-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Nikkei Rallies In Asia, China Evergrande Coupon Questions Remain

EXECUTIVE SUMMARY

- EVERGRANDE USD BONDHOLDERS YET TO RECEIVE INTEREST DUE THURS (BBG)

- CHINA SHOULD CONTROL IMPORTED INFLATION RISKS (ECONOMIC DAILY)

- GERMAN CANDIDATES CLASH IN LAST TV DEBATE BEFORE VOTE AS SPD LEAD NARROWS (RTRS)

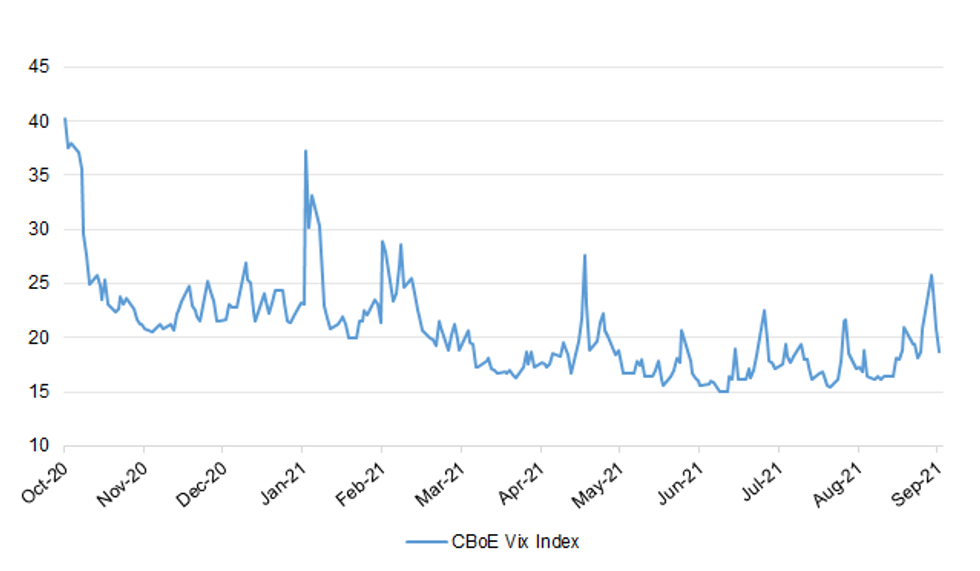

Fig. 1: CBoE Vix Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The environment secretary has said the government is looking at different options on how to fix labour shortages in the food sector. George Eustice said the government was considering whether changes could be made to the Seasonal Agricultural Workers' Scheme (SAWS). SAWS is a quota-based scheme that allows farmers to recruit overseas. Trade bodies have warned of panic-buying this Christmas unless action is taken to address the lack of staff. (BBC)

FUEL: Motorists have been urged by the government to "shop for fuel as usual" after BP said it had closed some of its petrol stations due to supply issues. The energy giant said tens of forecourts in its 1,200-strong network were experiencing shortages - blamed on the nationwide lack of HGV drivers - while rival Esso said a few of its sites were affected. Tesco said two of the 500 petrol stations it operates were currently affected, describing the impact as minimal and ensuring that supply is replenished whenever this happens. (Sky)

REGULATION: Chancellor Rishi Sunak has ordered two immediate reviews of UK financial regulation related to the collapse of Greensill Capital as he accepted some recommendations from a report by a committee of MPs into the scandal. Greensill, which collapsed in March 2021, employed former prime minister David Cameron as an adviser. The company had a "symbiotic relationship" — in Cameron's words — with GFG Alliance, a metals group now being investigated by the Serious Fraud Office. MPs and others have also questioned why Lex Greensill, founder of the company, was given an unpaid advisory role within Whitehall by the Cameron government in 2012 — where he pushed "supply-chain finance", a form of factoring. (FT)

EUROPE

GERMANY: Candidates vying to succeed Angela Merkel as German chancellor clashed on Thursday on tax, debt and foreign policy in a final television debate as opinion polls showed the race tightening three days before a federal election. A FGW poll for ZDF Television showed support for the conservative CDU/CSU alliance, whose chancellor candidate is Armin Laschet, up one percentage point at 23%. The Social Democrats are clinging to their lead, but only just. The FGW poll put the centre-left party, whose candidate is Finance Minister Olaf Scholz, unchanged on 25%. The Greens, likely to play a role in government, inched up half a percentage point to 16.5% and the pro-business Free Democrats (FDP) were stable on 11%. (RTRS)

ITALY: Italy's government approved a package of measures to mitigate the impact on consumers of a spike in energy prices. Prime Minister Mario Draghi's administration will spend more than 3 billion euros ($3.5 billion) to offset an increase in energy bills which could have been of as much as 40% without government intervention. The new measures include cuts to VAT on energy and will apply to the last quarter of the year. Italy is enjoying its strongest economic rebound since the 1970s as the world emerges from the coronavirus crisis, but along with other European countries it is dealing with the impact of soaring energy and gas prices on consumers. Addressing the business community earlier Thursday, Draghi said growth is expected to approach 6% this year and confirmed a pledge not to raise taxes. The government is due to present its new economic outlook next week. (BBG)

SPAIN: Former Catalan leader Carles Puigdemont was detained Thursday in Sardinia, Italy, his lawyer said. Lawyer Gonzalo Boye wrote on Twitter that the ex-Catalan regional president, wanted by Spain for his role in a failed bid for secession four years ago, was being held under a European arrest warrant issued by Spain in 2019. His arrest was confirmed by Boye to the Associated Press. Puigdemont, who now holds a seat in the European Parliament, lost his immunity earlier this year. (AP)

RATINGS: Potential rating reviews of note scheduled for after hours on Friday include:

- Fitch on Belgium (current rating: AA-; Outlook Negative) & Cyprus (current rating: BBB-; Outlook Stable)

- Moody's on Hungary (current rating: Baa3; Outlook Positive) & Sweden (current rating: Aaa; Outlook Stable)

- S&P on Germany (current rating: AAA; Outlook Stable)

- DBRS Morningstar on the European Union (current rating: AAA, Stable Trend) & Finland (current rating: AA (high), Stable Trend)

U.S.

ECONOMY: U.S. Commerce Secretary Gina Raimondo said on Thursday that the decision by the Biden administration to lift international travel restrictions in early November will be a boost to the U.S. economy, especially for tourist destinations like New York and for business travel. Raimondo said the decision announced Monday to allow fully vaccinated foreign nationals to fly to the United States "is huge. I think it will really be a boost to our economy, it will certainly be a boost to travel, tourism, hospitality." To address COVID-19 concerns, the U.S. has barred most foreign nationals from coming to the United States who have recently been in 33 countries including China, South Africa, Brazil, India and much of Europe. (RTRS)

FISCAL: The White House budget office notified federal agencies on Thursday to begin preparations for the first shutdown of the U.S. government since the coronavirus pandemic began, as lawmakers on Capitol Hill struggle to reach a funding agreement. Administration officials stress the request is in line with traditional procedures seven days ahead of a shutdown and not a commentary on the likelihood — or lack thereof — a congressional deal. Both Democrats and Republicans have made clear they intend to fund the government before its funding expires on Sept. 30, but time is running out and lawmakers are aiming to resolve an enormous set of tasks to in a matter of weeks. House Democrats earlier this week approved a measure to fund the government, suspend the debt ceiling and approve emergency aid such as disaster relief. But that plan is expected to die in the Senate amid GOP refusal to support Democratic attempts to lift the debt ceiling. (Washington Post)

FISCAL: House Speaker Nancy Pelosi signaled Democrats will avert a government shutdown by passing a stopgap spending bill without a debt ceiling increase in it, amid Republican opposition to linking the two measures. "Whatever it is, we will have a CR that passes both houses by September 30," Pelosi said at a press briefing Thursday, referring to the so-called continuing resolution that will be needed to fund the federal government at the start of the new fiscal year on Oct. 1. (BBG)

CORONAVIRUS: Kentucky Governor Andy Beshear said hospitals remain under unprecedented strain despite a leveling off of Covid-19 cases. "If we plateau at the level we're at right now we cannot sustain it in our hospitals," the Democratic governor said in a news briefing Thursday. "We have more people on ventilators now than we ever imagined were possible." (BBG)

CORONAVIRUS: Vaccinating against Covid does not increase the risk of miscarriage or birth defects, officials from the Centers for Disease Control and Prevention said at a meeting Wednesday. (CNBC)

CORONAVIRUS: A key panel at the Centers for Disease Control and Prevention on Thursday recommended the Pfizer-BioNTech coronavirus booster shots for people 65 years old and older, as well as those at high risk of severe COVID-19. The approval is the near-final step in making the booster shots available to tens of millions of Americans, and comes a day after the FDA approved Pfizer boosters for the two groups. CDC director Rochelle Walensky is expected to accept the recommendation. (Axios)

CORONAVIRUS: National Institutes of Health Director Dr. Francis Collins called Israel's data on Covid-19 booster shots "impressive," noting that they provided a tenfold reduction in infection for people who received a third dose. Israel began administering boosters in late July to individuals over 60, giving scientists more time to examine their ability to combat Covid and bolster the waning effectiveness of the initial series of doses. Collins' comments Thursday came just a day after the Food and Drug Administration approved Pfizer and BioNTech's Covid booster for high-risk people, including anyone 65 and older. "Without tipping my hand too much, I will say the data looks really impressive, that the boosters do in fact provide substantial reduction in infection," Collins said during a discussion on Covid hosted by Bloomberg Philanthropies. "Like a tenfold reduction just within 12 days after that booster, and also a reduction in severe illness, which is the thing we're most concerned about." (CNBC)

POLITICS: The House select committee investigating the deadly Jan. 6 Capitol riot announced Thursday it issued subpoenas to four of former President Donald Trump's closest allies late Thursday, including his former chief of staff Mark Meadows and his onetime close advisor Steve Bannon. The subpoenas, which were also sent to former White House Deputy Chief of Staff for Communications Daniel Scavino and ex-Defense Department official Kashyap Patel, instruct the witnesses to produce materials and appear at depositions in the coming weeks, the committee said in a press release. (CNBC)

OTHER

GLOBAL TRADE: U.S. Commerce Secretary Gina Raimondo said on Thursday it is time to get "aggressive" in addressing the worsening semiconductor chip shortage that has caused automakers and others to cut production and impacted thousands of U.S. workers. "It's time to get more aggressive. The situation is not getting better, in some ways it is getting worse," Raimondo told Reuters in an interview. She said a voluntary request for information issued on chips to industry this week "will give us more information about the supply chain, and the goal is to increase transparency so we can try to identify where the bottlenecks (are) and then predict challenges." (RTRS)

GLOBAL TRADE: The European Commission confirmed that the inaugural meeting of a new trade council with the U.S. will go ahead as planned after France sought to have it postponed. The Trade and Technology Council will meet in Pittsburgh next week, and will focus on "short-term semiconductor issues," Miriam Garcia Ferrer, a spokesperson for trade and agriculture at the European Commission, said in a tweet Thursday. After in-depth talks at the commission in October, conversations on mid- and longer-term strategic chip issues will begin in TTC working groups to prepare for the next council summit in Europe, she said. (BBG)

USMCA: Mexico's leader said any change to a trade pact between the three biggest north American economies would need input from all the nations, after a report that the U.K. was weighing joining the accord. "All of the actors have to look at this," President Andres Manuel Lopez Obradorsaid Thursday. "We cannot jump ahead," he said, adding that the agreement between the U.S., Canada and Mexico was "such an important achievement." A person familiar with the U.K.'s thinking said Tuesday that London is exploring its options to join the trilateral trade agreement known as the USMCA, a recognition that the Biden administration won't start talks on a bespoke bilateral deal with the U.K. -- billed as one of the prizes of Brexit -- any time soon. (BBG)

U.S./CHINA: U.S. Commerce Secretary Gina Raimondo said on Thursday the Biden administration will take further action against Chinese telecoms firm Huawei if necessary, even as some Republican lawmakers have pressed the administration to do more. In a Reuters interview, Raimondo was asked about Huawei and recounted how she told Republican lawmakers in January "that I wouldn't be soft and now the proof's in the pudding -- we haven't been. They shouldn't worry." Huawei was added to the U.S. Entity List in May 2019. Raimondo said the list "is a really powerful tool in our toolbox, and we will use it to the fullest extent possible to protect American national security." (RTRS)

GEOPOLITICS: China has denounced the Quad as a Cold War construct and said the AUKUS alliance would intensify an arms race in the region. The U.S. official rejected Beijing's concerns, and pointed out that China in recent decades has undergone one of the most rapid military expansions in history. "We've seen dramatic steps on China's military buildup over the course of the last couple of decades and much of that has triggered some anxiety in the region," the official said. (RTRS)

JAPAN: The Japanese government will raise the amount of low interest emergency yen loans available for Covid-hit developing nations by 200b yen to 700b yen, the Yomiuri newspaper reports without attribution. The loan facility, offered at 0.01% interest, doesn't restrict the purpose of use in principle. Prime Minister Yoshihide Suga is expected to announced the plan at Quad meeting in Washington. The government last year said it would offer as much as 500b yen of emergency yen loans over 2 years and has so far provided 300b yen to nations including India, Bangladesh and the Philippines. (BBG)

AUSTRALIA: Australian authorities need to tighten home loan standards to cool a red-hot housing market and reduce risks to the financial system, the IMF warned on Friday, while also calling for more action on climate change. (RTRS)

SOUTH KOREA: South Korea reported a record 2,434 new coronavirus cases in the wake of the Chuseok Thanksgiving holidays, which fell earlier this week. The total number of confirmed cases stood at 295,132, according to the Korea Disease Control and Prevention Agency. The death toll rose by seven to 2,434. More than 72% of the population has received at least one vaccine dose. (BBG)

BOK: South Korean companies and households should be able to handle the impact of another interest-rate hike to 1%, the Bank of Korea said, signaling it remains on course to normalize policy as it shifts focus to curbing debt growth. In a quarterly report on financial stability Friday, the BOK said another quarter-percentage-point raise would be "manageable" in terms of the added interest burden and changes in balance sheets. "Considering the macro-economy and financial imbalances comprehensively, higher rates would help maintain stability among households, businesses and the financial sector, while also contributing to easing imbalances over the mid-to-long term," the BOK said. The central bank raised its key interest rate to 0.75% last month from a record low of 0.5%, seeing debt bubbles as a bigger concern for the economy than the coronavirus outbreak. (BBG)

NORTH KOREA: North Korea on Friday rejected as "something premature" President Moon Jae-in's proposal to declare a formal end to the 1950-53 war. Vice Foreign Minister Ri Thae-song said in a statement carried by the Korean Central News Agency that "nothing will change" as long as the political situation surrounding the North and the U.S. hostile policy remains unchanged. "There is no vouch that the mere declaration of the termination of the war would lead to the withdrawal of the hostile policy toward the DPRK, under the present situation on the peninsula inching close to a touch-and-go situation," he said, referring to the North by its official name. (Yonhap)

BRAZIL: The two people infected with Covid-19 were vaccinated, Brazil's President Jair Bolsonaro told in his weekly live on social media, adding that he will disclose their names this Friday. Bolsonaro, who is in isolation, said he regrets that health regulator known as Anvisa recommended him to comply with quarantine. President showed signs of coughing. Bolsonaro said the First Lady Michelle Bolsonarowas vaccinated against Covid-19. President disapproves the idea of a health passport. Bolsonaro said that gasoline prices could decline if the ethanol concentration in the fuel is reduced. President said that such decision can be made by the National Energy Policy Council. (BBG)

RUSSIA: Russian inflation may exceed the government's 5.8% year-end forecast, pushed up by 200b rubles in recent state social payments, as well as global food and logistics price pressures, Economy Minister Maxim Reshetnikovtells reporters. Reshetnikov declines to forecast peak inflation level this year, citing uncertainties. (BBG)

IRAN: The window is still open to revive the 2015 Iran nuclear deal but won't be forever, a senior U.S. official said on Thursday, saying Iran has yet to name a negotiator, set a date for talks or say whether it would resume where they left off in June. (RTRS)

COMMODITIES: China's National Development and Reform Commission will study and solve issues that emerged this year for the private sector in a timely manner, NDRC official Jiang Yi says at a press conference. Those issues include power limits, rising raw material prices and increasing freight rates. (BBG)

CHINA

CREDIT: Three holders of a China Evergrande Group dollar bond with a coupon that was due Thursday said they hadn't received payment as of 8am Friday Hong Kong time. (BBG)

PBOC: The People's Bank of China may inject liquidity by larger and more frequent use of reverse repos and rolling over maturing medium-term instruments, while a more substantial measure like an RRR cut in Q4 has become less necessary, the Securities Times reported citing analysts. The PBOC has restarted 14-day reverse repurchase operations for four consecutive trading days so to meet the increased liquidity demand by month-end, quarter-end as well as before the week-long October holiday, the newspaper said. The current tightening of liquidity is mainly due to slower fiscal expenditures, and there is room for over CNY4 trillion of fiscal spending till yearend, which can help to make up for the funding demand caused by the issuance of local government bonds. (MNI)

INFLATION: China should pay close attention to rising global commodity price and its impact on different industries and companies, Economic Daily says in a front-page report. The imported inflation currently only has impact on raw materials costs but we should also keep alert on the delay in price transmission, which may gradually appear in the future. China should try to reduce the impact on profits of small and medium-sized companies. Global impact on China's consumer prices will be "limited and controllable" overall as fundamentals do not support long-term inflation or deflation. (BBG)

PROPERTY: China's real estate market has been on a downfall and it may be difficult for housing transactions in most cities to rebound even during the upcoming week-long National Day holiday when more consumers purchase homes, said the China Youth Daily citing industry insiders. The prices of preowned homes in many cities have been falling and developers reduced land purchases in recent auctions, signalling a bearish outlook of the property sector, the newspaper said. But the current declines in home prices can be controlled and a "black swan" incident may not trigger a systemic collapse seen in other markets, where the banks and the housing markets were more intertwined, as China had placed strict policies limiting banks' lending to developers and home buyers, the newspaper said. MNI noted that the officially owned newspaper may be warning the government efforts to correct the real estate bubbles will continue while downplaying the impact on the economy from the troubled Evergrande Group, which is on the brink of a collapse partly due to the government's heavy-handed measures. (MNI)

BONDS: China's issuance of CNY8 billion government bonds in Hong Kong has lifted the city's standing as an offshore yuan hub, improved the yield curve of offshore yuan government bonds, and demonstrated a strong demand for yuan assets as the bonds were oversubscribed two to three times, the China Securities Journal reported. The Ministry of Finance is scheduled to conduct two more rounds of sales of CNY6 billion in conjunction with the city, the first of which will take place Oct. 20, the newspaper said. In August, foreign institutions further increased their bond holdings by CNY8.4 billion in the inter-bank bond market. As of end-August, foreign institutions held CNY3.78 trillion of bonds on the Chinese inter-bank markets, the newspaper said. (MNI)

CORONAVIRUS: China reported 30 local Covid cases as more infections were found in the northeastern city of Harbin. A larger outbreak that started earlier this month in southeast China's Fujian province is ebbing, with 15 cases reported from Xiamen and Putian in the province. (BBG)

OVERNIGHT DATA

JAPAN AUG CPI -0.4% Y/Y; MEDIAN -0.3%; JUL -0.3%

JAPAN AUG CORE CPI 0.0% Y/Y; MEDIAN 0.0%; JUL -0.2%

JAPAN AUG CORE-CORE CPI -0.5% Y/Y; MEDAN -0.4%; JUL -0.6%

JAPAN SEP, P JIBUN BANK MANUFACTURING PMI 51.2; AUG 52.7

JAPAN SEP, P JIBUN BANK SERVICES PMI 47.4; AUG 42.9

JAPAN SEP, P JIBUN BANK COMPOSITE PMI 47.7; AUG 45.5

NEW ZEALAND AUG TRADE BALANCE -NZ$2.144BN; JUL -NZ$397MN

NEW ZEALAND AUG TRADE BALANCE 12 MTH YTD -NZ$2.944BN; JUL -NZ$1.099BN

NEW ZEALAND AUG EXPORTS NZ$4.35BN; JUL NZ$5.77BN

NEW ZEALAND AUG IMPORTS NZ$6.49BN; JUL NZ$6.17BN

SOUTH KOREA AUG PPI +7.3% Y/Y; JUL +7.4%

UK SEP GFK CONSUMER CONFIDENCE -13; MEDIAN -7; AUG -8

CHINA MARKETS

PBOC INJECTS CNY120BN VIA OMOS FRI; LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY120 billion via 14-day reverse repos with the rate unchanged at 2.35% on Friday. The operation left liquidity unchanged given it netted off CNY50 billion reverse repos and CNY70 treasury cash deposits at commercial banks maturing today, according to Wind Information.

- The operation aims to keep liquidity stable by the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.3238% at 09:36 am local time from the close of 2.1446% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 38 on Thursday vs 41 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4599 FRI VS 6.4749

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.4599 on Friday, compared with the 6.4749 set on Thursday.

MARKETS

SNAPSHOT: Nikkei Rallies In Asia, China Evergrande Coupon Questions Remain

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 591.31 points at 30231.22

- ASX 200 down 28.819 points at 7341.4

- Shanghai Comp. down 2.472 points at 3639.748

- JGB 10-Yr future down 27 ticks at 151.59, yield up 1.1bp at 0.050%

- Aussie 10-Yr future down 14 ticks at 98.575, yield up 13.5bp at 1.395%

- U.S. 10-Yr future -0-06 at 132-06, yield up 0.86bp at 1.439%

- WTI crude up $0.01 at $73.32, Gold up $8.04 at $1750.84

- USD/JPY up 11 pips at Y110.44

- EVERGRANDE USD BONDHOLDERS YET TO RECEIVE INTEREST DUE THURS (BBG)

- CHINA SHOULD CONTROL IMPORTED INFLATION RISKS (ECONOMIC DAILY)

- GERMAN CANDIDATES CLASH IN LAST TV DEBATE BEFORE VOTE AS SPD LEAD NARROWS (RTRS)

BOND SUMMARY: Core FI Weaker In Asia

T-Notes -0-06 at 132-06, 0-03 off worst levels after sliding through Thursday's low. A brief bid was seen on headlines pointing to the apparent continued non-payment of a coupon on one of China Evergrande's US$-denominated bonds that was due Thursday (a reminder there is a 30-day grace period on the coupon payment before a default would be triggered), before the cheapening resumed and fresh session lows were seen. Cash Tsys are little changed to 2.0bp cheaper on the day, with 20s leading the weakness. Fedspeak from Powell, Clarida, Bowman, Mester, George & Bostic is due during NY hours.

- It has been a heavy return to trade for JGBs, with futures last dealing 29 ticks lower on the day, just above session lows, as the pressure witnessed in the U.S. Tsy space on Thursday spilled over, pushing the contract through initial technical support in the process. 7s represent the weak point on the cash JGB curve, cheapening by ~2.5bp, with shorter dated paper 0.5-1.0bp softer and longer dated paper running ~1.5-2.0bp cheaper. The fact that 7s are leading the cheapening may point to futures driven activity. Meanwhile, 5+-Year swap spreads are generally wider on the day (7s are the exception to rule, given the move in the cash JGB space), suggesting that payside swap flow is aiding the broader cheapening in the cash JGB space. The latest BoJ Rinban ops saw the following cover ratios, which may be adding some light pressure in afternoon dealing: 1- to 3-Year 2.75x (prev. 1.97x), 3- to 5-Year 3.11x (prev. 2.25x), 5- to 10-Year 2.58x (prev. 2.04x), 25+-Year 5.40x (prev. 2.85x).

- The steepening extended in Aussie Bond trade, with nothing in the way of a fresh, overt catalyst observed. Perhaps lower liquidity owing to the holiday in play in the state of Victoria played a role here, allowing the overnight/early Sydney move to extend. YM -6.0, XM -14.5. There may also be some correlation in play with U.S. Tsys, as T-Notes slipped through Thursday's session low. A quick dive into today's A$1.0bn ACGB Jun '31 auction revealed that the weighted average yield printed 0.47bp through prevailing mids at the time of supply (per Yieldbroker). The cover ratio was comfortably above 4.00x. This represented a solid auction, even in the face of aggressive U.S. Tsy-driven cheapening, with a better entry point building on the support provided by the previously outlined (and well defined) supportive factors that have been in play in recent times.

JGBS AUCTION: Japanese MOF sells Y4.0730tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.0730tn 3-Month Bills:

- Average Yield -0.1383% (prev. -0.1135%)

- Average Price 100.0383 (prev. 100.0280)

- High Yield: -0.1300% (prev. -0.1094%)

- Low Price 100.0360 (prev. 100.0270)

- % Allotted At High Yield: 47.7341% (prev. 86.6212%)

- Bid/Cover: 3.805x (prev. 4.657x)

BOJ: BoJ Makes Rinban Purchase Offers

The BoJ offers to buy a total of Y1.375tn of JGBs from the market:

- Y450bn worth of JGBs with 1-3 Years until maturity

- Y450bn worth of JGBs with 3-5 Years until maturity

- Y425bn worth of JGBs with 5-10 Years until maturity

- Y50bn worth of JGBs with 25+-Years until maturity

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.50% 21 Jun ‘31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:

- Average Yield: 1.3348% (prev. 1.0895%)

- High Yield: 1.3375% (prev. 1.0900%)

- Bid/Cover: 4.3550x (prev. 3.5938x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 18.7% (prev. 70.0%)

- Bidders 45 (prev. 45), successful 23 (prev. 14), allocated in full 12 (prev. 5)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 28 September it plans to sell A$100mn of the 2.50% 20 September 2030 Indexed Bond.

- On Wednesday 29 September it plans to sell A$1.0bn of the 1.00% 21 November 2031 Bond.

- On Thursday 30 September it plans to sell A$1.0bn of the 26 November 2021 Note & A$1.0bn of the 25 March 2022 Note.

- On Friday 1 October it plans to sell A$1.0bn of the 2.75% 21 November 2028 Bond.

EQUITIES: Nikkei 225 Outperforms In Asia

Asia-Pac trade saw e-minis move away from best levels as BBG headlines pointed to a lack of coupon payment on a US$-denominated bond issued by China Evergrande, but the contracts have recovered from worst levels of the day to trade little changed. A reminder that the coupon payment was due yesterday, but there is a 30-day grace period before a default is triggered. There are also reports/chatter of the company's electric vehicle arm failing to pay salaries to some of its employees, in addition to a failure when it came to the timely payment covering factory equipment. There is an air of confusion re: the ultimate end game when it comes to Evergrande, although worries about contagion have receded.

- The Nikkei 225 managed to benefit from the uptick in USD/JPY evident over the last 24 hours, while playing catch up to 2 days of gains on Wall St after Thursday's Tokyo holiday.

- Elsewhere, performance was a little more mixed, with the remaining major regional indices lacking any sustained deviation from unchanged levels.

OIL: Oil On Track For Another Weekly Gain

The broader DXY consolidated Thursday's losses during Asia-Pac trade, while mixed equity market performance did little for crude futures over the session. This left WTI & Brent futures just a handful of cents higher on the day after the benchmarks added a little over $1.00 apiece come yesterday's settlement. Oil is on track to lodge a fifth consecutive weekly gain, supported by a tightening supply-demand backdrop, which has intensified on the back of the well-documented northern hemisphere gas shortage.

GOLD: Away From Thursday's Lows

Bullion has ticked away from Thursday's lows during Asia-Pac dealing to last deal $10/oz or so better off, just above $1,750/oz. This comes after the move higher in our weighted U.S. real yield monitor applied pressure on Thursday, with a softer USD providing little notable counter. Thursday's move saw a breach of Monday's low ($1,742.5/oz), before bottoming out at $1,738.0/oz. Bears now look to the 76.4% retracement of the Aug 9-Sep 3 rally ($1,724.5/oz). A plethora of Fedspeak headlines the broader docket on Friday.

FOREX: Evergrande Jitters Dampen Risk Recovery

Some degree of broader optimism carried over into the Asia-Pac session but dissipated amid lingering uncertainty surrounding the Evergrande situation. Bloomberg reported that three holders of the developer's dollar bond with a coupon that was due Thursday had not received their payments as of Friday morning.

- This amounted to a mixed picture for G10 FX space, with AUD still narrowly outperforming despite giving away almost all of its initial gains, which allowed AUD/USD to retest yesterday's high.

- NOK and CAD sit at the bottom of the G10 pile, even as crude oil prices are little changed, with major crosses generally holding narrow ranges.

- German IFO Survey, U.S. new home sales will take focus later in the day. Central bank speaker slate is quite tightly packed and features no less than six Fed members in addition to policymakers from ECB, BoE & Norges Bank.

FOREX OPTIONS: Expiries for Sep24 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1650(E664mln), $1.1675(E663mln), $1.1700(E1.3bln), $1.1765-85(E879mln)

- AUD/USD: $0.7275(A$685mln)

- USD/CAD: C$1.2585-00($1.2bln), C$1.2620-40($1.0bln), C$1.2650-55($1.2bln), C$1.2680-00($1.3bln), C$1.2800($1.6bln)

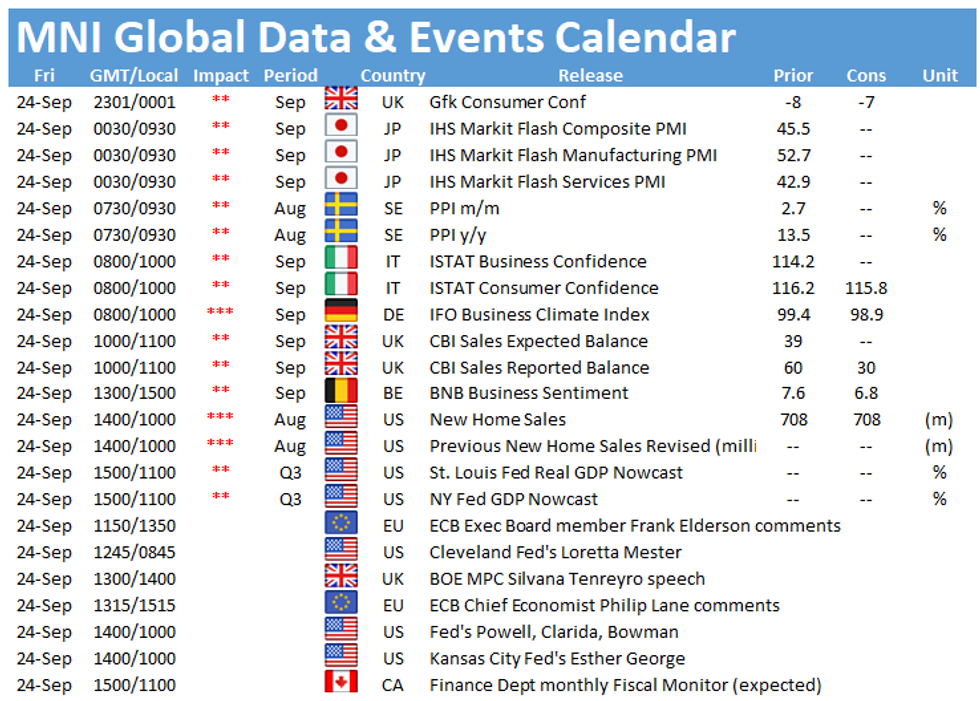

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.