-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI EUROPEAN MARKETS ANALYSIS: Tsys A Little Off Recent Richest Levels

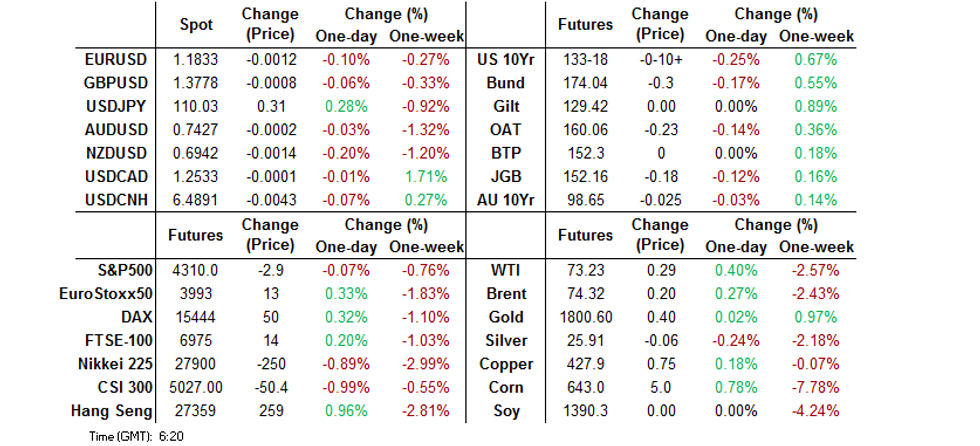

- Tsys cheapen a touch overnight, with some pointing to Monday's "double supply," while others point to overstretched valuations.

- USD a little firmer on the aforementioned room in U.S. Tsy yields.

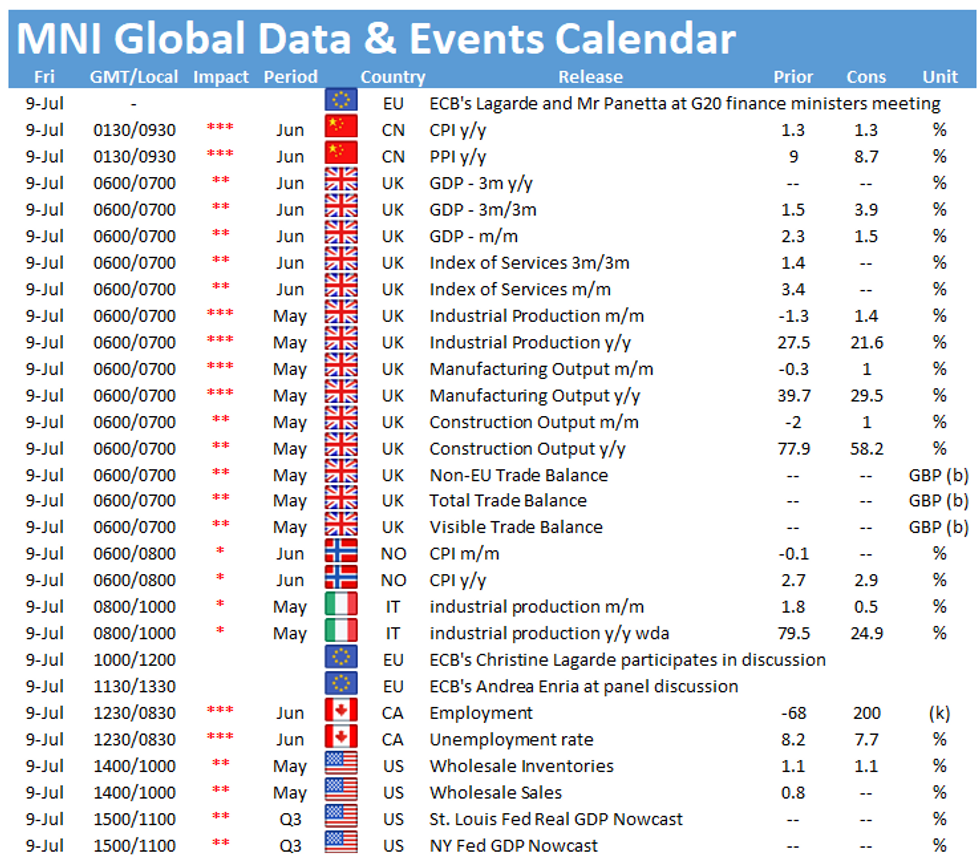

- ECB & BoE speak, as well as the Canadian labour market report, headline the broader docket on Friday.

BOND SUMMARY: Weakness Evident In Core FI After Recent Rally

Pockets of selling in fairly recent trade have allowed T-Notes to push to fresh session lows, printing -0-13+ at 133-15 at typing (0-00+ off lows) on above average volume of ~155K. Cash Tsys run 1.0-5.0bp cheaper on the day, with bear steepening in play. There hasn't been much in the way of meaningful news flow during Asia-Pac hours. A 5.0K block sale of FVU1 (~$255K DV01 equivalent) helped the space lower not long after the Asia-Pac reopen, providing the most notable round of flow during the overnight session. Thursday's rally in the space has now been unwound, with some pointing to focus on Monday's "double supply" of 3- & 10-Year Notes as a potential catalyst, although others have noted that the recent positioning washouts may have run their course given the overstretched valuations in Tsys vs. their in house models. Friday's domestic docket is relatively empty (wholesale inventories & sales data provides the only point of any note during NY hours).

- Looking to JGB futures, there hasn't been much in the way of idiosyncratic fundamental news flow to explain the pullback from overnight highs, with the initial overnight correction coming as U.S. Tsys moved back from Thursday's pre-NY richest levels. The contract last trades -20 vs. yesterday's settlement levels, which is 45 ticks off of the overnight peak. This comes after the contract finished overnight trade just a handful of ticks above Tokyo settlement. We have previously identified speculation surrounding CTA-like participation in the most recent legs higher in futures (which broke technical resistance levels), which can exacerbate moves when the trend falters a little. Cash JGB trade sees much of the movement limited to the 7-Year zone, pointing to futures driven moves, as opposed to outright cash JGBs being in the driving seat. 7-Year yields print ~2.5bp higher on the day at typing, shorter maturities run a modestly richer on the session, while longer dated paper is little changed to 1.0bp cheaper. 10-Year JGB yields do not seem willing to test the 0% mark without a fresh fundamental catalyst, this comes after the metric hit a low of 0.02% on Thursday, a level not printed since early January. Weakness in local equity markets may be helping limit the fall in JGBs, with the Nikkei 225 currently the best part of 2% softer on the day. Signs of paying have been seen in long dated swaps, resulting in some swap spread widening in the super-long zone.

- The Aussie bond curve was steeper on the wider dynamic, with YM +0.5 and XM -2.5. Cash trade saw deeper weakness further out the curve, with longer dated paper cheapening by ~5.5bp. Local news flow saw deeper COVID lockdown restrictions imposed in Sydney, while Australian Prime Minister Morrison detailed much wider Pfizer COVID vaccine access from the middle of July (which will see the weekly availability hit 1mn doses vs. the current 300-350K.)

FOREX: Risk Switch In G10 FX Space Still Flicked To Off, But Yen Bucks The Trend

Risk sensitive currencies remained under pressure, as concerns over the rapid spread of the Delta variant in Asia failed to dissipate, despite Pfizer's plan to seek emergency authorisation for a third booster dose of their Covid-19 vaccine. The greenback outperformed in G10 FX space, closely followed by the Swiss franc.

- NZD/USD tested a key support from Jun 18 low of $0.6923, with the kiwi sitting close to the lower end of the G10 scoreboard throughout the Asia-Pac session. BBG cited a trader source, who flagged AUD/NZD purchases following yesterday's speech from RBA Gov Lowe, which may have added some pressure to the kiwi.

- NZD/USD 1-week implied volatility extended the its sharp upswing to four days in a row, showing at the highest point since Mar 24. The move originated after the release of the upbeat NZIER QSBO survey this week, with participants assessing its ramifications for next week's RBNZ policy meeting.

- The yen failed to benefit from the broader risk-off impetus and USD/JPY edged towards the Y110.00 mark. On Thursday, Japan confirmed that Olympic events in Tokyo and neighbouring prefectures will be held without spectators.

- Offshore yuan gained, despite a marginal miss in China's headline CPI, which slowed to +1.1% Y/Y in June from +1.3% previously, as well as simmering Sino-U.S. tensions over Xinjiang.

- The account of the latest ECB MonPol Meeting and monthly UK economic activity indicators take focus in Europe, alongside comments from BoE's Bailey and ECB's Lagarde, de Cos & Rehn. Canada's labour market report will be eyed later in the day.

FOREX OPTIONS: Expiries for Jul09 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1780-00(E1.5bln), $1.1830-50(E1.5bln), $1.1875(E658mln), $1.1885-00(E1.6bln)

- USD/JPY: Y111.10-25($938mln)

- AUD/USD: $0.7500(A$575mln), $0.7550(A$754mln)

- USD/CAD: C$1.2350($600mln)

ASIA RATES: India To Tap New 10-Year Line

- INDIA: Yields mostly higher in early trade. Bonds giving back after rising yesterday following comments from RBI Governor Das, he reassured markets of the RBI's dovish intentions despite overshooting inflation. He noted that the Bank was monitoring the inflation situation and that price growth should slow in Q3. He said growth was the main focus and inflation was just a transitory hump. Das also confirmed that the GSAP operations were targeting the belly of the curve in the 6- to 12-Year maturities. Also supporting bonds was the GSAP operation, the operation went down smoothly and the Bank bought INR 200bn from the lines states with the majority of purchases coming from the 7.57% 2033 (INR 58bn) and 7.17% 2028 (INR 49.7bn) lines. Focus today will be on the INR 260bn auctions with markets watching to see the result of the first tap of a new 10-year line.

- SOUTH KOREA: Futures lower today after rising sharply this week. South Korea reports another record high daily COVID-19 cases of 1,316. The KDCA warned cases could peak at over 2,000 per day before they start dropping and predict approximately 1,400 per day by the end of July. As concerns over a fourth wave of outbreaks over the summer grew, health authorities decided to extend current distancing curbs in the greater Seoul area for one week on Wednesday but warned of further tougher measures unless the current situation is brought under control. Yesterday the government said this was the beginning for a fourth wave and today have made the decision to tighten restrictions to the highest level in Seoul.

- CHINA: The PBOC matched maturities with injections at its OMO operations again today. The overnight repo rate has jumped, rising above its 7-day counterpart. Overnight repo rate last up 32bps at 2.2266% while the 7-day repo rate is hovering around yesterday's intraday highs at 2.2143%, slightly above the PBOC's 2.20% prevailing rate. Futures are slightly lower after recovering opening losses. Data earlier showed CPI rose 1.1%, slightly below estimates of 1.2% and down from 1.3% in May. PPI rose 8.8%, in line with estimates and down from 9.0% in May. Slightly lower CPI figures could clear the way for the PBOC who have intimated a switch in policy bias with discussion of a targeted RRR cut and supportive fiscal measures.

- INDONESIA: Yields higher across the curve. The World Bank downgraded Indonesia to lower-middle income status after naming it an upper-middle income country last year. The revision came on the back of the economic hit from the Covid-19 pandemic. Data earlier showed Indonesia's retail sales index rose 14.7% Y/Y in May.

ASIA FX: USD/EM Crosses Move To Multi-Month Highs

Risk assets and EM currencies lose ground as slow progress in vaccination programmes amid fresh worries over elevated coronavirus case numbers hinder economic recoveries.

- CNH: Offshore yuan is slightly stronger, USD/CNH pulling back from the 6.50 handle. The rate initially moved higher after data showed CPI softened but the move was reversed.

- SGD: Singapore dollar is weaker, USD/SGD approaching its 2021 highs. Singapore Health Minister Ong said Singapore was on track to achieving mass vaccination targets and was in discussions with Hong Kong on air travel channel.

- KRW: The won is weaker, USD/KRW making a fresh 2021 high. After tightening restrictions South Korea reports another record high daily COVID-19 cases of 1,316. The KDCA warned cases could peak at over 2,000 per day before they start dropping and predict approximately 1,400 per day by the end of July.

- TWD: : Taiwan dollar is weaker, the government made the decision to extend the soft lockdown until July 26 from the previous July 12 deadline, while partially easing curbs as case numbers decline.

- MYR: Ringgit declined, speculation about the future of PM Muhyiddin's cabinet has been doing the rounds since UMNO President Zahid dropped the bombshell, announcing the withdrawal of support for the government. Despite Muhyiddin's meetings with some key cabinet members, it remains unclear if anti-Bersatu quarters within UMNO will be able to bring him down.

- IDR: Rupiah fell. The World Bank downgraded Indonesia to lower-middle income status after naming it an upper-middle income country last year. The revision came on the back of the economic hit from the Covid-19 pandemic.

- PHP: Peso is lower, the trade deficit shrank to $2.755bn in May from $3.085bn prior, vs. exp. of a $2.621bn shortfall. Exports grew 29.8% Y/Y, missing forecast of a 33.6% Y/Y increase. Imports rose 47.7% Y/Y, while analysts expected a growth rate of 49.0%.

- THB: Baht weakened, USD/THB hitting the highest since April. Thailand's Covid-19 task force will consider Health Ministry's proposal to implement a partial lockdown in regions most affected by the latest outbreak. These include Bangkok Metropolitan Area, which is home to 10mn people and contributes 45% to the Thai GDP.

JGBS AUCTION: Japanese MOF sells Y4.3162tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.3162tn 3-Month Bills:- Average Yield -0.1038% (prev. -0.0998%)

- Average Price 100.0259 (prev. 100.0249)

- High Yield: -0.1002% (prev. -0.0962%)

- Low Price 100.0250 (prev. 100.0240)

- % Allotted At High Yield: 99.8122% (prev. 3.8526%)

- Bid/Cover: 3.236x (prev. 3.168x)

EQUITIES: Coronavirus Woes Dampen Risk Sentiment

Another negative day for equities in the Asia-Pac region as slow progress in vaccination programmes amid fresh worries over elevated coronavirus case numbers hinder economic recoveries. In Japan the Nikkei 225 is down over 2% and on the verge of entering a technical correction. It has been confirmed that Japan will ban spectators from attending Olympic events in Tokyo and adjacent prefectures Saitama, Chiba and Kanagawa. The Hang Seng clawed back earlier losses and is now in positive territory having earlier lost over 1%, the index is now down around 20% from its peak in February as tech shares struggle. Markets in mainland China are lower but off worst levels after inflation figures softened from last month. Elsewhere tensions Sino-US tensions simmer after report the US will add at least 10 Chinese entities to its economic blacklist as early as today over Xinjiang. The ASX 200 in Australia is down over 1%, pressured by worries over another lockdown extension and lower iron ore. In the US futures are lower, major bourses looking set to add to losses from Thursday.

GOLD: Back To $1,800/oz After Foray Higher

U.S. real yield dynamics have been in charge over the last 24 hours, with gold easing back from best levels during Thursday's NY session before consolidating around the $1,800/oz mark in Asia-Pac hours. From a technical perspective. Thursday's brief showing above the 50-day EMA was fleeting, with any sustained break above the level set to expose the Jun 17 high ($1,825.7/oz). Initial support remains well defined.

OIL: On Track For Worst Week In Three Months

Oil is essentially flat on Friday, unable to sustain yesterday's upward momentum; WTI is up $0.05 from settlement at $72.99/bbl, Brent is down $0.06 at $74.06/bbl. The benchmarks are on track for their worst week since April. After several sessions of losses, WTI and Brent crude futures managed to hold onto positive territory Thursday as the market bias switched to short-covering, helped by a much larger-than-expected draw in crude oil inventories. The headline crude oil inventories number saw a near 7mln bbls draw on reserves vs. expectations of just 4.5mln bbls. Similarly, NatGas also saw solid gains on a much smaller than expected build in reserves, of just 16 BCF.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.