-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Time To Assess The De-escalation

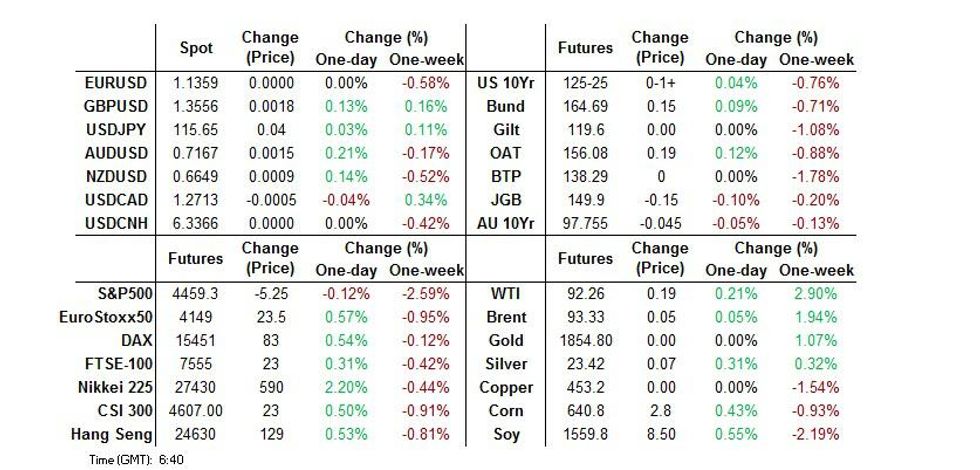

- Asia-Pac equities played catch up to Tuesday's apparent de-escalation in Russia-Ukraine tension, although a notable degree of Western skepticism re: the matter kept a lid on e-minis overnight.

- Inflation data from the UK and Canada will be published today, while other data highlights include U.S. retail sales & industrial output as well as Norwegian GDP. On the central bank front, the Fed will publish the minutes from their most recent monetary policy meeting. In addition, comments are due from Fed's Kashkari, BoC's Lane & RBA's Bullock/Debelle.

BOND SUMMARY: Mixed Performance For Core FI In Asia

U.S. Tsys have experienced some marginal richening in Asia dealing, with regional participants willing to buy Tuesday’s dip. Outright yield levels, questions re: the potential for further short-term hawkish Fed re-pricing, downside misses in the latest round of Chinese inflation data and questions in the West re: the apparent de-escalation in the Russia-Ukraine standoff (punctuated by U.S. President Biden’s continued alert re: the potential for a Russian invasion of Ukraine) are likely fostering the bid. Cash Tsys run 0.5-2.0bp richer across the curve, back from best levels, with the front end leading, facilitating some bull steepening. TYH2 prints +0-03+ at 125-26+, 0-03+ back from the peak of a 0-07+ range. TY block buys (+3,431/-3,431) and a block seller of the TYJ2 126.00/125.50 put spread (-20K), which looked like a rolldown of strikes, headlined on the flow side overnight. Looking ahead, NY hours will see the release of U.S. retail sales & industrial production data, as well as 20-Year Tsy supply. We will also get the minutes from the most recent FOMC meeting, in addition to Fedspeak from Kashkari (’23 voter, dove).

- JGB futures consolidated overnight losses during Tokyo trade, hitting the bell -15, sticking within a tight range. Cash JGBs are flat to ~3.5bp cheaper, steepening, with 30s providing the weak point on the curve. The early steepening extended on the back of a jump in the offer/cover ratio witnessed in the latest round of 25+-Year BoJ Rinban operations. 10s were little changed on the day, with participants seemingly unwilling to chase yields higher given the BoJ’s recent pre-emptive action to enforce the top end of its permitted 10-Year JGB yield trading band. Comments from BoJ Kuroda didn’t include any fresh points of note, with the same holding true when it comes to comments made by Japanese Finance Minister Suzuki.

- The impulse from U.S. Tsys provided a light bid for the Aussie bond space, with futures moving away from early Sydney lows, after bears failed to force a test of overnight troughs. YM -1.0 & XM -4.5 as a result, paring some of the overnight losses. Cash ACGB trade saw a fairly parallel shift in the 10+-Year zone, as the curve bear steepened. In local news, Australian Treasury Secretary Kennedy (who also sits on the RBA board) noted that fiscal stimulus should be tapered (a trend that is already in place) in order to facilitate the start of the monetary policy normalisation process. Kennedy did caution that premature tightening could prevent Australia from reaching full employment, while reaffirming the broader uncertainty when it comes to the required level of unemployment that would facilitate notable wage growth. The undertones of Kennedy’s remarks re: unemployment & the labour market were seemingly in line with wider RBA-think i.e. unemp. can (and needs) to be pushed lower.

JGBS: Implied Vol. Pares Back In Wake Of BoJ YCC Enforcement

Note that the BoJ’s pre-emptive enforcement of the top of its permitted 10-Year JGB yield trading band (0.25%) has facilitated a downtick in implied volatility in the JGB space, as measured via the Japan Exchange’s metric. The latest uptick in implied vol. got nowhere near the peaks witnessed in recent times, with the Mar ’20 COVID outbreak-related vol. of course providing the most extreme scenario in recent years.

Fig. 1: Japan Exchange JGB Implied Volatility Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: The AOFM sells A$1.0bn of the 4.50% 21 Apr ‘33 Bond, issue #TB140:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 4.50% 21 April 2033 Bond, issue #TB140:

- Average Yield: 2.2592% (prev. 1.7480%)

- High Yield: 2.2600% (prev. 1.7500%)

- Bid/Cover: 3.1090x (prev. 2.7550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 95.5% (prev. 59.2%)

- Bidders 45 (prev. 38), successful 18 (prev. 20), allocated in full 9 (prev. 10)

FOREX: Moderation In Russia Worry Saps Volatility

Market sentiment improved at the margin as latest headlines surrounding the Russia-Ukraine standoff raised hopes about potential de-escalation. Moscow's announcement of a partial withdrawal of troops from the Ukrainian border has met with initial scepticism of both Kyiv and NATO, as they await credible evidence of the promised pullback. Still, Russia's pro-diplomacy rhetoric has taken the edge off earlier geopolitical angst.

- Antipodean currencies eked out some gains, while the yen slipped in muted Asia-Pac trade. GBP led gains in G10 FX space, with EUR landing at the bottom of the pile. Major currency pairs generally held very tight ranges in the absence of fresh developments on the Russia crisis.

- Chinese inflation figures failed to move the dial for offshore yuan. Both consumer and factory gate prices grew slower than forecast in January, opening up some space for China's central bank to ease policy further. PBOC Gov Yi pledged to "keep accommodative policy flexible and appropriate."

- Inflation data from the UK and Canada will be published today, while other data highlights include U.S. retail sales & industrial output as well as Norwegian GDP.

- On the central bank front, the Fed will publish the minutes from their most recent monetary policy meeting. In addition, comments are due from Fed's Kashkari, BoC's Lane & RBA's Bullock/Debelle.

FOREX OPTIONS: Expiries for Feb16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1250(E860mln), $1.1280-00(E1.0bln), $ $1.1400-05(E1.1bln), $1.1425-30(E1.0bln)

- USD/JPY: Y114.40-50($1.6bln), Y115.00($619mln), Y115.25-40($1.0bln), Y116.00-05($1.0bln)

- EUR/JPY: Y128.50(E1.4bln)

- USD/CAD: C$1.2600($837mln), C$1.2785-90($630mln)

ASIA FX: Korean Won Leads Gains On Improving Sentiment, Firm Jobs Data

Receding geopolitical unrest surrounding the Russia-Ukraine standoff applied pressure to USD/Asia crosses, despite the lack of confirmation if Moscow has started reducing military presence on the Ukrainian border.

- CNH: Offshore yuan was unfazed by China's inflation data, with both PPI and CPI growth slowing more than expected. PBOC Gov Yi pledged to "keep accommodative policy flexible and appropriate."

- KRW: The won gained on the back of better risk environment and solid enough jobs data released out of South Korea, even as the nation's daily Covid-19 cases surged past 90k for the first time since the onset of the pandemic.

- IDR: Spot USD/IDR traded on the back foot as market sentiment improved. Bank Indonesia Gov Warjiyo stuck to familiar lines re: monetary policy, while noting that Indonesia will keep expanding local currency settlement programme.

- MYR: Spot USD/MYR clawed back its initial losses and moved into positive territory. Domestic headline flow failed to offer any notable catalysts.

- PHP: The peso appreciated on the eve of Bangko Sentral ng Pilipinas' monetary policy decision. Central bank chief Diokno said that the country's higher debt is not a problem and debt-to-GDP ratio remains manageable.

- THB: Thai markets were shut in observance of a public holiday.

EQUITIES: Higher In Asia As Geopolitical Tensions Ease

Major Asia-Pac equity indices sit 0.7% to 2.0% higher, tracking a strong lead from Wall St. following Tuesday’s apparent easing in Russia-Ukraine tensions. In local matters, the latest Chinese CPI and PPI prints provided downside surprises, lifting regional sentiment, as the dataset boosted hopes re: the prospects of further PBoC easing.

- The Nikkei 225 leads regional peers, lodging 2.0% gains, erasing losses made earlier in the week. Index heavyweights and blue chips such as Fast Retailing and Softbank led the way higher. These bellwethers broadly outperformed high-beta tech stocks, meaning the TOPIX trailed the Nikkei 225, although the former still added a more than healthy 1.5%.

- The CSI300 trails regional peers (even with the door to further PBoC easing opening further post-China inflation data), trading 0.7% higher, with the rare earth and real estate sub-indices providing the most notable gains. High-beta Chinese tech underperformed the broader market, with the ChiNext and STAR50 trading 0.5% and 0.1% higher, respectively.

- U.S. e-mini equity index futures are 0.1% to 0.2% softer as we type, a touch below Tuesday’s best levels. The continued scepticism from the West re: Russia’s outlined de-escalation on the Ukrainian border has capped the space since Tuesday’s settlement.

GOLD: Narrow Range After Tuesday Pullback

The apparent de-escalation in the Russia-Ukraine standoff allowed bullion to retrace from fresh multi-month peaks on Tuesday, although continued caution from the West when it comes to the touted Russian pullback from the Ukrainian border (several U.S. & NATO figures flagged uncertainty that such a move had taken place) limited the weakness in bullion. That leaves spot around the $1,850/oz mark after sticking to a tight range in Asia hours.

OIL: Narrow Asia Trade After Tuesday’s Pullback

WTI is unchanged and Brent is ~-$0.15 at typing, with the Ukraine situation remaining front and centre. Note that the market has looked through the latest Japanese announcement re: a release from the country’s strategic stockpiles.

- To recap, the benchmarks shed over $3.00 on Tuesday following an easing in Russia-Ukraine tensions, with crude’s direction of travel facilitated by the Russian government announcing partial troop pullbacks from the Ukrainian border.

- Still, Ukrainian and U.S. officials have reiterated the need to verify the Russian claims, while NATO Secretary General Jens Stoltenberg flagged that NATO hasn’t “seen any sign of de-escalation on the ground,” yet. The caution from the West allowed crude futures to pull back from worst levels of the day on Tuesday, before tight ranges were observed during Asia-Pac dealing.

- Ultimately, hope remains when it comes to a peaceful resolution re: the matter, with German Chancellor Scholz noting that “the diplomatic possibilities are far from being exhausted” following a meeting with Russian President Putin.

- Elsewhere, participants are likely keeping an eye on the progress of indirect Iran-U.S. talks in Vienna, with no notable changes observed since EU High Rep. Josep Borrell tweeted that an agreement was “in sight” on Monday.

- Tuesday’s API inventory estimates reportedly revealed declines in U.S. crude, gasoline, and distillate stockpiles (although the drawdowns in headline crude and distillate stocks apparently undershot analyst expectations). U.S. EIA inventory data is due later today (1530GMT), with the median estimates from the Platts survey calling for declines in all three of the aforementioned inventory measures as well.

- On the technical front, WTI and Brent trade comfortably above key short-term support at $88.41 (Feb 9 low) and $89.93 (Feb 8 low) respectively. Recent pullbacks remain relatively shallow, and resistance on the upside is seen at the Feb 14 highs of $95.82 (WTI) and $96.78 (Brent).

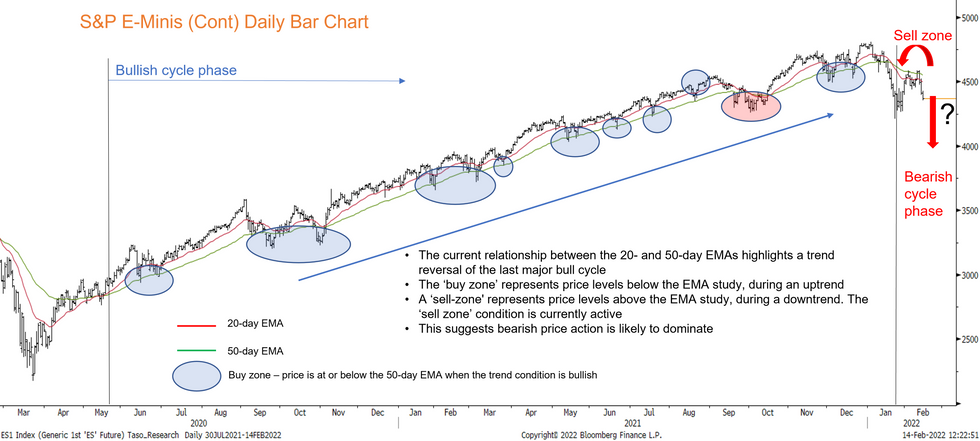

EQUITIES: Shift in Techs, Sentiment Point to Potential Equity Reversal

Executive Summary

- A shift in the equity trend condition may suggest the uptrend in stocks has reversed this year

- Technical trend condition has shifted from bull phase to a bearish signal

- With a rising number of economic and sentiment indicators pricing in a significant deceleration in economic activity, Fed may disappoint by delivering fewer hikes than the market is currently expecting

The EMA condition has changed and it appears that this contract has moved from a bull cycle phase to a bearish one.

Source: Bloomberg/MNI

Click to view the full analysis and charts.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/02/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 16/02/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 16/02/2022 | 0700/0800 | ** |  | NO | Norway GDP |

| 16/02/2022 | 0930/0930 | * |  | UK | ONS House Price Index |

| 16/02/2022 | 1000/1100 | ** |  | EU | industrial production |

| 16/02/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 16/02/2022 | 1330/0830 | *** |  | US | Retail Sales |

| 16/02/2022 | 1330/0830 | ** |  | US | import/export price index |

| 16/02/2022 | 1330/0830 | *** |  | CA | CPI |

| 16/02/2022 | 1330/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/02/2022 | 1330/0830 | ** |  | CA | Wholesale Trade |

| 16/02/2022 | 1415/0915 | *** |  | US | Industrial Production |

| 16/02/2022 | 1500/1000 | * |  | US | business inventories |

| 16/02/2022 | 1500/1000 | ** |  | US | NAHB Home Builder Index |

| 16/02/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 16/02/2022 | 1600/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 16/02/2022 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 16/02/2022 | 1830/1330 |  | CA | BOC Deputy Lane speech | |

| 16/02/2022 | 1900/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.