-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Markets Meander In Final Asia-Pac Session Of Year

- The Hang Seng outperformed in limited Asia hours, with some spill over from Thursday trade in Chinese ADRs noted.

- Core FI & FX markets were tight.

- Low liquidity conditions in place ahead of new year.

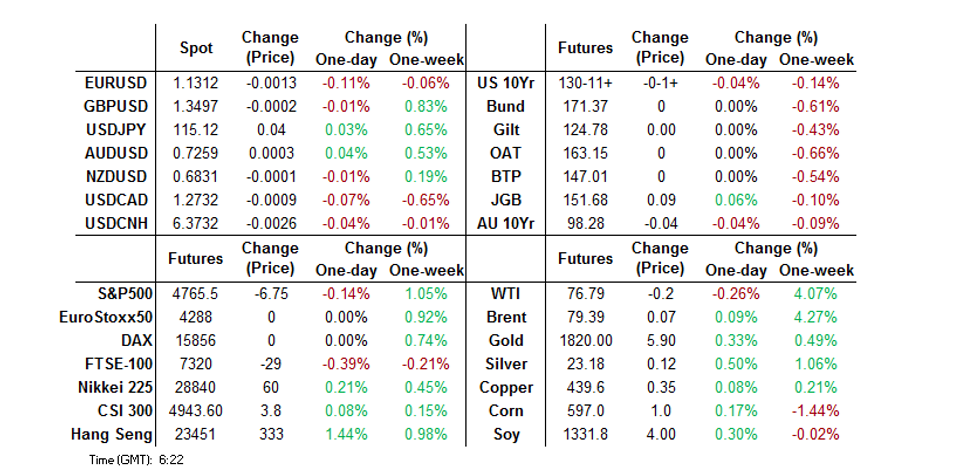

BONDS: Tight In Limited Asia Trade

TYH2 stuck to a narrow 0-04 range overnight. The contract last deals -0-01 at 130-12, just off lows, with nothing in the way of notable headline flow observed since the Asia open, outside of slightly firmer than expected official PMI data out of China. T-Notes looked through a brief & modest extension of the late NY downtick in e-minis, and the apparent lack of progress noted come the end of the Biden-Putin call. Cash Tsys are closed until the London open owing to a Tokyo holiday, with U.S. hours curtailed by the impending turn of the calendar year.

- Aussie bond futures moved lower into the bell. It was hard to ascertain an overt driver for the move, with official PMI data out of China only providing a modest beat. Perhaps some long liquidations in thin markets may have applied the weight. YM -3.0 and XM -4.0 come the bell, with the long end of the cash ACGB curve cheapening by ~5bp. Bills finished unch. to 3 ticks lower through the reds. A reminder that Australian fixed income futures will be closed on Monday.

FOREX: Coiling Into Year End

The major USD crosses operate within 10 pips of their respective closing levels owing to a lack of notable headline flow and relatively widespread market closures/shortened trading sessions in Asia ahead of the turn of the calendar year. Official Chinese PMI data failed to provide any meaningful impetus for markets.

EQUITIES: Hang Seng Outperforms, Still Comfortably Lower In ‘21

Thursday’s rally in Chinese ADRs spilled into Asia-Pac trade, supporting the Hang Seng Tech sector (although the NASDAQ Golden Dragon China index is still over 40% lower on a YtD basis), with the Hang Seng adding over 1% come the end of a curtailed trading session. The space was no doubt aided by comments from the CSRC Chair, made late Thursday, as he noted that the regulator will take measures to smooth capital market operations, to prevent major swings, while introducing more pro-growth policies to stabilise expectations. Still, the Hang Seng shed ~14% in ’21, with most of those losses coming on the back of the well-documented regulatory crackdowns in China & property sector woes.

- The remaining major regional equity indices traded in a limited fashion. The session was hampered by lower liquidity with early closes in the ASX 200 & Hang Seng in play, while Japan’s 4-day weekend got underway.

- Thursday’s late downtick in e-minis extended in early Asia-Pac trade, with a lack of headline flow evident as some pointed to the usual year-end profit taking in thin markets after a bumper year for U.S. equities. E-minis subsequently recovered from worst levels with the 3 major contracts sitting ~0.2% below settlement levels at typing.

GOLD: Gold Deals In Familiar Territory Into Year End

Gold has consolidated Thursday’s uptick, last dealing little changed around the $1,815/oz mark, after bullion drew support from a pull lower in U.S. real yields during the final full U.S. trading session of the year. Well-defined technical parameters remain in play. Spot gold is one course to lodge a ~4% loss for calendar ’21 (based on current spot levels).

OIL: Crude Futures Nudge Lower, On Track For Largest Annual Gain Since ‘09

WTI & Brent crude futures sit ~$0.35 below their respective settlement levels, pulled lower by a downtick in U.S. e-minis in a low liquidity, limited Asia-Pac session. Note that WTI is on course to register a ~$28 gain for calendar ’21, which would be the largest annual gain recorded since ’09, while Brent is on course to add ~$27 over the same period (note that these are rounded figures based on prevailing market levels). A reminder that ’21’s gains were fuelled by the COVID vaccination rollout and subsequent reopening drives, which have supported demand, alongside the well-documented inflationary impulse. OPEC+ has carefully managed the incremental release of additional supply to the market, which has also aided the rally. The group is set to meet next week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.