-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Usual ECB Hawks Reportedly Show Dissent, Aussie COVID Not Going Away

EXECUTIVE SUMMARY

- WEIDMANN, WUNSCH OPPOSED ECB'S NEW GUIDANCE ON INTEREST RATES (BBG)

- WARREN, BROWN CRITICIZE POWELL'S APPROACH ON BANK REGULATION (BBG)

- BIDEN TEAM PLANS FOR CHIPS FUNDING EVEN BEFORE CONGRESS ACTS (BBG)

- UK TO LAUNCH DAILY COVID TESTS TO ALLEVIATE PRESSURE ON CERTAIN SECTORS

- DUP THREATENS TO STYMIE 'UNACCEPTABLE' BREXIT DEAL (THE TIMES)

- NSW FLAGS NATIONAL EMERGENCY RE: COVID IN SYDNEY

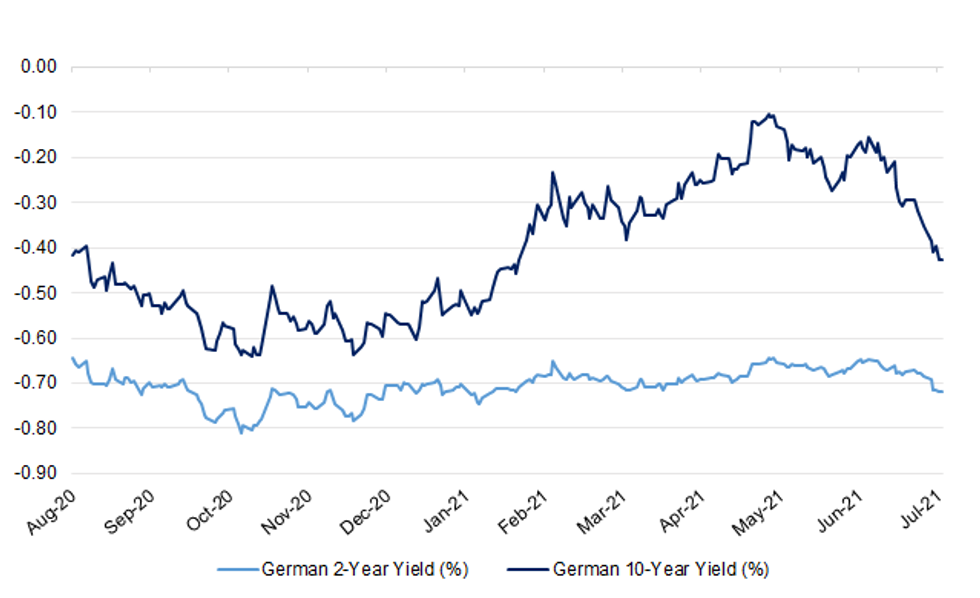

Fig. 1: German 2- & 10-Year Yields (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The government has released a list of 16 sectors where fully vaccinated workers may be exempt from isolation if they are told to quarantine after coming into close contact with a positive COVID case. The sectors include energy, civil nuclear, digital infrastructure, food production and supply, waste, water, veterinary medicines, essential chemicals, essential transport, medicines, medical devices, clinical consumable supplies, emergency services, border control, essential defence outputs, and local government. Those covered will be able to leave their COVID-19 isolation to travel to work and do their jobs after a negative daily test but must remain at home otherwise and go straight into quarantine if they receive a positive result. (Sky)

CORONAVIRUS/POLITICS: Boris Johnson could be facing a rebellion of a different kind, as Conservative MPs threaten to boycott the party conference over the Covid vaccine passport. (Telegraph)

BREXIT: Northern Ireland ministers will unilaterally suspend checks on goods crossing into the province from Britain if the prime minister signs up to an "unacceptable" new Brexit deal, the leader of the DUP has warned. Sir Jeffrey Donaldson told The Times yesterday in his first newspaper interview since being elected head of the largest unionist party in Northern Ireland that the DUP was "not going to be in the business" of implementing the protocol if it continued to damage the province's relationship with Britain. He also warned the Irish government that his party could suspend key parts of the peace agreement if a compromise could not be reached. (The Times)

BREXIT: France's Europe minister Clement Beaune rejected on Thursday Britain's request to renegotiate the Brexit deal governing trade with Northern Ireland, dismissing British accusations of European dogmatism as a "tall tale". Britain on Wednesday demanded a new deal from the European Union to govern post-Brexit trade with the British province, saying it already had cause to step away from parts of the deal that it struck with Brussels only last year. London accuses Brussels of being too purist, or legalistic, in interpreting what the deal means for some goods moving from Britain to Northern Ireland. (RTRS)

ECONOMY: MNI REALITY CHECK: Bottlenecks Weigh On UK June Retail Sales

- UK retail sales failed to recover significantly from the unexpectedly-weak decline in May, with many retailers unable to fulfil demand -- particularly for electronics and homewares -- as supply bottlenecks reduced imports into the UK, industry insiders told MNI. A lack of supply limited sales volumes growth, according to retailing executives, although sales values are likely to have increased in June as stock reductions resulting from shipping bottlenecks meant retailers had no need to implement discounting to shift goods - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

POLITICS: Sir Keir Starmer has declined to rule out forming a pre-election coalition with other parties such as the Liberal Democrats before the next election. The Labour leader said that there was "a majority broadly against the Tories in the country" when he was asked about the prospect of forming a political pact with smaller parties. "We've got to do a lot more work," he told the ITV podcast Calling Peston. "Obviously, going into the next general election . . . there will be a question of what we do. "There's a majority broadly against the Tories in the country and we'll have to see how we go into the next general election. (The Times)

EUROPE

ECB: Bundesbank President Jens Weidmann and Belgian Governor Pierre Wunsch opposed new European Central Bank policy guidance that signals a longer period of record-low interest rates, according to officials familiar with the matter. The two Governing Council members were concerned about wording that can be seen as making too much of a long-term commitment to loose monetary policy, the people said. Other officials agreed to the forward guidance on the condition that it only affects interest rates, not asset purchases, according to one official. A spokesman for the ECB declined to comment. (BBG)

ECB: A significant group of European Central Bank policymakers objected to the new interest rate guidance it gave on Thursday but most were won over and only two -- the German and Belgian central bank chiefs -- held out, four sources told Reuters. The ECB said after Thursday's meeting that it would not hike borrowing costs until it sees inflation reaching its 2% target "well ahead of the end of its projection horizon and durably", a commitment Bundesbank chief Jens Weidmann and Belgium's Pierre Wunsch objected to. "It was an unusually robust debate, and a lot more than just two people voiced concerns, but most were eventually won over by (ECB President Christine) Lagarde," one of the sources said. A third policymaker, who also voiced significant objections, had to leave the meeting early and was not present at the final tally, one of the sources added. The ECB, the Bundesbank and the National Bank of Belgium all declined to comment. (RTRS)

ECB: The European Central Bank's move to become more tolerant of inflation before raising interest rates has sparked immediate criticism from some of its more hawkish policymakers in an early indication of the divisions that will fuel its debate on when to scale back bond-buying. After its latest policy-setting meeting on Thursday the ECB said it would keep buying bonds and maintain its deeply negative interest rates in an attempt to shift the eurozone economy out of its persistent pattern of sluggish inflation, and was prepared to tolerate a moderate and transitory overshoot of its price growth target. But the wording of its new stance drew criticism from the leaders of the German and Belgian central banks, who both sit on its 25-person governing council, according to people familiar with the discussions. In addition, Klaas Knot, head of the Dutch central bank, called for the ECB to separate the timing of when it will stop buying bonds from its new rate guidance, those familiar with the discussions said. Another council member said this idea was dropped after policymakers decided to postpone a discussion of the asset purchase plans until the autumn. (FT)

FRANCE: France reported 21,909 new coronavirus cases and 11 deaths in 24 hours Thursday. On average, the number of positive cases is up by 133% in a week. (BBG)

ITALY: Italy's government will make a so-called coronavirus green pass necessary to eat and drink inside a restaurant or bar, announced Health Minister Roberto Speranza Thursday. The decision to adopt a green pass — a digital or paper certificate showing vaccination or a recent negative COVID-19 test — follows France's controversial example. It comes as the country has seen a spike in infections driven by the Delta variant, with new cases over the seven days to July 20 more than doubling to nearly 19,400 compared with the week before. The country will also extend its state of emergency to December 31. (POLITICO)

ITALY/BTPS: The Italian Treasury has modified its auction calendar for August, canceling some upcoming bond auctions due to cash availability, it said Thursday. The cancellation affects the auction of inflation-linked bonds, or BTPei, on July 27, and the mid-August BTP auction on Aug. 12, it said. Italy usually cancels some auctions in August, which is seasonally a very slow month in terms of government bond issuance in the eurozone due to the holiday season. Last year, however, was an exception and Italy held a mid-August BTP bond auction, although it skipped the linker sale at end-August, because of the surge in financing needs related to Covid-19. The Treasury added that, with settlement date Aug. 2, 2021, a partial reimbursement operation at maturity of the Aug. 2021-dated BTP will take place by means of the resources available on the Government bond Sinking Fund for an amount equal to 5.42 billion euros ($6.39 billion). (Dow Jones)

PORTUGAL: Portugal will apply restrictions including a nighttime curfew to more municipalities in an attempt to contain an increase in infections. The limit to movement in public spaces between 11 p.m. and 5 a.m. in regions including Lisbon will now be imposed in 116 municipalities, up from 90 previously, Presidency Minister Mariana Vieira da Silva said on Thursday. (BBG)

RATINGS: Potential rating reviews of note scheduled for after hours on Friday include:

- Moody's on Cyprus (current rating: Ba2; Outlook Positive)

- DBRS Morningstar on the EFSF (current rating: AAA, Stable Trend) & the ESM (current rating: AAA, Stable Trend)

U.S.

FED: Senate Banking Chair Sherrod Brown and Senator Elizabeth Warren kept up criticism of Federal Reserve Chairman Jerome Powell over his stance on bank regulation as the Biden administration is turning to the question of whether the central bank chief should be reappointed. "The chairman of the Federal Reserve has two obligations. One, to lead us in monetary policy, and the second, in regulating the largest financial institutions," Warren told reporters on Capitol Hill when asked whether President Joe Biden should renominate Powell. "I have asked the chairman repeatedly from the time he was nominated about his views on regulation. I am concerned when I see the rules weakened rather than strengthened." The remarks follow a Banking Committee hearing last week when Brown and Warren, both vocal proponents of tougher banking rules, laid out a laundry list of grievances as Powell appeared before the panel. (BBG)

ECONOMY: State withdrawals from pandemic-era unemployment programs aren't speeding up the job recovery, according to a new analysis. Twenty-five states have ended their participation in at least some of the programs since mid-June. Louisiana, will do so July 31. (CNBC)

ECONOMY: Commerce Secretary Gina Raimondo on Thursday brushed off concern among restaurant owners of a worker shortage and, instead, described the situation as a 'skills gap.' At a town hall in Cincinnati on Wednesday night, President Joe Biden was asked by restaurant owner John Lanni what his administration was going to do to end the worker shortages. He replied by telling Lanni that he should increase wages and that the reason restaurants were struggling to hire people was that workers were considering 'different opportunities'. Raimondo argued there was no shortage. (Daily Mail)

CORONAVIRUS: The U.S. is "at another pivotal moment in this pandemic," with Covid-19 cases once again climbing and beds at some hospitals filling up, Centers for Disease Control and Prevention Director Rochelle Walensky said at a Thursday briefing. Daily hospital admissions have risen by more than 30% over the last week, she said. The availability of highly effective Covid-19 vaccines has made the U.S. safer, but some communities remain vulnerable due to low vaccination rates and the highly-contagious delta variant. At the Thursday briefing, Walensky and other Biden administration officials urged Americans to get vaccinated. (BBG)

CORONAVIRUS: A panel of health experts advising the U.S. government on vaccines expressed preliminary support for giving Covid-19 boosters to immunocompromised people, but said they were waiting for regulatory action before making a formal recommendation. A work group of the Advisory Committee on Immunization Practices panel also on Thursday endorsed the continued use of J&J's vaccine, despite a recent warning about a low risk of a rare neurological disorder among people taking the shot. The ACIP panel, which advises the U.S. Centers for Disease Control and Prevention, develops recommendations for use of vaccines generally in the U.S. The committee is comprised of experts in infectious diseases, immunology and public health. (WSJ)

CORONAVIRUS: Dr. Scott Gottlieb told CNBC on Thursday the current spike in Covid infections due to the highly contagious delta variant may be over sooner than many experts believe. However, the former FDA chief urged Americans to take precautions in the meantime as delta, first found in India, takes hold as the dominant variant in the U.S. (CNBC)

CORONAVIRUS: The recent rise in Covid-19 cases shows no signs of abating in the U.S. states that have fueled the uptick as the delta variant proliferates. Nationally, cases are likely to rise to 306,909 for the week ending Aug. 14, up 39% from last week, according to an ensemble of forecasts from the Centers for Disease Control and Prevention. Surges are expected in some states where case rates are among the worst. Florida rates are seen climbing to 62,744 cases per week, more than half the state's winter peak. The trend looks similar in Missouri, where the governor this week announced a new vaccine incentive program. (BBG)

CORONAVIRUS: San Francisco and two other counties in the Bay Area -- Contra Costa and Santa Clara, home to many Silicon Valley tech companies -- are encouraging employers to consider requiring vaccinations for workers. Health officers for the counties said the rapid spread of the delta variant has led to significantly higher case rates and risk of transmission at jobs. "Workers who are unvaccinated against Covid-19 pose a substantial health and financial risk to the workplace," Chris Farnitano, health officer of Contra Costa County, said in a statement Thursday. While the health officers said they "strongly urge" employers to consider requirements, it isn't a mandate. Last week, the counties and others in the region said they were encouraging indoor mask use among all individuals to slow the virus's spread. (BBG)

CORONAVIRUS: Los Angeles County cases rose 80% in the past week to 2,767, health officials say, as the transmission rate climbed to a "substantial" level. The case count is the highest since February. The positive test rate rose to 5.26%, surging from 1.2% when California reopened and eased most of its curbs. (BBG)

CORONAVIRUS: Los Angeles County's top health official said fully vaccinated people made up 20% of cases in June, up from 11% in May, and warned the figure may rise in July with a higher level of community transmission. "We had a significant increase in the number of people who were fully vaccinated and tested positive," said Barbara Ferrer, the county's public health director, though she pointed out that the majority of these cases had no symptoms or had just very mild illness. "The numbers can go up again in July, until we get the community transmission back in control." (BBG)

CORONAVIRUS: Texas virus cases soared 77% in a 24-hour period to the highest daily tally since before Governor Greg Abbott lifted a mask mandate and other anti-pandemic restrictions more than four months ago. The state registered 6,417 new cases, the biggest increase since March 2, according to health department figures. Hospitalizations have been steadily rising for almost three straight weeks and have more than doubled so far this month to almost 4,000, a level not since since mid-March. (BBG)

CORONAVIRUS: Louisiana's Covid-19 hospitalizations have risen to more than 900, almost doubling in a week, according to state data released Thursday. With cases driven by the delta variant surging in Louisiana, the number of people hospitalized is the highest since February. Louisiana has the third-lowest rate of vaccination in the U.S., after Mississippi and Alabama, according to the Bloomberg Vaccine Tracker. Just over 40% of people in the state have received at least one dose of vaccine, compared with the national average of more than 56%. (BBG)

CORONAVIRUS: The University of Utah Hospital this week began postponing elective surgery to contend with a surge in Covid-19 admissions, the Deseret News reported. "We need to be able to create capacity to take care of those that are critically ill," said Kencee Graves, associate chief medical officer for inpatient services, noting the majority of new admissions have not been vaccinated. The hospital announced the policy Wednesday. (BBG)

CORONAVIRUS: The Capitol's chief physician is considering reimposing a mask recommendation in the Capitol after two months of mostly face-covering-free business in the House and Senate, according to three sources familiar with the matter. An imminent announcement is not expected, but the Office of the Attending Physician is weighing whether to suggest that people don masks again inside the Capitol complex as the Delta variant surges nationwide. (POLITICO)

OTHER

GLOBAL TRADE:Intel Corp. Chief Executive Pat Gelsinger sees the global semiconductor shortage potentially stretching into 2023, adding a leading industry voice to the growing view that the chip-supply disruptions hitting companies and consumers won't wane soon. The world-wide shortage has fueled rising prices for some consumer gadgets. Meanwhile, the auto industry has been particularly hard-hit as the lack of a key component causes production delays. German car maker Volkswagen AG this month warned the global shortage could worsen over the next six months. Others have said they were bracing for problems through next year. (WSJ)

GLOBAL TRADE: The Biden administration is laying the groundwork to spend roughly $52 billion on semiconductor research and manufacturing even as it's awaiting congressional approval of the funding, Commerce Secretary Gina Raimondo said. "We're putting plans in place right now already on the team to invest the $52 billion," she said Thursday during a White House press briefing. "We need to incentivize the manufacturing of chips in America and so we are very focused on putting the pieces in place so that can happen." She added that she's engaging with industry daily and doing "a lot" to address the shortage. (BBG)

GLOBAL TRADE: China launched an anti-dumping investigation on grain oriented flat-rolled electrical steel imported from Japan, South Korea and the European Union on July 23, the Ministry of Commerce said on Friday. The probe follows the expiry of anti-dumping tariffs in place for five years since July 23, 2016. The new review will be concluded before July 23, 2022, the ministry said. (RTRS)

U.S./CHINA: China is preemptively showing its bottom line ahead of the visit by U.S. Deputy Secretary of State Wendy Sherman by demanding the U.S. to stop inferring in its internal affairs and expressing its positions to guard its interests, the Global Times reported after an announcement by the Ministry of Foreign Affairs, which also said Minister and State Councillor Wang Yi will meet Sherman. A high-level meeting of this kind still underscores that a more stable China-U.S. relation will benefit the world, the newspaper said citing Diao Daming, a scholar at the Renmin University. If the U.S. brings up questions about Xinjiang and Hong Kong, it will be wasting its time, won't save the declining relationship and may damage cooperation on issues such as climate change, the newspaper said citing Lv Xiang, a researcher at the Chinese Academy of Social Sciences. (MNI)

GEOPOLITICS: Several airlines, banks and technology websites were coming back online on Thursday afternoon after a brief outage, the third such widespread incident noted in just a span of two months, raising alarms across social media. Websites of Delta Air Lines, Costco Wholesale Corp , American Express and Home Depot were down, displaying domain name system (DNS) service errors. Cloud services provider Akamai Technologies had given an alert on its "Edge DNS" service incident, noting a "partial outage" on its website. "We have implemented a fix for this issue, and based on current observations, the service is resuming normal operations," it said later in a tweet. (RTRS)

CORONAVIRUS: White House press secretary Jen Psaki said on Thursday that the Biden administration is "deeply disappointed" in China's decision and told reporters that "their position is irresponsible and, frankly, dangerous." (RTRS)

CORONAVIRUS: An interval of eight to 10 weeks between doses of the Covid-19 vaccine developed by Pfizer Inc. and BioNTech SE boosts the effectiveness of the two-shot regimen compared with a shorter interval, a U.K. study found. "Eight weeks is probably the sweet spot," in terms of the trade-off between getting as many people fully vaccinated as quickly as possible and allowing the population to produce higher antibody levels, professor Susanna Dunachie, the study lead from the University of Oxford, said at a briefing Thursday. After inoculating a larger proportion of people than any other major economy, Britain has seen infections soar in recent weeks as the delta variant spreads. The pickup in cases has led to some debate over whether the government should further shorten the recommended interval between doses, recently lowered from 12 weeks to eight. (BBG)

AUSTRALIA: The New South Wales Covid-19 outbreak is now considered to be a 'national emergency' after the state recorded its highest daily spike with 136 new cases. The figure prompted Gladys Berejiklian to not only announce an extension of work travel restrictions to parts of Sydney but admit that lockdown would likely not end on July 30. (Daily Mail)

AUSTRALIA: Victoria has recorded 14 new local Covid-19 cases overnight with all of them linked to current outbreaks but Premier Dan Andrews has still asked for a 'ring of steel' to be placed around Sydney to avoid any further outbreaks. Ten of the 14 new cases were quarantining during the entire period they were infectious while one of the other four cases is waiting to be interviewed. Victoria's latest cluster has risen to 147 cases and is linked to the Sydney removalists who brought the highly-infectious Indian delta strain to the Victorian capital and a family who returned to the city from a New South Wales red zone. (Daily Mail)

AUSTRALIA/NEW ZEALAND: New Zealand suspended its quarantine-free travel bubble with Australia for at least the next eight weeks, starting 11:59 p.m. local time Friday. The decision followed health advice on the growing number of Covid-19 cases across Australia. "This is not a decision we have taken lightly, but it is the right decision to keep New Zealanders safe," Prime Minister Jacinda Ardern said. "We do want the bubble to resume. We remain committed to it, and when I spoke to PM Scott Morrison this morning I conveyed this view directly. But it must be safe." For the next seven days there will be managed return flights for New Zealanders to return home from all states and territories in Australia that will require proof of a negative pre-departure test. The government will work with airlines to ensure flights are available for this period and extend it if necessary. (BBG)

SOUTH KOREA: South Korea will extend the toughest virus restrictions in the greater Seoul area for another two weeks amid the fourth wave of new COVID-19 outbreaks, health authorities said Friday. Seoul, the surrounding Gyeonggi Province and the western port city of Incheon have been placed under Level 4, the highest in the four-tier virus curbs, since July 12, and the measures will be extended for another two weeks Monday, according to the authorities. Gatherings of more than two people will be banned after 6 p.m. Demonstrations will also be restricted, although the government will allow one-person protests. Weddings and funerals can only be joined by relatives. Entertainment establishments, including night clubs, will be ordered to shut down, while restaurants only will be allowed to have dine-in customers until 10 p.m. (Yonhap)

CANADA: MNI DATA BRIEF: Canada May Retails Seen -3.2%; Ex-Autos -2.0%

- Canadian retail sales likely declined 3.2% in May, economists predict the federal statistics office will report Friday at 830am EST, as third-wave Covid lockdowns were in effect. Investors should watch for a flash estimate for June in the report from Statistics Canada, which could show a big gain because many of the health lockdowns have eased since then. Retail sales dropped 5.7% in April after a March gain of 4.5%, again reflecting the pattern of shutdowns and re-opening through wave of Covid. Sales excluding autos and parts are expected to decline 2% on the month, following a prior decline of 7.2%. The Bank of Canada last week tapered QE purchases for a third time on optimism that mass vaccinations will underpin an economic rebound led by consumer spending - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: President Jair Bolsonaro refused to answer a question on allegations that Brazilian Defense Minister Walter Braga Netto had threatened the 2022 elections during his weekly live on social media. Bolsonaro limited himself to saying that the answer was in a statement disclosed earlier today by Braga Netto. Bolsonaro said he expects the electronic voting system to be reliable. "I'll pass the presidencial sash on to anyone, without a problem, in a clean election." Both the 2014 and 2018 presidential elections suffered interference, he added, promising to deliver evidence on 2018 election fraud on July 29. (BBG)

BRAZIL: Brazil's Jair Bolsonaro tapped a centrist lawmaker outside his inner circle to oversee his cabinet, the president's latest maneuver to maintain congressional support amid police and senate probes into the government's handling of the pandemic. Senator Ciro Nogueira, a leader of the powerful block of ideologically fluid lawmakers know as the "centrao," will become Bolsonaro's chief of staff with the mission to maintain good relations with the legislature, the far-right president announced on Thursday. "This improves dialogue with congress, and we will be able proceed as normal, leading the nation's destiny," he said on a live stream broadcast from the presidential palace in Brasilia. (BBG)

BRAZIL: Leading Brazilian politicians lined up on Thursday to stress next year's presidential election is certain to take place, after a bombshell newspaper story that Brazil's defense minister had issued a threat about holding the highly polarized vote. Estado de S. Paulo, citing anonymous sources, reported that Defense Minister Walter Braga Netto, a former army general, had told House Speaker Arthur Lira via an interlocutor that the 2022 election would not take place unless printed ballots were used. Reuters was unable to independently verify the story. Both Lira and Braga Netto denied the report, which roiled Brazil's political class. (BBG)

BRAZIL: Brazil's government on Thursday cut its 2021 primary budget deficit forecast, based on a bimonthly revenue and expenditure report which showed an expected jump in tax revenues on the back of stronger economic growth. The Economy Ministry now expects a deficit excluding interest payments of 155.4 billion reais ($30 billion) this year, or 1.8% of gross domestic product, down from 187.7 billion reais, or 2.2% of GDP, in May's report. It raised its 2021 net revenue forecast by 43.1 billion reais to 1.476 trillion reais, and increased its primary spending forecast by 10.8 billion reais to 1.632 trillion reais. (RTRS)

BRAZIL: Brazil's Economy Minister Paulo Guedes said on Thursday that "under no circumstances" can value-added tax be above 20%, and reiterated the government's desire to set a new tax on dividends at 20%. Speaking at an event hosted by Brazil's national industry and banking associations, Guedes also said that he expects the Senate to turn its attention away from the inquiry into the government's handling of the COVID-19 crisis towards supporting the government's reform agenda. (RTRS)

CHINA

YUAN: The Chinese yuan is expected to remain stable with no substantial depreciation or appreciation basis in the near term, as it is supported by an improving economy, normal monetary policy, and steady international balance of payments, the Economic Daily reported citing analysts. Regulators will continue to urge companies to manage FX risk by improving FX market transparency and increase market expectation guidance to keep the basic stability of the yuan at a reasonable and balanced level, the newspaper said citing a source from the State Administration of Foreign Exchange. (MNI)

CORONAVIRUS: China reported 12 new confirmed cases and 10 asymptomatic infections, amid signs that a fresh outbreak at the airport in eastern Chinese city of Nanjing has quietly spread to other provinces. Northeastern province Liaoning, eastern province Anhui and southern province Guangdong have each reported one asymptomatic infection related to the Nanjing cluster. The city of Nanjing reported 12 confirmed cases and 7 asymptomatic infections on Friday. Authorities have expanded Covid testing to all of the city's over 9 million residents to curb the virus spread. (BBG)

PROPERTY: The PBOC will continue to build a long-term system managing the real estate industry through stabilizing the prices of land, houses and market expectation, according to a report on the central bank's WeChat account. Loans to property companies and consumer mortgage lending have steadily declined after the authorities pressured banks to reduce the concentration of real estate-related business and direct the funds to support small businesses, manufacturing and innovation, the report read citing PBOC's direct of financial markets Zou Lan. Real estate lending slowed by 2.2 pp at the end of June from a year ago, according to the report. (MNI)

PROPERTY: Home buyers in many Chinese cities need to wait longer for granting of housing mortgage as local governments step up home price curbing, Economic Information Daily reports, citing multiple property agents. Banks' quota for home loans are limited in cities including Guangzhou, Chengdu and Xi'an. Waiting time up to 6 months in Guangzhou and Hangzhou. Growth in home loans expected to slow as governments crack down on speculation. (BBG)

EQUITIES: China Evergrande Group may lose control of Shengjing Bank Co. after the local government urged state-owned enterprises in the lender's home city to gradually raise their stake. "Shengjing Bank is a lender that belongs to the government and ourselves," Gao Wei, vice mayor of the northeastern city of Shenyang, said during a visit to the bank on Thursday. "We need to step up Communist Party's leadership of the bank, and return it to the roots of serving the local economy and make it a better bank." Gao's comments underscore the mounting pressure on billionaire Hui Ka Yan to downsize his sprawling empire and pay down a mountain of debt. Evergrande's 36% stake in Shengjing Bank is among its most valuable financial asset, valued at about $2.8 billion. That holding has become less appealing as the regulator toughens oversight on dealings such as preferential lending and bond purchases between banks and their largest shareholders. (BBG)

OVERNIGHT DATA

AUSTRALIA JUL, P IHS MARKIT MANUFACTURING PMI 56.8; JUN 58.6

AUSTRALIA JUL, P IHS MARKIT SERVICES PMI 44.2; JUN 56.8

AUSTRALIA JUL, P IHS MARKIT COMPOSITE PMI 45.2; JUN 56.7

Latest indications from the IHS Markit Flash Australia Composite PMI suggested that Australia's growth streak had been brought to a halt in July, and perhaps no surprise given the renewed lockdowns aimed to bring the COVID-19 situation under control. While demand and output had evidently been badly affected in July, they are expected to improve once the restrictions are once again lifted. That said, the current COVID-19 disruption's effect on the supply chain remained evident. Manufacturing input costs continued to rise even as overall price pressures eased, which is an area to watch. On the outlook, private sector firms were less optimistic given uncertainties surrounding the more infectious Delta variant and the supply situation. Firms however continued hire across both manufacturing and services, speaking to the robust labour market conditions. (IHS Markit)

UK JUL GFK CONSUMER CONFIDENCE -7; MEDIAN -8; JUN -9

MNI DATA BRIEF: UK Consumer Sentiment Up in July: Gfk

- UK consumer confidence increased above its pre-pandemic level in July and the Gfk index now in a run of six straight months without a backwards step, data published Friday showed. "Personal finance expectations for the next year remain strong and there's a dramatic jump this month in our major purchase sub-measure with shoppers agreeing that now is the 'right time to buy'," said Joe Staton, group Client Strategy Director - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

CHINA MARKETS

PBOC INJECTS CNY10 BLN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Friday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.1812% at 09:23 am local time from the close of 2.1632% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 43 on Thursday vs 39 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4650 FRI VS 6.4651 THURS

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4650 on Friday, compared with the 6.4651 set on Thursday.

MARKETS

SNAPSHOT: Usual ECB Hawks Reportedly Show Dissent, Aussie COVID Not Going Away

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 0.907 points at 7385.5

- Shanghai Comp. down 23.186 points at 3551.548

- JGBs are closed

- Aussie 10-Yr future down 0.5 ticks at 98.805, Aussie 10-Yr yield up 0.1bp at 1.193%

- U.S. 10-Yr future down 7.8125 ticks at 134.171875, cash Tsys are closed

- WTI crude down $0.27 at $71.64, Gold down $3.46 at $1803.46

- USD/JPY up 11 pips at Y110.26

- WEIDMANN, WUNSCH OPPOSED ECB'S NEW GUIDANCE ON INTEREST RATES (BBG)

- WARREN, BROWN CRITICIZE POWELL'S APPROACH ON BANK REGULATION (BBG)

- BIDEN TEAM PLANS FOR CHIPS FUNDING EVEN BEFORE CONGRESS ACTS (BBG)

- UK TO LAUNCH DAILY COVID TESTS TO ALLEVIATE PRESSURE ON CERTAIN SECTORS

- DUP THREATENS TO STYMIE 'UNACCEPTABLE' BREXIT DEAL (THE TIMES)

- NSW FLAGS NATIONAL EMERGENCY RE: COVID IN SYDNEY

BOND SUMMARY: T-Notes Tight With Cash Closes, COVID Does Little For Aussie Bonds

T-Notes sticking to a narrow 0-03 range in Asia-Pac hours, -0-02+ at 134-05+ at typing, operating on very light volume of ~23K. A Japanese holiday (and subsequent closure of cash Tsys during Asia-Pac hours) is limiting broader participation, with a lack of macro news flow also evident.

- In Australia, the daily NSW COVID figures have stolen the headlines, with the state discovering 136 new cases. The situation around SW & W Sydney was described as a "national emergency." Some restrictions will be tightened in a couple of suburbs as a result, with the NSW Premier calling for access to additional Pfizer vaccine doses. The NSW Premier also noted that "there is no doubt that the numbers are not going in the direction we were hoping they would at this stage. It is fairly apparent that we will not be close to zero next Friday." An extension of the lockdown in Sydney was already widely expected. In terms of the exposure of today's new cases, NSW health noted that "53 cases were in isolation throughout their infectious period and 17 cases were in isolation for part of their infectious period. 53 cases were infectious in the community, and the isolation status of 13 cases remains under investigation." The local COVID situation has resulted in at least an 8-week suspension of the Australia-NZ travel bubble. Elsewhere, ACGB Apr '26 supply passed smoothly, with the weighted average yield pricing 0.76bp through prevailing mids at the time of supply (per Yieldbroker). Although the uptick in the cover ratio vs. the prev. auction was largely driven by the smaller notional amount on offer, there was still a modest uptick in the metric when adjusted for auction size. The supportive factors for takedown of ACGB supply are well known (international appeal, abundant liquidity, negative RBA-adjusted supply and the potential for the RBA to walk back its tapering announcement are the dominant ones). Futures hold to narrow ranges, with YM & XM printing 0.5 below their respective settlement levels, while the cash ACGB curve has twist flattened, with 15+-Year paper richening by ~1.5bp on the day. The release of the weekly AOFM issuance schedule was bland.

AUSSIE BONDS: A$700mn Of ACGB Apr '26 Auctioned

The Australian Office of Financial Management (AOFM) sells A$700mn of the 4.25% 21 April 2026 Bond, issue #TB142:

- Average Yield: 0.5124% (prev. 0.7149%)

- High Yield: 5150% (prev. 0.7175%)

- Bid/Cover: 6.6000x (prev. 3.9550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.9% (prev. 45.2%)

- bidders 53 (prev. 43), successful 13 (prev. 14), allocated in full 5 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance schedule:

- On Monday 26 July it plans to sell A$800mn of the 1.00% 21 November 2031 Bond.

- On Thursday 29 July it plans to sell A$1.5bn of the 22 October 2021 Note & A$500mn of the 25 February 2022 Note.

- On Friday 30 July it plans to sell A$700mn of the 2.75% 21 November 2027 Bond.

EQUITIES: Asia Markets Negative But US Futures On The Rise Again

Markets in the Asia-Pac region struggled to capitalize on gains in US equity markets, with returns mixed as regional coronavirus concerns weigh, Japan observes a national holiday on Friday. This resulted in the closure of Japanese financial markets, the holidays will result in thinner liquidity during Asia-Pac trading. Markets in mainland China were lower, snapping a four-day winning streak while the Hang Seng also saw losses of over 1%. Markets in South Korea, Taiwan and Australia managed to keep their heads above water, barely, while other regional markets also declined though moves were less pronounced. US futures are higher, gearing up for a fourth day of gains after declining sharply at the start of this week. Moves toward record highs for US markets are fueled by earnings season.

GOLD: Still Trading Between The Lines

Spot bullion trades a handful of dollars softer on the day at typing, just shy of $1,805/oz.

- This comes after a couple of brief and shallow forays below Wednesday's low on Thursday. Softer U.S. real yields helped gold firm into the NY close (a well-received round of 10-Year TIPS supply aided that particular dynamic). Still, the July 12 low and key near-term support ($1,791.7/oz) remains unchallenged, leaving the technical overlay unchanged.

OIL: Benchmarks On Track For Weekly Gain

Crude futures are hovering around neutral levels in Asia-Pac trade, holding Thursday's gains. WTI is down $0.26 from settlement levels at $71.64, Brent is down $0.29 at $73.50; both benchmarks are on track to post weekly gains after recovering from an 8-week low. Both WTI and Brent crude futures traded constructively Thursday, adding to the recovery from the week's low and remaining on course for 10% gains. Gains came despite the more mixed performance from equity markets as traders took the view that OPEC+'s recent agreement will likely fail to meet the demand from a tighter market throughout H2 this year, helping boost and steepen the front-end of the futures curve.

FOREX: AUD Underperforms, Weighed Down By COVID-19 Concerns

Early gains for Antipodean pairs were tempered as the session wore on, particularly in Australia where PMI surveys dropped, the Sydney lockdown was extended and the trans-Tasman travel bubble was suspended due to the elevated number of coronavirus cases. AUD/USD id down 2 pips, while NZD/USD is up 9 pips.

- Japan observed a national holiday on Friday which resulted in the closure of Japanese financial markets, the holidays will result in thinner liquidity during Asia-Pac trading. USD/JPY up 13 pips as the greenback rises slightly from opening levels, but stays within yesterday's range.

- Offshore yuan hovered in a narrow range, USD/CNH last down 16 pips and sticking to a 60 pip range through the session, the pair briefly touched 6.47 but bounced from the level. The PBOC set USD/CNY reference rate at 6.4650, in line with sell side estimates and essentially flat from the day before.

- GBP/USD is down 7 pips, data showed UK GfK consumer confidence for July was slightly better than expected at -7, which is the highest reading since February 2020. Elsewhere there were reports that Northern Ireland could suspend checking goods entering from Britain if the UK signs up to an unacceptable Brexit deal.

FOREX OPTIONS: Expiries for Jul23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.5bln), $1.1725-35(E1.2bln), $1.1800(E724mln), $1.1865-70(E1.1bln), $1.1925(E731mln)

- USD/JPY: Y110.75($500mln)

- GBP/USD: $1.3775-85(Gbp643mln)

- EUR/GBP: Gbp0.8525(E510mln)

- AUD/USD: $0.7400-20(A$1.1bln)

- USD/CAD: C$1.2470-75($576mln)

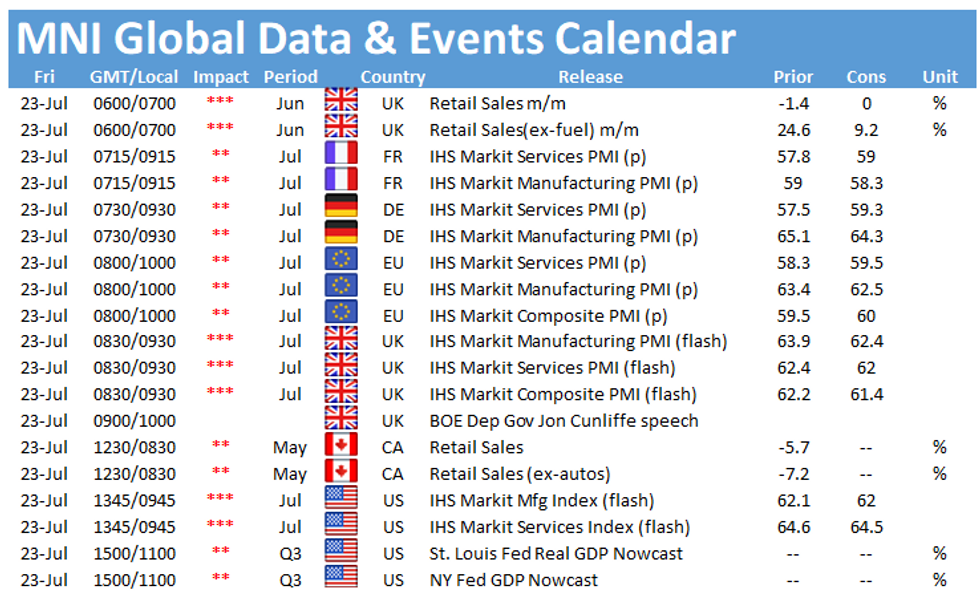

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.