-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBOC Provides Liquidity Boost

EXECUTIVE SUMMARY

- UNPUBLISHED ECB INFLATION ESTIMATE RAISES PROSPECT OF EARLIER RATE RISE (FT)

- ECB: FT REPORT ON INFLATION TARGET OUTLOOK ISN'T ACCURATE (BBG)

- BIDEN BOMBS WITH MANCHIN (AXIOS)

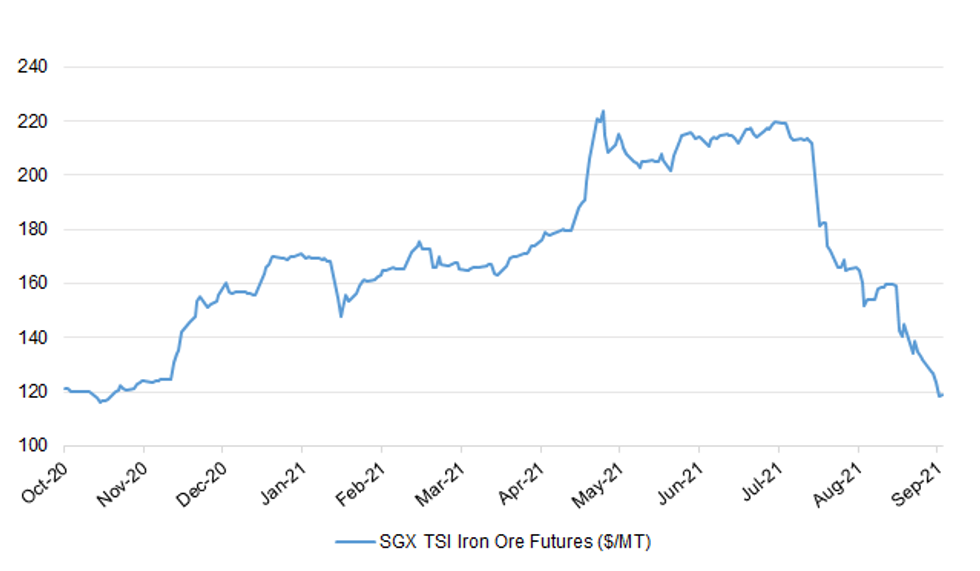

Fig. 1: SGX TSI Iron Ore Futures ($/MT)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Rip-off Covid tests for returning travellers are set to be scrapped for the double-jabbed in a boost to holiday plans for the autumn half term. On Friday, Boris Johnson is also expected to replace the traffic light system for travel and reduce the number of countries on the red list. However, the rules could get a little tighter for the unvaccinated, who may have to quarantine for 10 days whichever country they return from, increasing the incentives to get jabbed. The overhaul follows six months of fierce criticism over the cost of PCR tests and the complexity of the travel system, which has seen different rules for different groups of nations. (Telegraph)

CORONAVIRUS: Dozens of countries including Turkey will be removed from the red list banning international travel in time for next month's half-term as the government relaxes international travel rules. The red list, which prohibits travel to 62 countries, could be halved, meaning that most destinations will be opened up for the fully vaccinated. Grant Shapps, the transport secretary, is also expected to announce today that the traffic-light system for travel will be simplified by the scrapping of the amber classification. All destinations will be either red or green. (The Times)

FISCAL: UK chancellor Rishi Sunak is planning to use next month's Budget to set out new rules to rein in government borrowing, amid Treasury fears that any rise in interest rates could blow a hole in the heavily-indebted public finances. Sunak's new rules will commit him to stop borrowing to fund day-to-day spending within three years — a move intended to illustrate Tory fiscal discipline ahead of the next election. While the government's current spending plans fit within the new rules, they allow little room for extra giveaways to be unveiled at the Budget. (FT)

POLITICS: Boris Johnson will "go long" and wait until 2024 before holding an election amid concerns that moving earlier will repeat the mistake of Theresa May, allies have said. The prime minister's decision to appoint Oliver Dowden as co-chairman of the Conservative Party led to speculation that the prime minister could go to the polls in 2023. Dowden told staff at the Conservatives' campaign headquarters on Wednesday night to prepare for an election. "You can't fatten a pig on market day," he said. "It's time to go to our offices and prepare for an election." (The Times)

EUROPE

ECB: The European Central Bank expects to hit its elusive 2 per cent inflation target by 2025, according to unpublished internal models that suggest it is on course to raise interest rates in just over two years. This would be at least a year earlier than most economists expect the ECB to raise its deposit rate from a record low of minus 0.5 per cent. Many analysts predict benchmark rates in the 19 countries that share the euro will have stayed negative for a decade since being cut below zero in 2014. However, some investors are pricing in a rate rise by the end of 2023. This scenario appeared to be confirmed by the ECB's longer term inflation outlook, which its chief economist Philip Lane discussed in a private call with the economists of German banks this week, according to two people involved. The internal forecast is likely to intensify debate about how quickly major central banks will reverse the massive stimulus programmes they launched to counter the pandemic last year, and when they will start raising rates in response to rising inflation. (FT)

ECB: The European Central Bank dismissed a Financial Times report that said chief economist Philip Lane told analysts privately the institution expects to reach its 2% inflation target by 2025. "The FT story is not accurate," the ECB said in a statement. "Mr. Lane didn't say in any conversation with analysts that the euro area will reach 2% inflation soon after the end of the ECB's projection horizon." The newspaper cited unpublished internal models that suggest the ECB is on course to raise interest rates in just over two years. Bund futures dropped after the report. The central bank said Lane "made clear in a public event on Wednesday that by being persistent with a high level of monetary stimulus, the ECB can reach its 2% target over time, without mentioning a specific date." (BBG)

ITALY: Italy will require all workers to have a valid Covid passport, as the government led by Prime Minister Mario Draghi moves to set the toughest vaccination requirements in Europe. A cabinet meeting Thursday approved the measure, which applies to all public and private-sector workers and will come into force Oct. 15. Workers faces fines of as much as 1,500 euros ($1,763) for noncompliance, while employers who fail to check their workers may have to pay as much as 1,000 euros. The wider use of the passports -- dubbed Green Passes -- had met fierce opposition from right-wing parties including Matteo Salvini's League, which backs Draghi's government. (BBG)

SPAIN: Spain's Labor Ministry and unions agreed to increase the minimum wage for the second time in less than two years. The ministry and unions agreed to raise the wage by 15 euros per month, or about 1.6%, according to a statement from the ministry late Thursday. The increase is applicable as of Sept. 1. The administration aims to increase it further, to as much as 1,049 euros per month by 2023. The agreement did not receive support from business groups. The previous increase in January 2020, which was backed by industry groups, had set minimum wage at 950 euros. (BBG)

PORTUGAL: Portugal, which ranks among the European nations that are most dependent on tourism, expects annual revenue from the industry to reach the pre-pandemic record in about two years as the country continues to provide coronavirus vaccinations and eases travel restrictions. Total tourism revenue this year will be about 9 billion euros ($10.6 billion), half of the record figure of 18 billion euros posted in 2019, before the pandemic, Secretary of State for Tourism Rita Marques said. By 2023, revenue from tourism is expected to reach the level of 2019, she said. (BBG)

RATINGS: Rating reviews of note scheduled for after hours on Friday include:

- Moody's on the European Union (current rating: Aaa; Outlook Stable) & Portugal (current rating: Baa3; Outlook Positive)

- S&P on Belgium (current rating: AA; Outlook Stable) & Spain (current rating: A; Outlook Negative)

- DBRS Morningstar on Greece (current rating: BB (low), Stable Trend)

U.S.

FISCAL: President Biden failed to persuade Sen. Joe Manchin (D-W.Va.) to agree to spending $3.5 trillion on the Democrats' budget reconciliation package during their Oval Office meeting on Wednesday, people familiar with the matter tell Axios. (Axios)

FISCAL: President Joe Biden ratcheted up pressure on congressional Democrats on Thursday, as discord within the party threatened to derail key pieces of his economic agenda, including lowering prescription drug prices and some of his proposed tax hikes on the wealthiest Americans. "For a long time, this economy's worked great for those at the very top," Biden said in a speech Thursday at the White House. "This our moment to deal working people back into the economy." (BBG)

FISCAL: Mitch McConnell, the Senate's top Republican, has told Treasury Secretary Janet Yellen that congressional Democrats will have to raise the U.S. debt ceiling on their own, even as she warns of a default and new financial crisis if lawmakers do not raise the federal borrowing limit. (RTRS)

FISCAL: President Joe Biden discussed plans for advancing his economic policy agenda and addressing the debt ceiling with House Speaker Nancy Pelosi and Senate Majority Leader Chuck Schumer, according to a White House readout of Thursday's call. Biden, Pelosi and Schumer agree repealing tax cuts implemented during the Trump administration is "only fair" to support working families. (BBG)

CORONAVIRUS: President Joe Biden's push to begin offering third doses of Pfizer Inc.'s coronavirus vaccine faces the first of two crucial tests Friday when advisers to the Food and Drug Administration meet to discuss whether booster shots should be offered to most Americans. The meeting will take place as an extraordinary public debate plays out among administration officials, pharmaceutical executives, scientists, public health experts and global activists about whether boosters are even needed, and whether those doses would do more good being sent to poorer nations whose residents haven't received even a single shot. The White House's plan to begin offering boosters to almost all vaccinated adults starting next week has raised concerns among health experts that the administration is rushing ahead without enough data and regulatory oversight. (BBG)

CORONAVIRUS: Los Angeles County is requiring that guests attending large events like outdoor concerts and ballgames show proof of vaccination or a negative Covid-19 test from the past 72 hours, saying the change is needed to coax residents into getting their shots. Large outdoor venues will need to comply by Oct. 7, the county said Thursday in an emailed statement. Places like bars and nightclubs will have to require that customers and employees have at least one dose of the vaccine by that date and both doses by Nov. 4. (BBG)

OTHER

GEOPOLITICS: US Secretary of State Antony Blinken has raised concerns about China's use of economic coercion against Australia. Mr Blinken spoke in Washington at a joint news conference with Australia's Defence Minister Peter Dutton and Foreign Minister Marise Payne a day after the US and Britain said they would provide Australia with the technology and capability to deploy nuclear-powered submarines. The deal replaces a French submarine deal with Australia. Australia and the US have also reached new force posture agreements that will see greater air cooperation through rotational deployments of all types of US military aircraft to Australia. Mr Blinken said the US would stand with Australia against pressure from China. "This is an unshakeable alliance," he said. Ms Payne said the new AUKUS alliance, which includes the United Kingdom, was well suited for countering coercion in the Indo-Pacific. "We discussed the competition of China at a number of levels that requires us to respond and to increase resilience," she said. "This does not mean that there are not constructive areas for engagement with China." (ABC)

GEOPOLITICS: The White House on Thursday defended the U.S. decision to provide Australia with advanced technology for nuclear-powered submarines, rejecting criticism from both China and France over the deal. White House spokeswoman Jen Psaki said the agreement announced on Wednesday is not aimed at China, although the United States has mounting concerns about Chinese influence in the Indo-Pacific region. "We do not seek conflict with China," she told reporters. (RTRS)

GEOPOLITICS: Countries should urge the U.S. to take main responsibility for Afghanistan's rebuilding and provide economic and humanitarian assistance, China Foreign Minister Wang Yi said at an informal meeting with his counterparts from Russia, Pakistan and Iran in Dushanbe, Tajikistan Thursday. (BBG)

GEOPOLITICS: Boris Johnson will be offered a pact with the European Union on defence and security co-operation today during a meeting in Downing Street with Mark Rutte, the Dutch prime minister. Johnson turned down negotiations on defence last year during Brexit talks but Europeans believe the government is more open to the idea after America's behaviour over the withdrawal from Afghanistan. (The Times)

CORONAVIRUS: The fast-spreading delta variant is so contagious, it's exposed weaknesses in vaccine protection and changed the outlook for ending the pandemic, Moderna President Stephen Hoge said late Wednesday. Delta is "just so good at infecting people and replicating that it raises the bar on how good vaccines have to be," he said in a phone interview. "It's actually shown some of the weaknesses that [vaccines] have earlier than you might expect." (CNBC)

CLIMATE CHANGE: President Joe Biden will host a virtual discussion of climate change with world leaders Friday as he tries to accelerate efforts to slash greenhouse gases amid concerns that commitments are lagging before a pivotal United Nations summit. The leader-level summit is expected to be a sober assessment of global progress – or lack thereof – six weeks ahead of the UN gathering in Glasgow, which climate activists and government officials have described as a make-or- break moment to curb climate change. (BBG)

JAPAN: Campaigning for the Japanese ruling party's leadership election to choose the successor to Prime Minister Yoshihide Suga officially started Friday, with four veteran lawmakers -- two men and two women -- throwing their hats into the ring. The presidential election for the Liberal Democratic Party, set for Sept. 29, is being contested by former Foreign Minister Fumio Kishida, former communications minister Sanae Takaichi, vaccination minister Taro Kono and Seiko Noda, executive acting secretary general of the LDP, with none having a clear path to victory. (Kyodo)

RBA: MNI INSIGHT: RBA Review Call After Internal Proposals Rejected

- News that Treasurer Josh Frydenberg will consider following the OECD's advice to review the Reserve Bank of Australia's policy framework will be received coolly at the RBA, which has already conducted several internal reviews of its own, MNI understands - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

AUSTRALIA: Australia's most-populous state will trial home quarantine for people returning from overseas if they are fully vaccinated, signaling an easing of one of the most hardcore border regimes in the world. New South Wales Premier Gladys Berejiklian said Friday the pilot program in her state would begin in the next couple of weeks for around 175 people, selected by health authorities. The trial could apply to Australians, nonresidents and crew for flagship carrier Qantas Airways Ltd. (BBG)

AUSTRALIA/NEW ZEALAND: Quarantine-free travel with Australia will remain suspended for a further eight weeks, New ZealandCovid-19 Response Minister Chris Hipkins says in emailed statement. (BBG)

NORTH KOREA: New satellite images obtained by CNN reveal North Korea is expanding a key facility capable of enriching uranium for nuclear weapons, renovations that likely indicate the country plans to significantly ramp-up production at this once-dormant site in the near future, according to experts who analyzed the photos. (CNN)

HONG KONG: Hong Kong won't consider shifting its zero-tolerance Covid-19 strategy to one of "living with the virus" until the vaccination rate is 80% to 90%, with its fate tied to how China approaches reopening, said a top virus adviser to the government. "Covid Zero is not a long-term policy, we can try to boost the vaccination as much as we can during this policy," said David Hui, a professor at the Chinese University of Hong Kong who leads an expert panel that advises the government. (BBG)

HONG KONG: Hong Kong is testing whether people given Sinovac Biotech Ltd.'s Covid vaccine will fare better if they get a booster using BioNTech SE's more potent mRNA technology, as evidence emerges about how quickly antibodies from the Chinese-made vaccine fade. The trial involves 84 people given two doses of Sinovac's shot who didn't generate an adequate antibody response. They will be given another dose of the Sinovac vaccine or one made by BioNTech, then compared. The immunizations were completed this week and the results should be available in a month, said David Hui, a professor at the Chinese University of Hong Kong who leads an expert panel that advises the government. (BBG)

BOC: MNI INTERVIEW: BOC May Adjust Target As Spending Pledges Mount

- Canada's central bank may tweak its mandate towards the Fed's average inflation targeting regime after an election in which major parties have pledged to make life more affordable and to boost employment with deficit spending, a former adviser to the nation's biggest province told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

BRAZIL: Brazil's government decided to raise its financial transaction tax known as IOF to fund President Jair Bolsonaro's new social program called Auxilio Brasil, the Presidential Palace announced through a statement, adding the measure comes into force immediately. Earlier today, Valor Economico newspaper said the IOF tax for companies would increase to 2.04% a year from 1.5% previously. For individuals, tax hike would will be to 4.08% from 3%. Government expects to increase its tax collection by 2.1 billion reais ($399.3million) in 2021. (BBG)

RUSSIA: Annual inflation is currently near peak levels, will start easing in the fourth quarter, Bank of Russia Governor Elvira Nabiullina says in interview to RBC.ru. Inflation will start easing as impact of one-time factors fades, rate increases have impact. Pro-inflationary risks prevail for the moment. Lasting inflationary forces show rate over 4% currently. (BBG)

RUSSIA/CHINA: Russian President Vladimir Putin has accepted the invitation extended by Chinese leader Xi Jinping to attend the 2022 Winter Olympic Games, which will be held in Beijing in February, Russian Foreign Minister Sergey Lavrov said on Thursday at a meeting with his Chinese counterpart Wang Yi. "In the course of the conversation, President Vladimir Putin was delighted to accept Xi Jinping's invitation to the Winter Olympic Games in Beijing in February 2022. Of course, we hope that the summit will be held in person and that Chinese and Russian athletes will once again prove their highest sports and human qualities," he said. (TASS)

RUSSIA: The State Duma (lower house of parliament) elections have officially begun in Russia as the vote gets underway in the Kamchatsky and Chukotsky Regions. Polling stations in these two eastern-most regions of the country opened at 08:00 on September 17 (local time). The voting will be completed at 21:00 on September 19 after voting stations will be closed in the Kaliningrad Region, Russia's western-most enclave. (TASS)

MIDDLE EAST: The Arab Coalition early Friday intercepted and destroyed four explosive-laden drones, one ballistic missile launched by the Iranian-backed Houthi militia targeting Jazan. The Coalition said, in a tweet carried by the Saudi Press Agency (SPA), "this hostile escalation by Houthi militia targets civilians and innocent people." The coalition affirmed that it will take all necessary measures to protect civilians in accordance with international humanitarian laws. Friday's attack came a day after the coalition forces destroyed an explosives-laden drone that was launched towards Abha International Airport. The coalition will "firmly" deal with any threats to civilians and civilian objects, the statement added. (Saudi Gazette)

IMF: Kristalina Georgieva, managing director of the IMF, has been accused by a World Bank inquiry of directing efforts to artificially boost China's ranking in the lender's influential annual Doing Business report. The allegations pertain to the period when she was chief executive of the World Bank and overseeing its efforts to raise new capital from stakeholders including China. Georgieva said she disagreed fundamentally with the accusation, contained in a report commissioned by the bank from the law firm WilmerHale. It was presented internally on Wednesday and released by the World Bank's board on Thursday. (FT)

BRAZIL: Brazil's lower house Constitution and Justice Committee sees the court-ordered payments billknown as 'precatorios' as constitutional. (BBG)

BRAZIL: President Jair Bolsonaro sees a Datafolha poll showing his disapproval rating at a record level of53% as no parameter for anything, he said during a live on social media. Health Minister Queiroga, who joined Bolsonaro's live, said that there will be no shortage of vaccine doses in Brazil. (BBG)

METALS: United States Steel Corp. said it plans to begin construction of a new steel mill in the U.S. next year, as the company chases rising demand from a rebounding manufacturing sector. The Pittsburgh-based company said Thursday the new mill will have the capacity to produce three million tons of sheet steel annually, boosting its sheet-steel capacity by about 20% and helping to alleviate tight supplies of steel in the domestic market. The U.S. Steel mill would increase new production capacity under construction or planned in the U.S. to about 12 million tons annually, or almost 21% of sheet-steel consumption in 2019. (WSJ)

OIL: U.S. Gulf Coast crude oil exports are flowing again after recent hurricanes took out 26 million barrels of offshore production, according to sources and Refinitiv Eikon data, with local prices easing as more shipments moved out of the region. Hurricanes Ida and Nicholas damaged platforms, pipelines and processing hubs, shutting in most offshore production for weeks. Restarts continued on Thursday with about 28% of U.S. Gulf of Mexico crude output offline. Some vessels remained at sea waiting to load U.S. crude. But of more than 50 tankers set to load U.S. crude for exports or to discharge imported oil in Texas and Louisiana through early October, the majority remained on track on Thursday, according to Refinitiv Eikon vessel tracking data. Just 22% were showing delays. Some exporters of Mars crude, which is produced in the Gulf, have offered customers alternatives including switching to other crude grades, re-scheduling loadings or changing ports, traders involved in the sales said. (RTRS)

CHINA

BONDS: As China prepares to launch next Friday the southbound leg of the Bond Connect, a scheme that allows domestic investors to access Hong Kong-traded bonds, domestic institutional investors may start with buying yuan-denominated dim sum bonds as well as high-grade U.S. dollar bonds issued by Chinese local governments in Hong Kong, Yicai.com reported citing industry insiders. Investors are unlikely to buy high-risk real estate dollar-denominated bonds, the newspaper said. While the daily quota capped under CNY20 billion is very small, the opening of the southbound link will encourage domestic investors to buy dollar bonds issued by Chinese companies overseas, which generally have better liquidity and higher yield, the newspaper said. (MNI)

CREDIT: Shenzhen World Union Group has reached a settlement with Evergrande on payment of about246m yuan of receivables, World Union says in exchange filing. (BBG)

CREDIT: A group of China Evergrande Group bondholders has selected investment bank Moelis & Co and law firm Kirkland & Ellis as advisers on a potential restructuring of a tranche of bonds, two sources close to the matter said. The advice focuses on around $20 billion in outstanding offshore bonds in the event of non-payment, one of the sources said. (RTRS)

CORONAVIRUS: The top immunologist at China's CDC Wang Huaqing suggested vaccinating children under 12 years old after over 70% of the country's 1.4 billion population were fully vaccinated, said the Global Times. The country had vaccinated more than 1 billion people aged 12 and above, the newspaper said. So far China has approved three inactivated vaccines for emergency use on those three years or older. However, based on a gradual vaccination strategy, shots have only been given to people aged 12 and above. Fully vaccinated people include over 200 million aged 60 and above and another 95 million aged 12-17, the newspaper said. (MNI)

GEOPOLITICS: The trilateral Aukus alliance could make Australia a target for a nuclear strike as nuclear-armed states like China and Russia are directly facing the threat from Australia's nuclear submarines which serve U.S. strategic demands, the state-owned Global Times reported citing a "senior Chinese military expert" which the newspaper didn't identify. Deploying nuclear submarines will force China to change its attitude toward Australia and its military deployment and countermeasures, the Times said. The Aukus partnership confirms that Australia is going all the way with the US in what many have labeled a new 'cold war' with China, the newspaper said. (MNI)

ECONOMY: China will step up construction of highway charging facilities for new energy vehicles, Vice Transport Minister Wang Zhiqing says at World New Energy Vehicle Congress in Hainan Friday. China will cover 80% of highways with NEV charging by 2025. (BBG)

OVERNIGHT DATA

NEW ZEALAND AUG BUSINESSNZ M'FING PMI 40.1; JUL 62.2

Employment (54.5) managed to keep its head above water, but all other sub-index values were in contraction with Production (27.7) the hardest hit. Although manufacturers outside of Auckland have returned to alert levels that allow business operations to restart, any moves towards the sector getting back into expansion will ultimately depend on how soon Auckland can also return to lower alert levels. While many anticipate a bounce in activity as the country progresses down alert levels (all going well on the Covid front), today's PMI clearly demonstrates the economic pain being felt. This should not be underestimated, even if there is hope for the future. GDP and manufacturing output are expected to fall heavily in Q3. It is something of a reality check in the afterglow of yesterday's very strong Q2 GDP outcome. (BusinessNZ/BNZ)

CHINA MARKETS

PBOC INJECTS CNY90BN VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos and another CNY50 billion via 14-day reverse repos with the rate unchanged at 2.2% and 2.35%, respectively, on Friday. The operations lead to a net injection of CNY90 billion after offsetting the maturity of CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3600% at 09:47 am local time from the close of 2.2634% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 56 on Thursday vs 58 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4527 FRI VS 6.4330

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4527 on Friday, compared with the 6.4330 set on Thursday.

MARKETS

BOND SUMMARY: Core FI Happy To Hug Tight Ranges, ACGB Supply Well Received

T-Notes -0-01 at 133-02 at typing. The contract traded sideways, sticking to the confines of a 0-03 range. Cash Tsy curve runs flatter, with yields last seen flat to 0.9bp richer across the curve. Eurodollars sit +0.5 to -0.5 tick through the reds. Fiscal headwinds remain apparent, with Axios circulating a report pointing to a lack of breakthrough on that front, after talks between Pres Biden & key Democratic Senator Manchin yielded no progress. The preliminary reading of University of Mich. Sentiment takes focus from here.

- JGB futures ground higher initially, topped out at 151.75 and eased off into the Tokyo lunch break. The contract last sits at 151.71, 7 ticks shy of previous settlement. Cash JGB yields are marginally mixed. Official campaigning for LDP leadership election kicks off today, while Japan will observe a public holiday on Monday.

- Aussie bond futures held tight ranges, YM last trades -1.5, with YM -3.5. Cash ACGB yield curve has bear steepened, albeit yields have eased off initial highs. Bills run unch. to -2 ticks through the reds at typing. The supply of ACGB Apr '33 was well received by the market, as the dynamics surrounding relative appeal and expectations for the bond to outperform into XMH2 basket inclusion seemingly outweighed the headwinds touted ahead of the supply.

JGBS AUCTION: Japanese MOF sells Y4.0619tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0619tn 3-Month Bills:

- Average Yield -0.1135% (prev. -0.1174%)

- Average Price 100.0280 (prev. 100.0293)

- High Yield: -0.1094% (prev. -0.1122%)

- Low Price 100.0270 (prev. 100.0280)

- % Allotted At High Yield: 86.6212% (prev. 44.1559%)

- Bid/Cover: 4.657x (prev. 4.147x)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 22 September it plans to sell A$1.0bn of the 4.25% 21 April 2026 Bond.

- On Thursday 23 September it plans to sell A$1.0bn of the 26 November 2021 Note & A$1.0bn of the 25 March 2022 Note.

- On Friday 24 September it plans to sell A$1.0bn of the 1.50% 21 June 2031 Bond.

OIL: Little Movement Early In Asia

WTI and Brent crude futures sit a handful of cents lower on the day at typing, after finishing little changed on Thursday. The supply side headwinds that we flagged on Thursday (notably surrounding U.S. Gulf production coming back online, albeit slowly, and Libyan exports returning) provided some pressure for crude through early NY trade, with the usual round of profit-taking talk and uptick in the USD also weighing. Still, a recovery in U.S. equity indices as we moved through the day seemed to allow crude to end the session on a near enough neutral footing.

GOLD: Finally Out Of The Narrow Range

A flat start to Asia-Pac trade for spot gold, last dealing little changed at $1,755/oz.

- A firmer USD and uptick in our weighted U.S. real yield monitor allowed gold to break out of its recent range on Thursday, with firmer U.S. retail sales data proving decisive on the day. Still, bears only managed to force a very shallow and minor breach below the 61.8% retracement of the Aug 9-Sep 3 rally, with Thursday's low ($1,745.3/oz) now providing the initial point of support. A move below there would allow bears to target the 76.4% retracement of the same Aug 9-Sep 3 rally ($1,724.5/oz). Initial resistance has moved to the Sep 14 low ($1,781.8/oz).

- Note that known ETF holdings of gold have operated in a sideways fashion in recent weeks, hovering just above the post-COVID lows witnessed in April, with that particular metric last sitting 10.4% off of the all-time highs seen in October '20.

- Participants await next week's FOMC decision, which will see focus fall on any commentary surrounding the tapering of the central bank's QE programme.

FOREX: NZD, JPY Underperform In Muted Trade

The Asia-Pacific docket lacked tier 1 risk events, while headline flow was relatively limited, keeping volatility in G10 FX space subdued. NZD edged lower after New Zealand's BusinessNZ Manufacturing PMI plunged deep into contraction following the implementation of Covid-19 restrictions in August. NZD/USD tested yesterday's low of $0.7060 but that level provided a formidable layer of support.

- New Zealand's Manufacturing PMI fell to 40.1 from 62.2, with accompanying commentary noting that "GDP and manufacturing output are expected to fall heavily in Q3," which is something of a reality check in the afterglow of yesterday's very strong Q2 GDP outcome".

- The yen went offered against most of its G10 peers, with Japan set to observe public holidays next Monday and Thursday.

- Final EZ CPI and UK retail sales take focus in European hours, with flash U.S. University of Mich. Sentiment coming up later in the day. ECB's Makhlouf will speak at a workshop on inflation.

FOREX OPTIONS: Expiries for Sep17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740-50(E1.2bln), $1.1800(E1.2bln), $1.1970-80(E1.4bln)

- AUD/USD: $0.7300(A$511mln), $0.7325(A$2.5bln)

- USD/CAD: C$1.2635-45($896mln), C$1.2700($773mln), C$1.2745-60($1.5bln), C$1.2790-00($1.1bln)

- USD/CNY: Cny6.4300($652mln)

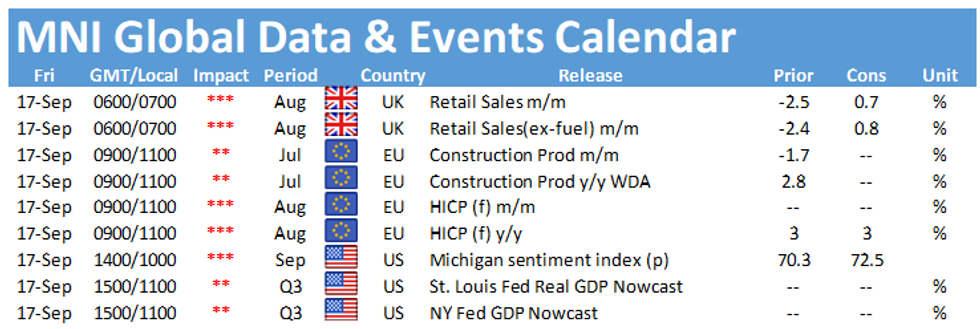

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.