-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Growth Worries & NSW COVID Case Count Headline

EXECUTIVE SUMMARY

- ECB'S LAGARDE SEES POLICY CHANGE IN JULY, POSSIBLE 2022 MEASURES (BBG)

- ECB'S SCHNABEL DOESN'T EXPECT 'EXCESSIVELY HIGH' INFLATION (RTRS)

- ECB'S VILLEROY SIGNALS NO URGENCY TO SETTLE POST-CRISIS STIMULUS (BBG)

- NEW NSW COVID CASES TOP 100

- PBOC ADVISER SEES STABLE CHINA LIQUIDITY AFTER RESERVE RATIO CUT (BBG)

- ANALYSTS: CHINA'S ECONOMIC GROWTH TO SLOW IN H221 (CSJ)

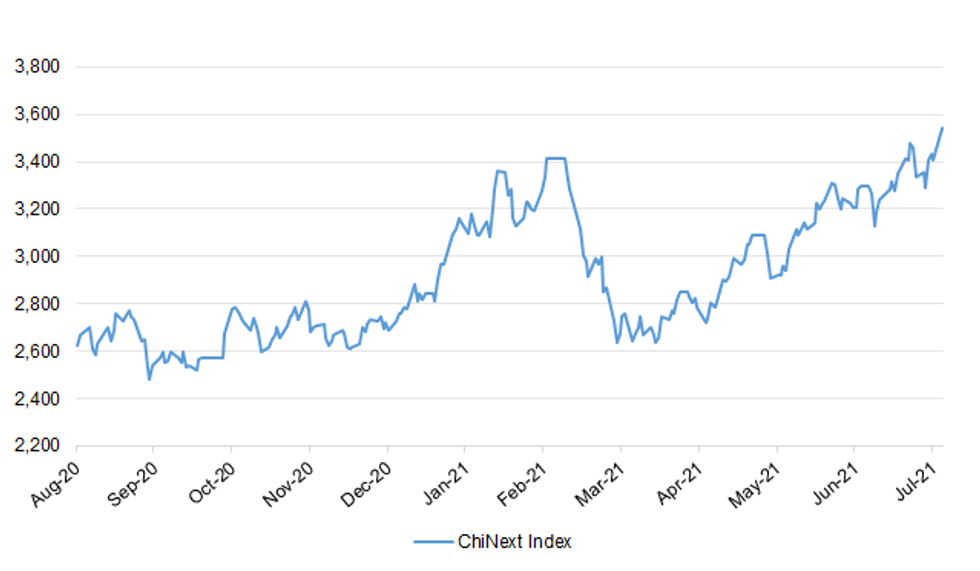

Fig. 1: ChiNext Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Prime Minister Boris Johnson has said "caution is absolutely vital" as he prepares to address the nation on Monday to announce whether the final stage of releasing coronavirus restrictions can go ahead. The prime minister is expected to confirm that England can move to step four of the government's roadmap out of lockdown, but to also warn "the global pandemic is not over yet" and that cases of the virus will rise as rules are relaxed. Mr Johnson will host a news briefing on Monday afternoon to inform the public of whether the easing of restrictions will go ahead as planned on 19 July. (Sky)

CORONAVIRUS: Covid restrictions will probably need to be reimposed across England after summer but the government may again delay doing so, a Conservative MP helping lead a Commons inquiry into ministers' handling of the pandemic has warned. Dr Dan Poulter, who has also been working on the NHS frontline since the outbreak began, said "challenging mutations" of the virus would probably emerge and set back a "return to normality" until at least 2022. Boris Johnson is expected to announce on Monday that most legal constraints will be scrapped from 19 July, as part of a pivot to telling people they must learn to live with the disease. Poulter, a vice-chair of the all-party parliamentary group (APPG) on coronavirus, said there was "a sense of worry" about the full unlocking, particularly about the risk that many young people – most of whom are not yet fully vaccinated – could develop long Covid. (Guardian)

CORONAVIRUS: No one around Boris Johnson is under any illusions about how tough the next eight months are going to be. Despite all the public talk of "freedom day" a week on Monday, when the vast majority of remaining restrictions will be lifted, in private Downing Street aides, government scientific advisers and Tory MPs feel trepidation. Before Johnson made the decision to tentatively go ahead with easing restrictions on July 19 he was shown projections that further relaxations would inevitably lead to a third wave of Covid-19 this summer. Not only was 100,000 cases a day a realistic prospect next month but this would lead to a further concerning spike in hospital admissions. (The Times)

CORONAVIRUS: The government will issue guidance stating that people will still be "expected to wear masks in indoor, enclosed places" after the final step of releasing lockdown restrictions, Nadhim Zahawi has said. The vaccines minister told Sky News he is "confident" that Prime Minister Boris Johnson will be able to announce on Monday that COVID restrictions will be lifted on 19 July as planned despite the surge in cases. But he revealed the PM will inform the public that they should continue to wear face coverings in crowded places, despite the legal requirement to do so ending from step four of the government's roadmap out of lockdown. (Sky)

CORONAVIRUS: Face masks will remain mandatory in some public places in Wales until COVID-19 is no longer a public health threat, the Welsh government has said. The move in Wales is in contrast to that of England, where legal requirements to wear masks look set to end once the country reaches Step 4 of roadmap out of lockdown on 19 July. A final decision on England's path out of restrictions is expected to be taken on Monday. (Sky)

CORONAVIRUS: Covid-19 certificates will be required for customers to enter bars, restaurants and nightclubs under plans to tackle a fourth wave of the virus in a move that experts hope will boost jab rates among the young. Entertainment venues in England would be forced to make customers use so-called vaccination passports from autumn, to prove that they had either had both doses or a negative test the day before. Recent figures have shown a reduction in the take-up of vaccines with first doses halving in two weeks. Fewer than 100,000 a day are being given out on average for the first time since April. (The Times)

CORONAVIRUS: Government modelling from two weeks ago underestimated the level of hospital admissions by more than a third, according to newly released documents. Projections produced by Spi-M, the Sage modelling committee, on June 28 estimated that there would probably be about 275 daily hospital cases in England by about July 6, with an upper estimate of 350. (The Times)

CORONAVIRUS: Pressuring young people to get vaccinated is "ludicrous", MPs have warned, after major brands appeared to promote the jab as a condition of normal life. (Telegraph)

CORONAVIRUS: The UK's large employers group has called on the government to bring forward the end of the mandatory self-isolation regime in line with the next stage of easing of economic restrictions. Bosses are concerned that they will not be able to open fully on July 19 — the date when most Covid-19 restrictions are due to end — because of staff shortages caused by workers forced to isolate. The self-isolation regime is not expected to change until August 16, several weeks after the "stage 4" easing of other restrictions. (FT)

CORONAVIRUS: The gap between coronavirus vaccine doses is set to be halved to four weeks to accelerate the administration of second jabs. No 10 officials have asked the Joint Committee on Vaccination and Immunisation (JCVI) to provide urgent advice on reducing the dosing interval from eight weeks in the light of surging cases of the Delta variant and the imminent easing of lockdown restrictions. If the JCVI approves the reduction in the vaccine interval, it will open up the prospect of quarantine-free foreign travel in time for the school holidays for millions of people who will otherwise have to wait a further month until they have been double-vaccinated. (Sunday Times)

CORONAVIRUS: An Opinium poll for the Observer found that 73% of people now believe wearing masks on public transport should continue while 50% said that "freedom day", when the vast majority of other controls are due to end, should be pushed back again beyond 19 July. This compared with just under a third (31%) who think the government should go ahead as planned. Only 10% think restrictions should have been lifted earlier. (Observer)

FISCAL: Sajid Javid hinted that a tax rise could pay for the long-awaited social care plan today as he insisted he wants a 'sustainable settlement'. The Health Secretary said he will not let 'ideology' stand in the way of a solution, amid growing pressure for the government to lay out proposals. (Mail On Sunday)

ECONOMY: Big businesses in Britain are rushing ahead with post-lockdown investment plans that could usher in a long-awaited improvement in the country's weak productivity growth, a survey of chief finance officers showed. Accountancy firm Deloitte said its poll found CFOs were planning to increase investment, as well as hiring, at the fastest pace in almost seven years and were their most aggressive about acquisitions in 11 years. Many firms around the world have ramped up their spending on digital technology in response to the coronavirus pandemic which up-ended their working practices. Ian Stewart, chief economist at Deloitte, said CFOs were much less concerned about Brexit. COVID-19 was still the top of the worry list, followed by inflation and climate change. Over three quarters of CFOs reported growing recruitment problems. (RTRS)

ECONOMY: Al fresco dining will become the norm in Britain under plans to revolutionize town centers and tackle economic inequalities after the pandemic, Prime Minister Boris Johnson will promise in a major speech this week. The government will extend sidewalk licences to make it easier for pubs, restaurants and cafes to set up tables and serve more customers, and takeaway pints of beer will continue for another 12 months. In his speech, confirmed by his office after Bloomberg first reported it on Friday, Johnson will vow to tackle the social divisions entrenched by the coronavirus crisis and 16 months of restrictions. He will pledge to create a more balanced economy with good jobs in every part of the U.K., "level up" between generations, invest in infrastructure and skills, and put local needs first, Downing Street said in an emailed statement Saturday. The speech is expected at the end of the week. (BBG)

INFLATION/BREXIT: Ministers have launched secret talks on a short-term visa scheme for foreign lorry drivers as they race to prevent a shortage of staff from overwhelming the haulage industry. (Telegraph)

BREXIT: Britain is unlikely to strike a trade deal with the US before 2023, the International Trade Secretary has conceded, ahead of a trip to the country to build "broader" support for an agreement. (Telegraph)

EUROPE

ECB: European Central Bank President Christine Lagarde told investors to prepare for new guidance on monetary stimulus in 10 days, and signaled that new measures might be brought in next year to support the economy after the current emergency bond program ends. Speaking to Bloomberg Television days after the ECB raised its inflation goal to 2% and acknowledged it may overshoot the target, Lagarde said the July 22 Governing Council session -- previously expected to be relatively uneventful -- will now have "some interesting variations and changes." "It's going to be an important meeting," she said on Sunday in Venice, after a meeting of Group of 20 finance ministers and central bankers. "Given the persistence that we need to demonstrate to deliver on our commitment, forward guidance will certainly be revisited." (BBG)

ECB: Inflation in the euro zone is unlikely to overshoot and the current increase in price growth driven by the coronavirus pandemic will be temporary, European Central Bank board member Isabel Schnabel was quoted on Saturday as saying. "I am sure that we will not experience any excessively high inflation," Schnabel told the Frankfurter Allgemeine Sonntagszeitung in extracts from an interview released ahead of publication. Schnabel's comments come a day after the accounts of the ECB's June policy meeting revealed growing concerns among conservative policymakers that the rise in inflation may be more durable than now predicted. (RTRS)

ECB: European Central Bank policy maker Francois Villeroy de Galhau signaled that he's in no rush to agree on new measures for supporting the euro-area economy to succeed the current emergency tools. After the ECB concluded an 18-month strategy review last week, raising its inflation goal and deciding to take issues such as climate change and owner-occupied housing costs into consideration, investors are focused on the implications for monetary stimulus. The next Governing Council decision is on July 22. "Strategy is long term but policy can be adapted at any monetary council meeting," Villeroy, the Bank of France governor, told reporters on the sidelines of the G-20 gathering in Venice. "We have at least four such meetings between now and the end of the year." (BBG)

ECB: Despite gradually recovering economies and summer tourism reopening in many parts of the euro zone, it's not time to end emergency stimulus measures yet, Italian Central Bank Governor Ignazio Visco told CNBC at the G-20 on Sunday. "This is an emergency program that had to do with the effects of the pandemic," Visco, who is also a member of the European Central Bank's Governing Council, told CNBC's Annette Weisbach in Venice, Italy. Visco was referring specifically to the pandemic emergency bond purchases, or PEPP, deployed in spring 2020 to shore up the economy as the pandemic-induced economic crisis engulfed Europe and much of the world. (CNBC)

FISCAL: Brussels will set out plans this week to increase taxes on polluting fuels and introduce an EU-wide levy on aviation kerosene for the first time, under measures intended to put it at the forefront of global efforts to reduce carbon emissions. The European Commission will propose a revamp of its 15-year-old rule book on carbon taxes to provide an incentive for low-emissions fuel and impose levies on heavily polluting energy used in the airline and shipping industry. The measure is one of a dozen policies to be unveiled on Wednesday to ensure the EU can meet a goal of reducing average carbon emissions by 55 per cent by 2030. Others include an extension of the EU's emissions trading scheme, tougher CO2 rules for cars and a carbon levy on some imports. A draft legal text of the energy taxation directive, seen by the Financial Times, proposes gradually increasing minimum rates on the most polluting fuels such as petrol, diesel and kerosene used as jet-fuel over a period of 10 years. Zero-emissions fuels, green hydrogen and sustainable aviation fuels will face no levies for a decade under the proposed system. (FT)

CORONAVIRUS: The European Union has delivered enough coronavirus vaccine doses to member states to reach a target to fully vaccinate at least 70% of adults in the bloc, European Commission chief Ursula von der Leyen said in a statement on Saturday. (RTRS)

GERMANY: Chancellor Angela Merkel's conservative bloc widened its lead in a weekly poll ahead of Germany's election as support for the Green party fell for a third consecutive week. With Merkel's Christian Democratic-led bloc steady at 28% in the Insa poll, the opposition Greens declined 1 percentage point to 17%, leaving them level with the Social Democrats, Merkel's junior coalition partner for the last eight years. (BBG)

FRANCE: As the French government warns increasingly of a "fourth wave" due to the now-dominant delta variant of the coronavirus, the number of new cases remains low but is rising steadily. France reported 4,256 new cases in 24 hours, up 60% in a week based on a 7-day rolling average, and four deaths, while the number of patients in need of intensive care continues to decline. President Emmanuel Macron is scheduled to address the nation Monday evening, when he's expected to speak about the risks of the delta variant and measures to counter its rapid spread, including mandatory vaccination for healthcare personnel. Separately, a key Macron ally said France must "live with the virus" rather than count on a new lockdown to contain the spread of a new variant of Covid-19. (BBG)

FRANCE: The Bank of France will ask businesses participating in its regular survey about their views on the evolution of prices and salaries, according to a letter by Governor Francois Villeroy de Galhau to President Emmanuel Macron. Questions will be given next winter to the 8,500 business executives taking part in the institution's monthly economic survey. "With better communication and better dialog we can hope there is a stronger alignment between the central bank's inflation objective and the inflation expectations of economic agents," Villeroy says at press briefing commenting on letter. "If the behavior of economic agents, those who set prices, is close to the 2% inflation target, it is self-fulfilling." (BBG)

SPAIN: Spain's prime minister Pedro Sánchez has carried out a far-reaching reshuffle of his government as his ruling Socialists seek to regain the initiative after a series of setbacks on the political, economic and diplomatic fronts. In a much wider ranging reshaping of the government than expected, Sánchez promoted Nadia Calviño, Spain's economy minister, to become his new number two, as several of the government's most prominent figures left office. In an address to the nation, Sánchez announced the formation of what he described as a new government that would focus on economic recovery and the use of the €140bn in EU funds that Spain hopes will help it bounce back from the ravages of the pandemic — and which the government hopes will help retrieve its fortunes. (FT)

NETHERLANDS: The Netherlands will re-introduce some restrictions after new cases doubled last week as the government attempts to prevent renewed pressure on the health system and avoid potential travel restrictions. Starting tomorrow morning, bars will have shorter opening hours and will close at midnight, while night clubs will be shuttered until Aug. 13, Dutch caretaker Prime Minister Mark Rutte said at a press conference Friday evening. Public events such as music festivals can last a maximum of 24 hours and are only allowed if visitors have fixed seating and 1.5 meters of distancing can be adhered to. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Lithuania at A; Outlook Stable

- DBRS Morningstar confirmed Malta at A (high), Stable Trend

AUTOS: French President Emmanuel Macron will meet with executives and union representatives from the automobile sector on Monday to discuss the green transition, ahead of the publication of a sweeping climate-policy package by the European Union. The meeting will revolve around "what's at stake for the sector," Macron's office said on Saturday. (BBG)

U.S.

FED: Federal Reserve Vice Chair for Supervision Randal Quarles is calling for an internationally coordinated approach to understanding and monitoring climate-related financial risks. Speaking on the sidelines of a Group of 20 Finance Ministers meeting in Venice on Sunday in his capacity as chair of the Financial Stability Board, Quarles said disclosures and data would be essential. (BBG)

CORONAVIRUS: Anthony Fauci, the top U.S. infectious disease specialist, said "ideological rigidity" is preventing people from getting Covid-19 shots and voiced frustration at the struggle to boost vaccination rates in parts of the country. "It's not an easy solution," Fauci said on ABC's "This Week" on Sunday. "We've got to get away from this divisiveness that has really been a problem right from the very beginning with this outbreak." (BBG)

CORONAVIRUS: California will continue to require students and teachers to wear masks in schools even though the Centers for Disease Controls and Prevention dropped the mandate, the Los Angeles Times reported. (BBG)

CORONAVIRUS: U.S. vaccinations have plunged to levels before Joe Biden was sworn in as president, despite the spread of the delta variant that is fueling a new rise in infections. The U.S. recorded 599,000 vaccinations on Saturday, the lowest level since early January, according to the Bloomberg Vaccine Tracker. Daily vaccinations peaked in mid-April at almost 4 million. (BBG)

CORONAVIRUS: Mississippi state health officials issued new guidance on Friday that calls for state residents over the age of 65 and immunocompromised residents, vaccinated or unvaccinated, to avoid any indoor mass gatherings for the next two weeks amid "significant transmission" of the delta variant over the coming weeks. The new guidance is in place until July 26 and is not mandatory. The guidance should instead be considered a recommendation. (CNBC)

CORONAVIRUS: Arkansas Governor Asa Hutchinson said that incentives to encourage inoculations in a state with one of the U.S.'s lowest vaccination rates had only "limited" success. He said "education" about the vaccines and their effectiveness against the delta variant is "the most powerful tool. (BBG)

OTHER

G20: Global finance chiefs signaled alarm over threats that could derail a fragile recovery as they concluded a meeting that sought to start reshaping the post-crisis economic order. New variants of the coronavirus and an uneven pace of vaccination could undermine a brightening outlook for the world economy, according to a communique agreed to on Saturday by Group of 20 finance ministers at a gathering hosted by Italy in Venice. They resolved to keep up support for growth to ensure recoveries can continue to take hold. (BBG)

G20: Finance ministers from the U.S. and Europe expressed confidence that a global tax deal endorsed by the Group of 20 on Saturday has enough momentum to overcome domestic political obstacles in time for it to be finalized in October. "There's more work to be done, but I'm really hopeful that with the growing consensus we're on a path to a tax regime that will be fair for all of our citizens," U.S. Treasury Secretary Janet Yellen told reporters on the sidelines of the G-20 meeting in Venice. (BBG)

G20: Countries should be able to tax a quarter of big multinationals' profits no matter where they are earned, France proposed on Saturday at a G20 finance ministers meeting focused on overhauling the rules for cross-border corporate taxation. (RTRS)

G20: Global proposals to make multinational corporations pay more tax haven't yet tackled deductions, leaving Switzerland and other low-tax countries room to maneuver. "Calculation of taxable profit has to happen according to international rules, and these haven't been decided yet," Swiss Finance Minister Ueli Maurer said after attending a meeting of Group of 20 finance chiefs in Venice. "Here lies the crux and here also lies the room to maneuver that Switzerland and other countries now have -- what counts as corporate profit and what isn't," Maurer told reporters in Bern on Saturday. While Switzerland is among 132 countries supporting a deal for a minimum corporate levy of ''at least 15%" and new rules for reapportioning revenue from the world's biggest companies, a few countries not in the G-20, including Ireland, have voiced concern that their strategy of using low taxes to attract businesses is under threat. (BBG)

U.S./CHINA: Beijing firmly opposes Washington's "unreasonable suppression" of its companies after the U.S. added 23 Chinese entities to an economic blacklist, the country's commerce ministry said in a statement. The move has seriously undermined international trade rules, a spokesman from the ministry said in the statement posted on its website. China will take necessary steps to protect its legitimate interests, the ministry said, without elaborating. (BBG)

GEOPOLITICS: China's President Xi Jinping and North Korean leader Kim Jong-un spoke of "hostile forces" as they vowed to strengthen ties on Sunday ahead of the 60th anniversary of the countries' treaty of friendship, per KCNA. The report by the state-run North Korean news agency is meant as a message to the U.S. amid stalled nuclear talks and escalating tensions between Washington and Pyongyang, as well as Washington and Beijing, analysts said, according to AFP. (Axios)

GEOPOLITICS: Huawei Chief Financial Officer Meng Wanzhou will not be allowed to submit new evidence in the extradition case against her, according to a ruling Friday by the British Columbia Supreme Court in Vancouver. (Nikkei)

CORONAVIRUS: A 90-year-old woman died after becoming infected with two different strains of Covid-19, revealing another risk in the fight against the disease, Belgian researchers found. In the first peer-reviewed analysis of an infection with multiple strains, scientists found the woman had contracted both the alpha variant, which first surfaced in the U.K., and the beta strain, first found in South Africa. The infections probably came from separate people, according to a report published Saturday and presented at the European Congress of Clinical Microbiology & Infectious Diseases. The woman was admitted to a Belgian hospital in March after a number of falls, and tested positive for Covid-19 the same day. She lived alone, receiving nursing care at home, and hadn't been vaccinated. Her respiratory symptoms rapidly worsened and she died five days later. (BBG)

JAPAN: Japan will start accepting applications for so-called vaccine passports from July 26 for people who have been fully inoculated against COVID-19 to travel internationally, the top government spokesman said Sunday. The government will also consider whether to use such certificates for domestic economic activities in response to a request to do so made by business circles, Chief Cabinet Secretary Katsunobu Kato said on an NHK TV program. (Kyodo)

BOJ: MNI BRIEF: BOJ Sees Inflation To Rise To Near 1% late 2021

- Bank of Japan officials expect the consumer price index, excluding special factors, to rise to near 1% in late this year unless new factors, such as the Government's 'Go To" travel campaign, intervene to exert downward pressure, MNI understands.

AUSTRALIA: Australia's most-populous city had 112 new coronavirus cases on Monday, and at the weekend recorded its first death since April. The delta-strain leaked into the local community in mid-June and the city has been in lockdown since June 26. New South Wales state Premier Gladys Berejiklian indicated that the current stay-at-home orders may be extended beyond Friday. "We just want people to stay at home," she said. "The virus won't spread if people don't leave home. That is the bottom line." (BBG)

RBNZ: There are growing calls amongst Shadow Board members for the Reserve Bank to tighten monetary policy given the pick-up in inflation pressures in the New Zealand economy. Many on the Shadow Board now see a tightening in monetary policy at the upcoming July meeting as appropriate. Beyond that, an overwhelming majority thinks monetary policy should be tightened within the coming year. Supply constraints stemming from acute labour shortages and COVID-related supply chain disruptions have driven up costs for businesses. Inflation pressures resulting from supply constraints alone would not warrant an increase in interest rates, given it will dampen demand. However, there are signs in recent months that strong demand has allowed firms to pass on higher costs onto customers by raising prices. These developments suggest higher inflation pressures are likely to persist in the New Zealand economy. Nonetheless, the risk of further COVID-19 outbreaks in New Zealand was highlighted by some Shadow Board members as a reason to remain cautious when deciding when the Reserve Bank should start raising interest rates. (NZIER)

CANADA: Ontario residents could see the vast majority of Covid-19 restrictions lifted in August, allowing them to finish the summer in near pre-pandemic conditions. On Friday, Canada's most populous province announced it was moving into Step Three of its reopening plan sooner than expected, as vaccination rates continue to exceed targets. (BBG)

MEXICO: Mexico's nominee to become central bank governor, Arturo Herrera, said the country's recent inflation spike seems to be related to temporary factors, in comments that suggest a dovish stance on recent price pressures. "Most of the data that we have points to temporary issues," Herrera told Bloomberg Television's Maria Tadeo in an interview at the conference of finance ministers from the Group of 20 countries in Venice. Herrera, who is currently finance minister, will step down after two years in his post next week. He has been nominated by President Andres Manuel Lopez Obrador to become central bank governor when current chief Alejandro Diaz de Leon's term finishes at the end of the year. (BBG)

BRAZIL: President Jair Bolsonaro said, without providing evidence, that Brazil's highest electoral authorities stole votes in previous elections and will do it again in the 2022 presidential contest unless congress approves his proposal to reintroduce paper ballots. The allegations are the latest in a series of unsubstantiated vote-fraud claims made by the far-right leader. They come just as opinion polls show his popularity dropping to record lows amid scandals involving the purchase of Covid-19 vaccines. "The fraud is inside the Superior Electoral Court, there's no doubt," Bolsonaro told a group of supporters in front of his official residence on Friday. "This happened in 2014," he said, referring to the re-election of leftist President Dilma Rousseff by 51.6% of the votes in a second-round runoff against center-right candidate Aecio Neves. (BBG)

RUSSIA: Moscow officials believe the city has passed the peak of infections and will start to see levels stabilize, RIA Novosti reported on Sunday, citing the capital's mayor, Sergei Sobyanin. Russia has reported more than 700 deaths during the last six days, with the seven-day average hitting a high of 725. (BBG)

RUSSIA: President Joe Biden warned Russian President Vladimir Putin on Friday that the United States will "take any necessary action" to defend critical American infrastructure following a massive ransomware attack by suspected Russian cybercriminals. The proliferation of ransomware attacks is heaping tension on an already spiraling relationship between Washington and Moscow. From Putin's invasion of Ukraine to a face-off over American citizens detained in Russia, ties between the two countries are largely in tatters. (POLITICO)

RUSSIA/RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Russia at BBB; Outlook Stable

SOUTH AFRICA: South African President Cyril Ramaphosa extended bans on alcohol sales and most public gatherings for two weeks as the government struggles to bring a third wave of coronavirus infections under control. The country will remain on virus alert level 4, the second-highest, although there will be adjustments to some curbs, including allowing restaurants to resume operating at half their seating capacity and gyms to reopen, Ramaphosa said Sunday in a televised address. A night-time curfew will remain in place from 9 p.m. to 4 a.m. and schools will remain shut until July 26. "We have had to make difficult decisions, knowing that almost every decision carries a cost to the economy and society," Ramaphosa said. "We remain committed to do all that we can to mitigate the impact of the lockdown on people's livelihoods." (BBG)

SOUTH AFRICA: Violent protests in South Africa linked to last week's arrest of former President Jacob Zuma have spread to Johannesburg, the nation's economic hub, with another major road shuttered. That followed the closure of a key trade route in the country's eastern KwaZulu-Natal province after trucks were torched on Friday night. Parts of the N3 Toll Route, which links the port city of Durban with important business districts in the Gauteng province, have reopened, yet access to the M2 highway in Johannesburg is restricted in some areas after violence erupted in the city overnight. (BBG)

MIDDLE EAST: U.S. Embassy officials in Afghanistan are developing plans to reduce the large contingent of contractors at the massive U.S. Embassy complex amid a worsening security situation across the country, according to embassy officials and contractors. State Department officials are undertaking what an embassy official said was an intensive look at the number of contractors and other personnel at the embassy, which houses roughly 4,000 diplomats, contractors and other staff, including about 1,400 Americans. (WSJ)

OIL: California denied 21 oil-drilling permits this week in the latest move toward ending fracking in a state that makes millions from the petroleum industry but is seeing widespread drought and more dangerous fire seasons linked to climate change. (FOX Business)

CHINA

PBOC: The PBOC's broad cut in lenders' reserve ratios last week was a normal liquidity operation and should not be interpreted as the central bank has changed its prudent monetary policy orientation, the Financial News reported citing Wang Yiming, a member of the Monetary Policy Committee. The funds unlocked will help meet maturing MLFs, including CNY400 billion due in July, Wang was cited as saying. China will also encounter large-scale tax remissions in July and government bond sales may also accelerate, Wang told the newspaper owned by the central bank. The RRR cuts will help banks improve financing capabilities as credit extended to the real economy has increased in recent years, increasing lenders' need for long-term capital, Wang was cited saying. The RRR cuts will also ease the difficulties of small businesses as the recovery remains unstable, while rising commodity prices raised production costs, Wang told the Financial News. (MNI)

ECONOMY: China's H2 growth may slow to 5%-7% after recording about 8% in Q2, the Shanghai Securities News reported citing Sheng Songcheng, a former statistics and analysis official at the PBOC. Relatively low inflation pressure in the short term and stable asset prices are the conditions for loosening policies, Sheng was cited saying. The current liquidity looks to be tight given factors such as banks' deposit/loan ratios and maturing MLFs, Sheng said in a forum. While the property sector and local government debt are two major areas of risks, they should be dealt with through macro-prudential management, and not tightening monetary policies, Sheng said according to the newspaper. (MNI)

ECONOMY: China's economic growth will slow in the second half due to uncertainties over the global economic recovery amid coronavirus pandemic, China Securities Journal reports, citing several analysts. More forceful and targeted supportive measures are needed from finance industry in 2H, Lian Ping, head of research at Zhixin Investment says. The reserve requirement ratio cut on Friday can help guide market expectations and encourage small companies to boost lending, and that can help stabilize 2H employment and consumption, the report says, citing Ren Zeping, chief economist at Soochow Securities. (BBG)

AUTOS: Auto sales in China fell 12.4% in June from the corresponding month a year earlier, industry data showed on Friday, as a global shortage of semiconductors hit autos production in the world's biggest car market. (RTRS)

EQUITIES: China said its companies which hold the data of more than 1 million users must now apply for cybersecurity approval when seeking overseas listings, as regulators tighten oversight of the country's tech giants. The new rule is required because of the risk that such data and personal information could be "affected, controlled, and maliciously exploited by foreign governments," the Cyberspace Administration of China said in a statement on Saturday. The cybersecurity review will also look into the potential national security risks from overseas IPOs, it said. (BBG)

EQUITIES: Chinese regulators rejected Huya Inc.'s proposal to acquire rival DouYu International Holdings Ltd., killing a deal that would have helped cement Tencent Holdings Ltd.'s lead in video game-streaming. The deal wasn't approved because it would strengthen Tencent's dominance in China's game streaming market, giving it an anti-competitive edge, the State Administration for Market Regulation said in a statement on Saturday. Huya and DouYu together have more than 80% of the market based on active users, they said. (BBG)

OVERNIGHT DATA

JAPAN MAY CORE MACHINE ORDERS +12.2% Y/Y; MEDIAN +6.3%; APR +6.5%

JAPAN MAY CORE MACHINE ORDERS +7.8% M/M; MEDIAN +2.4%; APR +0.6%

JAPAN JUN PPI +5.0% Y/Y; MEDIAN +4.8%; MAY +5.1%

JAPAN JUN PPI +0.6% M/M; MEDIAN +0.5%; MAY +0.8%

NEW ZEALAND JUN CARD SPENDING RETAIL +0.9% M/M; MAY +1.7%

NEW ZEALAND JUN CARD SPENDING TOTAL +1.6% M/M; MAY +2.0%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS MON; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Monday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) decreased to 2.2000% at 09:27 am local time from the close of 2.2142% on Friday.

- The CFETS-NEX money-market sentiment index closed at 40 on Friday vs 53 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4785 MON VS 6.4755

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4785 on Friday, compared with the 6.4755 set Friday.

MARKETS

SNAPSHOT: China Growth Worries & NSW COVID Case Count Headline

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 627.4 points at 28567.99

- ASX 200 up 55.007 points at 7328.3

- Shanghai Comp. up 32.843 points at 3556.931

- JGB 10-Yr future down 2 ticks at 152.2, yield down 0.3bp at 0.030%

- Aussie 10-Yr future up 4.0 ticks at 98.6750, yield down 3.9bp at 1.318%

- U.S. 10-Yr future +0-01 at 133-14+, yield down 0.84bp at 1.351%

- WTI crude down $0.05 at $74.51, Gold down $5.5 at $1802.82

- USD/JPY up 4 pips at Y110.18

- ECB'S LAGARDE SEES POLICY CHANGE IN JULY, POSSIBLE 2022 MEASURES (BBG)

- ECB'S SCHNABEL DOESN'T EXPECT 'EXCESSIVELY HIGH' INFLATION (RTRS)

- ECB'S VILLEROY SIGNALS NO URGENCY TO SETTLE POST-CRISIS STIMULUS (BBG)

- NEW NSW COVID CASES TOP 100

- PBOC ADVISER SEES STABLE CHINA LIQUIDITY AFTER RESERVE RATIO CUT (BBG)

- ANALYSTS: CHINA'S ECONOMIC GROWTH TO SLOW IN H221 (CSJ)

BOND SUMMARY: ACGB Matters Dominate

The first Asia-Pac session of the week was a little lacking in terms of meaningful macro headline news. A downtick for e-minis (after Friday saw a fresh all-time high for the S&P 500), coupled with some caution in Australia re: COVID was enough to generate some modest support for T-Notes, with that contract last dealing +0-01+ at 133-15, within the confines of a 0-04+ range. Cash Tsys saw some very modest twist flattening. Participants now look to Monday's "double supply" (in the form of 3- and 10-Year Notes) and an address from Minneapolis Fed President Kashkari.

- JGB futures trade 2 ticks lower on the day at typing, with the contract paring modest overnight losses, likely on the back of the light bid in broader core FI markets during regional trade (U.S. Tsys/ACGBs), given the lack of local news flow. The major cash JGB benchmarks mostly deal a little firmer on the day, but within the -/+1.0bp boundaries when compared to Friday's closing levels. Local PPI data (for June) revealed a slightly higher than expected uptick in both M/M & Y/Y terms, although both prints were a touch lower than the readings witnessed in May (which saw upward revisions). Core machine tool orders data provided healthy beats in both M/M & Y/Y terms. Note that 20s showed no sign of concession ahead of tomorrow's 20-Year JGB supply.

- The longer end of the curve has played catch up during Sydney trade, seemingly on the confirmation of 112 new local COVID cases in NSW (after such a number was touted by local reporters ahead of the release). Speculation re: deeper fiscal support packages and harder/longer lockdowns in NSW continues to intensify, which has underpinned the space today. YM +3.5, XM +4.0, with the long end now leading the way in cash ACGB trade, richening by a little over 5.5bp on the day. The monthly NAB business survey headlines the local docket on Tuesday.

EQUITIES: Asia-Pac Equities Higher, E-Minis Lower

The positive lead from Wall St. made for a buoyant start to the week for the major Asia-Pac equity indices. The Nikkei 225 led the way higher, aided by the broader theme, some modest JPY weakness vs. G10 FX since Friday's Tokyo close and firmer than expected core machine orders data out of Japan. Meanwhile, Chinese bourses drew support from Friday's after hours RRR cut from the PBoC, although the increased regulatory oversight evident in China perhaps limited the bid. The ASX 200 lagged on the back of the COVID situation in NSW, with worry re: a deeper and longer lockdown evident. E-Minis nudged lower after Friday saw fresh all-time highs for the S&P 500.

OIL: Little Changed

Crude has struggled for anything in the way of lasting, meaningful direction in early trade this week, leaving WTI & Brent futures at near enough unchanged levels at typing. Participants continue to weigh up the demand side of the equation (which is potentially clouded a little by the spread of the delta strain of COVID-19. Although that should at least be partially mitigated by the wider vaccine rollout that has been seen/is underway), while OPEC+ will continue to shape supply side issues over the coming months.

GOLD: Still Tethered To $1,800/oz

Bullion ultimately remains tethered to the $1,800/oz mark, with little in the way of meaningful macro headline flow evident at the start of a new week. An unchanged technical backdrop remains in play as gold takes a bit of a breather after the recent uptick.

FOREX: Not Too Much Appetite For Risk

Sentiment turned sour and the initial risk-on impulse dissipated, driving high-beta G10 FX lower. Covid-19 matters remained front and central, with the Sydney outbreak sapping some strength from the Aussie. AUD went offered as Sydney daily case count topped 100, while NSW Premier Berejiklian suggested an imminent extension to regional lockdown measures. NZD turned heavy in sync with its Antipodean cousin, while AUD/NZD operated below the previous close.

- Safe havens attracted demand, as U.S. e-minis gave away their initial modest gains and slipped into negative territory. USD/JPY tested last Friday's high of Y110.26, but failed to clear the level and backed off.

- USD/CNH lost some altitude, despite a slightly weaker than expected PBOC fix, which came in at CNY6.4785, 19 pips above sell-side estimate. China's moves against tech companies also failed to undermine the redback.

- It is a slow start to the week in terms of global data releases, while today's central bank speaker slate features Fed's Kashkari & ECB's de Guindos.

FOREX OPTIONS: Expiries for Jul12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1930-35(E528mln)

- USD/JPY: Y109.00($500mln), Y109.30-50($669mln), Y110.00($705mln)

- AUD/USD: $0.7400(A$627mln), $0.7500(A$758mln)

- USD/CAD: C$1.2360-68($870mln), C$1.2500($610mln), C$1.2505-25($1.5bln), C$1.2575($500mln), C$1.2695-05($1.1bln)

- USD/CNY: Cny6.4530($560mln)

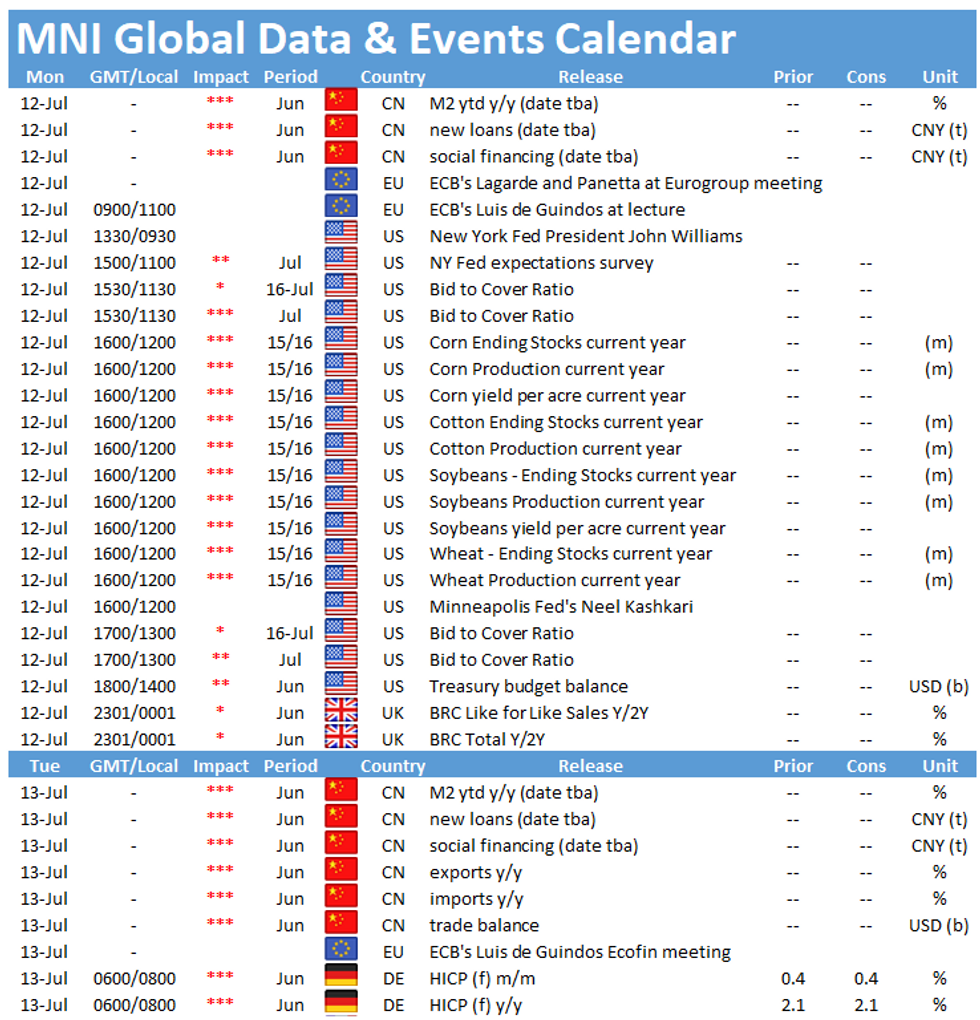

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.