-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Potential Of Faster Taper Pushes USD/JPY Above Y115.00, Pressures TY Futures

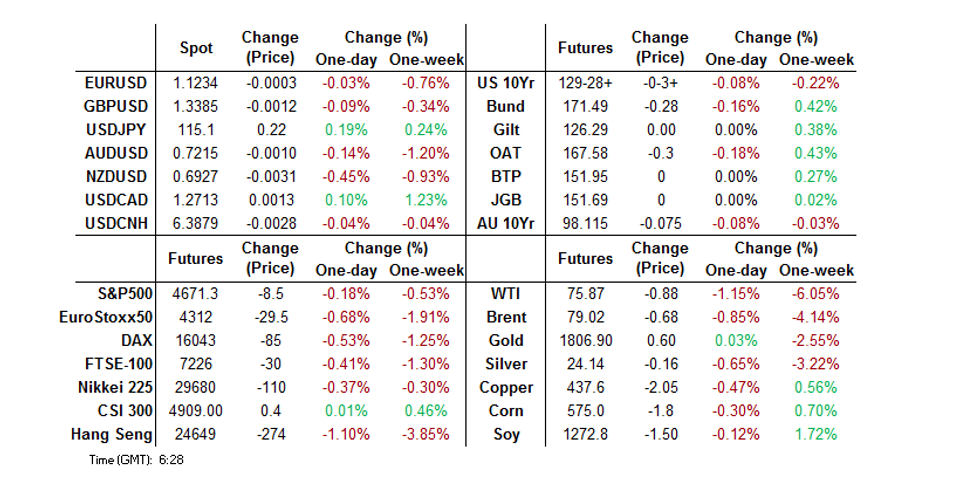

- Atlanta Fed President Bostic ('21 FOMC voter) became the latest Fed official to point to the potential for a faster tapering process, which pushed TYZ1 futures through key support & allowed USD/JPY to top Y115.00 for the first time since '17.

- Look to the re-open of U.S. cash Tsys for London trade to provide a potential catalyst for wider price action, in the wake of an Asia-Pac session session that was thinned out by a Japanese holiday

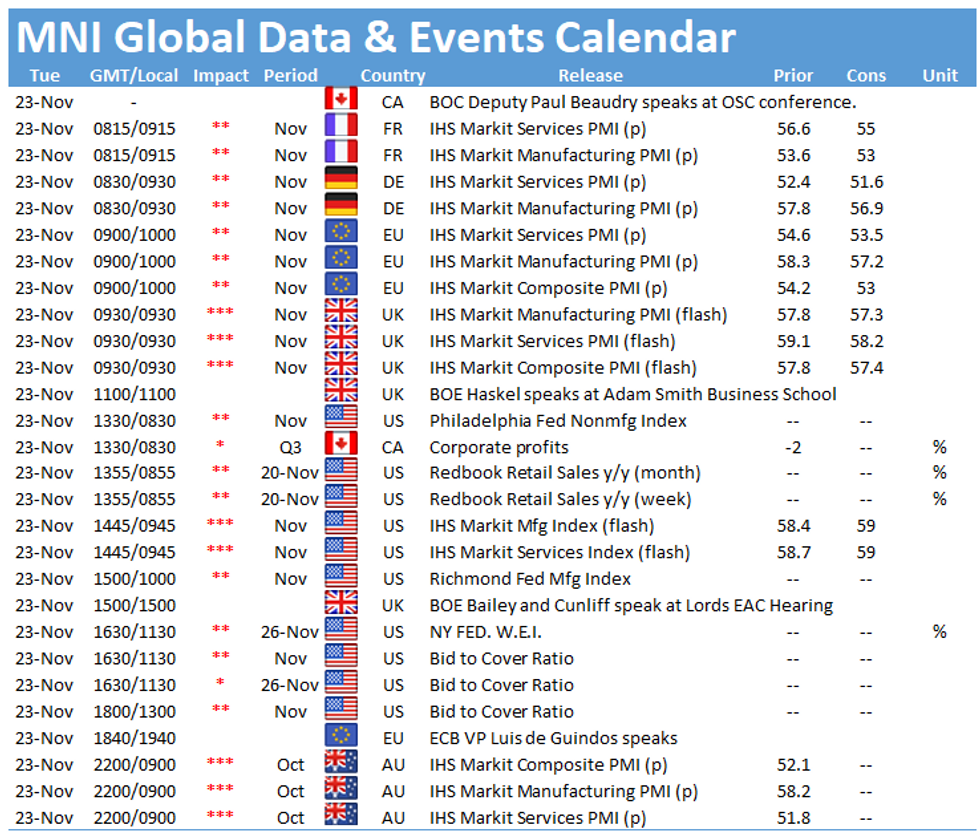

- Flash PMI data, in addition to central bank speak from the ECB, BoE & BoC, headlines the broader docket on Tuesday.

BOND SUMMARY: TYZ1 Through Tech Support As Bostic Flags Potential For Quicker Taper

Comments from Atlanta Fed President Bostic ('21 FOMC voter) hit during the NY-Asia crossover. Bostic pointed to the potential for a faster tapering process (the latest Fed official to sing from that hymn sheet), which he noted would afford the central bank wider optionality. Still, Bostic flagged that further progress on the labour market front would add to the case for a faster taper, while highlighting the lingering risks stemming from COVID. Bostic's comments seemingly applied some delayed pressure to Tsy futures, although the lack of cash Tsy trade until London hours, owing to a Japanese holiday, may have limited broader activity/the scope of the move. TYZ1 last -0-04+ at 129-27+, 0-02 off the lower boundary of its 0-07 overnight range, with the pressure pushing the contract through the bear trigger (Oct 21 low of 129-31), which allows bears to switch focus to the 50% retracement of the Oct '18 to Mar '20 bull cycle (129-03). Broader macro headline flow was light at best. Flash PMIs from across the globe will headline ahead of NY hours, while the Thanksgiving-related front-loaded supply will continue, with 7-Year Tsy & 2-Year FRN supply due.

- JGBs were closed as Japan observed a national holiday.

- The dip in U.S. Tsy futures failed to provide any notable pressure to the Aussie bond space, with bears unable to force a retest of the early Sydney lows which came on the back of local reaction to the U.S. Tsy-driven overnight session weakness. YM closed -5.0, while XM closed -7.5. The 7- to 12-Year zone of the cash ACGB curve presented the weak point. There hasn't been anything in the way of notable idiosyncratic news flow to digest today.

FOREX: USD/JPY Pierces Y115.00 Amid Holiday-Thinned Liquidity, Iron Ore Rally Aids AUD

The break lower in U.S. Tsy futures lent some further support to the USD, which coincided with a leg higher in USD/JPY. The pair pierced the Y115.00 figure for the first time since '17 as a result. Many have been linking these moves to the comments from Atlanta Fed Pres Bostic, who became the latest Fed member to flag the potential for a quicker pace of tapering. Worth mentioning that Japanese markets were closed in observance of a public holiday, which means that JPY crosses were subject to thinner liquidity.

- NZD/USD retreated to a fresh multi-week low, as the kiwi dollar showed some broad-based weakness, even as the contraction in New Zealand's retail sales was shallower than expected. The proximity of the RBNZ's monetary policy decision likely played a role here, as participants prepared for tomorrow's announcement. NZD/USD overnight implied volatility leapt to its highest point since Oct 5.

- AUD/USD recouped a dip driven by aforementioned greenback strength, as a surge in iron ore futures, which were aided by optimism surrounding Chinese demand. Antipodean divergence continued to unfold and AUD/NZD advanced towards its 50-DMA.

- Today's yuan fixing was softer than expected, with the central USD/CNY mid-point set 25 pips above sell-side estimate. Offshore yuan was unfazed and traded on a slightly firmer footing.

- A flurry of PMI readings from across the globe headline today's data docket. Speeches are due from BoE's Bailey, Cunliffe & Haskel, ECB's Makhlouf & de Guindos as well as BoC's Beaudry.

FOREX OPTIONS: Expiries for Nov23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1220(E767mln), $1.1340-55(E914mln), $1.1595-00(E1.7bln)

- USD/JPY: Y114.20($840mln)

- AUD/USD: $0.7310-25(A$622mln), $0.7350-60(A$651mln)

ASIA FX: All Eyes On Fed As Most USD/Asia Crosses Advance; Yuan Shows Resilience

The renomination of Jerome Powell as Fed Chair provided the initial impulse supporting USD/Asia crosses in early trade, with some pointing to comments from Atlanta Fed Pres Bostic, who advocated a quicker pace of tapering.

- CNH: Offshore yuan defied the PBOC's back-to-back softer-than-expected yuan fixings. The central USD/CNY mid-point was set at CNY6.3929 today, 25 pips above sell-side estimate. USD/CNH was biased lower but held a familiar range.

- KRW: The won helped bring up the read in Asia EM basket, owing to its characteristic exposure to moves in U.S. Tsy yields. Spot USD/KRW trimmed gains as South Korea's consumer sentiment continued to improve, while FinMin Hong flagged potential for fresh economic relief measures.

- IDR: Spot USD/IDR crept higher as the local headline flow remained rather thin. Fitch yesterday affirmed Indonesia's credit rating at BBB, keeping the outlook at stable.

- MYR: Spot USD/MYR climbed to its highest point since Sep 30, driven solely by broader market impetus.

- THB: The 100-DMA gave way to spot USD/THB. Worth noting that official data showed yesterday that Thailand's unemployment rate jumped to 2.25% in Q3, the highest level since 2005.

- PHP: Spot USD/PHP consolidated above its 50-DMA after breaking above that moving average on Monday.

EQUITIES: Mixed Fortunes

E-minis stabilised overnight after the impulse from higher U.S. real rates pressured the space into the close on Monday. The Hang Seng was the biggest mover, shedding ~1%, as fallout from Monday's tech-led weakness in the U.S. equity space, coupled with the potential for greater tax burdens for Chinese online platforms (per comments from state-owned media outlets), weighed on the tech space. The ASX 200 benefitted from strength in energy and material names, with M&A activity surrounding BHP Billiton & Woodside supporting the former, while a rebound in iron ore prices (on hopes for looser restrictions and support for the Chinese property sector) supported the latter. Japanese markets were closed as Japan observed a national holiday.

GOLD: Biden's Powell Pick Applies Pressure

A narrow Asia-Pac session for spot gold sees the benchmark trade a handful of dollars higher on the day, last printing just above $1,805/oz. To recap, Monday saw U.S. President Biden offer Fed Chair Powell the chance to serve a second term atop the central bank, triggering broader USD strength and a rally for our weighted U.S. real yield monitor, which weighed on gold (note that Powell was deemed the more hawkish when compared to his main challenger, Lael Brainard). Spot gold threatened to test $1,800/oz on Monday, but never quite got there. After moving through near-term support levels, a break through yesterday's low ($1,802.4/oz) would expose key support in the form of the Nov 3 low ($1,759.0/oz). Bulls need to reclaim yesterday's high ($1,849.1/oz) to regain some control.

OIL: A Little Softer In Asia

WTI & Brent crude futures sit ~$0.50 below their respective settlement levels, with the spectre of a multilateral inventory release from some of the major oil consuming nations, led by the U.S., weighing overnight (note that BBG has suggested that a formal announcement of such a move could come as soon as today). Monday saw the space make incremental gains, aided by a BBG sources piece, which cited OPEC+ delegates, who "warned they're likely to respond to plans by the world's largest oil consumers to release oil from their strategic stockpiles." Further afield, the weekly API inventory estimate will provide interest after hours on Tuesday.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.