-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Geopolitics & COVID Dominate A Light News Slate

EXECUTIVE SUMMARY

- BIDEN TEAM WEIGHS DIGITAL TRADE DEAL TO COUNTER CHINA IN ASIA (BBG)

- BORIS JOHNSON SHIFTS COVID ONUS ON TO COMPANIES AND INDIVIDUALS (FT)

- ECB COULD USE TOOLS TO REIN IN EXCESSIVE DIVIDENDS (BBG)

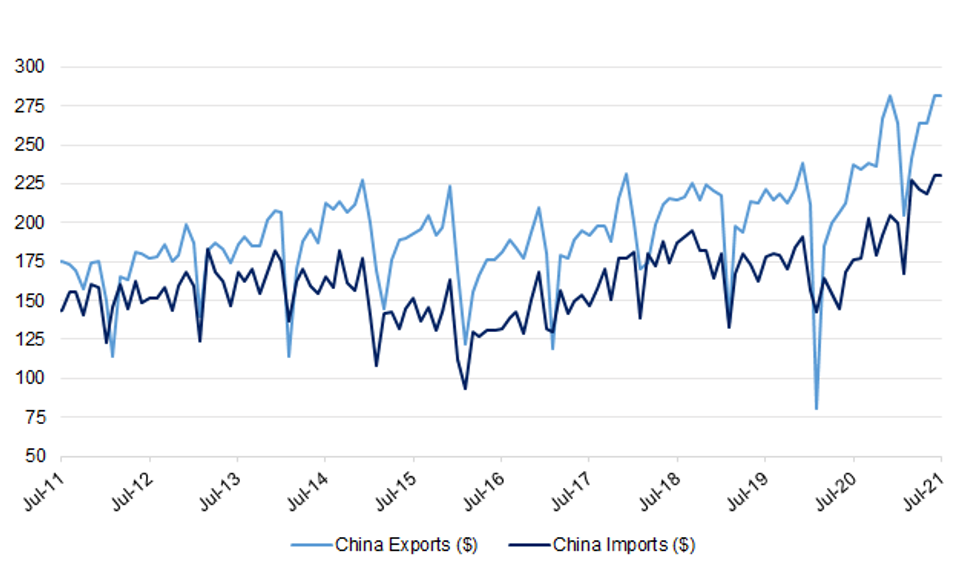

Fig. 1: China Exports vs. Imports ($)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Boris Johnson has urged people to exercise "extreme caution" when he lifts Covid-19 legal restrictions next Monday, as he shifted responsibility for tackling the rapidly spreading virus to companies and individuals. The prime minister wants to end "government by diktat" by scrapping most remaining Covid laws but some business leaders fear they are being left in an invidious legal position by ministers, without clear guidance on what to do next. While companies will be expected to continue imposing anti-Covid measures, Johnson suggested legal restrictions could be reimposed if the public became "demob happy". (FT)

CORONAVIRUS: Up to 4,800 people a day could be admitted to hospital with Covid-19 if England rushes back to normality, government scientists said yesterday, as Boris Johnson approved lifting the last remaining lockdown restrictions. Modelling by the Scientific Advisory Group for Emergencies (Sage) concluded that admissions could rise above January levels with up to 200 deaths a day unless the public took a "cautious" approach to reopening. The warning came as the prime minister said he would impose lockdowns if pressure on the NHS became too great. He said England was already facing an "exit wave" of the coronavirus and stressed that the country could not "revert instantly to life as was before Covid". (The Times)

ECONOMY: Payments processor Barclaycard said its measure of consumer spending was also up strongly in June and stood 11.1% higher than in June 2019. In May, the same measure - which is based on almost half of British credit and debit card payments - showed spending was up 7.6%. Spending at pubs and bars soared by 38% compared with two years ago, the biggest rise since September, and food and drink specialist stores such as off-licences saw sales jump by 76%. "June saw Brits flock back to pubs, bars and beer gardens to watch the football and tennis on the big screens, as the heatwave early in the month encouraged many of us to get out in the sunshine and socialise," Barclaycard's head of consumer products, Raheel Ahmed, said. (RTRS)

FISCAL: Conservative red-wall MPs have called on Boris Johnson to offer tax breaks for manufacturing as part of plans to deliver on "levelling up" the country. Before a speech by the prime minister this week, 65 MPs have backed a think-tank report that calls on the government to set up a national plan for manufacturing. This should include tax breaks for factories and extra investment in technology in an attempt to expand a sector known for higher wages. The report by Onward says that the move is important because outside the capital, those working in the manufacturing sector tend to earn more than the average employee. In 2018 median earners in the northeast working in manufacturing earned 22 per cent more than the average worker. (The Times)

FISCAL: Boris Johnson will on Tuesday set out a new "double lock" on the aid budget to head off a rebellion from Conservative MPs concerned that the Prime Minister will never restore spending to 0.7 per cent. (Telegraph)

EUROPE

ECB: The European Central Bank could take steps to ensure that lenders avoid paying excessive dividends later this year, when it will "most likely" lift a cap on payouts, a top official said. Margarita Delgado, a member of the ECB's supervisory board, said in an interview on Monday that the central bank will call on lenders to remain "cautious." Her remarks dampen the possibility of a surge in payouts as the European economy shakes off the worst impact of the pandemic. The ECB will push banks that propose excessive shareholder rewards "to go back to a more average distribution policy," said Delgado, who is also the deputy governor of Spain's central bank. "We have other tools if the bank doesn't accept the recommendation of the supervisor." (BBG)

FISCAL: Brussels wants to allow industry in the EU to maintain free carbon credits for more than a decade and offer potentially billions of euros of financial aid to poorer households in a bid to win support for its effort to limit global warming. According to leaked documents seen by the Financial Times, the European Commission on Wednesday will offer measures to help cushion the initial impact on households and parts of European industry as the bloc embarks on a goal of cutting emissions by 55 per cent by 2030, compared to 1990 levels. (FT)

FISCAL: Austria urges member states to maintain strict budget planning after pandemic in order to create fiscal space for next crisis, Finance Minister Gernot Bluemel says in interview on Bloomberg Television. Austria working with allies on budget policy as EU prepares review of fiscal rules in October. Sees EU member states ultimately agreeing on common position on global minimum tax. Agreement on global digital tax is "big step forward." (BBG)

FRANCE: President Emmanuel Macron turned up the pressure on the French to get themselves vaccinated against Covid-19 as he raised the country's growth outlook and pledged an economic reboot before next year's elections. Macron said France's efforts to contain the Covid-19 pandemic are bearing fruit and that the economy is set to grow by 6% this year, compared with a previous forecast for a 5% expansion. Still, he warned Monday that the recovery will be shaped by the success of the vaccination push -- the French government's previous forecast cited the risks of a resurgence in infections. (BBG)

FRANCE: France is set to make vaccines compulsory for health-care workers and those who work with vulnerable people, as President Emmanuel Macron tries to encourage the vaccine-shy French to get immunized. While European countries are on the whole pushing ahead with plans to reopen, they are also looking at new pandemic measures as the rate of infection rises. Macron said he will also force people to use so-called health passes to visit bars and restaurants and step up border controls. Meanwhile, the Spanish region of Catalonia will force restaurants and nightclubs to close at half-past midnight and limit meetings to 10 people, El Pais newspaper reported. (BBG)

GREECE: Greece is mandating vaccinations for those who work in senior citizen homes, within private or public health-care and for those in the military, Prime Minister Kyriakos Mitsotakis said Monday in a national television address. Meanwhile, all indoor areas -- including nightclubs and bars, cinemas and theaters -- will only be open for those who have been vaccinated, Mitsotakis said. Greece has seen a jump in the daily number of new coronavirus cases attributed mainly to large social gatherings of younger adults. (BBG)

U.S.

FED: MNI: Williams Favors Fed QE Taper Completion Before Rate Hikes

- New York Fed President John Williams Monday said he prefers seeing an end to the process of drawing back on asset purchases before raising short-term interest rates. "My own view is the simplest, natural way is to first do a taper or finish that then think about liftoff," he said. "That does seem to me the most straightforward way to do it and to communicate what we're doing." "I do think we have some flexibility to avoid" an overlap of QE taper and interest rate hikes at the same time, Williams told reporters after a speech to a Bank of Israel and Center for Economic and Policy Research conference - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

FED: "I'm in the camp that it's transitory," Minneapolis Fed President Neel Kashkari says, referring to above-target inflation rates. "It really is the labor market that I think is the most important factor in how much inflation we have on a sustained basis going forward," Kashkari says Monday during a virtual event. (BBG)

FISCAL: President Joe Biden does not yet have enough support from fellow Democrats to secure $400 billion in spending for at-home care for the elderly and disabled that the economy desperately needs, Commerce Secretary Gina Raimondo told Reuters on Monday. Raimondo, who is paying for round-the-clock care for her own 90-year-old mother, said America's aging demographics were going to hit the country "like a ton of bricks" without increased federal aid, and warned the current situation was "untenable." Failure to act, she said in an interview, would harm the U.S. economy by making it difficult for women – who fell out of the workforce by the millions during the COVID-19 pandemic – often to look after out-of-school children or parents – to return to work or remain in the workforce. (RTRS)

CORONAVIRUS: Pfizer officials briefed U.S. health officials on Monday about preliminary data concerning the need for a third shot of the company's COVID-19 vaccine, but the Biden administration said its stance has not changed that a booster shot is not currently needed. The meeting comes after Pfizer made some waves last week by saying it would be applying to the Food and Drug Administration (FDA) for authorization for a third shot of its COVID-19 vaccine. The FDA and Centers for Disease Control and Prevention (CDC) pushed back hours later in a rare joint statement saying a booster was not currently needed. (The Hill)

CORONAVIRUS: U.S. Commerce Secretary Gina Raimondo said on Monday she is pressing for the easing of coronavirus restrictions that bar much of the world from traveling to the United States but that U.S. health officials remain concerned about more outbreaks. Dozen of U.S. business groups, lawmakers and officials from foreign governments are urging President Joe Biden's administration to relax tough restrictions put in place under former President Donald Trump. read more "We're working it," Raimondo told Reuters in an interview "I'm pushing really hard." (RTRS)

OTHER

GLOBAL TRADE: White House officials are discussing proposals for a digital trade agreement covering Indo-Pacific economies as the administration seeks ways to check China's influence in the region, according to people familiar with the plans. Details of the potential agreement are still being drafted, but the pact could potentially include countries such as Canada, Chile, Japan, Malaysia, Australia, New Zealand and Singapore, according to one of the people, who asked not to be identified because the process isn't public. (BBG)

CORONAVIRUS: People who are fully vaccinated against Covid-19 are still getting infected with the delta variant, but global health officials said the shots have protected most people from getting severely sick or dying. "There are reports coming in that vaccinated populations have cases of infection, particularly with the delta variant," Dr. Soumya Swaminathan, the World Health Organization's chief scientist, said at a press briefing Monday. "The majority of these are mild or asymptomatic infections." However, hospitalizations are rising in some parts of the world, mostly where vaccination rates are low and the highly contagious delta variant is spreading, she said. (CNBC)

CORONAVIRUS: The fact sheet for Johnson & Johnson's Covid-19 vaccine was revised to warn of the risk of a rare immune-system disorder, adding new headwinds for a shot once expected to be a linchpin of the U.S. immunization effort. The Food and Drug Administration said in a statement Monday that it was adding the warning after 100 reports of Guillain-Barré Syndrome, a rare condition in which the immune system attacks the nerves, among people who had received the shot. So far, about 12.8 million Americans have been given the one-dose vaccine. The agency said that 95 of the cases required hospitalization and that one person had died. While the available evidence suggests a link between the shot and the syndrome, the agency said that the data was insufficient to be able to say definitively it had caused the illness. The revised fact sheet said symptoms began with 42 days of receiving the J&J shot. (BBG)

AUSTRALIA: The number of Sydney residents hospitalized from Covid-19 increased to 65 as the Australian city struggles to contain an outbreak of the delta variant. A man in his 70s died, the second fatality in the past week from an outbreak that's grown to more than 700 cases since mid-June. The hospitalizations are a worrying sign that authorities may impose tighter movement restrictions after Sydney was placed into a lockdown on June 26, as the city battles its largest coronavirus outbreak in more than a year. (BBG)

AUSTRALIA: A new commonwealth financial support package for locked-down greater Sydney is to be announced after the federal government signed off on a cash boost for affected businesses and households. The new Covid assistance package, which was approved by the federal government's expenditure review committee on Monday, was finalised by the federal and New South Wales Treasuries before a joint announcement expected on Tuesday. The NSW government, which will co-fund the business package, is also set to announce other new assistance measures, including cash for people waiting for Covid test results to encourage them to stay at home as well as tenancy protection measures for those unable to pay rent. (Guardian)

NEW ZEALAND: Finance Minister Grant Robertson says the Government is keen to open up quarantine-free travel bubbles with other countries as vaccination rates rise. He has not provided any firm dates however and says borders will be changed forever by Covid-19. New Zealand has travel bubbles with Australia and the Cook Islands that are intended to allow for quarantine-free two-way travel, although the Australian bubble has been fraught with pauses. (Stuff NZ)

JAPAN: Japan's health ministry plans to approve Regeneron's casirivimab-imdevimab antibody cocktail for the treatment of Covid-19 as soon as next week, the Mainichi newspaper reports, without attribution. The ministry will hold a panel meeting to discuss the treatment July 19. (BBG)

BOJ: Bank of Japan is expected to offer low-interest multi-year funds to lenders making loans that lead to combating climate change and buying green bonds in the new climate scheme, Nikkei reports, without attribution. Depending on the amount tapped, BOJ is considering applying zero interest to their deposits at the central bank's accounts to ease burden of negative rates. BOJ is cautious about adding interest to current account balances when it introduces the climate scheme. Separately, it is seen announcing other measures to combat climate change within the month, namely plans to buy green bonds from Europe and other areas using foreign reserves. (BBG)

SOUTH KOREA: Some parts of South Korean financial markets are seeing an increase in volatility on concerns about the resurgence of the coronavirus, Vice Finance Minister Lee Eog-weon says in a meeting. Can't rule out possibility financial market volatility may expand further amid uncertainty over the coronavirus variant spread; authorities will strengthen monitoring of financial markets and possible risk factors. (BBG)

NORTH KOREA: A North Korean propaganda outlet on Tuesday warned South Korea against pushing ahead with its planned joint military drill with the United States, saying that war exercises and peace cannot go hand in hand. Uriminzokkiri, a North Korean propaganda website, issued the warning as South Korea and the U.S. are expected to hold the joint military drill in August. Seoul's defense ministry earlier said that the allies are discussing when and how to stage their annual summertime military exercise. "The blame for the current instability on the Korean Peninsula should be squarely placed on warmongers among the South Korean military colluding with outside power and engaging reckless confrontational machinations," the website said. (Yonhap)

BOC: MNI: Canada Names Carolyn Rogers From BIS as New BOC Deputy

- Canada named Carolyn Rogers as the top deputy of its central bank on Monday, bringing home a veteran of the country's banking supervisor who had been working at the Bank for International Settlements to fill a spot that had been vacant since December. Rogers won't start until Dec. 15, meaning the position will be unfilled for a year after the departure of Carolyn Wilkins. The governor and senior deputy are recommended by the BOC's outside board of directors and approved by the finance minister for seven-year terms. "I am confident that, in addition to her exceptional resume, Ms. Rogers will bring a fresh perspective to the Bank of Canada," Finance Minister Chrystia Freeland said in a statement - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazilian President Jair Bolsonaro nominated Attorney General Andre Mendonca to the Supreme Court, making him the first evangelical Christian positioned to join the top court. The president announced his choice after meeting with Chief Justice Luiz Fux Monday evening and emphasized Mendonca's religion. "He is extremely evangelical, he's an evangelical pastor," the president said while speaking to journalists afterward. "I said that I make just one request of him -- and he says the deal is done -- to once a week start the session with a prayer." (BBG)

BRAZIL: Brazil's central bankers are now facing the "most critical time" in monetary policy, as the economy moves toward a post-pandemic time, but they remain committed to reach the inflation target of 3.75% for 2021 and 3.5% for 2022, economic policy director Bruno Serra said during a virtual event. "We are looking at the impact of the reopening on inflation", Serra said. Pandemic could have put pressure on prices of goods, which could remain difficult to ease. Central banker said rise on commodity prices is not necessarily due to structural reasons. Central banker said expectations of inflation for 2022 are within range and less disperse than in previous months. Fiscal policy remains problematic for estimates of future inflation, Serra said. (BBG)

RUSSIA: Inflationary pressure remains high in Russia, the central bank said in a report on Monday, but there are signs that some pressure is easing and annual inflation will start to fall in the autumn. In June, annual inflation accelerated to 6.5%, its fastest rate since August 2016, providing Russia with a strong argument to raise rates at its next rate-setting meeting on July 23 and adding to concerns that tighter monetary policy might hamper economic growth. The central bank on Monday said inflation would return to the 4% target in the second half of 2022 and remain near that level in the future. (RTRS)

SOUTH AFRICA: South Africa's Covid-19 vaccination program faltered amid widespread unrest and looting following the imprisonment of former President Jacob Zuma. The country vaccinated 146,577 people in the 24 hours to 5 p.m. local time compared with over 191,000 late last week, according to information on a National Department of Health website. Inoculation numbers had been climbing steadily toward a target of 300,000 a day set by President Cyril Ramaphosa. There were reports of some sites not operating on Monday while many people kept off the streets amid the violence. "Our vaccination program has been severely disrupted just as it is gaining momentum," Ramaphosa said in a televised address on Monday. "This will have lasting effects on our ability to consolidate some of the progress we were already witnessing in our economic recovery." (BBG)

IRAN: The United States will not impose a deadline on a seventh round of talks with Iran to revive the 2015 nuclear deal, but only Tehran can determine when talks will resume, U.S. State Department spokesman Ned Price said on Monday. "We're not imposing a deadline on these talks, but ... we are conscious that as time proceeds Iran's nuclear advances will have a bearing on our view of ultimately returning to the JCPOA," Price said. (RTRS)

OIL: Crude output from seven major shale formations is expected to rise by 42,000 bpd in August, to 7.907 million bpd, compared with a 28,000 bpd rise in July, according to the Energy Information Administration's (EIA) monthly drilling productivity report. (RTRS)

COMODITIES: Lumber, which at one point was among the world's best-performing commodities as the pandemic sent construction demand soaring and stoked fears of inflation, has officially wiped out all of its staggering gains for the year. Prices at Monday's close are now down 0.6% for the year as demand eases and supply expands in response to earlier gains. The rally turned a common building product into a social media sensation and a flash point in the debate over U.S. monetary policy. At one point, lumber futures were trading as high as $1,733.50 per thousand board feet, more than quadruple the level of a year earlier. (BBG)

CHINA

PBOC: The PBOC's decision to cut banks' reserve ratios (RRRs) by 0.5 pp announced on July 9 won't likely channel money into the property market as the authorities had introduced centralized loaning for real estate a half year ago, the Economic Daily said citing Lian Ping, the head of research at Zhixin Investment and the former chief economist at Bank of Communications. Regional authorities will also strictly implement government policies prohibiting property speculation, the newspaper said citing analyst Wen Bin of China Minsheng Bank. The RRR cut should be considered a normal operation to manage liquidity and help small businesses obtain financing, not a change in the central bank's prudent monetary policy stance, the newspaper said. (MNI)

ECONOMY: Consumer spending in China in H2 will continue to be impacted by recurring outbreaks both at home and abroad, and is unlikely to return to the previous usual level soon, the Shanghai Securities News reported citing Lian Ping, head of research at Zhixin Investment. Policymakers should try to encourage consumption by policies such as improving infrastructure supporting spending in smaller cities and rural areas, the newspaper said citing Wei Jianguo, a former Vice Minister of Commerce. A major rise in consumption likely won't happen until the October Golden Week holiday, Wei was cited as saying by the newspaper. The number of people traveling and tourism revenues in the second half will likely be around 80% of the levels in 2019, the newspaper said citing a study by the China Tourism Research Institute. (MNI)

ECONOMY: China will seek to protect exports by targeted measures that help exporters manage higher costs and declining profits, the China Securities Journal reported citing Assistant to the Minister of Commerce Ren Hongbin. Chinese exporters are facing higher costs in freight, raw materials and labour, while a more volatile yuan threatens profits and weakens exporters' confidence in accepting orders, the newspaper cited Ren as saying. The commerce ministry will closely monitor the economic situation. increase policy support, and strengthen cooperation with those Belt and Road countries, Ren was cited as saying. (MNI)

ECONOMY: Analysts expect China's exports growth to slow in the second half of this year, citing high comparison base and narrowing gap between global supply and demand, according to China Securities Journal. Analysts urge exporters to expand sales in emerging markets and adjust supply chain. (BBG)

OVERNIGHT DATA

CHINA JUN TRADE BALANCE +$51.53BN; MEDIAN +$44.75BN; MAY +$45.54BN

CHINA JUN EXPORTS +32.2% Y/Y; MEDIAN +23.0%; MAY +27.9%

CHINA JUN IMPORTS +36.7% Y/Y; MEDIAN +29.5%; MAY +51.1%

CHINA JUN TRADE BALANCE +CNY332.75BN; MEDIAN +CNY270.00BN; MAY +CNY296.00BN

CHINA JUN EXPORTS CNY +20.2% Y/Y; MEDIAN +15.1%; MAY +18.1%

CHINA JUN IMPORTS CNY +24.2% Y/Y; MEDIAN +20.8%; MAY +39.5%

AUSTRALIA JUN NAB BUSINESS CONFIDENCE 11; MAY 20

AUSTRALIA JUN NAB BUSINESS CONDITIONS 24; MAY 36

The June survey was conducted through the period of rising cases in NSW and the early part of the subsequent lockdowns both there and in other states. Unsurprisingly, business confidence has taken a hit. This was particularly evident in NSW and Qld but confidence was generally softer elsewhere. Rec & personal services, which bears the brunt of social distancing and lockdowns, also took a large hit to confidence and is back in negative territory. That said, overall confidence remains around twice its long-run average after strengthening in early 2021. Business conditions also saw a sharp fall in the month, driven by a weaker read for Victoria. This likely reflects the impact of the lockdown that started in late May which was eased in a series of steps over June. Conditions generally remain elevated across the states despite the broad-based weakening in the month. Overall, the survey points to a solid outcome in the June quarter for economic activity – and continues to reflect the support of both fiscal and monetary policy. The experience of lockdowns to date, is that there is a fairly rapid rebound in activity as restrictions are removed – and with most survey indicators still at high levels, the hope is that there is no material easing in hiring and investment intentions which have been critical to the recovery. However, as the economy passes through the rebound phase and into a new period of growth, we would expect some normalisation across the survey variables. We will continue to watch both capacity utilisation and forward orders, which pulled back in the month but are still elevated, alongside confidence and conditions as the economy again enters a period of heightened uncertainty. (NAB)

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 110.0; PREV. 107.8

Consumer confidence rose 2.0% despite the announcement of a third week of lockdown in Sydney as daily COVID-19 cases jumped. The easing of criteria for the federal government's AUD500 assistance payment may have helped, with Sydney itself recording a 3.7% rise in confidence after the plunge the prior week. The emergence of Brisbane, Perth and Darwin from their lockdowns also added to the rebound. A comparison between Sydney and Melbourne shows that even though there is a sharp decline in confidence in the particular city whenever a lockdown is imposed, sentiment tends to be similar in both cities and there was no great divergence even during Melbourne's prolonged lockdown in 2020. (ANZ)

NEW ZEALAND JUN REINZ HOUSE SALES +6.2% Y/Y; MAY +81.4%

House price rises have continued to defy expectations with every region in the country seeing an uplift in median house prices when compared to the same time last year, and five regions seeing outright records in June. Even the month-on-month data has shown a slight uplift (+0.3% nationally), and more than half of the regions saw an uplift when compared to May suggesting that the market is refusing to cool. Once more, we're seeing this story echoed by some very strong results in the REINZ House Price Index (HPI), which again reached a new high on the index. Every region saw an uplift in HPI values compared to the previous month – and the three months prior – suggesting that the market will hold strong for a few more months yet. Those buyers hoping for a bargain over winter might be disappointed, and today's data really points to how important it is to address the housing supply issues we have. (REINZ)

NEW ZEALAND JUN FOOD PRICE INDEX +1.4% M/M; MAY +0.4%

SOUTH KOREA MAY MONEY SUPPLY L -0.5% M/M; APR +1.8%

SOUTH KOREA MAY MONEY SUPPLY M2 +0.6% M/M; APR +1.5%

UK JUN BRC SALES LIKE-FOR-LIKE +6.7% Y/Y; MAY +18.5%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2000% at 09:27 am local time from the close of 2.1392% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday vs 40 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4757 TUES VS 6.4785

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4757 on Tuesday, compared with the 6.4785 set on Monday.

MARKETS

SNAPSHOT: Geopolitics & COVID Dominate A Light News Slate

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 152.74 points at 28721.88

- ASX 200 up 15.536 points at 7349

- Shanghai Comp. up 8.439 points at 3556.275

- JGB 10-Yr future up 6 ticks at 152.25, yield down 0.5bp at 0.025%

- Aussie 10-Yr future down 1.5 ticks at 98.6650, yield up 1.7bp at 1.333%

- U.S. 10-Yr future -0-02 at 133-11, yield up 0.67bp at 1.371%

- WTI crude up $0.24 at $74.34, Gold up $3.87 at $1810.20

- USD/JPY up 5 pips at Y110.42

- BIDEN TEAM WEIGHS DIGITAL TRADE DEAL TO COUNTER CHINA IN ASIA (BBG)

- BORIS JOHNSON SHIFTS COVID ONUS ON TO COMPANIES AND INDIVIDUALS (FT)

- ECB COULD USE TOOLS TO REIN IN EXCESSIVE DIVIDENDS (BBG)

BOND SUMMARY: Relative Outperformance For JGBs, Aus Fiscal Support Matters Eyed

T-Notes held to a very narrow 0-03 range overnight, last dealing -0-02+ at 133-10+ on volume of ~40K. Cash Tsys are unchanged to ~0.5bp cheaper across the curve. There has been little in the way of notable macro news flow during Asia-Pac hours, outside of a BBG report pointing to early discussions surrounding a Biden-led digital trade deal re: countering the influence of China in Asia (which would include the likes of Canada, Japan & Chile). Market flow has been dominated by the previously flagged ~31K screen lift of FFU1, with a total of ~46K lots trading at the same price in that contract overnight.

- Tokyo trade has seen JGB futures respect the range established during the previous after-hours session. The major cash JGB benchmarks trade little changed to ~1.0bp richer on the day. 20s have outperformed in the wake of supply, with the latest round of 20-Year JGB supply seeing the low price print comfortably above broader dealer expectations (proxied by the BBG dealer poll), while the cover ratio edged ever so slightly lower and the price tail saw an incremental widening vs. prev. auction.

- It has been a mundane session for ACGBs, with the latest NAB business survey showing a slight moderation from very upbeat levels (in terms of both confidence and conditions), with the risk seemingly for a lower print next month given the lockdown situation in Sydney. Still, NAB noted that "overall, the survey points to a solid outcome in the June quarter for economic activity - and continues to reflect the support of both fiscal and monetary policy. The experience of lockdowns to date, is that there is a fairly rapid rebound in activity as restrictions are removed - and with most survey indicators still at high levels, the hope is that there is no material easing in hiring and investment intentions which have been critical to the recovery. However, as the economy passes through the rebound phase and into a new period of growth, we would expect some normalisation across the survey variables." YM unch., XM -1.5. The 10+-Year zone of the cash ACGB curve is seeing the largest degree of cheapening on the day, with yields in that zone ~1.5bp higher vs. closing levels. Elsewhere, the Guardian noted that "a new commonwealth financial support package for locked-down greater Sydney is to be announced after the federal government signed off on a cash boost for affected businesses and households. The new Covid assistance package, which was approved by the federal government's expenditure review committee on Monday, was finalised by the federal and New South Wales Treasuries before a joint announcement expected on Tuesday."

JGBS AUCTION: Japanese MOF sells Y980.4bn 20-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y980.4bn 20-Year JGBs:

- Average Yield 0.404% (prev. 0.433%)

- Average Price 99.92 (prev. 101.21)

- High Yield: 0.408% (prev. 0.436%)

- Low Price 99.85 (prev. 101.15)

- % Allotted At High Yield: 9.4094% (prev. 31.0507%)

- Bid/Cover: 3.515x (prev. 3.618x)

AUSSIE BONDS: The AOFM sells A$100mn of the 0.75% 21 Nov '27 I/L Bond, issue #CAIN414:

The Australian Office of Financial Management (AOFM) sells A$100mn of the 0.75% 21 November 2027 I/L Bond, issue #CAIN414:- Average Yield: -1.0295% (prev. -0.8600%)

- High Yield: -1.0250% (prev. -0.8550%)

- Bid/Cover: 4.6800x (prev. 6.6533x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 7.1% (prev. 24.3%)

- bidders 31 (prev. 42), successful 12 (prev. 8), allocated in full 8 (prev. 4)

EQUITIES: Higher Across The Board

Equity markets are higher in Asia as risk assets find favour in a quiet session after taking a positive lead from the US where bourses hit another set of record highs. Markets in China are in positive territory, data showed the trade balance widened more than expected as exports and imports both continue robust gains. Markets in Australia are higher, though moves are muted compared to peers; demand concerns around the Delta-variant of coronavirus abound, but the drop in case numbers in Sydney helped underpin prices. Gains were solid in tech shares, the Hang Seng seeing gains of around 2% while in Taiwan markets hit an intraday record high. In the US futures are mixed, tech shares continue to outperform and have moved higher while e-mini S&P and e-mini Dow Jones are slightly lower.

OIL: Prices Drift Higher

Crude futures have drifted higher in Asia-Pac trade on Tuesday; WTI is up $0.21 from settlement levels at $74.31/bbl, Brent is up $0.20 at $75.36/bbl. Demand concerns around the Delta-variant of coronavirus abound, but the drop in case numbers in Sydney helped underpin prices. This keeps the technical outlook unchanged, with Brent still vulnerable following last week's downleg. The focus is on $71.24, the Jun 17 low. Gains are considered corrective. WTI has also cleared its 20-day EMA last week and attention turns to $69.54, Jun 17 low.

GOLD: Little Net Movement

Gold isn't going anywhere fast at present after dealing either side of $1,800/oz on Monday. Spot last deals little changed around $1,810/oz. The well-defined technical overlay remains in play after the recent consolidation, with U.S. CPI data (due for release on Tuesday) and Fed Chair Powell's semi-annual testimony on the Hill set to provide the major fundamental inputs over the coming sessions.

FOREX: Risk Tone Improves, Chinese Trade Data Support Yuan

Today's fairly lacklustre Asia-Pac session saw the Antipodeans take a narrow lead in the G10 pack, as most regional equity benchmarks eked out some gains. AUD/USD flirted with the round figure of $0.7500, while NZD/USD returned above the $0.7000 mark. AUD/NZD shed a handful of pips as Australia's NAB Business Confidence deteriorated.

- Better risk tone reduced demand for safe haven assets, leaving JPY and USD at the bottom of the pile. The DXY faltered ahead of the release of monthly U.S. CPI.

- An uptick in crude oil prices failed to shield the NOK, which was among the worst G10 performers.

- USD/CNH traded on a softer footing, as China reported a wider than expected trade surplus for the month of June, underpinned by considerable beats in both exports and imports. The PBOC fix came in 10 pips above sell-side estimate, provoking virtually no reaction.

- Focus turns to inflation data from the U.S., Germany & France, while BoE Gov Bailey is set to speak on the Financial Stability Report.

FOREX OPTIONS: Expiries for Jul13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740-45(E1.2bln), $1.1875(E605mln), $1.1900-15(E1.3bln)

- USD/JPY: Y109.70-85($883mln), Y110.30($545mln)

- EUR/JPY: Y132.85(E536mln)

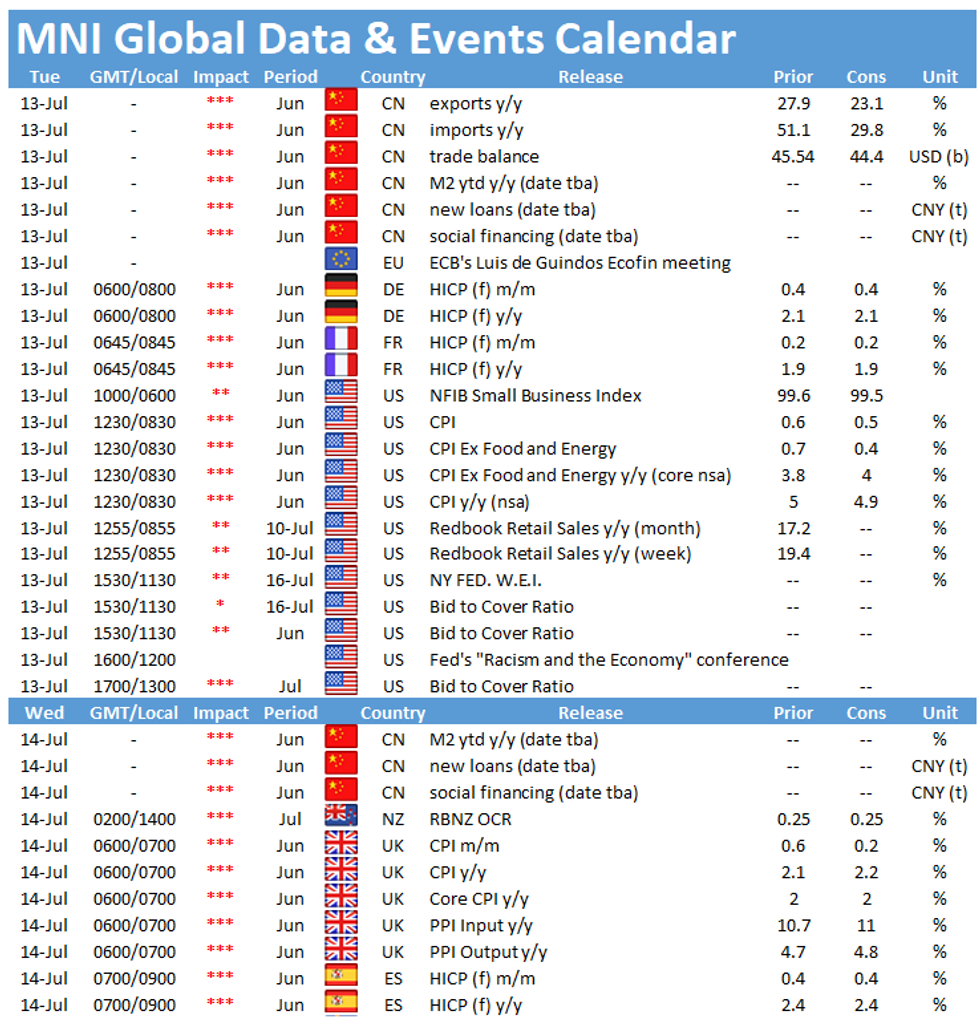

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.