoor spaces; when required to by an authority; or to make someone else feel comfortable. He said these situations were all particularly important at a time when "the epidemic is significant and rising". (Guardian)

CORONAVIRUS: Boris Johnson is suffering a backlash over his plans to ditch rules on wearing face masks. Doctors, regional mayors, trade unions and health charities are among those who have expressed fears over the relaxed measures. Labour leader Sir Keir Starmer has also warned that lifting all restrictions in one go would be "reckless" - and is calling for face coverings to remain mandatory on public transport. He said: "To throw off all protections at the same time when the infection rate is still going up is reckless. "We need a balanced approach, we need to keep key protections in place, including masks, including ventilation and crucially... proper payments to those who need to self-isolate." (Sky)

CORONAVIRUS: The prime minister has announced that he wants to scrap the work-from-home order later this month, as he moves to end England's remaining coronavirus restrictions. But businesses have called for urgent clarity on what they will need to do to keep staff and customers safe, saying the "logistical headache" they face has not disappeared. (Sky)

CORONAVIRUS: All adults in England will be offered their second dose of a coronavirus jab eight weeks after their first to try to speed up the vaccination programme, ministers announced yesterday. The government is aiming for everyone to have been offered both doses by mid-September after cutting the interval from 12 to eight weeks for under-40s. Second doses for over-40s were accelerated last month after ministers delayed the easing of restrictions by four weeks. Sajid Javid, the health secretary, said yesterday that 86 per cent of adults in the UK had received at least one jab and 64 per cent had had two. However, vaccination rates have slowed significantly in recent weeks, raising concerns about take-up. (The Times)

POLITICS: Sir Graham Brady is facing a challenge to be re-elected as chairman of the 1922 Committee of Conservative backbenchers amid accusations that he has not been loyal enough to the government during the pandemic. Heather Wheeler, the MP for South Derbyshire and a former whip, is the government's preferred candidate. She has said she wants to resolve disputes between ministers and backbenchers behind closed doors. The result of this week's election will be announced tomorrow. Only Conservative MPs not on the government's payroll are allowed to vote. Brady, 54, has been chairman of the 1922 Committee since 2010. He has been an outspoken critic of lockdown restrictions over the past year, regularly rebelling on votes to extend them. (The Times)

EUROPE

ECB: The European Central Bank is entering the final stretch of its biggest strategy review in almost two decades, with officials looking to hammer out key differences over future monetary policy. The central bank's top policy makers are gathering this week for discussions that were initially launched by President Christine Lagarde in early 2020 but were quickly delayed by the coronavirus pandemic. A key issue at stake is agreeing to a new formulation of the ECB's inflation target, a topic that dominated reviews by other major central banks such as the U.S. Federal Reserve after years of lackluster price growth. The ECB's role in fighting climate change, as well as how to address an ever-evolving labor market will also be high on the agenda. The discussions start with a dinner in Frankfurt on Tuesday and may culminate in an announcement as early as this week if final hurdles are cleared, according to people familiar with the matter. (BBG)

ECB: ECB Vice President Luis de Guindos says euro-area inflation could be as high as 3% during 4Q. Guindos, speaking at a virtual event, says jump in inflation will be temporary. Says monitoring potential second-round effects on prices. (BBG)

ECB: The European Central Bank plans to come down on banks that are taking too much risk via financial instruments such as leveraged loans and equity-related derivatives, the ECB's top supervisor Andrea Enria said on Friday. "In key areas such as leveraged finance ... we plan to deploy the full range of supervisory tools available to us, including minimum capital requirements commensurate with the specific risk profile of individual banks, should this become necessary," Enria said in a speech. (RTRS)

CORONAVIRUS: The German government is significantly easing entry restrictions imposed on Portugal, Britain, Russia, India and Nepal due to the spread of particularly contagious coronavirus variants. On Wednesday, the five countries will see their status downgraded from "virus variant areas" to "high incidence areas," the Robert Koch Institute for disease control said on Monday. This means that entry to Germany is possible again for all groups of people. For people who are fully vaccinated or have recovered from the coronavirus, the quarantine obligation has been completely scrapped; for all others, it is shortened. India had been classified as a virus variant area at the end of April, followed by Nepal and Britain in May. Portugal and Russia hit the list on June 29. Airlines, bus and train companies are not allowed to transport people from virus variant areas to Germany unless they are German citizens or have a residence in Germany. Furthermore, anyone entering Germany from virus variant areas must quarantine for 14 days - even if they are fully vaccinated or recovered. (DPA)

BONDS: The European Financial Stability Facility (EFSF) raised €2 billion on Monday with a tap sale of a 10-year bond tenor and completed its 2021 funding needs. The EFSF no-grow tap sale takes the outstanding issue of the 0% 20 January 2031 bond to €5 billion. The spread was fixed at mid-swaps minus 5 basis points, for a reoffer yield of 0.014%. The bond was first issued in January when it raised €3 billion. The order book was in excess of €16.5 billion, excluding joint lead manager interest. (EFSF)

OTHER

EU/CHINA: German Chancellor Angela Merkel and French President Emmanuel Macron urged China to allow more flights from Europe as the two leaders pressed Chinese President Xi Jinping on Monday to engage more closely with the bloc. China and the European Union have struggled to keep cooperation afloat as the bloc's leaders have turned sharply toward criticizing Beijing's human rights record. The overall focus of the video call, which covered a wide range of topics, was to try and fix that. (BBG)

CORONAVIRUS: Pfizer's vaccine appears to be less effective in halting the spread of the delta strain, though it remains highly effective at preventing severe illness, according to data from Israel's government. The shot protected 64% of people against Covid between June 6 and early July, down from 94% between May 2 and June 5, the Ynet news website reported, citing Health Ministry numbers. At the same time, the vaccine's efficacy at keeping people who get infected out of the hospital in that period slipped only slightly, to 93% from 98%. (BBG)

CORONAVIRUS: The strongest, most credible evidence indicate SARS-CoV-2 evolved in nature, and suggestions of a laboratory leak aren't backed by scientific evidence, scientists wrote in a letter to the Lancet Monday. In a follow up to a February 2020 letter to the medical journal, two dozen physicians, veterinarians, epidemiologists, virologists, biologists, ecologists, and public health experts said science, not speculation, is essential to determine how the pandemic began. "Allegations and conjecture are of no help," wrote the authors, who include Rita Colwell, Peter Daszak, Christian Drosten, Jeremy Farrar and Juan Lubroth. "It is time to turn down the heat of the rhetoric and turn up the light of scientific inquiry if we are to be better prepared to stem the next pandemic, whenever it comes and wherever it begins." (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga will meet with relevant ministers this afternoon to discuss whether enhanced virus steps in Tokyo and other areas will be extended, broadcaster TBS reports, without attribution. Extending enhanced virus measures by as much as ~1 month to cover the entire duration of the Tokyo Olympics is among proposals being considered. Given that virus cases are rising in Tokyo and other areas, ending the virus measures as scheduled on July 11 isn't an option, TBS says, citing an administration official. Expert panel expected to make decision Thursday. (BBG)

JAPAN: The Japanese government is planning to hold the opening ceremony of the Tokyo Olympics without fans, giving up earlier plans to have spectators at the July 23 event, the Asahi newspaper reported, citing several unidentified government officials. IOC committee members, sponsors and other officials will be allowed to attend the ceremony, but the government will attempt to further downsize the number. Venues with capacity of 10,000 people or more will be banned from having spectators as well as games scheduled later than 9 p.m. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda and his board are likely to offer incentives for lending in the battle against climate change when they meet later this month, according to economists. The central bank has promised to unveil the initial details of its green lending measure at a policy meeting ending on July 16, with most analysts expecting it to model the facility at least partially on Covid-19 loan incentives introduced in March. While that framework offers to pay commercial banks different rates depending on the purpose of lending, some BOJ officials want to avoid getting bogged down in trying to differentiate between green projects, according to people familiar with the matter. (BBG)

AUSTRALIA: The ABS notes that "payroll jobs rose by 0.3% nationally in the fortnight to 19 June 2021, following a 0.8% fall in the previous fortnight. Payroll jobs increased in every state and territory through the first half of June, ranging from 0.1% in New South Wales and Western Australia to 0.6% in the Australian Capital Territory. Payroll jobs in Victoria rose by 0.4% in the fortnight to 19 June 2021, as the restrictions associated with its recent lockdown eased. This followed a fall of 2.1% in the previous fortnight. Accommodation and food services in Victoria showed early signs of recovery from the lockdown, rising 6.4% across the fortnight, while Arts and recreation services fell, down by 3.2%. This followed large falls in the previous fortnight in both industries (down 15.3% and 10.4%). Nationally, payroll jobs in the Accommodation and food services industry rose by 1.4% in the fortnight and fell by 1.0% in Arts and recreation services. The Victorian lockdown had a more pronounced impact on payroll jobs in the Greater Melbourne region than in the Rest of Victoria. However, the early signs of recovery in payroll jobs were also more evident in Greater Melbourne." (MNI)

AUSTRALIA: Australia needs to vaccinate at least 85% of the population to achieve herd immunity, a James Cook University researcher said in a statement Monday. "Herd immunity has become more difficult to achieve with the delta variant, as it is both more infectious and less amenable to vaccination," said Emma McBryde, professor of infectious diseases epidemiology and modelling. If vaccine coverage was directed at the most infectious age groups, Australia could achieve herd immunity by vaccinating 75% of the population. However this may not be realistic, because it would require nearly 100% uptake in the 20-to-60-year age groups, she said. "We have also shown that even without herd immunity, vaccinated people are protected against severe disease and much less likely to be hospitalized or die," McBryde said. (BBG)

AUSTRALIA: The Australian Formula One Grand Prix and MotoGP are set to be cancelled on Tuesday for a second straight year because of the coronavirus pandemic, AFP understands. Organisers planned to stage the races in October and November, but have hit roadblocks over Australia's requirement for overseas arrivals to undergo 14 days of mandatory quarantine. An official announcement by Australian Grand Prix Corporation chief Andrew Westacott is expected later Tuesday, AFP has learned. (AFP)

NEW ZEALAND: The latest NZIER Quarterly Survey of Business Opinion (QSBO) shows a sharp improvement in both business confidence and demand in firms' own business. A net 10 percent of businesses expect an improvement in the economic outlook on a seasonally adjusted basis – a turnaround from the net 8 percent of businesses who had expected a deterioration in the previous quarter. Firms' own trading activity also picked up strongly, with a net 26 percent of businesses reporting increased demand in the June quarter. These results suggest the recovery in the New Zealand economy will remain robust over the coming year. (NZIER)

SOUTH KOREA: South Korea will review normalizing eased FX prudential rules, depending on future economic circumstances and FX demand and supply conditions, Vice Finance Minister Lee Eog-weon says during a FX prudence review meeting held for the first time. (BBG)

NORTH KOREA: North Korea's Premier Kim Tok-hun made field inspection visits to economic sites, state media said Tuesday, confirming that he has been spared from a recent reshuffle carried out to fire officials responsible for causing a "crucial case" in the country's fight against the coronavirus. Kim, also a member of the Presidium of the Politburo of the Central Committee of the ruling Workers' Party, "inspected several units concerning the national economy" and saw preparations to prevent flooding ahead of the summer monsoon season, according to the Korean Central News. (Yonhap)

TURKEY: President Recep Tayyip Erdoğan said in a press conference late Monday that Turkey's direct financial support during the COVID-19 pandemic has surpassed $17 billion (TL 147 billion). "Turkey's direct financial support during the pandemic topped $17.3 billion," he said. Erdoğan also said that the government's financial supports aim to reach 3.5% of gross domestic product (GDP) by the end of 2021. The president stated that Turkey boosted employment by 2.8 million since the start of the outbreak in April 2020 by compensating for lost jobs. Erdoğan also gave good news with regards to Turkey's exports. "Turkey will break a new record by exceeding $200 billion in total exports by the end of this year," he said. (Daily Sabah)

MEXICO: Mexico's energy ministry has designated Petroleos Mexicanos as the operator of the country's largest oil discovery by private companies, in the latest sign of the government's nationalist approach to the energy industry. The Zama field, discovered in 2017 by a private consortium led by Talos Energy Inc., will be operated by the state-owned producer, according to a statement by Talos on Monday. The resolution ends a long-standing conflict between Pemex, as the state company is known, and the Houston-based producer over the field, which contains as many as one billion barrels of oil equivalent. (BBG)

BRAZIL: Brazil President Jair Bolsonaro's popularity fell to the lowest level since assuming office as he's accused of turning a blind eye to an alleged kickback scheme in the purchase of coronavirus vaccines. Bolsonaro is approved by 34% of the population, down from 44% in February, according to an MDA poll published on Monday by the National Transport Confederation. Meanwhile, rejection rates for the president and his government hit all-time highs of 63% and 48%, respectively. Roughly 40% said they would prefer former President Luiz Inacio Lula da Silva to win next year's election, compared to 25% who want Bolsonaro as head of state for another term. About 30% would like to see someone who's not the former president nor the incumbent winning. (BBG)

BRAZIL: Brazil's govt is extending the emergency aid for another 3 months -- Aug., Sept. and Oct., President Jair Bolsonaro says in a video published on social media. These additional 3 months aim to protect the most vulnerable while Brazil does not achieve mass vaccination, Economy Minister Paulo Guedes says. Health Minister Marcelo Queiroga expects that in another 3 months there will be an epidemiological control and then Brazil will return to Bolsa Familia social program, according to Guedes. (BBG)

BRAZIL: Brazil's Economy Ministry is expected to revise its economic growth estimate for 2021 next week, Economic Policy secretary Adolfo Sachsida told the newspaper Valor Economico. The current forecast points to a 3.5% GDP growth this year. The quality of the economic growth is more important than the scope, Sachsida said, noting Brazil's GDP expansion has been mostly driven by private investment, the newspaper added. (BBG)

EQUITIES: Weeks before Didi Global Inc. went public in the U.S., China's cybersecurity watchdog suggested the Chinese ride-hailing giant delay its initial public offering and urged it to conduct a thorough self-examination of its network security, according to people with knowledge of the matter. But for Didi, waiting would be problematic. In the absence of an outright order to halt the IPO, it went ahead. The company, facing investor pressure to list after raising billions of dollars from prominent venture capitalists, wrapped up its pre-offering "roadshow" in a matter of days in June—much shorter than typical investor pitches made by Chinese firms. The listing on the New York Stock Exchange raised about $4.4 billion, making it the biggest stock sale for a Chinese company since Alibaba Group Holding Ltd.'s IPO in 2014. (WSJ)

MIDDLE EAST: A drone that was launched and aimed at the U.S. Embassy in Baghdad was shot down by U.S. troops protecting the building, al-Sumaria News reported, citing security officials. Siren alarms were heard; C-RAM defense system was activated to shoot down the drone. (BBG)

OIL: OPEC and its allies abruptly called off their July 5 meeting, after a flurry of mediation efforts failed to resolve a Saudi-UAE standoff, raising the risks that the producer group could steer the market into a supply squeeze if it sticks to current quotas – or potentially a bruising price war if the coalition collapses. No date has been set for a rescheduled meeting, though delegates said members were still holding backchannel consultations to try and broker a deal between the Gulf neighbors and growing rivals. (Platts)

OIL: The financial adviser to Iraq's prime minister said that "in the absence of coordination and understandings between OPEC producers, the beginnings of a price war will be formed again," the Iraqi News Agency (INA) quoted him as saying on Monday. Mazhar Mohammed Saleh added that "the increases in production within the OPEC member countries must be carried out with caution and in high coordination among the member countries themselves to avoid any potential glut in the crude oil supply market that may cause undesirable price imbalances." (RTRS)

OIL: The Biden administration is urging OPEC and its allies to find a compromise solution to increase production after the cartel abandoned a meeting Monday, according to White House officials familiar with the discussions. Even though the U.S. isn't a party to the talks, it's "closely monitoring the OPEC+ negotiations and their impact on the global economic recovery from the Covid-19 pandemic," a White House spokesperson said Monday. "Administration officials have been engaged with relevant capitals to urge a compromise solution that will allow proposed production increases to move forward." (BBG)

CHINA

ECONOMY: China's GDP growth may slow to 8.0% y/y in Q2 from Q1's 18.3% given the reduced base effect, and that the resurgence of the epidemic and rising commodity prices slowed the recovery of consumption and manufacturing investment, Yicai.com reported citing Luo Zhiheng, deputy dean of the research institute of Yuekai Securities. The pressure of stabilizing growth will increase in H2, as supply constraints and rising costs in the supply side, as well as high leverage and weak spending on the demand side both limit growth, the newspaper said citing Wang Jun, chief economist of Zhongyuan Bank. (MNI)

LOCAL GOV'T BONDS: Local government bond sales may remain sluggish in H2 as the central government has introduced several measures to tighten rules on special bonds backed by infrastructure, the 21st Century Business Herald reported citing analysts. As an example, in a province in western China, only 40% of over 2,000 infrastructure projects got approved as the review processes tightened, the newspaper said. The issuance of new special bonds has been slow with a quota of about CNY2.1 trillion to be issued in H2, the newspaper said. New quotas for special bonds may drop significantly from next year, as they are no longer needed for resecuring growth, the newspaper cited Zhou Yue, chief fixed-income analyst of Zhongtai Securities. (MNI)

OVERNIGHT DATA

JAPAN MAY LABOUR CASH EARNINGS +1.9% Y/Y; MEDIAN +2.1%; APR +1.4%

JAPAN MAY REAL CASH EARNINGS +2.0% Y/Y; MEDIAN +2.4%; APR +1.9%

JAPAN MAY HOUSEHOLD SPENDING +11.6% Y/Y; MEDIAN +11.0%; APR +13.0%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 107.8; PREV. 112.2

Consumer confidence dropped 3.9% over the past week to its lowest level since the first week of April. The fall came as lockdowns and restrictions broadened across a number of states to control the spread of the more infectious Delta variant of the pandemic. The drop in sentiment wasn't confined to those areas directly impacted by restrictions. For instance, while it fell by 8.9% in Sydney it also declined by 1.6% in the rest of NSW. Confidence fell in most other cities as well: Brisbane (-7.7%), Melbourne (-2.7%) and Adelaide (-6.5%).With the lockdowns in Brisbane and Perth coming to an end, we can expect confidence, and consumer spending, to rebound reasonably quickly given past experience, but much will depend on whether restrictions in Sydney are able to be eased. (ANZ)

CHINA MARKETS

PBOC NET DRAINS CNY20BN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation resulted in a net drain of CNY20 billion given the maturity of CNY30 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:24 am local time from the close of 1.9537% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 41 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4613 TUES VS 6.4695

People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4613 on Tuesday, compared with the 6.4695 set on Monday.

MARKETS

SNAPSHOT: Hawkish RBNZ View Changes Dominate In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 95.84 points at 28693.28

- ASX 200 down 23.65 points at 7291.3

- Shanghai Comp. down 18.677 points at 3515.645

- JGB 10-Yr future down 15 ticks at 151.97, yield up 0.4bp at 0.043%

- Aussie 10-Yr future down 1.5 ticks at 98.545, yield up 1.7bp at 1.451%

- U.S. 10-Yr future -0-01+ at 132-20, yield up 2.03bp at 1.444%

- WTI crude up $1.53 at $76.69, Gold up $5.71 at $1797.52

- USD/JPY down 12 pips at Y110.85

- COVID: MOST RULES SET TO END IN ENGLAND, SAYS PM (BBC)

- MERKEL, MACRON URGE CHINA TO ALLOW MORE FLIGHTS TO HELP TIES (BBG)

- RBA DECISION EYED

- 2 NOTABLE SELL-SIDE NAMES ROLL FORWARD THEIR CALL FOR RBNZ OCR HIKE TO NOV '21

- SAUDI-UAE RIFT CONTINUES TO THWART OPEC+ OIL QUOTA DEAL, AS MEETING IS CANCELLED (PLATTS)

- BIDEN OFFICIALS URGE OPEC MEMBERS TO FIND OUTPUT COMPROMISE (BBG)

BOND SUMMARY: RBNZ Views Push Around ACGBs Ahead Of RBA, 30-Year JGB Supply Well Received

The latest move higher in crude oil and building of the Asia-based US$ issuance slate applied some modest pressure to U.S. Tsys during overnight trade. 2s print at unchanged levels in cash trade, while 30s are ~2.5bp cheaper on the day, with bear steepening in play. T-Notes are still holding to a tight 0-03 range, with the contract last -0-02 at 132-19+, representing worst levels of the session. Volume isn't impressive, with ~41K T-Notes trading hands thus far, as liquidity picks back up after the Independence Day weekend.- The JGB space saw a bid kick in after the well-received round of 30-Year JGB supply. The low price comfortably topped broader expectations (which stood at 100.35 per the BBG dealer poll), while the cover ratio ticked higher and the tail narrowed. Futures unwound a chunk of their overnight/morning weakness to last print -8 vs. settlement, with super-long JGBs now printing a little richer on the day in cash trade. This came after some modest weakness during the Tokyo morning, in addition to signs of some paying flows in the super-long end of the swap curve ahead of supply.

- YM -4.5 at typing, XM -2.0, with the latter off of worst levels. Trans-Tasman impetus was in play ahead of today's key RBA decision, with 2 of NZ's big 4 (ASB & BNZ) now looking for the RBNZ to hike the OCR in November '21 applying some fresh pressure to YM. The 5-Year sector leads the cheapening in the cash ACGB space, with 5-Year yields ~4.0bp higher on the day (the NZ curve has been subjected to some bear flattening given the aforementioned RBNZ calls from the sell-side). A reminder that the belly is expected to be the hardest hit area of the curve if the RBA provides a hawkish surprise at today's monetary policy decision.

JGBS AUCTION: Japanese MOF sells Y727.8bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y727.8bn 30-Year JGBs:

- Average Yield 0.680% (prev. 0.693%)

- Average Price 100.48 (prev. 100.15)

- High Yield: 0.681% (prev. 0.697%)

- Low Price 100.45 (prev. 100.05)

- % Allotted At High Yield: 52.9631% (prev. 5.8287%)

- Bid/Cover: 3.632x (prev. 3.388x)

EQUITIES: Mixed Ahead Of US Return

Another mixed day in Asia-Pac equity markets; bourses in mainland China are lower, pressured by losses in Didi Global after China's cyberspace regulator said it was reviewing the company on national security grounds and found serious violations. The NZX 50 is also lower, pressured by a hawkish turn from several banks on the RBNZ and subsequent move higher in NZD. Other markets in the region generally higher, though risk sentiment remains uncertain due to elevated COVID-19 numbers and thin volumes as participants await the return of US markets. Ahead of their return US futures are mixed, the e-mini Nasdaq is lower, e-mini S&P flat, while e-mini Dow Jones is higher on the back of gains in oil.

OIL: OPEC+ Spat Support Gains

Crude futures continued to extend gains on Tuesday. Supported by reports that the prospective OPEC+ deal struck late last week had crumbled, as the UAE refused to budge on the demand for their production baseline to be revised. The preliminary deal could be revisited at a future meeting, but the group failed to set a date for further negotiations, meaning that the cooperative will revert to the pre-existing deal - and no increase in output has been agreed. There is a chance that the next set of talks could come in time to increase output in August, but the public spat has damaged the groups reputation and if no agreement is reached there is a chance members will take it upon themselves increase their own production quotas.

GOLD: Probing $1,800/oz

The softer USD has allowed bulls to test $1,800/oz in Asia-Pac spot trade, with the round number holding firm thus far, last dealing at $1,797/oz. From a technical perspective spot is now through the Jul 2 high, with any break above the $1,800/oz mark set to expose the nearby 20-day EMA. Above there bulls will look to the June 17 high ($1,825.4/oz). Initial support is seen at the June 29 low ($1,750.8/oz).

FOREX: NZD Rallies On Hawkish RBNZ Repricing

The repricing of future OCR path pushed the kiwi higher, as an upbeat NZIER Quarterly Survey of Business Opinion helped build RBNZ rate hike bets. The survey revealed a sharp improvement in business confidence and demand, combined with intensifying inflation pressures. The kiwi's rally accelerated after ASB and BNZ both revised their RBNZ calls and said that they now expect the tightening cycle to begin in November this year.

- NZD/USD surged past its 200-DMA, which limited gains in early Asia-Pac trade. AUD/NZD plunged to its lowest point in more than a month, albeit a BBG trader source flagged demand from short-term accounts looking to buy AUD on dips ahead of the RBA's policy announcement. A degree of spillover from kiwi strength provided further support to the Aussie.

- The greenback went offered across the board before U.S. markets reopen after the Independence Day. USD/JPY extended losses, but struggled to make any substantial headway beyond yesterday's low. Worth flagging that $2.2bn of USD/JPY options with strikes at Y111.00 expire at today's NY cut.

- GBP remained buoyant after PM Johnson confirmed that the UK was poised to ditch most Covid-19 rules on Jul 19.

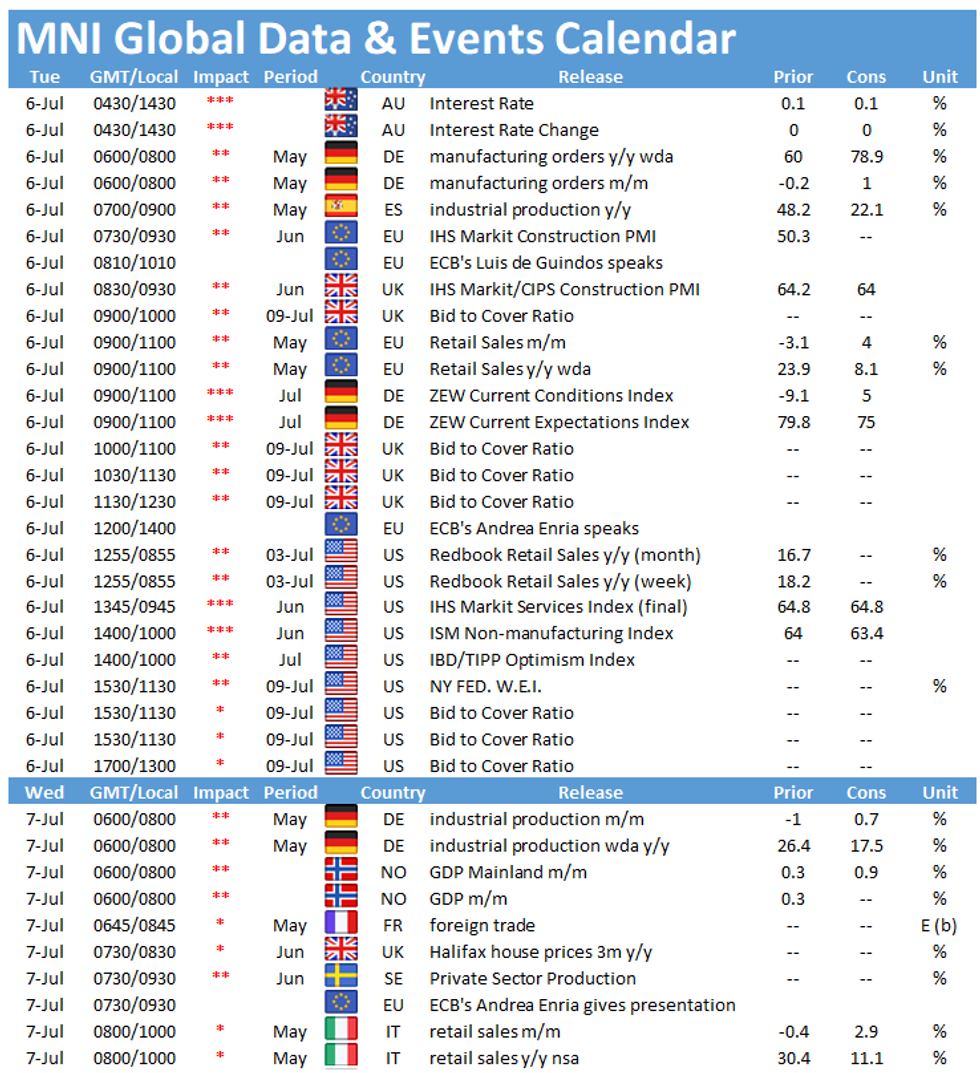

- The RBA's latest monetary policy decision, German ZEW survey & factory orders, U.S. ISM Services, EZ retail sales and ECB speak from de Guindos, de Cos & Visco take focus from here.

FOREX OPTIONS: Expiries for Jul06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1865-80(E1.6bln), $1.1900-10(E1.6bln)

- USD/JPY: Y109.60-70($1.6bln), Y111.00($2.2bln), Y111.20($615mln)

- USD/CNY: Cny6.45($1.7bln-USD puts)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.