-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Risk-Off As Taliban Takes Kabul & Chinese Data Misses

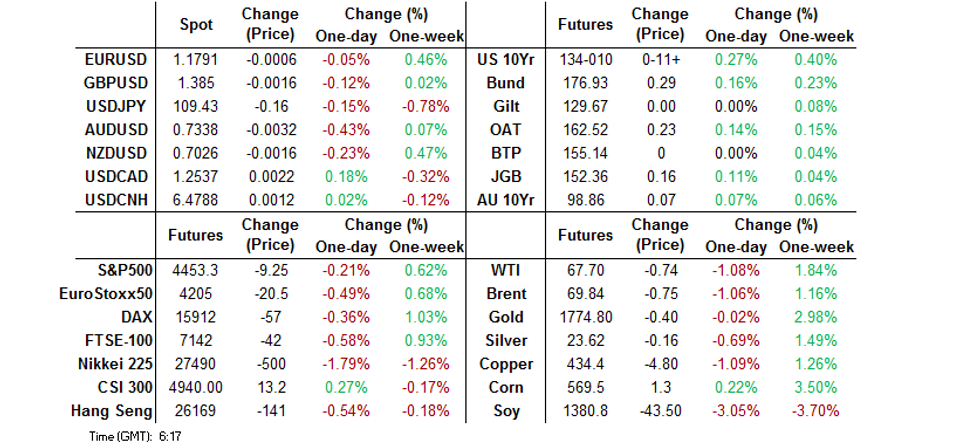

- A confluence of risk factors, from the Taliban taking the Afghan capital of Kabul to a softer round of Chinese economic activity data, resulted in a defensive feel during Asia-Pac hours.

- JPY sits a top the G10 FX pile while U.S. Tsys have richened.

- Monday's broader economic docket is relatively limited.

BOND SUMMARY: Core FI Bid In Asia

The mix of the Taliban taking the Afghan capital of Kabul, lower oil prices, general worry surrounding COVID and a softer than expected round of Chinese economic activity data for July combined to support the broader core FI bid during Asia-Pac hours.

- T-Notes trade +0-11 at 134-09+ as a result, a little shy of best levels. The major cash Tsy benchmarks run ~1.0-3.0bp richer on the day, with 7s outperforming on the curve. Pockets of TYU1 buying helped to support the space, with that contract running on more than healthy volume of ~172K ahead of European dealing.

- JGBs also benefitted from the broader defensive feel to the session, with continued reports surrounding the potential for a fairly imminent extension of the COVID-related state of emergency in play across several Japanese prefectures (in addition to the scope for the widening of the restrictions to other prefectures) bolstering the bid further. Futures last +16, with cash JGBs running 1.0-2.0bp richer on the day.

- The ACGB space drew support from the broader risk-off theme, in addition to the local COVID situation in Australia. A fresh snap lockdown in Darwin was declared on Monday, with the lockdowns in both Melbourne & the ACT extended. NSW saw restrictions broadened & deepened over the weekend, with harsher implementation of restrictions set to come into play (NSW recorded another record daily COVID case count on Monday). YM +4.5, XM +6.5, with the 10- to 12-Year zone of the cash ACGB curve outperforming.

FOREX: Risk Appetite Sours Amid Raging Covid-19, Soft Chinese Data, Fall Of Kabul

China's disappointing economic activity data put another nail in the coffin of risk appetite, after the seizure of the Afghan capital by Taliban and the deepening Covid-19 crisis in the Asia-Pacific region inspired risk aversion.

- This risk-off cocktail sent AUD tumbling to the bottom of the G10 pile amid the tightening of Covid-19 rules in Australia. Melbourne and ACT extended their lockdowns by two weeks each, while parts of NT were placed under snap restrictions.

- Other commodity-tied currencies retreated in tandem. A degree of political uncertainty surrounding the general election called by PM Trudeau for Sep 20 may have generated an additional headwind for the loonie, amid lack of clarity on the Premier's chance to win an outright majority in parliament.

- Participants flocked into safe haven assets for the benefit of the yen, which topped the G10 scoreboard. Worth noting that Japan's flash Q2 GDP numbers were better than expected, but Sankei reported that the country would extend and expand its state of emergency through mid-Sep.

- The yuan was surprisingly resilient, given underwhelming data released out of China and a soft PBOC fix, with the USD/CNY midpoint set at CNY6.4717, 22 pips above sell-side estimate. Spot USD/CNH bounced off session lows in reaction to the data, but struggled to register any material gains. The rate slipped earlier as the PBOC rolled over CNY600bn of MLF funds, letting CNY100bn mature.

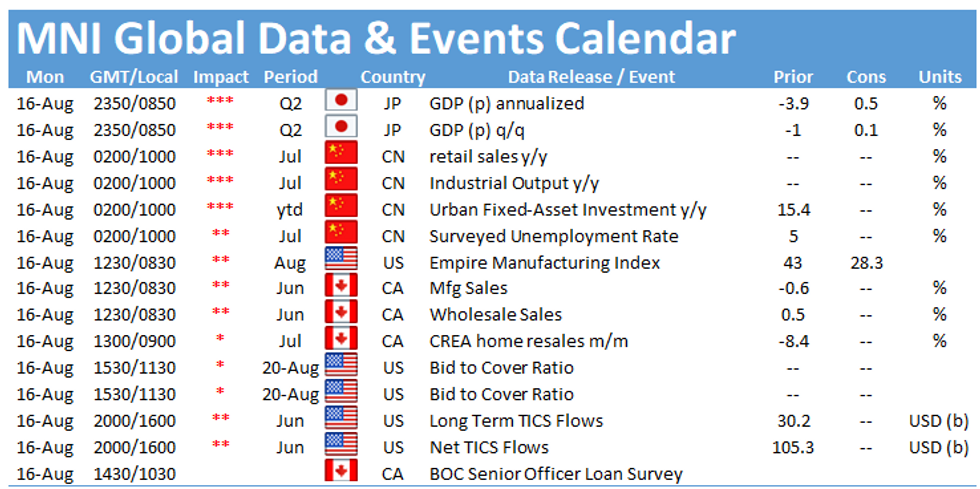

- The global economic docket is fairly empty later today, U.S. Empire Manufacturing & Canadian manufacturing sales take focus from here.

FOREX OPTIONS: Expiries for Aug16 NY cut 1000ET (Source DTCC)

- EUR/GBP: Gbp0.8590-00(E515mln)

- USD/CNY: Cny6.45($1.4bln)

ASIA FX: Baht Is The Laggard After GDP Estimates Cut

- CNH: Offshore yuan is marginally weaker, despite a busy session. The PBOC withdrew CNY 100bn at the MLF operation today, rolling over CNY 600bn and letting CNY 100bn of the total CNY 700bn coming due mature. Chinese data was weak with industrial production, retail sales and FAI all missing estimates.

- SGD: Singapore dollar is weaker, giving back some of Friday's gains. From a technical perspective the pair is just below resistance at 1.3567, a 23.6% retracement level.

- TWD: Taiwan dollar is stronger, but has given back the majority of its opening gains. Late on Friday Taiwan lifted its GDP growth forecast to 5.88% from 5.46% previously, citing an export and investment boom and looser virus restrictions.

- KRW: Korean markets closed for Liberation Day

- MYR: Ringgit is lower, PM Muhyiddin reportedly told his Cabinet colleagues that he intended to submit his resignation letter to the King today. Muhyiddin could remain in office in caretaker capacity until lawmakers select his successor. Local media outlets noted that current Deputy PM Ismail Sabri is seeking to muster enough support to replace Muhyiddin.

- IDR: Rupiah is flat. The government will today present the 2022 budget to lawmakers. The Jakarta Post reported that IDR100tn worth of capital injections for ailing state-owned enterprises. This represents 4% of the total size of the budget. Indonesian markets will be closed tomorrow in observance of the Independence Day.

- PHP: Peso is weaker. The Philippines reported 14,749 on Sunday, the largest daily case count since the beginning of April. OCTA Research Group warned that they expect daily cases to continue rising this week, adding that they estimate that the virus reproduction rate in the National Capital Region is at 1.90.

- THB: Baht is weaker, and the laggard among its peers. Data earlier showed GDP printed above estimates in Q1 at 7.5% Y/Y, following the release Thailand cut its 2021 GDP growth estimate from range 1.5% to 2.5%.

ASIA RATES: PBOC Lets CNY 100bn MLF Funds Mature

- INDIA: Yields mixed in early trade. Friday's auctions from the RBI were strong by recent standards which have seen the Central Bank devolve several issues on primary dealers. The RBI sold INR 365bn of debt, more than the INR 310bn planned, cutoffs were also strong even though the greenshoe option was utilized. Markets look ahead to wholesale price data later today, the index is expected to slow to 11.29% in July from 12.07% previously. Data on Friday showed CPI rose 5.59% in July Y/Y compared to 6.26% gain in June and is now back within the RBI's target band.

- SOUTH KOREA: Korean markets closed for Liberation Day

- CHINA: The PBOC withdrew CNY 100bn at the MLF operation today, rolling over CNY 600bn and letting CNY 100bn of the total CNY 700bn coming due mature. The Central Bank matched injections with maturities at its OMOs today, repo rates are higher but within recent ranges. There was an earlier article that flagged this course of action could be taken, a piece in the China Securities Journal said the PBOC would increase reverse repo injections this week while not fully roll over maturing MLF funds. Chinese data was weak with industrial production, retail sales and FAI all missing estimates. Futures hovering around neutral levels having come off early highs.

- INDONESIA: Yields mixed; some twist flattening seen. The government will today present the 2022 budget to lawmakers. The Jakarta Post reported that IDR100tn worth of capital injections for ailing state-owned enterprises. This represents 4% of the total size of the budget. Indonesian markets will be closed tomorrow in observance of the Independence Day. Following that, trade data will hit the wires on Wednesday and Bank Indonesia will deliver their monetary policy decision on Thursday. President Jokowi delivered his annual speech earlier, he said the pandemic put a heavy burden on the nation and Indonesia would target structural reforms to support the recovery.

EQUITIES: Japanese Markets Sustain Heavy Losses

A broadly negative session for equity markets in the Asia-Pac time zone, pressured by weak Chinese data and concerns over the delta variant with COVID-19 case numbers still elevated. There could also be some caution after Afghanistan fell to insurgents with the President fleeing the country. In China the PBOC let CNY 100bn of MLF funds mature, rolling over CNY 600bn. Chinese data was weak with industrial production, retail sales and FAI all missing estimates; indices on mainland China though are proving resilient and have managed to reclaim positive territory. Japan extended the state of emergency to mid-Sept, but earlier in the session data showed GDP was robust and came in well above estimates. Markets in Japan are the laggards, down approximately 1.8%. In the US futures are lower by around 0.3%; US bourses hit another fresh record high on Friday.

GOLD: Tight Range Despite Broader Risk-Off Flow

Spot gold has stuck to a particularly narrow ~$5/oz range during Asia-Pac hours, last dealing little changed just shy of $1,780/oz. This is despite a distinct risk-off feel to the broader Asia-Pac session. The tumble seen in the early part of last week (which has largely been recouped) has widened the gap between the initial technical lines in the sand, with initial support now located at the Aug 9 low ($1,690.6/oz), while resistance is noted at the July 15 high/bull trigger ($1,834.1/oz).

OIL: Crude Futures Extend Losses

Crude futures are lower in Asia-Pac trade, extending Friday's decline. WTI is down $0.76 from settlement levels at $67.88/bbl, Brent is down $0.74 at $69.85/bbl. WTI and Brent crude futures continues to fade as the recovery off the Monday low ran out of steam. The weakness on Friday was accelerated by a sharp downtick in the Uni. of Michigan sentiment survey, which dropped 11 points. A drop of that size has only been seen on a handful of occasions: the depths of the COVID crisis, the 2008 financial crisis, Hurricane Katrina and the 1990 Kuwait crisis. Data from China was weak today, with industrial production, retail sales and FAI all missing estimates. WTI crude futures hold south of the 50-day EMA at $69.98, which switches from support to resistance. This reinitiates the downside argument, opening $65.01, Jul 20 low and the key support.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.