-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Choppy Trade For Chinese Equities

- Chinese equities showed no clear sense of direction during a volatile morning session, with state-run media outlets trying to prop up the space.

- G10 FX pairs and U.S. Tsy yields are little changed.

- The latest FOMC monetary policy decision headlines Wednesday's docket. The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition). The December FOMC looks like the most likely meeting for a formal announcement. The risks to the July Statement lean hawkish, but the mood could swiftly change with Powell delivering a relatively dovish press conference. Moves in yields since the June FOMC suggest increasing market concerns over the growth outlook, but it's unlikely this will persuade the Fed to change course at this stage.

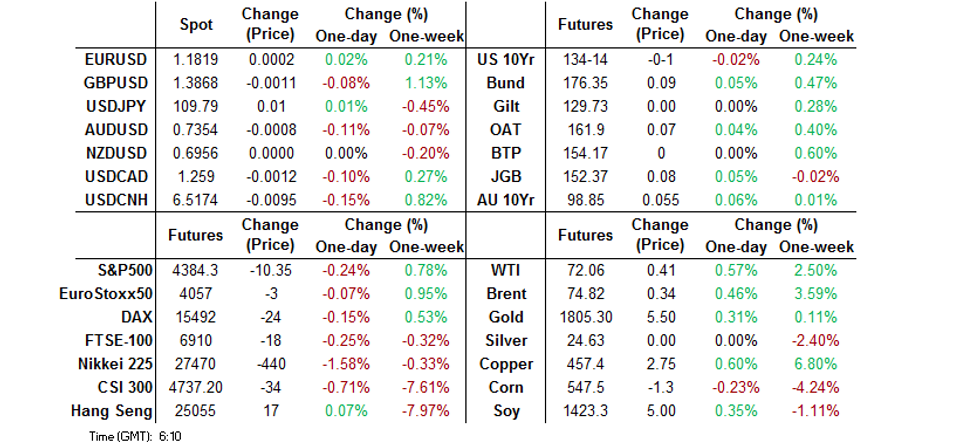

BOND SUMMARY: Core FI Coils In Asia

T-Notes have worked away from lows in Asia-Pac hours, with the gyrations in Chinese equities at the fore once again. Note that state-media took a much more active approach in trying to placate fears re: systemic risks causes by the recent sell off in Chinese equities ahead of the open of Chinese markets. The contract last trades -0-00+ at 134-14+, 0-05 off lows, sticking to a 0-06 range overnight. Cash Tsys have seen some modest twist flattening and print between -/+0.5bp across the curve. There has been some light demand for TY upside exposure via ~4.0K of screen lifts in the TYU1 135.50 calls. The latest FOMC monetary policy decision will headline the docket during NY hours. The FOMC will use the July meeting to debate its strategy to taper asset purchases (including timing, pace, and composition). The December FOMC looks like the most likely meeting for a formal announcement. The risks to the July Statement lean hawkish, but the mood could swiftly change with Powell delivering a relatively dovish press conference. Moves in yields since the June FOMC suggest increasing market concerns over the growth outlook, but it's unlikely this will persuade the Fed to change course at this stage.

- Tuesday's bid in U.S. Tsys supported the JGB space during Tokyo trade, as did the downtick in local equity markets. Futures were last +6 vs. settlemen, operating in a narrow trading band within the confines of the overnight range. Cash JGB trade has seen the major benchmarks firm by 0.5-1.5bp, with the super-long end outperforming. A quick look at the results of the latest BoJ Rinban operations (covering 3- to 10-Year JGBs) revealed steady to slightly lower offer/cover ratios when compared to prev. ops covering the respective buckets. Elsewhere, local news flow saw confirmation that Chiba, Saitama & Kanagawa are formally seeking the declaration of a state of emergency re: COVID, while Economy Minister Nishimura warned of a further uptick in COVID cases as we move through this week.

- Aussie bond futures have nudged higher on the back of the largely in line with expected Australian Q2 CPI data and bid in U.S. Tsys. Note that the headline CPI readings provided 0.1ppt beats vs. expectations for both the Q/Q and Y/Y readings, which is minimal in the current environment. The trimmed mean and weighted median readings met the broader consensus. These readings aren't seen as gamechangers for the RBA, given the exp. for transitory headline inflation and continued restrained core inflation prints. NSW provided another uptick in its daily COVID case count, with the Sydney lockdown extended through August 28 (meeting exp.). Fresh fiscal support packages for NSW employees & Victorian businesses impacted by COVID have been deployed.

FOREX: Firmer Crude Supports NOK & CAD, FOMC Decision Eyed

The yen led losses in muted Asia-Pac trade, which saw safe haven currencies unwind some of their Tuesday's gains. The summary of opinions from the BOJ's July monetary policy meeting provided little in the way of fresh insights.

- Australian CPI figures fell in line with expectations (headline readings saw modest 0.1ppt beats) and the Aussie was unfazed. Both Antipodean currencies struggled for any topside momentum. Meanwhile, CAD and NOK caught a modest bid as crude oil strengthened.

- The PBOC set its central USD/CNY mid-point at CNY6.4929, the weakest level in more than 3 months and 6 pips below sell-side estimate. Spot USD/CNH pulled back from a multi-month peak.

- The latest monetary policy decision from U.S. FOMC is set to steal the limelight today.

FOREX OPTIONS: Expiries for Jul28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1790-00(E1.7bln), $1.1820-40(E2.1bln), $1.1850-60(E1.6bln), $1.1880-00(E1.6bln)

- USD/JPY: Y110.00-20($713mln), Y110.25-40($878mln), Y110.65-70($910mln)

- GBP/USD: $1.3685-00(Gbp569mln)

- AUD/USD: $0.7390(A$710mln)

- USD/CAD: C$1.2555-65($510mln)

ASIA FX: Won Leads The Way Lower After Weak Data & Virus Case Jump

A fairly subdued session amid fragile risk sentiment with most pairs moving in narrow ranges ahead of the FOMC meeting later.

- CNH: The PBOC set its central USD/CNY mid-point at CNY6.4929, the weakest level in more than 3 months and 6 pips below sell-side estimate. Spot USD/CNH pulled back from a multi-month peak.

- SGD: Singapore dollar strengthened slightly, on the coronavirus front there were 136 new cases yesterday, 55 of which were unlinked which has raised concerns of an undetected cluster.

- TWD: Taiwan dollar is stronger, the government plans to increase its budget 5.4% Y/Y in 2022, revenues are forecast to rise 9%. The faster increase in revenue is expected to narrow the annual deficit to TWD 13bn, 84.3% lower.

- KRW: Won is sharply weaker after consumer confidence recorded the first decline since December 2020 and COVID-19 cases hit a record high.

- MYR: Ringgit gained, data showed Malaysia's trade balance widened more than expected, exports rose 27.2% compared to an estimated 11% rise but slowed down sharply from 47.3% in the previous month.

- IDR: Rupiah is slightly weaker, Indonesia's Investment Ministry said Tuesday that direct investment grew 10% Y/Y in the first half of 2021, but the resurgence of Covid-19 and resultant mobility restrictions are expected to negatively affect investment realisation in Q3.

- PHP: Peso hovers around neutral levels, Philippine overall BoP deficit shrank to $312mn in June from $1.397bn prior. The YtD BoP deficit printed at $1.94bn vs. $4.11bn a year ago.

- THB: Markets in Thailand are closed today in observance of the King's birthday. Late yesterday Thai Cabinet approved THB61bn worth of measures to mitigate the impact of Covid-19 restrictions on individuals and businesses.

ASIA RATES: China Bonds Showing Signs Of Stress

- INDIA: Yields mostly lower in early trade, short end moving higher ahead of the bill auction later today. Bonds could come under pressure as higher oil continues to fuel inflation worries. The IMF cut its estimate for Indian economic growth to 9.5% from 12.5% citing severe second COVID wave during March-May and expected slow recovery in confidence from that setback. Elsewhere junior Finance Minister Chaudhary said that government revenue collections were up INR 1.29tn from a year earlier at INR 2.46tn.

- SOUTH KOREA: Data earlier showed consumer sentiment dropped in July over a recent spike in COVID-19 infections, marking the first decline since December last year. Meanwhile after hovering around 1,300 earlier this week coronavirus cases hit a fresh record high of 1,896 in the past 24 hours

- CHINA: The PBOC matched maturities with injections today; repo rates have fallen from yesterday's intraday highs. The overnight repo rate is down 11bps at 2.0878%, the 7-day repo rate still showing some tentative signs of stress at 2.2bps on the day at 2.3722% and above the PBOC's 2.20% rate. Elsewhere futures are lower, holding yesterday's late decline. Chinese stocks trade without a decisive direction, swinging from gains to loses and back again amid fragile sentiment following the recent sell off and fears over further Chinese regulation. Speculation remains that foreign funds are selling off Chinese assets with unverified rumours that the US may restrict investments in China and Hong Kong.

- INDONESIA: Yields mostly lower. Indonesia's Investment Ministry said Tuesday that direct investment grew 10% Y/Y in the first half of 2021, but the resurgence of Covid-19 and resultant mobility restrictions are expected to negatively affect investment realisation in Q3. Tuesday was Indonesia's deadliest day on the Covid-19 front, as 2,069 patients passed away. Meanwhile, five out of six provinces in Java reported improvement in Covid-19 situation, with Central Java being the outlier.

EQUITIES: China Concerns Linger

Most markets in the Asia-Pac region lower on Wednesday amid fragile risk sentiment following the recent China sell off. Markets in mainland China currently hovering around neutral levels trading without a decisive direction, swinging from gains to loses and back again amid fragile sentiment following the recent sell off and fears over further Chinese regulation. Speculation remains that foreign funds are selling off Chinese assets with unverified rumours that the US may restrict investments in China and Hong Kong. Chinese state media released a piece saying investors shouldn't be worried about the stock plunge. Markets in Japan are lower, pressured by elevated COVID-19 cases. Most other markets in the region trading in the red.

- In the US futures are marginally lower, after the Nasdaq saw its biggest single day decline since May yesterday. After market earnings yesterday received a mixed response, Alphabet rose on the back of strong sales but Apple saw declines.

CHINA STOCKS: MNI MARKETS ANALYSIS: Chinese Equity Headwinds

Chinese equities have struggled in the early part of this week, with idiosyncratic headwinds at the fore. Sino-U.S. tensions are well documented, but the latest regulatory tussle centring on offshore Chinese equity listings was the first real warning shot for investors.

- Since then, the clampdown on the private tutoring sector and headwinds for TenCent have garnered the most attention. Core tenants of Chinese policy must be assessed here.

- In terms of broader financial markets, the contagion into the wider global equity space will be eyed (this has been relatively limited thus far). USD/CNH has moved to multi-month highs on the latest round of downward pressure for equities, after H121 saw the yuan draw support from its carry appeal, first to emerge from the shadow of COVID status and capital flow dynamics surrounding Chinese bond inclusion in the major global bond indices.

- Click for the full piece.

GOLD: Glued To $1,800/oz

More of the same for bullion over the last 24 hours, with spot struggling to gain traction either side of $1,800/oz, last printing a touch above the round number. The well-defined technical overlay remains in place.

OIL: Crude Futures Creep Higher Supported By Stockpile Data

Crude futures are higher in Asia-Pac trade on Wednesday, supported by stockpile data released after US market hours. WTI & Brent sit ~$0.30 above settlement levels. API data yesterday showed headline crude stocks fell 4.73m bbls, with the downstream report also bullish as gasoline stocks saw a 6.23m bbl decline and distillate stocks fell 1.88m bbls. If the gasoline print is confirmed it will be the biggest draw since March, while if the headline figure is decline that will represent the ninth draw in 10 weeks. Markets look ahead to US DOE stockpile data later today. Resistance for WTI is seen at $72.43 the high from Jul 26, Brent sees resistance at $75.39 the 76.4% retracement of the Jul 6 - 20 downleg.

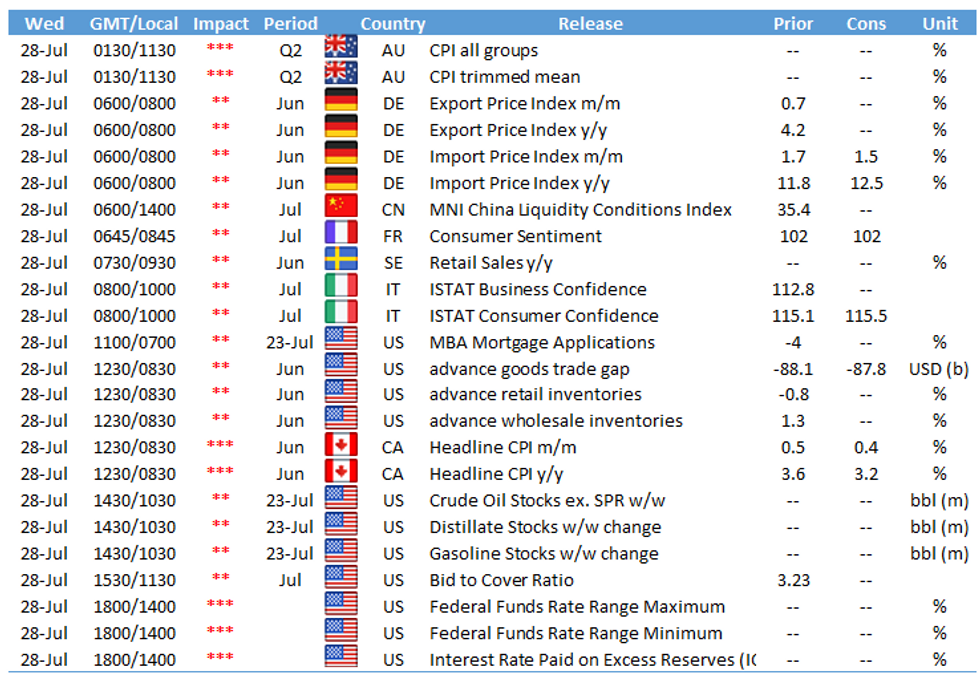

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.