-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Commodity Weekly: Oil Markets Assess Trump Impact

MNI Gas Weekly: Winter Weather Takes the Driver's Seat

MNI EUROPEAN OPEN: Familiar Matters Dominate Overnight News Flow

EXECUTIVE SUMMARY

- PFIZER DEVELOPING COVID BOOSTER TO TARGET DELTA VARIANT

- ECB STRIKES CLASSIC COMPROMISE TO SET TERMS OF INFLATION DEBATE (BBG)

- ECB FAILED TO AGREE ON NEW GUIDANCE, TO REVISIT JULY 22 (RTRS SOURCES)

- U.S. SET TO ADD MORE CHINESE COMPANIES TO BLACKLIST OVER XINJIANG (RTRS)

- CHINA MINISTRY SAYS EXPECTS RETAIL SALES TO GROW 5%/YEAR IN 2021-25 (RTRS)

- MSCI TO DELETE SOME CHINESE SECURITIES AS OF JULY 26 CLOSE (BBG)

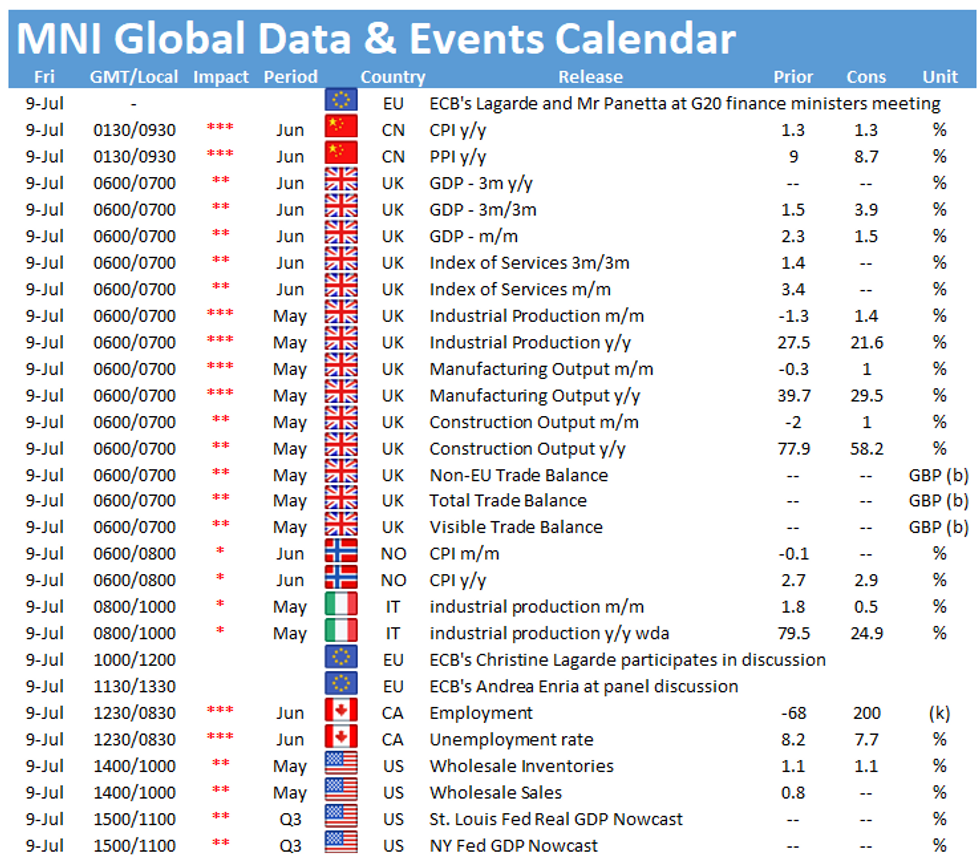

Fig. 1: China PPI vs. CPI Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The £22bn NHS test-and-trace system risks being overwhelmed by surging Covid infections after the planned wholesale lifting of restrictions in England this month, a leading academic has warned. Jon Deeks, a professor of biostatistics at the University of Birmingham, said at least 660,000 gold-standard PCR tests are likely to be needed each day to discover 100,000 daily infections this summer – the number forewarned by the health secretary, Sajid Javid, after the government announced plans to drop restrictions from 19 July. This level of testing is almost three times the current rate in the UK, more than double the highest volume achieved at any point during the pandemic, and at the peak of the system's theoretical laboratory capacity calculated this spring by the National Audit Office (NAO). (Guardian)

CORONAVIRUS: Covid-19 vaccine uptake in England has almost halved over the past fortnight, with health experts blaming mixed government messaging about normality returning on 19 July. Analysis from the Guardian found that take-up had particularly slowed among people under the age of 30 in the last three weeks after an initial surge of enthusiasm that the government likened to a "Glastonbury-style rush". There have been no significant supply issues reported with any of the three coronavirus vaccines licensed in the UK. (Guardian)

CORONAVIRUS: NHS chiefs are looking to cut the sensitivity of their Covid-19 app in England, as politicians fear workplace chaos if millions of people are told to self-isolate after being exposed to the disease. Sajid Javid, health secretary, has backed the review as Conservative MPs warned that the economy and public services could face heavy disruption if, as expected, most final Covid restrictions are lifted on July 19. Ministers have been warned that millions of people could be "pinged" by the app to tell them they had been in close contact with a positive Covid case; Javid has conceded cases could rise to a record 100,000 a day this summer. (FT)

CORONAVIRUS: Grant Shapps is facing a backlash over mandatory PCR tests for children as young as five as part of plans to scrap quarantine for fully vaccinated holidaymakers visiting amber countries from July 19. (Telegraph)

CORONAVIRUS: From 26 July, fully vaccinated people returning to Northern Ireland from so-called amber countries will not have to quarantine under new indicative dates agreed by the executive for lifting Covid restrictions. Stormont ministers agreed the changes when they met on Thursday. They also agreed that theatres are to be allowed to reopen on 26 July. The requirement for face coverings to be worn in places of worship could also be removed then. However, most proposals will need to be ratified at an executive meeting on 22 July. (BBC)

CORONAVIRUS: Airlines reported a five-fold rise in bookings for foreign travel yesterday after the government approved quarantine-free holidays in amber countries in ten days' time. Demand for seats soared after confirmation that fully vaccinated adults can travel to 140 destinations on the amber list from July 19 without isolating on their return to England. Holidaymakers have been told to expect long queues when checking in for their flight home. Grant Shapps, the transport secretary, said that government guidance against leisure travel in amber countries would be dropped. The Foreign Office also said that many amber countries such as France and Spain were now safe for UK tourists, allowing holidaymakers to take out travel insurance. (The Times)

CORONAVIRUS: The Chancellor is rallying Britons to return to the office as soon as the Government's "work from home" guidance lifts, declaring it "really important" for younger staff. Rishi Sunak conceded that operating remotely via Zoom during the pandemic had been "not great" for workers at the beginning of their careers, who find face-to-face interaction particularly "valuable". Signalling his strong support for workers to return to the office at step four of the Prime Minister's roadmap out of restrictions, scheduled for July 19, he said: "I think for young people, especially, that ability to be in your office, be in your workplace and learn from others more directly, is something that's really important and I look forward to us slowly getting back to that." The Telegraph spent an afternoon with the Chancellor in Wolverhampton to make a short film, released on Friday, examining government support for businesses and jobs during the pandemic. (Telegraph)

BREXIT: The government will set out its plans for post-Brexit arrangements for Northern Ireland within the next two weeks - as Labour claimed trust in Boris Johnson over the issue had fallen to "an all-time low". At the end of last month, the UK and EU agreed a three-month extension to a grace period to avert a ban on chilled meats - such as sausages - moving from Great Britain to Northern Ireland. After the extension was agreed, the UK government said it would work "energetically" with the EU to find a permanent solution to the "sausage war", as well as wider issues with the Northern Ireland Protocol. (Sky)

BREXIT: The European Union concluded that the U.K. owes it 47.5 billion euros ($56.2 billion) as part of the Brexit settlement, a higher figure than the U.K. had originally estimated. The EU assessment, which was published in a budget document, is aimed at reflecting the U.K.'s ongoing commitments to EU programs it's still benefiting from, as well as other obligations to the bloc. The bulk of funds are due to the EU in the coming years. (BBG)

ECONOMY: MNI BRIEF: UK Jun Retail Footfall Broadly Unchanged From May

- UK retail footfall ticked up only marginally in June as covid-rules were little changed on the previous, the BRC said Friday, with the BRC-Shoppertrak footfall monitor falling by 27.6% in June compared to June 2020 (Y/2Y), but up just 0.1pp from May. However, "footfall is down on pre-pandemic levels, as the public are making more purposeful shopping trips, with less browsing and more buying," said Helen Dickinson OBE, Chief-Executive of BRC.

POLITICS: Boris Johnson should have the power to appoint ministers who are not MPs or peers, an influential body set up to help overhaul Whitehall is set to recommend. (Telegraph)

EUROPE

ECB: European Central Bank policy makers rejected a proposal to clarify when and under which circumstances they might be ready to tighten monetary policy following changes to their inflation goal, according to officials familiar with the debate at meetings this week. Several parts of the ECB's guidance on future interest rates and asset purchases are tied to progress in lifting inflation to the institution's now out-of-date goal of just-under 2%. That language will need to change at the July 22 policy meeting to reflect the new 2% target and a strategy that could see prices temporarily growing even faster. (BBG)

ECB: European Central Bank policymakers failed to agree on a new policy guidance when they finalised the conclusion of a broad strategy review and will revisit the issue on July 22, three sources familiar with the discussion said on Thursday. The ECB unveiled a new inflation target on Thursday and carved out a role to fight climate change, heralding a potentially fundamental change in how it sets policy. While policymakers agreed on the conclusions of the review unanimously, they failed to agree on what this means for policy in the short term, particularly how the bank's so-called "forward guidance" should be amended. (RTRS)

ITALY: Mario Draghi's cabinet has approved a contentious plan to speed up Italy's chronically slow justice system. The overhaul seeks to address civil and criminal justice proceedings and is part of Italy's commitment to unlock the first tranche of European Union recovery funds. The cabinet approved to plan on Thursday even as the Five Star Movement -- the biggest party in Draghi's large government coalition -- has long been against the re-introduction of statutes of limitation on trials. (BBG)

ITALY/BTPS: Italy plans to sell up to 4.5 billion euros of 0 percent bonds due Aug 15, 2024 in an auction on Jul 13. Italy plans to sell up to 2.75 billion euros of 0.5 percent bonds due Jul 15, 2028 in an auction on Jul 13. Italy plans to sell up to 1.75 billion euros of 0.95 percent bonds due Mar 1, 2037 in an auction on Jul 13. (BBG)

PORTUGAL: Portugal said a nighttime curfew will apply to more municipalities as the government tries to contain an increase in coronavirus infections. The limit to movement in public spaces between 11 p.m. and 5 a.m. in regions including Lisbon will now be imposed in 60 municipalities, up from 45 municipalities previously, Presidency Minister Mariana Vieira da Silva said at a press conference on Thursday. Existing limits on weekend opening hours of restaurants and non-food stores will also apply to more municipalities, and remote working remains mandatory in those locations. The minister said that a negative Covid-19 test or a digital certificate will now be required to access hotels. (BBG)

RATINGS: Potential sovereign rating reviews scheduled for after hours on Friday include:

- Fitch on Lithuania (current rating: A; Outlook Stable)

- DBRS Morningstar on Malta (current rating: A (high), Stable Trend)

U.S.

FED: A top Federal Reserve official has warned the spread of the Delta coronavirus variant and low vaccination rates in some parts of the world poses a threat to the global recovery as she urged caution in removing monetary support for the US economy. "I think one of the biggest risks to our global growth going forward is that we prematurely declare victory on Covid," Mary Daly, the president of the Federal Reserve Bank of San Francisco, said in an interview with the Financial Times. "We are not through the pandemic, we are getting through the pandemic." (FT)

FED: Senate Banking Committee Chair Sherrod Brown said he expects Federal Reserve Vice Chair Randal Quarles's oversight of the central bank's financial supervision to end with the conclusion of his term in October. "He has frankly done the bidding of Wall Street far too many years," Brown said of Quarles in an interview on Bloomberg Television's "Balance of Power" with David Westin on Thursday. "He should not be there after October. I'd be very surprised if the president reappointed him." (BBG)

ECONOMY: U.S. consumer credit surged in May by the most on record, reflecting a jump in non-revolving loans that underscores solid household spending. Total credit climbed $35.3 billion from the prior month after an upwardly revised $20 billion gain in April, Federal Reserve figures showed Thursday. On an annualized basis, borrowing rose 10% in May. Economists in a Bloomberg survey had called for a $18 billion gain. (BBG)

FISCAL: House Speaker Nancy Pelosi said Thursday she is pushing to attach drug price cutting legislation to the major budget bill carrying most of President Joe Biden's $4 trillion economic agenda in the coming months. The top Democrat slammed drug companies for the level of stock buybacks and dividends in recent years and argued that cuts to prices will not harm research and development spending given new findings on buybacks. The House Democratic bill would allow Medicare to negotiate drug prices, and then force drug companies to lower the prices they charge private insurers or impose huge fines on the companies. Pelosi said she wants it to be part of a special budget bill that can pass the Senate without Republican support since it is immune from the filibuster. (BBG)

CORONAVIRUS: The White House defended a push to support groups with door-to-door efforts to encourage vaccinations -- a day after Missouri Governor Mike Parson said it would "not be an effective or a welcome strategy." (BBG)

EQUITIES: Two senior members of Congress have called on the Securities and Exchange Commission to investigate whether Didi Chuxing, the Chinese ride-sharing company, misled American investors ahead of its initial public offering last week. The senators, who sit on the powerful senate banking committee, said they wanted the SEC to examine whether Didi was forthcoming enough about its contact with Chinese regulators prior to the listing of its shares. (FT)

OTHER

U.S./CHINA: The Biden administration is set as early as Friday to add more than 10 Chinese companies to its economic blacklist over alleged human rights abuses and high-tech surveillance in Xinjiang, two sources told Reuters. The U.S. Commerce Department action will follow its announcement last month adding five other companies and other Chinese entities to the blacklist over allegations of forced labor in the far western region of China. The additions to Commerce Department's Entity List are part of the Biden administration's efforts to hold China accountable for human rights violations, the sources said. (RTRS)

EU/CHINA: European governments are unlikely to carry out the non-binding resolution of the European Parliament passed on Thursday, which advocated tough measures on China over Hong Kong freedom as well as a diplomatic boycott of the 2022 Beijing Winter Olympics, the Global Times said in a commentary. There is a large gap between the resolution of the EP and actual policies of the EU, it said. If Washington and Brussels insist on launching fierce confrontations with China regarding issues of Hong Kong and Xinjiang, China is willing to accept the result of such confrontations, it said. China doesn't believe the pressure piled from the U.S. and the West will have a big influence, it said. (MNI)

GEOPOLITICS: Biden said the US needs "to focus on shoring up America's core strengths to meet the strategic competition with China and other nations that is really going to determine our future. "We have to defeat COVID-19 at home and around the world [and] make sure we're better prepared for the next pandemic or biological threat. We need to establish international norms for cyberspace and the use of emerging technologies. We need to take concerted action to fight existential threats of climate change." (New York Post)

CORONAVIRUS: Pfizer and BioNTech announced Thursday they are developing a Covid-19 booster shot intended to target the delta variant as concerns rise about the highly transmissible strain that is already the dominant form of the disease in the United States. The companies said although they believe a third shot of their current two-dose vaccine has the potential to preserve the "highest levels" of protection against all currently known variants, including delta, they are "remaining vigilant" and developing an updated version of the vaccine. "As seen in real world evidence released from the Israel Ministry of Health, vaccine efficacy has declined six months post-vaccination, at the same time that the Delta variant is becoming the dominate variant in the country," the companies said in a written statement. "These findings are consistent with an ongoing analysis from the companies' Phase 3 study," they said. "That is why we have said, and we continue to believe that it is likely, based on the totality of the data we have to date, that a third dose may be needed within 6 to 12 months after full vaccination." (CNBC)

CORONAVIRUS: Pfizer Inc. plans to request U.S. emergency authorization in August for a third booster dose of its Covid-19 vaccine, based on early data showing that it can sharply increase immune protection against the coronavirus. At the same time, however, federal health officials signaled that they would take a cautious approach to potential booster shots, and underlined that the currently available vaccines are effective at keeping people from being sickened by the coronavirus. (BBG)

CORONAVIRUS: Growing concern that vaccines being deployed across much of the developing world aren't capable of thwarting the delta variant is prompting some countries to look at offering third doses to bolster immunity against more-infectious virus strains. Though definitive evidence is yet to emerge backing the need for so-called "booster" shots, health officials from Thailand to Bahrain and the United Arab Emirates have already decided to offer the extra doses to some people already inoculated with vaccines from Chinese makers Sinovac Biotech Ltd., Sinopharm and from AstraZeneca Plc. (BBG)

CORONAVIRUS: Most young people face an "extremely low" risk of illness and death from Covid-19 and have no need to shield from the virus, according to researchers behind a large U.K. study. The analysis, which its authors say is the most comprehensive on the topic to date, backs up clinical reports that show children and teens are less likely to be hospitalized or face severe effects from the virus. Covid-19 does increase the chance of serious illness in the most vulnerable children -- those with complex disabilities and severe existing medical conditions -- but even in those cases the risks are smaller compared with adults. "We see very few seriously unwell children," Elizabeth Whittaker, senior clinical lecturer in pediatric infectious diseases and immunology at Imperial College London, said in a statement. (BBG)

BOJ: Bank of Japan will disclose its basic policy on combating climate change this summer, Jiji reports, without attribution. The central bank will state that actions against climate change will contribute to its mission of achieving the sound development of national economy. Will also state that it plans to disclose its own climate change risks. (BBG)

AUSTRALIA: Australian authorities on Friday pleaded with Sydney residents to stay at home, warning a three week lockdown may be extended as they struggle to control a COVID-19 outbreak, with the city reporting its the biggest rise in local cases for the year. Hundreds of extra police patrolled parts of Sydney to enforce the city's lockdown orders imposed to stamp out an outbreak of the highly infectious Delta variant which now has a total of more than 400 cases. "New South Wales (state) is facing the biggest challenge we have faced since the pandemic started," state Premier Gladys Berejiklian told reporters in Sydney. "At the moment the numbers are not heading in the right direction." "Please do not leave your house. Do not leave your home, unless you absolutely have to," Berejiklian said. Fourty-four locally acquired cases were reported on Friday in NSW, Australia's most populous state, eclipsing 38 a day earlier, with 29 of those having spent time in the community while infected. There are currently 43 cases in hospital, with 10 people in intensive care, four of whom require ventilation. The rise in cases is despite a two week lockdown which has now been extended to a third week ending July 16. Authorities will tighten restrictions in Sydney from Friday evening with public gatherings limited to two people and residents limited to within 10 kms (6 miles) of their home. Berejiklian ruled out any suggestions of "living with the virus" considering the low vaccine coverage in Australia. (RTRS)

AUSTRALIA: Australian Prime Minister Scott Morrison said his government has negotiated with Pfizer Inc. for millions of coronavirus vaccine doses to be delivered ahead of previous schedules, with the aim of offering every Australian at least one jab by the end of the year. Pfizer doses will ramp up to about 1 million a week from July 19, more than double the weekly average of about 350,000 in June, according to a spokesperson for Morrison. That's expected to deliver 2.8 million jabs this month, and more than 4.5 million in August. "We've been working on this for some time to get those brought forward," Morrison said in a separate Australian Broadcasting Corp. interview on Friday. "We really are hitting the marks we now need to hit. We've done a lot of catch up over the month of June." (BBG)

SOUTH KOREA: South Korea announced Friday it will place the greater Seoul area under the toughest social distancing rules of Level 4 as concerns of a fourth wave of new COVID-19 outbreaks over the summer grow stronger. The decision to implement Level 4 guidelines in Seoul, Gyeonggi Province and Incheon, 40 kilometers west of the capital, Monday for two weeks was reached in an interagency COVID-19 response meeting chaired by Prime Minister Kim Boo-kyum. Under Level 4 rules, gatherings of more than two people will be banned after 6 p.m. Demonstrations will also be restricted, although the government will allow one-person protests. Weddings and funerals can only be joined by relatives. Entertainment establishments, including night clubs, will be ordered to shut down, while restaurants will be allowed to have dine-in customers until 10 p.m. The government also decided to suspend incentive programs, such as outdoor no-mask rules and exclusion from headcounts in private gatherings, for those who have received COVID-19 vaccine shots. (Yonhap)

SOUTH KOREA: The minimum wage is hotly contested every year in South Korea. This year the issue is more fraught than usual. Businesses say they can't afford to pay much more after the drubbing they took during the pandemic. Workers say the crisis has already put off long- overdue raises and has made inequality worse. They may all have a point. Meanwhile, President Moon Jae-in's legacy hangs in the balance. Elected on a platform of raising living standards for ordinary people, Moon is now in the last year of his term and although he's made progress he's still far short of delivering the 10,000 won per hour, or $8.75, minimum wage he promised. (BBG)

NORTH KOREA: North Korea has removed from its top leadership an official who played a major role in developing the regime's nuclear and missile arsenal, a newly released photo indicates. (Nikkei)

CANADA: Foreign tourists who are not vaccinated against Covid-19 will not be allowed to enter Canada for quite some time because the government is unwilling to jeopardize progress made on containing the virus, Prime Minister Justin Trudeau said on Thursday. "I can tell you right now that's not going to happen for quite a while," said Trudeau, when asked by reporters when Canada would allow unvaccinated tourists to enter the country. (CNBC)

BOC: The Bank of Canada will taper its asset purchases again at its July 14 meeting, encouraged by robust growth prospects, according to a Reuters poll of economists who also said a spread of new COVID-19 variants was the top economic risk this year. After recording its steepest annual decline last year since quarterly data was first noted in 1961, Canada's export-driven economy was forecast to grow 6.2% on average in 2021, the July 5-8 poll of 32 economists showed, marking the fastest annual expansion since 2007. The BoC's latest Business Outlook Survey indicator rose to a record high on a rapid vaccination drive and the lifting of some measures, pointing to a broadening economic recovery. (RTRS)

TURKEY: The doctoral thesis presented by Turkish central bank Governor Sahap Kavcioglu is being investigated after allegations of plagiarism, according to an official at Istanbul's Marmara University. "The issue is being investigated in line with the Marmara University Publication Ethics Board directive," Omer Akgiray, the board's chief, said in an email on Thursday. Birgun newspaper, a leftwing publication, first reported the allegations against Kavcioglu after making an official request for information through the communications center of Turkey's presidency. Akgiray told the paper the plagiarism claims were discussed on June 26 and a rapporteur had been appointed to investigate. Birgun's request, and the official response, were both seen by Bloomberg. (BBG)

BRAZIL: Brazil Regulator known as Anvisa approved good practices for a new manufacturing plant that can participate in the production of Pfizer's vaccine delivered to Brazil, according to a statement. Plant is from Hospira Inc., located in McPherson, Kansas. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro's disapproval rating rose to the highest level since he came to power two and a half years ago, with the far-right leader also slipping behind his main rival ahead of the election in 2022, a poll showed on Thursday. The survey, carried out by Brazilian pollster XP/Ipespe on July 5-7, showed voter support for Bolsonaro falling as much as 14 percentage points behind former leftist President Luiz Inacio Lula da Silva. According to the poll, 52% of respondents said Bolsonaro's government is doing a "bad/terrible" job, up from 50% in the June poll. That is the highest since these polls started in January 2019, when Bolsonaro took office. (RTRS)

BRAZIL: Brazil's President Jair Bolsonaro said that he will not answer anything for Senate Covid-19 inquiry committee questions "under any circumstances." Senators sent a letter to the president this Thursday requesting a position on complaints made at the inquiry committee. "It is an absurdity that does not deserve an answer," Bolsonaro said during a webcast. Committee does not do anything, it just wears out the government. Bolsonaro defended cutting fuel prices, saying it is needed to put an end to the transportation monopoly. Bolsonaro called the country's social movement for the rights of Black Brazilians "a fraud." Bolsonaro also said that he spoke with Health Minister Marcelo Queiroga about the use of face masks and that the minister is evaluating the issue. (BBG)

RUSSIA/RATINGS: Potential sovereign rating reviews scheduled for after hours on Friday include:

- Fitch on Russia (current rating: BBB; Outlook Stable)

MIDDLE EAST: President Joe Biden said the U.S. military mission in Afghanistan will end by August 31, and he called on the country's leaders to "come together" to prevent civil war. "We did not go to Afghanistan to nation build," Biden said Thursday in remarks at the White House. After 20 years of war, he said, the ideal conditions that the U.S. had once hoped to bring about before it withdrew troops had never materialized. (CNBC)

OIL: Venezuela's state-run oil company PDVSA has started producing two upgraded crude grades for domestic refining, aiming at reanimating the country's much-needed output of motor fuels, according to a company document and sources close the decision. (RTRS)

FOREX: The International Monetary Fund neared final approval to create a record $650 billion of new reserves, as Managing Director Kristalina Georgieva said she will present the proposal to the institution's board of governors to pave the way for issuing the funds by the end of August. The fund's executive board on Thursday concurred with the plan for a new allocation of so-called special drawing rights, the largest in its history, the Washington-based IMF said in statement. Bloomberg News on June 25 reported that the executive board gave unanimous support for the proposal. "This is a shot in the arm for the world,' Georgieva said. "The SDR allocation will boost the liquidity and reserves of all our member countries, build confidence, and foster the resilience and stability of the global economy. (BBG)

CHINA

PBOC: The PBOC may carry out structural monetary policies including cutting targeted reserve requirement ratios and refinancing to agriculture and small business in the second half, the 21st Century Business Herald reported citing analysts. Major moves such as a wide-ranging cut of interest rates or reserve ratio are unlikely, as the two-year GDP will be close to the potential, the newspaper said. There could be a RRR cut for lenders meeting the inclusive finance requirement to lend to SMEs, which can help resolve insufficient bank capital while keeping liquidity controlled, the newspaper said citing Wu Chaoming, chief economist of Chasing Securities. (MNI)

PBOC: The PBOC will continue to implement a prudent monetary policy, reform the loan prime rate system, and promote further reductions in actual loan rates, Deputy Governor Fan Yifei said at a press conference on Thursday, according to a transcript on China.com.cn. As the next step, the PBOC will merge the benchmark lending interest rates with market interest rates, Fan was cited as saying. The central bank must make good use of policies encouraging local banks to lend to SMEs, defer the businesses' loan repayments, and lowering their financing cost, Fan said. PBOC will also actively promote the wider use of its digital yuan both wholesaling to commercial banks for larger sums and to consumers for retail transactions, he said. (MNI)

ECONOMY: China's commerce ministry said on Friday it expects retail sales in the 14th five-year plan period, from 2021 to 2025, to grow by an average of 5% per year, and trade in goods to grow by 2% per year. The ministry also said in a notice online that it will explore setting up a pilot zone "to respond to trade frictions", and improve the "unreliable entity list" system. (RTRS)

EQUITIES: China's Ministry of Commerce plans to scrutinize foreign investment more closely on the basis of national security. The ministry's priorities for the next five years — released publicly this week — include reference to the "Measures for Security Review of Foreign Investment" that took effect in January. These measures generally require pre-review of foreign investment plans related to the Chinese military, and important agriculture, energy and technology products. (CNBC)

EQUITIES: MSCI said it will delete securities included in OFAC's NS-CMIC List from the MSCI ACWI Indexes and from relevant non-market capitalization weighted indexes and custom indexes as of the close of July 26. The seven securities that will be deleted represent 0.005% of the MSCI ACWI IMI and 0.042% of the MSCI EM IMI, based on data as of July 7. Four securities that were previously deleted from the MSCI ACWI Indexes are not included in the NS-CMIC List and will become eligible for potential inclusion in the MSCI ACWI Indexes and relevant non-market capitalization weighted indexes and custom indexes starting from the August 2021 Quarterly Index Review. In a separate statement, MSCI said it will delete the securities included in OFAC's NS-CMIC List from the MSCI China All Shares Indexes and from relevant non-market capitalization weighted indexes and custom indexes as of the close of July 26. The 18 securities that will be deleted represent 0.522% of the MSCI China All Shares IMI, based on data as of July 7. Five that were previously deleted from the MSCI China All Shares Indexes are not included in the NS-CMIC List and will become eligible for potential inclusion in the MSCI China All Shares Indexes and relevant non-market capitalization weighted indexes and custom indexes starting from the August Quarterly Index Review. (BBG)

OVERNIGHT DATA

CHINA JUN CPI +1.1% Y/Y; MEDIAN +1.2%; MAY +1.3%

CHINA JUN PPI +8.8% Y/Y; MEDIAN +8.8%; MAY +9.0%

JAPAN JUN MONEY STOCK M2 +5.9% Y/Y; MEDIAN +6.0%; MAY +7.9%

JAPAN JUN MONEY STOCK M3 +5.2% Y/Y; MEDIAN +5.2%; MAY +6.8%

NEW ZEALAND JUN ANZ TRUCKOMETER HEAVY +1.2% M/M; MAY -6.2%

Heavy traffic (trucks and buses) primarily reflects the movement of goods, while light traffic is about the movement of people. Traffic data remains volatile. The loss of tourism is affecting traffic in some areas (particularly the West Coast of the South Island), and there's plenty of disruption to both exports and imports from reduced and unpredictable shipping schedules. Lockdown a year ago is also causing some pretty extreme annual percent changes and probably confusing the seasonal adjustment algorithm to some extent. The normal relationship between GDP and traffic data may therefore not hold as closely as normal this year. But in the big picture, the traffic data certainly portrays a very busy economy. The New Zealand economy is strained. Alack of labour and delayed and more costly imports are hampering the supply side of the economy, while demand is extremely strong. It's a pretty stressful and inflationary combination, and transport companies are certainly in the thick of it, with a severe shortage of truck and courier drivers and very strong demand putting the pressure on. It's a bit of a microcosm of the state of the economy as a whole. (ANZ)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Thursday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2250% at 09:24 am local time from the close of 2.0866% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 53 on Thursday vs 40 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4755 FRI VS 6.4705

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4755 on Friday, compared with the 6.4705 set Thursday.

MARKETS

SNAPSHOT: Familiar Matters Dominate Overnight News Flow

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 370.82 points at 27745.93

- ASX 200 down 95.226 points at 7246.2

- Shanghai Comp. down 24.344 points at 3501.16

- JGB 10-Yr future down 20 ticks at 152.14, yield up 1bp at 0.036%

- Aussie 10-Yr future down 3,0 ticks at 98.645, yield up 2.6bp at 1.347%

- U.S. 10-Yr future -0-12+ ticks at 133-16, yield up 4.51bp at 1.338%

- WTI crude up $0.05 at $72.99, Gold down $0.80 at $1802.03

- USD/JPY up 24 pips at Y109.96

- PFIZER DEVELOPING COVID BOOSTER TO TARGET DELTA VARIANT

- ECB STRIKES CLASSIC COMPROMISE TO SET TERMS OF INFLATION DEBATE (BBG)

- ECB FAILED TO AGREE ON NEW GUIDANCE, TO REVISIT JULY 22 (RTRS SOURCES)

- U.S. SET TO ADD MORE CHINESE COMPANIES TO BLACKLIST OVER XINJIANG (RTRS)

- CHINA MINISTRY SAYS EXPECTS RETAIL SALES TO GROW 5%/YEAR IN 2021-25 (RTRS)

- MSCI TO DELETE SOME CHINESE SECURITIES AS OF JULY 26 CLOSE (BBG)

BOND SUMMARY: Weakness Evident In Core FI After Recent Rally

Pockets of selling in fairly recent trade have allowed T-Notes to push to fresh session lows, printing -0-11+ at 133-17 at typing (0-01 off lows) on above average volume of ~145K. Cash Tsys run 1.0-4.0bp cheaper on the day, with bear steepening in play. There hasn't been much in the way of meaningful news flow during Asia-Pac hours. A 5.0K block sale of FVU1 (~$255K DV01 equivalent) helped the space lower not long after the Asia-Pac reopen, providing the most notable round of flow during the overnight session. Thursday's rally in the space has now been unwound, with some pointing to focus on Monday's "double supply" of 3- & 10-Year Notes as a potential catalyst, although others have noted that the recent positioning washouts may have run their course given the overstretched valuations in Tsys vs. their in house models.

- Looking to JGB futures, there hasn't been much in the way of idiosyncratic fundamental news flow to explain the pullback from overnight highs, with the initial overnight correction coming as U.S. Tsys moved back from Thursday's pre-NY richest levels. The contract last trades -20 vs. yesterday's settlement levels, which is 45 ticks off of the overnight peak. This comes after the contract finished overnight trade just a handful of ticks above Tokyo settlement. We have previously identified speculation surrounding CTA-like participation in the most recent legs higher in futures (which broke technical resistance levels), which can exacerbate moves when the trend falters a little. Cash JGB trade sees much of the movement limited to the 7-Year zone, pointing to futures driven moves, as opposed to outright cash JGBs being in the driving seat. 7-Year yields print ~2.5bp higher on the day at typing, shorter maturities run a modestly richer on the session, while longer dated paper is little changed to 1.0bp cheaper. 10-Year JGB yields do not seem willing to test the 0% mark without a fresh fundamental catalyst, this comes after the metric hit a low of 0.02% on Thursday, a level not printed since early January. Weakness in local equity markets may be helping limit the fall in JGBs, with the Nikkei 225 currently the best part of 2% softer on the day. Signs of paying have been seen in long dated swaps, resulting in some swap spread widening in the super-long zone.

- The Aussie bond curve was steeper on the wider dynamic, with YM +0.5 and XM -2.5. Cash trade saw deeper weakness further out the curve, with longer dated paper cheapening by ~5.5bp. Local news flow saw deeper COVID lockdown restrictions imposed in Sydney, while Australian Prime Minister Morrison detailed much wider Pfizer COVID vaccine access from the middle of July (which will see the weekly availability hit 1mn doses vs. the current 300-350K.)

JGBS AUCTION: Japanese MOF sells Y4.3162tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.3162tn 3-Month Bills:- Average Yield -0.1038% (prev. -0.0998%)

- Average Price 100.0259 (prev. 100.0249)

- High Yield: -0.1002% (prev. -0.0962%)

- Low Price 100.0250 (prev. 100.0240)

- % Allotted At High Yield: 99.8122% (prev. 3.8526%)

- Bid/Cover: 3.236x (prev. 3.168x)

EQUITIES: Coronavirus Woes Dampen Risk Sentiment

Another negative day for equities in the Asia-Pac region as slow progress in vaccination programmes amid fresh worries over elevated coronavirus case numbers hinder economic recoveries. In Japan the Nikkei 225 is down over 2% and on the verge of entering a technical correction. It has been confirmed that Japan will ban spectators from attending Olympic events in Tokyo and adjacent prefectures Saitama, Chiba and Kanagawa. The Hang Seng clawed back earlier losses and is now in positive territory having earlier lost over 1%, the index is now down around 20% from its peak in February as tech shares struggle. Markets in mainland China are lower but off worst levels after inflation figures softened from last month. Elsewhere tensions Sino-US tensions simmer after report the US will add at least 10 Chinese entities to its economic blacklist as early as today over Xinjiang. The ASX 200 in Australia is down over 1%, pressured by worries over another lockdown extension and lower iron ore. In the US futures are lower, major bourses looking set to add to losses from Thursday.

OIL: On Track For Worst Week In Three Months

Oil is essentially flat on Friday, unable to sustain yesterday's upward momentum; WTI is up $0.05 from settlement at $72.99/bbl, Brent is down $0.06 at $74.06/bbl. The benchmarks are on track for their worst week since April. After several sessions of losses, WTI and Brent crude futures managed to hold onto positive territory Thursday as the market bias switched to short-covering, helped by a much larger-than-expected draw in crude oil inventories. The headline crude oil inventories number saw a near 7mln bbls draw on reserves vs. expectations of just 4.5mln bbls. Similarly, NatGas also saw solid gains on a much smaller than expected build in reserves, of just 16 BCF.

GOLD: Back To $1,800/oz After Foray Higher

U.S. real yield dynamics have been in charge over the last 24 hours, with gold easing back from best levels during Thursday's NY session before consolidating around the $1,800/oz mark in Asia-Pac hours. From a technical perspective. Thursday's brief showing above the 50-day EMA was fleeting, with any sustained break above the level set to expose the Jun 17 high ($1,825.7/oz). Initial support remains well defined.

FOREX: Risk Switch In G10 FX Space Still Flicked To Off, But Yen Bucks The Trend

Risk sensitive currencies remained under pressure, as concerns over the rapid spread of the Delta variant in Asia failed to dissipate, despite Pfizer's plan to seek emergency authorisation for a third booster dose of their Covid-19 vaccine. The greenback outperformed in G10 FX space, closely followed by the Swiss franc.

- NZD/USD tested a key support from Jun 18 low of $0.6923, with the kiwi sitting close to the lower end of the G10 scoreboard throughout the Asia-Pac session. BBG cited a trader source, who flagged AUD/NZD purchases following yesterday's speech from RBA Gov Lowe, which may have added some pressure to the kiwi.

- NZD/USD 1-week implied volatility extended the its sharp upswing to four days in a row, showing at the highest point since Mar 24. The move originated after the release of the upbeat NZIER QSBO survey this week, with participants assessing its ramifications for next week's RBNZ policy meeting.

- The yen failed to benefit from the broader risk-off impetus and USD/JPY edged towards the Y110.00 mark. On Thursday, Japan confirmed that Olympic events in Tokyo and neighbouring prefectures will be held without spectators.

- Offshore yuan gained, despite a marginal miss in China's headline CPI, which slowed to +1.1% Y/Y in June from +1.3% previously, as well as simmering Sino-U.S. tensions over Xinjiang.

- The account of the latest ECB MonPol Meeting and monthly UK economic activity indicators take focus in Europe, alongside comments from BoE's Bailey and ECB's Lagarde, de Cos & Rehn. Canada's labour market report will be eyed later in the day.

FOREX OPTIONS: Expiries for Jul09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1780-00(E1.5bln), $1.1830-50(E1.5bln), $1.1875(E658mln), $1.1885-00(E1.6bln)

- USD/JPY: Y111.10-25($938mln)

- AUD/USD: $0.7500(A$575mln), $0.7550(A$754mln)

- USD/CAD: C$1.2350($600mln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.