-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: DXY Nudges Higher In Asia, U.S. Tsys & E-Minis Consolidate

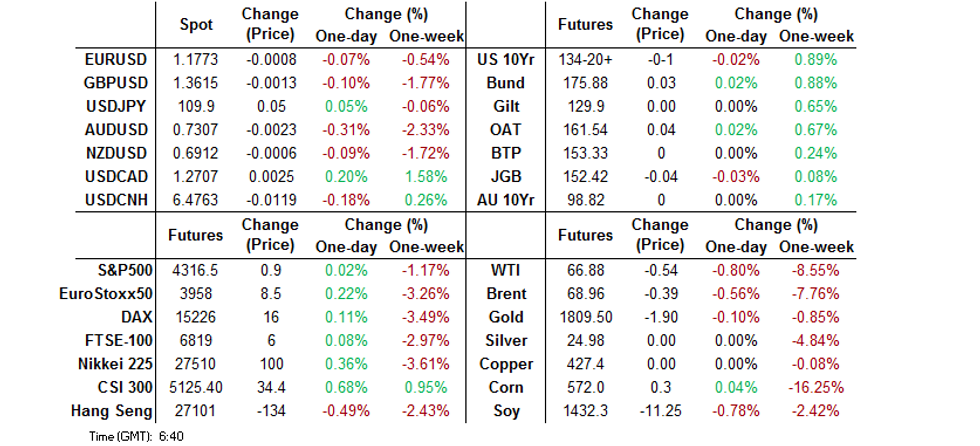

- There was a lack of tier 1 news flow overnight, leaving core markets to operate in relatively narrow ranges.

- AUD found itself at the bottom of the G10 FX table with continued worry re: the economic impact of COVID lockdowns, lower iron ore prices and speculation surrounding the likelihood of the RBA going through with its already announced tapering move weighing

- The broader global docket is once again sparse on Wednesday.

BOND SUMMARY: Core FI Little Changed In Asia

T-Notes pared their modest late NY/early Asia losses, last unch. at 134-21+. Cash Tsys have seen some bull flattening with the shorter end of the curve little changed, while the longer end has firmed by 1.0-1.5bp. There hasn't been much in the way of news flow to drive the move, with a downtick in e-minis & high beta FX seemingly lending support. In terms of $ supply, Indonesia outlined a tap of their '51 & '71 $ bonds, and a new 10-Year $ bond. The taps and the 10-Year supply will all be of benchmark size, with the potential for pricing in today's NY session (per BBG sources). Broader volume is a little lighter today, with TYU1 volume under 100K at this time of day for the first time this week. 20-Year Tsy supply and fiscal matters on the Hill are set to dominate during NY hours on Wednesday.

- Shorter dated JGBs have richened, 10-Year JGBs have failed to break below 0.01% thus far, while some modest cheapening witnessed in the long end of the curve (~1.0bp) has resulted in some twist steepening. JGB futures print 2 ticks below yesterday's settlement level, unwinding the late overnight bid that was witnessed (which seemed a bit out of line vs. the likes of U.S. Tsys). Comments from BoJ Deputy Governor Amamiya failed to introduce any new areas of interest, while the release of the stale minutes from the BoJ's June meeting was never going to be a major market mover. The latest round of BoJ Rinban operations revealed the following offer to cover ratios: 1- to 3-Year: 2.38x (prev. 2.83x), 3- to 5-Year: 2.63x (prev. 2.69x), 5- to 10-Year: 3.07x (prev. 1.82x), JGBis: 3.19x (prev. 5.50x). A reminder that Japanese markets will be closed on Thursday & Friday as the country observes a public holiday.

- The previously flagged and heavily discussed questions surrounding the economic impact of the Australian COVID lockdowns (NSW & Victoria saw an uptick in their new case counts today) & subsequent impact on RBA policy has provided some underlying support for the Aussie bond space, leaving YM & XM +0.5. The cash ACGB has twist steepened on the day, with the long end running ~2.5bp cheaper, albeit off of cheapest levels. The latest round of ACGB Dec '30 supply saw the weighted average yield print 0.32bp through prevailing mids at the time of supply (per Yieldbroker). The cover ratio firmed vs. the prev. auction of the line, even when you account for the decrease in the amount on offer, with the well-defined supportive factors re: ACGB demand outweighing some valuation headwinds.

FOREX: Aussie Faces Combination Of Headwinds

Cautious mood music returned into G10 FX space, even as dip-buying pushed most Asia-Pac equity benchmarks higher. The AUD led losses as local retail sales shrank more than expected, according to the flash reading for June. Relatively sizeable increase in NSW Covid-19 case count as well as softer crude oil and iron ore prices rubbed some salt into the Aussie's wounds.

- Oil-tied peers CAD and NOK were dragged lower by weaker crude prices, which came under pressure after the latest API report pointed to the first expansion in U.S. stockpiles since May, with the weekly DOE report coming up today.

- The Swiss franc paced gains among safe haven currencies and topped the G10 pile, while the greenback was the runner up.

- USD/CNH retreated after the first half of this week failed to bring a break above the CNH6.5000 mark. The PBOC fix fell virtually in line with sell-side estimate.

- The global economic docket is fairly empty today, with ECB's Visco & Perrazzelli set to speak.

FOREX OPTIONS: Expiries for Jul21 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700(E1.3bln), $1.1835-50(E1.1bln), $1.1900(E1.1bln)

- USD/JPY: Y110.00-15($947mln), Y110.50($820mln)

- AUD/USD: $0.7400(A$857mln)

ASIA FX: Delta Variant Concerns Weigh

A mostly negative day as most EM Asia economies remain in the thralls of the delta variant.

- CNH: Offshore yuan is stronger, USD/CNH retreated after the first half of this week failed to bring a break above the 6.50 mark. The PBOC fix fell virtually in line with sell-side estimate.

- SGD: Singapore dollar is weaker, the government will tighten restrictions again from Thursday as new cases hit a record daily high.

- KRW: Won is weaker, reversing early gains as markets chose to focus on record coronavirus cases instead of robust PPI and export data

- TWD: Taiwan dollar is weaker, reversing earlier strength as USD/TWD retreats from the 28.00 handle. There were reports that Taiwan's decision to open an office in Lithuania under the name Taiwan (as opposed to Tapei) has angered China.

- MYR: Ringgit is weaker, falling to the lowest since August. New virus cases remain above 10k a day while the government relaxed virus protocols for businesses, amid an acceleration of domestic vaccination drive.

- IDR: Rupiah declined, an extension to the current curbs through Jul 25 was announced, while elsewhere the government outlined a plan to relax restrictions from Jul 26, if daily case count continues to fall.

- PHP: Peso is lower, shaking off early gains. Senate Pres Vicente Sotto III confirmed to CNN that he will team up with Senator Panfilo Lacson for the 2022 presidential election and they would be making a formal announcement early next month.

- THB: Baht fell, it was reported late on Tuesday that the state of emergency will run through to the end of September while the budget for the e-voucher programme will be reduced.

ASIA RATES: Mostly Higher As EM Risk Off Continues

- INDIA: Bond market closed for Id-ul-zuha public holiday.

- SOUTH KOREA: Futures have moved higher from the open in South Korea, participants choosing to ignore strong exports and PPI data and focus on a record number of COVID-19 cases. There were 1,784 new cases in the past 24 hours, health officials warned that cases are expected to climb again tomorrow before declining from July 23/24. Elsewhere the BoK sold KRW 2tn of 2-Year MSB's at 1.29% with cover of 1.38x.

- CHINA: The PBOC matched injections with maturities at its OMOs today; repo rates are higher, the overnight repo rate has been climbing steadily through July, rising from July 1 lows of 1.2841% to hit 2.1846%, this is still below highs seen in previous months. The 7-day repo rate has remained steady and is within recent ranges at 2.1987%. Futures are higher for the sixth of the last eight sessions. There were reports in the Shanghai Securities News that bidding at recent local government bond auctions indicates that government bond issuance is becoming more market driven.

- INDONESIA: Yields mixed with the belly seeing buying while the long and short end sells off. The government announced an extension to the current curbs through Jul 25 was announced, while elsewhere the government outlined a plan to relax restrictions from Jul 26, if daily case count continues to fall.

EQUITIES: Mixed As Delta Variant Worries Linger

A mixed session for equities in the Asia-Pac region with some bourses struggling to shake off delta variant concerns and capitalize on a positive lead from the US. In Japan markets are higher by around 0.5% but have come off session highs seen shortly after the open, markets in mainland China have seen similar gains but the Hang Seng is lower by around 0.5%. Other gainers include markets in Australia and Thailand. Indices in Taiwan, Singapore, South Korea and the Philippines all fell on COVID-19 concerns. In the US futures are lower, pulling back after robust gains yesterday, US yields are lower with the 10-Year dropping back towards 1.2% after claiming the level yesterday. There were reports that the US Senate is to vote on the infrastructure bill later on Wednesday.

GOLD: Holding

The richening in the U.S. Tsy/real yield space has been countered by USD strength in recent days, with bullion staying in a narrow range as a result, failing to challenge the well-defined technical layover. Spot last deals little changed around the $1,810/oz mark, with nothing in the way of definitive catalysts eyed through the remainder of the week. The U.S. fiscal dynamic will be eyed on Wednesday, but there is a lack of clarity surrounding that particular situation.

OIL: Tepid Recovery Not Sustained In Asia

Crude futures are lower in Asia-Pac trade after staging a tepid bounce on Tuesday; with WTI & Brent both running $0.40 below settlement at typing. Data late yesterday showed US headline crude stockpiles rose 806k bbls according to the API, if confirmed by official figures it would be the first build since May. As such focus Wednesday turns to the weekly DoE crude oil inventories, in which markets see a draw of close to 4mln barrels in crude stocks for the week ending July 16th. For WTI support is seen at $65.56/64.60 - Low Jul 19 / 76.4% of the May 21 - Jul 6 rally, for Brent bears will target $67.43 - 76.4% retracement of the May 21 - Jul 6 rally.

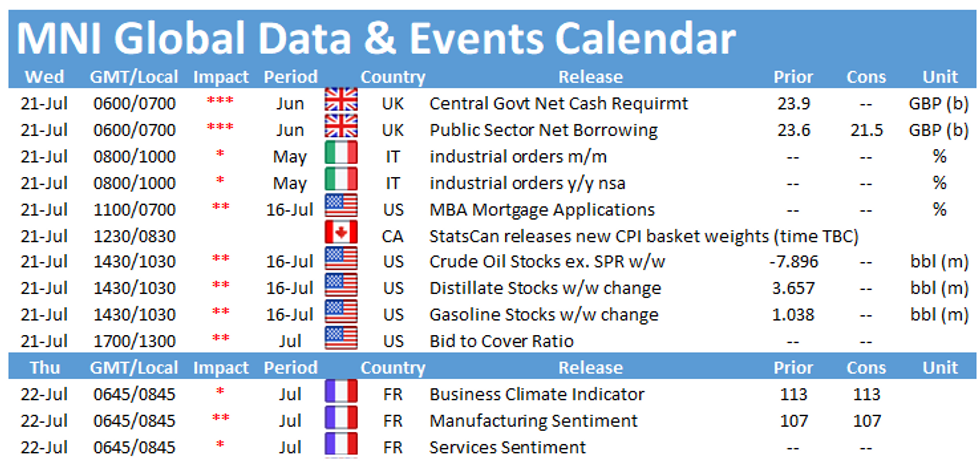

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.