-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Test RBA Resolve In Wake Of CPI Data

EXECUTIVE SUMMARY

- CHINA UNHAPPY WITH U.S. WORDS RE: TAIWAN

- UNDERLYING AUSSIE CPI BACK IN RBA'S TARGET BAND FOR FIRST TIME '15, TRADERS TEST RBA YCT

- DEM FISCAL DEAL STILL NOT OVER THE LINE IN DC

- ALPHABET AND MICROSOFT SMASH ESTIMATES WITH $110BN REVENUE HAUL (FT)

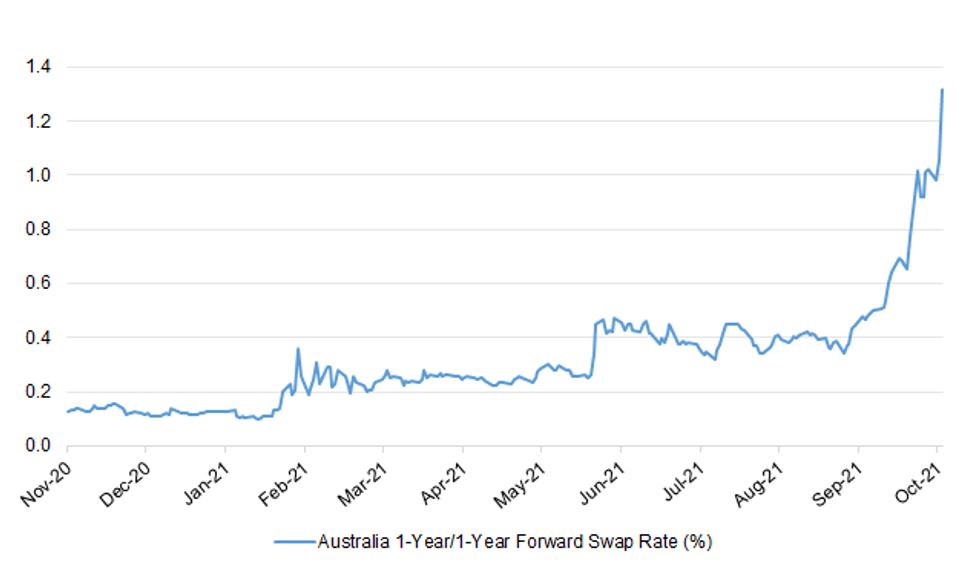

Fig. 1: Australia 1-Year/1-Year Forward Swap Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: Ministers will not make a decision on Covid-19 restrictions for two weeks until the impact of half-term on infections can be seen, The Independent understands. The measures under consideration include restricting household mixing indoors this winter, as data modelling suggests that working from home and mandatory mask wearing might not be enough to avoid an increase in hospital admissions. (Independent)

FISCAL: Rishi Sunak, chancellor of the exchequer, will on Wednesday claim that he has successfully steered the economy through the Covid-19 crisis, in a Budget combining a new commitment to fiscal discipline with extra spending on key public services and measures to tackle the cost-of-living crisis. Sunak will brandish new official forecasts showing that the economy has grown faster than expected this year and that long-term Covid "scarring" of the economy will be less severe than feared, giving him vital fiscal room for manoeuvre. The upgraded forecasts will allow the chancellor, in his third Budget, to trumpet investment in priorities including the NHS, local transport and support for "left behind" areas, while also helping families facing a winter of rising bills and energy costs, according to government insiders. (FT)

FISCAL: Rishi Sunak will introduce a business rates exemption for green property improvements including solar panels and heat pumps in an effort to encourage investment in making buildings energy efficient, The Times understands. Treasury officials have told businesses to expect the chancellor to announce new rates relief for investments in plant and machinery that make shops, offices and warehouses greener in today's budget. The exemption will include investments in features that improve working environments such as ventilation, according to briefed sources. The move could save businesses tens of millions of pounds if they invest to build or refurbish in an environmentally friendly way, analysis by Colliers, the property consultancy, found. (The Times)

BREXIT: MNI: EU Said Heading For Compromise On UK Euro Clearing

- The EU seems to be heading towards a solution for its dispute with London-based clearing houses and banks that would allow for an extension of an equivalence agreement as it seeks a balanced share of euro-denominated clearing between UK and eurozone centres, EU officials and industry sources told MNI - on MNI MainWire and email now, for more details please contact sales@marketnews.com.

EUROPE

ITALY: Italy plans to negotiate with the European Commission a "long extension" of the deadline to cut Rome's 64% stake in ailing bank Monte dei Paschi di Siena (MPS), a source close to the matter told Reuters. The extension to be requested by the Treasury to Brussels will amount to "years," the source said, without elaborating. (RTRS)

BELGIUM: Belgium will extend the use of a Covid pass (a proof of vaccination, recovery or negative test) to restrict access to bars, restaurants and fitness clubs in the northern Flemish region starting next week. The Brussels capital region and southern Wallonia already decided to use the pass in those venues. Prime Minister Alexander De Croo also announced the reinstatement of a mask requirement in indoor public spaces as of Friday, less than a month after abolishing the nationwide rule. Finally, Belgians got a "strong recommendation" to work from home again. Belgium has reported the highest daily number of Covid-19 infections of 2021 in recent days. Cases are currently doubling every nine days. (BBG)

U.S.

FED: President Joe Biden and key advisers have begun to zero in on filling a series of vacancies at the Federal Reserve as Chair Jerome Powell's term winds down amid a push for stricter ethics rules and a more diverse central bank board. Biden has started to meet with top White House and Treasury aides to review candidates, according to two people familiar with the process, even as the White House has been largely consumed with negotiations over the size and contents of the president's multi-trillion-dollar economic agenda. Biden hasn't settled on a choice, and it remains unclear whether he's leaning toward reappointing Powell or replacing him with the favored candidate of liberal Democrats, Fed Governor Lael Brainard -- or a different nominee altogether. Biden has made a point of appointing "firsts" in gender or race for a number of key positions across his administration. (BBG)

FED: Senate Banking Committee Chair Sherrod Brown said that he expects President Joe Biden will release a combination of nominations to the board of the Federal Reserve at the time he unveils his decision on the central bank chair, which may or may not be Jerome Powell. "I think the president -- I don't speak for him of course -- but is probably waiting, and going to put a whole slate forward" of up to four Fed board picks, Brown, an Ohio Democrat, said in an interview Tuesday on Bloomberg Television's "Balance of Power With David Westin." He said he has talked with the president about the matter, though couldn't predict what Biden will do. Brown declined to specify whether he wants Fed Chair Powell nominated for a second term, saying it's Biden's decision to make. He reiterated that he thought Powell has done a "reasonably good job" on monetary policy but has "fallen short" on regulating Wall Street and on climate change. (BBG)

FED: Separately Tuesday, Republican Senator Rick Scott of Florida became the first Republican to announce he will oppose a Powell renomination without a major change in policy -- blaming Powell's Fed in part for inflation and for ignoring Scott's advice on winding down its massive bond-buying programs. (BBG)

FISCAL: New details of a Democratic plan to enact a 15% minimum corporate tax on declared income of large corporations were released Tuesday by three senators, Elizabeth Warren, Mass., Angus King, Maine, and Senate Finance Committee Chair Ron Wyden, Ore. The senators will propose the tax be included as a source of revenue to help fund the massive "Build Back Better" bill that Democrats are currently negotiating. (CNBC)

FISCAL: More than $500 billion of an emerging Democratic spending plan is targeted to fight climate change, making it one of the biggest portions of a bill likely to top $1.5 trillion, according to people familiar with the discussions. While details are still being worked out, the framework is expected to include expanded tax credits for renewable power, advanced energy manufacturing and electric vehicles, as well as incentives to support investments in electric transmission, energy storage and sustainable aviation fuel. (BBG)

FISCAL: New proposals would fund social and climate programs by tapping billionaires' unrealized gains and by ensuring that the biggest companies cannot avoid income taxes altogether. Senate Democrats rushed on Tuesday to nail down the details of a groundbreaking tax on billionaires' wealth, part of an elaborate menu of tax increases to finance a significantly scaled-back bill that would strengthen the social safety net and address climate change. For the first time, billionaires would face a tax on the unrealized gains in the value of their liquid assets, such as stocks, bonds and cash, which can grow for years as vast capital stores that can be borrowed off to live virtually income tax-free. (BBG)

FISCAL: Moderate Democratic Senators Kyrsten Sinema and Joe Manchin visited the White House on Tuesday evening to discuss President Joe Biden's social policy and climate change agenda. A source familiar with the matter said Sinema was at the presidential mansion for talks, and journalists spotted Manchin coming out of an Oval Office meeting with Biden. (RTRS)

FISCAL: Sen. Joe Manchin (D-W.Va.) is telling colleagues he has deep concerns about a proposed "billionaire tax" but is waiting for more details before making a final decision, people familiar with the matter tell Axios' Hans Nichols. The senator's doubts reveal an uncomfortable truth for the White House and congressional leaders as they race to finish — and pay for — their nearly $2 trillion social spending and climate package: A tax solution designed to satisfy Sen. Kyrsten Sinema (D-Ariz.) isn't necessarily acceptable to Manchin. (Axios)

FISCAL: Top congressional Democrats had been forecasting that a deal on the larger package would be enough to get progressives on board with a vote on the bipartisan measure this week before key highway funding runs out on October 31. But Congressional Progressive Caucus Chair Pramila Jayapal squashed those hopes Tuesday afternoon. "There are some people who just want us to vote (the infrastructure bill) out on a framework," the Washington state Democrat said. "And I explained why our members don't want to do that." Jayapal cautioned against drawing red lines on whether any particular provision being stripped out would change her opinion of the overall package, and said lawmakers need to wait for the package to be done. (CNN)

CORONAVIRUS: A key Food and Drug Administration advisory committee on Tuesday recommended a lower dose of Pfizer and BioNTech's Covid-19 vaccine for children ages 5 to 11, a critical step in getting some 28 million more kids in the U.S. protected against the virus as the delta variant spreads. The endorsement by the agency's Vaccines and Related Biological Products Advisory Committee will now be considered by the FDA, which could issue a final decision within days. The vote was nearly unanimous with 17 backing it and one abstention. (CNBC)

EQUITIES: Alphabet, Google's parent company, and Microsoft both posted strong revenue growth in the third quarter, while Twitter swung to a loss, as the three tech companies released results late on Tuesday. (FT)

OTHER

GLOBAL TRADE: The Biden administration is hopeful new fines imposed on carriers at the nation's busiest port complex will abate the intensifying logjam of cargo ships. The twin ports of Los Angeles and Long Beach announced Monday that containers moved by trucks will have nine days before fines start accruing and containers scheduled to move by rail will have three days. In accordance with these deadlines, carriers will be charged $100 for each lingering container per day starting Nov. 1. (CNBC)

GLOBAL TRADE: Mexico plans to seek the arbitration of a panel of experts to resolve a simmering dispute with the United States over the interpretation of rules of origin in the automotive industry, three people familiar with the matter said on Tuesday. (RTRS)

U.S./CHINA/TAIWAN: A Chinese state-owned newspaper has accused the U.S. of opening a "new offensive" on Taiwan, as the world's two largest economies continue to clash over the self-ruled island. Secretary of State Antony Blinken's call for other countries to join the U.S. in pushing to give Taiwan a greater role at the United Nations marked an upgrade in Washington's policy, the Global Times newspaper said in an editorial Wednesday. (BBG)

EU/CHINA/TAIWAN: In a move sure to provoke Beijing, a delegation from the European Parliament will travel to Taiwan next week, as lawmakers push for closer ties with Taipei. The small party plans to travel early next week, according to multiple sources familiar with the schedule, taking high-level meetings with senior Taiwanese government officials. Leading the delegation will be Raphael Glucksmann, a French MEP and outspoken critic of China who was sanctioned by Beijing in March in a dramatic tit-for-tat escalation in bilateral tensions. (SCMP)

JAPAN: The latest projections based on large-sample opinion polls ahead of Sunday's general election suggest that Japan's ruling Liberal Democratic Party will retain a majority in the powerful lower house despite losing some seats.

- Kyodo News conducted a survey from Sunday through Tuesday, which showed that the LDP may lose some seats in the House of Representatives, but should retain a comfortable majority ("absolute stable majority" of 261 seats) together with its coalition partner Komeito. Kyodo noted that the LDP leads in around 200 single-member districts and faces "stiff competition" in 70 or so. In party-list vote, the ruling party was projected to win close to the 66 seats it held before. As many as 40% of respondents said they were undecided.

- Earlier on Tuesday, the Asahi Shimbun published a projection based on their weekend survey. The LDP was forecast to maintain a single-party majority in the lower house, despite losing some seats. The survey showed that the LDP could win between 251 and 279 seats, which indicates a likely reduction from the current 276. The Asahi noted that 40% of respondents did not indicate their preference for single-seat candidates, while 30% did not pick their preferred party in the proportional representation component. (MNI)

AUSTRALIA: The Therapeutic Goods Administration has provisionally approved a booster dose of the Pfizer Covid-19 vaccine for people 18 and older. The move means those individuals may receive a third dose at least six months after the completion of a Covid-19 vaccine primary series. (BBG)

MEXICO: Mexico's economy likely contracted in the third quarter compared to the previous three months, but growth will pick up in the fourth quarter, central bank board member Jonathan Heath said on Tuesday. "It is still feasible to grow 6% this year, but obviously it is going to be a bit more difficult because of this stagnation," Heath said at a press conference following a book presentation. Services seen picking up in September and October. Poor GDP data in August was temporary. (BBG)

BRAZIL: A Brazilian Senate committee recommended that President Jair Bolsonaro face a series of criminal indictments for actions and omissions related to the world's second highest Covid-19 death toll. It formally approved a report calling for prosecutors to try Bolsonaro on charges ranging from charlatanism and inciting crime to misuse of public funds and crimes against humanity, and in doing so hold him responsible for many of Brazil's more than 600,000 Covid-19 deaths.The president has denied wrongdoing. (CNBC)

IRAN: The United States is alarmed by Iran's actions since leaving talks over its nuclear program, but the White House still believes there is an opportunity to resolve the situation diplomatically, U.S. national security adviser Jake Sullivan said on Tuesday. (RTRS)

MIDDLE EAST: The Saudi-led coalition intercepted and destroyed an explosives-laden drone that attempted to attack Abha International Airport located in the southwestern part of the kingdom, state Al Ekhbariya television said late on Tuesday. (RTRS)

IMF: Almost 200 staff from the International Monetary Fund signed a petition asking Managing Director Kristalina Georgieva to clarify details of actions that led to the softening of a warning about environmental risks to Brazil's economy. The petition, signed by 194 employees of the Washington-based fund, was sent by the IMF's ombudsman to Georgieva's office on Monday, according to an internal fund email seen by Bloomberg News. (BBG)

ENERGY: Allowing Nord Stream 2 to pump Russian gas to Germany will not threaten supplies to the European Union, the German Economy Ministry said on Tuesday, clearing a major hurdle for the disputed pipeline. (RTRS)

ENERGY: Russian state gas company Gazprom has proposed that Moldova adjust its free trade deal with the EU and delay energy market reforms agreed with Brussels in exchange for cheaper gas for the country. The former Soviet republic has declared a state of emergency as it tries to secure enough shipments to make it through a winter gas crunch. Kremlin-controlled Gazprom cut supplies to Moldova by one-third last month following the end of a long-term contract and demanded more than double the previous terms to keep gas flowing. In negotiations this month, Gazprom told Moldovan officials it would reduce the price if the country was prepared to amend its tariff-free trade deal with the EU, said people briefed on the discussions. Gazprom also wanted Moldova to delay the implementation of EU rules that require gas markets to be liberalised and allow more competition, the people said. (FT)

OIL: White House press secretary Jen Psaki said Tuesday that the Biden administration will continue pressuring OPEC members to boost oil production amid a global energy crisis that has pushed gas prices to their highest level in a decade. "The president reserves a range of options, and he is certainly quite mindful of the impact of any increased cost on the American public," Psaki said during her daily press briefing. (FOX Business)

CHINA

POLICY: China should maintain general fiscal and monetary expansion policies to stabilise growth amid a slowing economic recovery, according to an article written by Liu Yuanchun, vice president of Renmin University posted by Toutiao.com. China may have normalized its macroeconomic policies too early as it spent two quarters in the first half of this year focused on growth rates of fiscal spending and credit back to normal levels, said Liu. Meanwhile, investment faces a period of interruption due to a lack of projects and local governments' declining off-budget funds to promote investment given shrinking land sales amid a cooling housing market, Liu added.

YUAN: The Chinese yuan will fluctuate against the dollar based on two factors - a stronger U.S. dollar index limiting appreciation and an uncertain trend for global trade, the China Securities Journal reported citing Zhong Zhengsheng, chief economist of Ping An Securities. The yuan may face depreciation pressures in the mid-term, as China' moves to stabilise the economy and on a possibly narrower growth gap with the U.S. in 2022, the newspaper cited Zhong as saying. But in the long-term, the yuan's mid-level is still supported by the stability of China's economy and strong export competitiveness, the newspaper said citing Zhong.

PROPERTY: Many banks in south China, east China and southwest China received verbal guidance from PBOC branches to ease real estate loan quotas from last week, the Economic Observer reported. But the guidance is seen as moderately fine-tuning as tougher regulations have led to weakening home sales, financing difficulties and debt repayment pressures for developers, the newspaper said citing Xie Yunliang, chief macro analyst at Minsheng Securities. In the future, the proportion of financial resources invested in the real estate sector will decrease accordingly, with more being invested in manufacturing, supporting technological innovation, and rural revitalization, the newspaper said. (MNI)

PROPERTY: Chinese authorities summoned 8 property companies to learn about their foreign debt on Tuesday. The companies reported difficulties faced by the market and hoped that the authorities would release policies to solve the issues. (Global Times)

CORONAVIRUS: With 100 days until the start of the Winter Olympics, Beijing is promising a "simple and safe" 2022 Games - although preparations are anything but simple as China readies to host thousands of athletes and personnel as it battles COVID-19 flare-ups. (RTRS)

ENERGY: China's top economic planner asks key coal producing provinces, including Shanxi, Shaanxi and Inner Mongolia, to check and strengthen oversight of coal storage sites, the National Development and Reform Commission says in a statement. NDRC will harshly crack down on coal hoarding and price manipulation. Illegal coal hoarding in key provinces disrupts market order. (BBG)

OVERNIGHT DATA

CHINA SEP INDUSTRIAL PROFITS +16.3% Y/Y; AUG +10.1%

AUSTRALIA Q3 CPI +3.0% Y/Y; MEDIAN +3.1%; Q2 +3.8%

AUSTRALIA Q3 CPI +0.8% Q/Q; MEDIAN +0.8%; Q2 +0.8%

AUSTRALIA Q3 CPI TRIMMED MEAN +2.1% Y/Y; MEDIAN +1.8%; Q2 +1.6%

AUSTRALIA Q3 CPI TRIMMED MEAN +0.7% Q/Q; MEDIAN +0.5%; Q2 +0.5%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +2.1% Y/Y; MEDIAN +1.9%; Q2 +1.6%

AUSTRALIA Q3 CPI WEIGHTED MEDIAN +0.7% Q/Q; MEDIAN +0.5%; Q2 +0.5%

NEW ZEALAND SEP TRADE BALANCE -NZ$2.171BN; AUG -NZ$2.139BN

NEW ZEALAND SEP TRADE BALANCE 12 MTH YTD -NZ$4.085BN; AUG -NZ$2.937BN

NEW ZEALAND SEP EXPORTS NZ$4.40BN; AUG NZ$4.36BN

NEW ZEALAND SEP IMPORTS NZ$6.57BN; AUG NZ$6.50BN

NEW ZEALAND OCT, F ANZ BUSINESS CONFIDENCE -13.4; FLASH -8.6

NEW ZEALAND OCT, F ANZ ACTIVITY OUTLOOK 21.7; FLASH 26.2

Cost and inflation pressures are off the charts. Inflation expectations jumped almost half a percent to 3.45% due to the strong CPI data. Survey indicators are still fairly robust but cracks are appearing. The resilience of Auckland businesses is impressive but this survey won't capture cumulative balance sheet damage. (ANZ)

SOUTH KOREA OCT CONSUMER CONFIDENCE 106.8; SEP 103.8

UK OCT BRC SHOP PRICE INDEX -0.4% Y/Y; SEP -0.5%

CHINA MARKETS

PBOC INJECTS NET CNY30BN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY200 billion via 7-day reverse repos with the rate unchanged at 2.2% on Wednesday. The operations lead to a net injection of CNY30 billion after offsetting the maturity of CNY100billion reverse repos and CNY70 billion of Treasury's cash deposits at commercial banks today, according to Wind Information.

- The operation aims to offset the impact of tax season and the issuance of government bonds, so to keep month-end liquidity stable, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2616% at 09:28 am local time from the close of 2.2454% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 41 on Tuesday vs 53 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3856 WEDS VS 6.3890

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3856 on Wednesday, compared with the 6.3890 set on Tuesday.

MARKETS

SNAPSHOT: Markets Test RBA Resolve In Wake Of CPI Data

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 102.3 points at 29003.86

- ASX 200 up 3.682 points at 7447.1

- Shanghai Comp. down 32.932 points at 3564.706

- JGB 10-Yr future up 3 ticks at 151.15, yield down 0.3bp at 0.105%

- Aussie 10-Yr future down 2.5 ticks at 98.140, yield up 2.8bp at 1.832%

- U.S. 10-Yr future -0-04+ at 130-15, yield up 1.94bp at 1.627%

- WTI crude down $0.59 at $84.05, Gold down $4.43 at $1788.47

- USD/JPY down 13 pips at Y114.03

- CHINA UNHAPPY WITH U.S. WORDS RE: TAIWAN

- UNDERLYING AUSSIE CPI BACK IN RBA'S TARGET BAND FOR FIRST TIME '15, TRADERS TEST RBA YCT

- DEM FISCAL DEAL STILL NOT OVER THE LINE IN DC

- ALPHABET AND MICROSOFT SMASH ESTIMATES WITH $110BN REVENUE HAUL (FT)

BOND SUMMARY: Underlying Aussie CPI Sees Traders Challenge RBA

Firmer than expected underlying inflation data out of Australia pressured core fixed income markets overnight

- TYZ1 -0-03 as a result, with the cash Tsy space seeing 1.0-2.5bp of weakness across the major benchmarks as the front end leads the way lower. NY hours will be headlined by 5-Year Tsy supply, with prelim. durable goods also due.

- JGB futures have recovered from worst levels, leaving the contract +1. The cash JGB curve flattened, with yields out to 20s ultimately little changed on net, while 30s & 40s run 1.5-2.0bp richer on the day, likely aided by the firming in longer dated U.S. Tsys on Tuesday and indications of continued long end demand from domestic life insurers. Local headline flow remains scarce. 2-Year JGB supply saw the low price narrowly miss broader exp. (which stood at 100.20, per the BBG dealer poll) while the global inflationary uncertainty and a lack of value proposition meant that the cover ratio nudged lower, but still held above 4.00x, just. Corporate supply saw Proctor & Gamble mandate for 5- & 10-Year JPY denominated bond issuance.

- Aussie bond futures struggled in the wake of the domestic Q3 CPI dataset. The headline readings were virtually in line with broader exp. at 3.0% Y/Y & 0.8% Q/Q, but the jump in the trimmed mean print, to 2.1% Y/Y, puts the RBA's preferred underlying measure back above the lower boundary of its 2-3% target band for the first time since Q415. A reminder that the RBA has noted that it will need to see realised inflation sustainably within its 2-3% target band before moving interest rates, and its sanguine view on medium term inflation and wage growth mean that the Bank isn't likely to shift its central opinion on the back of 1 CPI reading (although it may note heightened risks to its central view at next week's monetary policy decision). Still, the market is keen to test the RBA's resolve given the beat in the underlying print, leaving YM -16.0 and XM -2.5 at typing. For reference, ACGB Apr-24, the bond targeted by the Bank's YCT mechanism, last yields 0.205%. Focus will now move to whether the RBA chooses to step in to enforce YCT on Thursday.

JGBS AUCTION: Japanese MOF sells Y2.5174tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.5174tn 2-Year JGBs:

- Average Yield: -0.097% (prev. -0.115%)

- Average Price: 100.205 (prev. 100.242)

- High Yield: -0.092% (prev. -0.114%)

- Low Price: 100.195 (prev. 100.240)

- % Allotted At High Yield: 40.0564% (prev. 77.0964%)

- Bid/Cover: 4.038x (prev. 4.244x)

EQUITIES: Flat To Lower In Asia

The major regional equity benchmarks traded little changed to lower during Wednesday's Asia-Pac session.

- Chinese & Hong Kong equities have led the way lower, with Sino-U.S. tensions surrounding China Telecom not doing Chinese equities any favours. On the flow front, Hong Kong-China Stock northbound connect flows sit in negative net territory, but the scale of the net selling isn't sizeable.

- Evergrande woes also weighed on broader sentiment, after state-owned media outlets noted that policymakers have suggested that the Evergrande's Chairman should use his personal wealth to alleviate some of the company's debt burden, reducing the odds of an overt state-backed bailout.

- U.S. e-minis operate around unchanged levels, with the space digesting after hours earnings, which were headlined by tech giants Alphabet & Microsoft.

OIL: API Inventory Estimates Apply Modest Pressure Overnight

Reports of a slightly larger than expected uptick in the headline crude inventory estimate in the latest API release, coupled with surprise builds in both gasoline and distillate stocks, weighed on crude futures after settlement, even as stocks at the Cushing hub experienced a drawdown.

- That dynamic, coupled with weakness in Chinese equities, leaves WTI ~$0.50 lower on the day, with Brent sitting ~$0.40 worse off. The bulk of Tuesday's gains have been unwound in the process.

- DoE inventory data headlines on Wednesday.

GOLD: Oscillating

The DXY's recovery from intraday lows applied pressure to gold on Tuesday, allowing spot to extend its foray back below $1,800/oz, even as our weighted U.S. real yield monitor moved south. The modest uptick in U.S. Tsy yields during Wednesday's Asia session kept the pressure on bullion, with spot last dealing a handful of dollars lower on the day, just below $1,790/oz, although the metric has failed to threaten yesterday's low. Resistance is noted at the Oct 22 high ($1,813.8/oz). The 50-day EMA now provides the initial zone of support, followed by the Oct 18 low ($1,760.4/oz). Key support is located below there, coming in at the Oct 6 low ($1,746.0/oz).

FOREX: AUD Goes Bid After Core CPI Beat, Defies Broader Defensive Flows

The AUD caught a bid following the release of Australia's CPI data for the third quarter. Although headline figures fell virtually in line with expectations, the trimmed mean print beat consensus estimate and jumped to +2.1% Y/Y from +1.6%, putting the RBA's preferred underlying measure back above the lower boundary of its 2-3% target range for the first time since 2015.

- AUD/NZD gained for the third day in a row, as the kiwi landed at the bottom of the G10 pile. The Antipodean divergence was reflected AU/NZ 2-Year swap spread, which bounced off cycle lows.

- NZD weakness may have been linked to softer commodity prices, oil-tied CAD and NOK also struggled.

- The yen reversed its initial losses as risk sentiment soured amid signs of bubbling Sino-U.S. tensions.

- The BoC will deliver their monetary policy today. The global data docket features flash U.S. durable goods orders.

FOREX OPTIONS: Expiries for Oct27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1490-00(E834mln), $1.1600-15(E2.2bln), $1.1685-00(E1.2bln)

- USD/JPY: Y113.50-60($2.0bln), Y114.45-50($905mln)

- EUR/GBP: Gbp0.8515-25(E701mln)

- AUD/USD: $0.7400($1.3bln), $0.7500(A$697mln), $0.7530(A$606mln)

- USD/CNY: Cny6.4000($543mln)

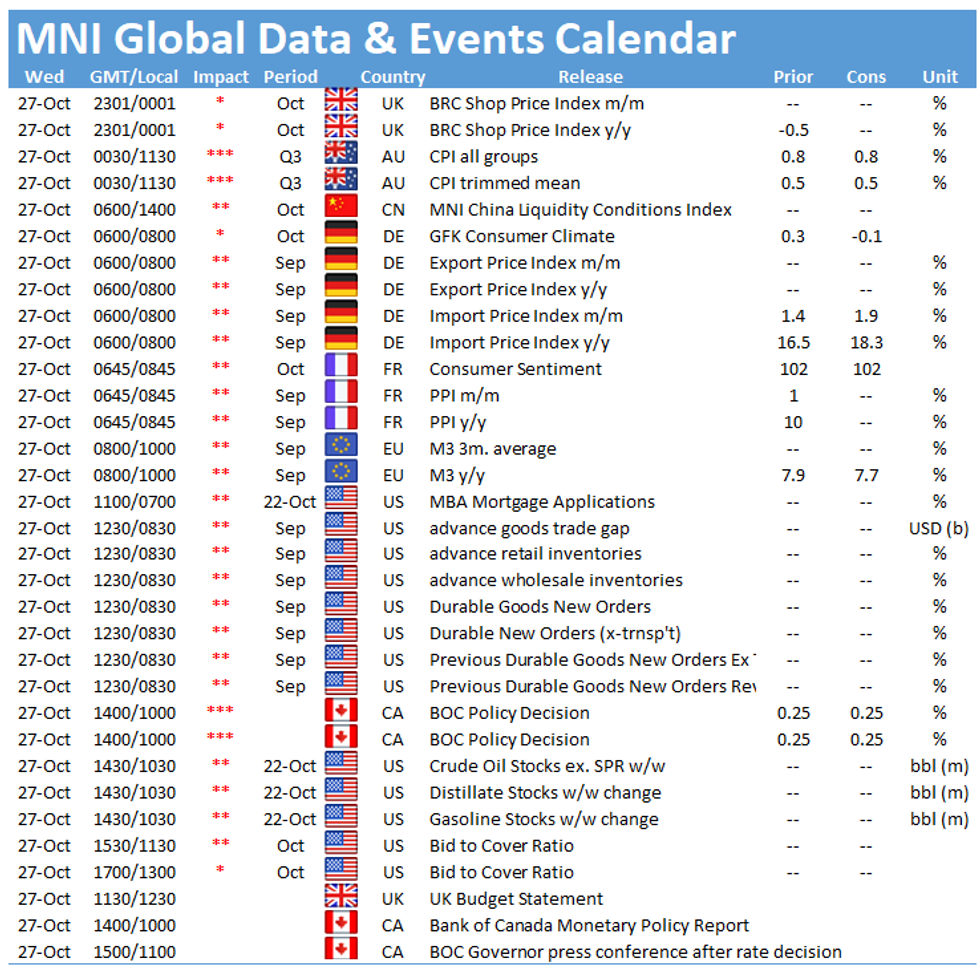

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.