-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessKey Inter-Meeting Fed Speak – Mar 2025

MNI US Inflation Insight: Price Pressures Remain Elevated

MNI EUROPEAN OPEN: Chinese Media Looks To Placate Equity Worry

EXECUTIVE SUMMARY

- CHINESE STOCK FALL TEMPORARY, FUNDAMENTALS UNCHANGED (SEC. TIMES)

- FED CHIEF POWELL HAS WON FANS AMONG SENIOR SENATE DEMOCRATS

- UK COVID-19 CASES FALL AGAIN AS PANDEMIC STARTS RETREAT (THE TIMES)

- UK TO CONSIDER RELAXING TRAVEL RESTRICTIONS FROM EU AND US (FT)

- CHINA VICE PREMIER LIU HE CALLS FOR SUPPORT TO SMALL COS.' DEVELOPMENT (BBG)

- CHINA MAY IMPOSE MORE STEEL EXPORT TARIFFS AS PRICE SURGE BITES (BBG)

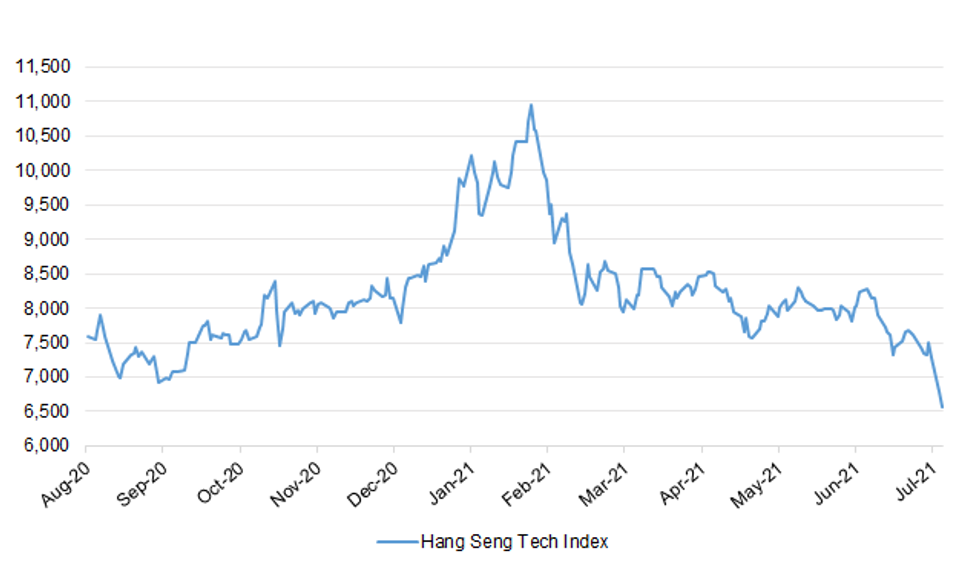

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The number of reported coronavirus cases has fallen for a sixth day in a row, offering further hope that the peak of a third wave has passed. There were 24,950 positive cases in the UK yesterday, a decrease of 15,000 from 39,950 last Monday and down from 54,000 on July 17. One model shows the R number at below one, suggesting that the pandemic is shrinking. Boris Johnson and health officials were still urging caution, particularly as the impact of lifting legal limits on social contact in England last Monday has not yet been reflected in the data. (The Times)

CORONAVIRUS: More than half of Covid hospitalisations are patients who only tested positive after admission, leaked data reveal. (Telegraph)

CORONAVIRUS: The UK government will this week consider loosening travel restrictions for travellers from the EU and the US, with one senior airport executive confident that ministers would broaden quarantine exemptions "imminently". The move, which one government official said was "finely balanced", would be a boost to the tourism sector and help to reopen the UK to mass foreign travel. Ministers are separately looking at removing France from the newly created "amber plus" category, which requires travellers from the UK to quarantine upon their return, amid hopes that the Beta variant of the coronavirus in that country is coming under control. Jean-Yves Le Drian, France's Europe minister, told Dominic Raab, UK foreign secretary, on Monday in Paris that there was no basis for keeping France on the amber plus list. Raab said decisions were reviewed regularly. (FT)

CORONAVIRUS: Americans will be allowed to enter the UK and avoid quarantining if they produce vaccine cards proving they have been double-jabbed, as part of a drive to open up transatlantic travel. Ministers are expected to sign off plans this week for US citizens arriving in the UK to be able to present the cards they were given when they were vaccinated as sufficient proof. Britain is prepared to make the concession because the US has yet to develop a consistently used digital form of proof for vaccinations. It contrasts with the EU's plans for a digital Covid certificate and the NHS Covid-19 app, which is used by Britons travelling abroad. However, the US announced yesterday that it would not lift any of its present travel restrictions "at this point" because the Delta variant of the coronavirus was spreading rapidly. Most European nations have relaxed restrictions on visitors from the US who are fully vaccinated. But the UK has kept the US on its amber list, meaning most arriving travellers must isolate for ten days. (The Times)

BREXIT: The EU has published its proposals for simplifying some aspects of the Northern Ireland Protocol. The proposals were announced in broad terms at the end of June and subsequently shared with the UK government. They include a plan for ensuring the continued supply of medicines from Great Britain to Northern Ireland. The UK government says the plans do not go far enough. The Northern Ireland Protocol was agreed by the UK and EU to avoid a hard border in Ireland. It does this by keeping Northern Ireland in the EU's single market for goods. That has caused some difficulties in moving goods from Great Britain to Northern Ireland. (BBC)

BREXIT: Rachel Reeves, UK shadow chancellor, has committed Labour to working with Brussels to fill in "gaps" in Boris Johnson's Brexit deal, to help professionals, the food sector and creative industries. Reeves said the prime minister had "a blind spot" when it came to improving relations with the EU — by far Britain's biggest trading partner — and that the Labour party wanted to bolster Britain's export sector. In an interview with the Financial Times, Reeves said boosting exports was one of the "five tests" Labour was setting the government as the economy started to recover from the effects of the coronavirus pandemic. She also confirmed that Labour was likely to oppose a mooted plan by Johnson to fund £10bn in improvements to social care through a 1 percentage point rise in national insurance contributions. (FT)

PROPERTY: Surging demand for houses will last well into 2022 as buyers continue to look for more room after being cooped up during the pandemic, says property website Zoopla. A search for space has pushed up the average price of a house by 7.3% over the past year, reaching a new high of £230,700, it says. While houses are proving popular, flats are less sought after. But properties of all kinds are in short supply, the firm stressed. "Demand for houses is twice as high as typically seen at this time of year between 2017 and 2019, accelerating away from demand for flats, creating a disparity in average price growth across the two property types," Zoopla said. "House prices are being supported in part by a severe shortage of homes for sale, with stock levels down some 25% in the first half of the year compared to 2020." (BBC)

EUROPE

ITALY/BTPS: Italy plans to sell up to 4.5 billion euros ($5.3 billion) of 0 percent bonds due Aug 1, 2026 in an auction on Jul 29. Italy plans to sell up to 3 billion euros ($3.5 billion) of 0.95 percent bonds due Dec 1, 2031 in an auction on Jul 29. Italy plans to sell up to 1.25 billion euros ($1.5 billion) of floating bonds due Apr 15, 2029 in an auction on Jul 29. (BBG)

PORTUGAL: Portugal posts first-half budget deficit of EU7.06b, EU150m wider than in the same period of 2020, Finance Ministry says in an emailed statement. Jan.-June primary spending rises 5.7% Y/y as the government implemented measures to help the economy. Spending on extraordinary measures to support families and companies reached EU3.8b, more than the figure of EU3.5b for the full year of 2020. Revenue rose 4.6% in Jan.-June after the government eased some confinement measures in the latter part of the first half. (BBG)

U.S.

FED: Senator Dick Durbin of Illinois, the No. 2 Democratic leader, said he has a favorable view of Federal Reserve Chairman Jerome Powell, potentially giving the central bank chief a powerful ally in his corner before his term as chair expires in February. "I have a good impression of what he's done and who he is, and that hasn't changed," Durbin told Bloomberg News when asked whether he thinks President Joe Biden should renominate Powell. Durbin, who voted to confirm Powell in 2018 after he was nominated by then-President Donald Trump, is the Democrats' chief vote counter in the Senate and has significant influence in the chamber. His comment comes after some other key Democrats, including Senate Banking Chair Sherrod Brown of Ohio and Senator Elizabeth Warren of Massachusetts, have criticized Powell over his stance on bank regulation. (BBG)

FED: Federal Reserve Chairman Jerome Powell has won over a number of influential Senate Democrats who are prepared to back him for another term, though a key pair remain holdouts and are unhappy with his leadership on regulation. A number of Democrats praise his handling of the coronavirus crisis in particular and say they trust President Joe Biden's judgment should he choose him for another term. Powell's present term expires in February. (BBG)

FISCAL: Senators ran into new problems Monday as they raced to seal a bipartisan infrastructure deal, with pressure mounting on all sides to show progress on President Joe Biden's top priority. Heading into a make-or-break week, serious roadblocks remain. Disputes have surfaced over how much money should go to public transit and water projects. And other disagreements over spending and wage requirements for highways, broadband and other areas remain unresolved, as well as whether to take unspent COVID-19 relief money to help pay for the infrastructure. Biden, asked about the outlook, told reporters at the White House he remained optimistic about reaching a compromise. Press Secretary Jen Psaki said that Biden himself "worked the phones all weekend," and that the administration was encouraged by the progress. But Psaki acknowledged that "time is not endless," as the White House works with the Senate to finish the package. (AP)

FISCAL: U.S. Senate Majority Leader Chuck Schumer said on Monday he is committed to passing a bipartisan infrastructure bill, and advised that the Senate may stay in session through the coming weekend to finish the measure. (RTRS)

CORONAVIRUS: A surge in new coronavirus cases related to the Delta variant is prompting health experts to discuss mitigation strategies such as updated guidance on wearing masks, White House spokeswoman Jen Psaki said on Monday. Psaki began her daily news briefing with a virus progress report, saying there has been a significant rise in COVID-19 cases among unvaccinated Americans but that people who have been vaccinated are avoiding major illness. She said there has been no sign as of yet that the Delta variant responsible for many new infections is having an impact on the U.S. economy. The latest guidance from the Centers for Disease Control says vaccinated people do not need to wear masks in many settings, but in recent weeks there has been more discussion about whether masks should be brought back. (RTRS)

CORONAVIRUS: As many as 60% of Covid-19 cases in the U.S. have gone unreported, and the coronavirus has infected nearly 1 in 5 Americans, according to a new model out of the University of Washington. The model, which aims to mitigate biases in data capture, estimates that 65 million people, or 19.7% of U.S. residents, had been infected as of March 7. The findings, which appear in Monday's issue of Proceedings of the National Academy of Sciences, indicate the U.S. is unlikely to reach community level protection without continuing an ambitious vaccination campaign. (BBG)

CORONAVIRUS: The U.S. Department of Justice issued a memorandum saying federal law allows governments, universities and private businesses to require their employees to be vaccinated. Although the Office of Legal Counsel memo isn't binding authority and thus doesn't guarantee court approval of a vaccine mandate, it provides a boost to employers and others that either have imposed such a requirement or are considering it. The memo, dated July 6, became public as concern is growing that unvaccinated Americans are contributing to the rapid spread of the Delta variant. It signals that the White House is beginning to embrace vaccine mandates, a sharp departure from the Biden administration's earlier hesitancy on the subject. (BBG)

CORONAVIRUS: The Department of Veterans Affairs will require 115,000 of its frontline health-care workers to be vaccinated against the coronavirus in the next two months, making it the first federal agency to mandate that employees be inoculated, government officials said on Monday, according to the New York Times. (BBG)

CORONAVIRUS: At the urging of federal regulators, two coronavirus vaccine makers are expanding the size of their clinical trials for children ages 5 to 11 — a precautionary measure designed to detect rare side effects including heart inflammation problems that turned up in vaccinated people younger than 30. President Biden promised at a meeting in Ohio last week that emergency clearance for pediatric vaccines would come "soon," but the White House has not been specific on the timeline. It was unclear whether expanding the studies will affect when vaccines could be authorized for children. The Food and Drug Administration has indicated to Pfizer-BioNTech and Moderna that the size and scope of their pediatric studies, as initially envisioned, were inadequate to detect rare side effects. Those include myocarditis, an inflammation of the heart muscle, and pericarditis, inflammation of the lining around the heart, multiple people familiar with the trials said. (New York Times)

CORONAVIRUS: California will require all state employees to prove they've been vaccinated or wear a mask in the office, and get tested for the coronavirus at least once a week, state officials announced Monday. In addition to the requirement for state employees, California will require workers in all health care facilities -- public and private -- to provide proof of vaccination or wear a mask and submit to twice-weekly tests. (BBG)

CORONAVIRUS: Missouri Attorney General Eric Schmitt, a Republican, filed suit to stop the reimposition of a mask mandate in St. Louis County and St. Louis City, his office said in a press release. The lawsuit notes that St. Louis had some of the most restrictive orders in Missouri and yet still suffered some of the highest Covid-19 case and death rates. It also argues that mandating children to wear masks in school is arbitrary and capricious. (BBG)

CORONAVIRUS: The United States will not lift any existing travel restrictions "at this point" due to concerns over the highly transmissible COVID-19 Delta variant and the rising number of U.S. coronavirus cases, the White House confirmed on Monday. The decision, which was first reported by Reuters, comes after a senior level White House meeting late on Friday. It means that the long-running travel restrictions that have barred much of the world's population from the United States since 2020 will not be lifted in the short term. (RTRS)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention (CDC) and State Department on Monday both warned against travel to Spain, Portugal, Cyprus and Kyrgyzstan because of a rising number of COVID-19 cases in those countries. (RTRS)

CORONAVIRUS: resident Joe Biden on Monday announced that some Americans experiencing long-term effects of Covid may qualify for disability resources and protections from the federal government. (BBG)

OTHER

U.S./CHINA: Chinese companies listed on U.S. stock exchanges must disclose the risks of the Chinese government interfering in their businesses as part of their regular reporting obligations, a top U.S. Securities and Exchange Commission official said on Monday. Democratic commissioner Allison Lee's comments are the first by an SEC official since Chinese regulators launched a massive cyber probe of ride-hailing giant Didi Global last week, just days after its $4.4 billion New York listing, wiping 25% off its share price. U.S. authorities have cracked down on other U.S.-listed Chinese companies and may require tutoring firms to become non-profits, according to a Bloomberg report that hit shares in the sector, including New York-listed TAL Education Group and Gaotu Techedu Inc. (RTRS)

U.S./CHINA: China's quick publication of a senior diplomat's "strong dissatisfaction" with the U.S. following a bilateral meeting shows it no longer tries to contain the opinion of its society "fed up with the bossy U.S." and that it holds no illusion that China and the U.S. will improve ties soon, the Global Times said in an editorial after Vice Minister Xie Feng criticized the U.S. rhetoric in a meeting with Deputy Secretary of State Wendy Sherman. The U.S. should abandon the idea of changing China's system and policies through sanctions and containment, and must accept that China has developed faster and the trend of its economy exceeding the U.S. is irreversible, the official newspaper said. (MNI)

GEOPOLITICS: China General Nuclear is likely to walk away from the Hinkley Point C power station being built in Somerset if the Chinese state-owned nuclear company is forced out of other future projects in the UK, industry experts warned on Monday. The Financial Times revealed that the British government was exploring ways to remove CGN from the consortium planning to build the new £20bn Sizewell C nuclear power station in Suffolk. Ministers are also going cold on plans by CGN to build a new plant at Bradwell-on-Sea in Essex using its own reactor technology. The company is already a minority investor in the 3.2 gigawatt Hinkley Point nuclear power station, which France's EDF is building. (FT)

CORONAVIRUS: African nations should build capacity to produce vaccines on the continent and work with pharmaceutical companies to ensure that the raw materials needed to produce the inoculations are available, according to World Trade Organization Director-General Ngozi Okonjo-Iweala. (BBG)

JAPAN: Japanese Prime Minister Yoshihide Suga's approval rating reached record depths across the board in July polls, entering into territory that for most has foreshadowed an end to their time in office. Approval of Suga's cabinet sank 9 percentage points from June to 34% in a weekend Nikkei/TV Tokyo poll -- the worst rating for a Japanese leader in nine years. An especially big hit came from a resurgence in daily coronavirus infections that triggered a fourth state of emergency in the capital region ahead of the Olympics. Japan's vaccine rollout has also stalled, with many workplaces and municipalities halting new reservations. Suga received his lowest-ever approval numbers in Asahi Shimbun, NHK and Kyodo News polls this month, while The Yomiuri Shimbun showed him staying flat from the record low of June. An approval rating under 35% for Liberal Democratic Party-led cabinets has historically signaled further trouble ahead, with the prime minister stepping down within a year in most cases. (Nikkei)

AUSTRALIA: Sydney's month-long lockdown shows no signs of being eased as the city's daily Covid-19 cases keep climbing, even as other Australian cities move to open back up after bringing their clusters under control. New South Wales Premier Gladys Berejiklian said Tuesday that the state had recorded 172 new cases from the day before, a record since the latest outbreak fueled by the highly-contagious delta variant emerged in mid-June. The new peak came as Adelaide and Melbourne -- Australia's second-largest city – announced that they would lift their own lockdowns at midnight. (BBG)

AUSTRALIA: Victoria state said most restrictions imposed on July 15 will be removed from Wednesday after recording just 10 infections of people already in quarantine. "All in all, this is a good day," Victoria state Premier Daniel Andrews told reporters in Melbourne. Victoria's 5 million residents will now be allowed to leave home freely and schools will reopen, though households will not be permitted to have visitors. (RTRS)

AUSTRALIA: Victoria has tightened its border restrictions with NSW, as Premier Daniel Andrews renewed his call for a "ring of steel" around COVID-19 ravaged Sydney. Mr Andrews on Tuesday burst the border bubble that had been operating during his state's fifth lockdown, which allowed residents to travel freely between towns despite the rest of NSW being declared an "extreme risk" zone. (The West Australian)

AUSTRALIA: South Australia will exit lockdown at midnight tonight after no new cases of COVID-19 were identified.Premier Steven Marshall said it was a "huge relief" that the Modbury cluster had not grown overnight and that the state could move to less severe restrictions."Thank you so much to those people who helped us get to this," Mr Marshall said."We won't be going straight back to where we were before – we don't want a relapse – so some restrictions will remain." (9 News)

AUSTRALIA: One of the federal government's key vaccine deals has been hit with major delays, with 51 million doses of Novavax originally due to arrive in the second half of this year now not expected until 2022. (Guardian)

AUSTRALIA: Freezing home loan repayments will be the last resort for borrowers experiencing stress from current lockdowns, with ANZ saying NSW accounts for three-quarters of the requests it is getting for help with mortgages. ANZ group executive for Australian retail and commercial banking Mark Hand said the bank had a range of alternatives for customers in hardship including a temporary cut in repayments, switching to interest only and drawing down from offset accounts. "Instead of the deferral option being like a cover-all insurance policy that everyone takes out, it will be an option customers take out only if they really need it – like an extra lever we can add to our existing financial hardship process," Mr Hand said. "Every customer's circumstances are different and a deferral may not be the best option for some of them. That's because the money still has to be repaid so there could be implications for their credit status down the track." (Australian Financial Review)

RBA: MNI INSIGHT: Lockdowns Could Delay But Not Derail Rebound: RBA

- The Reserve Bank of Australia expects that lockdowns to contain the delta variant of Covid-19 could delay recovery and cause the economy to contract in the third quarter, before a rebound on the back of improving world demand, MNI understands. An update on the RBA's outlook is expected at next week's board meeting, where the market should learn more on whether the bank believes that a delay in the recovery will have an impact on policy. Currently it expects to maintain interest rates at a record low 0.1% until 2024, after earlier saying rates would stay unchanged until 2024 "at the earliest" - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

SOUTH KOREA: Moderna Inc. has notified South Korea that an adjustment of its vaccine supply schedule is "inevitable" due to a "production setback issue," South Korean Prime Minister Kim Boo-kyum said. Seoul and Moderna are discussing details on shipments for July and August, he said. Around 14% of South Koreans have been fully vaccinated, while 34% have had one shot. (BBG)

SOUTH KOREA: At a briefing after the GDP report, BOK official Park Yang-su said the economy remains on track to grow in line with projections, though the outlook still depends on how the outbreak evolves. At its policy meeting earlier this month, the central bank said renewed risks from the virus are offset by resilient exports and more government spending. (BBG)

NORTH KOREA: Inter-Korean military hotlines are back to normal operation after a 13-month suspension, the defense ministry confirmed Tuesday, saying the two Koreas will resume regular daily calls via the communication lines. Earlier in the day, the presidential office Cheong Wa Dae and the North's Korean Central News Agency announced that the two sides agreed to reopen all direct communication lines from 10 a.m. as part of efforts to improve inter-Korean relations. "South and North Korean military authorities restored military communication lines and put them back to normal operations from 10 a.m. Tuesday, to implement agreements by the leaders," the ministry said in a release. "Phone calls and faxing to exchange documents now operate normally." (Yonhap)

NORTH KOREA: North Korean leader Kim Jong Un and South Korean President Moon Jae-in have exchanged letters since April to communicate on the issue of restoring inter-Korean relations, South Korea's Unification Ministry says in statement. (BBG)

BRAZIL: Brazil's Health Ministry is likely to reduce the vaccination interval between the 1st and 2nd dose of Pfizer shot in Brazil to 21 days from the current three months, minister Marcelo Queiroga told newspaper Folha de S.Paulo. Pfizer's leaflet recommends a 21-day interval, but the government had extended it to vaccinate a larger number of people with the 1st dose. (BBG)

IRAN: France's foreign ministry said on Monday that Iran was endangering the chance of concluding an accord with world powers over reviving its 2015 nuclear deal if it did not return to the negotiating table soon. (RTRS)

IRAQ: President Joe Biden agreed on Monday to formally conclude the US combat mission in Iraq by the end of the year, another step toward winding down the two prolonged military engagements that began in the years following the September 11 terror attacks. Biden told reporters in the Oval Office alongside Iraqi Prime Minister Mustafa al-Kadhimi that the US mission in Iraq will shift. "I think things are going well. Our role in Iraq will be ... to be available to continue to train, to assist, to help, and to deal with ISIS -- as it arrives. But we're not going to be, by the end of the year, in a combat mission," the President later said. (CNN)

METALS: China is considering imposing more tariffs on steel exports as it seeks to cap domestic production and tame surging prices. Potential rates being discussed range from 10% to 25% and products include hot-rolled coil, according to two people familiar with the matter, who asked not to be identified because they're not authorized to speak to the media. Officials are seeking to implement the levies in the third quarter, though they're still subject to final approval, one of the people said. The world's biggest steel industry already scrapped rebates on export taxes and raised tariffs on some products from the start of May to keep more supply at home. The new levies will target some products not covered by the earlier round, according to one of the people. (BBG)

OIL: American Airlines on Monday said it might have to add stops to certain flights because of fuel delivery delays at some midsize airports and asked pilots to conserve when possible, the latest headache during a surge in summer travel. The carrier said airlines, including American, have experienced the delays due to a lack of truck drivers, trucks and fuel supply. "American Airlines station jet fuel delivery delays initially affected mostly western U.S. cities, but are now being reported at American stations across the country. Delivery delays are expected to continue through mid-August," John Dudley, managing director of flight operations, told pilots in a memo, which was reviewed by CNBC. (CNBC)

CHINA

POLICY: China should create sound business environment for small and medium-sized companies, Vice Premier Liu He says in a speech at a forum in Changsha. Capital market will create conditions for the development of SMEs. China's steps on protecting fair competition and promoting healthy, orderly capital development have created good environment for SMEs. Liu also urges protection in property rights and intellectual property Rights. (BBG)

POLICY: China's macro leverage ratio at the end of this year may decrease by 8 percentage points y/y to 263% of its GDP, Yicai.com reported citing Liu Lei, an official at the National Institution for Finance & Development. Liu made the prediction after his research organization reported a total reduction of 4.7 pps in the first half, according to Yicai. Non-financial organizations reported four quarters of consecutive declines in leverages, while residents' leverages had been stable, Yicai said. The drop in macro leverage ratio was mostly due to the faster economic growth, Liu was cited as saying. Authorities also proactively tightened credit with the growth of social financing falling to 11% at the end of June from 13.3% at the end of last year, Yicai said citing researcher Ming Ming of Citic Securities. (MNI)

CORONAVIRUS: A Covid-19 outbreak in the eastern Chinese city of Nanjing is due to the delta variant, China Central Television reported, citing a briefing held by local government. Nanjing reported 31 new local confirmed infections on Monday, with total cases of the latest strain at 106. (BBG)

EQUITIES: Short-term fluctuations and some panic selling in China's stock market will not change the long-term positive and upward trend of A-shares, as the economy remains resilient, providing support for the market, Securities Times reported Tuesday, citing market analysts. Stock correction on Monday was due to a combination of factors including policy changes, valuation and liquidity. There are still opportunities for investors in the second half of the year, such as stocks related to technology innovation, industrial upgrading and consumer spending, according to CCB Principal Asset Management. Probability of a systemic decline in the market is low, fund said. Investors should closely watch for signals from high-level policy meetings in the near term, such as the Politburo meeting expected at end-July on macro economy and policies. (BBG)

EQUITIES: China Evergrande Group surprisingly decided against declaring a special dividend after investors were spooked by news that banks and ratings companies are growing wary of the debt-laden developer. The board chose to cancel the proposal less than two weeks after flagging it to investors. It took into consideration the current market environment, the rights of shareholders and creditors, and the long-term development of businesses, according to a statement to the Hong Kong stock exchange on Tuesday. (BBG)

EQUITIES: Hong Kong's major retail brokers lowered margin financing for battered Chinese education stocks as investors suffered steep losses amid Beijing's sweeping crackdown of the $100 billion sector. Bright Smart Securities and Chief Securities were among brokers that started to limit margin financing for education stocks since last Friday. Investors can pledge education stocks with Chief Securities for 20% of their market value, compared with 40% to 50% before the rout. Bright Smart only offers 10%, down from as high as 40%, and it no longer accepts New Oriental Education & Technology Group Inc.'s shares for loans. (BBG)

OVERNIGHT DATA

CHINA JUN INDUSTRIAL PROFITS +20.0% Y/Y; MAY +36.4%

JAPAN JUN SERVICES PPI +1.4% Y/Y; MEDIAN +1.3%; MAY +1.5%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 100.7; PREV. 104.3

Consumer confidence fell by 3.5% last week, to its lowest since early November 2020 right after Victoria's long second lockdown. Confidence fell in both Sydney (-2.2%) and Melbourne (-6.4%), but rose in Adelaide a touch (0.5%). Even with a much higher case load and longer lockdown, confidence in Sydney is a bit higher than in Melbourne. We would note that even during Melbourne's long lockdown in 2020 confidence levels in the two cities remained close. Sentiment declined in Brisbane (-6.1%) and Perth (-4.6%) despite the absence of lockdowns in those cities, further highlighting the interrelated nature of sentiment across Australia. Confidence remains well above the lows seen in the early stages of the pandemic, suggesting the economic hit from the current lockdowns will be less than that seen in the second quarter of 2020. (ANZ)

SOUTH KOREA Q2, P GDP +5.9% Y/Y; MEDIAN +6.0%; Q1 +1.9%

SOUTH KOREA Q2, P GDP +0.7% Q/Q; MEDIAN +0.8%; Q1 +1.7%

SOUTH KOREA JUN RETAIL SALES +11.4% Y/Y; MAY +12.9%

SOUTH KOREA JUN DISCOUNT STORE SALES -2.4% Y/Y; MAY +5.6%

SOUTH KOREA JUN DEPT STORE SALES +12.8% Y/Y; MAY +19.1%

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS TUES; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.2% on Tuesday. The operation left liquidity unchanged given it netted off CNY10 billion reverse repos maturing today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3017% at 10:00 am local time from the close of 2.2169% on Monday.

- The CFETS-NEX money-market sentiment index closed at 54 on Monday vs 38 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4734 TUES VS 6.4763

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4734 on Tuesday, compared with the 6.4763 set on Monday.

MARKETS

SNAPSHOT: Chinese Media Looks To Placate Equity Worry

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 161 points at 27995.15

- ASX 200 up 47.337 points at 7441.6

- Shanghai Comp. up 4.963 points at 3472.404

- JGB 10-Yr future down 14 ticks at 152.27, yield up 0.8bp at 0.020%

- Aussie 10-Yr future down 1.0 tick at 98.810, yield up 1.6bp at 1.198%

- U.S. 10-Yr future -0-01 at 134-05+, yield down 1bp at 1.280%

- WTI crude up $0.27 at $72.17, Gold up $0.20 at $1797.83

- USD/JPY down 16 pips at Y110.23

- CHINESE STOCK FALL TEMPORARY, FUNDAMENTALS UNCHANGED (SEC. TIMES)

- FED CHIEF POWELL HAS WON FANS AMONG SENIOR SENATE DEMOCRATS

- UK COVID-19 CASES FALL AGAIN AS PANDEMIC STARTS RETREAT (THE TIMES)

- UK TO CONSIDER RELAXING TRAVEL RESTRICTIONS FROM EU AND US (FT)

- CHINA VICE PREMIER LIU HE CALLS FOR SUPPORT TO SMALL COS.' DEVELOPMENT (BBG)

- CHINA MAY IMPOSE MORE STEEL EXPORT TARIFFS AS PRICE SURGE BITES (BBG)

BOND SUMMARY: JGBs Soften, Remainder Of Core FI Looks For A Lead

T-Notes consolidated a little above Monday's late lows in Asia trade, sticking within the confines of a 0-03+ range to last trade -0-01+ at 134-05. Cash Tsys run little changed to ~1.0bp richer across the curve at typing. Macro headline flow was on the light side, with the major Chinese equity indices trading either side of unchanged after Monday's regulatory-linked slide. Note that a Chinese state-run media outlet published a piece (citing analysts) flagging the "short-term" impact of Monday's headwinds for equities, pointing to expectations for the long-term uptrend to continue. Asia-Pac flow was headlined by a 1.5K lot block buy of UXYH1 (~$199K DV01 equivalent). The NY docket will be headlined by durable goods and consumer confidence data, as well as 5-Year Tsy supply.

- JGB futures moved to Tokyo session lows during the afternoon session, having a look through their overnight trough, last -15. The major cash JGB benchmarks run little changed to ~1.5bp cheaper on the day, led by 7s, suggesting the move there may be futures led. The latest 40-Year JGB auction was lukewarm. It saw the high yield print a touch below broader expectations (0.735% vs. the BBG dealer consensus which looked for 0.740%), while the cover ratio nudged lower to 2.716x (6-auction average 2.816x). BoJ Governor Kuroda will speak later in the Tokyo afternoon.

- In Australia, YM +0.5, XM -1.5 after the latter had a look at its overnight low in early Sydney dealing before recovering a little. NSW saw another uptick in new COVID cases today (172). On a more positive note, Victoria has wound back the harshest of its COVID restrictions. The state also declared that it is set to enforce a hard border with the state of NSW. Meanwhile, South Australia confirmed that it is moving out of its own lockdown, although the state Premier stressed that significant restrictions will remain. Q2 CPI data dominates the domestic docket on Wednesday, although the focus on the local COVID situation and perceived transitory nature of the uptick in the inflation readings cloud the potential for lasting market impact in the wake of the release.

JGBS AUCTION: Japanese MOF sells Y599.3bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y599.3bn 40-Year JGBs:- High Yield: 0.735% (prev. 0.710%)

- Low Price 98.80 (prev. 99.65)

- % Allotted At High Yield: 7.7654% (prev. 68.2525%)

- Bid/Cover: 2.716x (prev. 2.802x)

EQUITIES: China's Stock Crackdown Continues To Spook Investors

Mixed performance for equity markets in the Asia-Pac region; Chinese markets remain under pressure after a sharp sell off on Monday. The regulation crackdown continues to spook investors and has caused speculation over what could be next in the cross hairs though moves today have not been as extreme, the CSI 300 is down 0.2%. The Hang Seng Tech index has seen selling again bringing declines from the start of last week to around 12.5%. Markets in Japan were higher, data showed Japanese services PPI rose 1.4% Y/Y, above estimates of 1.3%. Markets in South Korea are higher, GDP data was slightly below estimates but the BoK reassured markets that the recovery was still on track. In the US futures are lower, coming off closing highs on Monday as major markets finished at yet another record high. Markets will have one eye on the FOMC rate announcement on Wednesday.

OIL: Crude Futures Build On Monday's Late Recovery

Crude futures have crept higher and are approaching Monday's opening levels and continuing yesterday's late recovery amid an approval in risk sentiment; WTI is up $0.37 from settlement levels at $72.30/bbl, Brent is up $0.51 at $75.01/bbl.

- The technical picture for oil remains intact for WTI, price is testing the 61.8% retracement of the Jul 6 - 20 downleg at $71.85. A breach of this retracement would strengthen a bullish case and place on hold the recent bearish theme. This would signal scope for a climb towards key resistance at $76.07, the Jul 6 high. A reversal lower would refocus attention on $65.01, Jul 20 low and the key support.

- Brent has tested above $73.87, the 61.8% retracement of the Jul 6 - 20 downleg. A clear breach of this level would strengthen a bullish case and put on hold the recent bearish theme. This would signal scope for a climb towards key resistance at $77.84, the Jul 6 high. A reversal lower is required to refocus attention on $67.44, Jul 20 low.

GOLD: Struggling To Make A Decisive Move

The initial impulse from lower U.S. real yields and a softer DXY waned on Monday, with gold easing back from best levels even as the move lower in the aforementioned metrics extended. Spot gold then stuck to a tight range in Asia-Pac hours, to last deal little changed around $1,800.oz, with no notable changes to the technical overlay.

FOREX: Risk Aversion Bolsters Yen

The yen picked up a bid as U.S. equity index futures edged lower in a sign that yesterday's risk-on impetus was fading. Fresh news flow was rather light, leaving the familiar themes of China's regulatory steps and virus outbreaks across Asia in focus. Japanese participants are yet to hear the latest address from BoJ Gov Kuroda.

- The Antipodeans were easily the worst performers in G10 FX space, with Australia's Covid-19 situation attracting much attention. Sydney remained under lockdown, even as Victoria and South Australia unwound some restrictions.

- Spot USD/CNH edged lower today, shrugging off the PBOC fix, which fell 7 pips below sell-side estimate. The rate extended losses registered late doors on Monday, but remained within that day's range.

- Most major crosses were happy to hug narrow ranges in Asia-Pac hours.

- U.S. durable goods orders & Conf. Board Consumer Confidence as well as comments from BoJ's Kuroda, RBA's Debelle and ECB's de Cos take focus from here.

FOREX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1725(E805mln), $1.1740-50(E1.4bln), $1.1775(E516mln), $1.1825(E813mln), $1.1850-70(E1.4bln)

- USD/JPY: Y109.00($1.1bln), Y109.50($740mln), Y111.00($632mln)

- AUD/USD: $0.7520(A$851mln)

- USD/CAD: C$1.2380-00($1.2bln), C$1.2600($550mln)

- USD/CNY: Cny6.4815($830mln)

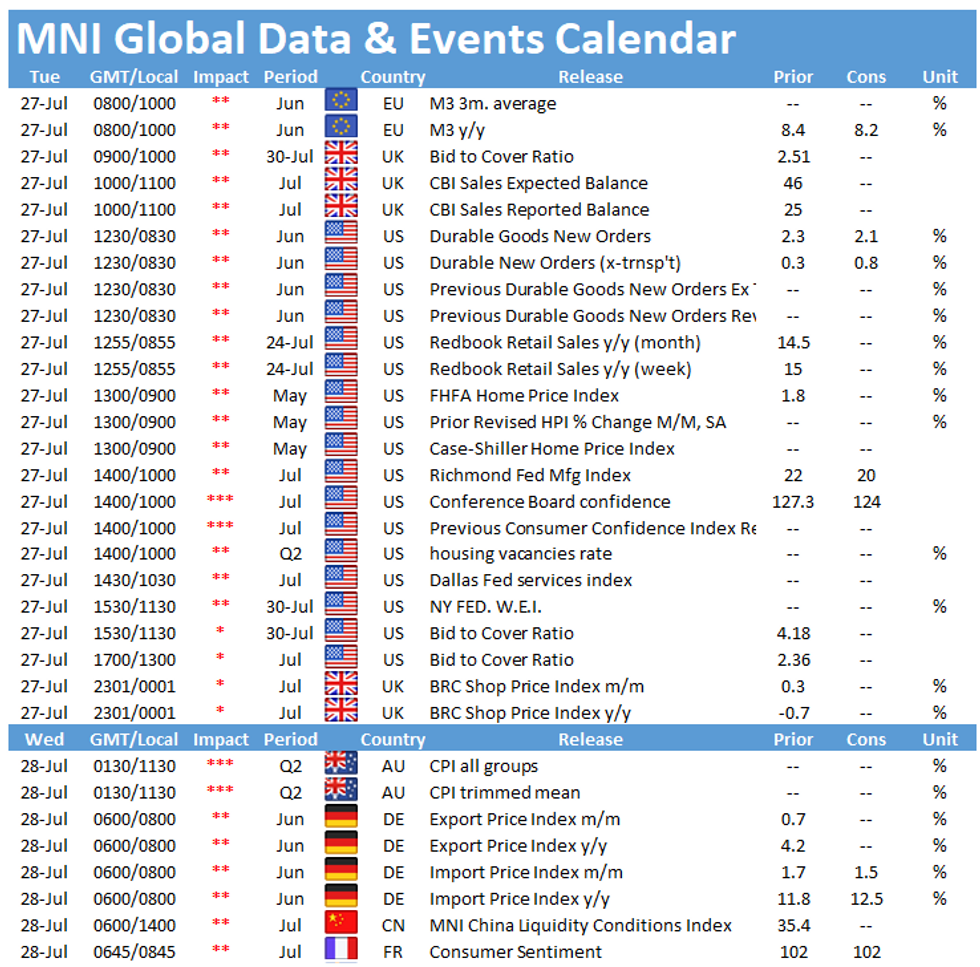

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.